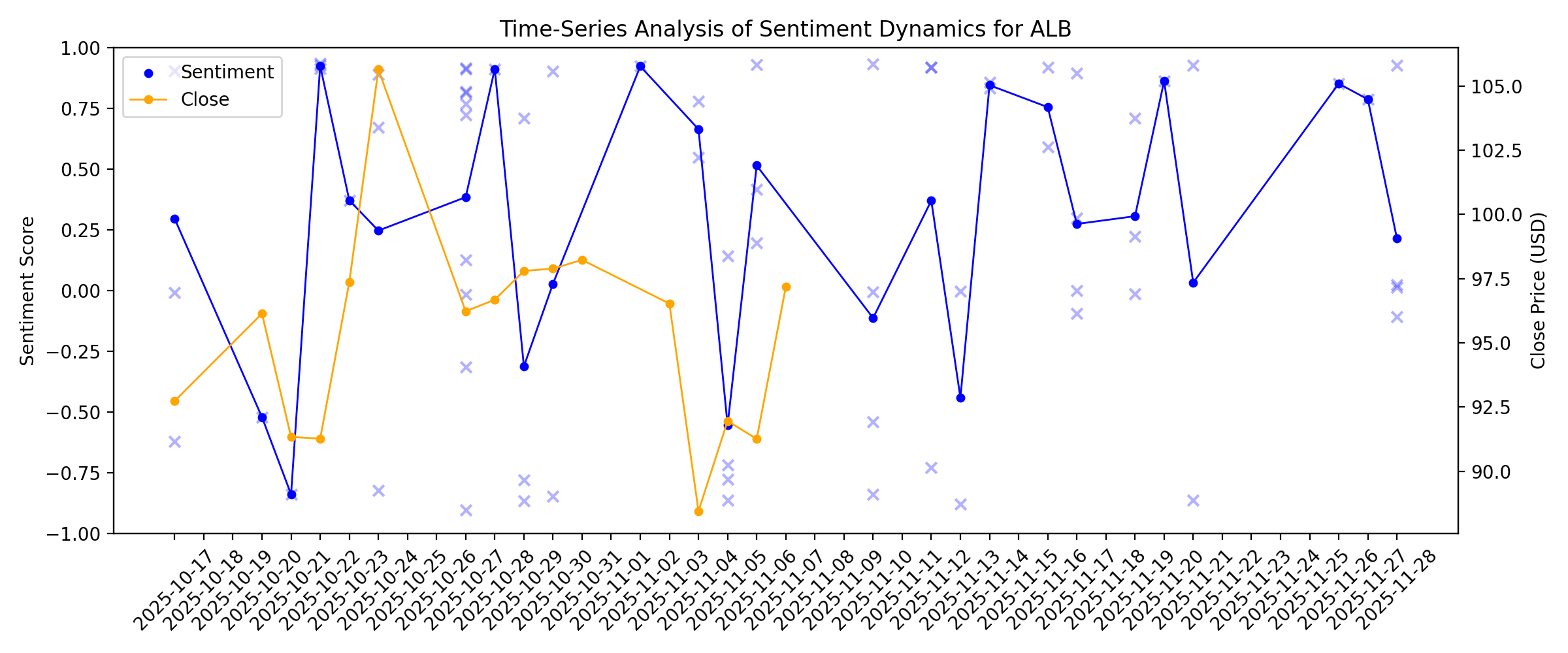

News sentiment analysis for ALB

Sentiment chart

2026-01-14

Albemarle (ALB) is a Great Momentum Stock: Should You Buy?

Description: Does Albemarle (ALB) have what it takes to be a top stock pick for momentum investors? Let's find out.

Jim Cramer Prefers Albemarle Over Lithium Americas

Description: Lithium Americas Corp. (NYSE:LAC) is one of the stocks Jim Cramer recently looked at. During the lightning round, a caller mentioned that they have been considering the stock, and Cramer replied: “No, no, no… Wrong one. You want Albemarle. Even though it’s up a lot, it’s a much safer stock. The symbol is ALB. Let’s […]

If You Invested $1000 in Albemarle a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

UPDATE ON CASE LAKE AS FIELD PROGRAMS RESUME

Description: Power Metals Corp ("Power Metals" or the "Company") (TSX VENTURE: PWM) (FRANKFURT: OAA1) (OTCQB: PWRMF) is pleased to provide an update on activities underway at the Company's Case Lake Project ("the Project") in Ontario, Canada.

2026 Rebound? This High-Voltage Lithium Stock Could Have An Explosive Snapback

Description: The lithium market is improving, and this company is ideally positioned to capture the upside potential.

2026-01-13

Wall Street Is Back on the Lithium Train. What Investors Should Know.

Description: Things appear to be turning around for a tiny element—lithium—that is at the center of battery technology powering so much of today’s technology. Tuesday, Deutsche Bank analysts Corinne Blanchard and David Begleiter upgraded some lithium shares to Buy, feeling “more optimistic” about the sector in 2026. The new price target is $185 a share.

'Influx Of Investor Interest' On Lithium Sends Albemarle To 2-Year Highs

Description: Albemarle received two upgrades this week as analysts are turning more bullish on the sector amid soaring lithium prices.

Albemarle Corporation to Release Fourth Quarter 2025 Earnings Results on Wednesday, February 11, 2026

Description: Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, announced today that it will release its fourth quarter 2025 earnings after the NYSE closes on Wednesday, February 11, 2026.

Best Momentum Stocks to Buy for Jan. 13

Description: ALB, KNOP and LINC made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on Jan.13, 2026.

Why Investors Need to Take Advantage of These 2 Basic Materials Stocks Now

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

China to Cut VAT Rebates on Lithium Batteries: Who Wins & Who Loses?

Description: China's move to reduce lithium battery VAT rebates could aid stocks like ALB, LAC, RIO, while TSLA and RIVN may struggle with higher costs.

Albemarle Hits Fresh 52-Week High: What's Driving the Stock?

Description: ALB shares touch a new 52-week high as lithium prices rebound and EV and energy-storage demand improve, lifting sentiment and earnings expectations.

2026-01-12

Why Sigma Lithium Stock Soared Today

Description: Is what's good for lithium prices good for all lithium producers -- or only Albemarle?

Albemarle Shares Surge 76% in a Year: What's Driving the Rally?

Description: ALB shares soar 76% as lithium prices rebound, EV and energy-storage demand improve and cost cuts lift earnings and investor confidence.

Olin (OLN) Surges 5.8%: Is This an Indication of Further Gains?

Description: Olin (OLN) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

RETRANSMISSION: Cruz Battery Metals Engages Stantec for Maiden Resource Estimate and Technical Report on the Solar Lithium Project in Nevada, Directly Bordering American Lithium

Description: Vancouver, British Columbia--(Newsfile Corp. - January 12, 2026) - Cruz Battery Metals Corp. (CSE: CRUZ) (OTCID: BKTPF) (WKN: A40YSN) ("Cruz" or the "Company") is pleased to announce that it has engaged Stantec Consulting Ltd. to complete a Maiden Resource Estimate ("MRE") and Technical Report for the Solar Lithium Project in Clayton Valley, Nevada. The Technical Report will be prepared in accordance with the requirements of National Instrument 43-101. The Stantec qualified person (Derek...

2026-01-11

Is It Too Late To Consider Albemarle (ALB) After A 90% One Year Rally?

Description: If you are wondering whether Albemarle's share price still offers value after a strong run, this article will walk you through what the numbers currently suggest about the stock. Albemarle's stock has recently closed at US$161.29, with returns of 12.1% over the last 7 days, 21.5% over the last 30 days, 12.1% year to date, 90.3% over 1 year, a 30.4% decline over 3 years, and a 5.0% decline over 5 years. This signals a mixed picture for investors thinking about entry or exit points. Recent...

2026-01-10

2026-01-09

Albemarle (ALB) Outpaces Stock Market Gains: What You Should Know

Description: Albemarle (ALB) closed the most recent trading day at $161.29, moving +1.88% from the previous trading session.

S&P 500 Climbs in First Full Week of 2026, Hits New Highs

Description: The Standard & Poor's 500 index rose 1.6% this week to a fresh closing high in a broad climb led by

Albemarle Corporation (ALB) Is a Trending Stock: Facts to Know Before Betting on It

Description: Zacks.com users have recently been watching Albemarle (ALB) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Cruz Battery Metals Engages Stantec for Maiden Resource Estimate and Technical Report on the Solar Lithium Project in Nevada, Directly Bordering American Lithium

Description: Vancouver, British Columbia--(Newsfile Corp. - January 9, 2026) - Cruz Battery Metals Corp. (CSE: CRUZ) (OTCID: BKTPF) (WKN: A40YSN) ("Cruz" or the "Company") is pleased to announce that it has engaged Stantec Consulting Ltd. to complete a Maiden Resource Estimate ("MRE") and Technical Report for the Solar Lithium Project in Clayton Valley, Nevada. The Technical Report will be prepared in accordance with the requirements of National Instrument 43-101. The Stantec qualified person (Derek Loveday,

2026-01-08

2026-01-07

Albemarle Stock Rises After Upgrade. Why Shares Aren’t Up Even More.

Description: Albemarle stock rose on Wednesday after getting upgraded to Buy from Hold at Baird. Albemarle stock closed up 2.2% at $161.57, while the and the fell 0.3% and 0.9%, respectively. The move came after Baird analyst Ben Kallo upgraded Albemarle stock to Buy from Hold and raised his price target to $210 a share from $113.

How Recent Lithium And Valuation Shifts Are Rewriting The Albemarle (ALB) Investment Story

Description: Albemarle’s latest valuation work shows its estimated fair value moving from about US$107.14 to roughly US$125.49, supported by a slightly lower discount rate of around 7.76% and updated assumptions for revenue growth. These shifts sit against a research backdrop where some analysts are more optimistic on lithium pricing and Energy Storage earnings, while others question how much good news is already embedded in the stock. As these views evolve and the fair value range adjusts, it is worth...

Rising Lithium Prices Get Miner Albemarle Off To A Flying Start In 2026

Description: Mining company Albemarle is up about 15% since the start of the year because of soaring lithium prices and the possibility it could become an AI play.

Baird upgrades Albemarle on strong lithium pricing

Description: Investing.com -- Baird upgraded Albemarle to Outperform given a sharp rebound in lithium prices. There is strong demand from stationary energy storage that should boost company earnings even after 2026.

Assessing Albemarle (ALB) Valuation After Analyst Upgrades And Lithium Demand Optimism

Description: Albemarle (ALB) has been back in the spotlight after recent analyst upgrades tied to firmer lithium prices and demand expectations from areas like robotics and energy storage, along with company moves to cut costs and sell non-core assets. See our latest analysis for Albemarle. The recent analyst upgrades and firmer lithium pricing have arrived alongside strong momentum, with Albemarle’s share price returning 26.33% over the last month and 72.48% over 90 days. Its 1 year total shareholder...

2026-01-06

Stock Market Today, Jan. 6: Vale Shares Jump on Strong Day for Mining Stocks

Description: Today, Jan. 6, 2026, institutional buying and a focus on AI-related machine growth helped the nickel miner's shares.

Albemarle Stock Soars. It’s the Robots.

Description: Shares of lithium miner Albemarle rose 8.3% on Tuesday to $158.15 apiece, while the and rose 0.6% and 1%, respectively. The jump came after Jefferies analyst Laurence Alexander raised his price target for Albemarle stock to $167 from $152, while reiterating his Buy rating. “Commodity fly-ups are usually a function of demand shocks,” added Alexander.

Here's Why Albemarle Stock Powered Higher Today

Description: An analyst upgrade, a lithium price spike, and renewed optimism for its end markets contributed positively today.

2026-01-05

Albemarle (ALB) Surpasses Market Returns: Some Facts Worth Knowing

Description: In the most recent trading session, Albemarle (ALB) closed at $146.13, indicating a +1.53% shift from the previous trading day.

2026-01-04

How Investors May Respond To Albemarle (ALB) After Bank Upgrades On Tighter Lithium Outlook

Description: In December 2025, several banks including RBC Capital, Morgan Stanley, and UBS upgraded Albemarle, citing improving lithium market fundamentals and stronger energy storage demand. The analysts’ focus on a potential lithium supply deficit by 2026 highlights how expectations around long-term resource tightness are shaping sentiment toward Albemarle today. We’ll now examine how this more optimistic view on lithium supply-demand balances could influence Albemarle’s existing investment...

2026-01-03

2026-01-02

RBC Sees Improving Lithium Fundamentals Lifting Albemarle (ALB) Outlook

Description: Albemarle Corporation (NYSE:ALB) is included among the 20 Best Performing Dividend Stocks in 2025. On December 18, RBC Capital raised its price target on Albemarle Corporation (NYSE:ALB) to $159 from $120 and kept an Outperform rating. The change came as part of a broader 2026 outlook for Chemicals and Packaging. In a research note, the […]

2026-01-01

2025-12-31

4 Stocks Positioned to Benefit From Lithium Rebound in 2026

Description: Lithium demand is set to rebound in 2026 as EVs, BESS and AI-driven energy lift demand, putting LAC, RIO, ALB and SQM in the spotlight.

2025-12-30

Why Albemarle (ALB) Dipped More Than Broader Market Today

Description: The latest trading day saw Albemarle (ALB) settling at $142.01, representing a -1.78% change from its previous close.

Zacks Investment Ideas feature highlights: REMX, ALB, SGML and LAR

Description: REMX signals a fresh breakout as rare earth stocks regain momentum after consolidation, fueled by geopolitics, AI demand and supply-chain risks.

2025-12-29

Tesla, These Mining Giants Are S&P 500's Biggest Losers Monday

Description: Tesla as well as Newmont and two other mining giants were the S&P 500's biggest losers Monday. But all are still near 52-week highs.

Could oil stocks become an unlikely AI play in 2026?

Description: While Wall Street grows more bullish on industrial companies that will be key to building out and powering AI data centers, could an energy giant like Exxon Mobil (XOM) be a part of the next phase of the AI Revolution? Yahoo Finance senior reporter Ines Ferré takes into account how natural gas (NG=F) and oil (CL=F, BZ=F) could react to the energy demands stemming from AI data centers. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

Rare Earth Metal Stocks Quietly Break Out Again

Description: The rare earth metals ETF staged a notable breakout last week, led by Albemarle, Sigma Lithium and Lithium Americas (Argentina) Corp stocks

A Battery Supply Chain ETF Quietly Returned 66%, Stomping AI Stocks

Description: While investors fixated on artificial intelligence throughout 2025, the battery supply chain quietly delivered exceptional returns, powering everything from electric vehicles to grid storage. A Supply Chain Play, Not Just an EV Bet Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT) returned 66% year-to-date in 2025, nearly tripling the Nasdaq-100’s 22% gain. This performance came from ... A Battery Supply Chain ETF Quietly Returned 66%, Stomping AI Stocks

Investors Heavily Search Albemarle Corporation (ALB): Here is What You Need to Know

Description: Albemarle (ALB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-28

2025-12-27

2025-12-26

Silver Topped Gold In 2025. It’s Copper’s Turn.

Description: Record gold and silver prices got all the publicity, but metals across the board, from uranium to copper to cobalt, took off this year and look likely to climb next year, too. Here’s why.

2025-12-25

2025-12-24

Albemarle (ALB) Outperforms Broader Market: What You Need to Know

Description: Albemarle (ALB) concluded the recent trading session at $148.51, signifying a +1.23% move from its prior day's close.

2025-12-23

Why Investors Need to Take Advantage of These 2 Basic Materials Stocks Now

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

Premarket Movers: Albemarle Gaining Momentum on Lithium Boom

Description: Albemarle (NYSE: ALB) had an incredible year. Since bottoming out at around $50 in April, the lithium giant exploded to $145.38. This morning, it’s up another $4.15 and could race even higher, especially with Ganfeng Lithium Chairman LI Liangbin noting that demand could rise 30% to 50% next year. In addition, according to Sprott, the ... Premarket Movers: Albemarle Gaining Momentum on Lithium Boom

Albemarle Shares Rally 81% in 3 Months: What's Driving the Stock?

Description: ALB has surged 81% in three months as forecast-topping earnings, Energy Storage volume growth and cost cuts offset pressure from weak lithium prices.

2025-12-22

The ALPS Clean Energy ETF Soared 30%, But Faces a 2026 Policy Cliff

Description: ALPS Clean Energy ETF (NYSEARCA:ACES) has surged 30% year-to-date through, nearly doubling the S&P 500’s 16% gain. But context matters: ACES remains down 49% over five years, trading around $33.60 versus its 2020 peak above $66. This is a recovery rally, not a breakout. The question heading into 2026 is whether momentum can continue or ... The ALPS Clean Energy ETF Soared 30%, But Faces a 2026 Policy Cliff

2025-12-21

2025-12-20

2025-12-19

S&P 500 Posts Slight Weekly Gain, Led by Consumer Discretionary

Description: The Standard & Poor's 500 index edged up 0.1% this week as gains led by the consumer discretionary s

2025-12-18

Intel, Paramount are some of Wall Street's best comebacks of 2025

Description: Paramount Skydance (PSKY), Intel (INTC), and Estée Lauder (EL) are just some of the S&P 500 (^GSPC) components that gained in 2025, rebounding from negative returns in 2024. Yahoo Finance Markets and Data Editor Jared Blikre, who also hosts Yahoo Finance's Stocks in Translation podcast, takes a closer look at some of 2025's best comebacks. Catch more Stocks in Translation, with new episodes every Tuesday and Thursday. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Albemarle (ALB) Valuation After China Lithium Permit Cuts and Stronger-Than-Expected Quarterly Results

Description: Albemarle (ALB) has been climbing the watchlists after a one two punch of catalysts: China tightening lithium mining permits and the company delivering better than expected quarterly results with stronger energy storage demand. See our latest analysis for Albemarle. Those catalysts are landing on a stock that already has the wind at its back, with a roughly 14% 1 month share price return and a powerful 66% 3 month share price return lifting the share price to around $134. However, the 3 year...

2025-12-17

Has Albemarle’s 58.1% Rally in 2025 Already Priced In Its Lithium Recovery Story?

Description: If you are wondering whether Albemarle is still a bargain after its rebound, or if the sweet spot has already passed, you are not alone. This is exactly what we are going to unpack. The stock has climbed 1.1% over the last week and 14.5% over the last month, and is now up 58.1% year to date. However, longer term holders will know it is still down 39.5% over three years and 4.7% over five. These moves have come as investors reassess the long term outlook for lithium demand and Albemarle's...

Stock Market Live December 17: Venezuela Blockaded, S&P 500 (VOO) Rebounds

Description: This article will be updated throughout the day, so check back often for more daily updates. The Vanguard S&P 500 ETF (NYSEMKT: VOO) closed down 0.2% on Tuesday, its third straight day of losses, after the U.S. Bureau of Labor Statistics reported fewer job losses for October, and more jobs gained in November — but ... Stock Market Live December 17: Venezuela Blockaded, S&P 500 (VOO) Rebounds

2025-12-16

3 Chemicals Stocks Set to Continue Their Winning Streaks in 2026

Description: While 2025 brought challenges for the chemical industry, PRM, ALB and SQM showed resilience and delivered solid returns on the bourses.

Here is What to Know Beyond Why Albemarle Corporation (ALB) is a Trending Stock

Description: Albemarle (ALB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-15

Albemarle and Power Metals Sign Cesium Concentrate Offtake Deal

Description: Albemarle agreed to a C$5M pre-payment to secure cesium oxide concentrate from Power Metals' Case Lake Project in Ontario, including existing offtake rights.

You're Nuts If You Own 10 S&P 500 Stocks In 2026, Analysts Say

Description: Coming off a strong 2025, S&P 500 investors might hope for a repeat. But analysts are warning that some members are likely to disappoint.

Is Albemarle Stock Outperforming the Dow?

Description: Albemarle stock continues to run ahead of the Dow, supported by largely favorable analyst views.

2025-12-14

Is Albemarle (ALB) Using Cesium Deals And Board Moves To Quietly Rebalance Its Battery Strategy?

Description: Albemarle Corporation recently saw board member Dean L. Seavers resign and secured an offtake and prepayment agreement with Power Metals for up to C$5 million of cesium oxide concentrate from the Case Lake project, while also boosting its profile through conference presentations in London and Houston earlier this month. This combination of board change and expanded access to specialty cesium supply highlights how Albemarle is adjusting its governance and raw-material footprint alongside its...

2025-12-13

2025-12-12

Lithium Royalty Corp. Congratulates Power Metals on Offtake Agreement with Albemarle; Power Metals Reaffirms 2026 Production Target

Description: TORONTO, December 12, 2025--Lithium Royalty Corp. (TSX: LIRC) ("LRC") congratulates Power Metals Corp. ("Power Metals") on the cesium concentrate offtake agreement that it announced today with Albemarle Corporation1. Albemarle Corporation (NYSE: ALB) is a US$16 billion company and one of the leading critical mineral companies in the world with a leading position in lithium and cesium. LRC holds a 2.0% GOR royalty on Power Metals’ Case Lake project.

Power Metals Higher As Seals $5 Million Pre-payment Cesium Oxide Deal With Albermarle

Description: Power Metals (PWM.V) up 7.5% on last look, said Friday it has sealed a $5 million pre-payment deal f

2025-12-11

Buy Stocks on the Dip? Here’s a Better Strategy.

Description: Many investors welcomed the market’s recent decline as an opportunity to buy the dip. That’s not the best strategy, argue two analysts.

Lithium Deficit Could Boost Albemarle (ALB) Stock, Says UBS

Description: Albemarle Corporation (NYSE:ALB) is included among the 15 Best Stocks to Buy for the Long Term. UBS upgraded Albemarle Corporation (NYSE:ALB) to Buy from Neutral on December 5, and also raised its price target to $185 from $107. The update came as the firm expects growing energy storage demand, coupled with years of slower capacity […]

2025-12-10

Buying Stocks on the Cheap Can Cost You More. Here’s a Better Strategy.

Description: Many investors welcomed the market’s recent decline as an opportunity to buy the dip. That’s not the best strategy, argue two analysts.

2025-12-09

Zacks Industry Outlook Highlights Air Products and Chemicals, Albemarle and Avient

Description: Air Products, Albemarle and Avient lean on cost cuts, productivity gains and strategic projects as diversified chemical demand stays under pressure.

2025-12-08

Albemarle (ALB) Just Overtook the 20-Day Moving Average

Description: Should investors be excited or worried when a stock crosses above the 20-day simple moving average?

3 Diversified Chemical Stocks to Watch Amid Demand Headwinds

Description: Soft demand in key end markets and sluggishness in Europe and China have put a dent in the Zacks Chemicals Diversified industry. APD, ALB and AVNT are poised to navigate the industry challenges.

2025-12-07

Don't Race Out To Buy Albemarle Corporation (NYSE:ALB) Just Because It's Going Ex-Dividend

Description: Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Albemarle...

2025-12-06

What Analysts Think Is Changing The Albemarle Story After Recent Lithium Market Shifts

Description: Albemarle’s fair value estimate has inched up to about $107 per share from roughly $103, as analysts factor in firmer medium term lithium pricing and improved earnings power. This comes alongside a slightly lower discount rate of around 7.81% versus about 7.83% and a marginally more conservative revenue growth outlook of roughly 10.46% compared with approximately 10.52%, reflecting a more balanced yet still constructive narrative. Stay tuned to see how you can track these evolving assumptions...

2025-12-05

Albemarle Stock Soars. The Reason Is Easy to See.

Description: It caught another upgrade with one analyst saying a new lithium mining upcycle is about to begin. The stock move came after UBS analyst Joshua Spector upgraded Albermarle to Buy from Hold on Thursday evening. “Deficit” in commodity markets is music to investors’ ears.

Wall Street Still Pounding the Table Over MP Materials, Albemarle, and Netflix

Description: With the U.S. battle over rare earth, Morgan Stanley just upgraded MP Materials (NYSE: MP) to an overweight rating with a price target of $71 a share. While China did pause its rare earth restrictions for a year, there is still a strong possibility of more rare earth supply issues, which MP Materials can assist ... Wall Street Still Pounding the Table Over MP Materials, Albemarle, and Netflix

Albemarle (ALB) Up 30.6% Since Last Earnings Report: Can It Continue?

Description: Albemarle (ALB) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Why Albemarle Stock Zoomed Higher by 32% in November

Description: The company is positioning itself for a long-awaited recovery in the lithium market.

These Are the 3 Hottest Stocks in the S&P 500 Heading Into the New Year. Should You Invest in Them?

Description: After tepid performances throughout most of 2025, these stocks are showing some upward momentum.

2025-12-04

Assessing Albemarle (ALB)’s Valuation After Its Recent Share Price Rebound

Description: Albemarle (ALB) has quietly staged a sharp rebound, with shares up roughly 31% over the past month and nearly 60% in the past 3 months, drawing renewed attention to its lithium-focused outlook. See our latest analysis for Albemarle. That surge comes after a tough stretch, with the share price still showing a weak three year total shareholder return. However, the strong recent share price momentum suggests sentiment toward Albemarle’s lithium earnings power is turning more optimistic. If...

2025-12-03

Baird Raises Albemarle (ALB) Price Target as Lithium Market Optimism Grows

Description: Albemarle Corporation (NYSE:ALB) is included among the 15 Dividend Stocks that Outperform the S&P 500. On December 2, Baird upgraded Albemarle Corporation (NYSE:ALB) to Neutral from Underperform and raised its price target to $113 from $81. The firm attributed the recent share rally to optimism around lithium demand for energy storage. While Baird is easing […]

Is Trending Stock Albemarle Corporation (ALB) a Buy Now?

Description: Albemarle (ALB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-02

Why Albemarle Stock Just Got Upgraded

Description: It has been tough for lithium producers like Albemarle over the past few years. On Tuesday, Baird analyst Ben Kallo upgraded Albemarle stock to Hold from Sell and took his price target to $113 from $81 a share. Albemarle stock rose early, but closed at $128.14, down 0.2%, while the and gained 0.3% and 0.4%, respectively.

Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

Description: Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

2025-12-01

11 Stocks Turn $10,000 Into $392,513 In 11 Months

Description: The S&P 500 eked out another gain in November, stringing together the seventh-straight monthly gain.

2025-11-30

Albemarle (NYSE:ALB) Is Due To Pay A Dividend Of $0.405

Description: The board of Albemarle Corporation ( NYSE:ALB ) has announced that it will pay a dividend on the 2nd of January, with...

2025-11-29

2025-11-28

Should You Revisit Albemarle After Its 52% Rally in 2025?

Description: Wondering if Albemarle is a hidden value play or if you're late to the party? Let's unpack what might be driving all the curiosity about this stock right now. Albemarle's share price has been on a tear, jumping 32.9% over the past month and delivering an impressive 52.5% return year-to-date. However, it is still down 52.3% over the last three years. Recent headlines have spotlighted the company’s pivotal role in global lithium supply chains, especially as battery demand heats up and nations...

Can Albemarle’s (ALB) Lithium Leadership Outweigh Concerns About Debt and Returns?

Description: In recent days, Albemarle has faced renewed investor concern as multiple analyses pointed to its low financial strength, high debt levels relative to earnings, and ongoing uncertainty around its revenue and earnings outlook. Analysts also noted that Albemarle's efficiency in generating shareholder value remains a key issue, with the company's return on invested capital significantly trailing its cost of capital. Adding to the debate is Albemarle's role as a key provider of lithium-based...

These Were the S&P 500’s Best and Worst Stocks in November

Description: Lithium miner Albemarle came out on top, while Super Micro Computer led the list of worst performers.

Can ALB's Cash Strength Power Bigger Shareholder Returns Ahead?

Description: Albemarle's $3.5B liquidity, rising cash flow, and 30-year dividend growth streak signal strength for future shareholder returns.

2025-11-27

LAC vs. ALB: Which Lithium Stock Has More Upside Potential Now?

Description: ALB's rising output, cost cuts and cash strength highlight its edge as investors weigh which lithium stock to invest in.

2025-11-26

Stock Market News: Alphabet inches closer to $4T, consumer spending rises in Midwest

Description: This is the market report as of 4 pm ET on Tuesday, November 25. The market continued to build upon its gains from Monday, and despite the Nvidia lull, it remained relatively calm. The S&P 500 closed 0.9% higher, led by Keysight Technologies, Chipotle, and Albemarle.The Nasdaq Composite closed ...

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Albemarle Stock Rises After Big Pullback. What’s Behind the Lithium Miner’s Volatility?

Description: Albemarle stock rose modestly Friday—a rare quiet day for a name that has become a picture of volatility in recent months. Shares of the lithium miner were up 0.6% on Friday after dropping 7.4% on Thursday, snapping a nine-session winning streak. Investors in the lithium miner should be pleased with their returns this year: Albemarle stock has gained 33%.

Is Most-Watched Stock Albemarle Corporation (ALB) Worth Betting on Now?

Description: Albemarle (ALB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-11-20

How Recent Developments Are Rewriting the Story for Albemarle Stock

Description: Albemarle stock has seen its consensus analyst price target increase from around $96.45 to $103.01 per share, as market experts revise their fair value estimates upward. This change reflects growing optimism around rising lithium demand and higher anticipated sales prices. Albemarle's strong positioning in the supply chain supports this positive outlook. Stay tuned to learn how you can keep up with shifts in analyst sentiment and evolving market expectations for Albemarle in the future. Stay...

2025-11-19

Analysts Tout 3 Rare Earth Stocks; Lithium Stocks Stay Hot As AI Boosts Demand

Description: Rare earth stocks MP Materials and NioCorp Developments rose early Wednesday as analysts touted the investment case, while Ramaco Resources fell after being hit with a sell rating at Goldman Sachs. With rare earth stocks having come back down to earth after China agreed to defer some export restrictions for at least a year, investors are beginning to separate the wheat from the chaff. Meanwhile, lithium stocks continued their recent surge, as SQM jumped after its Q3 earnings report and Albemarle was among the top S&P 500 performers in early stock market action.

Albemarle Rallies 26% in a Month: Here's How to Play the Stock

Description: ALB jumps 26% on strong Q3 volume gains and cost cuts, but soft lithium prices temper the momentum.

Analysts Warn 9 Stocks Are Due For A Big Drop

Description: The AI stock bubble is deflating and some S&P 500 stocks are already in a bear. But analysts think more pain lies ahead.

2025-11-18

2025-11-17

EV Sales Are Slowing. Why This Lithium Producer’s Stock Is on Fire.

Description: Electric-vehicle sales are slowing in the U.S. as the Trump administration cuts support for the transportation technology fueled by lithium-ion batteries. Albemarle stock is rising anyway. Albemarle stock traded as high as $125.85 on Monday before closing at $117.70, up 2.3%, while the and fell 0.9% and 1.2%, respectively.

Stock Market Today: Dow Skids, AI Play Dives As Peter Thiel Exits; Netflix Divvies Up Its Shares (Live Coverage)

Description: The Dow Jones index fell on the stock market today. Lithium stocks rose on bullish commentary. Alphabet jumped on a Warren Buffett move but Peter Thiel dumped a key AI stock.

Wolfspeed and 4 More Stocks That Could Get a Government Boost If Trump Keeps Investing

Description: Buying into stocks that might be next on President Donald Trump’s list could be a good way to see gains. The Trump Administration has already taken equity stakes via warrants in four publicly traded companies: MP Materials Intel, Lithium Americas and Trilogy. Similar deals have been inked with an Alcoa Gallium project in Australia, where the government will receive gallium output in proportion to its capital contribution, and a Cameco/ Brookfield partnership to develop nuclear energy.

Albemarle Leads S&P 500 As Lithium Becomes An AI Play

Description: Albemarle was the top-performing S&P 500 stock on Monday, after the chairman of Ganfeng Lithium Group, the world's largest lithium metal producer, forecast 30% or 40% growth in demand for the battery metal next year. Ganfeng Chairman Li Liangbin predicted that the market price for lithium carbonate in China could surge to 150,000 yuan per metric ton, just over $21,000, or even as high as 200,000 yuan. Reuters cited local media outlet Cailian for the report, which sparked a 9% jump in the lithium carbonate contract on the Guangzhou Futures Exchange to 95,200 yuan (or $13,400) per metric ton.

2025-11-16

Assessing Albemarle (ALB) Valuation Following Recent Share Price Gains

Description: Albemarle is in focus after a stretch of share price gains, with the stock rising 24% over the past month. Investors may be taking a second look at the company as its lithium business attracts renewed attention. See our latest analysis for Albemarle. Albemarle’s run over the past month is catching eyes, but it’s part of a larger rebound story. Momentum is clearly building, with a 24.15% 1-month share price return and year-to-date gains over 35%. Even factoring in last year’s volatility,...

Tesla Stock Hit This Record Right Before Its Slide

Description: The average analyst price target for Tesla stock passed $400 for the first time this past week, according to FactSet.

2025-11-15

2025-11-14

Albemarle (ALB) Rallies on 5th Day on Price Target Upgrade

Description: We recently published Market in Turmoil but These 10 Stocks Are on Fire. Albemarle Corp. (NYSE:ALB) is one of the best-performing stocks on Thursday. Albemarle extended its gains for a 5th straight day on Thursday, as investors gobbled up shares following an investment firm’s marked price target upgrade for its stock. At intra-day trading, Albemarle […]

Why Shares in Albemarle Popped by 18% This Week

Description: The lithium company is prepared for any price increase resulting from increased electric vehicle demand.

2025-11-13

Basic Materials Roundup: Market Talk

Description: Find insight on Albemarle, Aneka Tambang and more in the latest Market Talks covering Basic Materials.

Stock Market Wrap: Top stocks AMD, Oklo, and McGraw-Hill

Description: This is your daily market wrap as of 4 pm ET on November 12, 2025. We continue to remain in a mixed market, as investors digest updates on artificial intelligence and near-term headwinds on the record-breaking government shutdown. The S&P 500 barely edged into the positive territory, closing ...

2025-11-12

Does Albemarle’s Lithium Supply Deals Signal Real Value After a 17% Weekly Rally?

Description: Wondering if Albemarle's current price point offers real value, or if you're just catching the latest buzz? You're not alone; many investors are asking whether there's an upside hiding in plain sight. The stock just shot up 17.4% over the past week and is up 21.9% year-to-date, suggesting that market sentiment may be shifting in a major way after a long stretch of weakness. In the last few weeks, Albemarle has made headlines by announcing new supply deals and investments in lithium...

MinRes, POSCO sign binding deal for lithium partnership

Description: Under the deal, POSCO Holdings is set to acquire a 30% stake in MinRes’ operational lithium business.

Can Albemarle’s (ALB) Asset Sales Shift Its Fortunes in a Volatile Lithium Market?

Description: In its recent third-quarter earnings announcement, Albemarle Corporation reported sales of US$1,307.83 million and a net loss of US$160.69 million, alongside a goodwill impairment charge of US$181.07 million for the period ended September 30, 2025. The company highlighted a 7% increase in adjusted EBITDA and plans for asset divestitures expected to generate US$660 million in pre-tax cash proceeds, reflecting ongoing efforts to bolster efficiency and financial flexibility despite lower...

2025-11-11

2025-11-10

Palantir And Western Digital, S&P 500's Big 2025 Winners, Led Monday's Rally

Description: Palantir Technologies (PLTR), Western Digital (WDC), Albemarle (ALB), Micron Technology (MU) and Newmont Corp. (NEM) were the top five S&P 500 index gainers on the stock market today. . Western Digital stock is the No. 1 performer in the S&P 500 this year. Micron stock and Palantir are in the top five while Newmont Mining is No. 6. Palantir stock...

Albemarle Outlook Strengthens With Shrinking Inventories, Improving Demand, RBC Says

Description: Albemarle's (ALB) outlook is improving as firmer signs of a lithium market recovery emerge, with glo

Albemarle Corporation (ALB) is Attracting Investor Attention: Here is What You Should Know

Description: Albemarle (ALB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Albemarle Stock: Is Wall Street Bullish or Bearish?

Description: Specialty chemical giant Albemarle has underperformed the broader market over the past year, and analysts remain cautious about the stock’s prospects.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

What Recent Analyst Shifts Mean for Albemarle’s Story and Investor Outlook

Description: Albemarle's consensus analyst price target has edged upward from $92.92 to $96.45. This reflects a nuanced shift in market expectations. This modest adjustment comes as analysts weigh evolving lithium market dynamics and company-specific developments. Stay tuned to find out how investors can navigate these ongoing changes and remain updated on the latest shifts in Albemarle's outlook. Stay updated as the Fair Value for Albemarle shifts by adding it to your watchlist or portfolio...

Albemarle Corp (ALB) Q3 2025 Earnings Call Highlights: Navigating Market Challenges with ...

Description: Despite a net loss, Albemarle Corp (ALB) showcases strong cash flow and strategic asset sales to bolster financial flexibility.

Albemarle's Earnings and Revenues Surpass Estimates in Q3

Description: ALB narrows its quarterly loss and beats earnings estimates as cost cuts and higher Energy Storage volumes offset weaker lithium pricing.

2025-11-05

Compared to Estimates, Albemarle (ALB) Q3 Earnings: A Look at Key Metrics

Description: Although the revenue and EPS for Albemarle (ALB) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Albemarle (ALB) Reports Q3 Loss, Beats Revenue Estimates

Description: Albemarle (ALB) delivered earnings and revenue surprises of +79.35% and +1.23%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Albemarle: Q3 Earnings Snapshot

Description: The Charlotte, North Carolina-based company said it had a loss of $1.72 per share. Losses, adjusted for non-recurring costs, were 19 cents per share. The results topped Wall Street expectations.

Albemarle Reports Third Quarter 2025 Results

Description: Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, today announced its results for the third quarter ended September 30, 2025.

2025-11-04

Albemarle to Post Q3 Earnings: What's in the Cards for the Stock?

Description: Albemarle's Q3 results are likely to reflect pressure from weak lithium prices, though cost and efficiency actions could cushion margins.

Rothschild Redburn Starts Coverage on Albemarle (ALB) with a Buy Rating and $135 Price Target

Description: Albemarle Corporation (NYSE:ALB) is included among the 13 Best Consistent Dividend Stocks to Buy Now. On October 24, Rothschild Redburn began coverage on Albemarle Corporation (NYSE:ALB) with a Buy rating and a price target of $135, as per The Fly’s report. The firm noted that the company is well-positioned to benefit from rising lithium prices, […]

2025-11-03

2025-11-02

Albemarle (ALB) Valuation in Focus After Recent 43% Share Price Rebound

Description: Albemarle (ALB) has drawn attention as investors review its recent returns and financial performance. The conversation often turns to valuation, especially as shares have gained over 11% this month and about 43% in the past 3 months. See our latest analysis for Albemarle. Albemarle’s stock hasn’t just surged in recent months; it has staged a remarkable rebound with a 43% share price return over the last quarter, which has reignited investor optimism. While the pace has cooled slightly this...

2025-11-01

2025-10-31

2025-10-30

Ways To Cash In On Rare Earth Minerals Are In Plain Sight

Description: You don't need to scour the ends of the globe to invest in rare earth minerals. ETFs can do the hard work for you.

Washington’s $200 Million Move to Rebuild America’s Rare Earth Supply Chain

Description: EXIM Bank has signalled support for REalloys’ North American rare-earth project, marking a potential milestone in Washington’s drive to establish critical-mineral independence from China.

2025-10-29

Albemarle (ALB) May Report Negative Earnings: Know the Trend Ahead of Next Week's Release

Description: Albemarle (ALB) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Stepan Co. (SCL) Q3 Earnings and Revenues Surpass Estimates

Description: Stepan Co. (SCL) delivered earnings and revenue surprises of +33.33% and +1.56%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Is Albemarle’s Lithium Momentum a Sign of Recovery or Just a Short-Term Rally?

Description: If you are wondering what to do with Albemarle stock right now, you are not alone. Plenty of investors are on the fence, trying to weigh the risk and reward. The stock has had a bumpy ride, but lately there have been some signs of life. In the past month alone, Albemarle shares have jumped 9.7%, and they are up 13.4% year-to-date. That is in sharp contrast to a much bleaker showing over the last three years, when the stock plunged 63.8%. This sudden reversal in momentum is catching a lot of...

2025-10-28

Daily market wrap: top stocks - Qualcomm, Keurig Dr Pepper, and Albemarle

Description: Monday, October 27, 2025 The Market was bullish today, with a new wave of fresh records in the three major indices. The S&P 500 was up 1.2% at closing, thanks to easing US-China trade tensions.The Nasdaq Composite, up 1.9% gained more than 400 points on Monday.The Dow Jones Industrial Average ...

2025-10-27

Albemarle (ALB) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: In the most recent trading session, Albemarle (ALB) closed at $96.23, indicating a -8.91% shift from the previous trading day.

US Equity Indexes Touch Record Highs as Potential China Trade Deal Boosts Big-Tech Ahead of Earnings

Description: US equity indexes broke records on Monday as a potential trade deal with China prompted investors to

Albemarle Announces Quarterly Common Stock Dividend

Description: The Board of Directors of Albemarle Corp. (NYSE: ALB) announced today that it declared a quarterly common stock dividend of $0.405 per share. The dividend, which has an annualized rate of $1.62, is payable January 2, 2026, to shareholders of record at the close of business as of December 12, 2025.

US Equity Markets Close at Record Highs Amid High Expectations for US-China Trade Deal

Description: US equity indexes closed higher on Monday, reaching record highs after expectations for a US-China t

US Equity Indexes Jump as Potential China Trade Deal, Earnings Expectations Lift Big-Tech

Description: US equity indexes rose on Monday as anticipation of a trade deal with China and expectations for rob

Top Midday Decliners

Description: Intellia Therapeutics (NTLA) shares sank 41% after the firm said Monday it has paused dosing and scr

Decabromodiphenyl Ether (DecaBDE) Market to Reach USD 465.19 Million by 2032, Growing At An 2.4% CAGR - Credence Research

Description: Decabromodiphenyl Ether (DecaBDE) Market to Reach USD 465.19 Million by 2032, Growing At An 2.4% CAGR - Credence Research

Big-Tech Helps US Equity Indexes Break Records as China Trade Deal Expectations Slash Tail Risk

Description: US equity indexes broke records in midday trading on Monday as anticipation of a trade deal with Chi

KPS CAPITAL PARTNERS TO ACQUIRE CONTROLLING STAKE IN KETJEN FROM ALBEMARLE

Description: KPS Capital Partners, LP ("KPS") announced today that, through a newly formed affiliate, it has entered into a definitive agreement with Albemarle Corporation ("Albemarle") (NYSE: ALB) to acquire a controlling stake in Ketjen Corporation's refining catalyst solutions business (collectively, "Ketjen" or the "Company"). KPS and Albemarle, through affiliates, will own approximately 51% and 49% of Ketjen at close, respectively, with KPS having a majority of the Board of Directors and operational con

Albemarle Announces Sale of a Controlling Stake in Ketjen to KPS Capital Partners

Description: Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health today announced it has entered into a definitive agreement to sell a controlling stake in Ketjen Corporation's refining catalyst solutions business (collectively, "Ketjen" or the "Company") to KPS Capital Partners, LP ("KPS").

2025-10-26

2025-10-25

2025-10-24

S&P 500 Climbs to New Record on Strong Earnings

Description: Stocks finished the week on a high note after strong corporate earnings and a bit of encouraging data on the inflation front pushed all three major U.S. indexes to new records. Investors bought an array of companies, expanding beyond the artificial-intelligence giants that have fueled the market this year, bolstering automaker Ford, lithium producer Albemarle and defense contractor General Dynamics. The Nasdaq composite and S&P 500 also advanced, logging their second straight weekly gains.

Rothschild says lithium nearing bottom and supply crunch to lift Albemarle

Description: Investing.com -- Rothschild & Co said the lithium market has reached its cyclical bottom after a three-year supply glut and expects prices to rise sharply as demand from electric vehicles and battery storage outpaces new supply later this decade.

Albemarle (ALB) Crossed Above the 20-Day Moving Average: What That Means for Investors

Description: When a stock breaks out above the 20-day simple moving average, good things could be on the horizon. How should investors react?

2025-10-23

Ketjen, Axens Reach New Eurecat Relationship and Collaboration Agreements

Description: HOUSTON & RUEIL-MALMAISON, France, October 23, 2025--Ketjen Corporation and Axens SA today announced a change to Ketjen and Axens’ ownership of and collaboration with Eurecat. Under the agreements, Ketjen will extend its collaboration with Eurecat on advanced catalyst technologies and services, including regeneration, rejuvenation, ex-situ sulfiding, and spent catalyst processing. In addition, Ketjen will sell its 50 percent ownership stake in Eurecat SA to Axens, along with Ketjen’s Isomerizati

2025-10-22

Can Analyst Optimism on Lithium Prices Shift the Long-Term Story for Albemarle (ALB)?

Description: In recent weeks, Albemarle saw upward revisions in its earnings estimates following improved energy storage results linked to strengthening lithium prices, with multiple analysts raising their outlooks for the company. This sharp increase in earnings expectations stands out against broader industry challenges, reflecting Albemarle’s position as a leading global lithium producer with exposure to growing energy storage and electric vehicle demand. We will explore how this renewed analyst...

How the Story for Albemarle Is Shifting as Analysts Update Forecasts and Valuations

Description: Albemarle’s price target has recently been revised upward, with the Fair Value Estimate increasing from $87.79 to $92.92. This change reflects a wave of renewed optimism among analysts. The optimism is driven by government backing for domestic lithium and tightening global supply. Stay tuned to discover how you can track ongoing shifts in the narrative surrounding Albemarle’s stock and valuation outlook. What Wall Street Has Been Saying 🐂 Bullish Takeaways UBS upgraded Albemarle to Neutral...

Albemarle Earnings Preview: What to Expect

Description: Albemarle is prepared to release its third-quarter results next month, with analysts predicting a significant double-digit earnings rise.

2025-10-21

Albemarle Corporation (ALB) is Attracting Investor Attention: Here is What You Should Know

Description: Albemarle (ALB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-10-20

Rare Earth Boom: Defense Heavyweight Joins Critical Mineral Effort

Description: REalloys Inc. appoints GM Defense president Stephen S. duMont as non-executive chairman to align commercial growth with allied defense modernization and secure critical mineral supply chains.

2025-10-19

2025-10-18

2025-10-17

Albemarle (ALB) Stock Sinks As Market Gains: What You Should Know

Description: Albemarle (ALB) concluded the recent trading session at $92.74, signifying a -2.68% move from its prior day's close.

Trump Stock Market Bingo: These Miners May Be Next U.S. Equity Stakes

Description: Did you hear about the small Canadian company with a copper project in Alaska blocked by the Biden administration whose stock exploded higher in early October? No, not Trilogy Metals, which grabbed stock market headlines after President Donald Trump said on Oct. 7 that the U.S. will take a 10% stake in the company.

Lithium Stocks: Trump Administration's Mixed Signals Hit LAC, ABAT

Description: American Battery Technology stock nose-dived on Thursday and kept falling early Friday after the Trump administration terminated its $57.7 million grant for a battery-grade lithium hydroxide manufacturing plant. The move added to questions about whether lithium will receive the same kind of government guarantees provided to rare earth minerals as part of the Defense Department's investment in MP Materials in July. Lithium Americas stock also tumbled on Thursday after a JPMorgan downgrade to underweight.

Albemarle (ALB): Valuation in Focus as Geopolitical Tensions Spark Fresh Investor Interest in Critical Minerals

Description: Albemarle (ALB) has taken center stage as renewed US-China tensions around critical mineral exports stir up the market. Investors are watching closely because trade headlines are sparking a fresh debate on the company’s growth outlook. See our latest analysis for Albemarle. This burst of interest around Albemarle comes after a dramatic 17.7% one-month share price return, as investors digested headlines about critical minerals and strategic moves in the lithium space. Yet, the company’s...