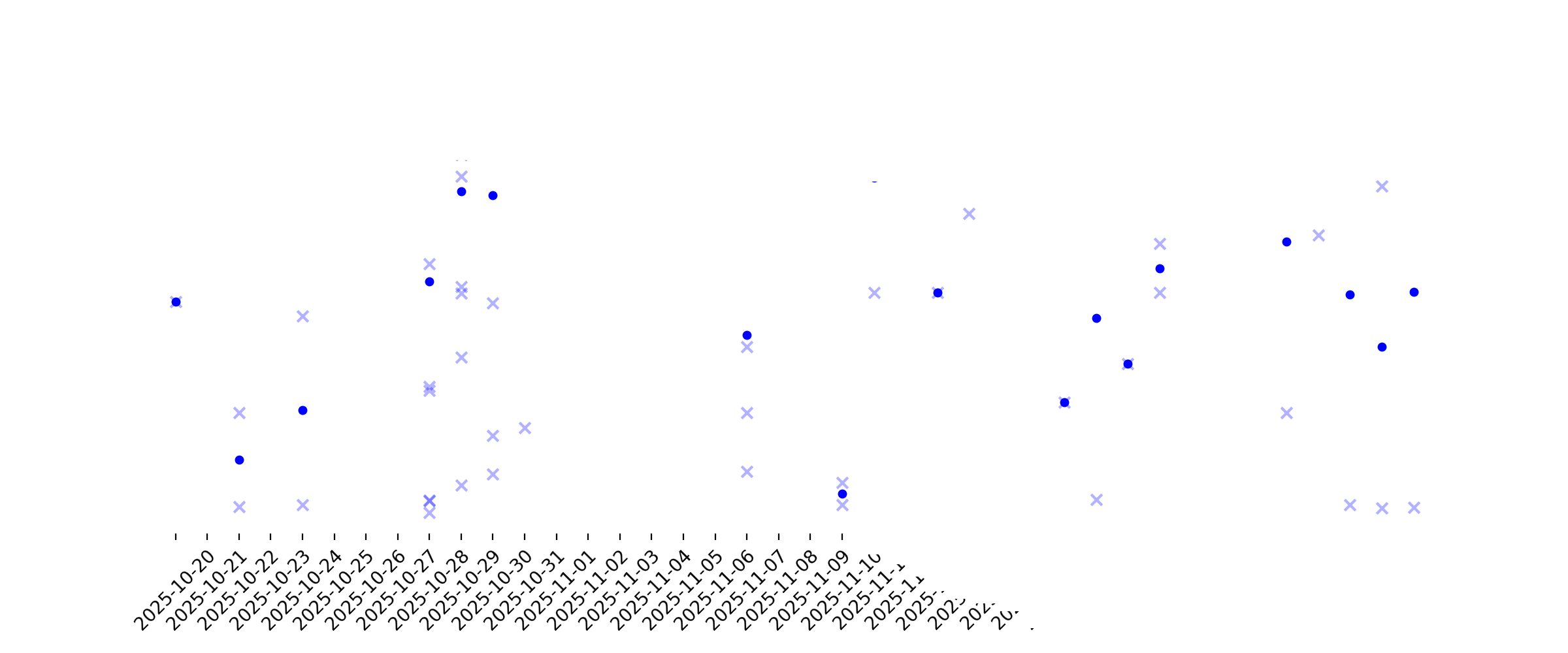

News sentiment analysis for C

Sentiment chart

2026-01-14

Citigroup Inc (C) Q4 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic Investments

Description: Citigroup Inc (C) reports robust financial performance with significant revenue growth across key segments and strategic capital returns to shareholders.

Q4 Earnings Season Gets Off To a Solid Start

Description: The Q4 earnings and revenue growth pace at this stage represents a clear acceleration from what we had seen from this same group of companies in the first three quarters of 2025. But what else should investors know?

Nasdaq Logs Worst Day in 4 Weeks as Big Tech, Major Banks Slide

Description: US equity benchmarks fell Wednesday, with the Nasdaq Composite posting its biggest one-day drop in f

Technology, Financials Push US Equity Indexes Lower

Description: US equity indexes fell on Wednesday as a sell-off in technology and consumer discretionary outpaced

Big Banks’ Bad Day: Bank of America, Wells Fargo, Citi Sink Most in Months

Description: Shares of some of the largest U.S. banks logged their steepest declines in several months after the lenders reported fourth-quarter earnings that fell short of investors’ high expectations. Investors found things to like about the reports from Citigroup, Bank of America, and Wells Fargo, such as solid measures of credit quality and positive commentary from executives across the three firms about their investment banking pipelines. Citigroup stock fell 3.3% to $112.41, its largest decline since October 2025, according to Dow Jones Market Data, while shares of Bank of America fell 3.8% to $52.48, their largest drop since April 2025.

US Equity Markets Fall Amid Disappointing Bank Earnings, Mixed Economic Data

Description: Major US equity indexes closed lower Wednesday amid disappointing bank earnings, mixed wholesale pri

Bank sell-off is more about valuation than earnings performances

Description: Bank stocks slid lower in Wednesday's session after Wells Fargo (WFC), Citigroup (C), Bank of America (BAC), and JPMorgan Chase (JPM) reported their latest earnings results this week. Morgan Stanley (MS) and Goldman Sachs (GS) also tick lower ahead of their earnings releases due out on Thursday. S&P Global Market Intelligence director of financial institutions research Nathan Stovall addresses the valuation concerns tied to the banking sector that may be dragging the financial sector down despite generally strong results. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Stock Market Today: Dow Closes Lower, But Nasdaq Is The Big Loser; This Robotics Name Slides (Live Coverage)

Description: The Dow Jones Industrial Average and other stock indexes ended Wednesday's session with losses, but improved from the day's lows. Among the losers was Nvidia as well as a number of banks after their earnings results. Also on the short end was a surgical robotic stock that sank on the stock market today.

These Stocks Are Today’s Movers: Bank of America, Wells Fargo, Citigroup, Tesla, Rivian, Intel, AppLovin, and More

Description: Shares of Bank of America, Citigroup, and Wells Fargo tumble after reporting earnings, a day after JPMorgan Chase posted a decline in quarterly profit.

Major Banks Are Tumbling Today. Here's Why.

Description: Bank of America, Wells Fargo, Citi report on busy day 2 of bank earnings. Shares slide on mixed results.

Sector Update: Financial Stocks Softer Late Afternoon

Description: Financial stocks declined in Wednesday late afternoon trading, with the NYSE Financial Index fractio

Net new assets stall at Citi Wealth following Q4 drop

Description: A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

Sector Update: Financial

Description: Financial stocks declined in Wednesday late afternoon trading, with the NYSE Financial Index fractio

Technology, Financials Hit US Equity Indexes in Final Leg of Trading

Description: US equity indexes fell ahead of Wednesday's close as financials declined amid a sell-off in technolo

Equity Markets Fall Intraday as Big Tech, Major Banks Slide

Description: US benchmark equity indexes were lower intraday amid a drop in the technology sector and a post-earn

US Equity Indexes Drop as Big Bank Earnings Disappoint, Inflation Data Mixed Amid Worsening Geopolitics

Description: US equity indexes fell in midday trading on Wednesday amid disappointing bank earnings, mixed wholes

Sector Update: Financial Stocks Decline Wednesday Afternoon

Description: Financial stocks were lower in Wednesday afternoon trading, with the NYSE Financial Index down 0.5%

Citigroup Q4 Earnings Beat Estimates on Y/Y NII Growth, Stock Down

Description: C tops Q4 earnings on strong Y/Y NII growth, but higher expenses and a weak capital position pushed the stock down nearly 4% early.

Citigroup CEO Jane Fraser warns of job cuts and says it’s time to raise the bar in a fiery memo to staff: ‘We are not graded on effort’

Description: Fortune's Most Powerful Woman on Wall Street is cutting 1,000 jobs now, with tens of thousands more to come as she says "old, bad habits" are over.

Why Investors Kept Banking on JPMorgan Chase Stock in 2025

Description: For many investors, it's the best large bank in this country.

2026-01-13

Bank earnings, retail sales, SCOTUS tariff ruling: What to Watch

Description: Market Domination Overtime Host Josh Lipton previews several of the biggest stories to come tomorrow, Wednesday, January 14, including earnings results from major banks Citigroup (C), Wells Fargo (WFC), and Bank of America (BAC); the latest print on US retail sales data from November; and the US Supreme Court's (SCOTUS) expected ruling on President Trump's tariff policies. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Markets Book Profits as Q4 Earnings Season Gets Rolling

Description: More bank earnings and economic reports await going into Hump Day.

Bank of America, Wells Fargo, and Citigroup to Report Earnings. What to Watch.

Description: Bank of America, Citigroup, and Wells Fargo are due to quarterly earnings on Wednesday, one day after JPMorgan Chase posted results that sent its shares tumbling. Analysts expect the three banks’ fourth-quarter earnings per share to have risen from a year earlier, according to estimates compiled by FactSet. Investors will look for executives’ outlooks on President Donald Trump’s proposed limit of 10% on credit card interest rates, consumer health, and dealmaking.

Energy & Utilities Roundup: Market Talk

Description: Find insight on electricity costs, crude futures and more in the latest Market Talks covering Energy and Utilities.

Dow, S&P 500 Retreat From Record as JPMorgan Slides Post Earnings

Description: The Dow Jones Industrial Average and the S&P 500 fell Tuesday as JPMorgan Chase (JPM) tumbled in a p

Equity Markets Fall, Oil Prices Rise Intraday; JPMorgan Drops

Description: US benchmark equity indexes were lower intraday amid a post-earnings sell-off in JPMorgan Chase (JPM

Trump's credit card cap could make most of industry 'unprofitable'

Description: JPMorgan Chase (JPM) reached a deal earlier this month to take over Goldman Sachs' (GS) Apple Card (AAPL) account; the costs related to this transfer weighed on the former's earnings figures for the fourth quarter. Additionally, President Trump suggested a 10% cap on credit card fees earlier this week. HSBC Head of US Financials Research Saul Martinez reacts to headlines of the Apple Card impacts and what Trump's policy proposal could mean for the financial sector and credit lenders. Also watch Saul Martinez discuss JPMorgan's latest earnings release. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Gold Steadies Near Record as Fed Independence Fears Return

Description: Bullion holds near $4,585 after a 2% jump, as political pressure on the Fed revives dollar and Treasury selling.

Citigroup to Axe 1,000 Jobs This Week: A Push for Efficiency?

Description: Will C's plan to cut about 1,000 jobs this week help to drive efficiency as its restructuring targets up to $2.5B in savings by 2026?

Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

Description: Citi is bullish on PLTR stock, citing the AI giant's widening moat and stellar revenue growth.

The Zacks Analyst Blog Highlights JPMorgan Chase, Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley and Taiwan Semiconductor Manufacturing

Description: JPMorgan kicks off Q4 earnings as big banks and Taiwan Semi set the tone for markets amid AI demand and global macro risks.

3 Sector ETFs to Play on Solid Q4 Earnings Trends

Description: Solid Q4 earnings trends put sector ETFs in focus as growth broadens beyond Tech. ETFs ITA, XLK, VFH stand out.

Is MS Stock a Buy Ahead of Q4 Earnings on Favorable Industry Trends?

Description: Morgan Stanley earnings set for Jan. 15, with strong trading and IB gains expected to lift Q4 revenue 6.8% year over year.

JPMorgan, Citigroup, Wells Fargo and Bank of America are part of Zacks Earnings Preview

Description: JPMorgan kicks off big bank earnings as easing rates, accelerating loan growth, and capital markets momentum test the sector's rally.

JPM's Q4 Earnings Beat Estimates on Solid Trading & NII, Weak IB Hurts

Description: JPMorgan's Q4 earnings beat estimates as trading and NII surge, but weak investment banking weighs on results.

Citigroup to lay off 1,000 employees as part of restructuring – report

Description: This development is part of a previously announced initiative aimed at cutting around 20,000 jobs by the end of this year.

Stock Market News for Jan 13, 2026

Description: U.S. stocks closed higher on Monday, with the S&P 500 and Dow recording fresh all-time closing highs, led by a tech rally, as investors kept aside concerns about the Justice Department launching a criminal investigation into Federal Reserve Chairman Jerome Powell.

Stocks Decline Pre-Bell Ahead of Key Inflation Report

Description: US equity futures were pointing lower on Tuesday as traders await a key inflation report and corpora

Jim Cramer on Citigroup: “It’s Gone From Ugly Duckling to Beautiful Swan”

Description: Citigroup Inc. (NYSE:C) is one of the stocks on Jim Cramer’s game plan for this week. Cramer explained why the stock “keeps surprising the upside,” as he said: “Wednesday also brings more bank earnings. The star most likely will be the one that’s been the star for a while now, Citigroup. It’s gone from ugly […]

Bank sector is hitting this 'trifecta,' set to outperform S&P 500

Description: Earnings season starts for major banks JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Morgan Stanley (MS), Wells Fargo (WFC), and Goldman Sachs (GS) this week, all of these major financial stocks set to report fourth quarter earnings results throughout the week. RBC Capital Markets analyst Gerard Cassidy shares his perspective on the KBW Bank ETF (KBWB) outperforming the S&P 500 (^GSPC), while also discussing his outlook for regional bank stocks Fifth Third Bancorp (FITB) and M&T Bank (MTB). Also hear Gerard Cassidy explain why President Trump's suggested 10% cap on credit card rates would have "real negative repercussions" for borrowers. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2026-01-12

Citigroup Declares Common Stock Dividend

Description: NEW YORK, January 12, 2026--The Board of Directors of Citigroup Inc. today declared a quarterly dividend on Citigroup’s common stock of $0.60 per share, payable on February 27, 2026, to stockholders of record on February 2, 2026.

S&P 500, Dow Clinch New Peaks as Traders Shrug Off Fed Independence Concerns

Description: The S&P 500 and the Dow Jones Industrial Average notched fresh highs on Monday as traders appeared t

Alibaba stock surges amid probe, Citi to cut 1,000 jobs

Description: Market Domination Overtime Host Brooke DiPalma tracks several of the day's top trending stock tickers, including Alibaba stock (BABA, 9988.HK) surging as Chinese regulators launch a probe into the food delivery space, Walmart (WMT) to join the Nasdaq 100 (^NDX) as it teams with Alphabet's Google Gemini AI (GOOG, GOOGL), and Bloomberg reporting that Citigroup (C) plans to lay off up to 1,000 workers this week. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Capital One, Credit Cards Dive As Trump Aims To Cap Interest Rates.

Description: Capital One, Synchrony Financial lead credit card retreat after President Trump says he wants to cap interest rates at 10%.

Delta, United, Other Airline Stocks Fall on Trump’s Credit-Card Plan. Why It’s Overdone.

Description: Delta United, and other airline stocks fell Monday as investors assessed President Donald Trump’s call for a 10% cap on credit-card interest rates. Airlines make billions of dollars in revenue each year from co-branded credit cards. Delta said it received $2 billion from American Express in the third quarter alone, up 12% year-over-year, driven by co-branded card growth.

Equities Rise Intraday Amid Probe Into Fed Chair Powell

Description: US benchmark equity indexes were higher intraday, while gold prices hit new records as markets react

Bank earnings: What to expect in 2026 amid capital market changes

Description: Earnings season starts for major banks JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Morgan Stanley (MS), Wells Fargo (WFC), and Goldman Sachs (GS) this week, all of these major financial stocks set to report fourth quarter earnings results throughout the week. RBC Capital Markets analyst Gerard Cassidy shares her outlook on the investment banking sector for 2026, referencing US real GDP (gross domestic product) forecasts. Also hear Gerard Cassidy explain why President Trump's suggested 10% cap on credit card rates would have "real negative repercussions" for borrowers. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Citi Sees Fresh Momentum Building at Zoom

Description: AI and products sharpen the growth outlook

Citigroup Q4 Earnings on the Deck: How to Approach the Stock Now?

Description: C's Q4 results will likely reflect higher revenues as NII and deal-making rebound, yet high costs and deteriorating asset quality might weigh on investor sentiment.

Some Credit Card Issuers' Revenue May Halve Due to Trump's Rate Cap Proposal, RBC Says

Description: Some credit card issuers may see their revenue slashed by more than half as a result of a 10% intere

Top Midday Stories: DOJ Opens Criminal Probe Into Fed Chair Powell; Trump Calls for 10% Credit-Card Rate Cap, Bank Shares Tumble

Description: US stocks were mixed in midday trading Monday, after Federal Reserve Chair Jerome Powell said Sunday

Can Bank Stocks Sustain Recent Momentum?

Description: Big bank stocks have not only outperformed the broader market over the past year but have also outperformed the Magnificent 7 stocks by a wide margin. With earnings looming, can the positivity continue?

Wall Street Gears up for Q4 Earnings Season

Description: Wall Street Gears up for Q4 Earnings Season

Trump's credit card cap would have 'real negative' impact on borrowers

Description: The earnings season's starting bell has rung, and bank stocks are off to the races this week with JPMorgan Chase & Co. (JPM) and the Bank of New York Mellon (BK) set to release fourth quarter earnings results on Tuesday. Additionally, President Trump's suggestion of a 10% cap on credit card fees has dragged down shares of major credit lenders on Monday. RBC Capital Markets analyst Gerard Cassidy speaks with Julie Hyman about the impact a possible executive order could have on credit card companies. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Big Week for Data: Q4 Earnings, Inflation Rate

Description: Big banks reporting Q4 results and a fresh CPI Inflation Rate are expected to be two highlights to enhance market activity this week.

Palantir Upgraded to Buy at Citi on Anticipated Government and Commercial 'Supercycle'

Description: Analyst sees 2026 as a breakout year for Palantir's AI and data contracts.

Citi Positive on Riot Platforms (RIOT) Through 2026 on Expected Regulatory Reforms

Description: Riot Platforms Inc. (NASDAQ:RIOT) is one of the promising stocks to buy under $50. On December 22, Citi lowered the firm’s price target on Riot Platforms to $23 from $28, while maintaining a Buy rating on the shares. Despite updating its valuation models, Citi remained positive on digital assets heading into 2026. Citi still expects […]

How Will Bank ETFs Perform in Light of Q4 Earnings?

Description: Q4 bank earnings kick off this week. Moderate beat odds; strong deal activity is a plus. But yield-curve risks may cap short-term gains in ETFs like XLF, KBWB.

Trump threats drag Exxon, JPMorgan, & more; Allegiant's $1.5B deal

Description: Morning Brief host Julie Hyman and Yahoo Finance Markets and Data Editor Jared Blikre track several of Monday's top trending stock tickers, including bank and credit card stocks, like JPMorgan (JPM), Bank of America (BAC), Citigroup (C), Capital One (COF), American Express (AXP), Mastercard (MA), and Synchrony (SYF); Exxon Mobil (XOM); Allegiant Travel Company (ALGT); and Sun Country Airlines (SNCY). Watch the video above to learn more about the stories driving investor interest in these names. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

DOJ subpoenas Fed, Sell America trade, earnings: 3 Things

Description: The US Department of Justice (DOJ) has subpoenaed the Federal Reserve as it launches a criminal investigation into the central bank's Chair Jerome Powell. US stock futures (ES=F, NQ=F, YM=F) drop in Monday's premarket as Wall Street finds the "Sell America" trade to be back on, finding safe haven in precious metals like gold (GC=F) and silver (SI=F). Earnings season kicks off for major bank stocks and Delta Air Lines (DAL) this week. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

2026-01-11

Big banks kick off fourth quarter earnings season, inflation data on deck: What to watch this week

Description: Investors will be watching for consumer and producer price data alongside bank earnings in the week ahead.

2026-01-10

Big Banks Expected to Post Higher Profits as Shares Surge

Description: JPMorgan Chase is set to release fourth-quarter earnings on Tuesday, followed by Bank of America, Wells Fargo, and Citigroup the next day.

2026-01-09

Citigroup (C) Valuation Check As Earnings Approach And Transformation Progress Draws Growing Optimism

Description: Citigroup (C) heads into its upcoming quarterly earnings with attention focused on three things: the stock's strong run over the past year, its ongoing restructuring, and improving sentiment from Wall Street research desks. See our latest analysis for Citigroup. Citigroup's recent hiring in APAC investment banking and a series of fixed income offerings come against the backdrop of a 29.16% 90 day share price return and a very strong 1 year total shareholder return of 74.63%. This is...

Bank earnings, CPI inflation data, Fed comments: What to Watch

Description: Market Domination Overtime Host Josh Lipton previews several of the biggest stories to come next week, including earnings results reported by the Big Banks, December's Consumer Price Index (CPI) inflation data, and a slew of commentary from Federal Reserve officials. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Can Strong Earnings Justify High Stock Valuations?

Description: With the 2025 Q4 earnings season about to begin, we discuss how critical the overall earnings picture is to the stock market.

What economic progress looks like for underserved communities

Description: Your bank account could look much better by the end of 2026. On this week's Financial Freestyle, host Ross Mac speaks with Lisa Frison, Head of Financial Inclusion at Citi. Frison lays out the tools and services that Citi is proving customers in 2026 to help save and invest in a future that is free of financial stress. To learn how you can grow your money with better banking, check out this episode of Financial Freestyle. Listen and subscribe to Financial Freestyle on Apple Podcasts, Spotify, or wherever you find your favorite podcasts. https://finance.yahoo.com/videos/seri... Financial Freestyle with Ross Mac on Yahoo Finance is dedicated to promoting economic prosperity for all. Through expert insights, practical advice, and inspiring success stories, we empower you to build and grow wealth. Join us on this transformative journey toward financial freedom and inclusive economic growth.

Jim Cramer Discusses Citigroup (C) in Detail

Description: We recently published 11 Stocks on Jim Cramer’s Radar. Citigroup Inc. (NYSE:C) is one of the stocks on Jim Cramer radar. Banking giant Citigroup Inc. (NYSE:C)’s shares are up by 66% over the past year. 2026 has started off on a strong note for the stock when it comes to analyst coverage. One fresh example comes […]

Should You Buy, Hold or Sell Wells Fargo Stock Ahead of Q4 Earnings?

Description: WFC's Q4 earnings likely show a rising NII and solid loan demand, but lower non-interest income and asset quality pressure may weigh on investor sentiment.

Navient's Leadership Changes: How Will it Impact Future Growth?

Description: Will NAVI's leadership overhaul, including a new CFO and expanded COO duties, help accelerate its future growth strategy?

Banks to report earnings next week: 3 things investors are watching

Description: Earnings season is close to kicking off for big banks, with companies JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Morgan Stanley (MS), Wells Fargo (WFC), and Goldman Sachs (GS) set to report their quarterly results throughout next week. Major US bank stocks notably ended 2025 at new record highs. Yahoo Finance senior bank reporter David Hollerith lists the three biggest themes that Wall Street investors will be watching from bank earnings. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

Countdown to Citigroup (C) Q4 Earnings: A Look at Estimates Beyond Revenue and EPS

Description: Evaluate the expected performance of Citigroup (C) for the quarter ended December 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

JPM Q4 Earnings on Deck: Buy, Sell or Hold the Stock Ahead of Results?

Description: JPMorgan's Q4 earnings preview shows strength in trading and lending, but expenses and valuation may weigh on investor sentiment.

Why Sampo (HLSE:SAMPO) Story Is Shifting With A Higher Target But Neutral Rating

Description: Sampo Oyj’s fair value estimate has been nudged to €10.665 from €10.64357, while the discount rate and core growth assumptions remain almost unchanged. This small adjustment reflects a slightly more confident yet still measured view tied to a higher €9.91 price target, with analysts keeping a Neutral stance that points to balanced risk and reward. Read on to see what this means for you as the Sampo Oyj story evolves and how you can stay on top of future shifts in the narrative. Analyst Price...

How Analyst Focus on AI Monetization and Upmarket Expansion Will Impact monday.com (MNDY) Investors

Description: In recent days, analysts at Jefferies, Citi, and BTIG updated their views on monday.com, emphasizing its focus on AI monetization, expansion beyond core work management, and resilience amid a cautious software demand backdrop. Across these reports, a common thread is monday.com's push upmarket and into additional product areas, which could meaningfully influence how investors think about its long-term growth mix and customer base. Next, we'll examine how the emphasis on monday.com's 2026 AI...

2026-01-08

How Citigroup Stock Got Out of the Discount Bin

Description: Following a 70% return in 2025, shares of the global banking behemoth finished the year trading solidly above book value, at about 1.1 times, and over 1.2 times tangible book value. Not since 2008 has Citigroup’s stock entered a year trading at such a premium to book, according to FactSet data.

Morgan Stanley (MS) Reports Next Week: Wall Street Expects Earnings Growth

Description: Morgan Stanley (MS) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Jefferies Cuts Monday.com (MNDY) PT to $260 Amid Focus on 2026 AI Monetization

Description: Monday.com Ltd. (NASDAQ:MNDY) is one of the best up and coming stocks to buy according to Wall Street. On January 5, Jefferies lowered the firm’s price target on Monday.com to $260 from $300 with a Buy rating on the shares. In a sector outlook note, the firm suggested that 2026 will likely be characterized by […]

Jim Cramer Says Citigroup Will “Continue Its Resurrection From the Dead”

Description: Citigroup Inc. (NYSE:C) is one of the stocks Jim Cramer offered insights on. Cramer noted the company’s low valuation despite a significant run, as he said: “Or how about Citi, which was up huge in the last year, but still only sells for 12 times this year’s earnings estimates. I think Citi will exceed those […]

How Citigroup Shares Can Keep Up Their Winning Run

Description: Following a 70% return in 2025, shares of the global banking behemoth finished the year trading solidly above book value, at about 1.1 times, and over 1.2 times tangible book value. Not since 2008 has Citigroup’s stock entered a year trading at such a premium to book, according to FactSet data. Coming out of a rocky period, Citigroup shares have posted an annualized return of around 42% over the past three calendar years.

What Recent Analyst Calls Mean For Visa’s (V) Evolving Story And Valuation

Description: Why Visa’s Price Target Just Nudged Higher Visa’s modeled fair value estimate has shifted only slightly to about US$395.85 from US$395.44, a small change that still reflects the company’s central role in global payments and its large, widely used network. This modest move aligns with views that Visa’s brand strength, cross border business and perceived quality versus some peers can support a higher price target, even as more cautious voices point to execution risks and already high...

2026-01-07

This Dividend Stock Gained 66% Last Year. Is The 2026 Forecast as Bright?

Description: Citigroup shares gained almost 65% last year and outperformed large-cap banking peers. However, after the rally, Citi's dividend yield is now comparable to peers, and the valuations look fair, making the risk-reward quite balanced.

Bank of America Joins JPMorgan, Citi, Morgan Stanley By Recommending Bitcoin Portfolio Allocation

Description: Bank of America Corp. (NYSE:BAC) will allow more than 15,000 Merrill and Private Bank advisers to proactively recommend four spot Bitcoin (CRYPTO: BTC) ETFs starting Jan. 5, formally opening Bitcoin access across its wealth platform. Big Four Banks Now All...

Will Citi’s Russia Exit and Asia Push Reshape Citigroup's (C) Long-Term Strategic Narrative?

Description: Citigroup Inc. recently advanced its Asia-Pacific investment banking franchise by hiring former Credit Suisse managing director Alexander Wong to strengthen senior client coverage across the region. This leadership addition comes as Citi continues to reshape its global footprint, including exiting its remaining Russia operations and issuing new senior unsecured notes across a range of maturities. We’ll now examine how Citi’s Russia exit and related business reshaping affect the bank’s...

Citigroup (C) Reports Next Week: Wall Street Expects Earnings Growth

Description: Citigroup (C) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Citi Wealth Releases Macroeconomic and Markets View for 1Q 2026 – Staying Grounded in a Noisy World

Description: NEW YORK, January 07, 2026--Today, Citi Wealth released The Short and Long: Q1 Macro Investment View, a new, quarterly report designed to offer global, data-driven guidance to help investors navigate increasingly complex markets with confidence and clarity.

Bank ETFs in Spotlight as US National Debt Crosses $38 Trillion

Description: Bank ETFs like KBE are in focus as U.S. debt tops $38T, reshaping rate policy risks and opportunities for the banking sector in 2026.

Bond Market Signals Go-Ahead for Bank Stocks With JPMorgan Earnings on Deck

Description: A steeper yield curve and strong deal activity are lifting bank stocks ahead of JPMorgan’s earnings, with analysts expecting financials to drive a fifth of S&P 500 profits.

BAC Shares Outpace the S&P 500 in 2025: Will Momentum Hold in 2026?

Description: BAC jumps 24.1% in 2025, beating the S&P 500 again. Will loan growth, branch expansion and a strong balance sheet keep the rally alive in 2026? Let's decipher.

The biggest market risk in 2026 is the one no one talks about

Description: Deal activity is heating up amid lower interest rates from the Fed and a sense from sellers that valuations are about as full as one could expect. Yahoo Finance executive editor Brian Sozzi sits down on the Opening Bid Unfiltered podcast with Apollo Global Management co-head of equity David Sambur. After being held by Liberation Day market related volatility, the environment for deal-making has picked up. 2025 was poised to become the second highest in deal activity, up 36% in value to an estimated $4.8 trillion according to Bain & Company. Megadeals greater than $5 billion represented more than 75% of incremental deal value. Meanwhile, exit activity for private equity companies accelerated meaningfully in the third quarter of last year. Private equity firms announced exits totaling $470 billion in 2025 per the latest data from EY, marking a 40% increase by value compared with the same period last year. Sambur shares his outlook for M&A and exits in 2026, the drivers of that potential activity and what he has learned from making big deals over the course of his career.Disclosure: Yahoo is a portfolio company of funds managed by affiliates of Apollo Global Management.

2026-01-06

Wells Fargo Recruits $1.2 Billion Advisory Team From Citigroup

Description: Wells Fargo has recruited an advisory duo in Texas managing $1.2 billion in client assets. Paul Cooke and Jake Trousdale have joined Wells Fargo’s Private Client Group in Dallas. The move comes amid a reorganization within Citigroup that will see a new CFO take over in March and the firm’s retail banking operations be consolidated and organized within the wealth business, headed by Andy Sieg.

Morgan Stanley Files for Bitcoin and Solana Trusts in ETF Push

Description: The bank submitted filings for crypto trusts holding Bitcoin and Solana, including a Solana staking component.

Citigroup Stock Reaches New 52-Week High: Hold or Fold Now?

Description: C hits a new 52-week high as strategic exits, easing regulation and a softer-rate backdrop lift confidence, but is there more upside left? Let us find out.

2026-01-05

Markets Risk-On with Venezuela News, Deregulation

Description: The Dow reached the close at 48,977 -- a record-high level. The blue-chip index gained +594 points on the day.

Citigroup's Planned Sale of Remaining Russian Operations Likely to Hit Core Operating Earnings, RBC Says

Description: Citigroup's (C) planned sale of its remaining operations in Russia is likely to weigh on its 2025 co

$1.2B Citigroup Team Jumps to Wells Fargo

Description: Advisors Paul Cooke and Jake Trousdale have moved their Dallas-based practice from Citigroup to Wells Fargo as the wirehouse continues its recruitment push.

Wells Fargo Stock Jumps Nearly 19% in 3 Months: Right Time to Buy?

Description: Does the WFC stock warrant buying now as asset cap removal, cost cuts and discounted valuation fuel optimism? Let us find out.

Looking At The Narrative For SITE Centers (SITC) After Target Cut And Special Dividends

Description: What Changed in the Latest SITE Centers Price Target The latest price target update for SITE Centers is essentially a small recalibration, with the discount rate edging up to about 8.42% and fair value per share holding steady at US$10.13. Analysts describe this as fine tuning, driven mainly by refreshed net asset value work after recent and pending asset sales, rather than a reset of the broader story around the company. If you want to keep on top of how these incremental price target tweaks...

Financial Stocks Poised for Record as JPMorgan Nears Milestone Closing Price

Description: The S&P 500’s financials sector was on track for a record closing high on Monday as investors appeared to find more opportunities than risk in the wake of the Trump administration’s intervention in Venezuela. JPMorgan Chase, the largest U.S. lender by assets and the second-largest component of the financials sector index after Warren Buffett’s Berkshire Hathaway, jumped 3.3%. Jamie Dimon’s JPMorgan was on pace to close above a market cap of $900 billion for the first time on record, according to Dow Jones Market Data.

Citigroup (C) Stock Is Up, What You Need To Know

Description: Shares of global financial services giant Citigroup (NYSE:C) jumped 3.6% in the morning session after Barclays raised its price target on the stock to $146 from $115 while maintaining its "Overweight" rating.

Market Awaits Labor Market Reports

Description: Market Awaits Labor Market Reports.

Looking Ahead to a New "Jobs Week"

Description: "Jobs Week" starts Wednesday with ADP private-sector payrolls and JOLTS numbers, and ends Friday with the full BLS report.

Citi cites $1.2B loss on Russia sale

Description: The bank’s board approved the transfer of its Russia business to Renaissance Capital and will reclassify the assets as “held for sale.”

2026-01-04

2026-01-03

2026-01-02

JPMorgan Backs Citigroup (C) as Russia Sale Lifts Capital Ratio

Description: Citigroup Inc. (NYSE:C) is included among the 20 Best Performing Dividend Stocks in 2025. On December 30, JPMorgan kept an Overweight rating on Citigroup Inc. (NYSE:C) after the bank said it plans to sell its remaining operations in Russia. The company expects to take a pre-tax loss of $1.2 billion in the fourth quarter, tied […]

Citigroup (C) Outperforms Broader Market: What You Need to Know

Description: Citigroup (C) reached $118.7 at the closing of the latest trading day, reflecting a +1.72% change compared to its last close.

These Healthcare and Bank Stocks Had Incredible Runs in 2025. Why Gains Will Continue This Year.

Description: The stock market powered through a year of volatility to mark a strong finish in 2025. While artificial intelligence was a theme that dominated 2025, many winners were instead linked to healthcare and banking. Case in point, CVS Health : The stock was among the names that had their best year in two decades.

Citigroup (C) Approves the Sale of its Russian Unit to Renaissance Capital

Description: Citigroup Inc. (NYSE:C) is included among the 7 Best Fortune 500 Dividend Stocks to Invest in Now. Citigroup Inc. (NYSE:C) is a leading global bank for institutions with cross-border needs, a global provider in wealth management, and a U.S. personal bank. On December 29, Citigroup Inc. (NYSE:C) said its board approved the sale of its […]

2026-01-01

2025-12-31

OS: Citi Cautiously Optimistic on Application Software as US Government Reopening Offsets Uncertain Demand

Description: OneStream Inc. (NASDAQ:OS) is one of the best low priced technology stocks to buy according to analysts. On December 23, Citi analyst Steven Enders lowered the firm’s price target on OneStream to $24 from $25 and kept a Neutral rating on the shares. This decision came as Citi revised its outlook on the application software […]

Company News for Dec 31, 2025

Description: Companies In The Article Are:META, C, BA, INTC,NVDA

Citi secures internal approval for sale of Russian business to RenCap

Description: Citi expects a fourth quarter 2025 pre-tax sale-loss of nearly $1.2bn, mainly from currency translation adjustment losses.

2025-12-30

Citi edges closer to Russia exit, bracing for over €1bn hit

Description: Citi has secured internal approvals to sell its remaining business in Russia to Renaissance Capital, moving closer to an exit from the market after years of delays.View on euronews

Ecolab (ECL) Target Trimmed at Citi Amid Shifting Views on Chemicals

Description: Ecolab Inc. (NYSE:ECL) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 18, Citi analyst Patrick Cunningham lowered the price target on Ecolab Inc. (NYSE:ECL) to $315 from $323 and maintained a Buy rating. The update followed revisions to estimates and targets across the chemicals group as part […]

Kimberly-Clark (KMB) Target Lowered as Citi Rebalances Household Care View

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 17, Citi lowered its price target on Kimberly-Clark Corporation (NASDAQ:KMB) to $95 from $100 and kept a Sell rating on the stock. The change came as part of the firm’s 2026 outlook for the beverages, household, […]

Citigroup Gets Board Nod to Sell AO Citibank, Advances Russia Exit

Description: C clears internal hurdle to sell AO Citibank, advancing its multi-year exit from Russia with a deal set to close in the first half of 2026.

Bank stocks: 3 themes to watch in 2026

Description: Shortly after the new year, banks will start reporting their quarterly earnings, with JPMorgan Chase (JPM) releasing its fourth quarter results on Tuesday, Jan. 13. Christopher McGratty, head of US bank research at KBW, a Stifel company, shares what he will be watching for from banks in 2026. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

South Korea Stocks Cap Strongest Rally in 25 Years as Kospi Surges 76%

Description: The Kospi outperformed global peers in 2025, led by chips, defense, nuclear power and K-beauty stocks.

Bank Stocks Shine in 2025: 3 S&P 500 Plays to Watch for 2026

Description: Bank stocks surge in 2025. With the Fed easing and earnings tailwinds, the sector shows no signs of slowing in 2026. Hence, C, BK and NTRS are worth a look.

Citigroup Flags $1.1 Billion Loss on Russia Exit Deal

Description: Citi plans to book a loss tied to selling its remaining Russia business and expects the transaction to close in 2026.

2025-12-29

Hideout in the Financial Sector as We Round out 2025?

Description: Entering the last trading week of the year, investors are certainly pondering where to put their money to work in 2026, and the financial sector may be at the forefront with the stock market near all-time highs.

Citigroup to Sell Remaining Business Operating in Russia

Description: Citigroup is expecting to take a pretax loss on the sale of about $1.2 billion in the fourth quarter of this year.

Citigroup’s $143K Bitcoin Call for 2026—Bull, Base, and Bear Scenarios Explained

Description: Citigroup’s Bitcoin prediction for 2026 is one of the most talked-about forecasts from Wall Street this year. Analysts at Citi have projected that Bitcoin (CRYPTO: BTC) could reach $143,000 over the next 12 months—about a 62% upside from today’s roughly $87,000 price level. But Citi didn’t stop there. Their Bitcoin prediction outlines a clear bear ... Citigroup’s $143K Bitcoin Call for 2026—Bull, Base, and Bear Scenarios Explained

How Deutsche Bank Plans to Achieve RoTE Above 13% by 2028

Description: DB aims to lift RoTE above 13% by 2028 through revenue growth, cost cuts, capital management and higher payouts.

2025-12-28

Citi Pivots to Household Care for 2026 Favoring Newell Brands (NWL) as Inventory Destocking and Negative Comparisons End

Description: Newell Brands Inc. (NASDAQ:NWL) is one of the cheap penny stocks to invest in. On December 17, Citi raised the firm’s price target on Newell Brands to $3.75 from $3.50 while keeping a Neutral rating on the shares. Citi is recalibrating its focus for 2026, moving away from the bullish stance it held on non-alcoholic […]

2025-12-27

2025-12-26

PNC Financial Hits a New 52-Week High: How to Approach the Stock?

Description: PNC touches a new 52-week high. Does the stock have more upside as strong Q3 U.S. economic growth and optimism around the FirstBank deal lift investor confidence?

Private credit risks: What to make of Oracle's debt, AI trade

Description: TPW Advisory founder Jay Pelosky and Whalen Global Advisors founder and chairman Chris Whalen come on Market Catalysts to discuss the credit risks materializing in the AI trade and Magnificent Seven tech names, most notably Oracle's (ORCL) growing debt amid concerns of an AI bubble risk. Also catch Jay Pelosky and Chris Whalen share their insights into the banking sector heading into 2026, the next phase in the commodities super cycle, and forecasts on non-US equities. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

The Zacks Analyst Blog Wells Fargo, Bank of America and Citigroup

Description: Wells Fargo leads a trio of big banks positioned to benefit as Fed rate cuts lift loan demand, stabilize funding costs and boost fee income.

2025-12-25

Citigroup (C): Valuation Check After Regulatory Relief, Banamex Stake Sale Progress and Turnaround Optimism

Description: Citigroup (C) has quietly cleared a major overhang, with U.S. regulators rolling back key trading risk and consent order restrictions just as the bank focuses on divestitures and a cleaner, more focused balance sheet. See our latest analysis for Citigroup. That regulatory relief has helped fuel a powerful move, with a roughly 22 percent 1 month share price return and a 74 percent year to date share price return. The 3 year total shareholder return above 200 percent shows momentum firmly...

Citi Sees Upside in Lear Corporation (LEA) Despite Cyclical Auto Headwinds

Description: We recently compiled a list of the 10 Cheap Stocks With Strong Buy Ratings on Wall Street. Lear Corporation is among the cheap stocks to buy. TheFly reported on December 15 that Citigroup maintained its Buy rating on LEA and raised the price target to $146 from $136, reflecting confidence in the company’s long‑term prospects amid a […]

Citi Reinstates CoreWeave (CRWV) with Buy as Q3 Bookings Surge 85% Despite Supply Delays

Description: CoreWeave Inc. (NASDAQ:CRWV) is one of the best high volume stocks to buy right now. On December 19, Citi resumed coverage of CoreWeave with a Buy rating and price target of $135, which trimmed dtown from $192. The firm reported that CoreWeave is rebounding from previous restrictions with a massive 85% jump in Q3 2025 […]

2025-12-24

Wells Fargo Stock Touched a New 52-Week High: Is More Upside Left?

Description: With WFC at a 52-week high, does improving U.S. economic confidence and expectations for 2026 support further upside? Let us find out.

Citigroup Seizes Japan's M&A Boom, Plans to Expand IB Team

Description: C ramps up Japan investment banking, planning a 30% headcount boost by 2026 as a record M&A boom reshapes the corporate landscape.

3 Banks Poised to Benefit Most From Declining Interest Rates

Description: With the Fed cutting rates in 2025, WFC, BAC and C are positioned to gain from stronger loan demand and steadier funding costs.

3 Bank Stocks to Keep on Your Radar as They Reach New 52-Week Highs

Description: C, BAC and USB hit new 52-week highs as economic growth, rate cuts and bank strategies fuel investor optimism.

Is JPMorgan Stock a Buy for 2026 as it Hits an All-Time High?

Description: JPM stock hits a record high on lower rates, GDP strength and crypto trading talks, even as it trades at a premium. Is it worth betting on for 2026?

Japan M&A boom drives Citigroup and Daiwa hiring push – report

Description: Citigroup intends to lift headcount in its Japan investment banking unit by around 30% by the first half of 2026.

Monday.com price target lowered to $293 from $319 at Citi

Description: Citi lowered the firm’s price target on Monday.com (MNDY) to $293 from $319 and keeps a Buy rating on the shares. The firm adjusted models in the application software group after catching up with managements. Companies are facing a stable but uncertain demand environment, with some relief from the reopening of the U.S. government, the analyst tells investors in a research note. Citi names Pegasystems (PEGA) its new top pick, saying the company is the leader in artificial intelligence monetizatio

2025-12-23

Wall Street Has a Consensus Hold Rating on Textron Inc. (TXT)

Description: Textron Inc. (NYSE:TXT) is among the 7 Best Defense Dividend Stocks to Buy. On December 11, Citigroup initiated coverage of the stock with a Neutral rating and announced a share price target of $91. The global investment bank recently launched coverage on aerospace and defense stocks, while noting several ‘megatrends’ in the sector, which Citi believes […]

Citi Makes Left-Field Choice For Top Pick Among Chip Stocks

Description: Investment bank Citi named Microchip as its top pick among chip stocks as it forecasts a resurgence for analog semiconductors in 2026.

Sector Update: Financial Stocks Rise Late Afternoon

Description: Financial stocks were higher in late Tuesday afternoon trading, with the NYSE Financial Index adding

Why Marvell Technology (MRVL) Stock Is Trading Up Today

Description: Shares of networking chips designer Marvell Technology (NASDAQ: MRVL) jumped 3.4% in the afternoon session after investment firm Citi issued a positive catalyst watch for the stock ahead of the upcoming Consumer Electronics Show (CES), contributing to a broader rally in the chip sector.

UBS Workforce Reduction: Turning Integration Synergies Into Efficiency

Description: UBS Group plans another wave of job cuts from January 2026 as CS integration nears completion, aiming to boost efficiency and unlock cost savings.

Citigroup or Bank of America: Which Big Bank is the Better 2026 Bet?

Description: Will Citigroup's global business revamp, rising earnings and valuation edge give it the upper hand over Bank of America in 2026? Let's find out.

2025-12-22

Citigroup (C) Outpaces Stock Market Gains: What You Should Know

Description: Citigroup (C) closed the most recent trading day at $118.09, moving +2.81% from the previous trading session.

2026 outlook: Big Banks are getting back their 'earnings mojo'

Description: Major bank stocks are poised to close 2025 with serious gains; most notably, Citigroup shares (C) are already up 67% while Goldman Sachs (GS) has surged 57% (or nearly $330) year-to-date. Whalen Global Advisors founder and chairman Chris Whalen — alongside TPW Advisory founder Jay Pelosky — speaks with Market Catalysts host Julie Hyman about his consensus on the banking sector heading into 2026, citing various corporate credit risks amid the Federal Reserve's current interest rate environment. Also catch Yahoo Finance Senior Banking Reporter David Hollerith and Hennion & Walsh CIO Kevin Mahn discuss the 2026 outlook for regional banks. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

How Regulatory and Legal Relief Shapes Citigroup’s (C) Turnaround and Risk-Management Story

Description: In recent days, Citigroup has secured meaningful regulatory relief as the Federal Reserve closed key supervisory notices and the Office of the Comptroller of the Currency withdrew a 2024 amendment to its 2020 consent order, while a UK Supreme Court ruling blocked a multibillion-pound forex lawsuit against the bank. Together, this easing of regulatory and legal pressure has helped clear some long-standing overhangs, giving analysts more confidence in Citi’s operational turnaround and...

How the Narrative Surrounding Severn Trent Is Shifting After Recent Analyst Reassessment

Description: Severn Trent's latest valuation update nudged its fair value estimate down slightly to £29.30 per share, with a modestly stronger revenue growth outlook and an unchanged discount rate signalling that the core investment story remains largely intact. Analysts frame this as a subtle recalibration rather than a rethink of the narrative, reflecting balanced views on both the upside potential and the risk backdrop. Stay tuned to see how you can track these incremental shifts in expectations and...

HSBC recruits ex-Citi executive Ida Liu to lead private bank

Description: Ida Liu, who resigned from Citi earlier this year, will join HSBC on Jan. 5 as the CEO of the private bank. Liu will be tasked with accelerating the growth of the private bank "at a defining moment for wealth," she said in a LinkedIn post.

OCC Lifts Oversight on Citigroup: Catalyst for Transformation Drive?

Description: Does the OCC's removal of a 2024 consent-order amendment give C room to accelerate its transformation plan?

Citi Raises Cummins (CMI) PT as Machinery Demand Outlook Improves

Description: Cummins Inc. (NYSE:CMI) is one of the best hydrogen stocks to buy right now. On December 11, Citi increased the price target for Cummins Inc. (NYSE:CMI) stock to $580 from $530 while keeping a Buy recommendation. The change was part of Citi updating its financial models for the machinery industry looking ahead to 2026. The […]

Trillion-Dollar Market Leader to Emerge from Aerospace and Defense Sector Within 5 Years, According to Citi

Description: GE Aerospace (NYSE:GE) is one of the best growth stocks to buy in 2026. On December 11, Citi initiated coverage of GE Aerospace with a Buy rating and $386 price target. This decision was made as Citi launched coverage on the aerospace and defense sector and predicted that current industry megatrends would lead to a […]

HSBC taps ex-Citi exec Liu to lead private bank

Description: Ida Liu’s 18 years at Citi culminated in her leading its private bank for four years. In January, she’ll take on the same role at HSBC.

2025-12-21

How the Narrative Surrounding Seplat Energy Is Shifting After New Targets and Project Updates

Description: Seplat Energy’s latest price target update keeps fair value steady at £4.82 per share, while a slightly lower discount rate and unchanged revenue growth outlook underscore growing confidence in the company’s long term cash generation potential. This subtle recalibration reflects optimistic expectations around execution and capital discipline, even as some investors remain cautious about regulatory and operational risks that could limit further upside. Watch how you can track these narrative...

Boeing (BA) Gets Buy Rating from Citi, Completes Spirit AeroSystems Acquisition

Description: The Boeing Company (NYSE:BA) is one of the 14 Best Large Cap Stocks to Invest In Now. On December 12, Citi initiated coverage of The Boeing Company (NYSE:BA), assigning the stock a Buy rating and setting the price target at $265. Citi started coverage on 24 stocks in the aerospace and defense sector. The research […]

2025-12-20

CoreWeave (CRWV) Climbs 22.6% on ‘Buy’ From Citigroup

Description: We recently published 10 Firms in the Limelight. CoreWeave Inc. (NASDAQ:CRWV) is one of the best performers on Friday. CoreWeave surged by 22.64 percent on Friday to close at $83 apiece as investors took path from an investment firm’s renewed coverage, but were generally optimistic for the stock. In a market report, Citigroup issued a […]

Why The Narrative Around Mastercard Is Shifting After Analyst Upgrades And New Growth Drivers

Description: Mastercard's fair value estimate has nudged up to about $657 from roughly $656, while the modeled discount rate has inched down to around 7.39% from about 7.40% and revenue growth assumptions have been trimmed slightly to near 11.16% from roughly 11.84%. These subtle shifts reflect growing confidence in the durability of Mastercard's role in the global shift to digital payments, balanced against a somewhat more measured outlook for top line expansion. Read on to see how you can stay on top of...

2025-12-19

What Analysts Think Is Shifting the Story for Breedon Group Today

Description: Breedon Group's latest valuation update shows its fair value target edging marginally lower to £4.52, driven by subtle refinements to analyst assumptions rather than any fundamental change in the long term story. At the same time, a small cut in the discount rate and a fractional uplift in revenue growth expectations underline a view that risk is easing even as growth remains steady. Read on to see how you can stay on top of these fast evolving valuation signals so you are better placed to...

Why CoreWeave Stock Skyrocketed 23% on Friday

Description: CoreWeave shares roared back to life today.

Bitcoin Bulls Are Blinking. 2026 Forecasts Look Soft.

Description: Bitcoin’s slump has prompted Wall Street banks and longtime crypto bulls to dial back longer-term price targets.

Bank ETFs Shine as US Banking Profit Hits Decade High in Q3

Description: Bank ETFs such as FTXO are drawing attention as U.S. banking profits reached a decade high in Q3 2025, setting the stage for continued gains in 2026.

Bitcoin gets 'base case' price target of $143,000 at Citigroup

Description: The Wall Street bank said its bitcoin forecast relies on further crypto ETF inflows and a continued rally in traditional equity markets.

CoreWeave Stock Soars After Citi 'Buy' Rating Highlighting Strong AI Demand

Description: CRWV Stock Moves Higher. Enterprise Contracts and GPU Capacity Are Key Drivers

CoreWeave Stock Soars. It Got a Buy Rating With a Big Asterisk.

Description: Citi renewed its coverage of the AI infrastructure stock with a Buy rating and added a High Risk designation.

Citi is still a believer in crypto stocks despite bitcoin being rocked to end the year

Description: Circle remains the bank's top pick in the sector, with Bullish and Coinbase following.

Friday Is Set for a Record 'Witching' Day

Description: $7.1 trillion That's the notional value of stocks, exchange-traded funds and indexes on which options are due to expire today. It will make Friday a record "witching" day, according to Citigroup strategists.

What Developments Are Reshaping the Narrative for SITE Centers Investors Now

Description: SITE Centers latest update leaves its fair value estimate steady at $10.13 per share, with only a marginal trim to the discount rate and virtually no change to expected revenue trajectory. Bulls see this stability as validation of disciplined capital recycling and portfolio reshaping, while bears argue that muted revisions reflect underlying asset pressures and execution risk around ongoing asset sales and special dividends. Read on to see how you can stay ahead of these shifting narratives...

What to Expect From Citigroup's Next Quarterly Earnings Report

Description: Citigroup is scheduled to release its fiscal fourth-quarter earnings next month, and analysts project a double-digit earnings rise.

How Will Surging IB Business Support Bank of America's Fee Income?

Description: BAC's IB fees are climbing, driven by stronger deal-making, rising IPOs and easing rates, with growth seen in 2025 and 2026.

Update: Market Chatter: Banks Win Bid to Block $3.2 Billion Foreign Exchange Rigging Lawsuit in UK

Description: (Updates to add JPMorgan, Barclays's comment in the sixth paragraph) Major banks, including JPMor

OCC withdraws amendment to Citi consent order

Description: The regulator is no longer requiring the bank to submit a breakdown of the resources it’s employing to resolve a 2020 order likely brought on by a $900 million errant transfer of funds.

How Recent Developments Are Reshaping The Banco BBVA Argentina Investment Story

Description: Banco BBVA Argentina’s latest narrative shift comes with a modestly higher fair value target, raised from $16,396 to $16,805, as analysts recalibrate expectations around the bank’s long term potential. A slightly lower discount rate, trimming from 29.35% to 29.30%, reflects marginally reduced perceived risk in the context of both improving macro signals and lingering competitive concerns on capital strength. Stay tuned to see how you can track these evolving assumptions and keep ahead of the...

2025-12-18

Sector Update: Financial Stocks Mixed Late Afternoon

Description: Financial stocks were mixed in late Thursday afternoon trading, with the NYSE Financial Index increa

US regulator loosens some compliance burdens for Citigroup

Description: Citigroup has said a US bank regulator has loosened some compliance burdens imposed on the bank over deficiencies in risk control and data management...

Sector Update: Financial Stocks Advance Thursday Afternoon

Description: Financial stocks were higher in Thursday afternoon trading, with the NYSE Financial Index increasing

Citigroup Stock Outshines Mag-7 in 2025: What Awaits in 2026?

Description: C shares jump 62.9% in 2025, beating most Mag-7 names as restructuring, rate cuts and revived deal activity lift confidence heading into 2026.

Citigroup Inks Partnership Deal With LSEG: A Push for Efficiency?

Description: C strikes a multi-year partnership with LSEG to standardize enterprise data, strengthen risk controls and boost efficiency across global client workflows.

Market Chatter: Banks Win Bid to Block $3.2 Billion Foreign Exchange Rigging Lawsuit in UK

Description: Major banks, including JPMorgan (JPM), UBS (UBS), and Citigroup (C), won a court ruling to block a 2

2025-12-17

JGBs Mixed on Possible Position Adjustments

Description: JGBs were mixed in price terms, on possible position adjustments as the Bank of Japan kicked off its two-day meeting.

Big Banks poised to end year at record highs, wider goals for 2026

Description: Big Bank stocks are set to close out 2025 at record-highs while projecting even broader growth goals for 2026. Yahoo Finance senior banking reporter David Hollerith sits down with Josh Lipton to talk about the banking sector's guidance and capital forecasts for the coming year. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Is It Too Late To Consider Citi After Its 59% 2025 Rally?

Description: If you are wondering whether Citigroup is still a value play after its big run, you are not alone. This article will unpack what the market might be missing. The stock has climbed 1.7% over the last week, 10.9% over the past month, and a striking 59.1% year to date, adding to a 60.8% 1 year gain and a 183.3% return over 3 years. Recent headlines have focused on Citigroup's ongoing restructuring efforts and strategic moves to streamline its global footprint, which investors are watching...

Citigroup Projects Higher Q4 IB Revenues: Fee Income to Benefit?

Description: C expects IB fees to jump in the mid-20% in 4Q25, fueled by strong M&A momentum and capital markets activity despite softer market revenues.

2025-12-16

Citigroup (C) Dips More Than Broader Market: What You Should Know

Description: In the closing of the recent trading day, Citigroup (C) stood at $111.54, denoting a -1.12% move from the preceding trading day.

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were lower late Tuesday afternoon, with the NYSE Financial Index and the State Stre

Sector Update: Financial Stocks Fall in Afternoon Trading

Description: Financial stocks were lower Tuesday afternoon, with the NYSE Financial Index shedding 0.9% and the S

Citi's Baldwin Sees Upside for US Equities in 2026

Description: Lucy Baldwin, Global Head of Research at Citi, discusses her outlook for 2026, and why she calls this a "goldilocks type scenario" for the equities market.

Citi’s investment management unit head joins BlackRock – report

Description: Jasminski joins BlackRock together with a team from Citi’s investment management unit.

$2.3 Billion Deal Puts Banamex in Mexican Hands--Citigroup's IPO Exit May Come Early

Description: A $2.3B stake sale, fast-track approvals, and a family-led takeover could reshape Mexico's banking future.

2025-12-15

Citigroup Nears Regulatory Approval for 25% Banamex Stake Sale

Description: C nears regulatory approval to sell a 25% stake in Banamex, advancing its plan to exit Mexican consumer banking.

Market Minute 12-15-25- Stocks Rally Amid "2026 Target" Season

Description: After falling on their face Friday, equity markets are starting the week off in a more positive fashion. Gold and silver are rallying again, while Treasuries and the dollar are mostly flat.

Amazon and 9 More Stocks to Buy for 2026

Description: Barron’s capitalized on the trends with Alibaba Group Holding Alphabet and ASML Holding as well as other winners, including Citigroup and Uber Technologies in our top 10 picks for 2025. Rounding out the list is pharmaceutical turnaround candidate Bristol Myers Squibb which yields almost 5%.

Why Investors Need to Take Advantage of These 2 Finance Stocks Now

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Citi sets 2026 S&P 500 target at 7,700, expects AI to remain key theme

Description: Citigroup has set a year-end target of 7,700 for the S&P 500 index for 2026, pointing to robust corporate earnings and sustained tailwinds from artificial intelligence investments. "While the AI emphasis is expected to be persistent, the evolution will likely follow a perceived winner versus loser dynamic," strategists at Citi said. Citi's target implies a 12.7% gain from the benchmark's last close of 6827.41 points.

How AI Is Impacting Productivity at JPM, BAC, C & Others

Description: AI is driving productivity gains at JPMorgan, Citigroup, Bank of America, WFC and PNC, reshaping workflows, budgets, and potentially, bank staffing.

2025-12-14

Street Calls of the Week

Description: Investing.com -- Here is your Pro Recap of the top takeaways from Wall Street analysts for the past week.

2025-12-13

2025-12-12

Jamie Dimon Praises Fed Chair Candidate Kevin Warsh at Closed-Door Event

Description: JPMorgan Chase CEO Jamie Dimon, the nation’s top banker, has some thoughts on the next Federal Reserve chair. At his bank’s private, annual asset-management industry event held this week, Dimon was asked about Kevin Hassett, a top White House economic adviser who is seen as the likeliest successor to Fed Chair Jerome Powell, and Kevin Warsh, a former Fed governor who President Donald Trump considered for chair during his first term. Hassett would likely move quickly to lower short-term interest rates, in line with what Trump has said he wants from the Fed, Dimon said, according to people familiar with his remarks.

Bank of America Shares Hit Record High. Why Citi is the One to Watch Next.

Description: BofA stock closed at a record for the first time since 2006, before the 2008-2009 financial crisis slammed shares of banks globally.

Sector Update: Financial Stocks Mixed Late Afternoon

Description: Financial stocks were mixed in late Friday afternoon trading, with the NYSE Financial Index shedding

Citi, Alphabet, Freddie Mac: Top Analyst Calls

Description: Yahoo Finance senior reporter Brooke DiPalma keeps track of several Wall Street analyst calls on top trending stocks, including calls around shares of Citigroup (C), Alphabet (GOOG, GOOGL), and FMCC (FMCC) — which is better known as Freddie Mac. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Roblox downgraded, Lululemon upgraded: Wall Street's top analyst calls

Description: Roblox downgraded, Lululemon upgraded: Wall Street's top analyst calls

Exchange-Traded Funds Lower, Equity Futures Mixed Pre-Bell Friday as Broadcom Results Deepen Fears

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.1% and the actively tr

Amazon and 9 More Stocks to Buy for 2026

Description: Barron’s capitalized on the trends with Alibaba Group Holding Alphabet and ASML Holding as well as other winners, including Citigroup and Uber Technologies in our top 10 picks for 2025. Rounding out the list is pharmaceutical turnaround candidate Bristol Myers Squibb which yields almost 5%.

2025-12-11

Citigroup (C) Valuation Check After New Preferred Stock, Strong Results and Upbeat 2025 Income Outlook

Description: Citigroup (C) has quietly stacked several positives at once, from a new 6.625% preferred stock series that refreshes its capital mix to management guiding for higher 2025 net interest income, all against a backdrop of rising investor enthusiasm. See our latest analysis for Citigroup. Those capital moves sit on top of strong recent momentum, with a roughly 9.5% 1 month share price return and a powerful year to date share price gain of about 59 percent. The 3 year total shareholder return above...

Why Big Bank Stocks Are Beating the Mag-7

Description: We explain why bank stocks are outperforming and feature three ETFs.

Big Bank CEOs discuss crypto regulation with US lawmakers

Description: Big Bank executives are meeting with lawmakers in DC on Thursday to discuss crypto regulation. Yahoo Finance Senior Reporter Jennifer Schonberger joins Market Catalysts from Capitol Hill to break down the details, including comments to Yahoo Finance from the Financial Services Forum spokeswoman Laura Peavey. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Fed Cuts Rates, Signals Caution Ahead: 5 Bank Stocks Set to Benefit

Description: BAC and other major banks rally as the Fed trims rates again and signals a cautious path for 2026, boosting expectations for lending and NII momentum.

Citi Hildebrandt Client Advisory Reports Expected Strong End to 2025 and Optimism for 2026 for Law Firm Industry

Description: NEW YORK, December 11, 2025--Citi Global Wealth at Work and Hildebrandt Consulting today released the 2026 Citi Hildebrandt Client Advisory. The Client Advisory covers the broad landscape for the legal industry, including how law firms are responding to market challenges and opportunities for growth in the year ahead.

2025-12-10

Citigroup (C) Beats Stock Market Upswing: What Investors Need to Know

Description: Citigroup (C) closed the most recent trading day at $111.12, moving +1.54% from the previous trading session.

Options plays to navigate Fed cut rates and year-end volatility

Description: As US stocks (^DJI, ^IXIC, ^GSPC) continue to navigate volatility at 2025's year-end tied to the Federal Reserve's latest decision to cut interest rates, how can investors play the options trade on these themes? Explosive Options technical analyst Bob Lang explains to Josh Lipton how one can reduce their volatility exposure through options plays, including his own calls on Citigroup (C) and Victoria's Secret (VSCO). To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend.

PNC Financial's Arm to Offer Direct Bitcoin Access via Coinbase

Description: PNC's arm rolls out direct bitcoin trading for private-wealthy clients, powered by Coinbase's CaaS to deliver integrated, on-platform digital-asset access.

JPMorgan Stock Slides on Warning of Steep 2026 Expense Growth

Description: JPM shares slide after the bank warns that 2026 expenses may surge more than $9B on growth spending, tech investments and inflation pressures.

Citi expects this chipmaker to deliver a ’significant beat and raise’ next week

Description: Investing.com -- Citi analysts highlighted one stock they believe will post results “significantly above Consensus” when it reports fiscal first-quarter earnings on Dec. 17 after the close.

2025-12-09

Will Citigroup’s New Buy Rating Reshape Matador Resources’ (MTDR) Risk‑Reward Narrative?

Description: Earlier this month, Citigroup initiated coverage on Matador Resources, assigning the company a Buy rating and adding a fresh analyst voice to the stock’s coverage universe. This new coverage aligns with an existing Outperform consensus from 21 brokerage firms, underscoring how analyst sentiment is helping shape institutional interest in Matador’s upstream energy profile. We’ll now examine how Citigroup’s initiation of coverage with a Buy rating could influence Matador’s existing investment...

JPMorgan shares drop as bank warns of fragile consumers, higher costs

Description: Investing.com -- JPMorgan Chase (NYSE:JPM) stock fell 4.3% by 2 pm Tuesday after the bank’s consumer and community banking CEO Marianne Lake warned of a "bit more fragile" consumer environment and projected higher-than-expected expenses for 2026.

2025-12-08

Is Citigroup Stock a Buy Now?

Description: Citigroup has had a great run, which makes buying it a bit of a stretch right now.

AI Policy, Chips, & China: What Investors Need to Know

Description: From potential federal regulation to semiconductor diplomacy and strategic corporate restructuring, AI's trajectory will have sweeping implications for markets and innovation.

Banks have a busy week: Fed decision, Goldman conference, & more

Description: It's an important week for banks and the financial sector (XLF), from the Federal Reserve's interest rate decision to Goldman Sachs's (GS) industry conference. Yahoo Finance Senior Reporter David Hollerith joins Market Domination Overtime host Josh Lipton to outline what's in store for the sector this week. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

UBS Group AG Plans 10,000 Job Cuts: Will it Boost Efficiency?

Description: Can UBS's plan to cut 10,000 jobs by 2027 sharpen efficiency as its Credit Suisse integration deepens? Let us find out.

This Bullish Spread Can Take Advantage Of Further Strength In Banking Giant Citigroup

Description: The stock of banking giant Citigroup has risen more than 55% in 2025. Options traders may want to consider a bull call spread.

Here’s What Drove Citigroup’s (C) Strong Share Performance

Description: Investment management company First Pacific Advisors recently released its third-quarter 2025 investor letter for the “FPA Source Capital.” A copy of the letter can be downloaded here. In the third quarter, the net asset value of the fund gained 4.59% and 13.76% for the trailing 12 months. Regarding the Fund’s recent performance, over the past twelve months, […]

Capitolis Appoints Okan Pekin as President

Description: NEW YORK, December 08, 2025--Capitolis appoints Okan Pekin as President to help scale and drive the company’s next phase of growth.

2025-12-07

How Shifting Analyst Targets Are Rewriting the Story for Schroders

Description: Schroders’ latest update has nudged its fair value estimate slightly higher to 4.15 times earnings, even as a marginally higher discount rate and a touch weaker revenue outlook temper enthusiasm. These shifts mirror a divided Street, where resilient profitability and a solid capital base are being weighed against fee pressure, softer flows, and macro uncertainty. Read on to see how investors can track these evolving price targets and stay ahead of the changing narrative from here. Analyst...

Is Citigroup’s (C) Funding Shuffle Quietly Rewriting Its Institutional Banking Playbook?

Description: Citigroup recently redeemed all US$1.50 billion of its 4.000% Fixed Rate Reset Noncumulative Preferred Stock Series W, while actively issuing a range of new callable senior unsecured notes and zero-coupon debt to adjust its funding mix and capital structure. Alongside these balance sheet moves, Citigroup is reshaping its operations through leadership hires in Japan equity capital markets and prime services, aiming to sharpen its institutional and capital markets franchises globally. We’ll...

2025-12-06

How are luxury homebuyers holding up amid macro uncertainty?

Description: Investing.com -- Luxury homebuyers are showing clearer signs of resilience even as broad housing demand softens under persistent macro uncertainty, according to Citi’s latest read on high-end market trends.

2025-12-05

Stocks to watch next week: Broadcom, Adobe, Oracle, British American Tobacco and Berkeley

Description: Earnings preview of key companies reporting next week and what to look out for

Bank of America Shares Climb 23.1% YTD: Is It Too Late to Buy?

Description: BAC shares are up 23.1% YTD, yet with NII growth, $40B in buybacks and a tech-driven strategy, the stock still looks attractive.

Will 2026 be a Great Year for Banks? ETFs in Focus

Description: Could 2026 be a great year for banks as rates stabilize, credit demand rises and earnings surge? Bank ETFs like IYG, IYF, KBWB, XLF and VFH may benefit.

Citi to Continue to Be Overweight on Banks in 2026

Description: Beata Manthey, Citi's European equity strategy head, talks about the outlook for 2026. "We continue to be overweight banks into the next year," she tells Bloomberg Television. Manthey adds that Citi has also upgraded industrials and basic resources to overweight.

2025-12-04

Citigroup (C) Laps the Stock Market: Here's Why

Description: Citigroup (C) concluded the recent trading session at $107.79, signifying a +1% move from its prior day's close.

Salesforce Earnings Might Have Been Good Enough to End Its Stock’s 3 Quarter Losing Streak

Description: Salesforce stock was rising Thursday after the company reported better-than-expected third-quarter earnings but missed on revenue. The company has fallen despite earnings beats in recent quarters, but look set to end that losing streak. Salesforce earnings, as per usual, were fine.

The U.S. Dollar Has Its Fans. Why Citi Is High on Next Year.

Description: The U.S. dollar has had a tough run this year and many expect the path to get tougher. The currency is lower compared to its major foreign counterparts as evidenced by the U.S. dollar index trading at 98.96 versus 109 earlier this year. About 18 researchers expect the exchange rate to move to 1.2 next year, according to a Bloomberg consensus highlighted by Citi.

Wells Fargo Stock Hits Record High: Buy, Hold or Take Profits?

Description: WFC hits a record high as the asset cap removal, rising NII outlook and strong capital moves fuel momentum. Let us find out how to play the stock now.

2025-12-03

A Key Citi Exec Leaves as the Bank Overhauls Its Wealth Business

Description: The chief operating officer of Citigroup wealth management division is leaving the bank after two decades at the company, the latest in a series of top leadership changes at the firm as Citi remakes itself. Valentin Valderrabano, who has helped oversee significant structural changes to the wealth business in recent years, is leaving the firm to pursue an outside opportunity, wealth head Andy Sieg said Tuesday in a memo to employees that was viewed by Barron’s. Valderrabano is leaving at a critical time.

Has Citi’s 47% 2025 Surge Fully Reflected Its Restructuring and Earnings Potential?

Description: If you have been wondering whether Citigroup is still a value play after its big run, you are not alone. This article is here to break that question down in a practical way. The stock has climbed 2.0% in the last week, 1.9% over the past month, and 47.5% year to date, adding up to 48.5% over 1 year, 155.9% over 3 years, and 111.4% over 5 years. Recent moves in Citigroup have been shaped by a mix of strategic restructuring updates, regulatory developments, and shifting expectations around...

Citigroup Announces Full Redemption of Series W Preferred Stock

Description: NEW YORK, December 03, 2025--Citigroup Inc. is redeeming, in whole, all $1.5 billion aggregate liquidation preference of Series W Depositary Shares representing interests in its 4.000% Fixed Rate Reset Noncumulative Preferred Stock, Series W (the "Preferred Stock").

2025-12-02

Sector Update: Financial Stocks Mixed Late Afternoon

Description: Financial stocks were mixed in late Tuesday afternoon trading, with the NYSE Financial Index increas

Musinsa Eyes $6.8 Billion IPO as Global Fashion Platform Teases New York vs. Seoul Showdown

Description: Backed by KKR and riding a 10 million-user wave, Musinsa's IPO could crown South Korea's next consumer-tech giant.

Morgan Stanley Bullish on Citigroup (C)

Description: Citigroup Inc. (NYSE:C) is one of the best dividend stocks in the financial sector. On November 24, Morgan Stanley analyst Betsy Graseck assigned a Buy rating on Citi, while setting a price target of $134. In a separate business update dated October 27, Citi and Coinbase disclosed their collaboration plan, which improves digital asset payments […]

2025-12-01