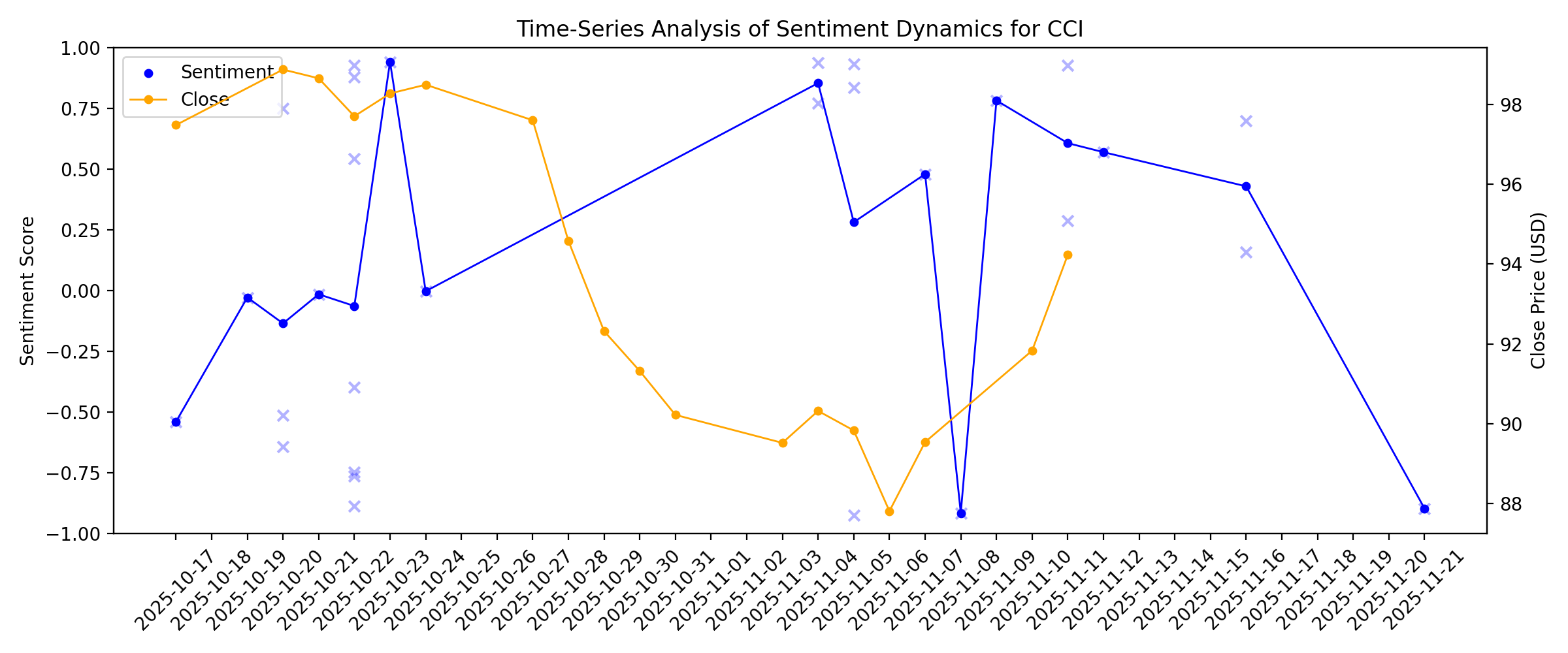

News sentiment analysis for CCI

Sentiment chart

2026-01-14

Crown Castle Terminates Agreement With DISH on Payment Default

Description: CCI cut ties with DISH after payment defaults, seeking over $3.5B owed as the move opens tower capacity for stronger 5G-focused carriers.

2026-01-13

Raymond James Analysts’ Best Picks Could Explode Again in 2026: 4 Red-Hot Dividend Stocks

Description: The Raymond James Best Picks list for 2026 is strong, and we identified four quality stocks for growth and income investors that offer solid dividends and strong upside potential.

Crown Castle price target lowered to $110 from $115 at JPMorgan

Description: JPMorgan lowered the firm’s price target on Crown Castle (CCI) to $110 from $115 and keeps a Neutral rating on the shares. The firm reduced new leasing estimates for the tower companies ahead of earnings to reflect a more conservative approach due to the potential impact from EchoStar. A “modest” industry outlook is outweighed by the EchoStar/Dish overhang, but deals could be a positive catalyst for the tower stocks, the analyst tells investors in a research note.Claim 70% Off TipRanks PremiumUn

2026-01-12

DISH Wireless Defaults on Payment Obligations to Crown Castle

Description: DISH Obligated to Pay Crown in Excess of $3.5 Billion as Crown Castle Terminates ContractHOUSTON, Jan. 12, 2026 (GLOBE NEWSWIRE) -- Crown Castle Inc. (NYSE: CCI) ("Crown Castle") today announced that DISH Wireless (“DISH”) has defaulted on its payment obligations to Crown Castle, causing Crown Castle to terminate its wireless infrastructure agreement with DISH. Statement by Crown Castle: “Crown Castle and many other American businesses helped DISH and its parent company, EchoStar, build its wire

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

A Look At Crown Castle (CCI) Valuation As Fiber Exit And Tower Focus Draw Investor Attention

Description: Why Crown Castle Is On Investors’ Radar Today Crown Castle (CCI) has drawn fresh attention after a period where the stock showed a 1 day return of about a 1.5% decline and a past 3 months return of roughly a 9.6% decline. This recent stretch of weaker returns sits alongside mixed fundamental data, including annual revenue of about US$6.4b and a reported net loss of roughly US$3.9b. This combination may prompt investors to reassess expectations for the tower and fiber operator. See our latest...

2026-01-06

2026-01-05

Here Are Monday’s Top Wall Street Analyst Research Calls: Adobe, Arista Networks, ASML, Coinbase Global, IBM, Marvell Technology, NetFlix, and More

Description: Pre-Market Stock Futures: Futures are mainly trading higher as we start the first full week of trading in 2026. Investors and traders who were missing in action due to the Christmas and New Year’s holiday are returning to a stock market that, for the third consecutive year, did not experience a “Santa Claus rally,” which ... Here Are Monday’s Top Wall Street Analyst Research Calls: Adobe, Arista Networks, ASML, Coinbase Global, IBM, Marvell Technology, NetFlix, and More

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Four Corners Expands Portfolio With Multiple Property Acquisitions

Description: FCPT adds two Buffalo Wild Wings, United Rentals and Sprouts properties across four states, buying multiple net-leased properties at roughly 6.8-6.9% cap rates.

2025-12-30

Terreno Realty Announces Redevelopment Property Lease in Queens

Description: TRNO secures a lease for its redevelopment property. This 48,000-square-foot property is now 100% leased through 2036.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

Crown Castle (CCI) Upgraded to Buy: Here's What You Should Know

Description: Crown Castle (CCI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

2025-12-25

2025-12-24

Americold Partners With OTR to Deliver Storage & Distribution Services

Description: COLD partners with OTR to provide storage and distribution in Adelaide, expanding its expertise into Australia's convenience retail sector.

Four Corners Continues Its Acquisition Spree to Boost Portfolio

Description: FCPT expands its portfolio with $2.6M Crash Champions and $2.2M Olive Garden buys, adding long-term net-leased assets in Ohio and Illinois.

Crown Castle (CCI): Evaluating Valuation After Recent Share Price Weakness

Description: Crown Castle (CCI) has quietly drifted lower over the past few months, even as its underlying tower and fiber business remains central to US wireless networks. That disconnect is where today’s opportunity and risk begins. See our latest analysis for Crown Castle. At around $87.42, Crown Castle’s recent slide, including a weaker 3 month share price return, contrasts with a modestly positive 1 year total shareholder return. This suggests momentum is still fading as investors reassess growth and...

2025-12-23

Key Reasons to Add Crown Castle Stock to Your Portfolio Now

Description: CCI is positioned to benefit from rising wireless data demand, long-term carrier leases and a solid balance sheet supporting network expansion.

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

Is Crown Castle Stock Underperforming the S&P 500?

Description: Crown Castle has significantly underperformed the S&P 500 over the past year, yet analysts remain moderately optimistic about the stock’s prospects.

2025-12-02

Barclays Analyst Bullish on Crown Castle (CCI)

Description: Crown Castle Inc. (NYSE:CCI) is one of the best dividend stocks in the real estate sector. On November 17, Barclays analyst Brendan Lynch upheld a Buy recommendation on CCI with a price target of $104. In a separate business update, dated November 12, Anterix Inc. (NASDAQ:ATEX) and Crown Castle Inc. (NYSE:CCI) revealed that they have […]

2025-12-01

Crown Castle (CCI): Assessing Valuation After Recent Shareholder Return Weakness

Description: Crown Castle (CCI) stock continues to be a topic of investor discussion, as recent price moves have caught the attention of those tracking the company’s position in U.S. communications infrastructure. Its long-term performance trends invite a closer look at current valuation. See our latest analysis for Crown Castle. Crown Castle’s latest share price, at $88.5, reflects a challenging period for the stock. While sentiment has fluctuated with shifts in network investment trends, the 1-year...

Crown Castle to Present at the UBS Global Media and Communications Conference

Description: HOUSTON, Texas, Dec. 01, 2025 (GLOBE NEWSWIRE) -- Crown Castle Inc. (NYSE: CCI) ("Crown Castle") announced today that Chris Hillabrant, Crown Castle’s President and Chief Executive Officer, and Sunit Patel, Crown Castle’s Executive Vice President and Chief Financial Officer are scheduled to present on Tuesday, December 9, 2025 at 1:30 p.m. Eastern Time at the UBS Global Media and Communications Conference. The presentation will be broadcast live over the Internet and is expected to last approxim

Carvana initiated, Zscaler downgraded: Wall Street's top analyst calls

Description: Carvana initiated, Zscaler downgraded: Wall Street's top analyst calls

Here Are Monday’s Top Wall Street Analyst Research Calls: Archer Aviation, Beta Technologies, Carvana, Chevron, MPLX, Toast, Zscaler and More

Description: Pre-Market Stock Futures: Futures are trading lower on Monday as traders and investors return from the Thanksgiving holiday, preparing to start the final trading month of 2025, which has been another outstanding year for investors and the stock market, with the potential for a third year of double-digit gains for the S&P 500 despite a ... Here Are Monday’s Top Wall Street Analyst Research Calls: Archer Aviation, Beta Technologies, Carvana, Chevron, MPLX, Toast, Zscaler and More

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Crown Castle (CCI) Down 8.3% Since Last Earnings Report: Can It Rebound?

Description: Crown Castle (CCI) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

The Bull Case For Crown Castle (CCI) Could Change Following Launch of TowerX Utility Network Service Collaboration

Description: In the past week, Anterix and Crown Castle announced a new turnkey tower service, TowerX, designed to accelerate and optimize 900 MHz private LTE network deployments for utilities by leveraging Crown Castle's nationwide portfolio of 40,000+ tower sites. This collaboration introduces a standardized approach for utility network rollouts, aiming to reduce costs, minimize delays, and improve long-term grid modernization outcomes through the combined expertise and infrastructure of both...

How the Narrative Around Crown Castle Is Evolving Amid Sector Headwinds and Strategic Shifts

Description: Crown Castle stock has seen its price target shift in response to recent market dynamics, with the discount rate nudging upward from 8.13% to 8.55%. While this adjustment is relatively modest, it reflects both optimism and caution from analysts reacting to operational changes and sector events. Stay tuned to discover the drivers behind these updates and learn how to keep informed as the narrative for Crown Castle continues to develop. Analyst Price Targets don't always capture the full story...

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Anterix Launches Groundbreaking Utility Tower Access Product with Crown Castle to Accelerate 900 MHz Private Network Deployments

Description: Crown Castle, one of the nation’s largest tower companies, and Anterix, the leader in private wireless broadband, introduce a nationwide tower optimization solution to streamline costs and accelerate grid connectivity for utilitiesWOODLAND PARK, N.J., Nov. 12, 2025 (GLOBE NEWSWIRE) -- Anterix (NASDAQ: ATEX), the nation’s leader in private wireless broadband for critical infrastructure, and Crown Castle, one of the nation’s largest tower companies, today announced a powerful new turnkey tower ser

2025-11-11

2 Dividend Stocks That Could Outperform If the Fed Keeps Cutting

Description: The U.S. Federal Reserve is in rate-cutting mode, with two 25-bps interest rate reductions already in the books. And while the recent cuts could precede a handful more (there’s still more than enough room for a handful of cuts, given easing inflationary pressures and concerns about the state of the economy), the Fed under chairman ... 2 Dividend Stocks That Could Outperform If the Fed Keeps Cutting

KeyBanc Reaffirms Crown Castle (CCI) Buy Rating Following Strong Q3 Performance

Description: Crown Castle Inc. (NYSE:CCI) ranks among the stocks in Bill Gates’ portfolio that analysts are watching. Following the third-quarter 2025 results for Crown Castle Inc. (NYSE:CCI), KeyBanc reaffirmed its Overweight rating and $120 price target on the company’s shares on October 23. Crown Castle Inc. (NYSE:CCI) delivered better-than-expected results across all key measures in the […]

2025-11-10

2025-11-09

Crown Castle (CCI): Assessing Valuation After Q3 Beat, Raised Outlook, and Strategic Fiber Divestiture

Description: Crown Castle kicked off the week with an upbeat third-quarter earnings report, not only surpassing forecasts but also boosting its 2025 guidance. Leadership reiterated plans to sell the fiber business, which will sharpen the company’s focus on U.S. towers. See our latest analysis for Crown Castle. The upbeat Q3 earnings and higher 2025 outlook gave Crown Castle a brief lift, but shares have come under pressure lately as investors weigh growth against industry headwinds and rental revenue...

2025-11-08

How To Put $100 In Your Retirement Fund Each Month With Crown Castle Stock

Description: Crown Castle Inc. (NYSE:CCI) is a real estate investment trust that owns, operates, and leases shared communications infrastructure, primarily cell towers and fiber networks. The 52-week range of Crown Castle stock price was $84.20 to $115.76. Crown ...

2025-11-07

BMO Capital Remains Bullish on Crown Castle Inc. (CCI) Following Strong Q3 Performance

Description: Representing 0.31% of Bill Gates’s stock portfolio, Crown Castle Inc. (NYSE:CCI) is one of his top 15 stock picks. On October 23, 2025, BMO Capital’s Ari Klein reiterated his “Buy” rating on Crown Castle Inc. (NYSE:CCI) with a $114 price target. Alongside the company’s strong performance in the third quarter, the analyst cited the company’s […]

2025-11-06

2025-11-05

Crown Castle Declares Quarterly Common Stock Dividend

Description: HOUSTON, Nov. 05, 2025 (GLOBE NEWSWIRE) -- Crown Castle Inc. (NYSE: CCI) ("Crown Castle") announced today that its Board of Directors has declared a quarterly cash dividend of $1.0625 per common share. The quarterly dividend is payable on December 31, 2025 to common stockholders of record at the close of business on December 15, 2025. Future dividends are subject to the approval of Crown Castle’s Board of Directors. ABOUT CROWN CASTLE Crown Castle owns, operates and leases approximately 40,000 c

Iron Mountain's Q3 AFFO Beats, Revenues Improve Y/Y, Dividend Raised

Description: IRM posts solid Q3 growth with AFFO up 16.8% and strong data center gains while boosting its dividend by 10%.

Do Wall Street Analysts Like Crown Castle Stock?

Description: While Crown Castle has underperformed relative to the broader market over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-11-04

SBA Communications' Q3 AFFO Beats Estimates, Revenues Grow Y/Y

Description: SBAC posts solid Q3 revenue growth and beats AFFO estimates, driven by strong site-leasing and development activity.

Crown Castle: Tower-Only, Measurable Growth that Compounds into AFFO

Description: Sustain ~4.5--5.0% U.S. tower organic growth (ex-Sprint) and convert escalators plus high-margin amendments into rising site-rental revenue.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Crown Castle (CCI): Forecast Profit Growth Challenges Bearish Narratives Despite Revenue Declines

Description: Crown Castle (CCI) reported continued losses, with net income declining at an annualized rate of 47% over the last five years. The company’s earnings are forecast to rise dramatically, with an average increase of 89.88% per year and an expectation to turn profitable within three years. However, revenue is projected to shrink by 9.1% per year in that same period. Shares are currently trading at $98.27, which is well below the estimated fair value of $127.83. Investors are weighing the...

2025-10-23

Crown Castle's Q3 AFFO Beats, Revenues Fall Y/Y, '25 View Raised

Description: CCI's Q3 AFFO beat is fueled by stronger services revenue growth, partly offset by lower site rental income and higher costs.

2025-10-22

Crown Castle Inc (CCI) Q3 2025 Earnings Call Highlights: Strong Organic Growth Amid Sprint ...

Description: Crown Castle Inc (CCI) reports a robust quarter with increased full-year outlook, despite challenges from Sprint cancellations and strategic shifts.

Crown Castle (CCI) Q3 2025 Earnings Transcript

Description: As a result, adjusted EBITDA, AFFO, and AFFO per share in our 2025 outlook and quarterly results may not be representative of the company's anticipated performance following the close of the sale. Chris Hillebrandt: Thank you, Kris, and good afternoon, everyone. It's an honor to address you for the first time as CEO of Crown Castle.

Crown Castle (CCI) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: While the top- and bottom-line numbers for Crown Castle (CCI) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Crown Castle raises annual site rental revenue forecast on robust demand

Description: Crown Castle derives majority of its revenue from leasing out tower infrastructure to U.S. wireless carriers such as AT&T, T-Mobile US, and Verizon Communications on a long-term basis. With about 40,000 cellular towers across the U.S., Crown Castle is looking to focus on growing its tower business, which is expected to benefit from the largest U.S. carriers upgrading their networks to 5G and increasing capacity to meet booming data demand. The real estate investment trust now sees annual site rental revenue in the range of $4.01 billion to $4.05 billion, compared with its earlier projection of between $4 billion and $4.04 billion.

Crown Castle (CCI) Q3 FFO and Revenues Beat Estimates

Description: Crown Castle (CCI) delivered FFO and revenue surprises of +7.69% and +1.98%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Crown Castle: Q3 Earnings Snapshot

Description: The results beat Wall Street expectations. The Houston-based real estate investment trust said it had funds from operations of $490 million, or $1.12 per share, in the period. The average estimate of four analysts surveyed by Zacks Investment Research was for funds from operations of $1.04 per share.

Crown Castle Reports Third Quarter 2025 Results and Increases Outlook for Full Year 2025

Description: HOUSTON, Oct. 22, 2025 (GLOBE NEWSWIRE) -- Crown Castle Inc. (NYSE: CCI) ("Crown Castle") today reported results for the third quarter ended September 30, 2025 and updated its full year 2025 Outlook, as reflected in the table below. (dollars in millions, except per share amounts)Current Full Year 2025 Outlook Midpoint(a)Full Year 2024 Actual% ChangePrevious Full Year 2025 Outlook(b)Current Compared to Previous OutlookSite rental revenues(c)$4,030$4,268(6)%$4,020$10Net income (loss)$285$(3,903)N/

2025-10-21

What's in Store for Crown Castle Stock This Earnings Season?

Description: Customer concentration and high interest expenses are likely to impact CCI's Q3 results despite its unmatched portfolio of wireless communication infrastructure assets.

2025-10-20

Crown Castle Q3 2025 Preview: Fiber Exit Tests the Tower-REIT's Focus

Description: As it moves toward a pure-play tower model, investors want clarity on growth, 5G demand, and dividend strength.

Tower-Focused Strategy Might Change The Case For Investing In Crown Castle (CCI)

Description: Crown Castle recently announced it is shifting to a pure-play U.S. tower operator by divesting its small cells and fiber solutions businesses, while raising its 2025 outlook due to stronger demand and improved operating efficiency. This strategic focus leaves Crown Castle trading at a premium to peers, reflecting the high value placed on the predictability of its core tower operations, which could in turn affect future return expectations. We'll explore how the company’s renewed focus on...

Crown Castle Delivers Stability but Premium Price Caps Returns

Description: Crown Castle is a high-quality tower operator with durable assets, but its premium valuation limits upside.

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

2025-10-18

2025-10-17

What Analyst Projections for Key Metrics Reveal About Crown Castle (CCI) Q3 Earnings

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Crown Castle (CCI), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.