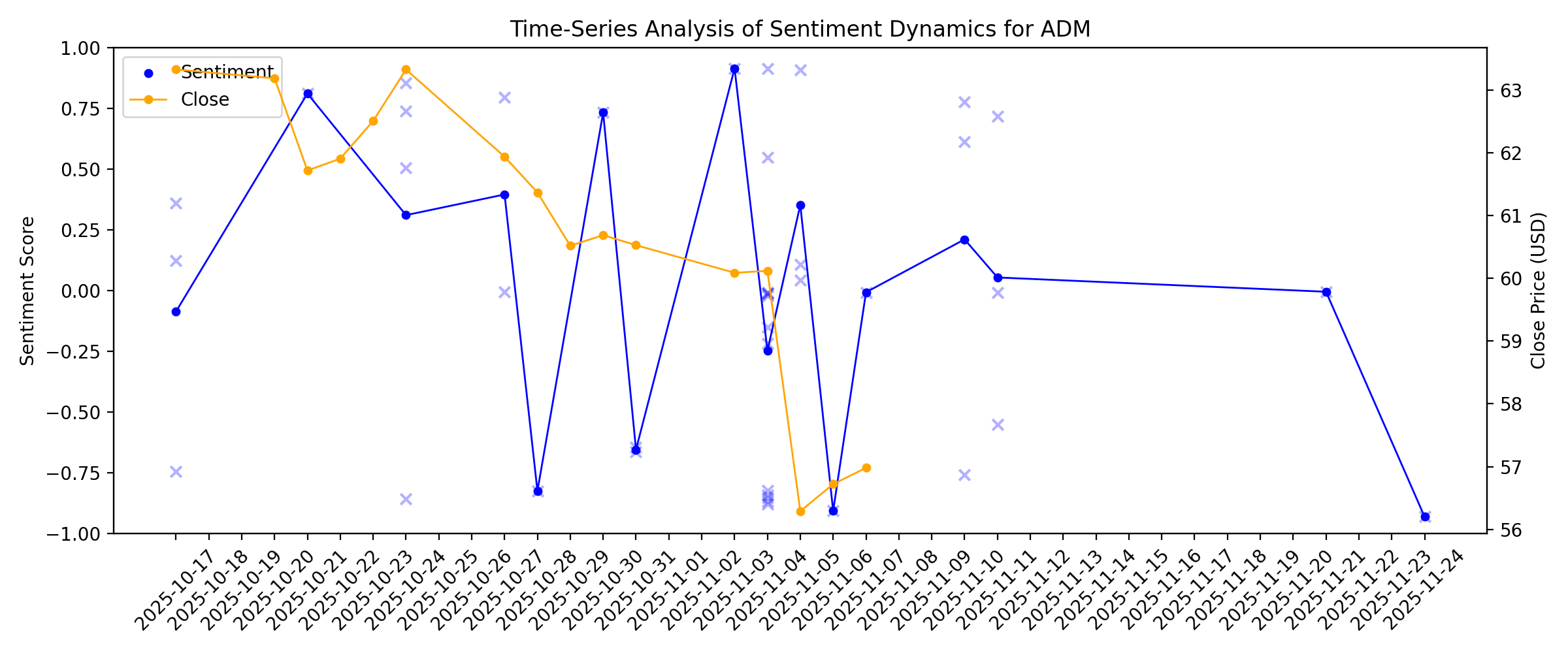

News sentiment analysis for ADM

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

ADM to Release Fourth Quarter Financial Results on Feb. 3, 2026

Description: CHICAGO, January 12, 2026--ADM (NYSE: ADM) today announced that ADM management will host an audio webcast on Tuesday, February 3, 2026, at 7:30 a.m. Central Time to discuss financial results for its fourth quarter of 2025 and provide a company update. Prior to the call, ADM will issue a press release and related presentation, which will be made available at ADM - Investor Relations.

2026-01-11

2026-01-10

2026-01-09

Archer Daniels Midland (ADM) Outpaces Stock Market Gains: What You Should Know

Description: Archer Daniels Midland (ADM) closed at $61.94 in the latest trading session, marking a +1.23% move from the prior day.

How Recent Moves Are Rewriting The Story For Archer Daniels Midland ADM

Description: Archer Daniels Midland just saw its fair value estimate edge to about US$57.09 per share, a very small change that keeps the stock in roughly the same price range even as the story around its earnings outlook becomes more debated. With Q3 earnings ahead of estimates and a fresh US$59 price target from JPMorgan, the latest update reflects a balance between support from recent results and caution around profit headwinds that analysts continue to flag. Read on to see how you can keep track of...

2026-01-08

Is the Options Market Predicting a Spike in Archer-Daniels-Midland Stock?

Description: Investors need to pay close attention to ADM stock based on the movements in the options market lately.

2026-01-07

2026-01-06

Archer Daniels Midland (ADM) Rises Higher Than Market: Key Facts

Description: In the most recent trading session, Archer Daniels Midland (ADM) closed at $60.49, indicating a +1.53% shift from the previous trading day.

Archer-Daniels-Midland’s Quarterly Earnings Preview: What You Need to Know

Description: Archer-Daniels-Midland is expected to release its fiscal fourth-quarter earnings soon, and analysts project an earnings decline.

2026-01-05

Is Archer-Daniels-Midland (ADM) Pricing Reflect Its Mixed Returns And Cash Flow Outlook

Description: Wondering if Archer-Daniels-Midland is offering fair value at today's price, or if there is a discount hiding in plain sight for long term investors? The stock closed at US$59.05, with returns of 1.4% over the last 7 days, 0.1% over the last 30 days, 0.0% year to date, 23.6% over 1 year, a 23.8% decline over 3 years and 30.4% over 5 years. Taken together, these figures give you a mixed picture of how the market has been reassessing the company over different time frames. These moves sit...

Is Morgan Stanley’s Downgrade and 2025 Earnings Cut Altering The Investment Case For Archer-Daniels-Midland (ADM)?

Description: Morgan Stanley recently downgraded Archer-Daniels-Midland (ADM) to Underweight, pointing to regulatory delays, weaker margins in its Carbohydrate Solutions unit, and a reduced 2025 profit outlook amid US biofuel policy uncertainty and global trade disruptions. This marks ADM’s third consecutive cut to its 2025 earnings guidance and its weakest projected earnings since 2019, highlighting how policy and margin pressures are weighing on one of the world’s largest agricultural processors. We’ll...

Gevo Strengthens Operational Leadership Amid Ongoing Growth and Succession Planning

Description: ENGLEWOOD, Colo., Jan. 05, 2026 (GLOBE NEWSWIRE) -- Gevo, Inc. (NASDAQ: GEVO), a leader in renewable fuels and chemicals, and carbon management, today announced the addition of agricultural industry veteran Greg Hanselman as executive vice president, operations and engineering. Mr. Hanselman’s hire is part of Gevo’s ongoing growth and succession planning, as Chris Ryan, Gevo’s long-time chief operating officer, is planning to retire from the company in June of 2026. Mr. Hanselman comes to Gevo f

New Strong Sell Stocks for January 5th

Description: CHMG, ADM and CLCO have been added to the Zacks Rank #5 (Strong Sell) List on January 5th, 2026.

2026-01-04

2026-01-03

2026-01-02

Regulatory Delays and Weakening Margins Weigh on Morgan Stanley’s ADM Outlook

Description: Archer-Daniels-Midland Company (NYSE:ADM) is included among the 12 Best Income Stocks to Buy Now. On December 16, Morgan Stanley analyst Steven Haynes downgraded Archer-Daniels-Midland Company (NYSE:ADM) to Underweight from Equal Weight and cut the price target to $50 from $57. The firm said expectations tied to the Environmental Protection Agency’s renewable volume obligation now stretch […]

2026-01-01

2025-12-31

Archer Daniels Midland (ADM) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Description: In the most recent trading session, Archer Daniels Midland (ADM) closed at $57.49, indicating a -1.17% shift from the previous trading day.

New Strong Sell Stocks for December 31st

Description: ADM, AVVIY and EMN have been added to the Zacks Rank #5 (Strong Sell) List on December 31, 2025.

2025-12-30

Archer-Daniels-Midland (NYSE:ADM) Reports Sales Below Analyst Estimates In Q3 CY2025 Earnings

Description: Agricultural supply chain giant Archer-Daniels-Midland (NYSE:ADM) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 2.2% year on year to $20.37 billion. Its non-GAAP profit of $0.92 per share was 7.9% above analysts’ consensus estimates.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

The Bruising Reality of Searching for a Job at 65

Description: KERSHAW, S.C.— Lynn Lee had just arrived for work at the ADM soybean processing plant one April morning when she spotted the cars with out-of-state license plates and knew something was wrong. Over the next 29 years, she worked packing, inspection and scheduling jobs for Springs Industries, whose textile plants were scattered across the area.

New Strong Sell Stocks for Dec. 26

Description: ADM, ASBFY and BMRRY have been added to the Zacks Rank #5 (Strong Sell) List on Dec.26, 2025

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Assessing ADM Stock Value After 16% 2025 Rally and DCF Premium Insight

Description: Wondering if Archer-Daniels-Midland is quietly turning into a value play while everyone is distracted by flashier names? This breakdown is designed to help you decide if ADM deserves a spot on your watchlist or in your portfolio. The stock has slipped 2.9% over the last week and is roughly flat over 30 days, yet it is still up 16.0% year to date and 19.9% over the past year, a recovery that stands in contrast to its 32.2% drop over three years and 35.4% gain over five years. Behind these...

Assessing Archer-Daniels-Midland’s (ADM) Valuation After Its Recent Share Price Rebound

Description: Archer-Daniels-Midland (ADM) has quietly outperformed the broader market this year, and that steady climb is catching investors attention as they reassess the stock after a tough past 3 years. See our latest analysis for Archer-Daniels-Midland. That improvement lines up with Archer-Daniels-Midland’s shift from a rough patch to steadier footing, with a year to date share price return of 15.97% contrasting a still weak three year total shareholder return of negative 32.21%, which suggests that...

2025-12-20

2025-12-19

New Strong Sell Stocks for Dec. 19

Description: ARR, ADM and BCC have been added to the Zacks Rank #5 (Strong Sell) List on Dec. 19, 2025.

2025-12-18

2025-12-17

Archer Daniels Midland (ADM) Increases Despite Market Slip: Here's What You Need to Know

Description: Archer Daniels Midland (ADM) closed at $58.56 in the latest trading session, marking a +1% move from the prior day.

New Strong Sell Stocks for Dec. 17

Description: AVNS, ADM and OZK have been added to the Zacks Rank #5 (Strong Sell) List on Dec. 17, 2025.

2025-12-16

Mission Produce Faces Headwinds Before Q4 Earnings: Buy, Hold or Sell?

Description: AVO prepares to post Q4 results with expected sales and EPS declines, facing tariff uncertainties, softer demand and margin challenges despite volume gains.

How Morgan Stanley’s Downgrade and Guidance Cut Will Impact Archer-Daniels-Midland (ADM) Investors

Description: Morgan Stanley recently downgraded Archer-Daniels-Midland from Equalweight to Underweight, citing persistent underperformance in its Crushing unit, ample global supplies, trade uncertainties, and delays in Renewable Volume Obligation decisions, while the company cut full-year EPS guidance to US$3.25–US$3.50 despite a prior quarterly earnings beat. At the same time, Archer-Daniels-Midland maintained its 94-year streak of uninterrupted dividend payments, underscoring management’s commitment to...

2025-12-15

2025-12-14

2025-12-13

2025-12-12

REX: 21 Profitable Quarters in a Row and Expansion Momentum Ahead — Quarterly Update Report

Description: Download the Complete Report Here By Brandon Hornback REX American Resources Corp. (NYSE: REX) continued its long-running winning of streak, making it 21 straight profitable quarters. Ethanol volumes edged higher and operational discipline helped offset softer pricing, reinforcing REX’s position as one of the sector’s most reliable performers. Growth investments remain firmly on track: The […]

2025-12-11

Archer Daniels Midland (ADM) Beats Stock Market Upswing: What Investors Need to Know

Description: In the most recent trading session, Archer Daniels Midland (ADM) closed at $59.92, indicating a +2.94% shift from the previous trading day.

With Trump Watching, Coke Makes Clear Its New CEO Is American

Description: Now, the beverage giant wants you to know that its new chief is a real American. In Wednesday’s press release announcing that Henrique Braun would succeed James Quincey as the company’s top executive, Coca-Cola said Braun “is an American citizen who was born in California and raised in Brazil.”

New Strong Sell Stocks for December 11th

Description: CBT, ADM and BCC have been added to the Zacks Rank #5 (Strong Sell) List on December 11, 2025.

2025-12-10

2025-12-09

2025-12-08

Trump Will Give Farmers $12 Billion. The Stocks That Could Get a Boost—Ones That Won’t.

Description: President Donald Trump is going to help American farmers. It might not help American investors, though—shares of agricultural equipment makers were falling after his remarks. Monday, Trump announced $12 billion in aid to U.S. farmers, who are beset by rising costs and trade uncertainty, including $11 billion in “bridge” payments.

Archer-Daniels-Midland Stock: Is ADM Outperforming the Consumer Staples Sector?

Description: Archer-Daniels-Midland has outperformed the Consumer Staples sector over the past year, but analysts are cautious about the stock’s prospects.

2025-12-07

Is ADM Still Attractive After a 17.5% Year to Date Rally in 2025?

Description: Wondering if Archer-Daniels-Midland is quietly turning into a value opportunity while everyone looks elsewhere? Here is a closer look at what the recent share price and fundamentals are really telling us. ADM's stock has slipped 2.8% over the last week but is still up 3.6% over the past month, which suggests some short term volatility. Zooming out, the shares are up 17.5% year to date and 19.2% over the last year, even after a 29.3% slide over three years and a 36.2% gain over...

2025-12-06

Assessing Archer-Daniels-Midland (ADM) Stock’s Valuation After Its Strong Year-to-Date Share Price Gain

Description: Archer-Daniels-Midland (ADM) has quietly outperformed this year, with the stock up about 18% year to date and roughly 19% over the past year, even after a recent pullback. See our latest analysis for Archer-Daniels-Midland. That recent 1 month share price return of 4.8% looks more like a reset than a breakout, but it still caps an impressive year to date run as investors reassess Archer-Daniels-Midland's earnings resilience and risk profile. If ADM has you thinking about where else momentum...

2025-12-05

Scotts (SMG) Down 3.1% Since Last Earnings Report: Can It Rebound?

Description: Scotts (SMG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Herbal Supplements Market Trends, Business Opportunities and Growth Outlook 2025-2030 Featuring Glanbia, Archer Daniels Midland, Nutramarks and Other Key Players

Description: Dublin, Dec. 05, 2025 (GLOBE NEWSWIRE) -- The "Herbal Supplements Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2020-2030F" has been added to ResearchAndMarkets.com's offering. The Global Herbal Supplements Market, valued at USD 88.96 Million in 2024, is projected to grow at a CAGR of 9.31% to reach USD 151.77 Million by 2030. Market growth is primarily driven by rising global consumer interest in natural and preventive health solutions and increasing awareness of the

New Strong Sell Stocks for Dec.5

Description: ALVO, ADM and ASBFY have been added to the Zacks Rank #5 (Strong Sell) List on Dec. 5, 2025

2025-12-04

ADM (ADM) Up 6.2% Since Last Earnings Report: Can It Continue?

Description: ADM (ADM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

New Strong Sell Stocks for Dec.3

Description: ALG, ADM and ASBFY have been added to the Zacks Rank #5 (Strong Sell) List on Dec. 3, 2025

2025-12-02

2025-12-01

2025-11-30

Here's What To Make Of Archer-Daniels-Midland's (NYSE:ADM) Decelerating Rates Of Return

Description: To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will...

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

ADM to Present at 2025 Goldman Sachs Industrials & Materials Conference

Description: CHICAGO, November 24, 2025--ADM (NYSE: ADM) will present at the 2025 Goldman Sachs Industrials & Materials Conference on Wednesday, Dec. 3, in New York City. The company will participate in a fireside chat at 3:30 p.m. Eastern Time.

2025-11-23

2025-11-22

2025-11-21

Mission Produce Slips Below 200-Day SMA: Growth Ahead or Caution?

Description: AVO is trading below its 200-day SMA as weakening momentum, margin pressures and volatile pricing weigh on sentiment.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

Investing in Resilience: How Extreme Weather Is Reshaping Infrastructure Investment and Risk

Description: By Jon Solorzano, Alan Alexander, and Mark Brasher Across sectors and jurisdictions, the data point to a world facing more frequent and intense physical disruptions. Extreme heat, heavy rainfall, rising sea levels, and prolonged droughts are no longer regional anomalies; they are macroeconomic factors shaping markets, policy, and investment strategy. The economic toll is mounting: […] The post Investing in Resilience: How Extreme Weather Is Reshaping Infrastructure Investment and Risk appeared f

Can ADM's (ADM) Carbon Capture Expansion Alter Its Profit Margins and Long-Term Strategy?

Description: Earlier this month, Archer-Daniels-Midland (ADM) opened a new carbon capture and storage facility at its Columbus, Nebraska Corn Processing Complex, utilizing Tallgrass's Trailblazer pipeline to permanently store captured CO2 underground in Wyoming. This project places the Nebraska site among the world’s largest bioethanol carbon capture operations and highlights ADM’s continued push towards sustainable technology adoption in its core business. We'll now examine how ADM's expansion into...

JPMorgan Downgrades Archer Daniels (ADM) to Underweight, Cuts Price Target to $59

Description: Archer-Daniels-Midland Company (NYSE:ADM) is included among the 15 Best Dividend Growth Stocks to Buy Now. On November 4, JPMorgan downgraded Archer-Daniels-Midland Company (NYSE:ADM) to Underweight from Neutral and reduced its price target to $59 from $61, as reported by The Fly. The firm noted that while the company’s third-quarter earnings surpassed estimates, the lowered guidance […]

2025-11-10

ADM, Tallgrass Celebrate Opening of World’s Largest Bioethanol Carbon Capture Facility in Columbus, Nebraska

Description: COLUMBUS, Neb., November 10, 2025--ADM (NYSE: ADM), a global leader in innovative solutions from nature, today marked the start of operations for a new carbon capture and storage project at its Columbus, Nebraska Corn Processing Complex, making the complex the largest bioethanol carbon capture facility in the world.

Ginger Market Competitive Analysis Report 2025: Key Players, Recent Developments, Strategies, Sustainability, Product Launches, Key Persons, and Revenue Forecasts to 2033

Description: The global ginger market is projected to grow substantially, from USD 4.41 billion in 2024 to USD 7.50 billion by 2033, with a CAGR of 6.08% from 2025-2033. The rise in demand across food, health, and traditional medicine sectors propels this growth. Notable companies in this expanding market include Archer Daniels Midland, Kerry Group, Olam International, and Nestle. Driven by innovations and sustainability efforts, key players are optimizing their supply chains and enhancing product offerings.

New Strong Sell Stocks for Nov. 10

Description: ADM, ASBFY and BUR have been added to the Zacks Rank #5 (Strong Sell) List on Nov.10, 2025

2025-11-09

2025-11-08

2025-11-07

Are Wall Street Analysts Predicting Archer-Daniels-Midland Stock Will Climb or Sink?

Description: Agriculture giant Archer-Daniels-Midland has lagged behind the broader market over the past year, and analysts remain cautious about the stock’s prospects.

2025-11-06

ADM Declares Cash Dividend

Description: CHICAGO, November 06, 2025--ADM’s (NYSE: ADM) Board of Directors has declared a cash dividend of 51.0 cents per share on the company’s common stock. The dividend is payable on Dec. 11, 2025, to shareholders of record on Nov. 19, 2025.

2025-11-05

A Fresh Look at Archer-Daniels-Midland (ADM) Valuation After Recent Share Price Strength

Description: Archer-Daniels-Midland (ADM) stock has seen some movement recently, and investors may be watching the company’s performance metrics for fresh signals. A review of ADM’s recent returns can offer insight into current sentiment. See our latest analysis for Archer-Daniels-Midland. ADM’s share price has drifted slightly over the past month but remains near recent highs, and momentum is building. Year-to-date share price return stands at nearly 20%, with total shareholder return topping 20% over...

ADM (NYSE:ADM) Profit Margin Decline Undercuts Bullish Narratives in Latest Earnings

Description: Archer-Daniels-Midland (ADM) reported revenue growth forecast at just 1.7% per year, trailing behind the broader US market’s estimated 10.5% annual growth rate. Earnings are expected to climb 10.7% per year moving forward, but this still lags the US market’s 16% pace, while the company’s net profit margin narrowed to 1.4% from 2.1% a year ago. With earnings having declined at a 4.9% annual rate over the past five years and shares trading above an estimated fair value ($60.12 against a...

Pinterest downgraded, Tractor Supply upgraded: Wall Street's top analyst calls

Description: Pinterest downgraded, Tractor Supply upgraded: Wall Street's top analyst calls

2025-11-04

Archer-Daniels-Midland Co (ADM) Q3 2025 Earnings Call Highlights: Navigating Challenges and ...

Description: Despite headwinds in the Ag Services and Oilseeds segment, ADM's Nutrition segment shines with significant growth and strategic ventures.

ADM Q3 Earnings Beat Estimates, Revenues Increase 2.2% Y/Y

Description: Archer Daniels' Q3 earnings top estimates despite lower profits, as revenue gains in Ag Services and Nutrition offset weakness elsewhere.

Archer Daniels Midland Cuts Outlook on Margin Pressure

Description: Archer Daniels Midland cut its full-year earnings outlook, citing pressured margins, despite logging higher profit and revenue in the third quarter as it continues to operate in a dynamic environment.

Earnings Data Deluge

Description: Earnings Data Deluge

ADM cuts guidance, awaits China trade deal ‘clarity’

Description: The grain trader’s CFO said the “evolving trade landscape” affected Q3 demand for its key agriculture services and oilseeds business.

Soybean-Market Uncertainty Strikes ADM

Description: Weaker soybean prices are hurting Archer Daniels Midland’s business. Bumper crops in North and South America are filling grain elevators. China’s limited purchases of soybeans from the U.S. this year have created a supply glut, pressuring crop prices.

Pre-markets Sell Off on No New Economic News

Description: This morning was to bring us new U.S. Trade Deficit figures, Factory Orders and JOLTS, but due to the government shutdown are not out.

Major Tesla investor opposes Musk's $1T pay, ADM & BP earnings

Description: Morning Brief host Julie Hyman examines what's driving interest in some of Tuesday's trending tickers, including Tesla (TSLA), ADM (ADM), and BP (BP). To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

Here's What Key Metrics Tell Us About ADM (ADM) Q3 Earnings

Description: Although the revenue and EPS for ADM (ADM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Stocks Down Pre-Bell Ahead of Latest Round of Corporate Earnings

Description: US equity futures were trending lower on Tuesday as traders await the latest batch of corporate earn

Archer Daniels Midland (ADM) Tops Q3 Earnings Estimates

Description: ADM (ADM) delivered earnings and revenue surprises of +3.37% and -1.38%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

ADM: Q3 Earnings Snapshot

Description: CHICAGO (AP) — Archer Daniels Midland Co. (ADM) on Tuesday reported third-quarter net income of $108 million. On a per-share basis, the Chicago-based company said it had net income of 22 cents. Earnings, adjusted for asset impairment costs and non-recurring costs, were 92 cents per share.

ADM Reports Third Quarter 2025 Results

Description: CHICAGO, November 04, 2025--ADM (NYSE: ADM) today reported financial results for the quarter ended September 30, 2025.

2025-11-03

Top Dividend Stocks To Consider In November 2025

Description: As October 2025 comes to a close, the U.S. stock market has shown resilience, with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly gains. In this environment of robust market performance, dividend stocks continue to attract attention for their potential to provide steady income streams alongside capital appreciation. A good dividend stock in such conditions typically combines a reliable payout history with strong fundamentals that can...

2025-11-02

2025-11-01

2025-10-31

Stock Market Week Ahead: October Marks A 7-Year Best For The Nasdaq

Description: After the Nasdaq sets a seven-year record, a slew of high flying stocks report in the coming week. Plus there's a bonus day from Tesla.

ADM (ADM) Q3 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Description: Beyond analysts' top-and-bottom-line estimates for ADM (ADM), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.

2025-10-30

Can Archer Daniels' Q3 Earnings Beat Despite Tough Market Conditions?

Description: ADM faces margin and demand headwinds in Ag Services and Oilseeds, but growth in Nutrition is likely to have helped its Q3 performance.

2025-10-29

2025-10-28

Analysts Estimate Archer Daniels Midland (ADM) to Report a Decline in Earnings: What to Look Out for

Description: ADM (ADM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

Archer Daniels Midland (ADM) Stock Drops Despite Market Gains: Important Facts to Note

Description: The latest trading day saw Archer Daniels Midland (ADM) settling at $61.94, representing a -2.19% change from its previous close.

Archer-Daniels-Midland’s Q3 2025 Earnings: What to Expect

Description: Archer-Daniels-Midland is expected to announce its third-quarter results next month, and the market anticipates its bottom line will fall by lower-double digits.

2025-10-26

2025-10-25

2025-10-24

Short line CEO joins STB rail advisory council

Description: The Surface Transportation Board has added another executive to its industry advisory council. The post Short line CEO joins STB rail advisory council appeared first on FreightWaves.

United States Artificial Sweetener Market Report 2025-2033 Featuring Tate & Lyle, Cargill, Archer Daniels Midland, DuPont de Nemours, Ajinomoto, Ingredion, GLG Life Tech

Description: Growth is driven by rising health awareness, increased demand for low-calorie sweeteners, and expanding applications in food, beverages, and pharmaceuticals. As consumers seek to reduce sugar intake due to health concerns like diabetes and obesity, artificial sweeteners are gaining popularity for their low-calorie benefits. Key market players such as Tate & Lyle, Cargill, and DuPont are innovating to meet the demand for sugar alternatives. California, Texas, New York, and Florida are leading mar

United States Sugar Market Forecast and Company Analysis Report 2025-2033 Featuring Archer Daniels Midland, Tate and Lyle, General Mills, MGP Ingredients, Kerry Group, Sudzucker, Tereos, Cosan

Description: The United States sugar market is projected to experience robust growth, increasing from $20.54 billion in 2024 to $32.49 billion by 2033 with a CAGR of 5.23%. Key drivers include rising consumer demands, evolving dietary habits, and broadened sugar applications across food and beverage sectors. Sugar, primarily sucrose from sugarcane and sugar beets, remains integral to U.S. food systems. The market faces challenges from health trends steering consumers towards sugar alternatives and price vola

United States Vegetable Oil Market Forecast and Company Analysis Report 2025-2033 Featuring ADM, Wilmar, AAK, Unilever, Bunge, Cargill, Sime Darby, Associated British Foods

Description: The United States Vegetable Oil Market, projected to grow from US$ 96.07 billion in 2024 to US$ 139.48 billion by 2033 at a CAGR of 4.23%, is driven by rising consumer demand, food processing industries, and the versatility of plant-based oils like soybean, canola, and sunflower. Key regional markets include California, Texas, New York, and Florida, which are boosted by industrial diversification and plant-based dietary trends. Challenges like price volatility and environmental concerns persist,

2025-10-23

2025-10-22

2025-10-21

Archer Daniels Midland (ADM) Stock Moves -2.33%: What You Should Know

Description: Archer Daniels Midland (ADM) reached $61.72 at the closing of the latest trading day, reflecting a -2.33% change compared to its last close.

2025-10-20

2025-10-19

2025-10-18

2025-10-17

Market Chatter: Archer-Daniels-Midland Offers Free Deferred Pricing to US Soybean Farmers

Description: Archer-Daniels-Midland (ADM) is offering free deferred pricing to US soybean farmers, allowing them

Stock Markets Are Gripped by Bank Loan Fears. Why the Fed Should Be in Focus.

Description: More credit “cockroaches” could be lurking at banks, Oracle fights low-margin cloud claims, U.S. and China still open to talks on trade, and more news to start your day.

Examining the Value of ADM Stock After 25% Gain and Strong Q1 Earnings in 2025

Description: Thinking about what to do next with Archer-Daniels-Midland stock? You are not alone. ADM just wrapped up a solid few months on the market, with a striking 25.2% gain year-to-date. While short-term pops like last week’s 2.6% return catch headlines, the longer-term picture is a bit more nuanced. The stock is up almost 40% over the past five years, but down nearly 22% over the past three. Investors have been weighing changes in global demand and volatility in agricultural commodity prices, all...