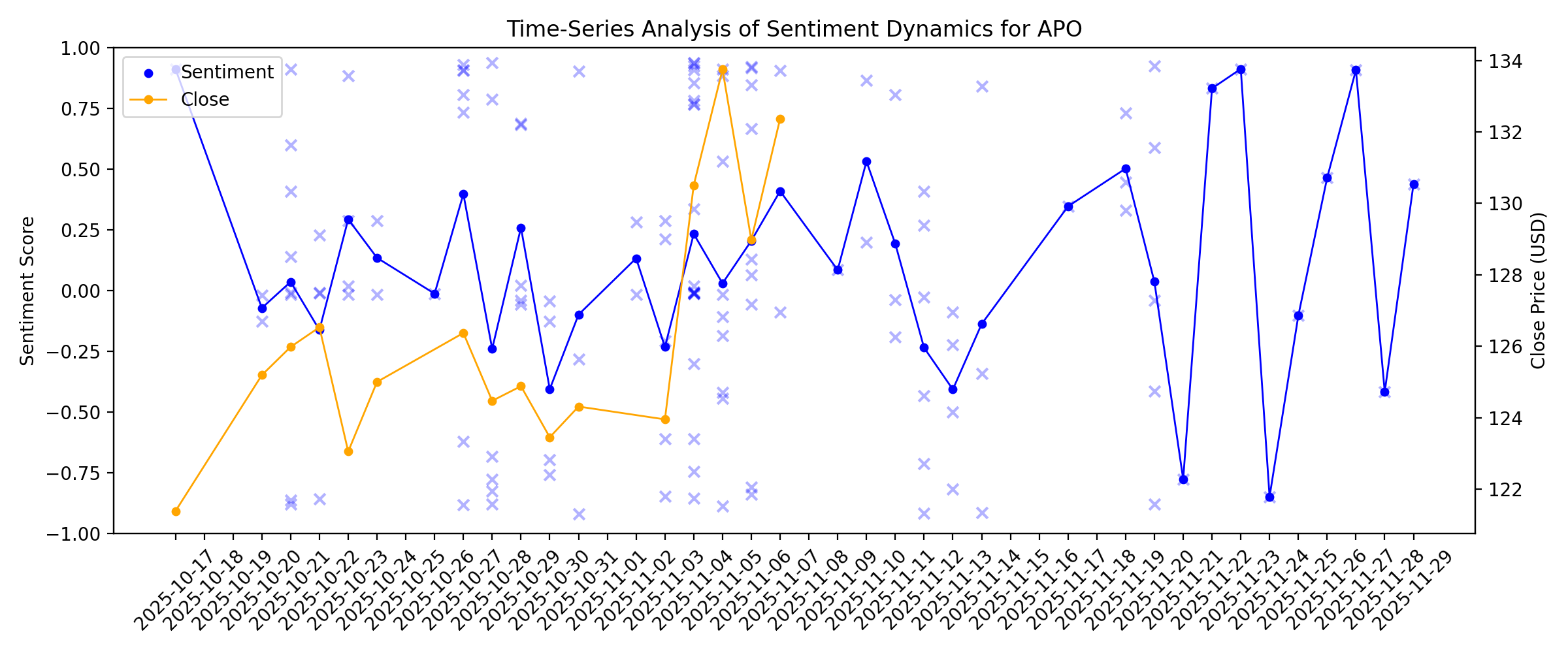

News sentiment analysis for APO

Sentiment chart

2026-01-14

A Look At Apollo Global Management’s Valuation After Recent Share Price Moves

Description: Apollo Global Management (APO) has come into focus for investors after its recent trading performance, with the shares closing at $143.24. That price now sits alongside a mixed set of recent return figures across different timeframes. See our latest analysis for Apollo Global Management. While the 1-day share price return of 0.47% and 7-day share price return of 6.20% point to near term weakness, the 12.17% 90-day share price return and multi year total shareholder returns of 118.27% over...

Saks Global, century-old high-end department store chain, files for bankruptcy

Description: The venerable retailer is seeking protection from its creditors after its $2.65 billion purchase of Nieman Marcus failed to spark growth.

Empower Adds Blackstone to Private Market Investment Providers

Description: The retirement plan provider has been forming partnerships with alternative asset managers and custodians since launching its private markets program last May.

KBRA Assigns a Preliminary Rating to MAPS 2026-1 Trust

Description: NEW YORK, January 14, 2026--KBRA assigns a preliminary rating to the Class A Notes issued by MAPS 2026-1 Trust (MAPS 2026-1), an aviation ABS transaction. MAPS 2026-1 represents the inaugural aviation ABS transaction serviced by Perseus Asset Management Limited (the Company). It is the fourth aviation lease ABS issued under Apollo’s aviation finance platform, following three prior transactions completed by Merx Aviation between 2018 and 2021. The Company is part of Apollo Global Management's avi

Coca Cola Halts Costa Coffee Sale After Offers Fall Short

Description: Company ends auction process as bids from private equity firms miss valuation expectations.

2026-01-13

2026-01-12

QXO Is Raising Another $1.8 Billion for Its M&A War Chest

Description: Building-supplies company QXO could be moving closer to making another big acquisition. The firm, led by serial entrepreneur Brad Jacobs, announced Monday that it is raising an additional $1.8 billion in financing for possible takeover offers. Shares of QXO had been up 3% in early trading Monday.

Athene 2026 Retirement Outlook: Retirees Drive Demand for Pension-Like Income Amid $4 Trillion Savings Gap

Description: As 12K Americans reach retirement age daily, the availability of stable long-term income solutions is growingWEST DES MOINES, Iowa, Jan. 12, 2026 (GLOBE NEWSWIRE) -- Athene, the leading retirement solutions company and subsidiary of Apollo Global Management (NSYE: APO), today released its 2026 Retirement Outlook. Retirement experts from Athene, Apollo and Vitera find that retiree demand is driving a structural return to pension-like income security across the retirement system. With a total addr

QXO Upsizes Convertible Preferred Equity Placement to $3 Billion

Description: GREENWICH, Conn., January 12, 2026--QXO, Inc. (NYSE: QXO) (the "Company" or "QXO") today announced a $1.8 billion increase to its previously announced $1.2 billion financing led by funds managed by affiliates of Apollo Global Management, Inc. (NYSE: APO) ("Apollo"), bringing the total investment in QXO to $3 billion. Apollo, Temasek, and certain other investors have agreed to make the investment through the previously disclosed series of convertible perpetual preferred stock (the "Series C Prefe

2026-01-11

How New Risk Signals Are Rewriting The Story For Apollo Tyres (NSEI:APOLLOTYRE)

Description: Apollo Tyres has just seen its fair value estimate trimmed slightly from ₹564.74 to ₹562.83, alongside a small reduction in the discount rate from 15.17% to about 15.12% and a marginal tweak to long term revenue growth assumptions from about 6.93% to about 6.90%. These shifts are being framed using fresh research on alternative asset managers, which is subtly reshaping how analysts think about risk, capital market conditions and required returns for Apollo Tyres. Stay with this article to see...

2026-01-10

2026-01-09

KBRA Assigns Ratings to MidCap Financial Issuer Trust

Description: NEW YORK, January 09, 2026--KBRA assigns an issuer rating of A-, a senior unsecured debt rating of A-, and a junior subordinated debt rating of BBB to MidCap Financial Issuer Trust, a wholly-owed subsidiary of MidCap FinCo Intermediate LLC ("the company" or "MidCap"), which serves as guarantor of the debt. MidCap is a commercial financial company that provides senior secured debt solutions to companies across multiple industries. The company is headquartered in Bethesda, MD. The ratings Outlook

Why Did QXO Stock Hit a 52-Week High This Week?

Description: Entrepreneur Brad Jacobs might be close to finalizing a new acquisition for QXO.

Why the stock market could easily get spooked

Description: Can you say priced for perfection?

2026-01-08

The Bull Case For Apollo Global Management (APO) Could Change Following Major QXO And Russell Financings

Description: Apollo Global Management has recently taken part in two large financings, providing about US$1.20 billion in convertible preferred equity to QXO and arranging US$1.23 billion in long-term capital for Russell Investments to refinance debt and support their growth plans. These transactions underline Apollo’s role as a key capital provider in complex funding deals, reinforcing its position at the center of major corporate growth and balance sheet reshaping efforts. We’ll now explore how...

Goldman Sachs Advises Selling Wagamama Bonds After Recent Price Rally

Description: This article first appeared on GuruFocus. Goldman Sachs Group Inc.'s (NYSE:GS) credit traders have advised clients to exit positions in bonds issued by Wagamama Holdings Ltd after a rally pushed prices to levels the bank views as relatively high. In a note sent to investors this week and seen by Bloomberg News, the trading and sales team said the recommendation reflects both the recent rise in cash prices and what it described as deteriorating fundamentals, while Goldman Sachs Group, Wagamama, and Apollo Global Management (NYSE:APO) declined to comment.

Stock Market News for Jan 8, 2026

Description: Wall Street closed mixed on Wednesday, pulled up by healthcare and AI-focused tech stocks.

Apollo's Zelter Says Bar Has Been Raised for Approving Investments

Description: Apollo Global Management President Jim Zelter says the gauntlet for approving investments at the firm has gotten higher and higher over the last year or so amid rising tail risk from geopolitics, but he finds the long-term trend to be "quite positive."

Saks Is Struggling to Stay Afloat. The Dealmaker Behind the Scenes Did Just Fine.

Description: It has long been a truism that retailing increasingly will become digital and that for a physical store to survive it must be special (or “experiential”) and probably have a digital presence. To wit, the Saks Fifth Avenue imbroglio, a complex stew of myriad brands and deals that was driven by one such individual. To get you up to speed—this is one of those “fast moving” situations—Saks Global Enterprises, the holding company that operates Saks (as well as Bergdorf Goodman and Neiman Marcus), is strapped for cash, having skipped a $100 million payment to bondholders on Dec. 30 (Happy New Year to you!).

2026-01-07

Dow, S&P 500 Fall From Records as Traders Assess Trump's Move to Ban Institutional Home Buying

Description: The Dow Jones Industrial Average and the S&P 500 fell from their record highs as traders assessed Pr

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were decreasing in late Wednesday trading, with the NYSE Financial Index down 1% an

Real Estate, Defense Stocks Fall as Trump Targets Institutional Home Buying, Defense Companies' Dividends

Description: Real estate and defense stocks fell after President Donald Trump said he would ban institutional inv

Pluto Launches an AI-Powered Lending Platform to Unlock Liquidity in Private Markets, Backed by Leading Credit Investors

Description: NEW YORK, January 07, 2026--Pluto Financial Technologies, Inc. has launched the first AI-powered lending platform purpose built for private markets, backed by Motive Ventures, Portage, Apollo Global Management (NYSE: APO), Hamilton Lane (Nasdaq: HLNE), Tectonic Ventures, and Broadhaven Ventures. Pluto has raised $8.6 million in equity and secured hundreds of millions in lending capacity.

Labor Department Promises Rule on 401(k) Private Investments

Description: Labor Department Deputy Secretary Keith Sonderling pledged to deliver a new rule on the inclusion of investments like private-equity and private-credit in pension plans. The rule will prioritize transparent standards that will give plan sponsors cover against potential litigation that has kept many retirement plans from adopting such “alternative assets,” he said at an industry event hosted Wednesday by the Securities Industry and Financial Markets Association. The proclamation follows an executive order President Trump signed last summer instructing the Labor Department to consult with other federal agencies to determine what regulatory changes to make.

Apollo Backs $5.4 Billion Valor and xAI Data Center Compute Infrastructure Transaction with $3.5 Billion Capital Solution

Description: GPU Lease Financing to Support xAI’s Second Data CenterNEW YORK, Jan. 07, 2026 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that Apollo-managed funds and affiliates (the “Apollo Funds”) have led a $3.5 billion capital solution for Valor Compute Infrastructure L.P. (“VCI”), a fund managed by Valor Equity Partners (“Valor”), to support its $5.4 billion acquisition and lease of data center compute infrastructure, including NVIDIA GB200 GPUs, to a subsidiary of xAI Corp (“xAI”). The financ

The biggest market risk in 2026 is the one no one talks about

Description: Deal activity is heating up amid lower interest rates from the Fed and a sense from sellers that valuations are about as full as one could expect. Yahoo Finance executive editor Brian Sozzi sits down on the Opening Bid Unfiltered podcast with Apollo Global Management co-head of equity David Sambur. After being held by Liberation Day market related volatility, the environment for deal-making has picked up. 2025 was poised to become the second highest in deal activity, up 36% in value to an estimated $4.8 trillion according to Bain & Company. Megadeals greater than $5 billion represented more than 75% of incremental deal value. Meanwhile, exit activity for private equity companies accelerated meaningfully in the third quarter of last year. Private equity firms announced exits totaling $470 billion in 2025 per the latest data from EY, marking a 40% increase by value compared with the same period last year. Sambur shares his outlook for M&A and exits in 2026, the drivers of that potential activity and what he has learned from making big deals over the course of his career.Disclosure: Yahoo is a portfolio company of funds managed by affiliates of Apollo Global Management.

2026-01-06

Apollo Reports Q4 Preliminary Net Investment Income of $325M

Description: APO posts preliminary Q4 alternative net investment income of $325M, a 10% annualized return that exceeds last year's result.

European Equities Rise Tuesday; Anheuser-Busch to Reacquire US Metal Container Plants Stake

Description: European stock markets closed higher Tuesday, with the Stoxx Europe 600 rising 0.6%, the FTSE 100 ga

Budweiser Maker Takes Back Plant Stake

Description: $3 billion deal brings packaging back in-house

AB InBev buys back $3B stake in US metal container plants

Description: The Bud Light maker sold a minority stake in the business to investors in 2020.

Apollo to Announce Fourth Quarter and Full Year 2025 Financial Results on February 9, 2026

Description: NEW YORK, Jan. 06, 2026 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) plans to release financial results for the fourth quarter and full year 2025 on Monday, February 9, 2026, before the opening of trading on the New York Stock Exchange. Management will review Apollo’s financial results at 8:30 am ET via public webcast available on Apollo’s Investor Relations website at ir.apollo.com. A replay will be available one hour after the event. Apollo distributes its earnings releases via its website and email

Russell Investments Announces Strategic Financing to Support Long-Term Growth

Description: SEATTLE, January 06, 2026--Russell Investments today announced the completion of a $1.225B strategic financing with Apollo (NYSE: APO) managed funds and affiliates associated with its hybrid and credit strategies (the "Apollo Funds"). The solution provides the firm with long-term capital and enhanced balance sheet flexibility to support continued execution of its growth strategy.

AB InBev Moves to Reclaim US Metal Container Plants in $3 Billion Deal

Description: The brewer plans to buy back a 49.9% stake in seven US facilities from Apollo, funding the deal with cash on hand.

AB InBev to buy back stake in US metal container plants

Description: The Stella Artois maker sold its 49.9% holding in the plants to an investor group led by private-equity firm Apollo Global Management in 2021.

Apollo Global's Q4 2025 Earnings: What to Expect

Description: Apollo Global is gearing up to release its fourth-quarter results soon, and analysts are expecting a single-digit rise in earnings.

Pluto Launches an AI-Powered Lending Platform to Unlock Liquidity in Private Markets, Backed by Leading Credit Investors

Description: NEW YORK, January 06, 2026--Pluto Financial Technologies, Inc. has launched the first AI-powered lending platform purpose built for private markets, backed by Motive Ventures, Portage, Apollo Global Management (NYSE: APO), Hamilton Lane (Nasdaq: HLNE), Tectonic Ventures, and Broadhaven Ventures. Pluto has raised $8.6 million in equity and secured hundreds of millions in lending capacity.

Pluto Raises $8.6M for Private Market Asset Lending Platform

Description: With backing from several alternative asset managers, the AI-powered platform will enable investors to borrow against private market holdings.

AB InBev Buys Back $3 Billion Stake in U.S. Metal Container Facility to Boost Supply Security

Description: The beer giant agreed to repurchase a minority stake in its U.S.-based metal container plants, taking back its share of the facilities that boost supply security.

QXO Inc. (QXO) Rockets 18% as New Investor Places $1.2-Billion Bet

Description: We recently published 10 Stocks With Easy Double-Digit Gains. QXO, Inc. (NYSE:QXO) was one of the top performers on Monday. QXO soared by 18.15 percent on Monday to close at $23.30 apiece after raising $1.2 billion in fresh funds from Apollo Global Management, Inc., in support of the former’s plans to acquire one or two […]

2026-01-05

Sector Update: Consumer Stocks Mixed Late Afternoon

Description: Consumer stocks were mixed late Monday afternoon with the State Street Consumer Staples Select Secto

Sector Update: Financial Stocks Rise Late Afternoon

Description: Financial stocks were advancing in late Monday trading, with the NYSE Financial Index rising 2% and

Is Apollo Global Management (APO) Attractively Priced After Recent Share Price Swings?

Description: If you are wondering whether Apollo Global Management is attractively priced right now, looking closely at how its valuation stacks up is a useful next step before making any decisions. The stock recently closed at US$146.61, with returns of 6.1% over the last 30 days, a 0.4% decline over the last 7 days, flat performance year to date, a 12.1% decline over 1 year, and gains of 136.3% over 3 years and 246.0% over 5 years. Recent share price moves have kept investor attention on how Apollo is...

Sector Update: Financial Stocks Rise in Afternoon Trading

Description: Financial stocks were advancing in Monday afternoon trading, with the NYSE Financial Index rising 2.

Sector Update: Consumer Stocks Mixed in Afternoon Trading

Description: Consumer stocks were mixed Monday afternoon, with the State Street Consumer Staples Select Sector SP

Jacobs’ QXO gets big investment from group led by Apollo

Description: Brad Jacobs’ latest venture, QXO with it plans to roll up a diffuse network of building product suppliers through acquisitions, has just armed itself with a lot more cash to do so. At its most basic, QXO is a logistics play: put a growing amount of assets of a fragmented building supply chain ecosystem under […] The post Jacobs’ QXO gets big investment from group led by Apollo appeared first on FreightWaves.

Why Did QXO Stock Soar Today?

Description: QXO announced a substantial investment agreement from an Apollo-led group.

Top Midday Stories: Oil Stocks Rise After US Attack on Venezuela; QXO Receives $1.2 Billion Investment From Apollo-Affiliated Funds

Description: All three major US stock indexes rose in late-morning trading Monday as investors weighed the US att

QXO Stock Soars After Striking Deal With Apollo. What Has Investors Excited.

Description: Building-supplies company QXO, led by serial acquirer Brad Jacobs, landed a major investment to help fund future deals.

US Equity Futures Mixed Pre-Bell Monday Despite Oil Sector Surge

Description: Investors revved up oil and oil services shares premarket Monday, but US equity futures were mixed f

QXO Announces $1.2 Billion Convertible Preferred Equity Investment Led by Apollo to Fund Future Acquisitions

Description: GREENWICH, Conn., January 05, 2026--QXO, Inc. (NYSE: QXO) (the "Company" or "QXO") today announced that funds managed by affiliates of Apollo Global Management, Inc. (NYSE: APO) ("Apollo") and certain other investors have agreed to invest $1.2 billion in QXO through a new series of convertible perpetual preferred stock. The investment further strengthens QXO’s financial flexibility in pursuing acquisition opportunities.

Apollo Said to Invest in Brad Jacobs’ Distribution Firm QXO

Description: The investment into Greenwich, Connecticut-based QXO is also backed by other firms including Franklin Templeton, the people said, asking not to be identified because the matter is private. The financing for the company, which is led by billionaire and serial dealmaker Brad Jacobs, will be in convertible preferred stock, they added. The investors’ initial conversion price into common stock will be $23.25 per share, roughly 18% above QXO’s Friday closing price of $19.72, the people said.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were lower in late Wednesday afternoon trading, with the NYSE Financial Index and t

Sector Update: Financial Stocks Decline in Afternoon Trading

Description: Financial stocks were lower in Wednesday afternoon trading, with the NYSE Financial Index shedding 0

Apollo to Sell Coinstar to Alaska Buyer, Bonds Set to Be Repaid

Description: The planned sale to Arctic Slope Regional Corp., created in 1972 as part of a US government settlement with the state’s indigenous residents, hasn’t been previously disclosed. As part of the acquisition ASRC will repay more than $750 million of principal plus all interest in early January, according to a notice posted privately to owners of Coinstar’s bonds, known as whole business securitizations. A spokesperson for Coinstar said it doesn’t comment on potential transactions, and Apollo declined to comment.

Apollo Global Management (APO) Explores Potential Sale of Aviation Company, Atlas Air Worldwide Holdings Inc., Reports Bloomberg

Description: Apollo Global Management, Inc. (NYSE:APO) is one of the High Growth Large Cap Stocks to Buy Right Now. On December 16, Bloomberg reported that Apollo Global Management, Inc. (NYSE:APO) has been exploring a potential sale of its aviation company, Atlas Air Worldwide Holdings Inc. The investment firm happens to be in early stages of considering a potential […]

2025-12-30

Apollo Global Management Insiders Sell US$268m Of Stock, Possibly Signalling Caution

Description: The fact that multiple Apollo Global Management, Inc. ( NYSE:APO ) insiders offloaded a considerable amount of shares...

2025-12-29

2025-12-28

All-In On AI: What Happens If the Bubble Pops In 2026?

Description: Apollo Global Management Inc.'s (NYSE:APO) 2026 outlook, spearheaded by chief economist Torsten Slok, gives a sharp warning: the U.S. economy has become dangerously reliant on a single engine of growth—artificial intelligence. As 2026 approaches, the S&P 500 has transformed into a concentrated bet. If the AI bubble were to pop, the fallout would likely cause widespread economic damage due to what Slok calls a “single point of failure.” Don't Miss: These five entrepreneurs are worth $223 billion

2025-12-27

2025-12-26

If You Invested $1000 in Apollo Global Management Inc. a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-12-25

How the Narrative Surrounding Apollo Tyres Is Shifting Amid Credit Risks and Valuation Resets

Description: Apollo Tyres has seen its street price target nudged lower even as the fair value estimate holds steady at ₹564.74 per share, underscoring that the core investment thesis remains largely unchanged. The slight uptick in the discount rate to 15.17% mainly reflects analysts rebalancing perceived risk in a more uncertain credit environment, while still acknowledging resilient fee based growth and constructive capital market conditions. As this tension between solid fundamentals and a more...

Warren Buffett and Private Equity Both Love Insurance. The Similarities End There.

Description: Lots of people want to invest insurance money these days. Nobody does it quite like Warren Buffett. The seed capital Buffett’s Berkshire Hathaway uses to maintain its vast investing empire comes from insurance premiums, dollars that often sit unused for months or years before going to pay claims.

2025-12-24

New Mountain Asset Sale Shapes Up as a Test of Private Credit Market

Description: The $1 trillion market is already under scrutiny. Concern has mounted about borrowers’ ability to handle their debts.

Ares Management Eyes Buyout to Strengthen Private Equity Business

Description: ARES is weighing a buyout to bolster private equity, citing capacity for deals as retirement plans open private markets.

State Street’s Private-Credit ETFs Outperformed in 2025. Is That Enough to Interest Investors?

Description: Its two diversified bond ETFs can’t match the private-credit allocations of less-liquid vehicles, but they are beating 92% of peers.

2025-12-23

The Bull Case For Apollo Global Management (APO) Could Change Following Its Defensive Turn And Gas Partnership - Learn Why

Description: Earlier in December 2025, Capital Power announced an MOU with Apollo Funds to create an investment partnership targeting up to US$3 billion of U.S. merchant natural gas generation assets, with Apollo committing up to US$2.25 billion and Capital Power up to US$750 million. At the same time, Apollo Global Management has been shifting into a more defensive stance, hoarding cash and cutting exposure to higher‑risk credit, signaling a cautious approach to potential systemic and insurance‑sector...

A Look at Apollo (APO) Valuation After Its New Capital Power U.S. Gas Generation Partnership

Description: Apollo Global Management (APO) is back in the headlines after Apollo Funds signed a memorandum of understanding with Capital Power to jointly target up to 3 billion dollars of U.S. merchant natural gas generation assets. See our latest analysis for Apollo Global Management. That backdrop helps explain why investors have been willing to look past a negative year to date share price return of 10.23 percent, especially as the 30 day share price return of 14.51 percent hints that momentum may be...

2025-12-22

State Street Private Credit ETF Stalls in Year of Industry Snags

Description: The fund’s struggles serve as a cautionary tale for those seeking to encourage retail investors into private markets.

Buyer Beware of Heritage Grocers Group Labor Risks and Dispute, says UFCW

Description: WASHINGTON, December 22, 2025--UFCW is urging prospective buyers of Heritage Grocers Group to conduct due diligence re: labor risks like litigation and an escalating labor dispute.

Walker & Dunlop Arranges $867 Million Financing Package for the Largest Single-Building, Office-to-Residential Conversion in the U.S.

Description: BETHESDA, Md., December 22, 2025--Walker & Dunlop, Inc. announced today that it has arranged a $778.6 million construction loan to facilitate the office-to-residential conversion of 111 Wall Street, located along the East River waterfront in Lower Manhattan’s Financial District. The closing of this financing marks the largest single-building office-to-residential conversion loan in New York City history, and the country.

2025-12-21

The Private-Credit Party Turns Ugly for Individual Investors

Description: Funds called BDCs that make corporate loans have had a rough 2025, just as the private-credit industry looks to “democratize” their offerings.

2025-12-20

2025-12-19

Golden Matrix Group Appoints Atul Bali, Gaming Industry Expert, as Non-Executive Director

Description: Former Lead Independent Director of Everi Holdings Brings Deep Public Company and Global Gaming Expertise to the Board LAS VEGAS, NV - December 19, 2025 (NEWMEDIAWIRE) - Golden Matrix Group Inc. (NASDAQ: GMGI) ("Golden Matrix," "GMGI," or the "Compan...

2025-12-18

2025-12-17

2025-12-16

Is Apollo Global Management Attractively Priced After Its Recent Private Credit Expansion?

Description: Wondering if Apollo Global Management is a bargain or a bubble at its current price? This article will walk you through what the numbers are really saying about the stock. Even though the shares are down 11.3% year to date and 15.4% over the last year, they have climbed 2.3% in the past week and 12.7% over the past month, against a backdrop of large 3 year and 5 year gains of 147.1% and 243.9%. Recent headlines have highlighted Apollo’s continued push into private credit and alternative...

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were lower late Tuesday afternoon, with the NYSE Financial Index and the State Stre

Apollo Funds to Acquire Prosol Group, a Leading French Fresh Food Retailer

Description: Investment Supports Growth of Prosol’s Proprietary Fresh Food Model and Distinctive Customer PropositionNEW YORK, Dec. 16, 2025 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that Apollo-managed funds (the “Apollo Funds”) have agreed to acquire a majority stake in Prosol Group (“Prosol” or the “Company”), the multi-specialist in fresh food businesses and food retail in France, from Ardian. Prosol’s existing shareholders and management team will reinvest alongside the Apollo Funds. Founde

2025-12-15

2025-12-14

2025-12-13

Green Stocks Are Big Winners as Tech Boom Drives Energy Demand

Description: Instead, the sector is booming as artificial intelligence powers massive demand for all kinds of energy. The S&P Global Clean Energy Transition Index has rallied this year, handily beating a advance in the S&P 500 Index. It’s also outpacing an gain in the S&P Global Oil Index, which was expected to be a big winner on the back of Trump’s “drill, baby, drill” agenda.

2025-12-12

How Is Apollo Global Management Stock Performance Compared to Other Financial Services Stocks?

Description: Although Apollo Global Management stock has underperformed other financial services stocks over the past year, analysts remain bullish about its prospects.

2025-12-11

Sector Update: Financial Stocks Gain Late Afternoon

Description: Financial stocks were advancing in late Thursday afternoon trading, with the NYSE Financial Index ri

Hollywood for Sale? Gulf Billionaires Back $24 Billion Blitz on Warner Bros. Discovery

Description: A rare alliance of Saudi, Qatari and Emirati cash could flip the script on the U.S. entertainment power structure.

Sector Update: Financial Stocks Gain Thursday Afternoon

Description: Financial stocks were advancing in Thursday afternoon trading, with the NYSE Financial Index rising

Apollo CEO says some AI fortunes may be lost

Description: Apollo chief Marc Rowan explains the high stakes of a long-term AI equity bet

Great fortunes will be made & lost in data centers, Apollo's CEO says

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance Executive Editor Brian Sozzi sits down with Apollo Global Management CEO Marc Rowan. One of the things they discussed is Rowan's belief that there is the potential for "great fortunes" to be made and lost in the AI data center boom. Be sure to check out the full interview with Marc Rowan. Disclosure: Yahoo is a portfolio company of funds managed by affiliates of Apollo Global Management. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

UBS launches coverage on U.S. brokers and asset managers, highlights 4 top picks

Description: Investing.com -- UBS initiated coverage on 20 U.S. brokers and asset managers in a note to clients on Thursday, highlighting four top picks.

Private credit: 2 things Apollo's Marc Rowan is focused on

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance Executive Editor Brian Sozzi sits down with Apollo Global Management CEO Marc Rowan. Rowan has been at the center of the private credit market revolution. In the video above, he shares two things he is focused on right now. Be sure to check out the full interview with Marc Rowan. Disclosure: Yahoo is a portfolio company of funds managed by affiliates of Apollo Global Management. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Paramount’s Mideast Backing Likely Runs Deeper Than $24 Billion

Description: Saudi Arabia’s Public Investment Fund and the Qatar Investment Authority joined the relatively-unknown Abu Dhabi firm L’imad Holding Co. to bankroll the hostile offer earlier this week. One example is Apollo Global Management Inc., which is among firms providing as much as $54 billion of financing for the Paramount offer.

2025-12-10

When do you exit a private equity investment? Apollo exec. explains

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance executive editor Brian Sozzi sits down with Apollo Asset Management Co-President Scott Kleinman to discuss the Federal Reserve's latest decision to cut interest rates at the US central bank's December FOMC and what the rate environment means for private equity dealmaking and investing. Note: Apollo Global Management is the parent company of Yahoo Finance. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Apollo CEO Marc Rowan: There's no need for another rate cut from the Federal Reserve

Description: Apollo Global Management CEO Marc Rowan is OK if the Fed stands pat on interest rates.

The Fed didn't need to cut rates, Apollo's Marc Rowan says

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance Executive Editor Brian Sozzi sits down with Apollo Global Management CEO Marc Rowan to discuss the Federal Reserve's rate cut decision, the rise of private credit markets, and data centers. Note: Apollo Global Management is the parent company of Yahoo Finance. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Fed has no 'tools' to solve affordability crisis: Torsten Sløk

Description: The Federal Reserve cut interest rates by 25 basis points on Wednesday, while Fed officials signaled that there will only be one rate cut in 2026. Apollo Global Management (APO) partner and chief economist, Torsten Sløk, sits down with Yahoo Finance Executive Editor Brian Sozzi and Market Domination host Josh Lipton as part of Yahoo Finance's exclusive coverage with Apollo Global executives. Watch the video above to hear Sløk discuss the impact artificial intelligence (AI) could have on the labor market, the Fed's role in tackling the affordability crisis, how inflation could unfold in 2026, and his expectations for internal Fed dissent next year. To watch more expert insights and analysis on the latest market action, check out more Market Domination. Note: Apollo Global Management is the parent company of Yahoo Finance.

Apollo exec says data center debt wave is 'tip of the iceberg'

Description: John Cortese, Apollo's head of portfolio management and trading, explains how private credit is financing the future of computing.

How lower interest rates impact your retirement: Athene COO

Description: Athene USA co-president and Athene Holding (ATH-PA) COO, Michael Downing, sits down with Yahoo Finance Executive Editor Brian Sozzi as part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO). Downing highlights that well over half of retirees fear running out of money. He says that the best way to close this savings gap is through annuities, which can take your retirement from "nervous" to "confident." He explains why this is still the case in a low-interest-rate environment. Watch the video above to learn more about annuities amid lower interest rates. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts. Note: Apollo Global Management is the parent company of Yahoo Finance.

Private markets: Thinking outside the traditional 60/40 portfolio

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance executive editor Brian Sozzi sits down with Apollo Global Management Chief Client & Product Development Officer Stephanie Drescher to talk about private market valuations and investment strategies outside of the traditional 60/40 portfolio. Also hear Stephanie Drescher discuss the importance of including private market investments to overcome possible 60/40 portfolio headwinds to come in 2026. Note: Apollo Global Management is the parent company of Yahoo Finance. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

Apollo Just Wrote a $3 Billion Check to Chase America's Power Gold Rush

Description: Capital Power strikes fast-track alliance with Apollo to snap up US gas plants as data center boom fuels energy scramble.

Retirees need guaranteed lifetime income, & annuities can help

Description: Athene USA co-president and Athene Holding (ATH-PA) COO, Michael Downing, sits down with Yahoo Finance Executive Editor Brian Sozzi as part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO). Downing highlights that well over half of retirees fear running out of money. He says that the best way to close this savings gap is through annuities, which can take your retirement from "nervous" to "confident." Watch the video above to learn more about annuities. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts. Note: Apollo Global Management is the parent company of Yahoo Finance.

Private markets will be key to overcoming 60-40 headwinds in 2026

Description: As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance executive editor Brian Sozzi sits down with Apollo Global Management Chief Client & Product Development Officer Stephanie Drescher to discuss the importance of building a winning portfolio through the inclusion of private market investments and why a higher-for-longer interest rate environment could be a headwind for the 60/40 portfolio construction in 2026. Note: Apollo Global Management is the parent company of Yahoo Finance. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

How Big Tech's AI build-out is 'mostly' a private credit story

Description: Big Tech companies are spending trillions to build out data centers, and the $40 trillion private credit market is supporting that build-out in a way public investors may not realize. As part of Yahoo Finance's exclusive coverage with executives at Apollo Global (APO), Yahoo Finance Executive Editor Brian Sozzi sits down with Apollo Global Management's co-head of corporate credit, John Cortese, to discuss how artificial intelligence (AI) infrastructure is a private credit story and to explain what investors get wrong about the space. To watch more expert insights and analysis on the latest market action, check out more Opening Bid. Note: Apollo Global Management is the parent company of Yahoo Finance.

Here's How Much a $1000 Investment in Apollo Global Management Inc. Made 10 Years Ago Would Be Worth Today

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

Capital Power Signs Agreements for U.S. Natural Gas Investment Partnership, Data Center in Alberta

Description: Capital Power (CPX.TO) on Wednesday announced new agreements for investments in U.S. natural gas gen

Capital Power 2025 Investor Day: Accelerating Growth to 2030

Description: Announces MOU with Apollo-managed funds for US$3 billion investment partnership to pursue merchant U.S. natural gas generation acquisitions Enters into a binding MOU with investment-grade data centre developer in Alberta EDMONTON, Alberta, Dec. 10, 2025 (GLOBE NEWSWIRE) -- Capital Power Corporation (“Capital Power” or the “Company”) (TSX: CPX) is hosting its 2025 Investor Day today in Toronto. The event will highlight the Company’s strategic priorities, 2030 growth targets, and 2026 guidance, un

2025-12-09

Apollo Commercial Real Estate Finance, Inc. Declares Quarterly Common Stock Dividend

Description: NEW YORK, Dec. 09, 2025 (GLOBE NEWSWIRE) -- Apollo Commercial Real Estate Finance, Inc. (the “Company”) (NYSE:ARI) today announced the Board of Directors declared a dividend of $0.25 per share of common stock, which is payable on January 15, 2026 to common stockholders of record on December 31, 2025. About Apollo Commercial Real Estate Finance, Inc. Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a real estate investment trust that primarily originates, acquires, invests in and manage

Where the $8T private equity market stands ahead of 2026

Description: To kickstart Yahoo Finance's exclusive coverage with executives at Apollo Global (APO) on Wednesday, Yahoo Finance Executive Editor Brian Sozzi joins Market Catalysts host Julie Hyman to discuss the state of the $8 trillion private equity industry and to explain what investors should be watching in 2026. Tune in to Yahoo Finance on Wednesday, Dec. 10 to catch Sozzi's exclusive interviews at Apollo. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts. Note: Apollo Global Management is the parent company of Yahoo Finance.

Morgan Stanley Maintains Bullish Stance on Apollo Global Management (APO) Stock

Description: Apollo Global Management, Inc. (NYSE:APO) is one of the Most Undervalued Stocks to Buy Right Now. On November 24, Morgan Stanley analyst Michael Cyprys maintained a bullish stance on the company’s stock, giving a “Buy” rating. The analyst’s rating is backed by a combination of factors demonstrating the company’s healthy growth potential, mainly via its retirement services business, Athene. […]

Paramount Hijacks Netflix's Hollywood Dream in $108 Billion Power Play

Description: A wild takeover twist pits Larry Ellison, Gulf billions, and Jared Kushner against Netflix in a battle for Warner Bros.

Consumer Loans Are Getting Harder to Tally—and the Risks Harder to Gauge

Description: Having trouble trying to figure out how the U.S. consumer is doing lately? Now, the increasing migration of consumer lending to less-visible parts of the financial system is only adding to the difficulty. Private credit is exploding onto the scene in what is known as alternative consumer lending.

2025-12-08

Sector Update: Financial Stocks Retreat Monday Afternoon

Description: Financial stocks were decreasing in Monday afternoon trading, with the NYSE Financial Index and the

Apollo buys stake in Wrexham football club

Description: Private capital giant Apollo Global Management has bought a minority stake in Wrexham AFC, the once sleepy Welsh football club whose fortunes...

Wrexham AFC Welcomes Apollo Sports Capital as a Minority Investor

Description: WREXHAM, Wales & NEW YORK, December 08, 2025--Wrexham AFC and its Co-chairmen, Rob Mac and Ryan Reynolds, are excited to welcome Apollo Sports Capital, an affiliate of Apollo (NYSE: APO), a global alternative asset manager, as new minority investors in the Club. The investment aligns with Wrexham AFC’s long-term growth strategy and Premier League aspirations, with majority shareholders Mac and Reynolds continuing to oversee the Club as controlling owners.

2025-12-07

2025-12-06

2025-12-05

BMO Launches New CDRs With Exposure to U.S. Stocks Including Apollo Global Management, ConocoPhillips, Northrop Grumman, Home Depot and Vistra

Description: Bank of Montreal (BMO) announced five new Canadian depositary receipts (CDRs) will begin trading on the Cboe Canada exchange today. The initial offering of these new CDRs has closed.

Apollo Global Management (APO): Revisiting Valuation After a Recent Short-Term Share Price Rebound

Description: Apollo Global Management (APO) has quietly outperformed the broader market over the past week, gaining about 5% as investors reassess the stock after a tough year and mixed top line trends. See our latest analysis for Apollo Global Management. The recent 7 day share price return of about 5 percent comes after a weak year to date share price return and negative 1 year total shareholder return, but the strong 3 year and 5 year total shareholder returns suggest longer term momentum and...

The New Private-Equity Billionaires Who Are Taking Over Wall Street

Description: This past Monday night in a packed Times Square ballroom, some 2,000 attendees rose out of their seats to salute the latest lion of Wall Street, Marc Rowan, CEO of Apollo Global Management It was the 50th UJA-Federation Wall Street Dinner, a signature fund-raising event in New York, which this year reaped some $57 million, and where Rowan was lauded for his “visionary leadership” in philanthropy and business. To a degree, the dinner manifested yet another step in the changing of the guard on Wall Street, from the old-line legacy banks to the new private-market institutions.

2025-12-04

Josh Harris’s Firm Strikes Deal for Middleby Unit That Makes Viking Stoves

Description: 26North is set to own 51% of the kitchen-products division that houses a number of luxury cookware-equipment brands.

Apollo Global Management (APO) Up 0.6% Since Last Earnings Report: Can It Continue?

Description: Apollo Global Management (APO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

Why Paramount (PSKY) Stock Is Down Today

Description: Shares of multinational media and entertainment corporation Paramount (NASDAQ:PARA) fell 5.4% in the morning session after reports surfaced that the company submitted a cash bid for Warner Bros. Discovery, an offer that was met with caution amid negative analyst sentiment.

2025-12-02

Comcast’s Bid Seeks to Merge NBCUniversal With Warner Bros.

Description: Comcast on Monday made a renewed offer for part of Warner Bros. that would give it control of the combined entity, according to the people, who asked not to be identified because the terms haven’t been made public. Warner Bros. shareholders would receive a combination of cash and stock in the new entity. Comcast, a Philadelphia-based cable-TV and internet-service provider, is among three Warner Bros. suitors that submitted offers this week in a second round of bidding.

How Morgan Stanley’s Upgrade and Asia-Pacific Focus Could Shape Apollo Global Management (APO) Investors’ Outlook

Description: Apollo Global Management recently participated in the Morgan Stanley 24th Asia-Pacific Summit in Singapore, with Brigitte Posch representing the firm's APAC Credit and Yield Multi Credit businesses. Morgan Stanley upgraded Apollo Global Management's rating to Overweight, highlighting expectations for accelerated growth and robust fee-related earnings in the coming years. We'll explore how this upgrade, driven by anticipated earnings momentum, could affect Apollo's investment narrative and...

Netflix Offers Mostly Cash for Warner Bros. in New Bid Round

Description: Bankers for Paramount Skydance Corp., Comcast Corp. and Netflix worked over the long Thanksgiving weekend on improved offers for all or part of Warner Bros., said the people, who asked not to be identified discussing nonpublic information. The stock was up as much as 1.8% to $24.30 on Tuesday, giving the company an equity market value of about $60 billion.

Netflix's Bold Cash Bid Sets Off Streaming's Biggest Power Shift Yet

Description: Warner Bros. auction heats up as Netflix, Paramount, and Comcast race to carve up Hollywood's crown jewels

Blackstone & Others to Take Part in BoE Private Credit Stress Test

Description: BX, APO and KKR to join BoE private credit stress test examining how the fast-growing sector will hold up under severe financial strain.

M&A Volume Set to Top $5 Trillion in 2025, Says Apollo's Zelter

Description: Apollo Global Management President Jim Zelter says that M&A activity is set to reach near-record performance this year, with a volume north of $5 trillion, partially helped by the fact that the Trump administration is "much more comfortable with large industrial mergers."

Apollo's Jim Zelter Looks Ahead to 2026

Description: Apollo Global Management President Jim Zelter looks at some of the expectations for the year ahead while highlighting this year's strengths in the M&A market and the "amazingly resilient" US economy.

Apollo to Present at the Goldman Sachs 2025 US Financial Services Conference

Description: NEW YORK, Dec. 02, 2025 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that Marc Rowan, Chief Executive Officer and Chair of the board of Apollo, will participate in a fireside chat at the Goldman Sachs US Financial Services Conference on Wednesday, December 10, 2025 at 8:00 am ET. A live webcast of the event will be available on Apollo’s Investor Relations website at ir.apollo.com. For those unable to join live, a replay will be available shortly after the event. About Apollo Apollo is

2025-12-01

Netflix Offers Mostly Cash for Warner Bros. in New Bid Round

Description: Bankers for Paramount Skydance Corp., Comcast Corp. and Netflix worked over the long Thanksgiving weekend on improved offers for all or part of Warner Bros., said the people, who asked not to be identified discussing nonpublic information. Paramount’s offer, while largely backed by the family of Oracle Corp. co-founder Larry Ellison, includes debt financing from Apollo Global Management Inc. Middle East funds are also contributing, the people said. Netflix, the streaming industry leader, is working on a bridge loan that totals tens of billions of dollars, one of the people said.

Sector Update: Energy Stocks Rise Late Afternoon

Description: Energy stocks were higher late Monday afternoon, with the NYSE Energy Sector Index up 0.7% and the E

Sector Update: Financial Stocks Retreat Late Afternoon

Description: Financial stocks were lower in late Monday afternoon trading, with the NYSE Financial Index down 0.5

Sector Update: Energy

Description: Energy stocks were higher late Monday afternoon, with the NYSE Energy Sector Index up 0.7% and the E

2025-11-30

2025-11-29

Is Apollo Global Management’s Recent Comeback a Sign of Further Upside in 2025?

Description: Wondering if Apollo Global Management stock is a hidden gem or priced at its peak? You are not alone in questioning if today’s price really reflects its long-term potential. After a rocky year with shares down 23.6%, Apollo’s stock price has staged a bit of a comeback recently, rising 1.4% in the last week and 5.6% over the last month. Some of this turnaround follows attention on the alternative asset sector, as investors weigh in on Apollo’s recent investments in credit markets and...

2025-11-28

Apollo Global Management (NYSE:APO) shareholders have earned a 25% CAGR over the last five years

Description: The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put...

2025-11-27

Apollo Global Management, Inc. (APO) Upgraded at Morgan Stanley on Growth Acceleration Prospects

Description: Apollo Global Management, Inc. (NYSE:APO) is an affordable blue-chip stock to buy. On November 20, Morgan Stanley upgraded Apollo Global Management, Inc. (NYSE:APO) to an Overweight from Equalweight. The investment bank also hiked the price target to $180 from $151 amid expectations of growth acceleration in 2026 and 2027. Morgan Stanley expects the asset management […]

2025-11-26

Bitcoin rises above $90,000 as cryptocurrency attempts recovery amid stock market gains

Description: Bitcoin has struggled to bounce back meaningfully despite a price uptick on Wednesday.

2025-11-25

Rowan Says People ‘Lost Their Minds’ Over Private Credit Fears

Description: Apollo’s CEO pushed back on the idea that private credit is less transparent than traditional loans during a presentation on the firm’s retirement services businesses.

2025-11-24

Apollo Global Management Insiders Sold US$617m Of Shares Suggesting Hesitancy

Description: In the last year, many Apollo Global Management, Inc. ( NYSE:APO ) insiders sold a substantial stake in the company...

2025-11-23

Why Apollo Global Management, Inc. (APO) Could Deliver Over 20% Earnings Growth

Description: Apollo Global Management, Inc. (NYSE:APO) is among the stocks Wall Street analysts are watching closely. On November 20, Morgan Stanley raised the price target on Apollo Global Management, Inc. (NYSE:APO) to $180.00 from $151.00 and upgraded the stock from Equalweight to Overweight. The firm is confident about the company’s ability to achieve over 20% fee-related […]

2025-11-22

What Aeva Technologies (AEVA)'s Shift to 4D LiDAR Solutions and $100M Funding Means for Shareholders

Description: Aeva Technologies announced an exclusive partnership with D2 Traffic Technologies to deliver 4D LiDAR-based smart infrastructure solutions across the U.S. and secured a US$100 million investment from funds managed by Apollo Global Management to accelerate the sales and deployment of its LiDAR technology. These actions mark a shift for Aeva from a LiDAR sensor supplier to a full-solution provider, offering integrated sensing, perception, and analytics for transportation infrastructure. We'll...

2025-11-21

Netflix, Comcast and Paramount Make Bids for Warner Bros.

Description: The submissions meet a Nov. 20 deadline for a first round of bids set by the board of Warner Bros. Discovery, the parent of HBO, CNN and the Warner Bros. movie and TV studios. Comcast and Netflix are most interested in the film and TV library, which includes everything fromto Bugs Bunny.

2025-11-20

How Blue Owl found itself at the middle of Wall Street's latest private credit fears

Description: Public worries over the world of private debt have forced major lender Blue Owl Capital (OWL) to scrap plans to give a clear way out to shareholders in one of its private funds.

PAX or APO: Which Is the Better Value Stock Right Now?

Description: PAX vs. APO: Which Stock Is the Better Value Option?

Examining Aeva Technologies’s Valuation Following $100 Million Apollo Investment and D2 Traffic Technologies Partnership

Description: Aeva Technologies (AEVA) is making headlines after securing a $100 million investment from Apollo Global Management to ramp up commercialization of its 4D LiDAR technology. The company also announced a new partnership with D2 Traffic Technologies, which signals a broader move into full-scale smart infrastructure solutions. See our latest analysis for Aeva Technologies. Momentum has shifted quickly for Aeva Technologies. While the company notched a stellar year-to-date share price return of...

Astera initiated, Nasdaq upgraded: Wall Street's top analyst calls

Description: Astera initiated, Nasdaq upgraded: Wall Street's top analyst calls

Here Are Thursday’s Top Wall Street Analyst Research Calls: AON, Apollo Global, Bullish, Jack Henry, Marsh & McClennan, Nasdaq, NVIDIA, and More

Description: Pre-Market Stock Futures: The futures are trading higher after NVIDIA Inc. (NASDAQ: NVDA) blew out its fiscal third-quarter results and offered strong forward guidance, though perhaps not as robust as Wall Street had hoped. Shares were up over 5% after the company reported earnings per share of $1.30, above estimates of $1.25, and revenue of ... Here Are Thursday’s Top Wall Street Analyst Research Calls: AON, Apollo Global, Bullish, Jack Henry, Marsh & McClennan, Nasdaq, NVIDIA, and More

2025-11-19

Partnership Between NH Based Energy Solutions Developer Granite Source Power & Great Bay Renewables to Tackle Grid and Energy Needs

Description: Granite Source Power ("GSP") and Great Bay Renewables ("Great Bay") are pleased to announce a new strategic partnership focused on tackling the rapidly growing demand for reliable energy and the evolving needs of the power grid. Together, the companies aim to accelerate the development of battery storage and energy generation projects across key U.S. markets.

JPMorgan’s Super-Sized Checks Are Blowing Away All Other Lenders

Description: Time and again, the firm has overwhelmed private credit managers and Wall Street rivals with substantial financing packages to win coveted debt deals. Then it stepped up $17.5 billion to help Warner Bros. Discovery Inc. split itself in two. After Silver Lake Management’s Egon Durban called JPMorgan Chief Executive Officer Jamie Dimon, seeking assurance his bank had the conviction to commit the necessary funds, it took just 11 days to iron out the deal.

Apollo Global Management (APO): Is the Current Valuation Justified After Recent Share Price Volatility?

Description: Apollo Global Management (APO) shares have caught investor attention following recent trading activity. With the stock showing mixed returns over the past month and year, those watching the financial sector may be considering what is ahead from a valuation standpoint. See our latest analysis for Apollo Global Management. Although Apollo Global Management's share price has seen some turbulence, with a 7-day slide followed by a modest rebound this month, the bigger story lies in its long-term...

2025-11-18

2025-11-17

Apollo vs. KKR & Co.: Which Asset Manager Offers Better Upside Now?

Description: Does APO's diversified growth, rising AUM and recent deals help it stand out over KKR as the asset manager offering greater upside? Let us find out.

2025-11-16

2025-11-15

2025-11-14

Major sportsbook operator files for Chapter 11 bankruptcy

Description: Casino bankruptcy filings on the Las Vegas Strip are extremely rare, with the last prominent one occurring over 10 years ago, when Caesars Entertainment, then-owned by Apollo Global Management and TPG Capital, filed for Chapter 11 to eliminate about $16 billion in debt in January 2015. Smaller ...

Can Goldman's Expansion in Private Equity Credit Drive Growth?

Description: GS ramps up private equity and credit with acquisitions, global expansion and boosted alternatives fundraising goals.

Apollo to Host Retirement Services Business Update on November 24, 2025

Description: NEW YORK, Nov. 14, 2025 (GLOBE NEWSWIRE) -- Apollo (NYSE:APO) today announced that it will host a Retirement Services Business Update for the investment community, which will provide information and business insights relating to Athene Holding Ltd. ("Athene"). The event will take place Monday, November 24, 2025, and will include a presentation by members of the Apollo and Athene senior management teams. The event will begin at 1:00pm ET, followed by a Q&A session. A live webcast of the event wil

2025-11-13

Kraken boss Arjun Sethi says company won't 'race to the door' to get an IPO done

Description: Crypto firms have flocked to this year’s IPO market, but major US exchange Kraken is in no rush to join.

KKR vs. Apollo: Medallia Loan Split Blows Open the Widest Valuation Gap Yet

Description: A single software loan is exposing how fragile private credit valuations could be when performance pressure kicks in.

N2Growth Announces Annual Leaders40 Top CHRO Award, Recognizing Excellence in Human Resources Leadership

Description: Philadelphia, Pennsylvania--(Newsfile Corp. - November 13, 2025) - N2Growth, a global leader in executive search and leadership advisory, today announced the 2025 Leaders40 Top Chief Human Resources Officers (CHRO) Award. This year's list includes leading CHROs at some of the world's largest and most influential companies, such as Lisa Buckingham (Vialto Partners), Matthew Breitfelder (Apollo Global Management), Robin Leopold (JPMorganChase), Christy Pambianchi (Caterpillar Inc.), Trisha Conley.

Big Tech’s Climate Strategists Feeling Strain of AI Power Needs

Description: On the tech giant’s 500-acre campus in Redmond, Washington, teams began holding regular “triage” meetings to confront serious questions posed by the artificial intelligence boom: Where would the company find the gigawatts — just one gigawatt can power nearly 750,000 US homes — needed for data centers? The AI discussions were “interesting and terrifying all at the same time,” said Brian Janous, who served until August 2023 as Microsoft’s vice president of energy.

2025-11-12

King US Bidco, Inc. Announces the Pricing of Its €750,000,000 Floating Rate Senior Secured Notes Due 2032

Description: WILMINGTON, Del., Nov. 12, 2025 (GLOBE NEWSWIRE) -- King US Bidco, Inc. (the “Issuer”), a Delaware corporation, that will be indirectly owned by investment funds managed by Apollo Global Management, Inc. and its subsidiaries and investment funds managed and/or advised by Triton Investments Advisers LLP and/or its affiliates, announced today it has successfully priced €750,000,000 in aggregate principal amount of Floating Rate Senior Secured Notes due 2032 (the “Notes”) at an issue price of 100.0

KKR, Apollo Back Blockchain Infrastructure Platform Corastone

Description: The digital infrastructure platform helps connect wealth and asset managers and processes transactions, but does not distribute investment products.

Private Credit Will Keep Growing, Apollo's Grewal Says

Description: Akila Grewal, Apollo Global Management partner and global head of product, says private credit is an enduring asset category and will continue to grow. Speaking with Dani Burger and Matt Miller on "Bloomberg Open Interest," Grewal says she is focusing on long-duration assets and also discusses the firm's approach to sports investing.

Does Apollo Global Management’s Recent Price Recovery Signal a New Opportunity in 2025?

Description: Wondering if Apollo Global Management is fairly priced, undervalued or already had its best days? You're not alone, and it's a question that savvy investors keep asking as the market shifts. Despite a bumpy year with shares down 17.8% over the past 12 months, Apollo's price has rebounded 12.4% in the last month and gained 1.8% just this week. This hints at renewed optimism or shifting risk perceptions. Recent headlines have spotlighted Apollo's ambitious moves in alternative asset...

Morgan Stanley integrates KKR-backed Corastone platform

Description: This platform will digitise investor onboarding and automate validation steps that previously relied on manual paperwork.

Papa John's Falls After Takeover Talk Fizzles Out

Description: Papa John's Falls After Takeover Talk Fizzles Out

2025-11-11

Market Chatter: Morgan Stanley Adds KKR-Backed Corastone for Streamlined Alternative Asset Transactions

Description: Morgan Stanley (MS) has added Corastone, a blockchain-based wealth technology platform backed by KKR

Apollo Global Management Inc.(APO) Earns Price Target Boost After Strong Q3 and Upbeat Outlook

Description: Apollo Global Management Inc. (NYSE:APO) is one of the top undervalued asset management stocks to buy. On November 5, Keefe, Bruyette & Woods bumped up its price target for Apollo Global Management (NYSE:APO) from $162 to $173, keeping its Outperform rating. The move came after Apollo’s latest earnings report, which showed adjusted net income per […]

Papa John’s Stock Surged on False Takeover Report. Shares Are Falling Today.

Description: Papa John’s International stock jumped as much as 15% and was halted on Monday after a now-deleted report of a potential takeover by TriArtisan Capital Advisors was published online. It appeared on ABC Money, a U.K.-based website that isn’t associated with ABC News, the news division of American Broadcasting Company owned by The Walt Disney Company. Barron’s reached out to Papa John’s and TriArtisan Capital Advisors on Monday to comment on the acquisition rumor, and didn’t get a response before publication.

2025-11-10

Apollo Buys Majority Stake in Soccer Club Atlético de Madrid

Description: The deal values the team at the equivalent of about $2.5 billion, and comes as U.S. investors have been pouring money into European soccer.

Atlético de Madrid to Welcome Apollo Sports Capital as Majority Shareholder

Description: The Club and leading global sports investor form long-term partnership to support continued growth under CEO Miguel Ángel Gil and President Enrique Cerezo From left to right: Miguel Ángel Gil, Enrique Cerezo, Robert Givone MADRID and NEW YORK, Nov. 10, 2025 (GLOBE NEWSWIRE) -- Atlético de Madrid and its major shareholders – Miguel Ángel Gil, Enrique Cerezo, Quantum Pacific Group and Ares Management funds – have reached an agreement for Apollo Sports Capital (‘ASC’), the global sports investment

2025-11-09

Valuation worries, record-long government shutdown hang over markets: What to watch this week

Description: Skepticism around sky-high tech valuations and a continued dearth of economic data set up the week for investors.

2025-11-08

2025-11-07

Does Record AUM and Earnings Beat Change the Bull Case for Apollo Global (APO)?

Description: Apollo Global Management reported strong third quarter results, with year-over-year growth in revenue and earnings per share that exceeded analyst forecasts, and announced record assets under management alongside continued business expansion. These results were accompanied by new investments in renewable energy and data centers, partnership announcements in industrial infrastructure, and updates on shareholder return programs, reflecting the company's multi-pronged approach to growth and...

Papa Johns CEO is ‘open-minded’ to acquisition, but turnaround strategy remains priority

Description: CEO Todd Penegor indirectly addressed rumors of a company sale amid speculation that Apollo Global withdrew its takeover bid

2025-11-06

Why One Economist Calls This the ‘Stupidest Chart in the World’

Description: A popular chart online compares the S&P 500’s big gain since the launch of ChatGPT to the decline in job openings.

Why breakups are in vogue for restaurant chains and Big Food

Description: Big Food and major restaurant chains are calling it quits on decades-old relationships.

Apollo Global Management (APO) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: Although the revenue and EPS for Apollo Global Management (APO) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Aeromexico shares edge higher in NYSE debut

Description: Investing.com -- Shares of Grupo Aeromexico rose 0.84% in their New York Stock Exchange debut on Thursday, valuing Mexico’s largest airline at nearly $2.8 billion.

Life insurer Brighthouse agrees to $4.1bn takeover by Aquarian

Description: Private capital group Aquarian Holdings has struck a deal to take private one of the largest remaining independent US life insurers for $4.1bn...

Citigroup's Bold Push Into Private Markets: A Long-Term Growth Driver?

Description: C is accelerating its push into private markets through major partnerships with BlackRock, Carlyle and Apollo to drive diversified growth.

Schwab notches a $660 million deal agreement with private asset firm Forge Global Holdings

Description: Charles Schwab said Thursday that it's buying publicly traded investing platform Forge Global Holdings, which acts as a marketplace for pre-IPO companies, for $660 million.

Papa John’s Touts Turnaround Plan but Stays 'Open-Minded'

Description: Papa John’s chief executive said the pizza chain has a turnaround strategy, but its board remains “open-minded” and will consider alternatives. “To the extent there is an alternative to our strategy that is available and maximizes shareholder value, we would fully consider it,” Chief Executive Todd Penegor said Thursday. Media reports this year have pointed to Papa John’s as a takeout target.

Aeva Technologies Inc (AEVA) Q3 2025 Earnings Call Highlights: Strategic Partnerships and New ...

Description: Aeva Technologies Inc (AEVA) advances with key OEM collaborations and secures significant investment, despite facing revenue challenges.

2025-11-05

Apollo Prices Offering of Senior Notes

Description: NEW YORK, Nov. 05, 2025 (GLOBE NEWSWIRE) -- Apollo Global Management, Inc. (NYSE: APO) (the “Issuer” and, together with its consolidated subsidiaries, “Apollo”) today announced that it has priced an offering (the “Offering”) of $400 million aggregate principal amount of its 4.600% Senior Notes due 2031 (the “2031 notes”) and an additional $350 million aggregate principal amount of its 5.150% Senior Notes due 2035 (the “new 2035 notes” and, together with the 2031 notes, the “notes”). The notes wi

Why Apollo Global Is Soaring This Week

Description: The investment manager had a strong third quarter.

Aeva Reports Third Quarter 2025 Results

Description: MOUNTAIN VIEW, Calif., November 05, 2025--Aeva® (Nasdaq: AEVA), a leader in next-generation sensing and perception systems, today announced its third quarter 2025 results.

Papa John's earnings, reportedly withdrawn Apollo bid: What to know

Description: Papa John's (PZZA) stock is in focus after Reuters reported that Apollo Global Management (APO) has withdrawn its bid to purchase the pizza chain, creating a challenging background for Papa John's to report quarterly results on Thursday. Yahoo Finance Senior Reporter Brooke DiPalma, Yahoo Finance Senior Business Reporter Ines Ferré, and FedWatch Advisors founder and chief investment officer Ben Emons join Opening Bid host Brian Sozzi to discuss Wall Street's expectations for the earnings print and what Papa John's ongoing struggles indicate about the state of the consumer. To watch more expert insights and analysis on the latest market action, check out more Opening Bid. Editor's note: Apollo Global Management is the parent company of Yahoo Finance.

Papa John's Crashes 21% After Apollo Walks--And Yum Wants Out of Pizza Hut Too

Description: Apollo pulls $64-a-share bid; Yum launches Pizza Hut sale in signal of sector-wide shake-up.

Apollo's Jim Zelter Says Not Seeing Credit Cycle Waning Anytime Soon

Description: Apollo Global Management President Jim Zelter discusses the state of the credit market and money being invested in AI data centers.

Apollo retracts takeover proposal for Papa John’s

Description: The company reportedly abandoned the bid amid signs of weakening consumer spending and early strains in the QSR sector.

Apollo Global reports Q3 adjusted EPS $2.17, consensus $1.90

Description: Reports Q3 revenue $1.15B, consensus $1.1B. Marc Rowan, CEO, said, “Our outstanding Q3 results reflect broad based momentum across the business. In a world of re-industrialization, aging populations, and investors seeking greater access to private markets, we are delivering with leading origination, new product solutions and distribution, and excess return for our clients. We are uniquely built to capitalize on these structural trends and our global team is making significant early progress exec

Apollo Global Management (APO): Evaluating Valuation as Analyst Upgrades, Insider Sales, and Portfolio Shifts Drive Investor Focus

Description: Apollo Global Management (APO) is in the spotlight as a wave of corporate activity and analyst commentary shapes market sentiment. Following recent dividend announcements, share buybacks, and shifting portfolio moves, investors are watching APO’s next steps with keen interest. See our latest analysis for Apollo Global Management. Amid headlines about Apollo's latest dividend payout, buyback milestone, and big-ticket transactions like its stake in the Hornsea 3 wind project, the stock has...

2025-11-04

Private-Credit Earnings Ease Investor Concern Over Asset Class’s Health

Description: Shares of Apollo Global Management rose around 5% on Tuesday after the private-markets giant reported better-than-expected third-quarter earnings. A day earlier, another firm, Ares Management also reported earnings that beat Wall Street expectations, sending its shares up more than 4% that day. The market reaction suggested that investor concern had diminished in the nearly two weeks since Blackstone reported earnings and private-credit fears weighed on its shares.

Apollo Asset Management, Inc. (APO) Q3 2025 Earnings Call Highlights: Record Earnings and ...

Description: Apollo Asset Management, Inc. (APO) reports a 17% increase in adjusted net income, driven by robust inflows and strategic partnerships, despite facing industry challenges.

Sector Update: Consumer Stocks Mixed in Late Afternoon Trading

Description: Consumer stocks were mixed late Tuesday afternoon, with the Consumer Staples Select Sector SPDR Fund

Apple reportedly eyes a budget laptop, Denny's to go private

Description: Some of the stories Wall Street is watching on Tuesday, Nov. 4, include: Apple (AAPL) is preparing to launch a low-cost Mac laptop next year, according to a report from Bloomberg. Papa John's (PZZA) shares are falling following a Reuters report that Apollo Global has pulled its offer to take the pizza chain private. Shares of Denny's (DENN) are soaring after agreeing to go private. To watch more expert insights and analysis on the latest market action, check out more Market Domination. Editor's note: Apollo Global Management is the parent company of Yahoo Finance.

Sector Update: Financial Stocks Advance Late Afternoon

Description: Financial stocks rose in late Tuesday afternoon trading with the NYSE Financial Index gaining 0.3% a

Apollo Invests $75 Billion in Quarter As Firm Continues to Grow Deal Capacity

Description: The New York credit investor is on track to meet a $275 billion annual goal for new investments this year.

Papa John’s Drops After Report Says Deal Is Shelved

Description: Papa John’s International’s shares tumbled about 10% after a report that a private-equity firm backed off a potential deal to acquire the pizza brand. Apollo Global Management recently had bid to take Papa John’s private but withdrew that offer about a week ago, Reuters reported Wednesday. Papa John’s is due to report quarterly results Thursday.

Papa John’s Stock Tumbles on Report That Apollo Won’t Take Pizza Chain Private

Description: Private-equity firm Apollo reportedly has backtracked on its bid because of concerns of weaker consumer spending on fast food, Reuters reported.

Apollo’s Rowan Targets Retail-Focused Firms to Back Private Asset Growth

Description: “This will allow our industry to reach clients we would never on our own reach and who want exposure to private assets, but will not get exposure to private assets directly,” Apollo CEO Marc Rowan told analysts.

Papa John’s shares plunge after Apollo reportedly withdraws takeover bid

Description: Investing.com -- Papa John’s shares are trading nearly 18% lower midday on Tuesday following a Reuters report that Apollo Global withdrew its $64 per share bid to take the pizza chain private.

Papa John’s Sinks Most Since 2020 on Report Apollo Pulled Bid

Description: Apollo Global withdrew its offer to take pizza chain Papa John’s private at $64 a share about a week ago, Reuters reported, citing people familiar with the deal. Papa John’s, which is scheduled to report third-quarter earnings on Thursday, didn’t immediately respond to a request for comment. Analysts polled by Bloomberg expect adjusted earnings to fall 5.2% from a year earlier.

Sector Update: Financial Stocks Rise Tuesday Afternoon

Description: Financial stocks were advancing in Tuesday afternoon trading, with the NYSE Financial Index up 0.1%

Apollo Global Q3 Earnings Beat Estimates, AUM Increase Y/Y

Description: APO's Q3 earnings and revenues top estimates as rising AUM and the Bridge acquisition fuel strong growth despite higher expenses.

Apollo Just Dropped $6.5 Billion on This UK Megaproject--Here's Why It Matters Now

Description: Orsted's flagship wind farm gets a lifeline as Apollo deepens its bet on Europe's energy future

WestCX Launches Engage: Real-Time AI That Speaks, Listens, and Learns Across Every Patient Interaction

Description: New Engage, LinguaAI, and Journey Insights solutions bring multilingual, measurable, and human-like communication to healthcare organizationsOMAHA, Neb., Nov. 04, 2025 (GLOBE NEWSWIRE) -- WestCX, part of West Technology Group, today announced the launch of Engage, the next generation of its AI-native engagement platform. The launch unites Engage, LinguaAI, and Journey Insights into a single ecosystem that enables healthcare organizations to deliver intelligent, multilingual, and measurable patie

Exchange-Traded Funds, Equity Futures Lower Pre-Bell Tuesday Amid Tech Rally Doubts

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down nearly 1% and the active

Apollo Reports Third Quarter 2025 Results

Description: NEW YORK, Nov. 04, 2025 (GLOBE NEWSWIRE) -- Apollo Global Management, Inc. (NYSE: APO) (together with its consolidated subsidiaries, “Apollo”) today reported results for the third quarter ended September 30, 2025. Marc Rowan, Chairman and Chief Executive Officer at Apollo said, “Our outstanding third quarter results reflect broad based momentum across the business. In a world of re-industrialization, aging populations, and investors seeking greater access to private markets, we are delivering wi

Ørsted sells 50% stake in Hornsea 3 offshore wind farm for $6.5bn

Description: Hornsea 3 is being constructed within Ørsted’s Hornsea zone, alongside the Hornsea 1 and 2 projects.

McDonald’s Earnings, Tariff Update, Musk Pay Vote: What to Watch This Week

Description: All eyes are on the government shutdown, which is nearing the longest on record. Meanwhile, investors will dig into earnings from McDonald’s, AMD and others. On Thursday, Tesla is due to publish the outcome of its shareholder vote on CEO Elon Musk’s pay package.

Ørsted Sells 50% of Hornsea 3 Offshore Wind Project to Apollo for $5.6 Billion

Description: Ørsted has agreed to sell a 50% stake in its 2.9 GW Hornsea 3 offshore wind farm to Apollo-managed funds for approximately DKK 39 billion ($5.6 billion).

2025-11-03

Apollo Funds Commit $6.5 Billion to Ørsted’s Hornsea 3 in the UK

Description: Apollo Infrastructure to Become 50-50 Joint Venture Partner in World’s Largest Offshore Wind Farm ProjectNEW YORK , Nov. 03, 2025 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that Apollo-managed funds have agreed to invest $6.5 billion in a 50% stake in Ørsted’s Hornsea 3. The $6.5 billion investment includes the acquisition price for a 50% interest in the joint venture holding Hornsea 3, the world’s largest offshore wind project, and a commitment to fund 50% of the project’s remaining

Trace3 Enters New Era of Growth, Innovation With Completion of Acquisition by Apollo Funds From American Securities

Description: IRVINE, Calif., November 03, 2025--Trace3 announced its completed acquisition by Apollo Funds, with Joe Quaglia succeeding Rich Fennessy as the company’s new CEO.

Apollo Funds Complete Acquisition of Stream Data Centers

Description: SDC Positioned to Accelerate Development Across Multi-Gigawatt Hyperscale Pipeline with Apollo Funds’ Capital and Strategic SupportNEW YORK, Nov. 03, 2025 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that Apollo-managed funds (the “Apollo Funds”) have completed the previously announced acquisition of a majority interest in Stream Data Centers (“SDC” or the “Company”), a leading developer and operator of hyperscale data center campuses across the United States. As part of the transactio

Apollo Global Management (APO) Eyeing $1.5B on Heritage Grocers Group Divestment