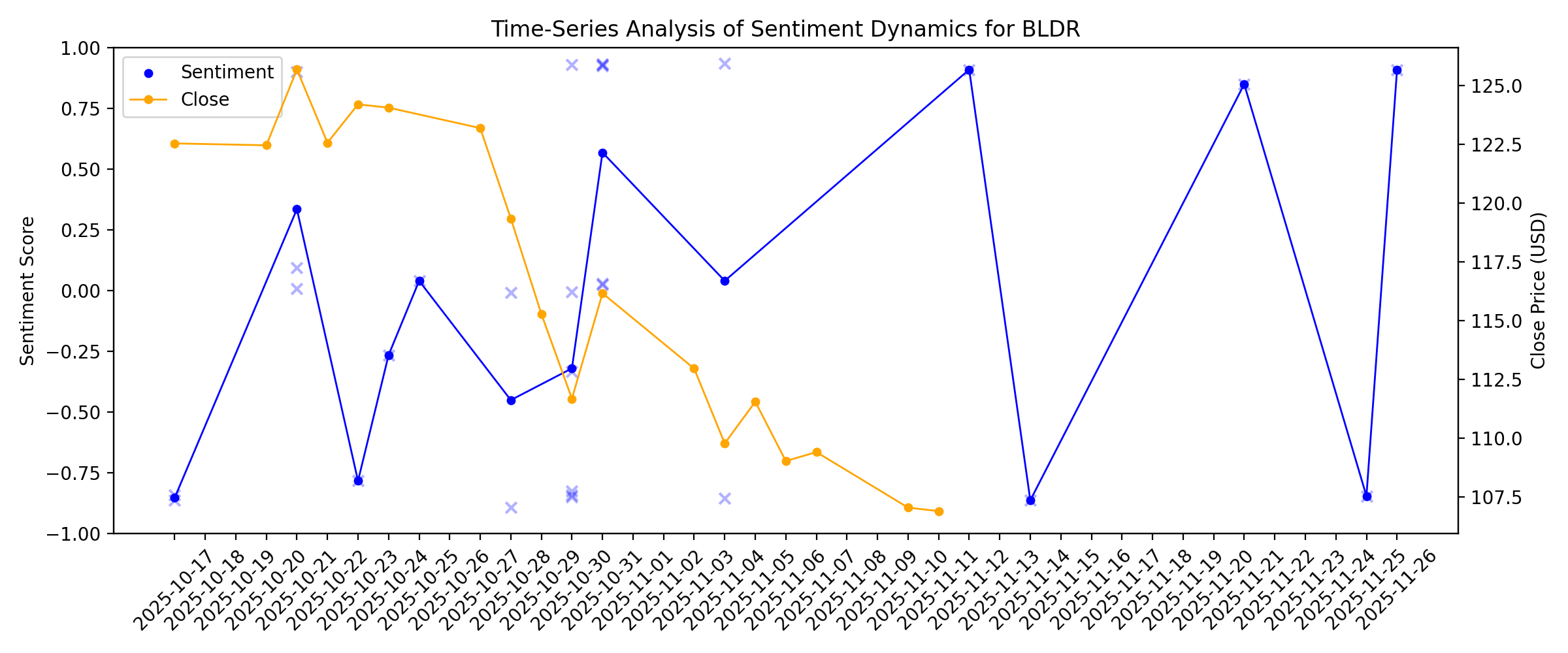

News sentiment analysis for BLDR

Sentiment chart

2026-01-14

Builders FirstSource (BLDR) Gains As Market Dips: What You Should Know

Description: In the latest trading session, Builders FirstSource (BLDR) closed at $126.38, marking a +1.22% move from the previous day.

2026-01-13

Should You Be Optimistic About Builders FirstSource (BLDR)?

Description: Heartland Advisors, an investment management company, released its “Heartland Value Plus Fund” fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the fourth quarter, the market’s gains continued to widen, as small value stocks outpaced the Magnificent 7, and the artificial intelligence (AI) trade pulled back in November amid concerns […]

2026-01-12

Builders FirstSource (BLDR) Surges 12.0%: Is This an Indication of Further Gains?

Description: Builders FirstSource (BLDR) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

Investors Heavily Search Builders FirstSource, Inc. (BLDR): Here is What You Need to Know

Description: Builders FirstSource (BLDR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Builders FirstSource (BLDR) Is Up 15.0% After US Mortgage-Bond Plan Boosts Housing Sentiment

Description: In early January 2026, Builders FirstSource drew attention after a White House plan for a US$200 billion mortgage-bond purchase and stronger housing starts data improved sentiment toward housing-related businesses. An institutional investor’s focus on Builders FirstSource’s free cash flow, acquisitions, and sizeable share repurchases underscored how its capital allocation approach is central to its appeal. We’ll now explore how the government’s mortgage-bond buying initiative could influence...

2026-01-11

US futures slip while Asian shares gain as Fed chair Powell faces legal threat

Description: U.S. futures slipped but markets in Asia advanced Monday after Federal Reserve Chair Jerome Powell said the Department of Justice had served the central bank with subpoenas. The threat of a criminal indictment over Powell’s testimony about the Fed’s building renovations is the latest escalation in President Donald Trump’s feud with the Fed. Trump has criticized the Fed’s $2.5 billion renovation of two office buildings as excessive. The future for the Nasdaq composite index slipped 0.8%.

2026-01-10

2026-01-09

S&P 500, Dow Rally to New Peaks After Jobs Report; Wall Street Posts Weekly Gains

Description: The S&P 500 and the Dow Jones Industrial Average reached new all-time highs on Friday following a ke

S&P 500 Climbs in First Full Week of 2026, Hits New Highs

Description: The Standard & Poor's 500 index rose 1.6% this week to a fresh closing high in a broad climb led by

Equities Rise Intraday as Markets Weigh Jobs, Other Macro Data

Description: US benchmark equity indexes were higher intraday as traders parsed latest economic data, including a

Do You Have a Positive Outlook on Builder First Source (BLDR)?

Description: Tapasya Fund, an investment management company, released its fourth quarter 2025 investor letter. A copy of the letter can be downloaded here. The firm celebrated its third anniversary in August 2025 and is happy with the fund’s performance. In 2025, the fund performed well and achieved strong absolute returns, outpacing the S&P 500 and several […]

2026-01-08

2026-01-07

Dow, S&P 500 Fall From Records as Traders Assess Trump's Move to Ban Institutional Home Buying

Description: The Dow Jones Industrial Average and the S&P 500 fell from their record highs as traders assessed Pr

Real Estate, Defense Stocks Fall as Trump Targets Institutional Home Buying, Defense Companies' Dividends

Description: Real estate and defense stocks fell after President Donald Trump said he would ban institutional inv

A Look At Builders FirstSource (BLDR) Valuation After Recent Share Price Moves

Description: Builders FirstSource (BLDR) has drawn investor interest after recent trading left the shares at a last close of $111.26, with mixed return patterns across the past week, month, past 3 months and year. See our latest analysis for Builders FirstSource. The recent 1-day share price return of 2.60% and 7-day share price return of 7.82% at a share price of $111.26 sit against a year-to-date share price return of 6.34%. The 1-year total shareholder return of a 22.37% decline contrasts with the...

2026-01-06

Builders FirstSource (BLDR) Rises Higher Than Market: Key Facts

Description: Builders FirstSource (BLDR) reached $111.26 at the closing of the latest trading day, reflecting a +2.6% change compared to its last close.

2026-01-05

Why Is Builders FirstSource (BLDR) Stock Soaring Today

Description: Shares of building materials company Builders FirstSource (NYSE:BLDR) jumped 5.4% in the morning session after the company received positive attention from Wall Street analysts.

2026-01-04

2026-01-03

2026-01-02

Builders FirstSource (BLDR) Beats Stock Market Upswing: What Investors Need to Know

Description: In the closing of the recent trading day, Builders FirstSource (BLDR) stood at $104.63, denoting a +1.69% move from the preceding trading day.

2026-01-01

2025-12-31

Builders FirstSource Insiders Placed Bullish Bets Worth US$56.3m

Description: Quite a few insiders have dramatically grown their holdings in Builders FirstSource, Inc. ( NYSE:BLDR ) over the past...

2025-12-30

Builders FirstSource, Inc. (BLDR) is Attracting Investor Attention: Here is What You Should Know

Description: Builders FirstSource (BLDR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Builders FirstSource, Inc. (BLDR) Is a Trending Stock: Facts to Know Before Betting on It

Description: Builders FirstSource (BLDR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-18

2025-12-17

Jim Cramer Prefers Home Depot Over Builders FirstSource (BLDR)

Description: Builders FirstSource, Inc. (NYSE:BLDR) is one of the stocks that Jim Cramer shared his take on. A caller asked if the stock could be positioned for significant growth, and in response, Cramer said: “I was a huge believer in Builders FirstSource. This is proving to be such a hard market that I had to default and switch […]

Builders FirstSource (BLDR): Assessing Valuation After a Sharp Share Price Pullback

Description: Builders FirstSource (BLDR) has quietly slid over the past year, with the stock down more than 35% even as its three year total return still looks strong. That disconnect sets up an interesting valuation debate. See our latest analysis for Builders FirstSource. Over the past year, selling pressure has clearly outweighed buying interest, with a steep year to date share price decline, even as the three year total shareholder return remains firmly positive. This suggests momentum has faded but...

2025-12-16

Is Builders FirstSource Attractively Priced After Recent Share Price Pullback in 2025?

Description: If you have been wondering whether Builders FirstSource is quietly turning into a bargain or a value trap, you are not alone. This is exactly the kind of setup where a closer look at valuation can really pay off. The stock is down 1.7% over the last week, 0.3% over the past month, and 27.3% year to date, but that pullback comes after gains of 58.0% over 3 years and 151.4% over 5 years. Those swings line up with shifting expectations around US housing demand and construction activity, as...

Stocks making big moves yesterday: Red Robin, Ingram Micro, Freshworks, Builders FirstSource, and Taboola

Description: Check out the companies making headlines yesterday:

2025-12-15

Builders FirstSource (BLDR) Stock Trades Down, Here Is Why

Description: Shares of building materials company Builders FirstSource (NYSE:BLDR) fell 3.8% in the afternoon session after Jefferies downgraded the stock to 'Hold' from 'Buy' and lowered its price target. The analyst firm significantly reduced its price target on the shares to $110 from $138. The downgrade reflected a more cautious view of the stock's future performance.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Is Builders FirstSource Stock Underperforming the S&P 500?

Description: Builders FirstSource has significantly underperformed the S&P 500 over the past year, but analysts remain moderately optimistic about the stock’s prospects.

2025-12-10

Does Berkshire's Building Products Arm Aid Its Manufacturing Business?

Description: BRK.B's building-products arm drives up to 45% of manufacturing earnings, adding strength through cyclical shifts.

2025-12-09

2025-12-08

Investors Heavily Search Builders FirstSource, Inc. (BLDR): Here is What You Need to Know

Description: Builders FirstSource (BLDR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-12-07

2025-12-06

Did Builders FirstSource, Inc. (NYSE:BLDR) Use Debt To Deliver Its ROE Of 14%?

Description: Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is...

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Stock Index Futures Gain on Fed Rate-Cut Optimism, U.S. Economic Data on Tap

Description: December S&P 500 E-Mini futures (ESZ25) are up +0.34%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.42% this morning, buoyed by rising expectations for a Federal Reserve rate cut next month, while investors await a new round of U.S. economic data.

2025-11-25

Here is What to Know Beyond Why Builders FirstSource, Inc. (BLDR) is a Trending Stock

Description: Builders FirstSource (BLDR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Builders FirstSource (BLDR): New Analyst Coverage Prompts Fresh Look at Valuation

Description: Builders FirstSource (BLDR) has just come under fresh analyst coverage from Wells Fargo, which could lift investor interest and trading activity for the stock. The new guidance provides a useful reference point for market watchers. See our latest analysis for Builders FirstSource. Builders FirstSource’s share price has had quite a ride recently, rebounding 7.1% in a day after a tough stretch that saw a 17.1% drop over the past month and a 28.4% slide year-to-date. Despite the short-term...

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Is Trending Stock Builders FirstSource, Inc. (BLDR) a Buy Now?

Description: Zacks.com users have recently been watching Builders FirstSource (BLDR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2025-11-13

2025-11-12

What Are Wall Street Analysts' Target Price for Builders FirstSource Stock?

Description: Builders FirstSource has continued to underperform the broader market over the past year, yet analysts remain optimistic on the stock’s prospects, with price targets suggesting significant upside potential.

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

Is Builders FirstSource's (BLDR) M&A Focus a Signal of Shifting Priorities in Capital Allocation?

Description: In the past week, Builders FirstSource reported third-quarter 2025 earnings with sales of US$3.94 billion and net income of US$122.38 million, surpassing analyst forecasts despite weaker year-over-year results and highlighting continued investment in digital tools and value-added acquisitions. A key insight is that management maintained a steady outlook for full-year 2025 sales and reinforced a commitment to disciplined capital deployment, including a pause in share repurchases and a focus...

Are Options Traders Betting on a Big Move in Builders FirstSource Stock?

Description: Investors need to pay close attention to BLDR stock based on the movements in the options market lately.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Champion Homes (SKY) Stock Is Up, What You Need To Know

Description: Shares of modular home and building manufacturer Champion Homes (NYSE:SKY) jumped 4.9% in the afternoon session after the homebuilding sector saw positive momentum, partly due to a favorable analyst action for a peer company. Benchmark analyst Reuben Garner maintained a 'Buy' rating on Builders FirstSource (BLDR) and increased its price target, signaling a positive outlook on companies within the building supply industry. Broader housing market trends also provided a supportive backdrop. The Fed

Weyerhaeuser Q3 Earnings & Sales Top Estimates, Both Increase Y/Y

Description: WY tops Q3 earnings and sales estimates, boosted by Timberlands' strength and strategic portfolio moves.

Why Builders FirstSource (BLDR) Stock Is Trading Up Today

Description: Shares of building materials company Builders FirstSource (NYSE:BLDR) jumped 2.6% in the afternoon session after the company reported decent third-quarter results that beat analyst estimates but also revealed a significant drop in year-over-year profit.

MasTec Beats Q3 Earnings & Revenue Estimates, Books Solid Backlog

Description: MTZ posts strong Q3 earnings and revenue beats, fueled by clean energy, power delivery and record backlog growth.

Builders FirstSource (BLDR) Margin Decline Tests Bullish Growth Narratives

Description: Builders FirstSource (NYSE:BLDR) reported a net profit margin of 4.7%, a significant drop from last year’s 8.2%. After a year of negative earnings growth that trails its five-year trend of 3.7% annualized gains, the outlook now calls for a sharp turnaround with projected earnings growth of 23.7% per year, even as revenue is only expected to rise by 3.1% annually, which is well behind the wider US market’s 10.3% pace. Investors are weighing recent margin compression against strong future...

2025-10-30

Builders FirstSource Beats on Q3 Earnings Despite Housing Weakness

Description: BLDR tops Q3 estimates despite a housing slowdown, lifted by value-added sales, acquisitions and free cash flow strength.

Builders FirstSource (NYSE:BLDR) Beats Q3 Sales Expectations

Description: Building materials company Builders FirstSource (NYSE:BLDR) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales fell by 6.9% year on year to $3.94 billion. The company expects the full year’s revenue to be around $15.25 billion, close to analysts’ estimates. Its non-GAAP profit of $1.88 per share was 8.8% above analysts’ consensus estimates.

Builders FirstSource (BLDR) Surpasses Q3 Earnings and Revenue Estimates

Description: Builders FirstSource (BLDR) delivered earnings and revenue surprises of +11.24% and +3.76%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

What Developments Are Shaping the Evolving Story for Builders FirstSource?

Description: Builders FirstSource has recently seen its consensus analyst price target slip slightly from $140.32 to $139.02. This reflects growing caution among market watchers. This adjustment comes as experts weigh the company's prospects in light of both proactive management moves and ongoing uncertainties. Stay tuned to discover how you can keep informed about evolving perspectives on Builders FirstSource as the narrative continues to shift. Stay updated as the Fair Value for Builders FirstSource...

Builders FirstSource: Q3 Earnings Snapshot

Description: IRVING, Texas (AP) — Builders FirstSource Inc. BLDR) on Thursday reported third-quarter earnings of $122.4 million. The Irving, Texas-based company said it had net income of $1.10 per share.

Builders FirstSource Reports Third Quarter 2025 Results

Description: IRVING, Texas, October 30, 2025--Builders FirstSource, Inc. (NYSE: BLDR) today reported its results for the third quarter ended September 30, 2025.

2025-10-29

2025-10-28

Builders FirstSource Earnings: What To Look For From BLDR

Description: Building materials company Builders FirstSource (NYSE:BLDR) will be reporting results this Thursday before market open. Here’s what to expect.

Builders FirstSource Set to Report Q3 Earnings: What's in Store?

Description: BLDR's third-quarter results may reflect housing market headwinds, with lower earnings and sales expected from last year.

2025-10-27

2025-10-26

2025-10-25

Assessing Builders FirstSource (BLDR) Valuation After Recent Share Price Movements

Description: Builders FirstSource (BLDR) stock has caught the eye of investors recently, with share performance showing mixed results over the past month and three months. The company’s valuation and future prospects remain a point of discussion for the market. See our latest analysis for Builders FirstSource. Despite some short-term swings, Builders FirstSource’s share price remains well below this year’s starting level, reflecting a broader pullback in building products stocks. However, if you look at a...

2025-10-24

1 Safe-and-Steady Stock on Our Buy List and 2 We Find Risky

Description: A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance. Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

2025-10-23

Earnings Preview: Builders FirstSource (BLDR) Q3 Earnings Expected to Decline

Description: Builders FirstSource (BLDR) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-22

2025-10-21

Builders FirstSource (BLDR) Stock Moves 2.63%: What You Should Know

Description: Builders FirstSource (BLDR) closed at $125.68 in the latest trading session, marking a +2.63% move from the prior day.

Here's What to Expect From Builders FirstSource's Next Earnings Report

Description: Builders FirstSource is expected to announce its third-quarter results next week, and analysts predict a double-digit decline in the company’s bottom-line figure.

Builders FirstSource (BLDR): Buy, Sell, or Hold Post Q2 Earnings?

Description: Even though Builders FirstSource (currently trading at $122.51 per share) has gained 7.4% over the last six months, it has lagged the S&P 500’s 30.6% return during that period. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

2025-10-20

2025-10-19

2025-10-18

2025-10-17

Jim Cramer on Builders FirstSource: “Can’t Go Up if You Don’t Have a Good Housing Market”

Description: Builders FirstSource, Inc. (NYSE:BLDR) is one of the stocks Jim Cramer recently discussed. Cramer mentioned the stock in light of housing market conditions. He commented: “Right underneath it was another driver of today’s rally, Builders FirstSource. You can rally when you have a housing market. That thing can’t go up if you don’t have a […]

Builders FirstSource, Inc. (BLDR) Is a Trending Stock: Facts to Know Before Betting on It

Description: Builders FirstSource (BLDR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.