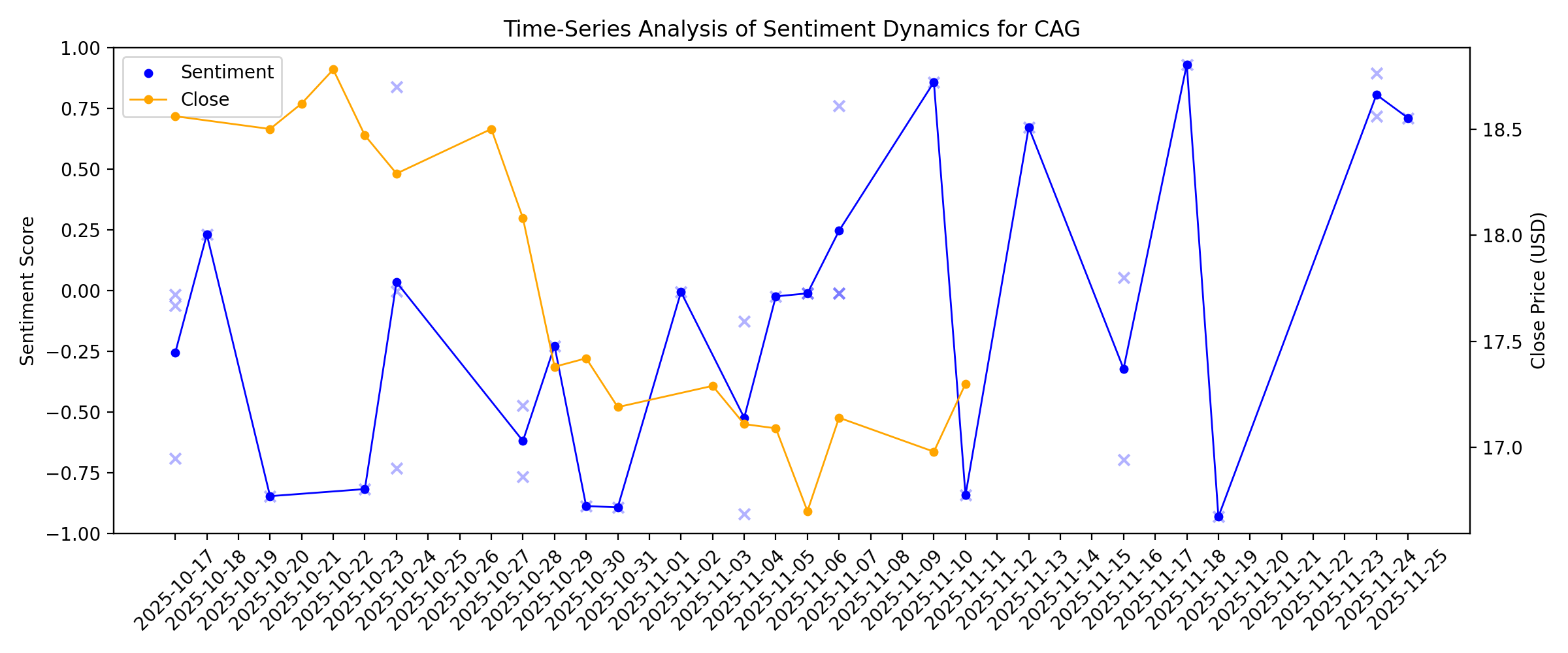

News sentiment analysis for CAG

Sentiment chart

2026-01-14

This Chemicals Company Pays a Nearly 11% Dividend Yield. Investors Are Doubtful.

Description: LyondellBasell’s stock tumbled sharply in 2025, leading to worries about its dividend. But the stock is surging this year.

Conagra Brands' Future of Frozen Food 2026 Reviews Trends Shaping $93.5 Billion Industry

Description: Protein-packed meals, restaurant-inspired favorites, family-style solutions, and all-day breakfast are among the key forces driving growth in the U.S. frozen food aisle, according to Conagra Brands' third annual Future of Frozen Food 2026 report. This data-driven report reveals how consumer behaviors, generational preferences, and innovations are reshaping the $93.5 billion U.S. frozen food market1.

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

This S&P 500 Stock Yields 12% — And It's Already Up 10% This Year

Description: Bummed that income is getting harder to find — now that interest rates are falling? There's a search for a solution in the S&P 500.

2026-01-08

2026-01-07

A Look At Conagra Brands (CAG) Valuation As Project Catalyst Targets Margin Expansion

Description: Conagra Brands (CAG) is in focus after launching Project Catalyst, a business overhaul using AI, data, and automation to cut costs and target margin expansion, while management also reaffirms full year guidance. See our latest analysis for Conagra Brands. Those moves come after a tough stretch for shareholders, with the 1 year total shareholder return down 32.36% and the 3 year total shareholder return down 51.36%, while the recent 90 day share price return of a 9.94% decline suggests...

2026-01-06

'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?

Description: Can AI save this consumer packaged foods company from the relentless margin pressure?

2026-01-05

Conagra (CAG) Target Trimmed as Wells Fargo Updates 2026 Food Sector Models

Description: Conagra Brands, Inc. (NYSE:CAG) is included among the 13 Best January Dividend Stocks to Invest in. On January 5, Wells Fargo lowered its price target on Conagra Brands, Inc. (NYSE:CAG) to $18 from $19 and kept an Equal Weight rating. The move came as the firm updated models across the Beverage, Food, and HPC space […]

2026-01-04

3 Dividend Stocks to Hold for the Next 3 Years

Description: In the medium to long term, these three dividend stocks could provide juicy payouts and strong price appreciation.

2026-01-03

2026-01-02

UBS Maintains Neutral Rating on Conagra Brands (CAG)

Description: Conagra Brands, Inc. (NYSE:CAG) is one of the top cheap stocks under $20 to buy now. UBS analyst Peter Grom cut the price target on Conagra Brands, Inc. (NYSE:CAG) to $18 from $19 on December 23 and maintained a Neutral rating on the shares. The rating came after Conagra Brands, Inc. (NYSE:CAG) reported results for […]

2026-01-01

2025-12-31

Top Natural and Organic Food Stocks for 2026 as Consumers Go Healthier

Description: United Natural Foods, Beyond Meat, Vital Farms and General Mills are betting big on organic, clean-label foods and redefining what's healthy on store shelves.

2025-12-30

Revenue Opportunities and Competition in the UK Meat Snacks Market, 2025-2033, Featuring Nestle, Hormel Foods, Conagra Brands, Bridgford Foods, Hershey and More

Description: United Kingdom Meat Snacks Market United Kingdom Meat Snacks Market Dublin, Dec. 30, 2025 (GLOBE NEWSWIRE) -- The "United Kingdom Meat Snacks Market Report by Product, Nature, Distribution Channel and Regions and Company Analysis, 2025-2033" has been added to ResearchAndMarkets.com's offering. United Kingdom Meat Snacks Market is anticipated to grow from US$ 335.18 million in 2024 to US$ 557.69 million by the year 2033, demonstrating a strong Compound Annual Growth Rate of 5.82% during the perio

2025-12-29

Conagra Brands Inc (CAG) Q2 2026 Earnings Call Highlights: Strategic Investments Drive Growth ...

Description: Conagra Brands Inc (CAG) reports strong performance in frozen and snacks segments, despite facing macroeconomic pressures and a decline in organic net sales.

2025-12-28

2025-12-27

“Conagra (CAG)’s Quarter Was Just Okay,” Says Jim Cramer

Description: We recently published 9 Stocks Jim Cramer Talked About. Conagra Brands, Inc. (NYSE:CAG) is one of the stocks on Jim Cramer talked about. Conagra Brands, Inc. (NYSE:CAG) is a consumer packaged goods company. After the firm reported its second-quarter earnings in December, RBC Capital cut its share price target to $20 from $22 and kept a […]

2025-12-26

2025-12-25

2025-12-24

Assessing Conagra After a 38.3% Slide and Deep Discount to Estimated Cash Flow Value

Description: Wondering if Conagra Brands is a beaten down staple stock hiding real value, or a name that deserves its slump? This breakdown will help you cut through the noise and focus on what the numbers actually say. The share price has slid to about $17.08, leaving the stock down 4.7% over the last week and 38.3% year to date. This long losing streak has many investors asking whether the risk or the opportunity is now bigger. Recent moves have been shaped by concerns around packaged food demand,...

Conagra’s Big Impairment and GLP-1 Pivot Could Be A Game Changer For Conagra Brands (CAG)

Description: Conagra Brands has already reported fiscal second-quarter 2025 results showing sales of US$2,979.1 million, a net loss of US$663.6 million, and US$968 million in non-cash goodwill and brand impairment charges tied to a sustained decline in its share price and market capitalization. Despite weaker earnings and impairment-related losses, Conagra kept its quarterly dividend at US$0.35 per share and highlighted share gains in key categories like single-serve frozen meals while repositioning...

Weight-loss pill approval spurs food industry overhaul

Description: <body><p>STORY: Packaged food makers and fast-food chains could be forced to overhaul more of their products next year as a newly-approved weight-loss pill hits the market.</p><p>That's according to food industry analysts who spoke to Reuters.</p><p>The U.S. Food and Drug Administration approved Novo Nordisk's Wegovy GLP-1 pill on Monday, sending shares of food companies down on Tuesday.</p><p>Eli Lilly's rival medication is expected to gain approval from regulators next year.</p><p>Up until now, GLP-1 medications have only been available in injectible form.</p><p>More Americans are expected to try the drugs as a pill rather than as a shot because the medication will be cheaper and many patients are hesitant to inject themselves.</p><p>Food companies including Conagra Brands and Nestle are already dealing with shifts in consumer tastes toward higher protein and smaller portions due to the popularity of weight-loss injections. </p><p>Earlier this year, Conagra started labeling some of its Healthy Choice frozen meals with high protein and fiber as, quote, "GLP-1 friendly." </p><p>Nestle, the world's biggest food company, has also introduced new frozen meals that cater specifically to GLP-1 users, called Vital Pursuit. </p><p>Some 40% of American adults are obese, U.S. government data shows, and around 12% of adults say they currently take GLP-1 drugs, according to a poll published last month by health policy research organization KFF.</p></body>

2025-12-23

2025-12-22

Conagra Brands Reports 'Softer' Fiscal Q2 as One-time Factors Weigh on Results, RBC Says

Description: Conagra Brands (CAG) reported a softer fiscal Q2, affected by several timing issues and one-time fac

Company News for Dec 22, 2025

Description: Companies In The News Are: FDX, HEI, CCL, CAG.

2025-12-21

Conagra Brands (NYSE:CAG) Has Affirmed Its Dividend Of $0.35

Description: Conagra Brands, Inc. ( NYSE:CAG ) has announced that it will pay a dividend of $0.35 per share on the 26th of February...

2025-12-20

2025-12-19

Conagra Brands Inc (CAG) Q2 2026 Earnings Call Highlights: Navigating Growth Amidst Market ...

Description: Conagra Brands Inc (CAG) anticipates organic sales growth and strategic advancements despite inflationary pressures and market volatility.

Conagra's $1.39 Shock Loss Sets Up a High-Stakes Comeback

Description: Food giant doubles down on full-year targets despite deep impairments and falling sales.

The Hidden Link Between Gas Prices and Slim Jim Sales

Description: An unusual correlation between gas prices and meat sticks is a rare boon in a tough time for the food business. Conagra said Friday that lower prices at the pump this year have boosted convenience-store traffic—and in turn, sales of its Slim Jim brand. CEO Sean Connolly explains: When gas prices are high, drivers are less inclined to head inside for a snack.

Why Conagra (CAG) Shares Are Trading Lower Today

Description: Shares of packaged foods company Conagra Brands (NYSE:CAG) fell 2.9% in the morning session after the company reported weak fourth-quarter results that showed a significant drop in sales and a swing to a net loss.

Carnival stock pops, Lamb Weston plunges, Conagra costs weigh

Description: Carnival (CCL), Lamb Weston (LW), and Conagra Brands (CAG) are some of the trending stocks that investors are watching on Yahoo Finance. Market Catalysts Host Julie Hyman outlines the stories that are driving interest in these names. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Pre-Markets Mixed on Last Trading Day of the Week

Description: Pre-Markets Mixed on Last Trading Day of the Week

Conagra's Q2 Earnings Top Estimates, Organic Sales Decline 3%

Description: CAG beat Q2 EPS estimates, but sales fell 6.8% and organic net sales dropped 3% as volumes declined amid a tough consumer backdrop.

Are the Markets Setting Up for a Santa Claus Rally?

Description: With equilibrium still being sought in the indexes this morning, it appears we are currently in a sweet spot for a Santa Claus Rally to occur.

Compared to Estimates, Conagra Brands (CAG) Q2 Earnings: A Look at Key Metrics

Description: The headline numbers for Conagra Brands (CAG) give insight into how the company performed in the quarter ended November 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Conagra Sales Decline as Consumer Spending Remains Challenged

Description: Conagra logged lower sales in its latest quarter as consumers continued to pull back on spending on its products.

Conagra Brands (CAG) Tops Q2 Earnings Estimates

Description: Conagra Brands (CAG) delivered earnings and revenue surprises of +2.27% and -0.35%, respectively, for the quarter ended November 2025. Do the numbers hold clues to what lies ahead for the stock?

Conagra (NYSE:CAG) Posts Q4 CY2025 Sales In Line With Estimates

Description: Packaged foods company Conagra Brands (NYSE:CAG) met Wall Streets revenue expectations in Q4 CY2025, but sales fell by 6.8% year on year to $2.98 billion. Its non-GAAP profit of $0.45 per share was 3.2% above analysts’ consensus estimates.

Stocks Mostly Up Pre-Bell as Traders Digest Latest Inflation Data

Description: The benchmark US stock measures were mostly pointing higher before the opening bell on Friday as tra

CONAGRA BRANDS REPORTS SECOND QUARTER RESULTS

Description: Today Conagra Brands, Inc. (NYSE: CAG) reported results for the second quarter of fiscal year 2026, which ended on November 23, 2025. All comparisons are against the prior year fiscal period, unless otherwise noted.

2025-12-18

Conagra Brands (CAG): Reassessing Valuation as Earnings Pressure Mounts and Dividend Yield Stays Elevated

Description: Conagra Brands (CAG) just reaffirmed its quarterly dividend at $0.35 per share, even as Wall Street braces for weaker second quarter earnings. That combination is exactly why the stock is drawing fresh attention. See our latest analysis for Conagra Brands. At a latest share price of $17.80, Conagra has seen a modest 1 month share price return, while its 1 year total shareholder return is still deeply negative. This signals that sentiment has been improving at the margin, although long term...

Carnival earnings, home sales, consumer sentiment: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come tomorrow, Friday, December 19, including earnings results from Conagra Brands (CAG) and cruise operator Carnival Corporation (CCL), existing home sales data, and the latest reading on consumer sentiment for the month of December. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Conagra Brands Earnings Preview: What to Expect

Description: Conagra Brands is scheduled to announce its fiscal second-quarter earnings tomorrow, and analysts project a double-digit profit drop.

Conagra Brands Announces Quarterly Dividend Payment

Description: Conagra Brands, Inc. (NYSE: CAG) today announced that its Board of Directors approved a quarterly dividend payment of $0.35 per share of CAG common stock to be paid on February 26, 2026 to stockholders of record as of the close of business on January 27, 2026. Conagra Brands, Inc. has paid consecutive quarterly dividends since January 1976.

Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500?

Description: These dividend stocks' high yields could be tempting, but they come with catches.

2025-12-17

Conagra Brands' Fundamentals 'Still Cold' Despite Low Expectations, RBC Says

Description: Conagra Brands (CAG) is expected to report a largely in-line fiscal Q2 performance though near-term

Lamb Weston Q2 Earnings on Deck: Key Factors You Should Understand

Description: LW's second-quarter results are likely to show softer revenues and pricing pressure, partly offset by steady volume growth and benefits from restructuring efforts.

General Mills (GIS) Surpasses Q2 Earnings and Revenue Estimates

Description: General Mills (GIS) delivered earnings and revenue surprises of +7.84% and +1.89%, respectively, for the quarter ended November 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-12-16

Conagra Sets the Tone for Q2 Earnings: Things to Watch for CAG Stock

Description: CAG's Q2 results are set to show a business in recovery mode, with restored service levels, a value-focused strategy and margin pressure from rising costs.

2025-12-15

General Mills Prepares for Q2 Earnings: Things to Watch for GIS Stock

Description: GIS approaches Q2 earnings with sales and margins under pressure as price resets and pet launch costs weigh, even as volumes and brand health show improvement.

Is Conagra Brands Stock Underperforming the S&P 500?

Description: Conagra Brands has lagged behind the broader S&P 500 Index over the past year and analysts are cautious about its future potential.

2025-12-14

Trump's Fed pick comes into focus, economic data backlog clears: What to watch this week

Description: With the December Fed meeting in the rear view, investor attention will turn toward Fed chair nomination drama and the potential for a Santa rally (or not)

2025-12-13

2025-12-12

Conagra Brands (CAG) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

Description: Conagra Brands (CAG) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-12-11

2025-12-10

2025-12-09

58 S&P 500 Stocks Have Dividends Higher Than Treasuries. 10 Look Better Than Bonds.

Description: As Treasury yields fall, dividend stocks with higher payouts and room to maintain them are becoming an appealing bond alternative.

Campbell's (CPB) Q1 Earnings and Revenues Beat Estimates

Description: Campbell (CPB) delivered earnings and revenue surprises of +5.48% and +0.67%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Does Conagra’s Sliding 2025 Share Price Match Its Cash Flow and Earnings Potential?

Description: Wondering if Conagra Brands could be a quietly mispriced staple stock, the kind value minded investors love to uncover? This breakdown will help you decide if it still earns a place on your watchlist. Despite its defensive profile, Conagra's share price has slid, down 3.2% over the last week, roughly flat over 30 days at -0.2%, and much weaker over the longer term with a -38.2% year to date move and -34.1% over the past year. Recent headlines have focused on Conagra's ongoing portfolio...

Did Weakening Demand and a Stretched Dividend Just Shift Conagra Brands' (CAG) Investment Narrative?

Description: In recent months, Conagra Brands has faced weakening demand, falling unit sales, and persistent category challenges, while continuing to operate with high debt and a dividend payout ratio near 80% that some investors now view as vulnerable. Institutional repositioning, bearish analyst ratings, and concerns that past profit drivers are fading suggest investors are increasingly questioning the durability of Conagra’s cash flows and income appeal. Against this backdrop of falling unit sales and...

2025-12-08

Conagra (CAG) Shares Remain Under Pressure as Goldman Sachs Cuts Target

Description: Conagra Brands, Inc. (NYSE:CAG) is included among the 11 Worst Performing Dividend Stocks Year-to-Date. On November 25, Goldman Sachs trimmed the firm’s price target on Conagra Brands, Inc. (NYSE:CAG) to $16 from $18 and maintained a Sell rating on the shares. Conagra Brands, Inc. (NYSE:CAG) is down by nearly 39% since the start of 2025 […]

10 Dividend Stocks That Look Better Than Bonds

Description: As Treasury yields fall, dividend stocks with higher payouts and room to maintain them are becoming an appealing bond alternative.

2025-12-07

Bath & Body Works Stock Tanked After Earnings. Directors Bought Up Shares.

Description: Bath & Body Works stock tanked following the release of third-quarter numbers, compounding an already grim year for the retailer. Six company directors recently bought up shares. Shares plunged 25% on Nov. 20 to $15.82, their largest single-day percentage drop in over five years, after the retailer missed earnings projections and cut its fiscal-year forecast.

2025-12-06

2025-12-05

Interest Rates Are Going Lower: 4 Quality 7%+ Dividend Stocks to Buy Now

Description: Four of our favorite high-yield dividend stocks are attractive from both yield and fundamental perspectives and offer outstanding entry points at current trading levels.

SCCM Enhanced Equity Income Fund Sold Conagra (CAG) in Q3

Description: Cullen Capital Management, LLC, operating under the name Schafer Cullen Capital Management, Inc. (SCCM), has released its “SCCM Enhanced Equity Income Fund” third-quarter investor letter. A copy of the letter can be downloaded here. US equities continued to rise in the third quarter, with the S&P 500 returning 8.1% while the Russell 1000 Value was up 5.3%. […]

2025-12-04

Conagra Brands (CAG): Assessing Valuation After Recent Share Price Weakness

Description: Conagra Brands (CAG) has been grinding through a weak share price stretch, and that kind of slide usually makes investors ask a simple question: is this just dead money or quiet value? See our latest analysis for Conagra Brands. At around $16.95, Conagra’s recent slide in its share price, including a notably weak year to date share price return and a deep three year total shareholder return loss, suggests momentum has been fading as investors reassess growth and margin resilience. If this...

2025-12-03

2025-12-02

Kraft Heinz, Mondelez, PepsiCo, Coca-Cola, General Mills Among Food Makers Sued by San Francisco Over Ultra-Processed Products

Description: Kraft Heinz (KHC), Mondelez (MDLZ), PepsiCo (PEP), Coca-Cola (KO), General Mills (GIS), Post Holding

Thompson, Siegel, & Walmsley Adds $36 Million of ConAgra: Is the Stock a Buy?

Description: ConAngra has quickly become TSW's 7th-largest holding.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

Is Conagra Still a Bargain After Big Leadership Changes and a 36% Drop in 2025?

Description: Wondering if Conagra Brands is a hidden gem or an overlooked risk? You're not alone, and the answer could surprise even seasoned investors. The stock has seen some ups and downs lately, with a 2.3% gain over the past week but still down a steep 36.7% year-to-date. Recent headlines have spotlighted Conagra's strategic moves in the food industry, including product innovation and leadership changes. Both are aiming to adapt to shifting consumer trends. These developments have sparked fresh...

2025-11-24

Meat Snacks Market Competitive Landscape Report 2025: Recent Developments, Company Strategies, Sustainability Benchmarking, Product Launches, Key Persons, and Revenue Forecasts

Description: The global meat snacks market is projected to grow from $9.56 billion in 2024 to $16.57 billion by 2033, at a CAGR of 6.30%. This growth is driven by increasing demand for convenient, high-protein snacks, flavor innovations, and clean-label offerings. Notable companies contributing to this growth include Nestlé, Hormel Foods, Conagra Brands, and Jack Link's. New product launches by Tyson Foods and Danish Crown highlight the industry’s focus on protein-rich and healthier options. Emerging economi

Yeast Market Competitor Landscape Report 2025: Recent Developments, Company Strategies, Sustainability Benchmarking, Product Launches, Key Persons, and Revenue Forecasts

Description: The global yeast market is poised for significant growth, with an expected increase from US$ 6.56 Billion in 2024 to US$ 13.79 Billion by 2033, at a CAGR of 8.60%. This expansion is driven by the rising demand for yeast across food, beverage, pharmaceutical, and animal feed sectors. Key applications include baking, brewing, and fermentation, enhancing flavor and nutritional value. Natural, clean-label trends, alongside technological advancements in yeast strains, are further propelling market gr

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

Conagra Brands to Release Fiscal 2026 Second Quarter Earnings on December 19, 2025

Description: Conagra Brands, Inc. (NYSE: CAG) will release its fiscal 2026 second quarter results on Friday, December 19, 2025. A press release and supplemental materials, including pre-recorded remarks, will be issued that morning prior to a live question-and-answer session with the investment community at 9:30 a.m. ET.

2025-11-18

Will McCormick Be Able to Sustain Its 2% Organic Growth in 2026?

Description: MKC posts its fifth straight quarter of volume-led growth as consumer demand and brand investment offset tariff and cost pressures.

2025-11-17

2025-11-16

Conagra Brands (CAG): Is the Current Valuation Attractive After Latest Share Price Dip?

Description: Conagra Brands (CAG) has experienced a series of shifts in its stock performance recently. Investors are keeping an eye on its valuation, especially after the past month saw a nearly 6% drop in share price. See our latest analysis for Conagra Brands. While Conagra Brands' share price has struggled for momentum this year, with a 1-year total shareholder return of -30.14%, the recent modest uptick in the past week suggests sentiment could be stabilizing. Despite new pressures, its longer-term...

Jim Cramer Notes Conagra’s “Flat Revenues for Multiple Years”

Description: Conagra Brands, Inc. (NYSE:CAG) is one of the stocks Jim Cramer discussed recently. A caller asked if the stock is a dividend trap or if they should start “nibbling” on it. Here’s what Mad Money’s host had to say: “The revenues are flat for Conagra for multiple years. I do not invest in companies that […]

2025-11-15

2025-11-14

2025-11-13

Conagra Brands Honors Employee Innovation with Its Sustainable Development Awards

Description: Conagra Brands (NYSE: CAG) announced the winners of its annual Sustainable Development Awards, honoring employees for their exceptional contributions that encourage sustainable behaviors across the organization. The program recognizes initiatives in five key areas, Climate Change, Water Reduction, Waste Reduction, Packaging, and Responsible Practices, and includes an overall "Award of Excellence" for the project that best reflects Conagra's six Timeless Values: Integrity, External Focus, Broad-M

2025-11-12

2025-11-11

5 Highest Yielding Dividend Stocks in the S&P 500

Description: The first thing that comes to mind when we speak about the S&P 500 is the biggest tech companies, high valuations, and fastest-moving giants. The S&P 500 is packed with the biggest and the best companies, celebrated for the price swings, cash flow, and high upside potential. The index is massive and is often associated ... 5 Highest Yielding Dividend Stocks in the S&P 500

2025-11-10

This Dividend Stock Yields More Than 8% and Analysts Say You Can ‘Count on It’ Here

Description: Conagra pays a quarterly dividend of $0.35 per share, translating to an 8.19% yield—more than four times the sector average, with a payout ratio near 79% and a record of five consecutive annual increases.

2025-11-09

2025-11-08

2025-11-07

The Bull Case For Conagra Brands (CAG) Could Change Following Upbeat Q1 and Maintained Guidance Despite Inflation

Description: Conagra Brands recently reported better-than-expected Q1 2026 revenue and adjusted EPS, while also reaffirming its annual forecasts despite ongoing inflation and tariff pressures. The company's approach to managing rising costs through pricing actions and cost-saving initiatives has drawn investor interest given the current economic climate. Let’s explore how maintaining full-year guidance in the face of inflationary pressure reshapes Conagra Brands’ investment narrative. Explore 27 top...

PepsiCo to shutter 2 Frito-Lay facilities in Florida, lay off 500 workers

Description: The closures mark the latest response by the food and beverage giant to a slowdown in snack consumption and a shift toward healthier offerings.

Why Staples Aren’t Safe Anymore—and 11 Stocks That May Be Worth a Look

Description: For a sector known for safety, consumer staples have been living dangerously. It’s been a tough year for consumer staples. The exchange-traded fund is down 1.7% this year, while all other sectors were in the green as of Wednesday’s close.

2025-11-06

1 Consumer Stock Worth Investigating and 2 We Turn Down

Description: Regarded as defensive investments, consumer staples stocks are generally safe bets in choppy markets. The flip side is that they frequently fall behind growth industries when times are good, and this perception became a reality over the past six months as the sector was down 8.3% while the S&P 500 was up 20.1%.

Conagra ramps production after supply setbacks

Description: The food maker prioritized rebuilding store inventory in product categories affected by shortages in the last fiscal year.

2025-11-05

Conagra Brands Stock: Analyst Estimates & Ratings

Description: As Conagra Brands has lagged behind the broader market over the past year, Wall Street analysts maintain a cautious outlook on the stock’s prospects.

2025-11-04

10 High-Yield Dividend Stocks You Can Count On

Description: Here are some high-yielding stocks in the S&P 500 that still boast healthy looking profits to cover coming payout obligations.

Conagra Brands to Participate in the J.P. Morgan U.S. Opportunities Forum

Description: Conagra Brands, Inc. (NYSE: CAG) will attend the J.P. Morgan U.S. Opportunities Forum on Wednesday, November 12.

2025-11-03

2025-11-02

Does Conagra’s 38% Share Price Drop Signal a Value Opportunity in 2025?

Description: If you have ever found yourself wondering whether Conagra Brands is a bargain or a value trap, you are in the right place. Despite a challenging few months, with Conagra’s stock price down 6% over the last week and nearly 38% year-to-date, there are important clues about future potential hidden in that volatility. Recent headlines have spotlighted industry shifts and changing consumer trends, both of which have played a role in Conagra’s share price decline. News about increased competition...

2025-11-01

2025-10-31

Why Is Conagra Brands (CAG) Down 9.2% Since Last Earnings Report?

Description: Conagra Brands (CAG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-10-30

2 Stocks Insider Keep Buying

Description: It can be a good idea for traders and long-term investors to keep tabs on what insiders (think directors, the CEO, CFO, and a whole bunch of other executives) are up to when it comes to their own shares. Undoubtedly, there may be a ton of reasons as to why an executive would sell shares ... 2 Stocks Insider Keep Buying

2025-10-29

Top Natural Food Stocks to Watch as the Clean-Eating Trend Grows

Description: Vital Farms, United Natural Foods and Conagra Brands are betting big on organic, clean-label foods and redefining what's healthy on store shelves.

2025-10-28

Uh Oh !! Cathie Wood Predicts “Reality Check” (Sell-off) – 5 High-Yield Dividend Safety Stocks

Description: Following in the footsteps of David Solomon at Goldman Sachs and Jamie Dimon at JPMorgan, Ark Investments guru Cathie Wood recently warned of the potential for a reality check for the stock market after the massive Artificial Intelligence rally that has driven the major indices to all-time highs over the last three years. Of course, ... Uh Oh !! Cathie Wood Predicts “Reality Check” (Sell-off) – 5 High-Yield Dividend Safety Stocks

Bernstein Maintains a Hold Rating on Conagra Brands (CAG)

Description: Conagra Brands, Inc. (NYSE:CAG) is one of the Best 52-Week Low Mid Cap Stocks to Buy Now. On October 10, Bernstein analyst Alexia Burland Howard maintained a Hold rating on Conagra Brands, Inc. (NYSE:CAG) without disclosing any price target. The cautious rating comes after the company released its fiscal Q1 2026 results on October 1. […]

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Conagra Brands (CAG): Assessing Fair Value After Recent Share Price Weakness

Description: Conagra Brands (CAG) shares have drifted in the past month, even as the broader food sector has weathered its own changes. Looking at recent moves, investors might be curious about the drivers impacting the stock’s performance now. See our latest analysis for Conagra Brands. After a tough stretch for food stocks in general, Conagra Brands’ share price return remains firmly in the red, down over 33% year-to-date, and the one-year total shareholder return slipped a similar 33%. This suggests...

United States Diabetic Food Market Trends and Company Analysis Report 2025-2033 Featuring Nestle, Unilever, Kellogg Co, Conagra Brands, Tyson Foods, The Hershey Co, and Hain Celestial

Description: The United States diabetic food market is projected to reach US$ 7.35 billion by 2033, growing from US$ 4.4 billion in 2024 at a CAGR of 5.85%. This growth is fueled by rising health consciousness, increased diabetes prevalence, and demand for low-calorie, low-sugar options. Consumer interest in blood glucose management is driving expansion, as is the innovation in snacks, drinks, and meal solutions. Retail and e-commerce channels enhance accessibility, while challenges include high product cost

1 Profitable Stock with Exciting Potential and 2 We Ignore

Description: Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

2025-10-23

3 Consumer Goods Stocks That Are Screaming Deals Right Now

Description: Grab these bargains while they remain at dirt-cheap prices.

2025-10-22

2025-10-21

2025-10-20

Valmont Appoints William Eric Johnson as Chief Accounting Officer

Description: OMAHA, Neb., October 20, 2025--Valmont® Industries, Inc. (NYSE: VMI), a global leader that provides products and solutions to support vital infrastructure and advance agricultural productivity, today announced William "Eric" Johnson will join the company as Chief Accounting Officer effective October 20, 2025. Mr. Johnson will be an integral leader on the finance team overseeing the Company’s accounting and SEC reporting functions, and reporting directly to Tom Liguori, Executive Vice President a

2025-10-19

2025-10-18

Is New Financial Leadership Amid Tariff Pressures Shaping the Outlook for Conagra Brands (CAG)?

Description: Earlier this month, Conagra Brands appointed Melissa Napier as Senior Vice President and Corporate Controller following the previously announced departure of William E. Johnson, bringing nearly 25 years of food industry finance experience to the role. This change in financial leadership arrives as the company faces pressures from declining unit sales and higher costs driven by new tariffs on packaging materials, raising questions about future performance. We’ll examine how the anticipated...

2025-10-17

Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500?

Description: The high dividend yields of each of these stocks reflect some business challenges.

ConAgra (CAG) Delivers a “Better Than Feared” Quarter, Says RBC Capital

Description: With a share price drop of nearly 34% in 2025 so far, Conagra Brands, Inc. (NYSE:CAG) is is included among the 10 Best Beaten Down Dividend Stocks to Buy Right Now. On October 2, RBC Capital reaffirmed its Sector Perform rating and $22.00 price target on CAG following the company’s latest quarterly results. The firm described […]

3 Cash-Producing Stocks Walking a Fine Line

Description: Generating cash is essential for any business, but not all cash-rich companies are great investments. Some produce plenty of cash but fail to allocate it effectively, leading to missed opportunities.