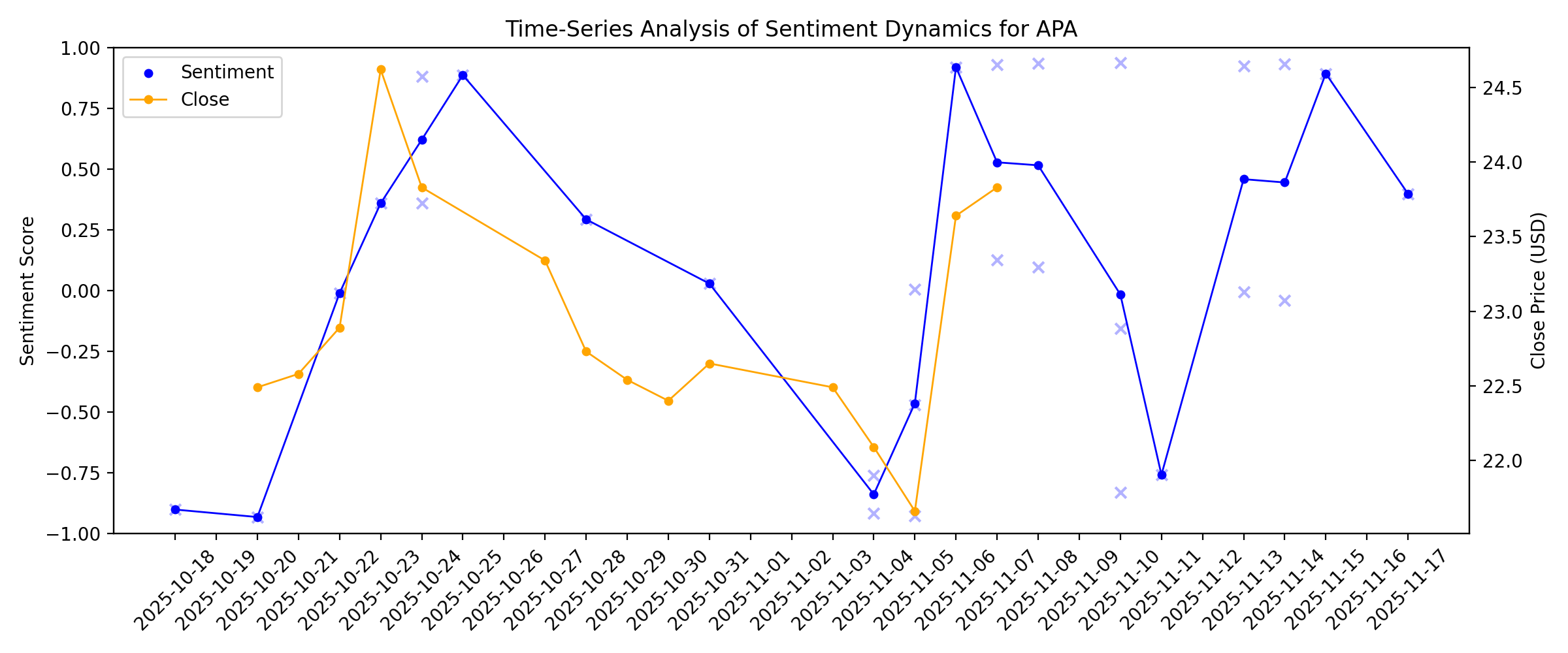

News sentiment analysis for APA

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

APA (APA) Stock Sinks As Market Gains: Here's Why

Description: In the closing of the recent trading day, APA (APA) stood at $24.92, denoting a -1.11% move from the preceding trading day.

2026-01-11

2026-01-10

2026-01-09

How APA’s LNG Positioning and Cost Discipline Will Impact APA (APA) Investors

Description: In recent days, APA Corporation has drawn attention as investors reacted to its positioning in liquefied natural gas amid a colder season and rising gas-fired power demand across its US, Egypt, and North Sea operations. What stands out is how APA’s cost-saving initiatives and disciplined spending are enhancing operational flexibility just as interest in its LNG exposure is building. We’ll now examine how APA’s growing LNG-related interest and cost discipline could influence its existing...

One APA Insider Raised Stake By 115% In Previous Year

Description: Insiders were net buyers of APA Corporation's ( NASDAQ:APA ) stock during the past year. That is, insiders bought more...

2026-01-08

APA Corp (APA) Jumps 8.5% on LNG Demand Growth, Colder Season

Description: We recently published Wall Street Can’t Keep up With These 10 Stocks on Fire. APA Corporation (NASDAQ:APA) was one of the top performers on Thursday. APA Corporation (NASDAQ:APA) grew its share prices by 8.47 percent on Thursday to close at $25.37 apiece as investors took heart from an investment firm’s bullish outlook for the overall […]

US Equity Markets End Mixed Thursday as Risk-Off Sentiment Weighs on Tech Stocks

Description: US equity indexes closed mixed Thursday as risk-off sentiment weighed on technology stocks, meanwhil

Zacks Industry Outlook Highlights Coterra Energy, Antero Resources, APA and W&T Offshore

Description: Coterra Energy and peers offer selective appeal as U.S. oil and gas producers navigate price volatility and lean on natural gas demand support.

2026-01-07

2026-01-06

2026-01-05

APA (APA) Stock Dips While Market Gains: Key Facts

Description: APA (APA) closed at $24.47 in the latest trading session, marking a -3.51% move from the prior day.

Venezuela Fuels Broad Sector Rally But These Oil And Gas Plays Slide

Description: Venezuela news hit the stock market Monday, boosting many oil stocks, but several slid as natural gas prices sank.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Stock Market Today, Dec. 16: Energy Stocks Slide as Oil Drops to Multi-Year Lows

Description: On Dec. 16, 2025, oil’s slide to multi‑year lows rattled energy leaders and helped pull major U.S. benchmarks off recent highs.

How Is APA's Stock Performance Compared to Other Oil & Gas Stocks?

Description: Energy major APA has notably outperformed other oil & gas exploration and production stocks over the past year, yet analysts remain cautious about the stock’s prospects.

2025-12-15

2025-12-14

2025-12-13

APA (NASDAQ:APA) Has Affirmed Its Dividend Of $0.25

Description: The board of APA Corporation ( NASDAQ:APA ) has announced that it will pay a dividend of $0.25 per share on the 23rd of...

2025-12-12

2025-12-11

2025-12-10

2025-12-09

Johnson Rice Upgrades APA Corporation (APA) To Accumulate, Lifts Price Target

Description: APA Corporation (NASDAQ:APA) is among the Top 15 Lowest P/E Ratios of the S&P 500 in 2025. On December 5, Johnson Rice upgraded its rating on the stock to Accumulate from Hold and lifted its price target to $40 from $35. The adjustment follows Goldman Sachs’ update on December 1, when it raised its price […]

2025-12-08

2025-12-07

2025-12-06

Is APA’s 33% Rally Just the Start After Recent Cash Flow and Portfolio Moves?

Description: If you are wondering whether APA is still a value play after its latest run, or if you have missed the boat, this breakdown will help you decide whether the current price really stacks up against the fundamentals. The stock has climbed 8.5% over the last week, 13.7% over the past month, and 33.2% over the last year, but that comes after a choppy 3 year stretch. It is still down 27.8% over that period, even as the 5 year return sits at 92.2%. Recent headlines have focused on shifting energy...

How Recent Developments Are Reshaping The APA Investment Story

Description: APA stock’s latest narrative update comes with a modestly higher fair value estimate, ticking up from about $25.37 to roughly $25.89 per share as analysts reward steadier execution and improving cash generation. A slightly lower discount rate of around 7.08%, alongside less negative revenue growth assumptions, reflects incremental confidence that recent operational outperformance and cost savings can be sustained despite mixed views on commodity exposure and strategic outcomes. Read on to see...

APA (APA) Is Up 8.5% After Analyst Upgrade Sparks 52-Week High – Has The Bull Case Changed?

Description: Johnson Rice recently upgraded APA from “Hold” to “Accumulate,” reflecting a more favorable view of the company’s prospects and contributing to a multi-day run of gains that pushed the stock to a fresh 52‑week high. This shift in analyst sentiment, absent any major new operational developments, highlights how changing expectations alone can materially influence how investors view APA’s risk‑reward profile. We’ll now explore how Johnson Rice’s upgrade and the sentiment shift it signals may...

2025-12-05

S&P 500 Starts December With Slight Weekly Gain Led by Energy, Tech

Description: The Standard & Poor's 500 index edged up 0.3% as gains led by the energy and technology sectors slig

Sector Update: Energy Stocks Mixed Late Afternoon

Description: Energy stocks were mixed late Friday afternoon, with the NYSE Energy Sector Index decreasing 0.5% an

Why Is APA (APA) Up 13% Since Last Earnings Report?

Description: APA (APA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-04

2025-12-03

2025-12-02

Renewed Momentum in Energy Stocks Suggests Sustainable Upswing. Which Charts Look Best?

Description: The oil services ETF has climbed above a bull flag pivot at $290 and the Energy Select Sector SPDR Fund is approaching its $92.32 cup-with-handle pivot. Meanwhile, the State Street ETF sits right at its own $135.26 cup-with-handle pivot, signaling potential upside. Keep in mind that this resilience is unfolding even as crude prices hover near $60/barrel.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

Can Energy’s Strength Continue Into Year End? What the Charts Say About 3 Stocks.

Description: Exploration stocks have also done well, with the up 8% over the same stretch. Doug Busch is the senior technical analyst at Barron’s Investor Circle glossary of technical terms is updated regularly with new entries.

2025-11-16

2025-11-15

Is There Now an Opportunity in APA After Recent Asset Expansion and Price Jump?

Description: Curious if APA is really trading at a bargain or just looks cheap on the surface? You are not alone. We are diving into the numbers to get a clearer picture. APA’s share price recently climbed 4.0% in the past week and is up 6.0% year-to-date, with a 16.6% gain over the last 12 months. The ride has definitely had its ups and downs. Over the past several weeks, APA has grabbed headlines through its ongoing efforts to streamline operations and explore new assets in key energy regions. These...

2025-11-14

APA Stock Clears Technical Benchmark, Hitting 80-Plus RS Rating

Description: APA shows improving price performance, earning an upgrade to its IBD Relative Strength Rating from 79 to 84.

Repsol explores reverse merger for upstream unit with US partners

Description: In 2022, Repsol agreed to sell a 25% stake in its upstream unit to EIG in a transaction that valued the division at $19bn (€16.36bn) including debt.

2025-11-13

Sector Update: Energy Stocks Mixed Late Afternoon

Description: Energy stocks were mixed late Thursday afternoon, with the NYSE Energy Sector Index down 0.4% and th

Sector Update: Energy Stocks Rise Thursday Afternoon

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index up 0.5% and the Ener

2025-11-12

2025-11-11

Compared to Estimates, APA (APA) Q3 Earnings: A Look at Key Metrics

Description: While the top- and bottom-line numbers for APA (APA) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

2025-11-10

Bank of America’s Akamine Remains Bearish on APA Corporation (APA), Cites High Operating Costs

Description: APA Corporation (NASDAQ:APA) is one of the 12 deep value stocks to invest in. On November 6, 2025, Bank of America Securities’ analyst Kalei Akamine maintained his “Sell” rating on APA Corporation (NASDAQ:APA) with a $20 price target. His bearish outlook stems from concerns over the company’s higher operating costs in the Permian Basin, North […]

APA Corporation Announces Appointment of Robert P. Rayphole as Vice President, Chief Accounting Officer and Controller

Description: HOUSTON, Nov. 10, 2025 (GLOBE NEWSWIRE) -- APA Corporation (Nasdaq: APA) today announced that Robert P. Rayphole has been promoted to vice president, chief accounting officer and controller, effective Nov. 15. Rayphole will lead APA’s Accounting department, providing global oversight of the company’s accounting organization and overseeing financial reporting, accounting operations and compliance with U.S. GAAP and SEC requirements. The role of chief accounting officer and controller was previous

APA Corporation Q3 Earnings Beat Estimates Despite Weak Oil Prices

Description: APA posts stronger-than-expected Q3 earnings as solid production and cost control offset weaker oil prices.

2025-11-09

2025-11-08

APA Corp. (APA) Surges 9% on Strong Earnings

Description: We recently published 10 Stocks on Fire Amid Market Chaos. APA Corp. (NASDAQ:APA) is one of the best-performing stocks on Thursday. APA snapped a three-day losing streak on Thursday, jumping 9.14 percent to close at $23.64 apiece as investors cheered its return to profitability in the third quarter of the year. Based on its financial […]

Why APA (APA) Is Up 5.2% After Returning to Profitability and Raising Production Guidance

Description: APA Corporation reported third-quarter 2025 results on November 5, highlighting revenue of US$2.02 billion and net income of US$205 million, a return to profitability compared to a net loss for the same period a year earlier. An accelerated timeline for cost reductions and the raising of U.S. oil production guidance for the next quarter reflect improved operational efficiencies and financial discipline across the company’s core assets. With APA exceeding production guidance and advancing...

2025-11-07

Positive Earnings Report Lifted APA Corp. (APA) in Q3

Description: Hotchkis & Wiley, an investment management company, released its “Hotchkis & Wiley Large Cap Disciplined Value Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The S&P 500 Index recorded a return of +8.1% in the third quarter of 2025, closing the period near its all-time highs. Technology and communication […]

Evaluating APA’s (APA) Current Valuation After a Notable Share Price Rebound

Description: APA (APA) has been showing some interesting moves lately, with its share price up slightly over the past week. Investors keeping an eye on recent trends will want to dig deeper because the broader market is reacting. See our latest analysis for APA. APA’s share price pop this week comes after a stretch of volatility, with momentum rebounding sharply, most notably a 9.1% jump in just the past day and a 5.5% gain over the last seven days. Zooming out, while the one-year total shareholder return...

2025-11-06

APA Corp (APA) Q3 2025 Earnings Call Highlights: Strong Cash Flow and Strategic Cost Management ...

Description: APA Corp (APA) reports robust free cash flow and significant debt reduction, while navigating challenges in commodity prices and production adjustments.

2025-11-05

Compared to Estimates, APA (APA) Q3 Earnings: A Look at Key Metrics

Description: The headline numbers for APA (APA) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

APA: Q3 Earnings Snapshot

Description: The results beat Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of 74 cents per share. The oil and natural gas producer posted revenue of $2.02 billion in the period, which did not meet Street forecasts.

APA Corporation Announces Third-Quarter 2025 Financial and Operational Results

Description: HOUSTON, Nov. 05, 2025 (GLOBE NEWSWIRE) -- APA Corporation (Nasdaq: APA) today announced third-quarter 2025 results. Results can be found on the company’s website by visiting www.apacorp.com or investor.apacorp.com. APA will host a conference call on Nov. 6 at 10 a.m. Central time via the webcast link available on the company website to discuss the results. Following the conference call, a replay will be available for one year on the “Investors” page of the company’s website. About APA APA Corpo

2025-11-04

What Analyst Projections for Key Metrics Reveal About APA (APA) Q3 Earnings

Description: Get a deeper insight into the potential performance of APA (APA) for the quarter ended September 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Are These 4 Energy Stocks Set to Beat Q3 Earnings Estimates?

Description: Here is a look at what to expect from energy stocks APA, PR, ET and DVN ahead of their quarterly earnings reports, which are set to be released tomorrow.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

APA Corporation Stock: Is Wall Street Bullish or Bearish?

Description: APA Corporation has underperformed the broader market over the past year, and analysts remain cautious about the stock's growth potential.

2025-10-30

2025-10-29

2025-10-28

APA Corporation Q3 Earnings on Deck: Here's How It Will Fare

Description: APA is likely to report lower revenues compared with the year-ago level. However, its bottom line is expected to have benefited from cost reductions.

2025-10-27

2025-10-26

2025-10-25

What Catalysts Are Reshaping the Narrative for APA Amid New Industry Risks and Opportunities

Description: APA stock has recently seen a slight uptick in its consensus analyst price target, rising from $24.19 to $24.93 per share. This change reflects analyst optimism driven by the company's improved operational efficiency and rising U.S. gas demand, though ongoing industry headwinds keep risk at the forefront of investor discussions. For those following APA's ever-shifting outlook, it is important to stay tuned for guidance on tracking these narrative changes as they unfold. What Wall Street Has...

2025-10-24

APA (APA) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: APA (APA) closed the most recent trading day at $23.83, moving 3.21% from the previous trading session.

Energy Stocks Rise Sharply After U.S. Sanctions Hit Russia's Oil Giants

Description: Oil Prices Spike, APA, OXY And FANG Lead Gains

2025-10-23

Energy Stocks Rise Sharply -- U.S. Sanctions Hit Russia's Oil Giants

Description: Oil Prices Spike, APA, OXY And FANG Lead Gains

2025-10-22

What You Need To Know Ahead of APA's Earnings Release

Description: Energy major APA is set to announce its third-quarter results in the upcoming weeks, and analysts expect a massive drop in earnings.

2025-10-21

2025-10-20

Company News for Oct 20, 2025

Description: Companies in The News Are: AXP, FNB, TFC, APA

2025-10-19

2025-10-18

APA (NASDAQ:APA) Will Pay A Dividend Of $0.25

Description: APA Corporation ( NASDAQ:APA ) will pay a dividend of $0.25 on the 21st of November. Based on this payment, the...