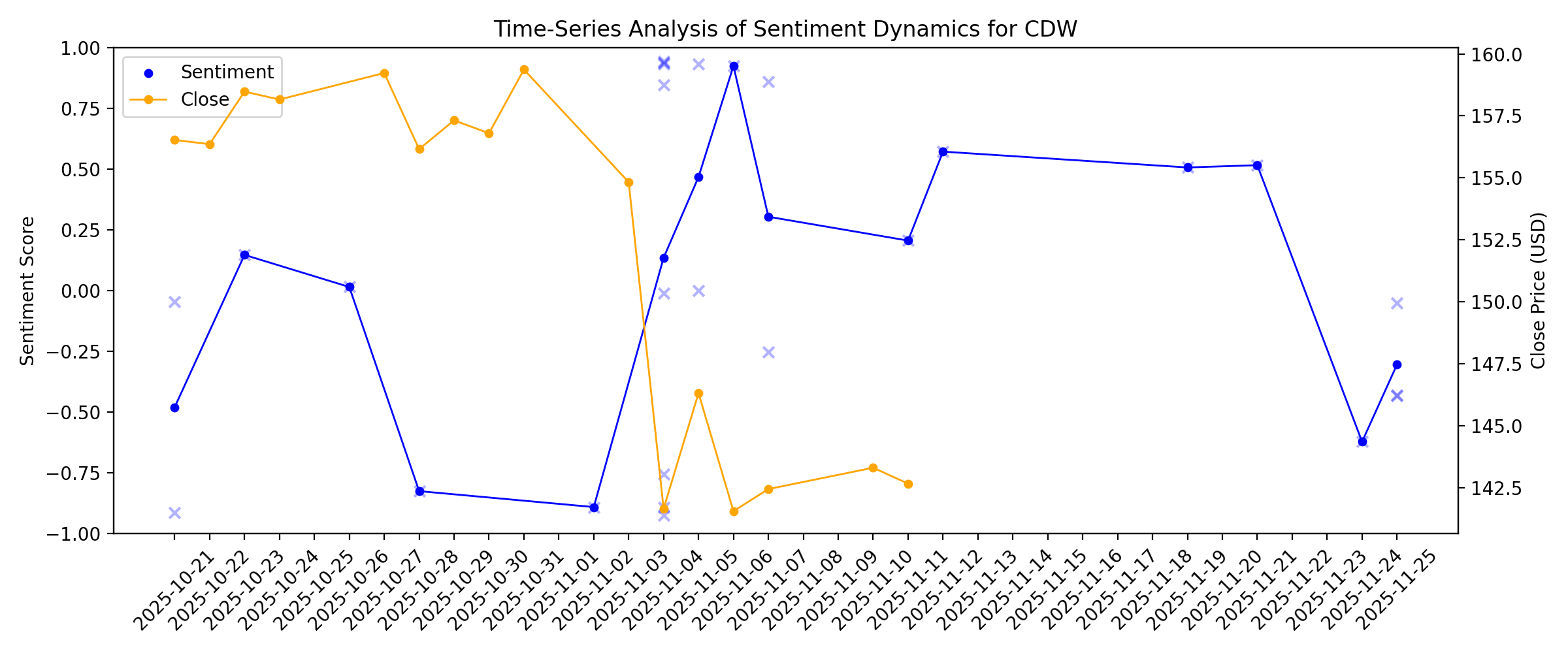

News sentiment analysis for CDW

Sentiment chart

2026-01-14

Oakmark Fund Added CDW (CDW) Citing Diverse Growth Signals

Description: Oakmark Funds, advised by Harris Associates, released its “Oakmark Fund” fourth-quarter 2025 investor letter. The objective of the fund is to deliver capital appreciation by investing in diverse large-cap US companies. A copy of the letter can be downloaded here. In the quarter, the fund (investor class) outperformed the S&P 500 Index, returning 4.78% vs. 2.66% for […]

Assessing CDW (CDW) Valuation After A Year Of Weak Shareholder Returns

Description: CDW (CDW) has drawn investor attention after recent trading left the shares with a negative return over the past year. This has prompted a closer look at how its current valuation lines up with its scale and profitability. See our latest analysis for CDW. At a latest share price of $134.60, CDW’s 1 month share price return of 7.13% decline and 3 month share price return of 9.56% decline sit against a 1 year total shareholder return of 26.76% decline, pointing to fading momentum as investors...

What CDW (CDW)'s Rising Analyst Support for Cloud and Cybersecurity Focus Means For Shareholders

Description: In recent days, CDW has attracted louder support from major Wall Street analysts and institutional investors, reflecting renewed confidence in its integrated IT solutions and services spanning cloud, cybersecurity, and hybrid work. This upswing in analyst attention highlights how CDW’s focus on higher-value, services-led offerings may be enhancing perceptions of its earnings resilience and business durability. Next, we’ll explore how this stronger analyst confidence around CDW’s cloud and...

Has CDW (CDW) Become More Attractive After A 26.8% One-Year Share Price Decline?

Description: If you are wondering whether CDW is attractively priced or not, the key question is whether the current share price reflects the business you are actually getting. CDW closed at US$134.60 most recently, with returns of 0.2% over 7 days, a 7.1% decline over 30 days, 1.1% year to date, and a 26.8% decline over 1 year, which may have changed how investors see its potential and risk. Recent attention on CDW has centered on how the stock has performed over different periods, with a 29.2% decline...

2026-01-13

Raymond James Analysts’ Best Picks Could Explode Again in 2026: 4 Red-Hot Dividend Stocks

Description: The Raymond James Best Picks list for 2026 is strong, and we identified four quality stocks for growth and income investors that offer solid dividends and strong upside potential.

Do Options Traders Know Something About CDW Stock We Don't?

Description: Investors need to pay close attention to CDW stock based on the movements in the options market lately.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

CDW Earnings Preview: What to Expect

Description: CDW is scheduled to announce its fiscal fourth-quarter earnings soon, and analysts project a single-digit profit drop.

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

Should You Investigate CDW Corporation (NASDAQ:CDW) At US$133?

Description: Today we're going to take a look at the well-established CDW Corporation ( NASDAQ:CDW ). The company's stock received a...

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

CDW Price Target Reduced as Morgan Stanley Analyst Turns More Selective on IT Hardware Exposure

Description: CDW Corporation (NASDAQ:CDW) is included among the 13 Top Tech Stocks Paying Consistent Dividends. On December 17, Morgan Stanley cut its price target on CDW Corporation (NASDAQ:CDW) to $177 from $191. The firm kept its Overweight rating. In its year-ahead view on IT hardware, Morgan Stanley said it prefers companies tied to cloud spending, product refresh […]

2025-12-21

2025-12-20

2025-12-19

Is CDW’s Recent Share Price Slide Creating a 2025 Value Opportunity?

Description: Wondering if CDW is quietly turning into a value opportunity while everyone is distracted by flashier tech names? This article will walk through whether the current price really makes sense. The stock has slipped about 4.5% over the last week and sits roughly 15.9% down year to date, even though it is still up around 17.5% over the past 5 years. This pattern often flags a potential reset in expectations rather than a broken business. Recent headlines have focused on shifting enterprise IT...

2025-12-18

2025-12-17

IT Hardware Sector Faces Cyclical Challenges in 2026, Opportunities Remain, Morgan Stanley Says

Description: IT hardware companies face growing cyclical challenges in 2026, but pockets of opportunity remain, M

2025-12-16

2025-12-15

MicroStrategy retains place in key index despite delisting threats

Description: Michael Saylor's Bitcoin (BTC) treasury company, Strategy (Nasdaq: MSTR), earlier known as MicroStrategy, has been successful in retaining its spot in the Nasdaq 100 (NDQ). A benchmark stock market index in the U.S., the Nasdaq 100 tracks hundred of the largest non-financial ...

Western Digital stock rises after inclusion in Nasdaq-100 Index

Description: Investing.com -- Western Digital Corp. (NASDAQ:WDC) stock rose 1.7% Monday following the announcement of its inclusion in the Nasdaq-100 Index as part of the annual reconstitution.

2025-12-14

2025-12-13

2025-12-12

Rumble, Crane NXT, Arlo Technologies, CDW, and Insight Enterprises Shares Are Falling, What You Need To Know

Description: A number of stocks fell in the afternoon session after investors rotated out of AI-linked high-flyers following underwhelming earnings updates from Oracle and Broadcom as the core thesis shifted from "growth at any cost" to "prove the returns."

Tracking the Changing Narrative for CDW After Mixed Results and Macro Headwinds

Description: CDW’s latest narrative update leaves its estimated fair value essentially unchanged at about $182.00 per share, even as the discount rate nudges higher from roughly 9.30% to 9.31% amid a choppy macro backdrop. This subtle shift reflects a market weighing CDW’s resilient, higher margin software and services mix against concerns over slower near term demand and lingering uncertainty in IT spending. Continue reading to see how you can track these evolving assumptions and monitor future narrative...

2025-12-11

Why Is Amdocs (DOX) Up 1.3% Since Last Earnings Report?

Description: Amdocs (DOX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-10

2025-12-09

The next 3 phases of the AI cycle to come in 2026

Description: US stocks (^DJI, ^IXIC, ^GSPC) closed Tuesday's trading session mixed ahead of the Federal Reserve's next interest rate decision on Wednesday. Some Wall Street experts are forecasting the economic setup for 2026 to be a healthy environment for equities. Allspring Global Investments Senior Portfolio Manager Bryant VanCronkhite highlights several of the market drivers that could materialize in 2026, defining the three phases he sees the AI landscape evolving through. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

2025-12-08

Is CDW Stock Underperforming the Dow?

Description: Although CDW has lagged behind the Dow over the past year, analysts remain moderately optimistic about the stock’s prospects.

2025-12-07

2025-12-06

2025-12-05

2025-12-04

CDW (CDW): Assessing Valuation After New AWS AI Recognition and Cloud Solutions Launch

Description: CDW (CDW) is back on traders radar after its Mission subsidiary rolled out six integrated cloud solutions on AWS Marketplace and secured AWS Agentic AI Specialization, sharpening the companys positioning in cloud, security, and autonomous AI services. See our latest analysis for CDW. Even with Mission’s AWS wins sharpening the growth story, CDW’s 1 year total shareholder return of negative 17.68 percent and 3 month share price return of negative 14.81 percent show momentum has cooled. This...

Why Is CDW (CDW) Down 1.8% Since Last Earnings Report?

Description: CDW (CDW) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

1 Volatile Stock on Our Buy List and 2 We Avoid

Description: A highly volatile stock can deliver big gains - or just as easily wipe out a portfolio if things go south. While some investors embrace risk, mistakes can be costly for those who aren’t prepared.

Brinker upgraded, Coinbase downgraded: Wall Street's top analyst calls

Description: Brinker upgraded, Coinbase downgraded: Wall Street's top analyst calls

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, ServiceNow and More

Description: Pre-Market Stock Futures: The futures are lower on Tuesday after traders kicked off the holiday-shortened trading week with a massive Monday rally, with all major indices finishing the day higher. A combination of an oversold market, a big bounce-back rally on Friday that saw follow-through on Monday, and some positive AI/Data Center/Hyperscaler commentary to help ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, Serv

2025-11-24

Boasting A 41% Return On Equity, Is CDW Corporation (NASDAQ:CDW) A Top Quality Stock?

Description: One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will...

2025-11-23

2025-11-22

2025-11-21

Pitney Bowes, CDW, Connection, Diebold Nixdorf, and Hewlett Packard Enterprise Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official hinted at a potential interest rate cut in December.

2025-11-20

2025-11-19

Do Wall Street Analysts Like CDW Stock?

Description: Despite CDW's weak performance relative to the broader market over the past 52 weeks, Wall Street analysts remain moderately optimistic about the stock's prospects.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Mirion, Dell, Globalstar, Flex, and CDW Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investors continued to pile into value-oriented names amid growing valuation concerns. This shift reflects growing caution over high valuations within the technology and artificial intelligence (AI) spheres. As market participants reassessed risk, they reallocated capital from growth-heavy indices, like the Nasdaq, to companies in areas like industrials and financials, which were perceived to be more reasonably priced. Contributing to the

2025-11-11

5 Revealing Analyst Questions From CDW’s Q3 Earnings Call

Description: CDW’s third quarter results met Wall Street’s revenue expectations but drew a significant negative market reaction, with shares selling off after the report. Management attributed the quarter’s performance to solid execution across its diversified end markets, particularly highlighting strong growth in small business and international operations. CEO Christine Leahy noted that customer spending was concentrated on essential needs such as security and device upgrades, while discretionary projects

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Analysts Have Been Trimming Their CDW Corporation (NASDAQ:CDW) Price Target After Its Latest Report

Description: Shareholders might have noticed that CDW Corporation ( NASDAQ:CDW ) filed its quarterly result this time last week. The...

The Zacks Analyst Blog CDW, California Resources, Exxon Mobil Corp and Entergy

Description: CDW Corp. joins CRC, XOM, and ETR in raising dividends, offering investors steady income amid market volatility and economic uncertainty

2025-11-06

Focus on 4 Stocks That Recently Hiked Dividends Amid Market Volatility

Description: CDW, CRC, XOM and ETR lifted their dividends, offering investors income stability amid ongoing market volatility.

2025-11-05

CDW (CDW) Margin Decline Reinforces Concerns Over Slower Growth Versus Market Expectations

Description: CDW (CDW) is projected to see its revenue rise 3.7% per year, lagging behind the broader US market’s 10.5% forecast. Annual EPS growth is also slower, expected at 9.4% compared to the US market’s 16%. Over the past five years, CDW’s earnings have grown by 5.3% a year, but net profit margins recently slipped to 4.8% from last year’s 5.3%. For investors, the appeal lies in a stock priced below analyst and discounted cash flow estimates, a below-average P/E ratio within the sector, and an...

CDW Q3 Deep Dive: Services Momentum and Margin Pressures Amid Uncertain IT Spending

Description: IT solutions provider CDW (NASDAQGS:CDW) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4% year on year to $5.74 billion. Its non-GAAP profit of $2.71 per share was 3.4% above analysts’ consensus estimates.

2025-11-04

CDW Corp (CDW) Q3 2025 Earnings Call Highlights: Navigating Growth Amidst Challenges

Description: CDW Corp (CDW) reports a 4% increase in net sales, with strong performance in small business and government sectors, despite pressures in education and healthcare.

Arlo Technologies, Kyndryl, CDW, Grid Dynamics, and Hewlett Packard Enterprise Shares Plummet, What You Need To Know

Description: A number of stocks fell in the morning session after markets became increasingly wary of high valuations following a significant AI-driven rally.

CDW's Q3 Earnings & Revenues Top Estimates, Up Y/Y on Cloud Tailwinds

Description: CDW posts higher Q3 2025 earnings and revenues, fueled by strong notebook, software and networking demand despite macro headwinds.

Here's What Key Metrics Tell Us About CDW (CDW) Q3 Earnings

Description: While the top- and bottom-line numbers for CDW (CDW) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

CDW (NASDAQ:CDW) Posts Q3 Sales In Line With Estimates

Description: IT solutions provider CDW (NASDAQGS:CDW) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4% year on year to $5.74 billion. Its non-GAAP profit of $2.71 per share was 3.4% above analysts’ consensus estimates.

CDW: Q3 Earnings Snapshot

Description: On a per-share basis, the Vernon Hills, Illinois-based company said it had profit of $2.21. Earnings, adjusted for amortization costs and stock option expense, came to $2.71 per share. The results exceeded Wall Street expectations.

CDW Increases Quarterly Cash Dividend 1% to $0.630 Per Share

Description: VERNON HILLS, Ill., November 04, 2025--CDW Corporation (Nasdaq: CDW), a leading multi-brand provider of information technology solutions to business, government, education and healthcare customers in the United States, the United Kingdom and Canada, today announced that its Board of Directors has declared a quarterly cash dividend of $0.630 per common share to be paid on December 10, 2025 to all stockholders of record as of the close of business on November 25, 2025. This amount represents appro

CDW Reports Third Quarter 2025 Earnings

Description: VERNON HILLS, Ill., November 04, 2025--CDW Corporation (Nasdaq: CDW):

2025-11-03

2025-11-02

CDW (CDW) Reports Earnings Tomorrow: What To Expect

Description: IT solutions provider CDW (NASDAQGS:CDW) will be reporting results this Tuesday before market hours. Here’s what to expect.

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

CDW Announces Leadership Changes to Amplify Its Go-To-Market as Sona Chawla Retires

Description: VERNON HILLS, Ill., October 28, 2025--CDW Corporation (Nasdaq: CDW), a leading multi-brand provider of information technology solutions to business, government, education and healthcare customers in the United States, the United Kingdom and Canada, today announced that Sona Chawla, chief growth and innovation officer, will retire from CDW at the end of 2025.

2025-10-27

2025-10-26

CDW (CDW) Valuation in Focus as Investors Spotlight AI Infrastructure Potential and Revenue Growth

Description: CDW (CDW) has come into focus after recent investor letters underscored its growing involvement in supporting AI infrastructure upgrades for small businesses. Steady revenue growth is drawing attention, even though the market remains cautious on its AI prospects. See our latest analysis for CDW. CDW’s share price has lost ground in 2025, with a year-to-date decline of nearly 7% and a one-year total shareholder return of -26%. Recent investor buzz around its AI infrastructure potential appears...

2025-10-25

2025-10-24

2025-10-23

CDW (CDW) Fell as Market Yet to Accept it as an “AI Winner”

Description: Wedgewood Partners, an investment management company, released its third-quarter 2025 investor letter. The letter is available for download here. AI stocks remain the favorite topic of Wall Street in the third quarter. In the third quarter, Wedgewood Composite’s net return was 5.9% compared to the Standard & Poor’s 8.1%, the Russell 1000 Growth Index’s 10.5%, and […]

2025-10-22

2025-10-21

CDW to Announce Third Quarter 2025 Results on November 4

Description: VERNON HILLS, Ill., October 21, 2025--CDW Corporation (Nasdaq: CDW) announced today that it will host a webcast conference call to discuss its third quarter 2025 results on Tuesday, November 4, 2025, at 7:30 a.m. CT/8:30 a.m. ET.

1 Profitable Stock with Exciting Potential and 2 We Question

Description: Even if a company is profitable, it doesn’t always mean it’s a great investment. Some struggle to maintain growth, face looming threats, or fail to reinvest wisely, limiting their future potential.