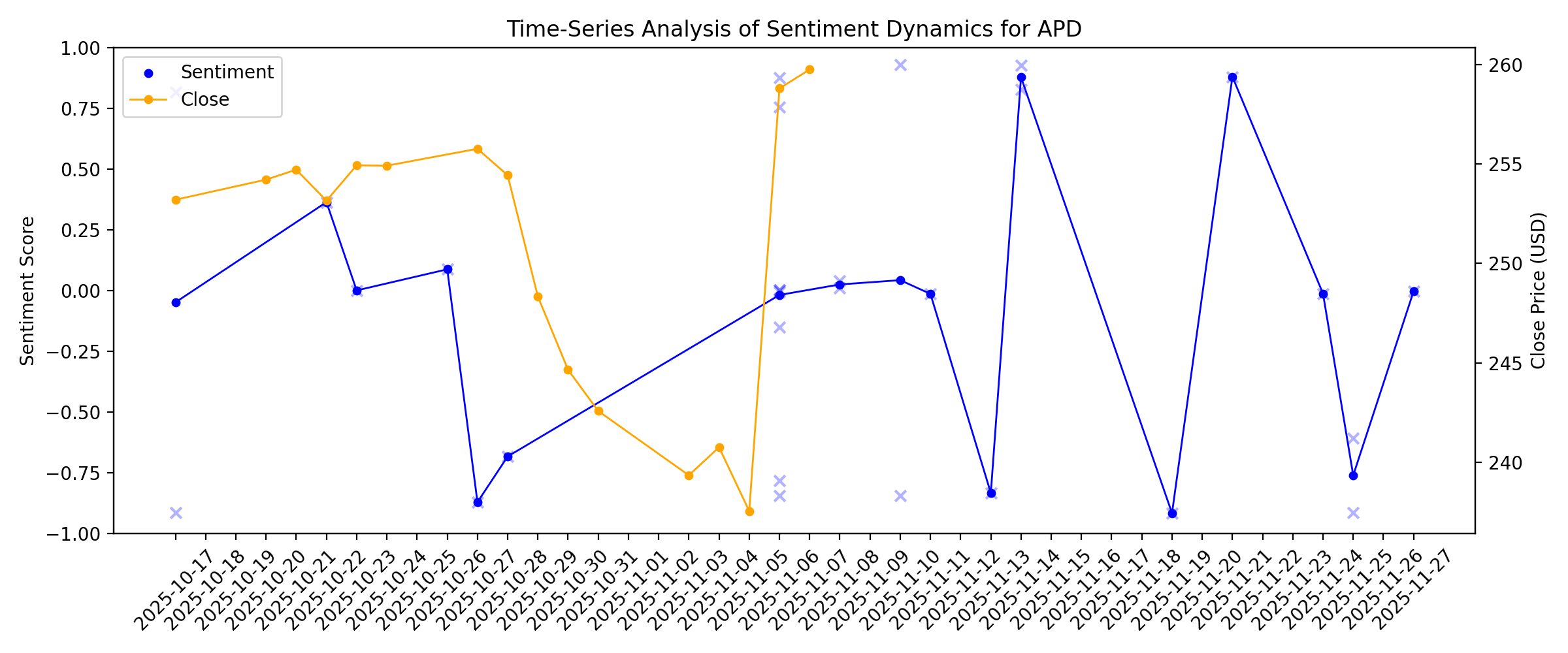

News sentiment analysis for APD

Sentiment chart

2026-01-14

Air Products to Broadcast Fiscal 2026 First Quarter Earnings Teleconference on January 30, 2026

Description: Air Products (NYSE: APD) will hold a conference call to discuss its fiscal 2026 first quarter financial results on Friday, January 30, 2026 at 8:00 a.m. ET. The teleconference will be open to the public and the media in listen-only mode by telephone and Internet broadcast.

2026-01-13

2026-01-12

Earnings Preview: What to Expect From Air Products and Chemicals' Report

Description: Air Products and Chemicals is ready to announce its fiscal first-quarter earnings soon, and analysts project a single-digit profit growth.

Assessing Air Products And Chemicals (APD) Valuation As Long Term Returns Lag Short Term Momentum

Description: Why Air Products and Chemicals is on investors’ radar Air Products and Chemicals (APD) has drawn attention recently as its shares trade around $263.72, with mixed return patterns that include a loss over the past year and modest gains year to date. See our latest analysis for Air Products and Chemicals. Recent trading has tilted positive, with a 1 month share price return of 8.53% and a 7 day share price return of 3.89%. However, the 1 year total shareholder return of 10.27% and 3 year total...

2026-01-11

Does BofA’s Upgrade Recast Air Products (APD) Leadership And Project Mix As A More Balanced Story?

Description: Earlier this week, BofA Securities upgraded Air Products and Chemicals to neutral from underperform, expressing greater confidence in CEO Eduardo Menezes and highlighting the need for new conventional gas project wins to rebuild the company’s backlog. This reassessment comes as Air Products balances its large-scale energy transition ambitions with the practical requirement to secure traditional industrial gas contracts that can underpin future project momentum. We’ll now examine how BofA’s...

2026-01-10

2026-01-09

2026-01-08

Air Products Needs 'Wins' to Refill Project Backlog, Turn Business Around, BofA Says

Description: Air Products and Chemicals (APD) Chief Executive Eduardo Menezes is capable of turning the business

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Bernstein Maintains Outperform on Air Products (APD) Following Hydrogen Megaproject Announcements

Description: Air Products and Chemicals, Inc. (NYSE:APD) ranks among the best hydrogen and fuel cell stocks to buy for 2026. On December 9, Air Products and Chemicals, Inc. (NYSE:APD) stock plummeted 11%, with Bernstein SocGen Group maintaining its Outperform rating and $320 price target for the company’s shares. According to Bernstein analyst James Hooper, the market […]

2026-01-01

2025-12-31

2025-12-30

Mixed Analyst Moves on Air Products (APD) Highlight Ongoing Sector Headwinds

Description: Air Products and Chemicals, Inc. (NYSE:APD) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 19, Wells Fargo analyst Michael Sison downgraded Air Products and Chemicals, Inc. (NYSE:APD) to Equal Weight from Overweight and cut the price target to $250 from $330. The firm lowered ratings on four […]

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Does Air Products-Yara Clean Ammonia Push Reshape the Bull Case for Air Products (APD)?

Description: Earlier this week, Air Products and Chemicals and Yara reported progress in negotiations to jointly develop large-scale, low-emission ammonia projects in the US and Saudi Arabia, combining Air Products’ hydrogen capabilities with Yara’s global ammonia distribution network. The collaboration is intended to de-risk capital-intensive clean ammonia developments while strengthening both companies’ positions across emerging blue and green hydrogen value chains. Next, we’ll examine how this push...

Is Air Products a Long Term Opportunity After Recent Share Price Weakness?

Description: If you have been wondering whether Air Products and Chemicals is quietly turning into a value opportunity or just a value trap, you are not alone. This article is going to unpack that question head on. Despite its reputation as a steady industrial name, the stock is down around 0.1% over the past week, roughly 4.9% over the last month, and sits about 13.6% lower year to date. The 1 year return is roughly minus 14.5% and 3 year performance is also negative, even though the 5 year return is...

2025-12-22

Air Products and Chemicals (APD): Valuation Check After Analyst Optimism on Yara Low-Emission Ammonia Partnership

Description: Air Products and Chemicals (APD) just caught fresh attention after analysts highlighted its ongoing negotiations with Yara on large scale, low emission ammonia projects in the US and Saudi Arabia as a potential long term growth driver. See our latest analysis for Air Products and Chemicals. Even with this potential Yara partnership pointing to a stronger long term growth runway, the stock has been under pressure, with a double digit year to date share price decline and a slightly negative...

How New Hydrogen Projects Are Shaping the Story Behind Air Products and Chemicals Valuation

Description: Air Products and Chemicals has seen its fair value estimate revised modestly lower from about $309 to $293 per share as analysts factor in slightly more cautious assumptions. A small uptick in the discount rate to roughly 8.00% and a trim to anticipated revenue growth near 5.72% a year highlight how sentiment remains constructive but more measured while investors await clearer proof of execution on key projects. Stay tuned to learn how you can monitor these evolving targets and the shifting...

Bernstein Reiterates Outperform on Air Products (APD) After Yara Partnership Update

Description: Air Products and Chemicals, Inc. (NYSE:APD) is one of the best hydrogen stocks to buy right now. On December 9, Bernstein SocGen Group reiterated an Outperform rating on Air Products and Chemicals, Inc. (NYSE:APD) stock and kept the price target at $320. The analysts cited Air Products’ update on the negotiations with Yara. The negotiations […]

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

Argus Research Slashes Air Products and Chemicals, Inc. (APD)’s Price Target To $265, Maintains Buy Rating

Description: Air Products and Chemicals, Inc. (NYSE:APD) is among the 11 Most Oversold S&P 500 Stocks Heading into 2026. On December 11, Argus Research lowered its price target on the stock to $265 from $317, while maintaining a Buy rating on the shares. In a research note to investors, the analyst mentioned ongoing macroeconomic headwinds from soft […]

2025-12-11

2025-12-10

2025-12-09

Air Products & Yara Advance Talks on Low-Emission Ammonia Projects

Description: APD and Yara move toward a partnership on large low-emission ammonia projects, including a major deal at the Louisiana Clean Energy Complex.

US Stock Market Today: S&P 500 Futures Edge Higher amid Strong Global Factory Demand

Description: The Morning Bull - US Market Morning Update Tuesday, Dec, 9 2025 US stock futures are pointing slightly higher this morning, with contracts tied to the S&P 500 and Nasdaq up about 0.1 percent, as investors weigh strong global factory demand against stubborn inflation worries. Taiwan just reported exports soaring 56 percent from a year ago, a surge in electronics and machinery that signals healthy demand for tech gear and industrial equipment worldwide. At the same time, the US 10 year...

Zacks Industry Outlook Highlights Air Products and Chemicals, Albemarle and Avient

Description: Air Products, Albemarle and Avient lean on cost cuts, productivity gains and strategic projects as diversified chemical demand stays under pressure.

2025-12-08

Is Air Products Offering Value After 2024 Declines and Mixed Valuation Signals?

Description: Wondering if Air Products and Chemicals is quietly turning into a value opportunity after a rough patch? You are not alone, and this is exactly what we are going to unpack. The stock is trading around $260.69, down 15.6% over the past year and 8.0% year to date, even though it is roughly flat over the last month and slightly negative over the past week. Recently, investors have been refocusing on industrial gas names like Air Products as potential beneficiaries of long term demand for clean...

US Equity Markets Lower Ahead of Fed's Decision on Interest Rates

Description: US equity indexes closed lower Monday as government bond yields rose and investors awaited the Fed's

Top Midday Decliners

Description: Meihua International Medical Technologies (MHUA) shares plunged 43% after the company reported late

This Chemicals Stock Is Worst Performer in the S&P 500 Today. Here’s Why.

Description: Air Products & Chemicals plans to partner with Yara International on ammonia production and distribution.

Nvidia Takes Top Spot in the List of Best-Managed Companies of 2025

Description: Tech companies continue to dominate in the Drucker Institute’s annual ranking, although Intel and Adobe saw major drops

3 Diversified Chemical Stocks to Watch Amid Demand Headwinds

Description: Soft demand in key end markets and sluggishness in Europe and China have put a dent in the Zacks Chemicals Diversified industry. APD, ALB and AVNT are poised to navigate the industry challenges.

The Bull Case For Air Products (APD) Could Change Following Yara Ammonia Talks And Board Transition - Learn Why

Description: In late November 2025, Air Products and Chemicals disclosed that director Lisa A. Davis will retire from the board after the January 28, 2026 Annual Meeting, concluding nearly six years of service while continuing to chair the Management Development and Compensation Committee and sit on the Corporate Governance and Nominating Committee until then. Separately, Air Products and Yara advanced discussions on a potential low-emission ammonia partnership, which could link multibillion-dollar...

Why The Narrative Around Air Products Is Shifting As Decarbonization Upside Meets Lower Targets

Description: Air Products and Chemicals has seen its fair value estimate nudged down from about $310.76 to roughly $308.86 per share as analysts recalibrate expectations in light of recent developments. This modest trim, paired with a slight dip in the discount rate from around 7.96% to about 7.94%, reflects a more measured stance on future growth while still recognizing the potential of the decarbonization pipeline. Read on to see how you can track these evolving assumptions and stay informed about the...

Air Products to Host Investor Teleconference on December 8, 2025 at 9:00 a.m. USET

Description: Air Products (NYSE: APD) will host an investor teleconference today, Monday, December 8, 2025, at 9:00 a.m. USET to discuss its joint announcement with Yara International ASA (OSE:YAR) issued earlier this morning. The teleconference will be open to the public and the media in listen-only mode by telephone and Internet broadcast.

Air Products and Yara in Advanced Negotiations to Partner on Low-emission Ammonia Projects

Description: World-leading hydrogen supplier and global industrial gases company Air Products (NYSE: APD) and world-leading crop nutrition and ammonia company Yara International ASA (OSE: YAR) are working to combine Air Products' industrial gas capabilities and low-emission hydrogen with Yara's ammonia production and distribution network:

Air Products in Partnership Talks With Yara International on Low-Emission Ammonia Projects

Description: Air Products (APD) is in talks with Yara International to team up on low-emission ammonia projects i

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

C3 AI Announces Fiscal Second Quarter 2026 Results

Description: REDWOOD CITY, Calif., December 03, 2025--C3.ai, Inc. ("C3 AI," "C3," or the "Company") (NYSE: AI), the Enterprise AI application software company, today announced financial results for its fiscal second quarter ended October 31, 2025.

Plug Power (PLUG) Surges 9.9% on NASA Million-Dollar Deal

Description: We recently published 10 Stocks Stealing the Spotlight Early as Christmas Looms. Plug Power Inc. (NASDAQ:PLUG) is one of the top performers on Tuesday. Plug Power saw its share prices jump by 9.90 percent on Tuesday to finish at $2.11 apiece as investor sentiment was boosted by the start of its supply of hydrogen fuel […]

2025-12-02

2025-12-01

Is Air Products and Chemicals Stock Underperforming the Dow?

Description: While Air Products and Chemicals has considerably underperformed the Dow recently, analysts remain moderately optimistic about the stock’s prospects.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Air Products and Chemicals (APD): Evaluating Valuation After Q4 Results, Cost Reset, and Hydrogen Project Updates

Description: Air Products and Chemicals (APD) released its Q4 2025 results, reporting earnings per share slightly above forecasts and maintaining steady operating margins. The company also announced a 16% workforce reduction as part of a cost-reset initiative. See our latest analysis for Air Products and Chemicals. Air Products and Chemicals’ recent cost reduction drive and positive Q4 results gave investors a reason to pause, but momentum hasn’t yet shifted upward. Its share price is still down over 8%...

2025-11-26

2025-11-25

Air Products Director Lisa Davis Elects to Not Stand for Re-election at the Company's January 2026 Annual Meeting of Shareholders

Description: Air Products (NYSE:APD) today announced that Lisa A. Davis has decided to not stand for re-election at the Company's 2026 Annual Meeting of Shareholders on January 28, 2026 and to retire from the board following the conclusion of the Annual Meeting.

Air Products Leadership to Speak at Citi's Basic Materials Conference

Description: Air Products' (NYSE:APD) Chief Executive Officer Eduardo Menezes and Chief Financial Officer Melissa Schaeffer will participate in a fireside chat at Citi's Basic Materials Conference on Tuesday, December 2, 2025 at 8:40 a.m. USET.

2025-11-24

Evercore ISI Remains Bullish on Air Products and Chemicals (APD) Following Q4 2025 Results

Description: Air Products and Chemicals, Inc. (NYSE:APD) is one of the 12 best commodity stocks to buy right now. On November 11, 2025, The Fly reported that Air Products and Chemicals, Inc. (NYSE:APD) saw its price target reduced from $375 to $325 by Evercore ISI, while maintaining its “Outperform” rating. With the firm noting a shift away from […]

2025-11-23

2025-11-22

2025-11-21

Hydrogen Fueling Station Industry Research 2025-2030 Featuring Key Players - Air Liquide (France), Linde (Ireland), Air Products and Chemicals (US), Nel (Norway)

Description: The hydrogen fueling stations market is projected to rise significantly from USD 1.01 billion in 2025 to USD 2.76 billion by 2035, achieving a CAGR of 10.6%. Key drivers include the growing adoption of zero-emission vehicles and stringent emission regulations. Europe is set to lead market growth due to robust policy support and substantial investment in hydrogen refueling infrastructure. Mid-sized stations are anticipated to grow rapidly, offering a balanced solution with operational efficiency

2025-11-20

2025-11-19

Air Products Declares Quarterly Dividend

Description: The Board of Directors of Air Products (NYSE: APD) today declared a quarterly dividend of $1.79 per share of common stock. The dividend is payable on February 9, 2026 to shareholders of record at the close of business on January 2, 2026.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Can Air Products and Chemicals’ (APD) Dividend Resilience Offset Lower Profits in Investors’ Eyes?

Description: Air Products and Chemicals reported fourth quarter 2025 results earlier this month, with sales of US$3,166.9 million and net income of US$4.9 million, compared to sales of US$3,187.5 million and net income of US$1,949.9 million in the same period last year. Despite lower net income, the company’s consistently increasing dividends and the recent upgrade in its earnings outlook have drawn significant investor attention. We’ll explore how Air Products’ upwardly revised earnings outlook and...

Are Wall Street Analysts Predicting Air Products and Chemicals Stock Will Climb or Sink?

Description: Despite Air Products and Chemicals’ underperformance relative to the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-13

Are Options Traders Betting on a Big Move in Air Products and Chemicals Stock?

Description: Investors need to pay close attention to Air Products and Chemicals stock based on the movements in the options market lately.

2025-11-12

2025-11-11

RBC Capital Maintains Outperform Rating on Air Products (APD) Despite Lower Price Target

Description: Air Products and Chemicals Inc. (NYSE:APD) is included among the 15 Best Dividend Growth Stocks to Buy Now. On November 7, RBC Capital reduced its price target on Air Products and Chemicals Inc. (NYSE:APD) to $325 from $350 while maintaining an Outperform rating on the stock, according to a report by The Fly. The firm […]

2025-11-10

What Makes Air Products and Chemicals (APD) a New Buy Stock

Description: Air Products and Chemicals (APD) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Air Products and Chemicals (APD) Could Be a Great Choice

Description: Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Air Products and Chemicals (APD) have what it takes? Let's find out.

2025-11-09

2025-11-08

How Recent Developments Are Reshaping the Story For Air Products and Chemicals

Description: Air Products and Chemicals stock has seen its consensus analyst price target dip slightly, now standing at $315.00 per share compared to the previous $324.14. This adjustment reflects shifting sentiment as experts respond to changes in industry conditions and expectations for the company's revenue growth trajectory. Stay tuned to discover how you can keep informed on evolving analyst perspectives and what they might mean for Air Products in the future. Analyst Price Targets don't always...

Air Products and Chemicals (APD): Exploring Valuation After Latest Earnings Recovery

Description: Air Products and Chemicals (APD) reported annual net income growth topping 31% despite broader industry challenges. That increase caught investors’ attention, given the company generated over $12 billion in revenue during the past year. See our latest analysis for Air Products and Chemicals. Following that standout earnings report, Air Products and Chemicals' share price has rebounded in the past week, rising more than 7%. However, the stock is still down year-to-date. The total shareholder...

2025-11-07

2025-11-06

Why Did Air Products Stock Pop Today?

Description: Air Products lost a lot of money in fiscal 2025 -- and investors don't seem to mind at all.

Air Products' Earnings and Revenues Lag Estimates in Q4, Down Y/Y

Description: APD's Q4 earnings and revenue fell short of estimates, with lower volumes weighing on results despite regional gains and currency tailwinds.

Here's What Key Metrics Tell Us About Air Products and Chemicals (APD) Q4 Earnings

Description: Although the revenue and EPS for Air Products and Chemicals (APD) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Stocks Mostly Up Pre-Bell as Traders Assess Supreme Court Hearing on Trump Tariffs

Description: US equity markets were mostly pointing higher before Thursday's opening bell as investors assess the

Air Products and Chemicals (APD) Misses Q4 Earnings and Revenue Estimates

Description: Air Products and Chemicals (APD) delivered earnings and revenue surprises of -0.59% and -1.58%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Air Products fourth-quarter income matches expectations

Description: Investing.com - Air Products has posted fiscal fourth-quarter sales of $3.17 billion, meeting Bloomberg consensus estimates, as weak industrial gas sales in its Americas region were offset by demand in international markets.

Air Products and Chemicals: Fiscal Q4 Earnings Snapshot

Description: The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of $3.41 per share. The seller of gases for industrial, medical and other uses posted revenue of $3.17 billion in the period, also falling short of Street forecasts. Five analysts surveyed by Zacks expected $3.22 billion.

Air Products Reports Fiscal 2025 Full-Year and Fourth Quarter Results

Description: Air Products (NYSE:APD) today reported full-year fiscal 2025 GAAP results, including a loss per share# of $1.74 and an operating loss of $877 million, compared to GAAP EPS# of $17.24 and operating income of $4.5 billion in fiscal 2024. Fiscal 2025 results include approximately $3.7 billion in pre-tax charges related to business and asset actions ($3.0 billion after tax, or $13.68 per share). Fiscal 2024 GAAP results included a $1.6 billion pre-tax gain on the September 2024 sale of the Company's

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

3 Potential Future Dividend Kings to Buy and Hold for Growing Passive Income

Description: All of these dividend growth stocks are in line to become Dividend Kings.

2025-10-27

JMPLY or APD: Which Is the Better Value Stock Right Now?

Description: JMPLY vs. APD: Which Stock Is the Better Value Option?

2025-10-26

Will APD’s Earnings Dip Challenge the Long-Term Clean Energy Narrative?

Description: Air Products and Chemicals recently announced it will report its fourth-quarter earnings on November 6, with analysts anticipating a year-over-year decline in earnings per share. Despite near-term earnings pressure, analysts remain moderately optimistic about the company's outlook, reflecting confidence in longer-term opportunities across clean energy and industrial gas sectors. We'll explore how analyst expectations for lower near-term profits, balanced by longer-term optimism, may shift...

2025-10-25

2025-10-24

2025-10-23

Air Products and Chemicals’ Quarterly Earnings Preview: What You Need to Know

Description: Air Products and Chemicals is gearing up to unveil its fourth-quarter results later this month, and analysts are predicting a slight dip in earnings.

2025-10-22

Welding Materials: Global Market Trends, Value Chain Analysis and Growth Forecast to 2030 Featuring Air Liquide, Air Products, ESAB, Illinois Tool Works, Linde, Lincoln Electric, Ador Welding and More

Description: Global Welding Materials Market Global Welding Materials Market Dublin, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The "Welding Materials Market by Type (Electrodes & Filler Materials, Fluxes & Wires, Gases), Technology (Arc, Resistance, Oxy-Fuel Welding), End-use Industry (Transportation, Building & Construction, Heavy Industries), and Region - Global Forecast to 2030" has been added to ResearchAndMarkets.com's offering. The global welding materials market is expected to expand significantly, growing fr

2025-10-21

2025-10-20

2025-10-19

2025-10-18

2025-10-17

Goldman Sachs 4 New Conviction List Stocks Offer Dividends and Growth

Description: Here are the four new stock additions to the Goldman Sachs Conviction List for October—all outstanding total return ideas for growth and income investors.

LYB Introduces New Polypropylene Copolymer ProFax EP648R

Description: LYB launches ProFax EP648R copolymer, boosting strength, efficiency and sustainability in molded and packaging applications.