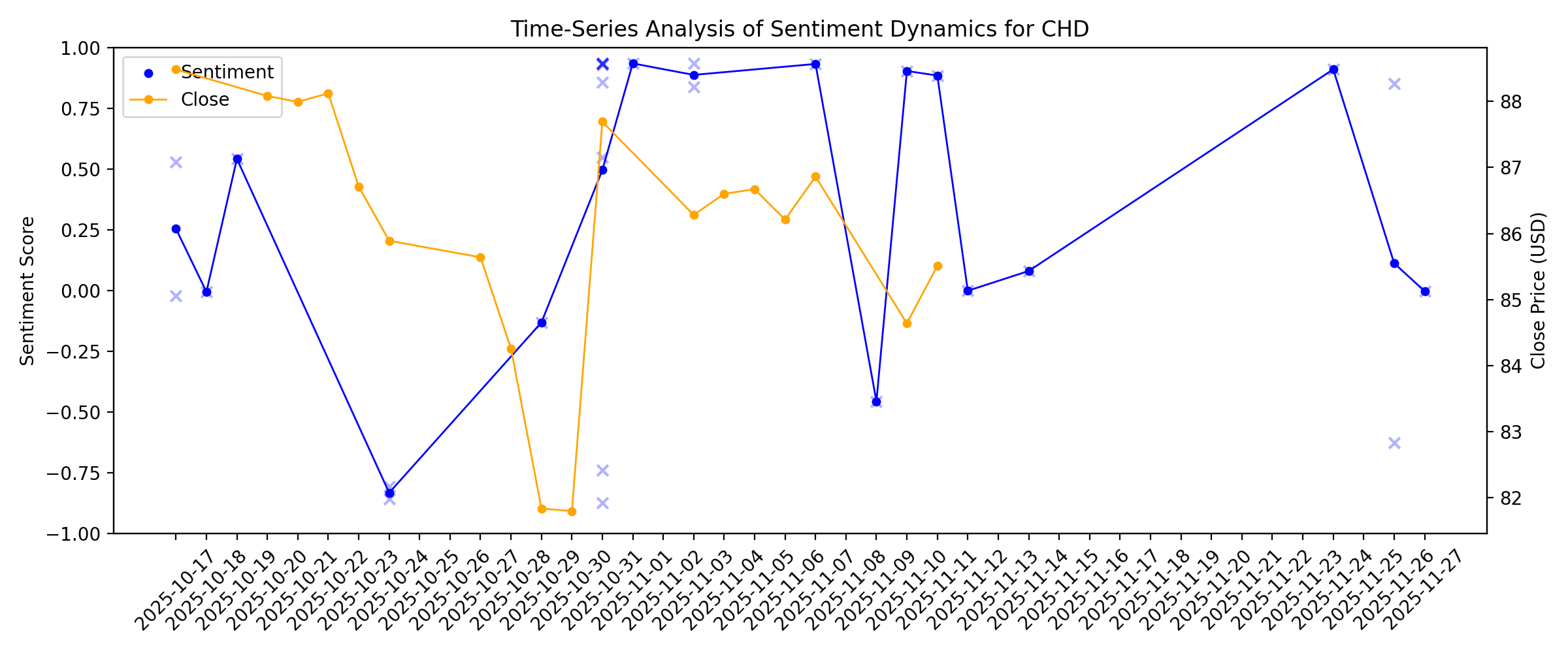

News sentiment analysis for CHD

Sentiment chart

2026-01-14

2026-01-13

Is Procter & Gamble's 4% Sales Growth Target at Risk From Tariff Woes?

Description: Tariff costs test PG's plan for upto 4% organic sales growth, as pricing limits and slower consumption tighten execution risks.

Here’s What Hit Church & Dwight (CHD) in 2025

Description: Fundsmith, an investment management firm based in London, has released its annual 2025 investor letter for its “Fundsmith Equity Fund.” A copy of the letter can be downloaded here. The fund focuses on investing in equities globally. The T Class Accumulation shares where the firm invested returned 0.8% in 2025, compared to 12.8% for the […]

2026-01-12

2026-01-11

Wells Fargo Reworks 2026 Staples Outlook, Cuts Church & Dwight (CHD) Target

Description: Church & Dwight Co., Inc. (NYSE:CHD) is included among the 13 Best Consumer Staples Dividend Stocks to Invest in Now. On January 5, while maintaining an Overweight rating on the stock, Wells Fargo trimmed its price target on Church & Dwight Co., Inc. (NYSE:CHD) to $92 from $100. The change comes as the firm updates […]

2026-01-10

2026-01-09

2026-01-08

Is Church & Dwight (CHD) Attractive After A 17.2% One Year Share Price Decline

Description: If you are wondering whether Church & Dwight is reasonably priced or not, this article walks through what the current numbers actually say about its value. The stock last closed at US$83.88, with returns of 0.0% over 7 days, 2.8% over 30 days, 1.5% year to date, 6.4% over 3 years and 5.3% over 5 years, while the 1 year return stands at a 17.2% decline. Recent coverage around Church & Dwight has focused on its position in the household products sector and how investors are assessing consumer...

Procter & Gamble Hits 52-Week Low: Buy Opportunity or Warning Sign?

Description: PG hits a 52-week low as soft demand, heavy promotions and tariff costs weigh on shares. Are near-term pressures masking resilience?

Church & Dwight Accelerates Innovation to Defend Market Share

Description: CHD is leaning on steady product innovation across power brands to defend market share and stay competitive in a promotion-heavy consumer market.

2026-01-07

ADRNY or CHD: Which Is the Better Value Stock Right Now?

Description: ADRNY vs. CHD: Which Stock Is the Better Value Option?

2026-01-06

2026-01-05

Procter & Gamble Delivers, But Is Volume Growth Still a Worry?

Description: PG posts solid Q1 earnings via pricing and productivity, but weak volume in North America raises doubts about sustaining top-line momentum.

Church & Dwight to Webcast the 2026 Analyst Day and Full Year 2025 Earnings Results on January 30

Description: EWING, N.J., January 05, 2026--Church & Dwight Co., Inc. (NYSE: CHD) will host a webcast from the Church & Dwight 2026 Analyst Day to discuss fourth quarter and year end 2025 earnings results on January 30, 2026, at 12:00 p.m. ET.

2026-01-04

2026-01-03

2026-01-02

Earnings Preview: What To Expect From Church & Dwight's Report

Description: Church & Dwight is scheduled to announce its fourth-quarter results soon, and analysts are projecting a double-digit earnings growth.

2026-01-01

2025-12-31

2025-12-30

Citi Upgrades Church & Dwight (CHD) to Neutral as Sales Outlook Improves

Description: Church & Dwight Co., Inc. (NYSE:CHD) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 17, Citi moved Church & Dwight Co., Inc. (NYSE:CHD) to Neutral from Sell and raised its price target to $87 from $85. The firm said its Sell view had largely run its course. […]

2025-12-29

2025-12-28

Church & Dwight Insiders Placed Bullish Bets Worth US$2.71m

Description: Over the last year, a good number of insiders have significantly increased their holdings in Church & Dwight Co., Inc...

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Can Procter & Gamble's Shift to DTC and Digital Win New Consumers?

Description: PG is recalibrating its digital and DTC strategy to deepen engagement, capture first-party data and influence purchases earlier across omnichannel paths.

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

How Church & Dwight’s Vitamin Exit and One-Time Charge Will Impact Church & Dwight (CHD) Investors

Description: Church & Dwight Co., Inc. has already agreed to sell its VitaFusion and L’il Critters vitamin, minerals and supplement brands, including related trademarks and its Vancouver and Ridgefield, Washington facilities, to Piping Rock Health Products, Inc., and expects a one-time after-tax charge of US$40 million to US$45 million in the fourth quarter of 2025. While these vitamin brands contribute less than 5% of anticipated 2025 net sales, their sale marks a clear shift in Church & Dwight’s...

2025-12-13

2025-12-12

2025-12-11

Renewed Brand Focus Could Support Church & Dwight’s (CHD) EPS Growth, Says Argus

Description: Church & Dwight Co., Inc. (NYSE:CHD) is included among the 15 Best Stocks to Buy for the Long Term. On December 4, Argus lowered its price target on Church & Dwight Co., Inc. (NYSE:CHD) to $102 from $110 but maintained a Buy rating on the shares. The firm mentioned that, as Consumer Goods names faced […]

2025-12-10

Can Procter & Gamble's $15B Shareholder Return Offset Tariff Headwinds?

Description: PG faces tariff pressures despite cost cuts and price hikes, while strong cash flow supports $15B in fiscal 2026 shareholder returns.

2025-12-09

Church & Dwight to Sell VitaFusion and L’il Critters Brands

Description: EWING, N.J., December 09, 2025--Church & Dwight Co., Inc. (NYSE:CHD) has concluded its strategic review of its vitamin, minerals and supplement (VMS) business and is announcing today a definitive agreement to sell the VitaFusion® and L’il Critters® brands to Piping Rock Health Products, Inc. This agreement includes the VitaFusion® and L’il Critters® brands, relevant trademarks and licenses, and the company's manufacturing and distribution facilities in Vancouver and Ridgefield, Washington.

How Is Church & Dwight's Stock Performance Compared to Other Consumer Staples Stocks?

Description: Church & Dwight has significantly underperformed other consumer staples stocks over the past year, yet analysts remain optimistic about the stock’s prospects.

2025-12-08

2025-12-07

2025-12-06

Is Church & Dwight (CHD) Undervalued After Its Recent Share Price Slide?

Description: Church & Dwight (CHD) has quietly slid about 20% over the past year, even as earnings and revenue kept growing. That disconnect is exactly what has value focused investors taking a closer look now. See our latest analysis for Church & Dwight. At around $84.52, the latest share price reflects a weak year to date share price return as investors reassess how much they are willing to pay for steady mid single digit growth, even though the three year total shareholder return remains positive. This...

2025-12-05

Campbell's Readies for Q1 Earnings: Things to Watch for CPB Stock

Description: CPB faces tariff pressures and higher marketing costs, while steady at-home cooking may boost its Meals & Beverages results.

Zacks Industry Outlook Highlights Procter & Gamble, Church & Dwight, Ollie's Bargain Outlet and Grocery Outlet

Description: Procter & Gamble, Church & Dwight, Ollie's Bargain Outlet and Grocery Outlet stand out as consumer product companies navigate cost pressures and value-driven demand shifts into 2026.

2025-12-04

4 Consumer Product Stocks to Watch as the Market Resets for 2026

Description: Despite rising costs and changing consumer trends, PG, CHD, OLLI and GO remain resilient, leveraging strategic measures to sustain growth.

2025-12-03

2025-12-02

Procter & Gamble's $1.5B Cost Savings Plan: Efficacy or Overreach?

Description: PG's $1.5B cost-savings push aims to protect margins and fuel innovation as the company balances efficiency risks with the need to sustain its competitive edge.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Is Arm & Hammer Owner a Bargain After Recent Share Price Drop in 2025?

Description: Wondering if Church & Dwight's stock is offering good value right now? You are not alone. Many investors are searching for clarity on whether this household products giant is priced right or primed for opportunity. Recently, the share price has bounced around, rising 2.5% in the past week but dropping 1.3% over the last month and down a notable 18.6% year-to-date. This signals some changing sentiment around the stock. Recent headlines highlight Church & Dwight's ongoing investments in brand...

2025-11-26

Margins Flat, Innovation High: Is PG Trading Growth for Stability?

Description: Procter & Gamble leans on major product upgrades and flat margins to balance stability with growth amid soft demand and uncertainty.

Procter & Gamble vs. Church & Dwight: Which Household Stock Outshines?

Description: PG and CHD battle for household dominance, with shifting demand, pricing power and strategy defining which name holds the edge.

2025-11-25

2025-11-24

Are Wall Street Analysts Bullish on Church & Dwight Stock?

Description: Church & Dwight has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

A Fresh Look at Church & Dwight (CHD) Valuation Following Strong Earnings Turnaround and Upgraded Outlook

Description: Church & Dwight (CHD) just posted a sizeable turnaround in their third quarter results, swinging from a loss last year to a strong net profit. The company also lifted its full-year outlook and expects continued sales growth ahead. See our latest analysis for Church & Dwight. The upbeat quarterly results and upgraded outlook have sparked fresh interest, but Church & Dwight’s momentum has faded recently, with a year-to-date share price return of -18.2% and a 1-year total shareholder return of...

2025-11-13

2025-11-12

Procter & Gamble Trades Near 52-Week Low: Buy, Hold or Sell?

Description: PG hovers near a 52-week low as soft demand, inflation and fierce competition pressure growth and margins.

2025-11-11

BofA lists 16 stock opportunities away from AI

Description: Investing.com -- Bank of America analysts said investor enthusiasm around artificial intelligence has left a range of attractively valued companies overlooked, identifying 16 “non-AI” opportunities that combine solid earnings momentum with discounted valuations.

2025-11-10

PG Sees North America Slowdown, China Rebound: Can It Realign Growth?

Description: Procter & Gamble sees slowing North American demand but rising momentum in China, as innovation and premiumization fuel its regional rebound.

2025-11-09

Be Sure To Check Out Church & Dwight Co., Inc. (NYSE:CHD) Before It Goes Ex-Dividend

Description: Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Church...

2025-11-08

2025-11-07

5 Revealing Analyst Questions From Church & Dwight’s Q3 Earnings Call

Description: Church & Dwight delivered a notably positive third quarter, with management attributing performance to broad-based share gains across both value and premium products. CEO Richard Dierker emphasized the success of ARM & HAMMER in value laundry, as well as strong growth from personal care brands like THERABREATH and HERO. The recent acquisition of TOUCHLAND, which exceeded early expectations in the hand sanitizer category, also contributed to the company’s outperformance. Dierker noted, "Our innov

2025-11-06

2025-11-05

2025-11-04

2025-11-03

CHD Q3 Deep Dive: Value Brands, Premium Personal Care, and Acquisition Momentum Support Results

Description: Household products company Church & Dwight (NYSE:CHD) announced better-than-expected revenue in Q3 CY2025, with sales up 5% year on year to $1.59 billion. The company expects next quarter’s revenue to be around $1.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.81 per share was 9.9% above analysts’ consensus estimates.

Church & Dwight (CHD) Q3 2025 Earnings Transcript

Description: $0.81 was better than our $0.72 outlook, driven by higher volume and gross margin results favorable to our outlook. Reported revenue was up 5% and organic sales were up 3.4%. The organic sales were broad-based across the globe, pricing, and mix.

2025-11-02

2025-11-01

Church & Dwight (CHD) Earnings Surge 42%, Challenging Bearish Growth Narratives

Description: Church & Dwight (CHD) grew earnings by 42.3% over the past year, a sharp turnaround from a 6.1% average annual decline over the previous five years. Net profit margins climbed to 12.7%, up from 9.1% a year ago, and the company’s earnings quality remains high. Looking forward, forecasts call for 7.8% annual earnings growth and a 3.6% yearly rise in revenue, though both rates lag behind the broader US market. Despite trading at a 26.9x P/E multiple above industry and peer averages, the current...

2025-10-31

Church & Dwight Co Inc (CHD) Q3 2025 Earnings Call Highlights: Surpassing Expectations with ...

Description: Church & Dwight Co Inc (CHD) reports robust Q3 performance with significant gains in organic sales and adjusted EPS, despite challenges in the consumer environment.

Church & Dwight Q3 Earnings Beat Estimates, Sales Up 5% Y/Y

Description: CHD posts third-quarter EPS and sales beats, driven by volume gains, e-commerce growth and strength across key consumer brands.

Compared to Estimates, Church & Dwight (CHD) Q3 Earnings: A Look at Key Metrics

Description: While the top- and bottom-line numbers for Church & Dwight (CHD) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Church & Dwight (CHD) Q3 Earnings and Revenues Top Estimates

Description: Church & Dwight (CHD) delivered earnings and revenue surprises of +10.96% and +3.32%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Stocks Mostly Up Pre-Bell as Traders Parse Apple, Amazon Earnings

Description: The benchmark US stock measures were mostly pointing higher before the open Friday as traders digest

Church & Dwight's Q3 Adjusted Earnings, Sales Rise

Description: Church & Dwight (CHD) reported Q3 adjusted earnings Friday of $0.81 per diluted share, up from $0.79

Church & Dwight (NYSE:CHD) Exceeds Q3 Expectations

Description: Household products company Church & Dwight (NYSE:CHD) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 5% year on year to $1.59 billion. The company expects next quarter’s revenue to be around $1.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.81 per share was 10.1% above analysts’ consensus estimates.

Church & Dwight: Q3 Earnings Snapshot

Description: The results exceeded Wall Street expectations. The average estimate of 10 analysts surveyed by Zacks Investment Research was for earnings of 73 cents per share. The maker of household and personal products posted revenue of $1.59 billion in the period, which also beat Street forecasts.

Church & Dwight Reports Q3 2025 Results

Description: EWING, N.J., October 31, 2025--Church & Dwight Co., Inc. (NYSE: CHD) today reported strong third quarter results highlighted by strong innovation, marketing and sales execution leading to share gains in many of our brands. Our third quarter reported net sales increased 5.0% to $1,585.6 million. Organic sales increased 3.4% driven by volume growth of 4.0% partially offset by negative pricing and mix of 0.6%.

2025-10-30

2025-10-29

Oppenheimer Lowers Price Target on Church & Dwight (CHD) to $100 Amid Sector Challenges

Description: Church & Dwight Co., Inc. (NYSE:CHD) is included among the 13 Most Undervalued Dividend Stocks to Buy According to Wall Street Analysts. Church & Dwight Co., Inc. (NYSE:CHD) is a New Jersey-based consumer goods company specializing in personal care, household, and specialty products. On October 21, Oppenheimer lowered its price target on Church & Dwight […]

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Earnings Preview: Church & Dwight (CHD) Q3 Earnings Expected to Decline

Description: Church & Dwight (CHD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Procter & Gamble (PG) Q1 Earnings and Revenues Top Estimates

Description: P&G (PG) delivered earnings and revenue surprises of +4.74% and +1.05%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-23

2025-10-22

2025-10-21

2025-10-20

2025-10-19

Can Church & Dwight (CHD) Balance Growth Ambitions Against Rising Input Costs?

Description: In the past week, concerns have surfaced about Church & Dwight's ability to sustain organic sales growth as rising input costs are outpacing revenue increases, prompting speculation about the need for strategic changes such as mergers and acquisitions. This development has elevated focus on the company's operational resilience and potential adjustments to its growth strategy going forward. We'll examine how pressure to accelerate growth amid cost challenges could impact Church & Dwight's...

2025-10-18

Church & Dwight (CHD): Assessing Valuation as Share Price Dips and Analyst Upside Remains

Description: Church & Dwight (CHD) shares have been fluctuating lately, raising some questions among investors about the company’s outlook. Over the past month, the stock has dipped by around 4%, while its longer-term performance paints a more mixed picture. See our latest analysis for Church & Dwight. After starting the year on a softer note, Church & Dwight's share price has slipped nearly 15% since January, with short-term momentum fading even as the company delivered annual revenue growth and stronger...

2025-10-17

Procter & Gamble Eyes Gains Amid Tariff Turmoil: Can It Deliver?

Description: PG ends fiscal 2025 strong with broad-based growth and innovation, but faces a $1B tariff hit that can test its 2026 momentum.

3 Profitable Stocks We’re Skeptical Of

Description: While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".