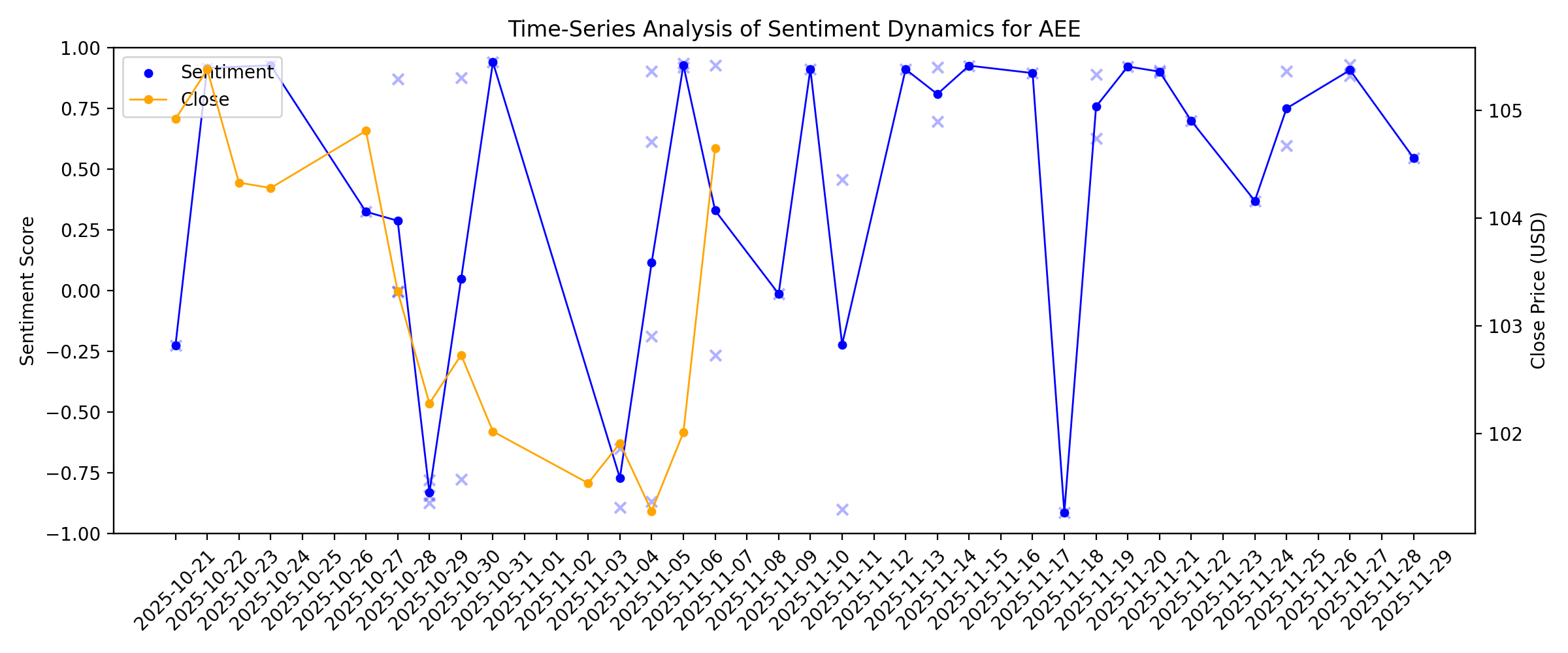

News sentiment analysis for AEE

Sentiment chart

2026-01-14

3 Sales Growth Picks to Bet on for Steady Returns in 2026

Description: MKSI, AEE and OGS are showing strong sales growth potential for 2026, offering steady returns amid shifting market dynamics.

2026-01-13

Will Ameren (AEE) Beat Estimates Again in Its Next Earnings Report?

Description: Ameren (AEE) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

New Year Relief: New Funds Available for Ameren Customers

Description: Ameren is reminding residential customers across Missouri and Illinois that a wide range of resources remain available to support qualifying households with their energy bills in 2026. In addition to programs funded by the company, Ameren partners with United Way of Greater St. Louis, the Energy Assistance Foundation and hundreds of Community Action Agencies to ensure customers can apply for funds, including the Low Income Home Energy Assistance Program (LIHEAP).

2026-01-07

2026-01-06

Ameren (AEE) Valuation Check As Recent Short Term Weakness Meets Conflicting Fair Value Estimates

Description: Ameren stock in focus without a clear headline catalyst Ameren (AEE) is back on investor watchlists, even without a specific headline event driving attention, as some shareholders reassess the utility’s recent share performance and fundamentals in the current market context. See our latest analysis for Ameren. At a share price of $99.60, Ameren’s recent 1 day, 7 day and 90 day share price returns all sit in slightly negative territory, yet its 1 year, 3 year and 5 year total shareholder...

2026-01-05

2026-01-04

UBS Keeps Buy Rating on Ameren Corporation (AEE)

Description: Ameren Corporation (NYSE:AEE) is among the 8 Most Profitable Utility Stocks to Buy Right Now. TheFly reported on December 17, 2025, that UBS kept its buy recommendation on Ameren Corporation (NYSE:AEE) shares while reducing its price objective to $115 from $121. Separately, Morgan Stanley maintained an Equal Weight rating on Ameren Corporation (NYSE:AEE) and lowered […]

2026-01-03

2026-01-02

2026-01-01

2025-12-31

American Electric's Investments and Renewables Fuel Long-Term Growth

Description: AEP's $72B capital plan and renewable buildout aim to lift efficiency and revenues, but reliance on a few REPs poses cash-flow risk.

2025-12-30

EIX to Gain From Infrastructure Upgradation & Renewable Expansion

Description: EIX is ramping up grid investments and clean energy to meet AI data center and EV-driven demand supports its outlook.

2025-12-29

Fed Caution Ahead: 5 Low-Volatility Stocks to Buy for 2026

Description: As Fed uncertainty looms, MNST, MAMA, D, AEE and SRE stand out as low-volatility picks with 2026 earnings growth in focus.

2025-12-28

2025-12-27

2025-12-26

ETR to Gain From Strategic Nuclear Expansion & Renewable Transition

Description: Entergy ramps up grid hardening and nuclear bets, backing $41B capex and solar growth as shares beat industry gains over the past six months on renewables.

Here's Why You Should Add PCG Stock to Your Portfolio Right Now

Description: PCG benefits from infrastructure upgrades, which increase the reliability of services. Ongoing clean energy investments and favorable decisions from the CPUC are expected to drive operations.

CMS Energy Poised to Gain From Renewable Expansion & Investments

Description: CMS to invest $20B in grid upgrades and clean power, with plans to add major solar, wind, and battery capacity despite regulatory and debt pressures.

2025-12-25

Has Ameren’s Recent Run Leave Limited Upside After Mixed Valuation Signals?

Description: If you are wondering whether Ameren is still a sensible buy after its recent run up, or if most of the upside is already priced in, this breakdown will help you consider whether the current share price matches the company’s long term potential. The stock is up 1.4% over the last week and 12.2% year to date, but that follows a recent 5.8% pullback over the past month. This may have opened a window for value focused investors, despite the solid 14.0% gain over the past year and 48.1% over five...

2025-12-24

Here's Why AWR Stock Deserves a Place in Your Portfolio Right Now

Description: American States Water benefits from new regulated rates, while rising demand from an expanding customer base will support stable earnings growth.

2025-12-23

Here's Why You Should Add Ameren to Your Portfolio Right Now

Description: AEE's clean energy push, rising 2025 earnings estimates, massive infrastructure spending and a growing dividend make the utility stock stand out now.

2025-12-22

SO's Georgia Power Approves Power Expansion to Serve Data Centers

Description: Southern Company's Georgia Power approved a major power build-out for data centers, sparking debate over costs, risks and who ultimately pays the bill.

2025-12-21

2025-12-20

2025-12-19

NRG Energy and Sunrun Partner to Expand Distributed Energy in Texas

Description: NRG teams up with Sunrun to link Texas home batteries to the grid to form a large virtual power plant (VPP).

2025-12-18

2025-12-17

Ameren Illinois, Illinois EDC, and Local Economic Development Partners Launch Site Development Program

Description: Ameren Illinois, the Illinois Economic Development Corporation, and local partners are teaming up to launch the Ameren Site Acceleration Program (ASAP) to prepare prime development-ready sites in economically disadvantaged areas for business expansion and economic growth. Through ASAP, due diligence studies, conceptual site plans, and targeted industry analyses will be completed for several key properties within Ameren's downstate service territory.

2025-12-16

2025-12-15

Ameren (AEE) Valuation Check After Recent Pullback and Strong Year-to-Date Share Price Gains

Description: Ameren (AEE) has quietly outperformed many utilities this year, and with the stock up 11% year to date and about 15% over the past year, investors are revisiting its defensive appeal. See our latest analysis for Ameren. The recent pullback, including a 1 month share price return of negative 5.9 percent from a last close of 98.87 dollars, comes after a steady year to date share price gain and solid multi year total shareholder returns. This suggests that momentum is pausing rather than...

Jamie Engstrom joins Ameren board of directors

Description: Ameren Corporation (NYSE: AEE) announced today that Jamie L. Engstrom has been elected to the Ameren board of directors, effective Jan. 1, 2026.

Here's Why You Should Add OGE Stock to Your Portfolio Right Now

Description: OGE Energy is ramping up infrastructure and renewable investments while maintaining solid returns and dividends, positioning the utility for steady long-term growth.

2025-12-14

2025-12-13

2025-12-12

AES Boosts Growth Outlook With Renewables & Data Center Deals

Description: AES accelerates growth with expanding renewables, major data-center PPAs and continued progress on its clean-energy transition.

Zacks.com featured highlights include Vertiv, RenaissanceRe, Ameren, Canadian Natural Resources and FedEx

Description: VRT and peers stand out as sales-growth leaders as investors seek clearer signals amid inflation, rate cuts and uneven economic trends.

2025-12-11

Top Technology Executives Recognized at the 2025 St. Louis ORBIE Awards

Description: Leading CIOs honored for leadership, innovation, and business impact. ST. LOUIS, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The 2025 St. Louis ORBIE Awards recognized the exceptional leadership and innovation of top technology executives from Olin Corporation, Mastercard, Ameren, Distribution Management, Inc, Delta Dental of Missouri, Axia Women’s Health, and Saint Louis Zoo. The prestigious ORBIE Awards - hosted by St.LouisCIO, a chapter of the Inspire Leadership Network - honor CIOs who drive business

SO Stock Declines 6% in Past 6 Months: Here's How to Play

Description: Southern Company faces stock underperformance, yet rising large-load demand, strong regulation and $76B growth pipeline strengthen its long-term outlook.

Spire to Benefit From Its Investment in Infrastructure & Acquisition

Description: Spire ensures reliability and growth with major infrastructure upgrades, and acquisitions of complementary assets.

5 Sales Growth Picks Positioned to Generate Steady Returns

Description: Sales growth shines as a key metric in volatile markets, with VRT, RNR, AEE, CNQ and FDX standing out as solid picks.

Is Ameren Stock Underperforming the Dow?

Description: Ameren has slightly lagged behind the Dow Jones Industrial Average over the past year, and analysts remain cautiously optimistic about the stock’s prospects.

2025-12-10

Down 6.5% in 4 Weeks, Here's Why Ameren (AEE) Looks Ripe for a Turnaround

Description: Ameren (AEE) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

2025-12-09

XEL's Unit to Supply 200 MW Electric to Fermi's Project Matador Campus

Description: XEL secures a 200 MW power supply with Fermi America. The company is investing steadily to enhance its transmission & distribution capabilities.

2025-12-08

Is Ameren Still Attractive After 2025 Grid Modernization And Recent Share Price Swings?

Description: Wondering if Ameren at around $99 a share is still a smart place for your money, or if the easy gains are already behind it, you are not alone. Despite a choppy last month, with the stock down about 5.1% over 30 days and 3.6% over the past week, Ameren is still up 11.6% year to date and 12.2% over the last year, building on a solid 47.8% gain over five years. Recent headlines have focused on Ameren's ongoing grid modernization and regulated utility investments, themes that tend to support...

2025-12-07

2025-12-06

2025-12-05

OGE's Long-Term Growth Supported by Robust Capex & Renewable Expansion

Description: OGE Energy leans on rising renewables and a larger capital plan to strengthen reliability and long-term growth momentum.

Ameren (AEE) Down 1.1% Since Last Earnings Report: Can It Rebound?

Description: Ameren (AEE) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-04

2025-12-03

ConnectDER Secures Illinois Approvals From ComEd and Ameren, Enabling Lower-Cost Solar, Battery, and EV Charger Installations

Description: ConnectDER, a leading developer of meter socket adapters for residential distributed energy resource (DER) installations such as solar, battery storage, and EV charging, today announced that its products are approved for use in Illinois in the ComEd and Ameren service areas. These approvals immediately streamline the installation process for DERs, enabling installers to cut costs and timelines for the majority of residents across the state. Illinois is now part of ConnectDER's growing national f

Southern Company Pledges Steady Customer Rates Through 2027

Description: SO's subsidiary Alabama Power commits to steady rates through 2027 while strengthening the grid and offering tools to help households manage monthly bills.

2025-12-02

WIRES Announces 2026 Officers and Board of Directors

Description: WIRES, the transmission trade association dedicated to advancing investment in all aspects of the high-voltage grid, announced today its 2026 leadership team. David Burnham, Director, Transmission Policy, Eversource Energy, was elected as WIRES President for the coming year.

2025-12-01

2025-11-30

2025-11-29

How the Narrative Surrounding Ameren Is Evolving Amid Earnings Growth and Regulatory Shifts

Description: Ameren’s price target has recently been reviewed, with its fair value holding steady at $112.57 per share despite adjustments in other forecasted parameters. The slight changes reflect a mix of analyst optimism over earnings momentum and growth opportunities, balanced by caution around regulatory risks that may impact rate approvals. Investors interested in the evolving outlook for Ameren can monitor updates to stay informed about future changes to the company’s narrative. Analyst Price...

2025-11-28

2025-11-27

Here's Why NI Stock Deserves a Spot in Your Portfolio Right Now

Description: NiSource accelerates clean-energy expansion with a 14.7% revenue growth outlook for 2025.

PPL vs. AEE: Which Dividend-Paying Utility Looks More Attractive?

Description: AEE edges past PPL with stronger earnings growth, ROE, and capex plans, despite trading at a premium valuation.

2025-11-26

2025-11-25

Here's Why EVRG Stock Deserves a Spot in Your Portfolio Right Now

Description: Evergy accelerates its clean energy strategy, boosts grid investment and strengthens returns for long-term growth.

Nuclear Energy Stocks Gain Traction as Clean Power Demand Surges

Description: Investors seeking to build a nuclear-focused portfolio may find compelling opportunities in companies like Dominion Energy, Ameren Corporation and BWX Technologies.

2025-11-24

State regulators approve Ameren Missouri's plan to reliably serve new large businesses, boosting state's economy while safeguarding consumers

Description: Today Ameren Missouri, a subsidiary of Ameren Corporation (NYSE: AEE), announced that the Missouri Public Service Commission (PSC) has approved a new large load user rate structure. The new structure is designed so that high-usage customers, such as data centers and advanced manufacturing businesses, pay their fair share of grid enhancements and energy costs. The PSC decision follows an agreement resolving all pending issues in the Powering Missouri Growth Plan proceeding, which was originally f

2025-11-23

2025-11-22

A Fresh Look at Ameren (AEE) Valuation After a Year of Steady Gains

Description: Ameren (AEE) shares have seen a quiet drift lately, edging up about 1% in the past day and gaining 15% over the past year. The recent price action reflects steady investor sentiment, with little to sway momentum sharply. See our latest analysis for Ameren. Ameren’s latest 1-day share price gain keeps a steady streak going. What really stands out is its 1-year total shareholder return of nearly 15%, reflecting persistent demand and a touch of defensive appeal. Momentum is not off the charts,...

2025-11-21

Here's Why ETR Stock Deserves a Spot in Your Portfolio Right Now

Description: Entergy raises its 2025 outlook and commits $41B to grid upgrades, nuclear expansion and a cleaner energy mix.

Consolidated Edison Rides on Investments & Renewable Energy Expansion

Description: ED's massive capital plan and expanding renewables aim to boost reliability and advance its net-zero push despite regulatory constraints.

2025-11-20

Here's Why Edison International Could Be a Smart Buy at This Moment

Description: EIX raises its 2025 outlook and accelerates major infrastructure spending to support growing electricity needs and long-term growth.

2025-11-19

Here's Why AEE Stock Deserves a Place in Your Portfolio Right Now

Description: Ameren raises its 2025 outlook and invests heavily in long-term growth with clean-energy and nuclear expansion plans.

3 Low-Beta Utility Stocks to Navigate Through Market Volatility

Description: Low-volatility utilities like AWR, AEE and ETR offer steady earnings growth and dividends as tech stocks stumble.

2025-11-18

STATE REGULATORS TO RULE WEDNESDAY ON AMEREN'S MASSIVE RATE-HIKE PROPOSAL, CUB AVAILABLE TO COMMENT

Description: STATE REGULATORS TO RULE WEDNESDAY ON AMEREN'S MASSIVE RATE-HIKE PROPOSAL, CUB AVAILABLE TO COMMENT

2025-11-17

Here's Why Spire Stock Deserves a Spot in Your Portfolio Right Now

Description: Spire's rising earnings estimates, strong dividends and a major long-term investment plan are making it attractive for investors.

2025-11-16

2025-11-15

Is Now the Moment to Reassess Ameren After an 18% Share Price Rise in 2025?

Description: Wondering if Ameren could be offering hidden value right now? You are not alone, as many investors are taking a closer look given the stock’s recent moves. Ameren shares have seen a steady rise so far this year, climbing 18.5% over the past 12 months and 18.0% year-to-date, despite more muted action of 0.4% over the last 7 days. Much of this momentum has been driven by industry-wide shifts in utilities, including new infrastructure initiatives and a heightened interest in renewable energy...

2025-11-14

How Recent Developments Are Shaping the Ameren Investment Story

Description: Ameren stock has drawn close attention after analysts nudged their consensus price target upward, from $111.43 to $112.57. This adjustment reflects persistent bullish sentiment, with many experts citing Ameren’s earnings strength and leading sector position. Stay tuned to find out how you can track these ongoing shifts in the company’s investment narrative as they develop. Stay updated as the Fair Value for Ameren shifts by adding it to your watchlist or portfolio. Alternatively, explore our...

Reasons to Add AWR Stock to Your Portfolio Right Now

Description: American States Water boosts its growth outlook with rising estimates, steady dividends, and ongoing infrastructure upgrades.

2025-11-13

Renewable Energy & Battery Stocks to Watch as Renewables Beat Coal

Description: Renewables outshine coal as global solar and wind output surge, boosting energy storage demand and lifting stocks such as AEE, AEP, and CSIQ.

2025-11-12

2025-11-11

Vistra Q3 Earnings Beat Estimates, Revenues Lag, '25 Guidance Narrowed

Description: Vistra tops Q3 earnings forecasts but misses on revenues, trims 2025 outlook, and continues its aggressive share buybacks.

Zacks.com featured highlights include Vertiv, Universal Health Services, Aptiv, Ameren and FirstCash

Description: vertiv, Universal Health Services, Aptiv, Ameren and FirstCash have been highlighted in this Screen of The Week article.

2025-11-10

Buy These 5 Stocks With Solid Sales Growth Despite Volatile Markets

Description: Vertiv, Ameren, Universal Health Services, Aptiv and FirstCash stand out with strong 2025 sales growth despite market uncertainty.

2025-11-09

Ameren Corporation Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

Description: Ameren Corporation ( NYSE:AEE ) defied analyst predictions to release its third-quarter results, which were ahead of...

2025-11-08

2025-11-07

Is Ameren’s Upgraded 2025 Earnings Guidance Reshaping the Investment Case for AEE?

Description: Ameren Corporation recently reported its third quarter 2025 results, with sales reaching US$2.70 billion and net income of US$640 million, alongside raised 2025 GAAP EPS guidance and a new earnings outlook for 2026. The company’s improved earnings guidance reflects stronger-than-expected financial performance and growing confidence in continued demand, regulatory support, and investment returns. We'll examine how Ameren's raised 2025 earnings guidance could reshape the company's long-term...

Are Wall Street Analysts Predicting Ameren Corporation Stock Will Climb or Sink?

Description: Are Wall Street analysts bullish or bearish on utility firm Ameren Corp?

2025-11-06

Ameren Corp (AEE) Q3 2025 Earnings Call Highlights: Strong EPS Growth and Robust Infrastructure ...

Description: Ameren Corp (AEE) reports a significant rise in adjusted EPS and outlines a decade-long $68 billion investment pipeline, despite facing regulatory challenges.

Ameren Q3 Earnings Higher Than Expected, Revenues Increase Y/Y

Description: AEE's Q3 earnings surge past expectations with higher revenues, stronger operating income and improved segment performance.

2025-11-05

Compared to Estimates, Ameren (AEE) Q3 Earnings: A Look at Key Metrics

Description: The headline numbers for Ameren (AEE) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Ameren (AEE) Q3 Earnings and Revenues Surpass Estimates

Description: Ameren (AEE) delivered earnings and revenue surprises of +3.33% and +12.01%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Ameren: Q3 Earnings Snapshot

Description: The results surpassed Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for earnings of $2.10 per share. The utility posted revenue of $2.7 billion in the period, also topping Street forecasts.

Ameren Announces Third Quarter 2025 Results

Description: Ameren Corporation (NYSE: AEE) today announced third quarter 2025 net income attributable to common shareholders in accordance with generally accepted accounting principles (GAAP) of $640 million, or $2.35 per diluted share, compared to third quarter 2024 GAAP net income of $456 million, or $1.70 per diluted share. Excluding a third quarter 2025 tax benefit and certain 2024 charges described below, Ameren recorded third quarter 2025 adjusted (non-GAAP) net income attributable to common sharehold

2025-11-04

Ameren Corporation names new general counsel

Description: Ameren Corporation (NYSE: AEE) today announced the appointment of David M. Feinberg as executive vice president, general counsel and corporate secretary.

Seeking Clues to Ameren (AEE) Q3 Earnings? A Peek Into Wall Street Projections for Key Metrics

Description: Besides Wall Street's top-and-bottom-line estimates for Ameren (AEE), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

WEC Energy Q3 Earnings Beats Estimates, Revenues Rise Y/Y

Description: WEC Energy Q3 earnings and revenues top estimates, fueled by higher electricity demand and steady financial momentum.

2025-10-30

Earnings Preview: Vistra Corp. (VST) Q3 Earnings Expected to Decline

Description: Vistra (VST) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Ameren (AEE): Assessing Valuation as Shares Show Mixed Momentum in 2024

Description: Ameren (AEE) has been on investors’ radar as its stock has shown mixed momentum in recent months. It has gained about 1% over the past 3 months and risen 21% year to date. See our latest analysis for Ameren. After a steady climb throughout the year, Ameren's recent 1-day and 7-day share price declines have not erased its strong momentum. The company has a year-to-date share price return of nearly 15% and an impressive 1-year total shareholder return of over 21%. This suggests positive...

2025-10-29

Ameren (AEE) Could Be a Great Choice

Description: Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Ameren (AEE) have what it takes? Let's find out.

Ameren (AEE) Reports Next Week: Wall Street Expects Earnings Growth

Description: Ameren (AEE) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

OGE Energy (OGE) Q3 Earnings Lag Estimates

Description: OGE Energy (OGE) delivered earnings and revenue surprises of -1.72% and +17.24%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-28

Sector Update: Energy Stocks Retreat Late Afternoon

Description: Energy stocks were lower late Tuesday afternoon, with the NYSE Energy Sector Index easing 0.4% and t

Sector Update: Energy Stocks Lower Tuesday Afternoon

Description: Energy stocks were lower Tuesday afternoon, with the NYSE Energy Sector Index easing 0.1% and the En

Ameren Faces Favorable Regulatory Position With Limited Near-Term Growth Catalysts, RBC Says

Description: Ameren (AEE) is facing a favorable regulatory position and forecasted growth appears fairly priced i

2025-10-27

Buy 5 Nuclear Energy Stocks Amid Massive AI-Powered Data Center Growth

Description: AI-driven data center demand is fueling a nuclear energy boom. D, DUK, AEE, ETR and PCG are five stocks poised to benefit from the surge.

2025-10-26

2025-10-25

2025-10-24

Ameren (AEE) Upgraded to Buy: Here's What You Should Know

Description: Ameren (AEE) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-10-23

2025-10-22

Ameren Earnings Preview: What to Expect

Description: Utilities giant Ameren is gearing up to release its third-quarter results by early November, and analysts expect a high single-digit surge in earnings.

2025-10-21

Adopt these habits to save energy and money this fall

Description: As fall brings cooler mornings and milder afternoon temperatures, it's the perfect time to revisit home energy habits and prepare for the winter heating season. Ameren encourages customers to actively monitor their energy usage – a routine that can help save money at home and work, and reduce strain on the grid.