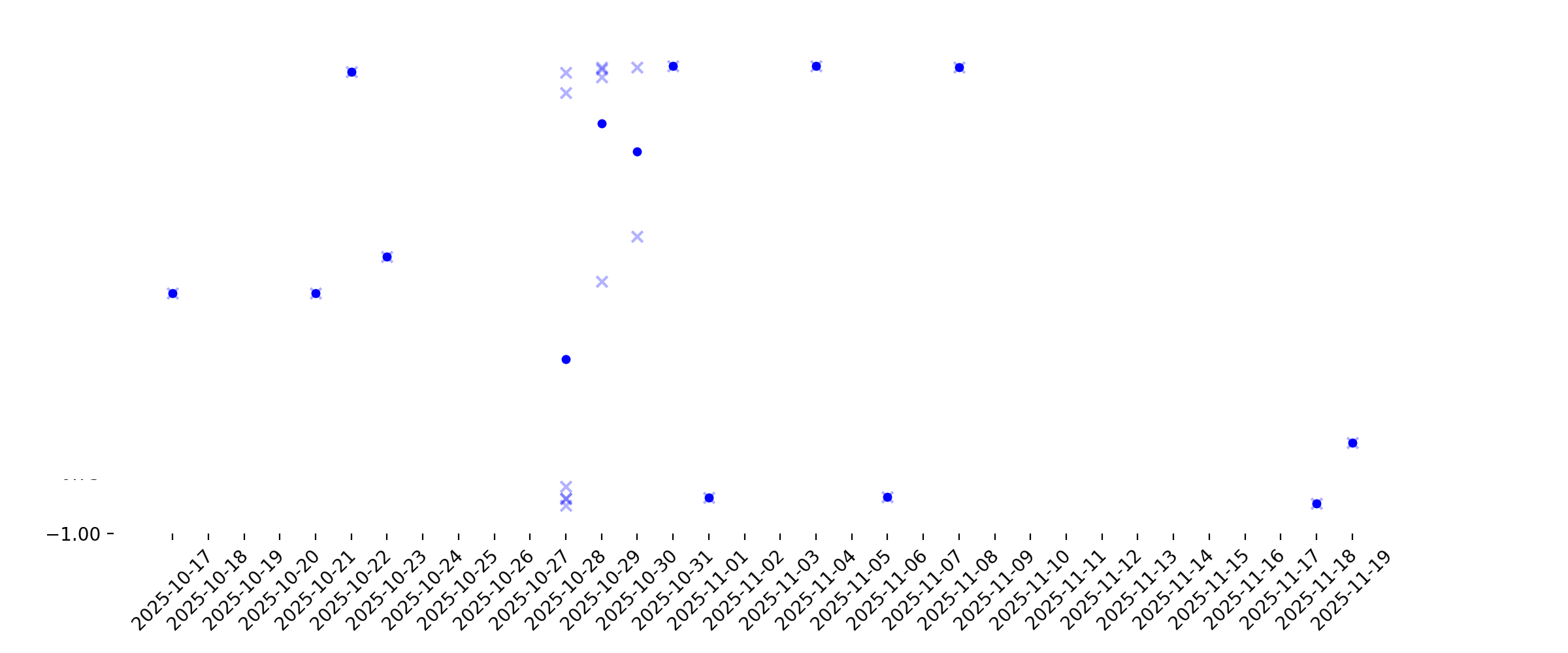

News sentiment analysis for BXP

Sentiment chart

2026-01-14

BXP Announces Strategic Dispositions Totaling More than $1.0 Billion

Description: BOSTON, January 14, 2026--BXP (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today that it has completed property sales with aggregate net proceeds of more than $1.0 billion, marking significant progress toward the 2025 through 2027 strategic asset sales plan outlined at BXP’s Investor Day in September 2025. Dispositions through year end 2025 totaled approximately $845 million, and two additional sales closed in Januar

2026-01-13

2026-01-12

2026-01-11

2026-01-10

How Investors Are Reacting To BXP (BXP) Securing Starr as Anchor Tenant at 343 Madison

Description: BXP recently secured a 20-year, roughly 275,000-square-foot lease with global investment and insurance firm Starr at its under-construction 343 Madison Avenue tower in Midtown Manhattan, giving Starr about 30% of the planned 46-story building for its future New York headquarters. This long-term anchor lease at a yet-to-be-completed, amenity-rich project underscores sustained tenant interest in high-quality Manhattan offices despite broader sector uncertainty. We’ll now explore how locking in...

2026-01-09

2026-01-08

How Does the Starr Lease at 343 Madison Shape BXP's Growth Story?

Description: BXP lands a 20-year Starr lease for 275,000 sq ft at 343 Madison, boosting cash flow visibility and validating its bet on premier Midtown offices.

2026-01-07

BXP and Starr Announce Lease Signing at BXP’s 343 Madison Avenue in Midtown Manhattan

Description: BOSTON, January 07, 2026--BXP (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today the signing of an approximately 275,000 square foot, 20-year lease with Starr, a global investment and insurance organization, at 343 Madison Avenue, a 930,000 square foot premier workplace currently under construction, with direct access to Grand Central’s Madison Concourse between 44th and 45th Street. Starr will occupy floors 16 throu

2026-01-06

BXP to Release Fourth Quarter 2025 Financial Results on January 27, 2026

Description: BOSTON, January 06, 2026--BXP, Inc. (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today that it will release financial results for the fourth quarter 2025 on Tuesday, January 27, 2026, after the close of trading on the NYSE. BXP will host a conference call and webcast on Wednesday, January 28, 2026, at 10:00 A.M. Eastern Time, to discuss the financial results and provide an update on BXP.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

REITs Should Bounce Back in 2026. 3 Stocks to Consider Buying Now.

Description: As would-be home buyers know, real estate is all about interest rates. That could set the sector up for gains.

2025-12-28

2025-12-27

2025-12-26

BXP, Inc.'s Quarterly Earnings Preview: What You Need to Know

Description: BXP, Inc. will release its fourth-quarter earnings soon, and analysts anticipate a marginal bottom-line growth.

2025-12-25

2025-12-24

Is Boston Properties (BXP) Undervalued After Its Recent Share Price Weakness?

Description: BXP (BXP) has been grinding through a weaker share price in the past 3 months, even as its annual revenue and net income growth trends look surprisingly better than what the recent chart might suggest. See our latest analysis for BXP. At around $69.22, BXP’s recent share price weakness, including a softer year to date share price return, sits in contrast to its resilient multi year total shareholder return. This suggests momentum has cooled as investors reassess office REIT risks. If BXP’s...

2025-12-23

2025-12-22

BXP Extends CEO’s Employment Agreement and Announces Outperformance Plan for Senior Leadership Team

Description: BOSTON, December 22, 2025--BXP, Inc. (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today that it amended and restated its employment agreement with Owen D. Thomas, the current Chief Executive Officer and Chairman of the Board of Directors of BXP. Mr. Thomas’ new agreement is fundamentally the same as his previous agreement, and it is intended to more closely align the term of his employment with the multi-year, strate

2025-12-21

2025-12-20

2025-12-19

2025-12-18

BXP Declares Regular Quarterly Dividend

Description: BOSTON, December 18, 2025--BXP, Inc. (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today that its Board of Directors declared a regular quarterly cash dividend of $0.70 per share of common stock for the period October 1, 2025 to December 31, 2025, payable on January 29, 2026 to shareholders of record as of the close of business on December 31, 2025.

2025-12-17

Cross Ocean Partners and Lincoln Property Company Acquire 409,000-SF Office Campus in Needham, Massachusetts

Description: NEEDHAM, Mass., December 17, 2025--Cross Ocean Partners ("Cross Ocean"), a global asset management platform focused on special situations, credit and hard asset investments, and Lincoln Property Company ("Lincoln"), a global, full-service real estate firm, today announced the acquisition of a trophy office campus in Needham, Massachusetts for $132 million.

How Is BXP, Inc.'s Stock Performance Compared to Other REIT Stocks?

Description: BXP, Inc. has underperformed the REIT industry over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

Description: Pre-Market Stock Futures: The futures are trading modestly higher on Thursday after a rollercoaster session on Wednesday, as stocks fell after the open on weak ADP data showing private-sector employment shed 32,000 jobs in November, the largest in 2-1/2 years. That didn’t last long, as bonds rallied on hopes of a rate cut next week ... Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

BXP Stock: Is Wall Street Bullish or Bearish?

Description: Are Wall Street analysts favoring REIT BXP’s stock?

2025-11-18

BXP vs. GLPI: Which Stock Should Value Investors Buy Now?

Description: BXP vs. GLPI: Which Stock Is the Better Value Option?

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

How BXP’s (BXP) Shift Toward Disciplined Acquisitions Is Reframing Its Growth Narrative

Description: In recent days, BXP, Inc. reported third-quarter 2025 earnings and full-year guidance, noting US$845.21 million in sales and a net loss of US$121.71 million for the quarter, accompanied by management's continued focus on new development projects and disciplined acquisition opportunities. Management expressed confidence in maintaining strong leasing performance despite new competition in Boston and highlighted a shift in acquisition opportunities emerging over the past six months, reflecting...

2025-11-07

2025-11-06

3 Interest Rate Sensitive Stocks to Buy Before Rates Fall Off a Cliff

Description: Investors looking to put capital to work in this difficult-to-predict market certainly have plenty to consider right now. Whether we’re talking about monetary policy (what the Federal Reserve will do with interest rates) fiscal or trade policy (largely set by congress and the White House) or other geopolitical concerns stemming from domestic or international shifts, ... 3 Interest Rate Sensitive Stocks to Buy Before Rates Fall Off a Cliff

2025-11-05

2025-11-04

Vornado's Q3 FFO & Revenues Beat Estimates, Occupancy Improves

Description: VNO posts stronger Q3 results with higher FFO, rising occupancy and robust leasing across key New York assets.

2025-11-03

2025-11-02

2025-11-01

Here's How You Can Earn $100 In Passive Income By Investing In BXP Stock

Description: BXP Inc. (NYSE:BXP) is a real estate investment trust that develops, owns, and manages premier workplaces, primarily in major U.S. cities like Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, D.C. It will report its Q4 2025 ...

2025-10-31

Cousins Properties Q3 FFO Matches Estimates, Revenues Top, '25 View Up

Description: CUZ posts steady Q3 results with strong leasing and higher revenues while boosting its 2025 FFO outlook.

2025-10-30

BXP Inc (BXP) Q3 2025 Earnings Call Highlights: Strong Leasing Activity and Strategic Asset Sales

Description: BXP Inc (BXP) surpasses FFO expectations and raises full-year guidance amid robust leasing and asset sales.

BXP (BXP): Losses Worsen at 37.1% Rate, Profitability Forecast Within Three Years Challenges Bears

Description: BXP (BXP) posted another year of losses, with its net profit margin remaining negative and annual losses growing at an average rate of 37.1% over the past five years. Still, earnings are forecast to climb at a robust 44.86% per year, and the company is projected to become profitable within the next three years. Revenue is expected to grow by 2.1% annually, trailing the wider US market’s forecast of 10.2% a year. With notable risks still in play and a balance between near-term losses and...

2025-10-29

How Recent Developments Are Shaping the BXP Investment Story

Description: BXP stock’s consensus analyst price target has inched higher, moving from $79.45 to $79.50 after the latest round of research reports. This modest increase reflects a mix of optimism around rising demand for prime office space in major cities, anchored by growth in AI-driven industries, as well as ongoing caution related to the company’s asset disposition strategy. Stay tuned to see how evolving market sentiment continues to shape the narrative for BXP in the coming months. What Wall Street...

Highwoods Properties Q3 FFO Meets Estimates, Revenues Miss

Description: HIW posts solid leasing gains and rent growth in Q3, but lower occupancy and NOI weigh on results as the 2025 outlook edges higher.

Boston Properties Q3 Revenues & FFO Beat Estimates, '25 View Raised

Description: BXP posts stronger-than-expected Q3 results on solid leasing gains, even as occupancy softens and 2025 FFO guidance edges higher.

A Look at Boston Properties (BXP) Valuation After Record Leasing and Mixed 2025 Guidance

Description: BXP (BXP) just reported its third-quarter results, capturing attention with more than 1.5 million square feet of new leases, its best Q3 tally since 2019. This surge spotlights sustained demand in the company’s core office portfolio. See our latest analysis for BXP. Recent months have brought a flurry of activity for BXP, from refinancing a major project at Hudson Yards to starting vertical construction at 343 Madison Avenue. Despite booking a large net loss due to one-off charges, the...

2025-10-28

Here's What Key Metrics Tell Us About Boston Properties (BXP) Q3 Earnings

Description: Although the revenue and EPS for Boston Properties (BXP) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Boston Properties (BXP) Q3 FFO and Revenues Beat Estimates

Description: Boston Properties (BXP) delivered FFO and revenue surprises of +1.16% and +0.24%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Boston Properties: Q3 Earnings Snapshot

Description: BOSTON (AP) — Boston Properties Inc. (BXP) on Tuesday reported a key measure of profitability in its third quarter. The results beat Wall Street expectations. The real estate investment trust, based in Boston, said it had funds from operations of $276.7 million, or $1.74 per share, in the period.

BXP Reports Continued Strong Leasing Momentum in Q3 2025

Description: BOSTON, October 28, 2025--BXP (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, announced today that it signed more than 1.5 million square feet of leases in the third quarter of 2025 with a weighted-average lease term of 7.9 years, representing BXP’s strongest third quarter of leasing since 2019 and a 38% increase over the third quarter of 2024. Leasing activity through the third quarter totals approximately 3.8 million square fee

BXP Announces Third Quarter 2025 Results

Description: BOSTON, October 28, 2025--BXP, Inc. (NYSE: BXP), the largest publicly traded developer, owner, and manager of premier workplaces in the United States, reported results today for the third quarter ended September 30, 2025.

Are Options Traders Betting on a Big Move in BXP Stock?

Description: Investors need to pay close attention to BXP stock based on the movements in the options market lately.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Is BXP’s Recent 4.7% Price Jump a Signal to Reconsider Its Value in 2025?

Description: Thinking about what to do with BXP right now? You are definitely not alone. Even seasoned investors are revisiting their stance after the latest moves, especially with BXP’s stock closing at $73.73 and ticking up by 4.7% over the last week. Although the one-month return is slightly down by 3.2%, and the one-year change is still in the red at -11.4%, the big picture is not all gloom and doom. In fact, over three and five years, BXP has managed to gain an impressive 24.2% and 32.7%,...

2025-10-22

BXP to Post Q3 Earnings: What to Expect From the Stock?

Description: BXP's focus on high-quality and life science office conversions is likely to have lifted Q3 leasing, while debt and higher interest costs may weigh on results.

2025-10-21

BXP’s Q3 2025 Earnings: What to Expect

Description: BXP is slated to report its third-quarter earnings next week, and analysts anticipate a single-digit decline in profits.

2025-10-20

2025-10-19

2025-10-18

2025-10-17

Offices Are Back. It Could Give BXP Stock a Lift.

Description: Office markets in coastal cities like New York and Boston are starting to look up—good news for shares of BXP the stock market’s largest diversified office real estate investment trust. Shares of office REITs have been struggling with a host of problems, including the trend toward hybrid work and, until recently, relatively high interest rates. During the first nine months of the year, businesses leased Manhattan real estate at a faster clip than they have in nearly 20 years, according to a recent Wall Street Journal report.