News sentiment analysis for AOS

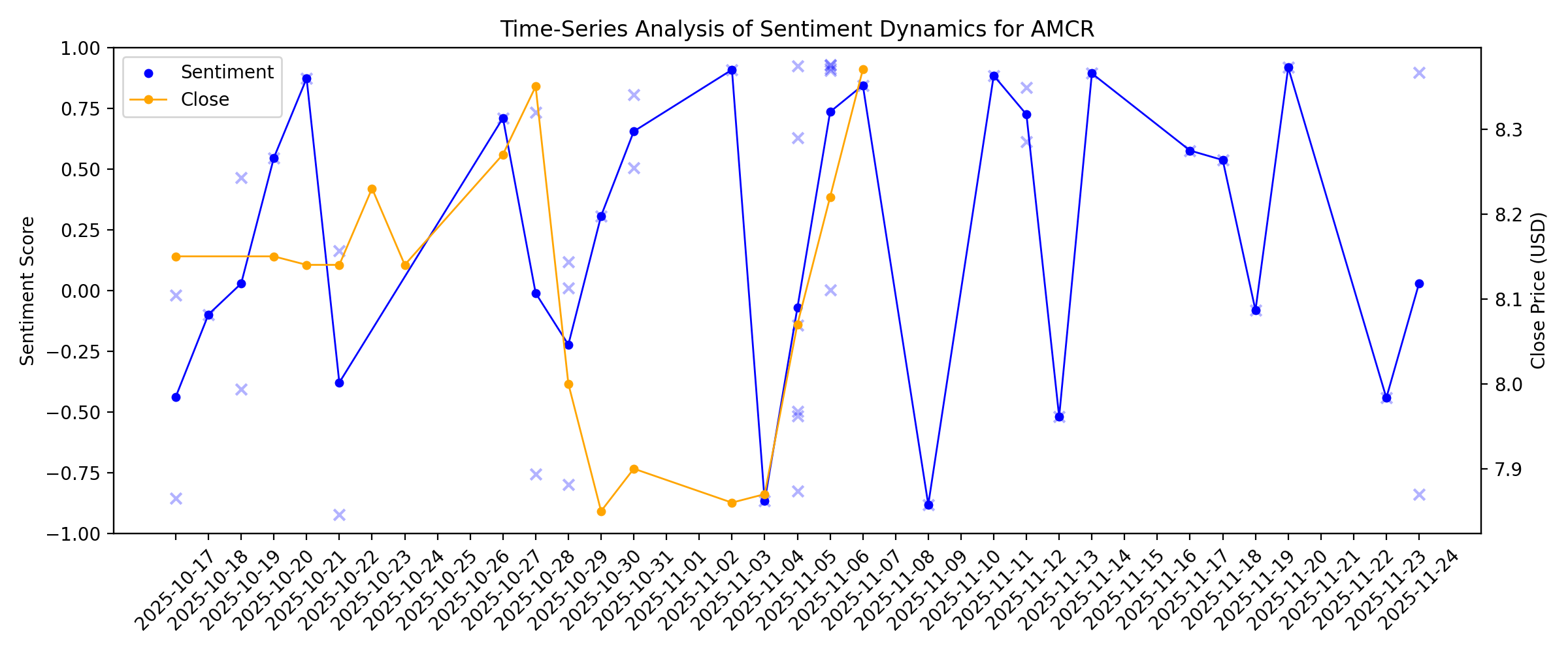

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

Is It Time To Reconsider A. O. Smith (AOS) After Recent Share Price Gains?

Description: If you are wondering whether A. O. Smith at around US$70.52 is offering fair value or looking a bit stretched, you are not alone. The stock has returned 3.2% over the last 7 days, 3.8% over the last 30 days, 3.2% year to date, 6.5% over 1 year, 19.9% over 3 years and 35.8% over 5 years. This naturally raises questions about how that lines up with the current price. Recent attention on A. O. Smith has focused on how the business is positioned in its markets and how that positioning is...

2026-01-09

2026-01-08

A. O. Smith Acquires Leonard Valve, Strengthens Product Offerings

Description: AOS expands its water management portfolio with the $470 million acquisition of Leonard Valve, boosting digital and thermostatic mixing offerings.

2026-01-07

A. O. Smith to Hold Fourth Quarter Conference Call on January 29, 2026

Description: A. O. Smith Corporation (NYSE: AOS) will release its fourth quarter 2025 financial results before the market opens on Thursday, Jan. 29, and has scheduled an investor conference call to follow at 10:00 a.m. (Eastern Standard Time).

2026-01-06

Bessemer Investors Announces Sale of Leonard Valve Company to A. O. Smith Corporation

Description: Leonard Valve Company ("Leonard Valve" or the "Company"), a leading provider of water temperature and flow control solutions, and Bessemer Investors LLC ("Bessemer"), a New York-based investment firm, today announced that Bessemer has completed the sale of Leonard Valve to A. O. Smith Corporation ("A. O. Smith") (NYSE: AOS). A. O. Smith previously announced the signing of a definitive agreement to acquire Leonard Valve on November 12, 2025.

A. O. Smith Completes Acquisition of Leonard Valve Company

Description: Global water technology company A. O. Smith Corporation (the "Company" or "A. O. Smith") (NYSE: AOS) announced today that it has completed the acquisition of LVC Holdco LLC ("Leonard Valve") for $470 million, subject to customary adjustments. The all-cash transaction is valued at approximately $412 million after adjusting for estimated tax benefits and was funded with cash borrowed under a new credit agreement.

A. O. Smith Exhibits Strong Prospects Despite Persisting Headwinds

Description: AOS gains from North America strength, expands via acquisitions and boosts shareholder returns, but faces China softness and rising costs.

2026-01-05

A. O. Smith Corporation (NYSE:AOS) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Description: With its stock down 4.3% over the past three months, it is easy to disregard A. O. Smith (NYSE:AOS). However, a closer...

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

A.O. Smith’s Quarterly Earnings Preview: What You Need to Know

Description: A. O. Smith is expected to release its fourth-quarter results next month, and Wall Street is bracing for a modest single-digit pullback in earnings.

2025-12-30

Global Water Purifier Market to Grow at 8.3% During 2026-32 | MarkNtel Advisors (Leading Market Players: Kent RO System Ltd, A. O. Smith Corporation (Aquasana Inc.), Eureka Forbes Limited, Panasonic Corporation)

Description: According to recent analysis by MarkNtel Advisors, the Water Purifier/Filter market is estimated to grow at a CAGR of around 8.3% during the forecast period, i.e., 2026-32, growth propelled by increasing consumer awareness about waterborne diseases, rapid urbanization, and expanding access to advanced filtration technologies.

2025-12-29

A. O. Smith: Margin Stability and Water Technology Expansion in a Soft Demand Cycle

Description: Recent pricing actions, cost controls, and new treatment capacity reshape the earnings mix.

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Assessing A. O. Smith (AOS) Valuation After Recent 4% Share Price Gain

Description: A. O. Smith (AOS) has quietly outperformed many industrial peers over the past 3 years, and with the stock up about 4% over the past month, investors are rechecking its valuation. See our latest analysis for A. O. Smith. That recent 1 month share price return of about 4.5% looks more like a breather within a longer grind higher, with a 3 year total shareholder return above 26% hinting that steady fundamentals, rather than hype, are driving sentiment. If A. O. Smith’s slow and steady...

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Is A. O. Smith Stock Underperforming the Dow?

Description: Although A. O. Smith has lagged behind the Dow over the past year, analysts remain moderately optimistic about the stock’s prospects.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Do Options Traders Know Something About A. O. Smith Stock We Don't?

Description: Investors need to pay close attention to AOS stock based on the movements in the options market lately.

2025-12-10

2025-12-09

2025-12-08

2025-12-07

Does A O Smith’s DCF And PE Suggest a Value Opportunity After Recent Gains?

Description: Wondering if A. O. Smith is quietly becoming a value opportunity, or if the recent price action is just noise? This breakdown will help you decide whether the stock still deserves a spot on your watchlist. Over the last week the share price is up 3.1%, building on a 2.7% gain over the past month. However, that sits against a modest 1.0% return year to date and a slightly negative 1 year return of -4.4%, even though the 3 year and 5 year gains of 23.2% and 32.1% hint at longer term...

Assessing A. O. Smith’s Valuation After Recent Share Price Strength and Longer-Term Mixed Returns

Description: A. O. Smith (AOS) has quietly outperformed the broader market over the past week, and that short term strength comes against a more mixed backdrop for the stock over the past year. See our latest analysis for A. O. Smith. That recent 3.11% 7 day share price return comes after a softer patch. The 90 day share price return is down 8.02%, while the five year total shareholder return of 32.10% shows longer term momentum is still intact. If A. O. Smith has you rethinking what steady compounders...

2025-12-06

2025-12-05

Why Is Emerson Electric (EMR) Up 3.9% Since Last Earnings Report?

Description: Emerson Electric (EMR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-04

Small Industrials Are on Cusp of ‘Supercycle.’ Ten Stocks to Ride the Wave.

Description: One is coming for small and mid-capitalization industrial stocks in 2026, according to JPMorgan analyst Tomohiko Sano. Essentially, the term means a sector or group of stocks that will see faster earnings growth than they have experienced in prior economic cycles.

Why Is Eaton (ETN) Down 12.9% Since Last Earnings Report?

Description: Eaton (ETN) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

2025-12-02

2025-12-01

Why Investors Should Retain A. O. Smith Stock in Portfolio Now

Description: AOS rides strong North American heater demand and strategic acquisitions, though China weakness and rising costs pose challenges.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

A. O. Smith Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Although A. O. Smith has considerably underperformed the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-20

A. O. Smith Corporation's (NYSE:AOS) recent 4.2% pullback adds to one-year year losses, institutional owners may take drastic measures

Description: Key Insights Given the large stake in the stock by institutions, A. O. Smith's stock price might be vulnerable to their...

2025-11-19

2025-11-18

5 Dividend Aristocrats I Recommend Now

Description: These five long-standing dividend growers combine durability, reasonable valuations and solid economics--qualities that often hold up well when markets turn unsettled.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

A. O. Smith's Leonard Valve Acquisition Offers Medium-Term Upside, Oppenheimer Says

Description: A. O. Smith's (AOS) acquisition of water management technology firm Leonard Valve is a strategic fit

2025-11-12

A. O. Smith to Acquire Leonard Valve Company, a Leader in Water Temperature and Flow Solutions

Description: Global water technology company A. O. Smith Corporation (the "Company" or "A. O. Smith") (NYSE: AOS) announced today that it has signed a definitive agreement to acquire LVC Holdco LLC ("Leonard Valve") of Cranston, Rhode Island, for $470 million, subject to customary adjustments. The Company expects the transaction to close in the first quarter of 2026, subject to the satisfaction of customary closing conditions and receipt of regulatory approvals. The all-cash transaction is valued at approxim

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

A. O. Smith (AOS): Assessing Valuation After Strong Earnings, Dividend Hike, and Strategic Buybacks

Description: A. O. Smith (AOS) had an eventful quarter, announcing a 15% jump in earnings per share for the third quarter and a 6% rise in its quarterly dividend. Management’s commentary showed confidence in ongoing acquisition efforts and capital return strategy, which likely drew attention from investors. See our latest analysis for A. O. Smith. Despite a strong quarter and steady investor-friendly moves like increased buybacks and a higher dividend, A. O. Smith’s shares have struggled to gain momentum...

2025-11-05

2025-11-04

Eaton Q3 Earnings Beat Estimates, Organic Sales Boost Revenues

Description: ETN's third-quarter earnings and sales outperform estimates, fueled by strong organic growth, acquisitions and solid segment gains.

Implied Volatility Surging for A. O. Smith Stock Options

Description: Investors need to pay close attention to AOS stock based on the movements in the options market lately.

5 Revealing Analyst Questions From A. O. Smith’s Q3 Earnings Call

Description: A. O. Smith’s third quarter results saw a negative market reaction, reflecting investor concern over persistent challenges in China and muted organic growth. Management attributed the quarter’s performance to strong commercial water heater and boiler volumes in North America, which benefited from pricing actions and production efficiency initiatives. CEO Stephen Shafer noted, “Our market-leading high-efficiency condensing gas and heat pump products continue to have a compelling payback story in

Stifel Trims A.O. Smith (AOS) Price Target to $80; Maintains Buy Rating

Description: A. O. Smith Corporation (NYSE:AOS) is included among the 13 Best Consistent Dividend Stocks to Buy Now. On October 29, Stifel adjusted its outlook on A. O. Smith Corporation (NYSE:AOS), cutting the price target to $80 from $89 while maintaining a Buy rating on the stock, according to The Fly. The firm noted that although […]

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Japan Water Heater Market Overview and Forecast (2025-2033) Featuring Analysis of A.O. Smith, Rinnai, Whirlpool, Bajaj Electricals, Haier and Other Key Players

Description: Key trends include a focus on eco-friendly refrigerants, hydrogen-based systems, and energy efficiency, driven by carbon neutrality goals and innovation. Government incentives, technology advancements like smart integration, and rising environmental awareness fuel growth. However, challenges like skills gaps and space constraints in urban homes persist. Japanese Water Heater Market Japanese Water Heater Market Dublin, Oct. 31, 2025 (GLOBE NEWSWIRE) -- The "Japan Water Heater Market Overview 2025

A. O. Smith's (NYSE:AOS) Upcoming Dividend Will Be Larger Than Last Year's

Description: A. O. Smith Corporation ( NYSE:AOS ) will increase its dividend from last year's comparable payment on the 17th of...

2025-10-30

A.O. Smith Corp (AOS) Q3 2025 Earnings Call Highlights: Strong North America Growth Amid Global ...

Description: A.O. Smith Corp (AOS) reports robust North American sales and earnings growth, while navigating economic headwinds in China and tariff impacts.

A. O. Smith (AOS) Earnings Growth Lags Historical Trend, Undermining Bullish Narratives

Description: A. O. Smith (AOS) posted average earnings growth of 7.5% annually over the past five years, with net profit margins currently at 13.9%, down from 14.4% last year. While profitability over the long term has remained solid, the latest results revealed negative earnings growth for the past year, putting the company below its historical trend. Looking forward, forecasts point to annual earnings growth of 6.5% and revenue growth of 3.7%, both trailing the broader US market, suggesting momentum may...

2025-10-29

2025-10-28

A. O. Smith Q3 Earnings Surpass Estimates, Sales Increase Y/Y

Description: AOS posts double-digit earnings growth in Q3 2025, fueled by strong North American water heater and boiler demand.

A O Smith (AOS) Q3 2025 Earnings Call Transcript

Description: Stephen M. Shafer: Thank you, Helen. In the quarter, our global A. O. Smith team delivered third quarter sales of $943 million, a year-over-year increase of 4%, and EPS of 94¢, a 15% increase over 2024. Continued economic challenges and more limited availability of government stimulus programs led to a 12% decrease in local currency sales in China.

A.O. Smith (AOS) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: The headline numbers for A.O. Smith (AOS) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

A.O. Smith (AOS) Tops Q3 Earnings and Revenue Estimates

Description: A.O. Smith (AOS) delivered earnings and revenue surprises of +5.62% and +0.69%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

A. O. Smith’s (NYSE:AOS) Q3 Earnings Results: Revenue In Line With Expectations

Description: Water heating and treatment solutions company A.O. Smith (NYSE:AOS) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.4% year on year to $942.5 million. On the other hand, the company’s full-year revenue guidance of $3.83 billion at the midpoint came in 1.7% below analysts’ estimates. Its GAAP profit of $0.94 per share was 3.3% above analysts’ consensus estimates.

A.O. Smith: Q3 Earnings Snapshot

Description: The results surpassed Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 89 cents per share. The maker of water heaters and boilers posted revenue of $942.5 million in the period, which also beat Street forecasts.

A. O. Smith Reports Third Quarter Earnings Per Share (EPS) of $0.94, a 15% Year-Over-Year Increase, and Updates Full Year Guidance

Description: Global water technology company A. O. Smith Corporation ("the Company") (NYSE: AOS) today announced its third quarter 2025 results.

Is It Smart To Buy A. O. Smith Corporation (NYSE:AOS) Before It Goes Ex-Dividend?

Description: Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see A. O. Smith...

2025-10-27

2025-10-26

A. O. Smith (AOS) Q3 Earnings Report Preview: What To Look For

Description: Water heating and treatment solutions company A.O. Smith (NYSE:AOS) will be reporting results this Tuesday before the bell. Here’s what you need to know.

2025-10-25

2025-10-24

How a 6 Percent Dividend Increase at A. O. Smith (AOS) Has Changed Its Investment Story

Description: On October 13, 2025, A. O. Smith's board approved a 6% increase to US$0.36 per share in its quarterly cash dividend, payable November 17 to shareholders of record as of October 31. This dividend boost comes as anticipation builds for A. O. Smith's upcoming earnings report and ongoing growth in the US water purifier market. With the dividend increase signaling management's confidence, we'll examine what this means for A. O. Smith's investment narrative moving forward. Find companies with...

United States Water Purifier Market Report 2025-2033: Technology, Distribution Channel, End User, Key States and Company Analysis

Description: The United States water purifier market is poised for significant growth, projected to expand from $17.30 billion in 2024 to $29.73 billion by 2033, at a CAGR of 6.20%. Key drivers include heightened awareness of water quality, health issues, and technological innovations. Increasing concerns about pollutants like PFAS and lead propel demand for reliable purification solutions. Technological advancements, such as smart purifiers with IoT capabilities, are enhancing consumer interest and convenie

2025-10-23

A. O. Smith Gears Up to Report Q3 Earnings: What to Expect?

Description: AOS gears up for Q3 results as steady estimates meet headwinds from weak China demand and supply-chain pressures.

2025-10-22

2025-10-21

Pentair Surpasses Q3 Earnings Estimates, Raises 2025 Guidance

Description: PNR posts a strong Q3 with higher sales, margins and EPS, prompting the company to raise its full-year 2025 earnings outlook.

A.O. Smith (AOS) Earnings Expected to Grow: Should You Buy?

Description: A.O. Smith (AOS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-20

2025-10-19

2025-10-18

2025-10-17

A. O. Smith's (NYSE:AOS) Upcoming Dividend Will Be Larger Than Last Year's

Description: A. O. Smith Corporation's ( NYSE:AOS ) periodic dividend will be increasing on the 17th of November to $0.36, with...