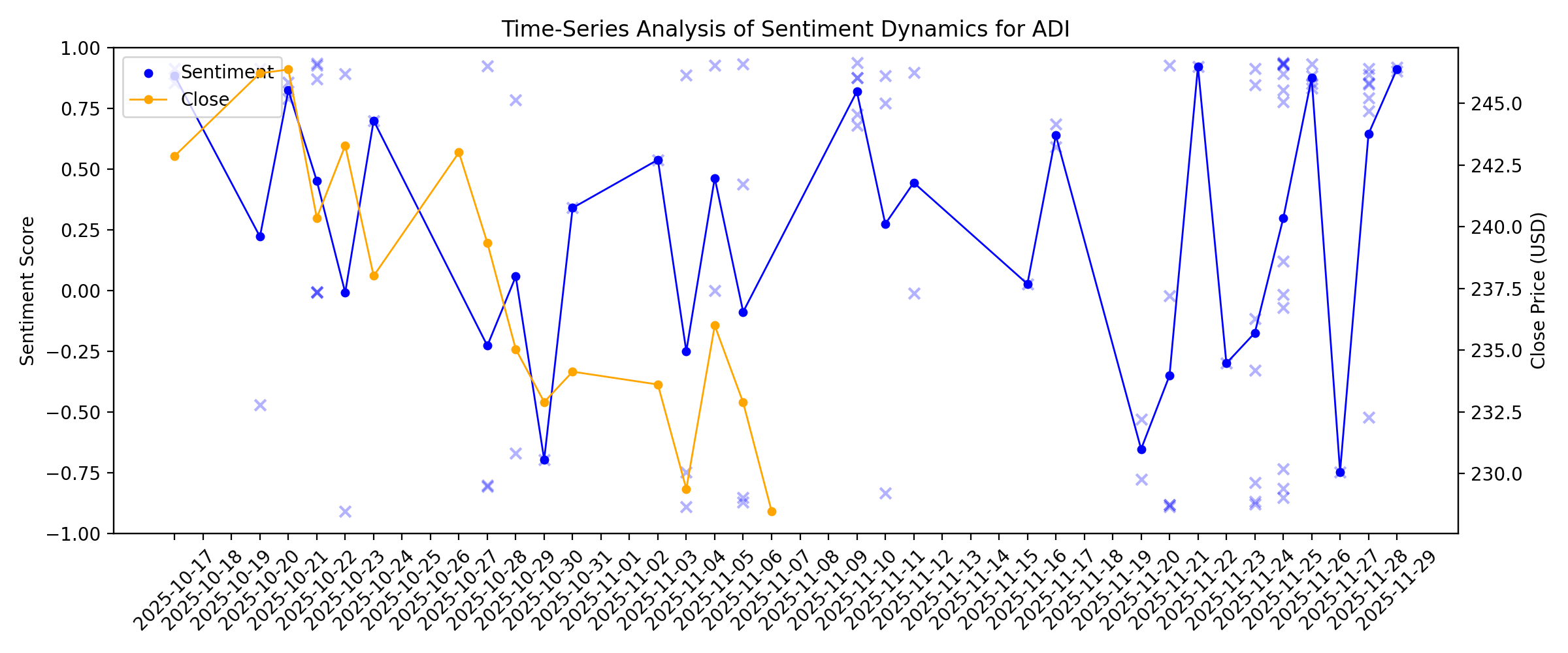

News sentiment analysis for ADI

Sentiment chart

2026-01-14

The Returns At Analog Devices (NASDAQ:ADI) Aren't Growing

Description: If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an...

2026-01-13

Are You Looking for a Top Momentum Pick? Why Analog Devices (ADI) is a Great Choice

Description: Does Analog Devices (ADI) have what it takes to be a top stock pick for momentum investors? Let's find out.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Is It Too Late To Consider Analog Devices (ADI) After A 44% One Year Rally?

Description: If you are wondering whether Analog Devices at around US$300.93 is priced for perfection or still offers value, this article will walk through what the current market price might be telling you. The stock has posted returns of 9.9% over the last week, 6.9% over the last month, 9.9% year to date and 44.0% over the past year, with longer-term returns of 87.6% over three years and 108.2% over five years. Recent coverage of Analog Devices has focused on its role as a major analog and mixed...

Assessing Analog Devices (ADI) Valuation After AI-Fueled Semiconductor Rally And CES Optimism

Description: Analog Devices (ADI) is back on traders’ radar after a sector wide semiconductor rally, linked to artificial intelligence enthusiasm at CES and shifting expectations for a more accommodative Federal Reserve policy. See our latest analysis for Analog Devices. The recent CES driven AI buzz and hopes for easier Federal Reserve policy have coincided with strong momentum for Analog Devices, with a 7 day share price return of 9.93% and a 90 day share price return of 33.56%. The 1 year total...

4 Stocks to Boost Your Portfolio on Steady Jump in Semiconductor Sales

Description: Rising global chip sales and AI-driven demand put ADI, NVDA, MTSI and ASYS in focus as semiconductor stocks gain momentum in a strong market.

2 Top-Ranked AI-Powered Tech Giants to Enhance Your Portfolio Returns

Description: APH and ADI stand out in the AI boom, supported by the massive growth of cloud computing and data centers.

ADI Climbs 35.7% in a Year: Should You Buy, Sell or Hold the Stock?

Description: Analog Devices shares surge 35.7% in a year as AI-driven demand lifts industrial and communications growth, boosts data center sales and supports strong margins.

2026-01-08

Why Analog Devices (ADI) Outpaced the Stock Market Today

Description: Analog Devices (ADI) concluded the recent trading session at $299.16, signifying a +2.14% move from its prior day's close.

2026-01-07

Microchip Tech (MCHP) Surges 11.7%: Is This an Indication of Further Gains?

Description: Microchip Tech (MCHP) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

If You Invested $1000 in Analog Devices a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2026-01-06

Analog Devices, Applied Materials, KLA Corporation, Monolithic Power Systems, and onsemi Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after a broader market rally drove investor optimism in artificial intelligence and big tech stocks.

How Power Integrations’ (POWI) New Marketing Chief from Micron and ADI Has Changed Its Investment Story

Description: Power Integrations recently appointed Chris Jacobs as Senior Vice President for Marketing and Product Strategy, bringing experience from senior roles at Micron Technology and Analog Devices. This hire signals a push toward a more customer-focused product roadmap in industrial, data center, and automotive power-conversion markets. We’ll now examine how Chris Jacobs’ appointment to lead marketing and product strategy could reshape Power Integrations’ existing investment narrative. Trump has...

2026-01-05

Power Integrations Names Chris Jacobs Senior Vice President, Marketing and Product Strategy

Description: SAN JOSÉ, Calif., January 05, 2026--Chris Jacobs has joined Power Integrations as senior vice president for marketing and product strategy.

S&P 500 Continues Its Stellar Run to Open New Year: 4 Solid Picks

Description: After a tech-driven 2025, the S&P 500 opens higher, with AMZN, ADI, APP and CDNS standing out as solid picks for the year ahead.

2026-01-04

2026-01-03

2026-01-02

Analog Devices, Inc. (ADI) Balances Analyst Optimism With Insider Share Sale

Description: We recently compiled a list of the 10 Best Long-Term Investments for Kids. Analog Devices, Inc. stands third among the best long-term investments. TheFly reported on December 19 that Truist Securities analyst William Stein maintained a Hold rating on ADI while raising the price target to $291 from $258. The update reflects the firm’s latest […]

Those who invested in Analog Devices (NASDAQ:ADI) five years ago are up 89%

Description: Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the...

2026-01-01

2025-12-31

Analog Devices (ADI) Registers a Bigger Fall Than the Market: Important Facts to Note

Description: Analog Devices (ADI) reached $271.2 at the closing of the latest trading day, reflecting a -1.32% change compared to its last close.

Buy 5 Solid Semiconductor Stocks of 2025 With Room for Growth in 2026

Description: AI-driven chip demand powered a strong 2025 and sets up more growth in 2026, making ADI, MTSI, SLAB and NVDA compelling buys.

Brokers Suggest Investing in Analog Devices (ADI): Read This Before Placing a Bet

Description: Based on the average brokerage recommendation (ABR), Analog Devices (ADI) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2025-12-30

The Zacks Analyst Blog Highlights International Business Machines, Analog Devices, Johnson & Johnson's, The Gap and Hewlett Packard Enterprise

Description: IBM leads a list of high-yield S&P 500 picks for 2026 as steady cash flow, dividends and AI exposure appeal amid market volatility.

2025-12-29

Chip sales could top $1T in 2026. Is Nvidia still top AI play?

Description: While Nvidia (NVDA) was one of the standout winners of the AI trade in 2025, will the chipmaker remain a tried-and-true stock pick in 2026? Winthrop Capital Chief Investment Officer Adam Coons weighs in on the importance of diversification in the artificial intelligence ecosystem, especially as Bank of America analysts forecast semiconductor sales to top $1 trillion next year. Yahoo Finance senior reporter Brooke DiPalma also joins the discussion. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

These 4 Measures Indicate That Analog Devices (NASDAQ:ADI) Is Using Debt Safely

Description: David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the...

2025-12-28

2025-12-27

2025-12-26

The Zacks Analyst Blog Analog Devices, Amazon.com and Fortive

Description: Amazon.com stands out as tech stocks rebound in a Santa Claus rally, with easing AI fears and strong earnings outlook lifting S&P 500 sentiment.

2025-12-25

Possible Bearish Signals With Analog Devices Insiders Disposing Stock

Description: In the last year, many Analog Devices, Inc. ( NASDAQ:ADI ) insiders sold a substantial stake in the company which may...

2025-12-24

Buy 3 Tech Stocks as Santa Rally Begins With a Record High S&P 500

Description: Tech stocks rebound as the S&P 500 hits a record close, putting ADI, AMZN and FTV in focus as investors eye growth potential into 2025.

These 6 stocks will lead the $1 trillion chip surge in 2026, BofA says

Description: Bank of America's Vivek Arya sees a 30% surge in chip sales and a $900 billion accelerator market just over the horizon.

2025-12-23

Citi Makes Left-Field Choice For Top Pick Among Chip Stocks

Description: Investment bank Citi named Microchip as its top pick among chip stocks as it forecasts a resurgence for analog semiconductors in 2026.

2025-12-22

2025-12-21

Analog Devices, Inc.'s (NASDAQ:ADI) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Description: Most readers would already be aware that Analog Devices' (NASDAQ:ADI) stock increased significantly by 18% over the...

2025-12-20

2025-12-19

Has AXT (AXTI) Outpaced Other Computer and Technology Stocks This Year?

Description: Here is how AXT (AXTI) and Analog Devices (ADI) have performed compared to their sector so far this year.

2025-12-18

BofA Raises Analog Devices (ADI) Target, Sees Long AI-Driven Upgrade Cycle Ahead

Description: Analog Devices, Inc. (NASDAQ:ADI) is included among the 12 Best Long Term US Stocks to Buy Now. On December 16, BofA raised its price target on Analog Devices, Inc. (NASDAQ:ADI) to $320 from $290 and kept a Buy rating. The move came as the firm refreshed price targets across its US semiconductor coverage. BofA sees […]

Top Semiconductor Stocks for 2026 -- Nvidia and Broadcom Lead Chip Picks

Description: Nvidia and Broadcom Lead Morgan Stanley's 2026 Chip Picks

2025-12-17

Has Analog Devices’ 110% Five Year Surge Left Much Upside at $278?

Description: Wondering if Analog Devices is still worth buying after its huge run, or if most of the upside is already priced in, you are not the only one asking that question right now. The stock has climbed to around $278.40, adding 0.8% in the last week, 18.5% over the last month, and delivering 31.7% year to date and 32.4% over the past year, with a massive 110.6% gain over five years that highlights its long term momentum. Much of this strength ties back to the market rewarding high quality analog...

2025-12-16

UBS Lifts Analog Devices (ADI) Target, Keeps Buy Rating

Description: Analog Devices, Inc. (NASDAQ:ADI) is included among the 15 Best Blue-Chip Stocks with Growing Dividends. On December 8, UBS analyst Timothy Arcuri raised his price target on Analog Devices, Inc. (NASDAQ:ADI) to $320 from $280, keeping a Buy rating on the shares. In its fiscal Q4 2025 report, Analog Devices, Inc. (NASDAQ:ADI) showed solid growth. […]

Earnings Estimates Moving Higher for Analog Devices (ADI): Time to Buy?

Description: Analog Devices (ADI) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Nvidia and Broadcom Are Wall Street's Top Chip Picks for 2026

Description: Analog Chips Face Headwinds, AI Chips Still Hot

Top 6 chip stocks to buy for 2026, according to this semiconductor analyst

Description: Investing.com -- In a note to clients on Tuesday, Bank of America analyst Vivek Arya named six large-cap stocks he believes are best positioned to outperform as spending on AI infrastructure accelerates.

2025-12-15

Wall Street Bulls Look Optimistic About Analog Devices (ADI): Should You Buy?

Description: According to the average brokerage recommendation (ABR), one should invest in Analog Devices (ADI). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

Here's How Much a $1000 Investment in Analog Devices Made 10 Years Ago Would Be Worth Today

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

Is It Time To Consider Buying Analog Devices, Inc. (NASDAQ:ADI)?

Description: Analog Devices, Inc. ( NASDAQ:ADI ) received a lot of attention from a substantial price increase on the NASDAQGS over...

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Return Trends At Analog Devices (NASDAQ:ADI) Aren't Appealing

Description: There are a few key trends to look for if we want to identify the next multi-bagger. Ideally, a business will show two...

2025-12-10

2025-12-09

2025-12-08

Truist Stays Neutral on Analog Devices (ADI) Amid Strong Auto and AI Growth

Description: Analog Devices, Inc. (NASDAQ:ADI) is included among the 14 Best US Stocks to Buy for Long Term. On November 26, Truist analyst William Stein increased the price target for Analog Devices, Inc. (NASDAQ:ADI) from $249 to $258 and kept a Hold rating on the stock. The analyst noted in the research note that the company […]

2025-12-07

Analog Devices (ADI): Evaluating Valuation After Strong Earnings Beat and Upgraded Outlook

Description: Analog Devices (ADI) just delivered a quarter that checked most of the boxes investors care about, with double digit sales and earnings growth, plus guidance that points to that strength carrying into early 2026. See our latest analysis for Analog Devices. The market has taken notice, with a 30 day share price return of 23.11% and a year to date share price return of 33.09%. The five year total shareholder return of 116.71% shows momentum has been building for years. If this kind of strength...

2025-12-06

2025-12-05

See How Analog Devices Attracts Huge Institutional Inflows

Description: Since first Big Money outlier inflow signal in 1996, shares of Analog Devices, Inc. (ADI) are up 4,105%.

2025-12-04

Analog Devices (ADI) is a Great Momentum Stock: Should You Buy?

Description: Does Analog Devices (ADI) have what it takes to be a top stock pick for momentum investors? Let's find out.

2025-12-03

This Chip Maker Is the S&P 500’s Top Stock Today. It’s Having a Great Quarter.

Description: Microchip Technology was the top performer in the on Wednesday after the chip maker boosted its financial forecasts for the current quarter. Microchip now expects adjusted earnings of 40 cents a share for its fiscal third quarter, which ends in December. Microchip also anticipates net sales growth of roughly 1% from the prior quarter, while the midpoint of the range it had forecast earlier pointed to a decline of less than 1%.

What Will the Future of Farming Look Like? DigiKey's New Episodes of "Farm Different" Share Three Notable Outlooks

Description: DigiKey, the leading global electronic components and automation products distributor, announced the release of season 4 of its informative "Farm Different" video series. The series explores how the integration of advanced technology is reshaping and propelling the agricultural industry forward, and DigiKey is diving deep to understand its impact.

Are Computer and Technology Stocks Lagging Analog Devices (ADI) This Year?

Description: Here is how Analog Devices (ADI) and AXT (AXTI) have performed compared to their sector so far this year.

Analog Devices' (NASDAQ:ADI) five-year earnings growth trails the 16% YoY shareholder returns

Description: Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses...

2025-12-02

The Top 5 Analyst Questions From Analog Devices’s Q3 Earnings Call

Description: Analog Devices delivered a quarter that surpassed Wall Street’s expectations, with management attributing these results to robust demand across all key end markets, particularly industrial, automotive, and communications. CEO Vincent Roche cited the company’s focus on research and development and success in capturing value from new products as core contributors to the performance. Roche highlighted that “AI, automation, and the drive for efficient energy management” were among the most powerful

2025-12-01

2025-11-30

2025-11-29

Benchmark Maintains Buy Rating on Analog Devices (ADI) After Solid Q4 Results

Description: Analog Devices, Inc. (NASDAQ:ADI) ranks among the best slow growth stocks to invest in. On November 26, Benchmark reaffirmed its Buy rating on Analog Devices, Inc. (NASDAQ:ADI), maintaining its price target of $285 in light of the company’s fourth-quarter results. The semiconductor company announced quarterly results that modestly exceeded projections, with performance exceeding guidance in […]

Is Analog Devices Still a Smart Pick After New Product Launches and a 25% Rally in 2025?

Description: Wondering if Analog Devices is a bargain or priced for perfection? You are not alone. We are about to break down what the current price really means for investors thinking long term. The stock has climbed 14.2% in just the past week and has gained an impressive 25.5% since the start of the year, signaling renewed enthusiasm from the market. Recent news of new product launches and expanded partnerships in key markets has fueled optimism, reinforcing Analog Devices’ reputation for innovation...

2025-11-28

Nasdaq Notches First Monthly Loss Since March as Dow, S&P 500 Make Gains

Description: The S 500 and Dow both rose for a seventh consecutive month.

Walmart Stock Hits Record High On Black Friday, Along With Analog Devices And A Metals Miner

Description: Walmart shares reach a record high on Black Friday. Analog Devices and a precious metals miner also hit new price peaks.

Analog Devices Stock Scores Relative Strength Rating Upgrade

Description: A Relative Strength Rating upgrade for Analog Devices shows improving technical performance. Will it continue?

AI Stocks You Should Buy to Boost and Reenergize Your Portfolio

Description: Here, we have picked three AI stocks, NVDA, MU and ADI, which are well-poised to benefit from AI's growing use and ability to solve complex problems.

Analog Devices Stock: Is ADI Underperforming the Technology Sector?

Description: Analog Devices has underperformed the technology sector over the past year. However, Wall Street analysts remain moderately optimistic about its prospects.

If You Invested $1000 in Analog Devices a Decade Ago, This is How Much It'd Be Worth Now

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

How Recent Developments Are Shaping the Analog Devices Investment Story

Description: Analog Devices' fair value estimate has recently been raised from $267.47 to $280.31 per share, reflecting renewed confidence in the company’s long-term outlook. This upward revision follows an upgraded revenue growth forecast, supported by ongoing strength in the automotive and AI markets as well as management’s consistently positive guidance. Stay tuned to learn how you can keep up with key developments and shifts in the narrative surrounding Analog Devices stock. Analyst Price Targets...

2025-11-27

Wall Street Analysts Think Analog Devices (ADI) Is a Good Investment: Is It?

Description: Based on the average brokerage recommendation (ABR), Analog Devices (ADI) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2025-11-26

Analog Devices Q4 Earnings Beat Estimates, Revenues Rise Y/Y

Description: ADI posts strong Q4 with rising revenues and margins, powering upbeat Q1 guidance that signals continued momentum.

Stock Market News for Nov 26, 2025

Description: Wall Street closed higher on Tuesday after a choppy session.

Is Analog Devices’ (ADI) Robust Capital Return Plan a Sign of Enduring Business Strength?

Description: Analog Devices, Inc. recently declared a quarterly cash dividend of US$0.99 per share, approved a share repurchase totaling over US$841 million in the past quarter, and released forward earnings guidance with revenue forecasted at US$3.1 billion for the first quarter of fiscal 2026. The combination of a sustained dividend, significant share buybacks, and positive outlook highlights the company’s commitment to shareholder returns and confidence in ongoing business strength. We’ll examine how...

Stock Market News: Alphabet inches closer to $4T, consumer spending rises in Midwest

Description: This is the market report as of 4 pm ET on Tuesday, November 25. The market continued to build upon its gains from Monday, and despite the Nvidia lull, it remained relatively calm. The S&P 500 closed 0.9% higher, led by Keysight Technologies, Chipotle, and Albemarle.The Nasdaq Composite closed ...

2025-11-25

Analog Devices Inc (ADI) Q4 2025 Earnings Call Highlights: Record Revenue and Strong Growth ...

Description: Analog Devices Inc (ADI) reports robust financial performance with significant gains in revenue, EPS, and free cash flow, despite macroeconomic challenges.

Analog Devices Stock Rises on Earnings. Chip Maker Is ‘Well Positioned’ for 2026.

Description: Shares of Analog Devices rose Tuesday after the chip maker reported better-than-expected quarterly earnings. The company posted adjusted earnings of $2.26 a share for its fiscal fourth quarter, narrowly ahead of analysts’ consensus estimate of $2.24, according to FactSet. Analog Devices is benefiting from a recovery in the highly cyclical market for analog semiconductors, which measure things like sound, temperature, and light.

The Stock Market Is Struggling. Blame Nvidia, Crypto Stocks.

Description: The S&P 500 struggled at the open on Tuesday, but the majority of stocks in the index were rising. With the market benchmark down 0.6%, more than 350 stocks in the index were set to close higher. The Invesco S&P 500 Equal Weight ETF, which weighs every stock in the index the same, was up 0.2%.

ADI vs. TXN: Which Semiconductor Stock Has an Edge Now?

Description: Analog Devices' broad-based segment gains and margin strength set it apart as it outperforms Texas Instruments amid shifting semiconductor demand.

Analog Devices (ADI) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: While the top- and bottom-line numbers for Analog Devices (ADI) give a sense of how the business performed in the quarter ended October 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Analog Devices sees upbeat quarterly results on resilient demand

Description: Analog Devices on Tuesday forecast first-quarter profit and revenue above estimates, after beating fourth-quarter expectations, as the chipmaker benefited from strong demand despite tariff uncertainties. Shares of the company, which are up 12.7% this year, rose nearly 4% in early morning trading. After a prolonged slump in demand, Analog has been seeing a recovery across its business sectors as enterprises loosen budgets and prioritize infrastructure expansion despite tariffs threatening to hike costs and weigh on the market's outlook.

Analog Devices (ADI) Q4 Earnings and Revenues Surpass Estimates

Description: Analog Devices (ADI) delivered earnings and revenue surprises of +1.80% and +2.17%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Stocks Down Pre-Bell as Investors Await Wholesale Inflation Data

Description: The benchmark US stock measures were lower before Tuesday's open as investors await key economic dat

Analog Devices posts higher-than-expected revenue amid automotive unit strength

Description: Investing.com - Analog Devices has posted fourth-quarter revenue which topped estimates, as strength at the chipmaker’s automotive division helped to offset lower-than-anticipated sales at its key industrial segment.

Analog Devices: Fiscal Q4 Earnings Snapshot

Description: The average estimate of 10 analysts surveyed by Zacks Investment Research was for earnings of $2.22 per share. The semiconductor maker posted revenue of $3.08 billion in the period, also topping Street forecasts. Nine analysts surveyed by Zacks expected $3.01 billion.

Analog Devices (NASDAQ:ADI) Beats Q3 Sales Targets

Description: Manufacturer of analog chips Analog Devices (NASDAQ:ADI) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 25.9% year on year to $3.08 billion. On top of that, next quarter’s revenue guidance ($3.1 billion at the midpoint) was surprisingly good and 4.4% above what analysts were expecting. Its non-GAAP profit of $2.26 per share was 1.1% above analysts’ consensus estimates.

Analog Devices Reports Strong Fourth Quarter and Fiscal 2025 Financial Results

Description: Analog Devices, Inc. (Nasdaq: ADI), a global semiconductor leader, today announced financial results for its fiscal fourth quarter and fiscal year 2025, which ended November 1, 2025.

Dell Earnings, Inflation Data, Retail Sales: What to Watch This Week

Description: Before Thanksgiving travel and Black Friday shopping grab the spotlight, some notable earnings and delayed economic reports are due. Here's what to watch for: Today Earnings (a.m.): Abercrombie & Fitch, Alibaba, Analog Devices, Best Buy, J.

2025-11-24

CORRECTING and REPLACING Mouser Congratulates the Winners of 2025 Create the Future Design Contest

Description: DALLAS & FORT WORTH, Texas, November 24, 2025--Item under "Automotive and Transportation" in the bulleted list of release dated November 19, 2025, should read: Making Diesel Engines Nearly Emission-Free.

Semtech (SMTC) Surpasses Q3 Earnings and Revenue Estimates

Description: Semtech (SMTC) delivered earnings and revenue surprises of +9.09% and +0.13%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Intel, Amtech, Photronics, Magnachip, and Analog Devices Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after renewed enthusiasm for Alphabet reinvigorated the artificial intelligence trade, propelling a market rebound heading into the Thanksgiving holiday.

Jim Cramer on Analog Devices: “I Believe It’s Not Worth Buying”

Description: Analog Devices, Inc. (NASDAQ:ADI) is one of the stocks on Jim Cramer’s game plan for the week. Cramer showed mixed feelings about the company’s stock, as he stated: “Analog Devices reports too, and I’ve been worried about this one because it’s all about the Internet of Things, industrial semiconductors, which have been very, very weak. […]

Stocks Gain Pre-Bell as Fed Rate Cut Hopes Rise; Traders Await Key Economic Data

Description: The benchmark US stock measures were trending higher before the opening bell Monday amid renewed hop

US Equity Investors to Watch Out for Evolving Fed Policy Outlook, Greenlight to Nvidia's China Chip Sales

Description: US equity investors will focus on the impact of incoming economic data on monetary policy expectatio

Dell Earnings, Inflation Data, Retail Sales: What to Watch This Week

Description: Before Thanksgiving travel and Black Friday shopping grab the spotlight, some notable earnings and delayed economic reports are due. Here's what to watch for: Today Earnings (p.m.): Agilent Technologies, Zoom Communications Economic data: Dallas Federal Reserve manufacturing survey Overseas: Japanese markets are shut for a holiday.

2025-11-23

Economic data returns, retail earnings feature in holiday-shortened week: What to watch this week

Description: Investors will be tracking retail earnings and economic data as the government works through a backlog of reports delayed by the shutdown.

2025-11-22

A Fresh Look at Analog Devices (ADI) Valuation After Recent Share Price Movement

Description: Analog Devices (ADI) stock has seen a modest move recently, drawing attention from investors curious about its current valuation. Some are weighing its recent performance patterns and considering what could come next for the semiconductor company. See our latest analysis for Analog Devices. Despite some short-term choppiness, Analog Devices’ 1-year total shareholder return of 10.1% and 46.6% over three years point to steady value creation, even as recent share price movement reflects shifting...

2025-11-21

Analog Devices to Participate in the UBS Global Technology Conference

Description: Analog Devices, Inc. (Nasdaq: ADI) today announced that the Company's Executive Vice President & Chief Financial Officer, Richard Puccio, will discuss business topics and trends at the UBS Global Technology Conference, taking place at the Phoenician Hotel, located in Scottsdale, Arizona on Tuesday, December 2, 2025, at 10:15 a.m. MST.

Deere Earnings, Inflation Data, Black Friday: What to Watch in the Next Week

Description: Before Thanksgiving travel and Black Friday shopping take the spotlight, a few notable earnings and economic reports lie ahead for investors. Here's what to watch for: This weekend G-20 summit: Leaders from major economies will meet in Johannesburg on Saturday and Sunday.

What Stocks Al Gore’s Investment Firm Bought and Sold This Quarter

Description: Generation Investment Management, the firm co-founded and chaired by former vice president Al Gore, made key changes to its holdings between the second and third quarters. The firm unloaded shares of Nike and Toast, initiated a new stake in Salesforce, and made several other moves. A Form 13-F filed with the Securities and Exchange Commission on Nov. 10 shows the firm exited Nike through the sale of 3,635,710 shares, worth $258 million at the time.

1 Profitable Stock to Target This Week and 2 Facing Headwinds

Description: While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

Analog Devices to Report Q4 Earnings: What's in Store for the Stock?

Description: ADI's Q4 results are likely to reflect a significant increase in revenues and EPS as industrial, communications and consumer demand gains offset broader macro pressures.

2025-11-20

Unveiling Analog Devices (ADI) Q4 Outlook: Wall Street Estimates for Key Metrics

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Analog Devices (ADI), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended October 2025.

Analog Devices Insiders Sold US$15m Of Shares Suggesting Hesitancy

Description: Over the past year, many Analog Devices, Inc. ( NASDAQ:ADI ) insiders sold a significant stake in the company which may...

2025-11-19

2025-11-18

2025-11-17

Profit Margins Point to Winners. 30 Stocks to Play Now.

Description: Toy maker Hasbro and other consumer stocks have lofty gross profit margins. So, unsurprisingly, do many big tech firms.

ADI Climbs 10.5% YTD: Should Investors Buy, Sell or Hold the Stock?

Description: Analog Devices' broad segment gains, margin strength and solid growth prospects raise the question of whether its recent 10.5% YTD climb makes it a hold.

2025-11-16

Analog Devices, Inc. (NASDAQ:ADI) is a favorite amongst institutional investors who own 89%

Description: Key Insights Institutions' substantial holdings in Analog Devices implies that they have significant influence over the...

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Saudi Arabia Radio Frequency Components Market Forecast Company Analysis Report 2025-2033 Featuring Analog Devices, Broadcom, Fujitsu, Gotmic, IQE, Knowles,MACOM, and Marki Microwave

Description: The Saudi Arabia Radio Frequency Components Market is poised for robust growth, increasing from USD 1.31 billion in 2024 to USD 4.11 billion by 2033, at a CAGR of 13.53% from 2025 to 2033. This surge is driven by advancements in telecommunications, the rising demand for wireless technologies, and the proliferation of IoT devices. Key market drivers include the accelerated rollout of 5G, growing consumer electronics demand, and government investments in smart infrastructure. Challenges include hi

Nvidia, Micron Lead Chip Selloff as Nasdaq Falls Ahead of Shutdown Talks

Description: Semiconductor Stocks Tumble: Nvidia, Micron Lead Sector Lower

2025-11-11

How Investors Are Reacting To Analog Devices (ADI) Expanding Embedded AI Tools With CodeFusion Studio 2.0

Description: Analog Devices recently launched CodeFusion Studio 2.0, a major upgrade to its open-source embedded development platform that introduces complete AI workflow support, model compatibility checks, and enhanced debugging tools for its processor and microcontroller portfolio. This move signals ADI's deepening commitment to developer-centric innovation in embedded AI, further strengthening its ecosystem for edge intelligence and streamlined AI deployment. We'll examine how the new AI-focused...

Lattice to Showcase Advanced Industrial and Edge AI Solutions at SPS 2025

Description: HILLSBORO, Ore., November 11, 2025--Lattice Semiconductor (NASDAQ: LSCC), the low power programmable leader, today announced its participation in the upcoming SPS 2025, taking place on November 25 – 27, 2025 in Nuremberg, Germany.

Analog Devices Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Analog Devices has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-10

BNP Paribas Spots Major Upside in Analog Devices, Inc. (ADI) Ahead of Earnings

Description: Analog Devices, Inc. (NASDAQ:ADI) is among the most profitable semiconductor stocks to buy. On Tuesday, November 4, BNP Paribas analyst David O’Connor initiated coverage on Analog Devices, Inc. (NASDAQ:ADI) with an ‘Outperform’ rating and a price target of $200. This positive outlook, implying a potential upside of around 33%, comes ahead of the company’s fiscal […]

Analog Devices (ADI) Stock Moves 1.54%: What You Should Know

Description: In the most recent trading session, Analog Devices (ADI) closed at $232, indicating a +1.54% shift from the previous trading day.

TaskUs Q3 Earnings Beat Estimates, Revenues Up Year Over Year

Description: TaskUs posts solid Q3 results with earnings and revenues surpassing estimates, driven by strong AI Services and Trust & Safety growth.

AI Optimism Powers Semiconductor Sales: 5 Stocks to Buy Now

Description: AI-driven demand is fueling a semiconductor surge, with SLAB, ADI, NVDA, ASML and AEIS all poised for strong growth.

Is Analog Devices, Inc. (NASDAQ:ADI) Potentially Undervalued?

Description: Analog Devices, Inc. ( NASDAQ:ADI ) received a lot of attention from a substantial price movement on the NASDAQGS over...

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Microchip Technology (MCHP) Q2 Earnings and Revenues Top Estimates

Description: Microchip Tech (MCHP) delivered earnings and revenue surprises of +6.06% and +0.75%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Is Analog Devices Still a Smart Bet After 11.7% Gain and Policy Headlines in 2025?

Description: Curious if Analog Devices is really worth its price tag? You are not alone. With markets constantly changing, it's smart to take a closer look at what you are getting for your money. After a strong run so far this year with an 11.7% gain, but with the last month dipping by 2.7%, the stock's recent moves may signal shifting investor confidence and fresh opportunities. In the past few weeks, the semiconductor industry has been in the spotlight as new US policy initiatives and sector-wide...

Fortinet Q3 Earnings & Revenues Surpass Estimates, Both Increase Y/Y

Description: FTNT posts strong Q3 gains with EPS and revenues topping estimates, driven by double-digit growth across segments.

Analog Devices, Inc. (ADI) is Attracting Investor Attention: Here is What You Should Know

Description: Zacks.com users have recently been watching Analog Devices (ADI) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2025-11-05

Astera Labs Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: ALAB posts a sharp Q3 earnings and revenue beat on soaring demand for its AI platform, yet shares slip in pre-market trading.

Analog Devices' Consumer Segment Improves: Is the Momentum Sustainable?

Description: ADI's consumer segment surges 21% YoY as strong demand in hearables, wearables, and gaming drives sustained growth momentum.

2025-11-04

Analog Devices (ADI) Dips More Than Broader Market: What You Should Know

Description: Analog Devices (ADI) closed the most recent trading day at $229.38, moving 1.81% from the previous trading session.

Analog Devices (ADI) Is Considered a Good Investment by Brokers: Is That True?

Description: Based on the average brokerage recommendation (ABR), Analog Devices (ADI) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

Analog Devices (NASDAQ:ADI) Might Be Having Difficulty Using Its Capital Effectively

Description: If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for...

2025-11-03

Analog Devices Unveils CodeFusion Studio™ 2.0 to Simplify and Accelerate Embedded AI Development

Description: Analog Devices, Inc. (Nasdaq: ADI), a global leader in semiconductor innovation, today launched CodeFusion Studio™ 2.0, a significant upgrade to its open source embedded development platform. Designed to simplify and accelerate the development of AI-enabled embedded systems, CodeFusion Studio 2.0 introduces advanced hardware abstraction, seamless AI integration and powerful automation tools to streamline the journey from concept to deployment across ADI's diverse processors and microcontrollers.

2025-11-02

2025-11-01

2025-10-31

Analog Devices (ADI): Is the Chipmaker Undervalued After Recent Share Price Dip?

Description: Analog Devices (ADI) stock is drawing attention this week, with prices easing slightly over the past month. Investors tracking the stock may be weighing recent performance, as ADI shares have slipped 5% in the same period. See our latest analysis for Analog Devices. While Analog Devices’ share price has softened over the past month, the bigger picture is more positive. After notching a 10.2% share price return year to date, and with a 6.2% total shareholder return over the last year, momentum...

2025-10-30

Balancing Bull and Bear Views

Description: It is Halloween. Should you be frightened, or not, by this rally?

2025-10-29

Analog Devices (ADI) and ASE Form Strategic Partnership in Penang, Malaysia

Description: Analog Devices, Inc. (NASDAQ:ADI) is included among the 13 Most Undervalued Dividend Stocks to Buy According to Wall Street Analysts. Analog Devices, Inc. (NASDAQ:ADI) designs and produces integrated circuits (ICs), software, and subsystems that process real-world data, supporting technologies across industries such as automotive, communications, healthcare, and industrial automation. On October 21, ASE Technology Holding […]

Analog Devices (ADI) Stock Moves -1.80%: What You Should Know

Description: Analog Devices (ADI) reached $235.04 at the closing of the latest trading day, reflecting a -1.8% change compared to its last close.

2025-10-28

Analog Devices (ADI) Balances R&D Leadership with Reliable Dividends

Description: Analog Devices, Inc. (NASDAQ:ADI) is included among the 10 Best Rising Dividend Stocks to Buy Now. Analog Devices, Inc. (NASDAQ:ADI) is a prominent company in the semiconductor industry, specializing in products designed to meet diverse market needs. The company primarily develops, designs, and manufactures high-performance analog, mixed-signal, and digital signal processing integrated circuits, which play […]

Analog Devices' Q4 2025 Earnings: What to Expect

Description: Analog Devices will release its fourth-quarter earnings next month, and analysts anticipate a double-digit bottom-line growth.

Estimating The Intrinsic Value Of Analog Devices, Inc. (NASDAQ:ADI)

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, Analog Devices fair value estimate is US$210 Current share...

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Does Analog Devices' (ADI) New Power Studio Suite Signal a Digital Edge in Competitive Sectors?

Description: Earlier this month, Analog Devices introduced the ADI Power Studio suite, featuring new web-based tools, Power StudioPlanner and Power StudioDesigner, for interactive power architecture and supply design to accelerate customer development cycles and bring power-dense systems to market faster. This launch signals Analog Devices' push to enhance digital workflows and engineering productivity at a time when efficient power system development is becoming increasingly important for customers in...

2025-10-23

Why Analog Devices (ADI) Outpaced the Stock Market Today

Description: In the latest trading session, Analog Devices (ADI) closed at $243.29, marking a +1.22% move from the previous day.

Analog Devices, Inc. to Report Fourth Quarter Fiscal Year 2025 Financial Results on Tuesday, November 25, 2025

Description: Analog Devices, Inc. (Nasdaq: ADI) today announced it will release financial results for the fourth quarter fiscal year 2025 at 7:00 a.m. Eastern time on Tuesday, November 25, 2025. Following the press release, the Company will host a conference call at 10:00 a.m. Eastern time, the same day. Vincent Roche, Chief Executive Officer and Chair, Richard Puccio, Executive Vice President and Chief Financial Officer, and Jeff Ambrosi, Head of Investor Relations, Senior Director, will discuss ADI's resul

2025-10-22

Analog Devices (ADI) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Description: In the latest trading session, Analog Devices (ADI) closed at $240.36, marking a -2.44% move from the previous day.

Lam Research expects upbeat quarterly revenue on demand for chipmaking tools

Description: Lam Research forecast second-quarter revenue above Wall Street estimates on Wednesday, as chipmakers ordered more of its equipment used to manufacture semiconductors for artificial intelligence applications. Shares of the Fremont, California-based company rose 2.2% in trading after the bell. The stock has doubled so far this year, supported by strong demand for AI semiconductors as chip designers seek equipment to create processors capable of meeting growing computing needs.

Why Analog Devices (ADI) Stock Is Trading Lower Today

Description: Shares of manufacturer of analog chips Analog Devices (NASDAQ:ADI) fell 2.7% in the morning session after a broader sell-off in the semiconductor industry was triggered by a weak revenue forecast from competitor Texas Instruments.

Texas Instruments Issues 'Surprise' Q4 EPS Guidance Below Expectations, Morgan Stanley Says

Description: Texas Instruments (TXN) reported late Tuesday mixed Q3 results and issued Q4 guidance that was label

Texas Instruments Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: TXN beats Q3 estimates with 14% revenue growth and solid Analog demand, signaling steady momentum into Q4.

TI shares slide as bleak outlook signals prolonged chip market slump

Description: (Reuters) -Shares of Texas Instruments fell 6% on Wednesday, after the chipmaker's downbeat fourth-quarter profit and revenue outlook deepened worries over a drawn-out recovery in the analog chip market as tariff uncertainty plagues the wider industry. Unresolved regulatory and tariff rules are driving customer hesitancy, even as TI reduced some of its business exposure to the Trump administration's levies through trade deals. Shares of On Semiconductor, NXP Semiconductors and Analog Devices were down 2% to 3% in morning trading.

2025-10-21

Zacks Industry Outlook Highlights Analog Devices, ON Semiconductor and NXP Semiconductor

Description: Analog Devices, ON Semiconductor, and NXP Semiconductor stand out as Zacks spotlights steady growth across the resilient analog chip sector.

ASE and Analog Devices Announce Strategic Collaboration

Description: PENANG, Malaysia & WILMINGTON, Mass., October 21, 2025--ASE Technology Holding Co., Ltd. (NYSE: ASX, TAIEX: 3711), and Analog Devices, Inc. (NASDAQ: ADI), today announced strategic joint efforts in Penang, Malaysia with the signing of a binding Memorandum of Understanding.

2025-10-20

Analog Devices, onsemi & NXP Ride Semiconductor Growth Wave

Description: ADI, ON and NXPI look poised for long-term upside as AI, EV and industrial tailwinds keep analog chip demand growing despite tariff headwinds.

Zacks.com featured highlights include Red Robin Gourmet Burgers, 10x Genomics, Norwegian Cruise Line, Electromed and Analog Devices

Description: Zacks spotlights five efficient stocks Red Robin, 10x Genomics, Norwegian Cruise Line, Electromed, and Analog Devices that excel in turning assets and operations into profits.

2025-10-19

2025-10-18

2025-10-17

5 Must-Buy Efficient Stocks to Increase Your Portfolio Returns

Description: From Red Robin to Analog Devices, these five high-efficiency stocks stand out for their strong ratios and surprise earnings potential.

Is Analog Devices Still Attractive After Strong Year to Date Gains in 2025?

Description: If you’ve got Analog Devices on your watchlist and are wondering whether now’s a smart time to buy, hold, or take profits, you’re not alone. The stock has seen its fair share of movement lately, and there are a few layers to unpack before making your next move. In the last week, shares ticked up by 1.6%, adding a bit of optimism to the mix. That’s on top of a robust 14.3% gain year-to-date, and a long-term return of 111.5% over five years. While the past month dipped modestly by 1.0%, the...