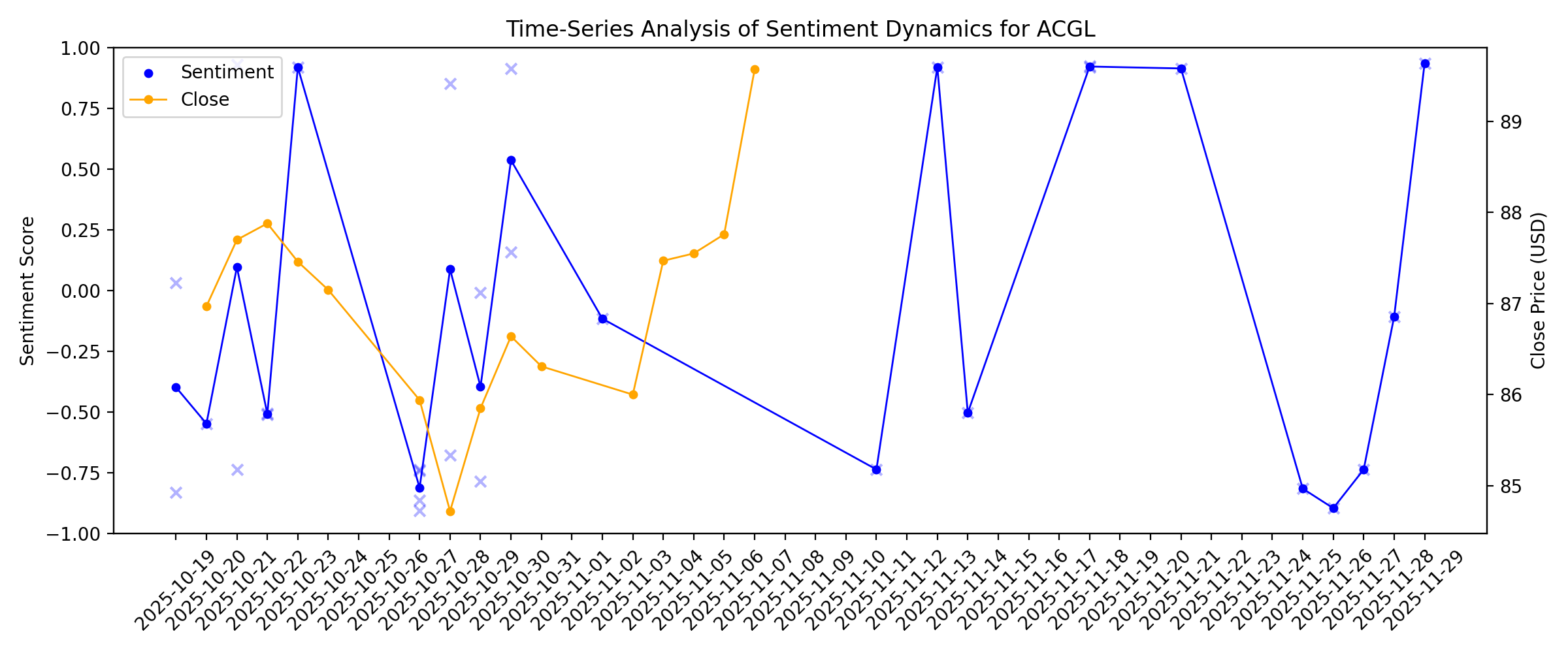

News sentiment analysis for ACGL

Sentiment chart

2026-01-14

2026-01-13

A Look At Arch Capital Group (ACGL) Valuation As Recent Share Price Momentum Cools

Description: With no single headline event driving attention, Arch Capital Group (ACGL) has still caught investors’ eyes as they reassess insurance names following recent share moves and measured shifts in company financials. See our latest analysis for Arch Capital Group. Recent trading has been softer, with the share price at $90.77 after a 1-day share price return decline of 2.65% and a 7-day share price return decline of 3.35%. A 5-year total shareholder return of 179.28% shows the longer term picture...

Arch Capital Group (ACGL) Suffers a Larger Drop Than the General Market: Key Insights

Description: Arch Capital Group (ACGL) closed at $90.77 in the latest trading session, marking a -2.65% move from the prior day.

Arch Capital's Q4 2025 Earnings: What to Expect

Description: Arch Capital is set to deliver its fourth-quarter results next month, and analysts project single-digit earnings growth.

2026-01-12

Why Arch Capital (ACGL) Could Beat Earnings Estimates Again

Description: Arch Capital (ACGL) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2026-01-11

2026-01-10

2026-01-09

ACGL Outperforms Industry, Trades Near 52-Week High: Time to Hold?

Description: Arch Capital is poised to gain from new business opportunities, rate increases, solid premium growth and effective capital deployment.

2026-01-08

Arch Capital Group Ltd. to Report 2025 Fourth Quarter Results on February 9

Description: PEMBROKE, Bermuda, January 08, 2026--Arch Capital Group Ltd. (NASDAQ: ACGL) ("Arch" or the "Company") today announced it expects to release its 2025 fourth quarter results after the close of regular stock market hours on Monday, Feb. 9. The Company will hold a conference call for investors and analysts at 10 a.m. ET on Tuesday, Feb. 10.

Arch Capital Group Insiders Sell US$31m Of Stock, Possibly Signalling Caution

Description: In the last year, many Arch Capital Group Ltd. ( NASDAQ:ACGL ) insiders sold a substantial stake in the company which...

2026-01-07

Arch Capital Group (ACGL) Rises As Market Takes a Dip: Key Facts

Description: Arch Capital Group (ACGL) closed at $95.16 in the latest trading session, marking a +1.32% move from the prior day.

KNSL Lags Industry, Trades at Premium: How to Play the Stock

Description: Kinsale Capital is poised to gain from a focus on the excess and supply market, prudent underwriting, lower expense ratio, solid investment portfolio and capital deployment.

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Arch Capital Group (ACGL) Stock Sinks As Market Gains: What You Should Know

Description: Arch Capital Group (ACGL) closed the most recent trading day at $93.86, moving 2.15% from the previous trading session.

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

Is the Options Market Predicting a Spike in Arch Capital Stock?

Description: Investors need to pay close attention to ACGL stock based on the movements in the options market lately.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Does AM Best’s Upgraded Credit View Reshape the Bull Case for Arch Capital Group (ACGL)?

Description: In recent days, AM Best upgraded Arch Capital Group’s long-term issuer credit ratings and reaffirmed its A+ financial strength rating, citing robust balance sheet strength, diversified earnings across insurance, reinsurance and mortgage, and consistently strong underwriting results even through events such as the 2025 California wildfires. At the same time, analysts acknowledge pressures like moderating property and casualty pricing and softer premium growth, yet point to Arch’s risk...

2025-12-20

Evaluating Arch Capital Group (ACGL) After Recent Share Price Consolidation and Slower Profit Growth

Description: Arch Capital Group (ACGL) has quietly kept investors interested, with the stock edging up about 4% over the past month and roughly 9% in the past 3 months, even as annual profit growth softened. See our latest analysis for Arch Capital Group. Zooming out, Arch Capital’s roughly flat year to date share price return, alongside a solid multi year total shareholder return north of 50%, suggests momentum is consolidating after a strong run as investors reassess growth versus valuation. If Arch...

Is Arch Capital Group Still Attractive After Its Strong Multi Year Share Price Surge?

Description: Wondering if Arch Capital Group is still a smart buy after such a strong run, or if the easy money has already been made? This article will walk through what the current price really implies about its value. The stock closed at $96.20 recently, and while the 7 day return of 2.4%, 30 day return of 5.5% and 1 year gain of 5.7% are solid, the real story is the 59.6% 3 year and 190.2% 5 year performance that has many investors reassessing both upside and risk. Recent headlines have focused on...

2025-12-19

Roth Capital Cites Low Catastrophe Losses for Arch Capital (ACGL) Earnings Beat While Highlighting Growth Concerns

Description: Arch Capital Group Ltd. (NASDAQ:ACGL) is one of the most profitable value stocks to invest in right now. On December 2, Roth Capital lowered the firm’s price target on Arch Capital to $110 from $125 with a Buy rating on the shares. The firm noted that the company’s earnings beat was primarily driven by an […]

2025-12-18

AM Best Upgrades Issuer Credit Rating for Arch Capital Group Ltd. and Its Subsidiaries

Description: OLDWICK, N.J., December 18, 2025--AM Best has upgraded the Long-Term Issuer Credit Ratings (Long-Term ICR) to "aa" (Superior) from "aa-" (Superior) and affirmed the Financial Strength Rating (FSR) of A+ (Superior) of Arch Reinsurance Ltd. (Arch) (Bermuda) and its strategic affiliates. The outlook of the Long-Term ICRs has been revised to stable from positive, while the outlook of the FSRs is stable.

If You Invested $1000 in Arch Capital Group a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

Wall Street Has a Mixed Opinion on Arch Capital (ACGL), Here’s Why

Description: Arch Capital Group Ltd. (NASDAQ:ACGL) is one of the Cheap NASDAQ Stocks to Buy Now. On December 2, Harry Fong from Roth MKM lowered the firm’s price target on the stock from $125 to $110, while reiterating a Buy rating. Earlier on November 24, Rowland Mayor from RBC Capital initiated Arch Capital Group Ltd. (NASDAQ:ACGL) […]

Is Weakness In Arch Capital Group Ltd. (NASDAQ:ACGL) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

Description: It is hard to get excited after looking at Arch Capital Group's (NASDAQ:ACGL) recent performance, when its stock has...

2025-12-08

2025-12-07

2025-12-06

2025-12-05

What Analysts Think Is Changing the Story for Arch Capital Group Now

Description: Arch Capital Group’s fair value estimate has been nudged higher to about $107.56 per share as analysts balance the company’s strong underwriting discipline and investment income against a softer growth backdrop. This slight upward adjustment comes even as the assumed discount rate rises to around 6.96% and revenue growth expectations turn more cautious at roughly -1.52%, reflecting a market that sees Arch as a relative winner in a tougher property and casualty cycle. Stay tuned to see how...

2025-12-04

Arch Capital Group Ltd. (ACGL): A Bull Case Theory

Description: We came across a bullish thesis on Arch Capital Group Ltd. on Value investing subreddit by InternationalTop4495. In this article, we will summarize the bulls’ thesis on ACGL. Arch Capital Group Ltd.’s share was trading at $92.69 as of December 2nd. ACGL’s trailing and forward P/E were 8.73 and 10.19 respectively according to Yahoo Finance. Arch Capital (ACGL) […]

Is Arch Capital Stock Underperforming the Dow?

Description: Arch Capital has underperformed the Dow over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-12-03

2025-12-02

AXS Near 52-Week High: Time to Add the Stock for Better Returns?

Description: AXIS Capital gains from a well-performing specialty insurance, reinsurance, and the accident and health portfolio.

2025-12-01

Here's How Much a $1000 Investment in Arch Capital Group Made 10 Years Ago Would Be Worth Today

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

2025-11-30

2025-11-29

The Bull Case for Arch Capital Group (ACGL) Could Change Following Q3 Earnings Beat and Analyst Optimism

Description: In the past week, Arch Capital Group reported third-quarter 2025 results that surpassed forecasts, with higher operating and underwriting income driven by improved performance in its Insurance segment and stronger net investment income. This strong performance was accompanied by a wave of positive analyst sentiment, including coverage reinstatements and optimistic recommendations reflecting growing confidence in Arch Capital’s operational efficiency. We'll examine how Arch Capital's...

2025-11-28

Possible Bearish Signals With Arch Capital Group Insiders Disposing Stock

Description: Many Arch Capital Group Ltd. ( NASDAQ:ACGL ) insiders ditched their stock over the past year, which may be of interest...

2025-11-27

Should Value Investors Buy Arch Capital Group (ACGL) Stock?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2025-11-26

Why Is Arch Capital (ACGL) Up 10.5% Since Last Earnings Report?

Description: Arch Capital (ACGL) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-25

Ackman Seeks to Sell New Fund With a Bonus: a Stake in His Firm

Description: Such a transaction probably would be a first for the closed-end fund market. It would be a rare instance of buyers in an IPO getting stock in a related company.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Arch Capital Trades Above 50-Day SMA: Time to Buy ACGL Stock?

Description: ACGL is poised to gain from new business opportunities, rate increases, solid premium growth and effective capital deployment.

2025-11-20

2025-11-19

2025-11-18

Arch Capital Group (ACGL): Evaluating Undervaluation After Recent Share Price Pullback

Description: Arch Capital Group (ACGL) has been navigating a mixed stretch in the market, with shares showing a small pullback this week but maintaining a steady climb over the past month. Investors might be watching for what could move the stock next. See our latest analysis for Arch Capital Group. Arch Capital Group has kept its long-term momentum alive, delivering a robust 68.9% total shareholder return over the past three years and an impressive 184% over five years. However, the 1-year total return...

KNSL Lags Industry, Trades at Premium: Time to Hold the Stock?

Description: Kinsale Capital is poised to gain from a focus on the excess and supply market, prudent underwriting, lower expense ratio, solid investment portfolio and capital deployment.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Here's How Much You'd Have If You Invested $1000 in Arch Capital Group a Decade Ago

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-11-13

Are Wall Street Analysts Predicting Arch Capital Stock Will Climb or Sink?

Description: Arch Capital has notably trailed the broader market over the past year, but analysts remain fairly confident in the company’s fundamentals and long-term growth potential.

2025-11-12

2025-11-11

Are Investors Undervaluing Arch Capital Group (ACGL) Right Now?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

Investing in Arch Capital Group (NASDAQ:ACGL) five years ago would have delivered you a 188% gain

Description: When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far...

2025-11-01

2025-10-31

2025-10-30

Arch Capital Group Ltd (ACGL) Q3 2025 Earnings Call Highlights: Record Profits and Strategic ...

Description: Arch Capital Group Ltd (ACGL) reports robust earnings growth and strategic capital returns, while navigating competitive market pressures and potential natural disaster impacts.

Arch Global Services India Opens New Office in Trivandrum to Drive Innovation

Description: TRIVANDRUM, India, October 30, 2025--Arch Global Services India today announced the grand opening of its new office in Trivandrum’s Technopark.

2025-10-29

Arch Capital Group (ACGL) Profit Margin Decline Challenges Bullish Value Narrative

Description: Arch Capital Group (ACGL) reported net profit margins of 20.8%, a significant drop compared to the prior year’s 33.6%. Revenues are forecast to grow at just 0.08% each year, which is far slower than the 10.1% average growth rate of the US market. Earnings are expected to decline by 1.4% per year over the next three years. While these numbers could prompt caution given the tightening profitability and muted growth forecast, ACGL trades at a lower Price-to-Earnings ratio than both its peers and...

Arch Capital Group Ltd. (NASDAQ:ACGL) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Description: It is hard to get excited after looking at Arch Capital Group's (NASDAQ:ACGL) recent performance, when its stock has...

2025-10-28

Arch Capital Q3 Earnings Beat, Revenues Miss Estimates

Description: Arch Capital's strong underwriting and investment gains drive Q3 earnings beat, even as revenues narrowly miss estimates.

Arch Global Services India Opens Technology Hub in Hyderabad to Accelerate Innovation

Description: HYDERABAD, India, October 28, 2025--Arch Global Services India, a wholly-owned subsidiary of Arch Capital Group Ltd. (NASDAQ: ACGL) — a global provider of insurance, reinsurance and mortgage insurance and member of the S&P 500 — today announced the grand opening of its new office in Hyderabad.

2025-10-27

Arch Capital (ACGL) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for Arch Capital (ACGL) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Arch Capital Group (ACGL) Q3 Earnings Beat Estimates

Description: Arch Capital (ACGL) delivered earnings and revenue surprises of +26.48% and -0.59%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Arch Capital: Q3 Earnings Snapshot

Description: PEMBROKE, Bermuda (AP) — Arch Capital Group Ltd. (ACGL) on Monday reported third-quarter net income of $1.35 billion. On a per-share basis, the Pembroke, Bermuda-based company said it had profit of $3.56. Earnings, adjusted for non-recurring gains, were $2.77 per share.

Arch Capital Group Ltd. Reports 2025 Third Quarter Results

Description: PEMBROKE, Bermuda, October 27, 2025--Arch Capital Group Ltd. (NASDAQ: ACGL; "Arch," "our" or "the Company") announces its 2025 third quarter results. The results included:

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Can Arch Capital Sustain the Surprise Streak With Q3 Earnings Beat?

Description: ACGL eyes another earnings beat as premiums, investment income and underwriting strength drive Q3 momentum.

2025-10-22

Skyward Specialty Insurance (SKWD) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Skyward (SKWD) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

What Analyst Projections for Key Metrics Reveal About Arch Capital (ACGL) Q3 Earnings

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Arch Capital (ACGL), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

2025-10-21

All You Need to Know About Arch Capital (ACGL) Rating Upgrade to Buy

Description: Arch Capital (ACGL) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Should Value Investors Buy Arch Capital Group (ACGL) Stock?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2025-10-20

Arch Capital Group (ACGL) Reports Next Week: Wall Street Expects Earnings Growth

Description: Arch Capital (ACGL) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-19

Arch Capital Group (ACGL): Is the Insurer Undervalued After Recent Share Price Swings?

Description: Arch Capital Group (ACGL) shares have seen some swings recently, drawing attention from investors curious about what might be next for the insurer. The stock’s performance over the past month offers some food for thought for those watching its valuation. See our latest analysis for Arch Capital Group. Arch Capital Group’s share price has taken a hit this year, with a year-to-date return of -5.33%, and the 1-year total shareholder return down 16.17%. Despite these setbacks, the insurer still...

Possible Bearish Signals With Arch Capital Group Insiders Disposing Stock

Description: In the last year, many Arch Capital Group Ltd. ( NASDAQ:ACGL ) insiders sold a substantial stake in the company which...