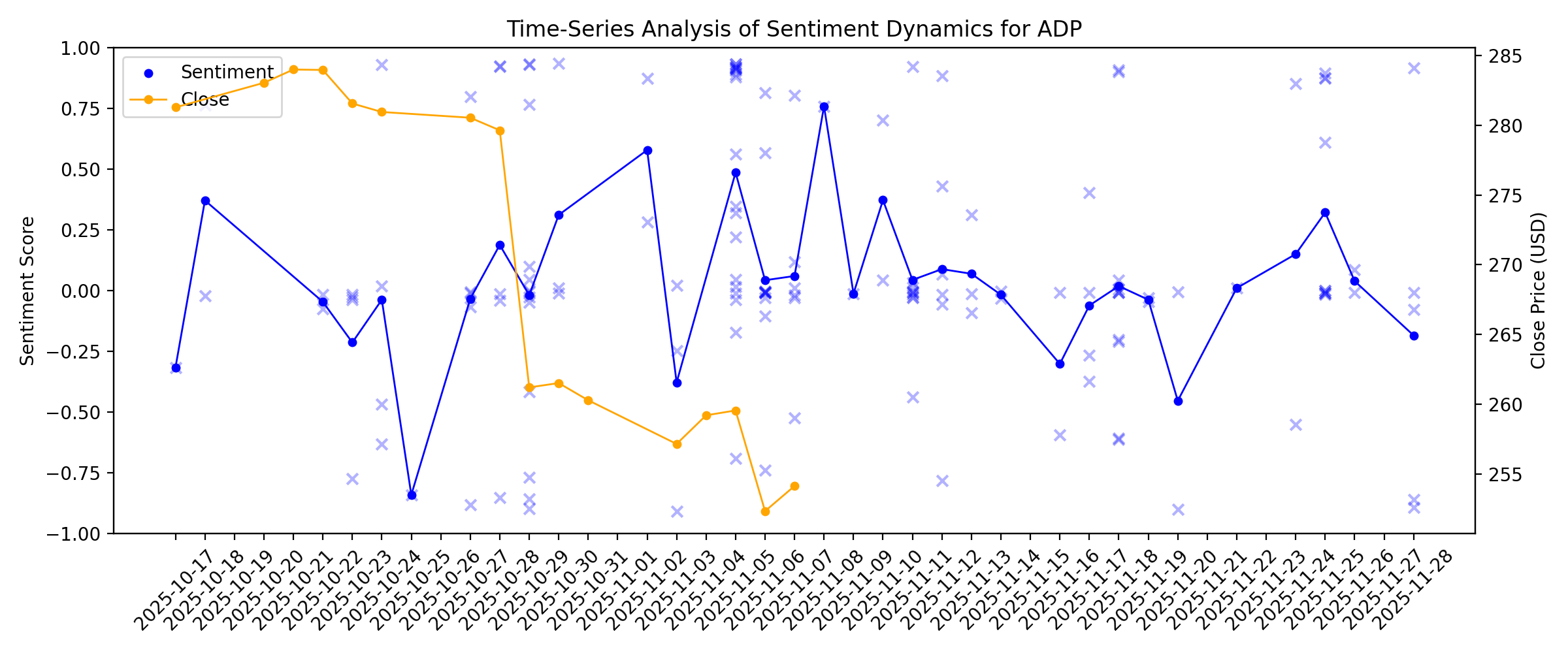

News sentiment analysis for ADP

Sentiment chart

2026-01-14

ADP AUTHORIZED TO PURCHASE $6 BILLION OF ITS COMMON STOCK

Description: Automatic Data Processing, Inc. (Nasdaq: ADP), a global leader in HR and payroll solutions, announced today that the ADP Board of Directors authorized the purchase of $6 billion of its common stock.

ADP Declares Regular Quarterly Dividend

Description: The board of directors of Automatic Data Processing, Inc. (Nasdaq: ADP) has declared a regular quarterly dividend of $1.70 per share payable April 1, 2026 to shareholders of record on March 13, 2026.

2026-01-13

How The Story Behind Automatic Data Processing (ADP) Is Shifting With New Analyst Targets

Description: Automatic Data Processing is back in focus as analysts update their narrative around the stock, highlighted by a fresh change in its price target. This article looks at what that new target could be telling you about shifting expectations and how the story around ADP is evolving. Stay with this piece to see how you can keep on top of these narrative changes as they unfold. Stay updated as the Fair Value for Automatic Data Processing shifts by adding it to your watchlist or portfolio...

ADP National Employment Report Preliminary Estimate December 20, 2025

Description: For the four weeks ending December 20, 2025, U.S. private employers added an average of 11,750 jobs per week, according to the NER Pulse, a weekly update of the monthly ADP National Employment Report (NER).

2026-01-12

Top Stocks From the Staffing Services Industry to Buy Now

Description: PCTY, HQI, and ADP highlight top staffing stocks as AI-driven HR platforms, flexible hiring and workforce solutions fuel investor interest.

Automatic Data Processing (ADP) Fell Due to Weakness in the US Job Market

Description: Fundsmith, an investment management firm based in London, has released its annual 2025 investor letter for its “Fundsmith Equity Fund.” A copy of the letter can be downloaded here. The fund focuses on investing in equities globally. The T Class Accumulation shares where the firm invested returned 0.8% in 2025, compared to 12.8% for the […]

Bond Traders’ Big Bet for 2026 Vindicated by Soft US Job Growth

Description: A much-anticipated employment report on Friday showed job growth was below forecasts last month, leaving intact expectations for additional Fed interest-rate cuts to support the economy. The result confirmed confidence in bets that short-maturity Treasuries, which are the most sensitive to the central bank’s policy, will outpace their longer-term counterparts this year, widening the yield gap between those maturities. The gap between 2- and 10-year Treasury yields reached the largest in almost nine months last week.

2026-01-11

Bond Traders’ Big Bet for 2026 Vindicated by Soft US Job Growth

Description: A much-anticipated employment report on Friday showed job growth was below forecasts last month, leaving intact expectations for additional Fed interest-rate cuts to support the economy. The result confirmed confidence in bets that short-maturity Treasuries, which are the most sensitive to the central bank’s policy, will outpace their longer-term counterparts this year, widening the yield gap between those maturities. The gap between 2- and 10-year Treasury yields reached the largest in almost nine months last week.

Is ADP’s (ADP) 51-Year Dividend Streak Still Justified by Its Evolving Labor-Market Insights?

Description: Automatic Data Processing’s latest ADP National Employment Report showed private-sector payrolls rising by 41,000 in December, alongside mixed sector trends that highlighted strength in services and ongoing softness in goods-producing and white-collar roles. At the same time, ADP is drawing attention for its upcoming second-quarter earnings release and its 51-year dividend growth streak, underscoring its role as both a key labor-market bellwether and an income-oriented HR technology...

2026-01-10

2026-01-09

December Nonfarm Payrolls Miss Estimates; Unemployment Rate Declines

Description: The US economy added fewer jobs than projected in December, while the unemployment rate moved down,

Jobs report: US economy adds 50,000 jobs in December to cap worst year of hiring since 2020

Description: The US economy added 50,000 jobs in December, according to Labor Department data published Friday, amid broader concerns about 2025's cooling job market.

Nonfarm Payrolls Set to Grow Moderately in December as Markets Assess Fed Rate Cut Bets

Description: The US NFP report may sway the Federal Reserve's rate cut expectations and trigger volatility in EUR/USD depending on the jobs and wage data.

2026-01-08

Equities End Mixed Ahead of Friday's Nonfarm Payrolls Report; Defense Stocks Rise

Description: US equity benchmarks closed mixed Thursday, with the Nasdaq Composite snapping a three-day advance,

The Dividend Aristocrats No One’s Talking About (And Their 30+ Year Track Records)

Description: Dividend aristocrats get plenty of attention, but most of the time the spotlight falls on the big names like Johnson & Johnson (NYSE:JNJ), Coca-Cola (NYSE:KO), and Procter & Gamble (NYSE:PG), among others. These are the names and stocks that dominate articles around dividend growth and, unsurprisingly, fill up income portfolios around the country. There is ... The Dividend Aristocrats No One’s Talking About (And Their 30+ Year Track Records)

Final jobs report for 2025 set for release on Friday

Description: The federal government will release December’s unemployment rate and payroll changes Friday morning, helping to make sense of a cooling labor market.

Fewer layoffs don't mean a healthier job market. Here's why

Description: Fewer layoff announcements may be masking a deeper slowdown as white-collar and manufacturing hiring continues to fall

Stocks Fall Pre-Bell as Investors Assess Trump's Defense Budget Plans

Description: US equity markets were trending lower before the opening bell Thursday as investors remain cautious

What You Need to Know Ahead of Automatic Data Processing’s Earnings Release

Description: Automatic Data Processing is poised to deliver its second-quarter earnings later this month, and Wall Street anticipates a solid high-single-digit growth in profits.

US Stock Market Today S&P 500 Futures Ease As Rate Cut Hopes Hinge On Jobs

Description: The Morning Bull - US Market Morning Update Thursday, Jan, 8 2026 US stock futures are slightly softer this morning, as investors weigh strong services activity against cooler hiring signals and what that could mean for interest rates. The ISM Services PMI rose to 54.4 in December 2025, a level that points to solid growth in areas like healthcare, finance and travel, while price pressures in the survey eased a bit, hinting that inflation may be calming. At the same time, ADP private payrolls...

2026-01-07

Stock Market Today, Jan. 7: Banks Slide as Stock Rally Slows

Description: Today, Jan. 7, 2026, a slide in major banks left financials reeling even as AI-fueled tech kept the Nasdaq in the green.

Dow, S&P 500 Fall From Records as Traders Assess Trump's Move to Ban Institutional Home Buying

Description: The Dow Jones Industrial Average and the S&P 500 fell from their record highs as traders assessed Pr

Dollar steady, range-bound as investors assess US labor data

Description: By Chibuike Oguh NEW YORK, Jan 7 (Reuters) - The dollar was steady against major currencies including the yen and euro on Wednesday amid market positioning around several U.S. labor market data

US Equity Markets End Mixed Wednesday as Investors Assess Recent Labor, Services Data

Description: US equity indexes closed mixed Wednesday amid choppy trading, with the Nasdaq Composite rising and t

Stock market today: Dow, S&P 500 slide from records as rally loses steam amid growing risks

Description: The S&P 500 is eyeing a fresh record after a roaring start to the week, with Venezuela, CES, and jobs data releases all in focus.

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were decreasing in late Wednesday trading, with the NYSE Financial Index down 1% an

US Equity Indexes Mixed as S&P 500, Dow Jones Retreat From All-Time Highs

Description: US equity indexes traded mixed ahead of Wednesday's close, with the S&P 500 and the Dow Jones Indust

Treasury Yields Mixed Ahead of Claims Data

Description: TREASURYS 1542 ET – Treasury yields are mixed as a string of indicators prop up bets on a Fed hold this month. Private-sector job creation rebounded in December, ADP says. The broader JOLTS report says job creation in November was little changed, but so were layoffs, corroborating the low-hiring-low-firing state of the labor market.

Daily Roundup of Key US Economic Data for Jan. 7

Description: ADP private payrolls rose by 41,000 in December after a decline of 29,000 in November, a positive fo

Equities Mixed Intraday After Job Market Data

Description: US benchmark equity indexes were mixed intraday as traders evaluated fresh labor market data. The

US Equity Indexes Mixed as Job Openings Unexpectedly Drop While ISM Services Hits Highest for 2025

Description: US equity indexes traded mixed in midday trading on Wednesday as investors weighed the job openings

Gold falls more than 1% as investors lock in profits

Description: By Anmol Choubey Jan 7 (Reuters) - Gold prices fell more than 1% on Wednesday as investors booked profits after a recent rally, though it pared some losses after weaker-than-expected U.S. jobs data

US Equity Indexes Mixed in Midday Trading

Description: US equity indexes traded mixed in midday trading on Wednesday as investors weighed the job openings

December Private Sector Hiring Rebounds Less Than Expected, ADP Data Show

Description: Employment in the US private sector increased less than estimated in December as large companies pul

Market Awaits JOLTS Numbers

Description: Market Awaits JOLTS Numbers.

Job openings in November fall to 7.1 million, missing forecasts, as hiring slows

Description: The Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics showed 7.15 million jobs open at the end of November, by which point the unemployment rate was at a four-year high of 4.6%.

ADP Jobs, ISM Services Data Will Keep Fed On Hold; S&P 500 Steady

Description: Payroll processor ADP's monthly jobs report showed a modest rebound in private-sector hiring in December, while the Institute for Supply Management service-sector activity index saw its strongest reading of 2025. The S&P 500 gave up modest early gains after the 10 a.m. ISM report, which seems to slightly lower the urgency of another Federal Reserve rate cut. ADP said private employers added 41,000 jobs last month vs. forecasts of a 47,000 gain, according to the Econoday consensus.

ADP Rebounds to +41K, JOLTS & ISM Services After the Open

Description: Private-sector payrolls hit +41K last month, -7K from consensus and nicely up from the prior month's upwardly revised -29K.

Dow Slips From Record High as Stock Market Takes a Breather

Description: With the S&P 500 and Dow Jones Industrial Average hovering around highest levels on record, the stock market took a breather at the start of Wednesday's session. The S&P 500 was up 0.1%. The Dow was down 109 points, or 0.2%, after opening higher.

ADP employment report shows white-collar jobs wipeout

Description: Beneath headline employment growth, a new ADP jobs report shows major contraction in the white-collar labor market, especially in tech and consulting

2026-01-06

Stock market today: Dow, S&P 500, Nasdaq futures trade flat with jobs data set to test early 2026 rally

Description: Markets are holding steady after a roaring start to the week, with Venezuela, CES, and jobs data releases all in focus.

U.S. Yields Drift Higher; Calendar Heats Up Wednesday

Description: Econ data has been sparse since Christmas, but the cadence of labor-market stats picks up on Wednesday with the December private-payrolls numbers from ADP, followed by the JOLTS report’s update on the labor market. That said, a below-forecast U.S. ISM business manufacturing PMI reading on Monday was a reminder of the fragile outlook, coupled with signals of a cooling labor market.

Is Automatic Data Processing (ADP) Attractive After Recent Share Price Pullback?

Description: If you are wondering whether Automatic Data Processing (ADP) is reasonably priced at around US$257 per share, you are not alone. A closer look at its valuation tools can help frame that question more clearly. The stock has had mixed returns, with a 1.8% gain year to date but an 8.8% decline over the past year, which may have some investors rethinking both its upside and its risks. Recent attention on payroll, HR outsourcing, and broader employment trends has kept ADP in focus for investors...

2026-01-05

ADP to Announce Second Quarter Fiscal 2026 Financial Results on January 28, 2026

Description: ADP (Nasdaq: ADP), a global leader in HR and payroll solutions, is scheduled to release its financial results for the second fiscal quarter ending December 31, 2025 before the opening of the Nasdaq on January 28, 2026.

US Dollar Mixed Early Monday Ahead of Busy Data Schedule, December Nonfarm Payrolls Employment Data Friday

Description: The US dollar was mixed against its major trading partners early Monday -- up versus the euro and Ca

2026-01-04

CES 2026, Sector Rotation and Other Key Things to Watch this Week

Description: Markets enter 2026's first full trading week with an extraordinary convergence of events including the Consumer Electronics Show (CES) in Las Vegas where Nvidia CEO Jensen Huang and AMD CEO Lisa Su will deliver keynote speeches that could significantly influence AI infrastructure investment narratives

Once a Market Darling, This Software-as-a-Service Stock Has Been Crushed. Time to Buy?

Description: ADP's business still looks solid. But the stock's pullback doesn't automatically make shares attractive.

December jobs numbers get data back on track during first full week of trading in 2026: What to watch

Description: Investors will start the first full week of 2026 watching to see if the market can post positive returns for the "Santa Claus rally" period, with all eyes on the December jobs report, set for Friday.

2026-01-03

2026-01-02

Treasury Yields Have Mixed Weekly Performance Ahead of Labor Data

Description: Treasury yields inched higher to start the new year, but ended the week with mixed results, ahead of a fresh batch of data releases.

Labor Market Data in Focus

Description: Labor Market Data in Focus

2026-01-01

2025-12-31

2025-12-30

ADP Downgraded to Underperform as Jefferies Flags Structural Headwinds

Description: Automatic Data Processing, Inc. (NASDAQ:ADP) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 16, Jefferies analyst Samad Samana downgraded Automatic Data Processing, Inc. (NASDAQ:ADP) to Underperform from Hold and cut the price target to $230 from $245. The firm said it “thinks highly” of management, but described […]

Reasons Why Investors Can Consider Buying ADP Stock Now

Description: Automatic Data Processing accelerates growth via DataCloud, Q1 FY26 mid-single-digit gains and 25.5% margins, plus smart deals and a 51st straight dividend hike.

2025-12-29

Pre-Market In Red

Description: Pre-Market In Red

2025-12-28

Stocks sit near record highs as 'Santa Claus rally' builds, 2026 approaches: What to watch this week

Description: Markets will enter 2026 coming fresh off record highs for major stock indexes as investors face a year of 'cautious optimism.'

2025-12-27

2025-12-26

2025-12-25

2025-12-24

Soft Weekly Jobless Claims Data

Description: Soft Weekly Jobless Claims Data.

Xmas Eve Jobless Claims: Still Accommodating

Description: Despite today being Christmas Eve and markets closing at 1pm ET, we see new Weekly Jobless Claims numbers ahead of today's opening bell.

2025-12-23

Is ADP (ADP) Undervalued After Its Recent Pullback? A Fresh Look at the Stock’s Valuation

Description: Automatic Data Processing (ADP) has quietly pulled back about 10% over the past year even as revenue and net income kept growing, which sets up an interesting entry point for long term dividend focused investors. See our latest analysis for Automatic Data Processing. That pullback roughly lines up with a 90 day share price return of about negative 10 percent, even though three and five year total shareholder returns of 15 percent and 63 percent still point to a solid long term compounding...

What should Fed do after hot Q3 GDP data? Wall Street weighs in

Description: Investing.com -- Wall Street analysts say hotter-than-expected third-quarter GDP data reinforces the strength of the U.S. economy but is unlikely to prompt an immediate shift in Federal Reserve policy, even as markets debate the timing of the next rate cut.

ADP National Employment Report Preliminary Estimate December 6, 2025

Description: For the four weeks ending December 6, 2025, U.S. private employers added an average of 11,500 jobs per week, according to the NER Pulse, a weekly update of the monthly ADP National Employment Report (NER).

2025-12-22

Stocks Advance Toward Records in Broad Rally

Description: Stocks advanced broadly to start the holiday-shortened week, sending the S&P 500 to the brink of a record. Every sector except consumer staples closed higher, with financials, energy and materials leading the way. The S&P 500 added 0.6% to close within 0.3% of a record.

2025-12-21

Stocks enter final stretch of 2025 just off record highs: What to watch this week

Description: Consumer spending data and employment numbers from ADP will headline a quiet holiday week as investors look for signs of a 'Santa rally.'

2025-12-20

2025-12-19

Paychex's higher quarterly expenses overshadow annual earnings forecast raise

Description: Payroll services provider Paychex reported higher expenses for the second quarter on Friday, taking the shine off its raise in annual adjusted earnings growth forecast. Shares of the company were down 2.6% in early trading. They have fallen around 18% so far this year.

2025-12-18

2025-12-17

The New Tech Dividend King Poised for Explosive Growth

Description: This quiet compounder, backed by a solid dividend yield, could see its earnings growth accelerate.

2025-12-16

Does ADP’s Recent Share Price Weakness Present a Long Term Opportunity in 2025?

Description: Wondering if Automatic Data Processing is fairly priced at around $264.95, or if the recent weakness is actually a chance to buy quality at a discount? Let's break down what the market might be missing. Despite a solid long term climb of 66.7% over five years, the stock is down about 8.5% year to date and 8.4% over the last year, even after a 2.6% bump in the past week and a 4.7% gain over the past month. That mix of short term recovery and longer term underperformance has come as investors...

Should Jefferies’ Downgrade and Earnings Reassessment Require Action From Automatic Data Processing (ADP) Investors?

Description: In December 2025, Jefferies downgraded Automatic Data Processing (ADP) to Underperform, citing intensifying growth challenges and a reassessment of long-term earnings expectations for the payroll software group. This shift in analyst sentiment contrasts with ADP's recent product momentum, including embedded ICHRA health benefits via Thatch and the new Save4Retirement pooled employer 401(k) plan. We’ll now examine how Jefferies’ downgrade, despite ADP’s expanding embedded benefits and...

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Allstate, Chubb Ltd., Eli Lilly, KLA Corp., Lockheed Martin, MongoDB, Roku, and More

Description: Pre-Market Stock Futures: The futures are trading lower after what started as a bounce-back Monday turned into a reversal Monday, as the AI/Datacenter rotation trade continues to gather steam during the last whole trading week of 2025. Stocks rallied Monday on the open as traders tried to inject some holiday spirit, but by 12 noon ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Allstate, Chubb Ltd., Eli Lilly, KLA Corp., Lockheed Martin, MongoDB, Roku, and More

ADP National Employment Report Preliminary Estimate November 29, 2025

Description: For the four weeks ending November 29, 2025, U.S. private employers added an average of 16,250 jobs per week, according to the NER Pulse, a weekly update of the monthly ADP National Employment Report (NER).

Jefferies maps 2026 software winners and laggards as AI fears ease

Description: Investing.com -- U.S. software stocks are expected to head into 2026 with a more balanced setup after a difficult 2025 marked by valuation pressure and heightened concern over artificial intelligence disruption, according to Jefferies.

2025-12-15

‘We are now firmly back in a good is bad/bad is good regime’: Weak job data may lead to more rate cuts and boost stocks, Morgan Stanley economist says

Description: Morgan Stanley’s top strategist Michael Wilson noted the labor market, more so than inflation, has become a crucial factor in determining future monetary policy.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Thatch and ADP Simplify Small Business Healthcare with Seamless ICHRA Integration via RUN Powered by ADP

Description: ADP® (Nasdaq: ADP) announced a new integration with Thatch, an Individual Coverage Health Reimbursement Arrangement (ICHRA) platform, now embedded within the RUN Powered by ADP® (RUN) payroll platform. The experience gives small and mid-sized businesses direct access to ICHRA health benefits from within their payroll workflow.

Automatic Data Processing (NASDAQ:ADP) Is Increasing Its Dividend To $1.70

Description: Automatic Data Processing, Inc. ( NASDAQ:ADP ) has announced that it will be increasing its dividend from last year's...

2025-12-10

ADP Unveils Lyric HCM in Australia and New Zealand

Description: ADP®, a global leader in HR and payroll solutions, has rolled out ADP Lyric HCM® (Lyric) across Australia and New Zealand (ANZ) – an AI-powered, award-winning platform that brings together payroll, HR, and people experience in one unified ecosystem.

Fed lowers interest rates by 0.25 percentage points in third straight cut

Description: The Federal Reserve is grappling with economic issues including higher inflation and a slowing labor market.

ADP®'s New Save4Retirement Pooled Employer Plan Cuts Cost and Complexity

Description: ADP (Nasdaq: ADP) today launched the Save4Retirement Pooled Employer Plan (PEP), a retirement plan that allows multiple unrelated employers to join a single, professionally managed 401(k) structure that consolidates administration and shifts key administrative fiduciary responsibilities to a pooled plan provider.

2025-12-09

Treasury Yields Rise on Upbeat Jobs Signal

Description: Treasury yields climbed following a reassuring signal from the JOLTS report that the labor market hasn’t deflated too much since the summer.

‘Fodder for a recession’: Top economist Mark Zandi warns about so many Americans ‘already living on the financial edge’ in a K-shaped economy

Description: The latest JOLTS report shows hiring stuck at 3.2% and quits falling again as the Fed prepares to cut rates.

Job openings inched up in October, but labor market worries persist

Description: Job openings ticked slightly higher in October, surpassing economists’ expectations, government data released Tuesday showed.

ADP Announces 2026 HCM Distinction Award Finalists

Description: ADP, a global leader in HR and payroll solutions, today announced the finalists for the 2026 HCM Distinction Awards. Celebrating the transformation of work, the awards program recognizes a select group of large employers that demonstrate excellence in HCM and lead the way in workplace innovation.

ADP National Employment Report Preliminary Estimate for November 22, 2025

Description: For the four weeks ending November 22, 2025, U.S. private employers added an average of 4,750 jobs per week, according to the NER Pulse, a weekly update of the monthly ADP National Employment Report (NER).

2025-12-08

2025-12-07

Crucial Fed decision looms as stocks fly high near records: What to watch this week

Description: This week, we're closely watching the Fed's comments and dot plot, a nervous bond market, bitcoin, and signs of a Santa Claus rally.

Assessing ADP (ADP) Valuation After Weak November Private Payrolls Deepen Fed Rate Cut Speculation

Description: Automatic Data Processing (ADP) is back in the spotlight after its November report showed private employers cut 32,000 jobs instead of adding positions, sharply undershooting expectations and immediately reshaping rate cut speculation. See our latest analysis for Automatic Data Processing. Despite the weak hiring signal, investors have treated the ADP report as just one piece of the puzzle. The latest share price of $261.63 and a 30 day share price return of 2.94 percent have helped to...

2025-12-06

Dollar stores continue to see higher-income shoppers, even as consumer sentiment improves

Description: Dollar stores have outperformed the broader market as consumers seek out savings.

With next Fed interest rate cut in sight, Wall street rebounds, a bit

Description: Investors expected the Fed to deliver a 25-basis-point cut on Dec. 10, the third consecutive reduction, with market-implied odds approaching 90%.

2025-12-05

Fed Policy Easing Expectations Help Push Gains in US Equity Indexes This Week

Description: US equity indexes rose this week as the odds of a third consecutive interest rate cut remained eleva

Consumer sentiment ticks higher in December as inflation expectations improve

Description: US consumer sentiment improved slightly in December, rising for the first time in months.

Is Now The Time To Look At Buying Automatic Data Processing, Inc. (NASDAQ:ADP)?

Description: Today we're going to take a look at the well-established Automatic Data Processing, Inc. ( NASDAQ:ADP ). The company's...

The labor market is not going to give any straight answers anytime soon

Description: Investors looking for a straight answer on the health of the labor market will have to keep waiting or make sense of mixed signals.

2025-12-04

Asian markets mixed ahead of US data, expected Fed rate cut

Description: Asian markets struggled into the weekend on Friday following a bland lead from Wall Street as a mixed bag of US data did little to move the needle on expectations the Federal Reserve will cut interest rates next week.And while figures Thursday on jobless claims and layoffs came in slightly better than expected, markets have priced the chances of a rate cut Wednesday at around 90 percent.

S&P 500 ekes out slight gain as investors await Fed decision

Description: <body><p>STORY: U.S stocks were little changed at the end of trading on Thursday, with the Dow closing slightly lower, the S&P 500 rising a tenth of one percent and the Nasdaq adding two tenths of a percent.</p><p>Investors weighed a report from the Labor Department that showed initial jobless claims dropped to their lowest level in more than three years, potentially reducing the odds of a rate cut by the Federal Reserve next week.</p><p>But in the absence of the November jobs report, which was delayed by the government shutdown, some economists said Fed officials could lean more on the ADP and Revelio Labs reports, which offered a weaker picture of the labor market.</p><p>Chris Konstantinos of RiverFront Investment Group says he expects the Fed to cut rates next week.</p><p>“So in terms of what I think the Fed will do, I do believe they’re going to cut interest rates again next week. And I think it’s because even though we’re getting a lot of crosscurrents in the employment data, when you take a step back, the mosaic that emerges is that the labor market is indeed weakening. And I think the Fed is pretty laser focused on maintaining full employment without overheating the job market.”</p><p>Markets are now pricing in an 87% chance the Fed will cut rates by 25 basis points next week, according to CME’s FedWatch tool.</p><p>Stocks on the move Thursday included Amazon, which dragged on the S&P 500 with shares falling nearly one and a half percent.</p><p>Shares of Salesforce climbed more than three and a half percent after the company raised its revenue and profit forecasts, anticipating demand for its artificial intelligence agent platform.</p><p>And shares of Kroger fell more than four and a half percent after the supermarket chain narrowed its annual sales forecast and missed quarterly sales estimates.</p></body>

Equities Mixed as Traders Assess Labor Market Data Amid Fed Rate-Cut Expectations

Description: US equities ended mixed on Thursday as markets digested the latest labor market data, while keeping

Mixed day for US equities as Japan's Nikkei rallies

Description: Wall Street stocks finished mixed at the end of a choppy session Thursday as markets digested varying labor market data and looked ahead to next week's Federal Reserve decision.According to Bloomberg, Meta plans to cut its Metaverse costs by 30 percent -- news that drove its share price up as much as four percent in Thursday trading on Wall Street.

Treasury Yields Rise as Layoff Indicator Falls

Description: Treasurys sold off and yields snapped a two-day falling streak, as data corroborated the notion that U.S. employers aren’t hiring or firing en masse.

Gold Inches Higher as Traders Continue to Mull ADP Jobs Report

Description: Gold futures closed higher, with investors continuing to digest yesterday’s ADP report that reinforced expectations that interest rates will come down in December.

US weekly jobless claims drop to more than 3-year low

Description: <body><p>STORY: The number of Americans filing new applications for unemployment benefits last week fell to its lowest level in more than three years, potentially giving the Federal Reserve a reason to hold interest rates steady when it meets next week.</p><p>A report from the Labor Department on Thursday showed initial jobless claims fell by 27,000 last week, coming in well below economists’ expectations and painting a more robust picture of labor market conditions than other recent data.</p><p>A day earlier, for instance, a report from private payroll processor ADP showed employers unexpectedly cut jobs in November, while economists had been expecting job gains.</p><p>The ADP report pushed traders to price in about a 90% chance of an interest rate cut by the Federal Reserve at the conclusion of its policy meeting next week. </p><p>But Dean Smith, chief strategist and portfolio manager at FolioBeyond, gives little credence to the ADP numbers.</p><p>"The reason that ADP is being used is because we don't have the nonfarm payroll number, which is sort of the benchmark that everybody, including the Federal Reserve, uses to gauge the strength in the labor market. So ADP has kind of filled the gap. The problem with ADP is that it's a very noisy indicator. The reach of its survey data, the way that it collects it, the way it analyzes it is not nearly as comprehensive as the Bureau of Labor Statistics. So it's sort of a poor substitute."</p><p>The closely watched nonfarm payrolls report for November, originally due on Friday, has been delayed because of the more than month-long government shutdown and will now be published on December 16 - after next week's Fed meeting.</p><p>As many as five of the 12 voting policymakers on the central bank's rate-setting committee have voiced opposition to or skepticism about cutting rates further, while a core of three members of the Washington-based Board of Governors wants rates to fall.</p></body>

Layoff Announcements Top 1.1 Million in Year Through November, Challenger Gray Says

Description: Job cuts in the US surpassed 1.1 million in the year through November, reaching their highest year-t

Gold Rises as Traders Await U.S. Inflation Data

Description: Gold prices regain ground as traders await a key U.S. inflation report on Friday for more clues on the Federal Reserve's policy path. Futures in New York rise 0.4% to $4,248.60 a troy ounce. Investors almost unanimously expect the Federal Reserve to cut interest rates by 25 basis points at its December meeting next week, leaving attention on Fed Chair Jerome Powell's signals for what is ahead.

Why Is Paylocity (PCTY) Up 0.2% Since Last Earnings Report?

Description: Paylocity (PCTY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Bond Investors Cast Doubt on Hassett as Fed Chair

Description: Some bond investors are worried that Kevin Hassett would cut interest rates too aggressively according to the Financial Times. President Donald Trump has signaled Hassett will be his choice to replace Chair Jerome Powell. Ed Mills of Raymond James and Nela Richardson of ADP talk about Trump's choices on "Bloomberg Surveillance."

U.S. Weekly Jobless Claims Fall to 3-Year Low Ahead of FOMC Meeting

Description: The weekly jobless claims have fallen to its lowest level in over three years, a development that could allay fears over a weakening labor market. This comes ahead of the FOMC meeting, where the Fed is likely to lower rates, which is a positive for Bitcoin and the broader crypto market. U.S. Weekly Jobless Claims

Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

Description: Pre-Market Stock Futures: The futures are trading modestly higher on Thursday after a rollercoaster session on Wednesday, as stocks fell after the open on weak ADP data showing private-sector employment shed 32,000 jobs in November, the largest in 2-1/2 years. That didn’t last long, as bonds rallied on hopes of a rate cut next week ... Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

Treasury Yields, Dollar Get Support From Labor Data

Description: Treasury yields and the dollar rise as data show layoffs falling in the U.S. Weekly jobless claims drop to 191,000 from an upwardly revised 218,000. The number is well below the 220,000 forecast by economists in a WSJ survey, and the lowest since September 2022.

Job market mixed bag: Jobless claims drop to 3-year low, but employers shed 71,000 jobs in worst November since 2022

Description: US employers announced 71,321 layoffs last month, according to a Thursday report from the global outplacement firm Challenger, Gray & Christmas, as workers stressed about the state of a sluggish job market.

Stocks Mostly Up Pre-Bell as Rate Cut Bets Strengthen After Latest Data

Description: US equity markets mostly edged higher before the opening bell Thursday amid growing expectations for

Spencer Jakab | We Might Really, Really Need a Rate Cut

Description: 📉 This is an online version of my Markets A.M. newsletter. Stock investors’ attitude towards rate cuts has long been that too much of a good thing can be wonderful. Next week’s widely expected one by a divided Federal Reserve is seen as a “just-in-case” move that has buoyed valuations in a strong economy.

Markets View Weak Job Data as Good News. Why That’s a Problem.

Description: Job losses raise hopes for rate cut, Salesforce’s AI agents are picking up corporate customers, PayPal forecasts slower growth, and more news to start your day.

Treasury Yields Rise as Fed Rate Cut Priced In

Description: U.S. Treasury yields rise in midday European trade as markets have largely priced in a 25-basis-point interest-rate cut by the Federal Reserve next week. Wednesday's November U.S. ADP private payrolls report was weak and "appears to have shortened the odds of the Fed delivering the now widely expected 25 basis-point rate reduction next week," First Abu Dhabi Bank analysts say in a note.

Things to Think About Thursday

Description: Most of the talk early Thursday morning has to do with the US labor market following Wednesday's weak ADP number for November.

2025-12-03

Asian markets stumble as traders struggle to hold Fed cut rally

Description: Asian markets struggled to maintain their early momentum Thursday, even after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.The reading was also the most since early 2023 and is the latest example of a stuttering labour market.

Crypto hiring surges even as U.S. payrolls shrink under tariff pressure

Description: U.S. private payrolls unexpectedly declined in November, but new industry data shows crypto hiring soaring. This raises fresh questions about whether clearer regulation could keep more high-skill digital-asset jobs inside the country rather than overseas. According to the Labor Department’s Bureau ...

Markets Gain on Fed Rate Cut Likelihood - CRM, FIVE Beat & Raise

Description: Weak jobs figures from ADP has helped solidify the belief that another 25 basis-point (bps) rate cut is coming next week.

November job losses hit two US regions the hardest

Description: Labor data sources not affiliated with the government have become invaluable this year. The White House recently announced that there will likely be no October Bureau of Labor Statistics jobs report due to the government shutdown, and the previously reported blowout positive September data have ...

Prospect of Rate Cut Lifts Shares of Smaller Companies

Description: The prospect of lower interest rates lifted shares of smaller companies on Wednesday. The Russell 2000 index of small-cap companies rose 1.9%, leading gains among major U.S. stock benchmarks. Investors expect lower rates will decrease borrowing costs and boost economic growth, lifting profits at smaller companies.

US Equity Indexes Rise as Unexpected Drop in Private Payrolls Lifts Fed Rate Cut Bets

Description: US equity indexes rose amid Wednesday's broad-based gains as a surprise plunge in private sector job

Dow Hits 3-Week High as Fresh Data Reinforce Fed Rate Cut Bets

Description: US equity benchmarks rose on Wednesday, with the Dow Jones Industrial Average notching its highest c

US stocks rise as weak jobs data boosts rate cut odds

Description: Wall Street stocks shrugged off early weakness Wednesday and finished with solid gains after poor US hiring data boosted expectations that the Federal Reserve will cut interest rates next week.Meanwhile the pound gained around one percent against the dollar, also receiving a boost from data showing stronger than expected activity from the UK services sector.

US Equity Markets Close Higher After Surprise Drop in Private-Sector Jobs

Description: US equity indexes closed higher Wednesday after the odds of an interest rate cut next week rose foll

Stocks Large and Small Advance on Fed Rate Cut Hopes

Description: Wall Street traders pushed up the U.S. stock market higher on Wednesday, and this time the smaller companies tagged along and outperformed. What’s more notable is that the index covering smaller companies, the Russell 2000, did even better, rising 1.9% on Wednesday. One doesn’t see such a broad rise without some good news on the economy or interest rates.

Stock market today: Dow, S&P 500, Nasdaq rise as weak ADP jobs data reinforces growing Fed rate cut bets

Description: Doubts over AI demand put pressure on tech and a surprise fall in private-sector employment revealed cracks in the job market.

Treasury Yields Fall Amid Signs of Softening U.S. Employment

Description: Treasury yields fell as data backed the idea that U.S. employment is weakening fast enough to secure a third consecutive interest rate cut by the Fed next week.

Sector Update: Financial Stocks Advance Late Afternoon

Description: Financial stocks gained in late Wednesday afternoon trading with the NYSE Financial Index rising 0.7

Daily Roundup of Key US Economic Data for Dec. 3

Description: ADP private payrolls fell by 32,000 in November after a 47,000 gain in October. The services sec

Equities Rise Intraday as Markets Parse Macro Data

Description: US benchmark equity indexes were higher intraday as traders evaluated fresh economic data, including

US Equity Indexes Rise as Fed Rate Cut Heads Toward Certainty After Private Payrolls Drop Unexpectedly

Description: US equity indexes rose in midday trading on Wednesday as the odds of an interest rate cut next week

Today's Market: Dow Rises, Nasdaq Slides as Microsoft Sparks Fresh AI Selloff

Description: Market Whiplash: Dow Surges, Nasdaq Sags as Microsoft Spooks Traders

Gold Futures Gain After U.S Labor Weakness Raises Rate-Cut Prospects

Description: Gold prices extend gains after weaker U.S. private payrolls data reinforced expectations of a December interest-rate cut by the Federal Reserve. Futures in New York rise 0.8% to $4,254.10 a troy ounce, while the U.

US Equity Indexes Rise, Treasury Yields Fall Amid Unexpected Drop in Private Payrolls

Description: US equity indexes rose in midday trading on Wednesday as a surprise drop in private sector jobs sent

Inflation is still 'under control': Citizens CEO on the Fed

Description: A majority of investors are forecasting Federal Reserve officials to cut interest rates at their December FOMC meeting next week, according to the CME FedWatch tool, even as ADP reported a decline of 32,000 private payroll jobs in November. Citizens Financial Group (CFG) chairman and CEO Bruce Van Saun sits down with Julie Hyman to share his outlook on the Fed's interest rate policy and the central bank's inflation target, while also commenting on the K-shaped economy. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-12-02

Most Asian markets rise as traders await key US data

Description: Markets mostly rose Wednesday, following a resumption of Wall Street's rally, but gains were muted as investors await the last tranche of US data before next week's Federal Reserve meeting.IG market analyst Fabien Yip wrote: "Friday's core PCE index represents the final major inflation gauge before the Fed's December policy meeting.

Stock market today: Dow, S&P 500, Nasdaq futures climb as key ADP jobs data looms

Description: Key jobs data looms as one of the final potential catalysts ahead of the Federal Reserve's interest rate move.

Treasury Yields Decline Ahead of Labor Data

Description: Demand for Treasurys bounced back, sending yields lower, ahead of the last batch of labor data before next week’s Fed decision on interest rates.

Wall Street Awaits More Economic Data

Description: Wall Street Awaits More Economic Data

Pre-markets Move Back into the Green, SIG Beats by +293%

Description: Signet Jewelers reported earnings nearly 4x higher than the consensus estimate.

2025-12-01

Is Now the Right Moment for ADP Shares After a 2.1% Weekly Rebound?

Description: Thinking about whether Automatic Data Processing is attractively valued? You are not alone, as investors are always trying to figure out if now is the right time to buy in or wait for a better opportunity. The stock has climbed 2.1% in the past week, even though it is down 11.9% year-to-date and off 14.8% from a year ago. This highlights some volatility and reevaluated expectations in the market. Recent news around sector trends and broader economic updates have...

Treasury Yields Little Changed as Markets Position for Fed Cut

Description: Bond markets are little changed to start the week preceding the Fed's last rate-setting meeting of 2025, on Dec. 10. Futures markets price in 88% odds of a Fed cut, on the CME's FedWatch tool. ADP's jobs report, due Wednesday, is expected to show hiring softening, in a WSJ consensus.

US Dollar Falls Early Monday, Focus on ADP Payrolls This Week

Description: The US dollar fell against its major trading partners early Monday before a busy week, with ADP priv

2 Cash-Producing Stocks Worth Your Attention and 1 We Turn Down

Description: A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

SocGen's Overnight Economic News Summary

Description: Societe Generale in its early Monday economic news summary pointed out: -- Risk off start to Dece

Global Markets Slip Amid Risk Aversion

Description: U.S. futures and international equities markets started the week lower and bond yields rose as investors shifted away from risky assets.

Is Automatic Data Processing Stock Underperforming the S&P 500?

Description: With Automatic Data Processing underperforming the S&P 500 during the past year, analysts have adopted a more reserved view of the stock’s future prospects.

2025-11-30

Stock market today: Dow, S&P 500, Nasdaq futures slide as Wall Street enters final trading month of 2025

Description: US stock futures slid ahead of the start of December trading.

These 2 Under-the-Radar Dividend Kings Just Declared Dividend Raises

Description: These companies aren't household names, but among income investors, they really should be.

2025-11-29

2025-11-28

S&P 500 Ends November With Broad Weekly Climb, Slight Monthly Rise

Description: The Standard & Poor's 500 index rose 3.7% this week in a broad climb that helped the market benchmar

What Catalysts Could Shift the Narrative for ADP Amid New Analyst and Market Trends

Description: Automatic Data Processing's latest fair value estimate has remained unchanged at $293.23 per share following small shifts in market expectations and underlying assumptions. A slight increase in the discount rate and steady revenue growth forecasts reflect both supportive demand in core business areas as well as ongoing macroeconomic challenges facing the sector. Stay tuned to discover how investors and analysts can track evolving perspectives and stay informed about ADP's investment narrative...

ADP (ADP) Down 2.8% Since Last Earnings Report: Can It Rebound?

Description: ADP (ADP) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Private Sector Job Losses Ahead of Holidays Could Be a Game Changer for ADP (ADP)

Description: Earlier this month, Automatic Data Processing (ADP) reported that U.S. private employers shed an average of 13,500 jobs per week in the four weeks ending November 8, 2025, based on preliminary employment data. This release raised concerns about potential labor market softness ahead of the holiday hiring season, with ADP's chief economist highlighting uncertainty in consumer strength that could affect job creation. We’ll explore how reports of private sector job losses could influence the...

Is the Options Market Predicting a Spike in ADP Stock?

Description: Investors need to pay close attention to Automatic Data Processing stock based on the movements in the options market lately.

2025-11-27

2025-11-26

Mortgage rates dropped this week amid fresh signs of job market weakness

Description: Mortgage rates fell this week after Federal Reserve governors signaled openness to cutting benchmark interest rates next month.

Fresh Data Tilts Markets Into Rate-Cut Camp, But Fed's December Move Not Guaranteed, Macquarie Says

Description: A couple of weak economic reports on Tuesday have helped convince markets that the Federal Reserve w

2025-11-25

Asian stocks extend global rally as data boost rate cut hopes

Description: Asia extended a global equities rally Wednesday after another round of tepid US data reinforced expectations that the Federal Reserve will cut interest rates again next month."Hassett is viewed as closely aligned with President Trump's preference for lower interest rates, and his appointment would likely reinforce the administration's push for easier policy," said National Australia Bank's Rodrigo Catril.

Workday posts lukewarm quarterly subscription revenue, shares fall

Description: Workday reported third-quarter subscription revenue in line with Wall Street estimates on Tuesday, signaling softer demand and sending its shares down nearly 7% in extended trading. The human resources software provider's fourth-quarter subscription revenue forecast was also barely above estimates, hit by sluggish demand from certain higher education customers that depend heavily on federal funding. Workday competes with Oracle, SAP and payroll providers such as Automatic Data Processing.

US Equity Indexes Jump as Weakness in Consumer Confidence, Retail Sales Help Rate-Cut Bets Fly High

Description: US equity indexes rose on Tuesday as the odds of the third consecutive interest-rate cut in December

Stocks Settle Higher as US Economic News Lifts Fed Rate Cut Expectations

Description: The S&P 500 Index ($SPX ) (SPY ) on Tuesday closed up by +0.91%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed up by +1.43%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed up by +0.58%. December E-mini S&P futures (ESZ25 ) rose +0.90%, and December...

US Equity Indexes Rise as Consumer Confidence, Retail Sales Weakness Keep Fed Rate-Cut Bets Elevated

Description: US equity indexes rose ahead of Tuesday's close as bets for a third consecutive interest-rate cut in

Dollar Tumbles and Gold Rallies on Improved Fed Rate Cut Chances

Description: The dollar index (DXY00 ) on Tuesday fell by -0.44%. The dollar is sliding after today’s weaker-than-expected US economic news on Sep retail sales, Sep core PPI, and weekly ADP employment bolstered the chances for a Fed rate cut at next month’s FOMC meeting. Also, falling bond yields have weakened...

Consumer Confidence Dives, Employment Falls, Supporting Fed Cut

Description: Retail sales came in below forecasts for September and a dive in consumer confidence may point to a less-buoyant holiday season, while ADP's new weekly jobs report showed payrolls sliding through early November. The producer price index was mixed, but core PPI was below expectations. The data, though some of it is stale, will shape the Federal Reserve outlook for the Dec. 10 meeting and beyond.

U.S. Lost Average of 13,500 Private-Sector Jobs a Week in Latest ADP Report

Description: Private-sector employers shed an average of 13,500 private-sector jobs a week in the four weeks ended Nov. 8, payroll processor ADP said in a new report. “Consumer strength remains in question as we enter the holiday hiring season, which might be playing into delayed or curtailed job creation,” ADP said.

ADP National Employment Report Preliminary Estimate for November 8, 2025

Description: For the four weeks ending November 8, 2025, U.S. private employers shed an average of -13,500 jobs per week, according to the NER Pulse, a weekly update of the monthly ADP National Employment Report (NER).

US Dollar Falls Early Tuesday Ahead of Busy Economic Release Schedule

Description: The US dollar fell against its major trading partners early Tuesday, except for an increase versus t

2025-11-24

ADP Workforce Now® Named a Leader in Human Capital Management 2025 Evaluation by Independent Research Firm

Description: ADP Workforce Now® has been recognized as a Leader in The Forrester Wave™: Human Capital Management Solutions, Q4 2025 evaluation. ADP Workforce Now received the highest scores possible in 17 criteria within the Current Offering and Strategy categories. ADP Workforce Now was chosen as a Leader after being evaluated alongside eleven other vendors in this comprehensive review.

These 2 Computer and Technology Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

2025-11-23

2025-11-22

Assessing ADP (ADP) Valuation After Recent Share Price Weakness

Description: Automatic Data Processing (ADP) shares have shown only small changes over the past week. Investors watching for longer-term patterns will notice the stock is down about 11% in the past month. While recent headlines have been limited, ADP remains a closely watched name for consistent dividend payments and earnings stability among payroll and HR service providers. See our latest analysis for Automatic Data Processing. After posting steady gains in recent years, Automatic Data Processing’s...

2025-11-21

2025-11-20

ADP to Present at Upcoming Investor Conference

Description: ADP (Nasdaq: ADP), a global leader in HR and payroll solutions, today announced that it will present at the Nasdaq Investor Conference in London on Tuesday, December 9th, 2025 at 5:00 a.m. ET / 10:00 a.m. GMT.

ADP Launches Unified Global Workforce Management Suite Across HCM Platforms

Description: ADP®, a global leader in HR and payroll solutions, today announced the availability of ADP® WorkForce Suite, the industry's #1-rated workforce management solution, now within ADP Workforce Now®, ADP® Lyric HCM, and ADP Global Payroll®. This gives employers and their millions of employees in 140+ countries and territories access to powerful workforce management technology, including time and attendance management, employee scheduling, absence management and workforce analytics tools that can help

2025-11-19

BLS cancels October jobs report, pushes back November jobs report release date

Description: The BLS said it will not publish an October jobs report due to a lack of data and pushed back the release date for November's report.

Jobs report: Delayed September data set for release Thursday

Description: September’s federal jobs report will break a more than monthlong data drought on the official state of the labor market.

2025-11-18

US Equity Markets Close Lower as Consumer Discretionary, Tech Sectors Slump

Description: US equity indexes closed lower Tuesday as consumer discretionary and technology sectors slumped.

Stock market today: Dow slides 500 points, S&P 500 notches 4th day of losses as Nvidia earnings loom

Description: This year's AI-fueled stock rally faces two key tests this week.

Sector Update: Financial Stocks Edge Up Late Afternoon

Description: Financial stocks edged up late Tuesday afternoon trading, with the NYSE Financial Index and the Fina

Dollar Slips on Weak US Labor Market News

Description: The dollar index (DXY00 ) on Tuesday fell by -0.05%. The dollar was under pressure on Tuesday as signs of weakness in the US labor market have bolstered the outlook for the Fed to keep cutting interest rates after ADP reported employers cut jobs this month. Losses in the dollar...

Sector Update: Financial Stocks Advance Tuesday Afternoon

Description: Financial stocks were advancing in Tuesday afternoon trading, with the NYSE Financial Index up 0.2%

Crude Prices Pressured by Risk-Off Sentiment as Stocks Tumble

Description: December WTI crude oil (CLZ25 ) today is down -0.04 (-0.07%), and December RBOB gasoline (RBZ25 ) closed down -0.0246 (-1.24%). Crude oil prices are under pressure today as a selloff in the S&P 500 to a 1-month low has sparked risk-off sentiment in asset markets. Also, signs of weakness...

Markets Await Factory Orders Report

Description: Markets Await Factory Orders Report

Dollar Slides on Signs of US Labor Market Weakness

Description: The dollar index (DXY00 ) today is down by -0.13%. The dollar is under pressure today as signs of weakness in the US labor market have bolstered the outlook for the Fed to keep cutting interest rates after ADP reported employers cut jobs this month. Losses in the dollar are...

Pre-markets Stay Red Ahead of NVIDIA Earnings, Jobs Data

Description: Until one or both of these brings a sigh of relief to market participants, we'll likely see a "risk-off" trading environment.

Treasury Yields Fall as U.S. Labor Data Gets Updated

Description: Treasury yields fall amid a global stocks selloff and signs of labor softness in delayed U.S. data. Worries around tech stocks trigger risk aversion around the world, following Monday's losses. The Labor Department says 232,000 unemployment claims were filed in the week of October 18, up from 219,000 in September 20, with data still missing for the weeks in between.

America’s labor market is cooling, and workers are quietly turning to Uber and DoorDash to fill the income gap

Description: The gig economy is quietly propping up a cooling labor market as more Americans turn to Uber, DoorDash, and Instacart to replace shrinking wages and lost hours.

2025-11-17

North Carolina man who voted for Trump forced to shut family lumber mill due to tariffs. What's next for rural America?

Description: 'In a way it's as unnerving as watching a loved one take their final breath.'

ADP Canada Unveils 2026 Workplace Trends for Employers

Description: As AI becomes an integral component within the world of work, organizations are aligning people and strategy to technological advancements according to ADP's 2026 HR Trends Report. In Canada, that trend is especially apparent as business leaders are using data and technology to enhance the employee experience and strengthen compliance according to the Canada Workplace Trends for 2026 report by ADP Canada. The findings underscore the growing importance of HR-IT collaboration, responsible AI gover

HR in 2026 will be Defined by the Impact of AI Innovation on Work

Description: ADP's 2026 HR Trends Guide reveals how organizations around the world are preparing for an AI-driven workplace. To better align people and strategic objectives, businesses are adopting a more skills-based approach and using data and technology to optimize talent, navigate compliance and enhance employee experience. The report also underscores the growing importance of HR-IT collaboration, responsible AI governance and transparency in shaping the future of work.

Bond Traders Eye Make-or-Break Data to Chart Fed’s Next Move

Description: The end of the government shutdown means that agencies will start releasing key reports that were held back since the start of October, including the September employment report on Thursday. Data from private data sources, like the payroll company ADP, however, continued to underscore the weakening in the job market that drove the Fed to lower its benchmark rate at the September and October meetings, ending what had been a nine-month pause. “As the economic data starts to trickle in, it is possible that the labor market shows more stability,” said Priya Misra, a portfolio manager at JPMorgan Investment Management.

2025-11-16

Bond Traders Eye Make-or-Break Data to Chart the Fed’s Next Move

Description: The end of the government shutdown means that agencies will start releasing key reports that were held back since the start of October, including the September employment report on Thursday. Data from private data sources, like the payroll company ADP, however, continued to underscore the weakening in the job market that drove the Fed to lower its benchmark rate at the September and October meetings, ending what had been a nine-month pause. “As the economic data starts to trickle in, it is possible that the labor market shows more stability,” said Priya Misra, a portfolio manager at JPMorgan Investment Management.

Nvidia, Walmart earnings, and the return of jobs numbers: What to watch this week

Description: The final full week of trading in November will bring investors key results from the biggest AI and retail names in the market.

2025-11-15

2025-11-14

Does the Recent 10.9% Drop Make ADP a Bargain in 2025?

Description: Wondering if Automatic Data Processing is offering investors real value, or if it is walking a fine line between steady blue-chip and overvaluation? Let’s dive into the numbers together. Lately, the stock price has shown some turbulence, down 10.9% in the last month and -13.2% over the past year, despite returning a strong 63.8% over the past five years. This recent dip has caught attention, especially as broader market sentiment has shifted and macroeconomic concerns have weighed on many...

A recession is brewing at the bottom of the K-shaped economy

Description: The affordability crunch is a recession indicator.

2025-11-13

'Most jobs are going to go away': Shark Tank's Daymond John on how workers can stay ahead of a changing job market

Description: Shark Tank's Daymond John says the job market is changing faster than people realize — and those who don't adapt will be left behind.

El-Erian: Low-income Americans are near recession, putting rest of economy at risk

Description: Mohamed El-Erian, chief economic adviser at Allianz, warned that lower-income Americans are under "significant pressure" and that a halt to their spending would weigh on the economy as a whole.

U.S. Treasuries Stabilize as Investors Stay Cautious Despite Government Reopening

Description: U.S. Treasury yields stabilize in European mid-morning hours, having risen earlier on news that the U.S. government is set to reopen as caution creeps in. "Markets remain cautious as attention shifts to the backlog of economic data soon to be released, which could paint a softer picture of the labor market and overall demand," says Exness' Eric Chia in a note. The two-year Treasury yield rises 0.8 basis points to 3.573%; the 10-year Treasury yield is unchanged at 4.078%; and the 30-year yield stays steady at 4.662%, Tradeweb data show.

2025-11-12

Why Analysts Are Rethinking ADP’s Outlook as the Story Shifts Amid New Developments

Description: Automatic Data Processing has recently seen its consensus analyst price target drop from $311.62 to $293.23. This change reflects a shift in sentiment among market watchers. Analysts are weighing a combination of cautious near-term outlooks alongside long-term growth factors for the company. Stay tuned to discover how you can stay informed about ongoing updates to the stock's evolving narrative. Analyst Price Targets don't always capture the full story. Head over to our Company Report to find...

ADP Increases Cash Dividend; Marks 51st Consecutive Year of Dividend Increases

Description: The board of directors of ADP (Nasdaq: ADP) approved a $0.16 increase in the quarterly cash dividend to an annual rate of $6.80 per share, Maria Black, ADP's President and Chief Executive Officer, announced today. The increased cash dividend marks the 51st consecutive year in which ADP, a leading global technology company providing human capital management (HCM) solutions, has raised its quarterly dividend."Our dividend is a cornerstone of our long-standing commitment to our shareholders and thi

Should You Be Excited About Automatic Data Processing, Inc.'s (NASDAQ:ADP) 65% Return On Equity?

Description: While some investors are already well versed in financial metrics (hat tip), this article is for those who would like...

Hopes for a December rate cut are fading fast despite labor fears—Jerome Powell will have his work cut out attempting to unite the Fed

Description: Weaker labor market data should be building the case for Powell to post a cut—and yet expectations are leaning toward the hawkish.

U.S. Futures Rise After Dow Closes at Record High

Description: U.S. stock futures gained as attention turns to the resumption of key economic data as lawmakers in the U.S. approach the end of the government shutdown.

U.S. Treasury Yields Decline on ADP's Weak Labor Market Signals

Description: U.S. Treasury yields declined in early trade after payrolls firm ADP's estimate that the private sector was shedding 11,250 jobs a week in the four weeks through Oct. 25. "With the U.S. federal government expected to reopen within days, delayed economic data will eventually be released and may give a clearer picture of the state of the U.S. economy ahead of the FOMC meeting in December," Danske Bank's Kristoffer Kjaer Lomholt said in a note. Investors will watch out for Federal Reserve speakers as well as the Treasury's $42 billion auction of 10-year notes.

2025-11-11

Gold Rises Amid Fed Rate-Cut Prospects

Description: Gold rose in the morning Asian session amid prospects of Fed rate cuts, which would enhance the appeal of the non-interest-bearing precious metal.

Stock market today: Dow, S&P 500, Nasdaq futures rise as key shutdown vote looms in House

Description: Stock futures mostly moved sideways as traders hoped for the end of the government shutdown.

Stock market today: Dow jumps over 500 points to record close, Nvidia's slide drags on Nasdaq

Description: Wall Street is crossing its fingers for the end of the government shutdown.

Dollar Falls as ADP Report Shows US Job Losses

Description: The dollar index (DXY00 ) on Tuesday fell to a 1.5-week low and finished down by -0.16%. Signs that the US labor market has weakened are weighing on the dollar after a report Tuesday from ADP showed US private employers shed more jobs than they created in the four weeks...

ADP Reports Solid Q1 Results; JPMorgan Lowers Price Target to $295

Description: Automatic Data Processing, Inc. (NASDAQ:ADP) is included among the 15 Best Dividend Growth Stocks to Buy Now. On October 30, JPMorgan lowered its price target on Automatic Data Processing, Inc. (NASDAQ:ADP) to $295 from $340 while maintaining an Underweight rating on the shares, according to a report by The Fly. The firm made minimal adjustments […]

Market expert sees Fed rate cut in December amid weakening job data

Description: <body><p>STORY: U.S. firms were cutting more than 11,000 jobs a week through late October, payroll processor ADP said on Tuesday, signaling further weakness in the labor market closely watched by Federal Reserve officials.</p><p>While ADP’s earlier report showed a gain of 42,000 jobs in October, the latest data point to a slowing trend, fueling investors bets that the Fed will have to cut rates in December, said Stovall.</p><p>“With consumer confidence now hitting an extreme low level, according to the University of Michigan data combined with joblessness, as well as the disruptions because of the government shutdown, I think that we could end up seeing that the Fed needs to sort of come to the rescue, if you will."</p></body>

US Equity Indexes Trade Mixed Amid Declines in Technology, Communication Services

Description: US equity indexes were mixed in midday trading on Tuesday, led by declines in the technology and com

Dollar Slides on Signs of US Labor Market Weakness

Description: The dollar index (DXY00 ) today fell to a 1.5-week low and is down by -0.22%. Signs that the US labor market has weakened are weighing on the dollar after a report today from ADP showed US private employers shed more jobs than they created in the four weeks ending...

Treasury Futures Rise, Dollar Falls on Weak ADP Jobs Data

Description: The dollar slumped and Treasury futures rose after a fresh report showed signs of a weakening jobs market. The U.S. Dollar Index, which measures the value of the dollar against a basket of foreign currencies, fell 0.3% during Tuesday's trading. Meanwhile, futures prices tracking the 30-year Treasury bond have increased by the same amount.

ADP’s Weekly Payrolls Data Show Labor Market Weakening

Description: The U.S. shed an average of 11,250 private-sector jobs a week in the four weeks ended Oct. 25, ADP said. The payroll processor said the data suggested “the labor market struggled to produce jobs consistently during the second half of the month.” ADP started issuing more-frequent readouts on the labor market last month, to complement its longrunning monthly report.

2025-11-10

Hopes For New Government Data Lift Gold

Description: Gold futures jumped as the potential of an end to the government shutdown would allow government data to resume its normal release schedule.

14 charts from unofficial data show a cooling labor market

Description: Almost all of the private sector data confirms that the labor market continues to cool, increasing the risk that the economy tips into recession.

2025-11-09

'Hiring has dramatically slowed': What private data says about America's job engine

Description: With official data releases frozen by the government shutdown, private reports reveal a labor market that is still losing steam.

2025-11-08

ADP (ADP) Earnings Beat and Jobs Data Role Could Be a Game Changer for Investors

Description: Automatic Data Processing, Inc. recently reported first-quarter fiscal 2026 earnings that beat analyst expectations, with revenue of US$5.18 billion and net income of US$1.01 billion, and also confirmed its fiscal year 2026 consolidated revenue growth guidance of 5% to 6%. With the ongoing federal government shutdown preventing release of official jobs data, ADP's employment reports have gained additional prominence as a vital proxy for US labor market trends. We’ll explore how ADP’s robust...

2025-11-07

Assessing ADP's Valuation After Q1 Earnings Beat and Ongoing Buybacks

Description: Automatic Data Processing (ADP) just exceeded expectations for its first-quarter fiscal 2026 earnings and revenue. The company also maintained its annual guidance and continued its share buyback program. These moves suggest steady confidence despite recent sector headwinds. See our latest analysis for Automatic Data Processing. ADP has weathered recent market and sector challenges, hitting a 52-week low as momentum faded, but its latest earnings beat and ongoing buybacks have supported the...

Unemployment Expectations Worsen in October, New York Fed Says

Description: Unemployment rate expectations continued to worsen in the US last month, a survey by the Federal Res

Labor market check-in: Private data paints a 'mixed picture'

Description: Investors didn't get a fresh jobs report as scheduled on Friday due to the ongoing government shutdown. During the government data blackout, the market has been especially reliant on private data sources. PNC Asset Management Group chief investment strategist Yung-Yu Ma discusses what recently released private data, like the ADP payroll print and the Challenger layoff report, indicate about the economy. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

There’s no jobs report today. Here’s what it might’ve shown.

Description: The shutdown of the federal government — now the longest-running in US history — has delayed two consecutive job reports. Private data has helped shed some light on the labor market in the meantime.

Fed’s Jefferson supported last week’s rate cut, but wants to move slowly on further cuts

Description: Federal Reserve Vice Chair Philip Jefferson said Friday that he supported cutting rates at the last policy meeting given greater concerns about the job market, but he wants to move more slowly going forward on future rate cuts.

Fed’s December Rate Decision Won’t Come Easy, Even if Shutdown Ends Soon

Description: The data they will receive when the government reopens probably won’t make the next decision any easier. Friday marks the second month without a national employment report since federal agencies publishing economic data went dark. The uncertainty will prolong a debate among Fed officials about whether the labor market is really weakening fast enough to warrant another rate cut in December amid ongoing inflation risks — a question over which they’re already split.

2025-11-06

Earnings, not data, should guide stock moves, market expert says

Description: <body><p>STORY: U.S.-based employers announced more than 150,000 job cuts in October, marking the biggest reduction for the month in more than 20 years, a report by Challenger, Gray & Christmas said on Thursday as industries adopt AI-driven changes and intensify cost cuts.</p><p>"Reading that at face value, boy, that's awful," Landsberg said. "[But] ADP [private payrolls report] came out and they saw job growth in October."</p><p>As a result, Landsberg advises investors focus on earnings rather than "whipsaw data."</p></body>

Treasury Yields Whipsawed This Week By Conflicting Data

Description: Treasury yields declined in response to a selloff in stocks and private-sector data that suggested that there was a rise in layoffs last month.

ADP's Richardson Sees Recovery in Jobs Market

Description: Nela Richardson, ADP chief economist and ESG officer and Bloomberg Contributor, says there has been a "tepid" recovery in the US jobs market. Challenger, Gray & Christmas Inc. says companies announced 153,704 job cuts last month. Richardson says transportation, utility and health care companies are hiring. She speaks on "Bloomberg Surveillance."

Last month marked worst October for layoffs in more than 20 years: Challenger

Description: Employers announced 153,074 cuts last month, the highest total for October since 2003, according to Challenger, Gray & Christmas.

Wall Street can’t decide whether the job market is showing a ‘rebound’ or declining to ‘stall speed’

Description: U.S. futures are flat this morning as traders try to figure out whether new jobs data makes a Fed rate cut in December more or less likely.

Automatic Data Processing (NASDAQ:ADP) shareholders have earned a 11% CAGR over the last five years

Description: Automatic Data Processing, Inc. ( NASDAQ:ADP ) shareholders might be concerned after seeing the share price drop 14% in...

Modest jobs growth isn't enough to change the economic narrative — but enough to cast doubt

Description: A litany of economic caveats and qualifiers weakens the certainty of a December rate cut.

Trump's economy is worse than it looks. Here's why

Description: The headline numbers average out the extremes, but the underlying picture is one of wealthy consumers thriving and everyone else trading down

Bitcoin Stabilizes as Risk Appetite Improves

Description: Bitcoin was stabilizing after recently falling below $100,000 for the first time since June as U.S. stocks recovered overnight on improved risk appetite, Deutsche Bank analysts said in a note. "The main driver was stronger-than-expected data, alongside growing speculation that the government shutdown might come to an end soon," they said.

Pound near seven-month lows ahead of UK interest rate decision

Description: Traders are cautious as the city awaits the Bank of England’s decision on interest rates.

Dollar Eases After Reaching 5-Month High on Upbeat Data

Description: The dollar was easing after reaching a five-month high against a basket of currencies in the previous session following better-than-expected U.S. data. The ADP private payrolls report and the ISM services purchasing managers' survey exceeded expectations Wednesday.

2025-11-05

Asian markets bounce from selloff as US jobs beat forecasts

Description: Asian markets rose Thursday to claw back some of the previous day's hefty losses as investors tracked a bounce on Wall Street sparked by jobs data that soothed worries about the US economy.The rush for cover -- which tracked big losses on Wall Street -- hammered some regional giants including Japanese tech investor SoftBank and South Korean chipmakers Samsung and SK hynix.

Gold Edges Lower Amid Reduced Odds of Fed Rate-Cut

Description: Gold edged lower in the early Asian session. Wednesday’s better-than-expected ADP employment data and ISM services-sector index reduced odds of a Fed rate cut.

ADP jobs report surprises amid data drought

Description: The experts call it a "data fog," or even "flying blind." The government shutdown has shuttered monthly leading economic indicators. Markets, economists, and even the Federal Reserve are now turning to private sources of data to determine the state of the economy. Here’s what has closed since the ...

Nasdaq Composite Rebounds Following Tuesday's Tech-Driven Selloff

Description: The Nasdaq Composite rose Wednesday as technology stocks rebounded following a rout in the previous

Wall Street stocks rebound after positive jobs data

Description: Wall Street stocks advanced Wednesday after better-than-expected jobs data soothed concerns about the US economy with equity buyers stepping in following the prior session's retreat.US private sector employment jumped 42,000 in October, ADP said, rebounding from a loss of 29,000 jobs in September, nearly double the amount forecasted by economists surveyed by Dow Jones Newswires and The Wall Street Journal.

Stock market today: Dow, S&P 500, Nasdaq rise as tech rebounds, Supreme Court questions Trump tariffs

Description: ADP private payrolls took center stage as the US shutdown, which has stifled the flow of official data, became the longest ever.

Sector Update: Financial Stocks Rise Late Afternoon

Description: Financial stocks rose in late Wednesday afternoon trading, with the NYSE Financial Index up 0.5% and

ADP jobs data should keep Fed 'in cutting mode,' market expert says