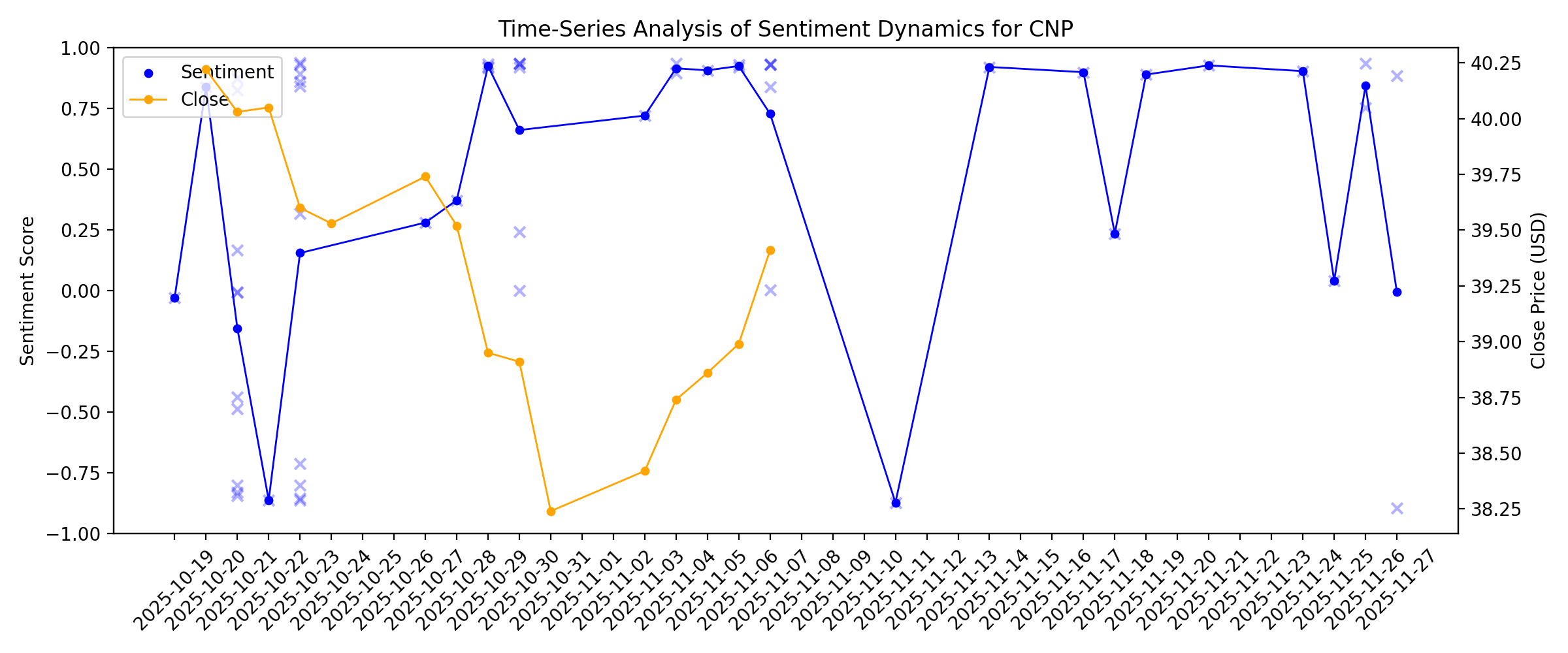

News sentiment analysis for CNP

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Natural Gas Demand Shift Supports JPMorgan’s Higher Target for National Fuel Gas (NFG)

Description: National Fuel Gas Company (NYSE:NFG) is included among the 12 Best Income Stocks to Buy Now. On December 8, JPMorgan analyst Zach Parham raised the firm’s price target on National Fuel Gas Company (NYSE:NFG) to $96 from $95 and kept a Neutral rating on the shares. The change came as JPMorgan updated its ratings and […]

2026-01-01

2025-12-31

2025-12-30

2025-12-29

CNP to Benefit From Infrastructure Upgradation & Renewable Expansion

Description: CNP is betting $65B on grid upgrades and renewables as power demand rises, targeting 1,000 MW by 2026 and an 8.86% long-term earnings growth rate.

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Did Fitch’s Stable Outlook and Massive Grid Plan Just Shift CenterPoint Energy's (CNP) Investment Narrative?

Description: CenterPoint Energy’s board previously declared a regular quarterly cash dividend of US$0.23 per share, payable on March 12, 2026, to shareholders of record as of February 19, 2026. Fitch Ratings’ move to affirm CenterPoint’s credit ratings while revising the outlook to Stable, alongside a US$65.00 billion grid-focused capital plan, underscores the company’s emphasis on financial resilience and long-term infrastructure investment. Next, we’ll examine how Fitch’s outlook revision to Stable may...

2025-12-20

2025-12-19

How Much You’d Have If You Bet $10,000 on Palantir Stock in January and 1 Key PLTR Catalyst to Watch in 2026

Description: Palantir has teamed up with Nvidia and CenterPoint Energy to launch its new Chain Reaction platform.

2025-12-18

2025-12-17

4 Stocks That Declared Dividend Hikes Amid Ongoing Economic Uncertainty

Description: CNP, VAC, PCG and ZTS raised dividends as tech volatility and economic uncertainty push income-focused investors toward steadier stocks.

5 Stocks Worth Watching on Their Recent Dividend Hikes

Description: PNR, NVT, CNP, VAC and PCG stand out as dividend payers as market volatility persists, with each company recently announcing higher shareholder payouts.

2025-12-16

2025-12-15

National Fuel Announces Successful $350 Million Private Placement of Common Stock

Description: WILLIAMSVILLE, N.Y., Dec. 15, 2025 (GLOBE NEWSWIRE) -- National Fuel Gas Company (“National Fuel” or the “Company”) announced today that it has entered into a subscription agreement (the “Subscription Agreement”) with a group of investors (the “Investors”) for a private placement of common stock (the “Offering”). Upon closing of the Offering, the Company expects to receive gross proceeds of $350 million, before deducting fees and expenses, resulting from the sale of approximately 4.4 million sha

Has the Market Run Ahead of CenterPoint After Grid Modernization Driven Gains?

Description: If you are wondering whether CenterPoint Energy at around $37.84 is still a smart buy or if most of the easy gains are already behind it, this article will walk you through that value puzzle step by step. Despite a soft patch in the last week and month, with returns of about -0.7% over 7 days and -4.8% over 30 days, the stock is still up 20.2% year to date and about 20.8% over the past year, following a 104.6% gain over five years. Recent news flow around CenterPoint has focused on its...

2025-12-14

CenterPoint Energy (CNP): Valuation Check After Q3 Beat, Mixed 2026 Guidance and Diverging Analyst Calls

Description: CenterPoint Energy (CNP) has investors talking after a mixed third quarter, where earnings and utility revenue topped forecasts, but softer looking 2026 guidance and diverging analyst reactions cooled some of the enthusiasm. See our latest analysis for CenterPoint Energy. The latest move leaves CenterPoint at a $37.84 share price, with a solid year to date share price return of just over 20 percent and a five year total shareholder return approaching 100 percent. This pattern signals that...

2025-12-13

2025-12-12

AES Boosts Growth Outlook With Renewables & Data Center Deals

Description: AES accelerates growth with expanding renewables, major data-center PPAs and continued progress on its clean-energy transition.

2025-12-11

SO Stock Declines 6% in Past 6 Months: Here's How to Play

Description: Southern Company faces stock underperformance, yet rising large-load demand, strong regulation and $76B growth pipeline strengthen its long-term outlook.

Down 5.3% in 4 Weeks, Here's Why CenterPoint (CNP) Looks Ripe for a Turnaround

Description: CenterPoint (CNP) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

CenterPoint Energy Stock: Is CNP Outperforming the Utilities Sector?

Description: While CenterPoint Energy has underperformed in recent months, it has significantly outperformed over the past year, and analysts remain moderately bullish on the stock’s prospects.

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

Should CenterPoint’s Role in Palantir’s AI Grid Platform Reshape Long-Term Plans for CNP Investors?

Description: In early December 2025, Palantir Technologies announced Chain Reaction, an AI energy infrastructure operating system, naming CenterPoint Energy and NVIDIA as founding partners to help modernize power generation, stabilize grids, and support hyperscale data centers. This partnership highlights CenterPoint Energy’s growing involvement in supporting AI-related power demand, potentially reshaping how its grid assets are planned, operated, and digitally managed. We’ll now examine how...

2025-12-05

Inside the Secret AI Alliance Powering Tomorrow's Data Centers

Description: Palantir, Nvidia, and CenterPoint team up to solve the trillion-dollar bottleneck behind the AI boom.

Palantir Draws Analyst Praise as Customer Momentum Builds and New Teton Ridge Deal Expands AI Reach

Description: Analysts point to expanding platform adoption and AI partnerships as growth drivers.

OGE's Long-Term Growth Supported by Robust Capex & Renewable Expansion

Description: OGE Energy leans on rising renewables and a larger capital plan to strengthen reliability and long-term growth momentum.

2025-12-04

Nvidia CEO Jensen Huang Just Won the AI Chip Restriction Battle

Description: Nvidia stock was gaining amid reports it won a major political battle over restriction on exports of AI chips.

Palantir Stock Rises -- Teams Up with Nvidia to Accelerate AI Infrastructure

Description: Palantir Unveils Platform to Modernize Power for AI Expansion

Meta faces EU probe, Palantir's software deal & Salesforce results

Description: Shares of Meta (META) edged higher ahead of the open, even as the company faces a new antitrust probe in the EU. Regulators are focused on Meta's WhatsApp messaging app and the use of AI on the platform. Separately, Palantir (PLTR) is teaming up with utility company CenterPoint (CNP) and Nvidia (NVDA) to create new software to speed up the building of AI data centers. Salesforce (CRM) shares are rising after third quarter earnings beat expectations. For more live coverage of the markets, watch the full episode of Market Sunrise and visit Yahoo Finance.

Palantir teams with Nvidia, CenterPoint Energy for software to speed up AI data center construction

Description: Palantir Technologies, Nvidia and U.S. utility CenterPoint Energy on Thursday said they are developing a new software platform to accelerate the building of new artificial intelligence data centers. The new software system will be called Chain Reaction. It will seek to help firms that are building AI data centers, which can consume as much electricity as a small city, with permitting, supply chain and construction challenges.

Palantir Launches Chain Reaction to Build American AI Infrastructure; Founding Partners Include CenterPoint Energy and NVIDIA

Description: DENVER, December 04, 2025--Palantir Technologies Inc. (NASDAQ: PLTR) today unveiled Chain Reaction, the operating system for American AI infrastructure.

2025-12-03

2025-12-02

Origis Energy Secures Tax Equity Commitment and Initial Funding with J.P. Morgan for Wheatland Solar

Description: Origis Energy, one of America's leading renewable energy and decarbonization solution platforms, today announced it has secured a tax equity commitment from J.P. Morgan for the Wheatland Solar project in Knox County, Indiana. The initial funding was made alongside the commitment.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Here's Why NI Stock Deserves a Spot in Your Portfolio Right Now

Description: NiSource accelerates clean-energy expansion with a 14.7% revenue growth outlook for 2025.

Why Is NextEra (NEE) Up 4.6% Since Last Earnings Report?

Description: NextEra (NEE) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

Here's Why PCG Stock Deserves a Spot in Your Portfolio Right Now

Description: PCG has a massive $73B grid modernization plan aimed at driving long-term growth and expanding clean-energy capacity.

CenterPoint Energy (CNP): Assessing Valuation Following Recent Gains and Investor Sentiment Shift

Description: CenterPoint Energy (CNP) shares have moved slightly over the last week, showing a minor dip of about 1%. Investors are eyeing its recent trends given the utility sector’s focus on steady returns and reliable dividends. See our latest analysis for CenterPoint Energy. CenterPoint Energy’s share price has gained notable ground in 2024, with a 25.2% year-to-date rise and a strong one-year total shareholder return of 24.1%. This points to renewed optimism and a shift in investor sentiment around...

2025-11-25

4 Low-Beta Defensive Stocks to Buy as Consumer Sentiment Plummets

Description: ETR, CNP, JBSS and UVV stand out as consumer sentiment sinks, with low beta, rising earnings estimates and a steady dividend drawing defensive investors.

2025-11-24

Reasons to Give Dominion Energy a Spot in Your Portfolio Right Now

Description: Dominion Energy sharpens its 2025 outlook with rising estimates and a massive investment plan to expand clean-energy capacity.

2025-11-23

2025-11-22

2025-11-21

CenterPoint (CNP) Upgraded to Buy: Here's Why

Description: CenterPoint (CNP) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-11-20

2025-11-19

Here's Why AEE Stock Deserves a Place in Your Portfolio Right Now

Description: Ameren raises its 2025 outlook and invests heavily in long-term growth with clean-energy and nuclear expansion plans.

2025-11-18

Is Ballard Power Systems (BLDP) Outperforming Other Utilities Stocks This Year?

Description: Here is how Ballard Power Systems (BLDP) and CenterPoint Energy (CNP) have performed compared to their sector so far this year.

2025-11-17

What Recent Analyst Upgrades and Investments Mean for CenterPoint Energy’s Growth Story

Description: CenterPoint Energy’s stock has seen a slight increase in its consensus analyst price target, rising from $42.47 to $42.67 per share. This uptick reflects a broadly optimistic stance among analysts, who are citing the company’s steady performance, ambitious capital investment plans, and favorable demand outlook as key drivers behind the adjustment. Stay tuned to find out how you can keep ahead of evolving analyst perspectives and what future catalysts might mean for CenterPoint’s narrative...

2025-11-16

2025-11-15

2025-11-14

Reasons to Add AWR Stock to Your Portfolio Right Now

Description: American States Water boosts its growth outlook with rising estimates, steady dividends, and ongoing infrastructure upgrades.

2025-11-13

2025-11-12

2025-11-11

PCG vs. CNP: Which Stock Should Value Investors Buy Now?

Description: PCG vs. CNP: Which Stock Is the Better Value Option?

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Alliant Energy Lags on Q3 Earnings, Beats on Sales, Narrows View

Description: Alliant Energy posts mixed Q3 results with higher revenues but lower earnings, raises capex forecast and unveils 2026 outlook.

Duke Energy Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: DUK delivers double-digit earnings growth and a solid revenue beat in Q3, while tightening its 2025 EPS guidance range.

Consolidated Edison Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: ED posts a solid Q3, with earnings and revenue gains driving a guidance boost toward the upper end of its 2025 range.

Is CenterPoint Energy's (CNP) $53 Billion Investment Plan Changing Its Long-Term Growth Outlook?

Description: Earlier this week, CenterPoint Energy announced a plan to invest US$53 billion over the next 10 years to expand its operations in response to rising electricity demand fueled by commercial growth. This substantial commitment is paired with expectations for long-term earnings growth and significant year-over-year increases projected for 2025 and 2026. With this considerable US$53 billion investment plan announced, we’ll explore how CenterPoint Energy’s growth prospects could shift moving...

CenterPoint Energy (CNP): Is There More Value After a 24% Share Price Surge?

Description: CenterPoint Energy (CNP) shares have climbed steadily this year, gaining 24% year-to-date and 36% over the past year. Recent trading activity has reflected a measured optimism as investors weigh the company's strong earnings growth and steady revenue gains. See our latest analysis for CenterPoint Energy. Momentum has clearly been building for CenterPoint Energy, with a 23.8% share price gain so far this year and a robust 36.1% total shareholder return over the past twelve months. Investors’...

2025-11-06

Are Wall Street Analysts Bullish on CenterPoint Energy Stock?

Description: CenterPoint Energy has outperformed the broader market over the past year, and analysts are cautiously optimistic about the stock’s prospects.

Duke Energy to Release Q3 Earnings: Here's What You Need to Know

Description: DUK's Q3 results may reflect gains from grid upgrades, stronger power demand, and new solar output despite higher interest costs.

2025-11-05

PPL Beats Q3 Earnings & Revenues Estimates, Narrows EPS Guidance

Description: PPL posts solid third-quarter results with earnings and revenue beats, boosted by stronger sales and segment gains, while tightening its 2025 EPS outlook

2025-11-04

Exelon Beats Q3 Earnings & Sales Estimates, Serves More Customers

Description: EXE's third-quarter earnings and revenues beat estimates as customer growth, higher rates and lower storm costs lifted results.

Zacks Industry Outlook Highlights Duke Energy, Dominion Energy, Entergy and CenterPoint

Description: Duke Energy, Dominion, Entergy, and CenterPoint emerge as strong utility picks amid clean energy growth and lower rates.

2025-11-03

How Recent Developments Are Shaping the CenterPoint Energy Investment Story

Description: Analyst consensus on CenterPoint Energy has shifted, with the average price target rising slightly from $41.57 to $42.47 per share. This change reflects growing confidence in the company's earnings growth potential, supported by positive sector trends and an ambitious long-term capital plan. Stay tuned to discover how you can keep informed on evolving analyst narratives and what they might mean for investors going forward. Analyst Price Targets don't always capture the full story. Head over...

2025-11-02

2025-11-01

2025-10-31

2025-10-30

American Water Works Q3 Earnings Beat Estimates, Revenues Up Y/Y

Description: AWK posts strong Q3 results with higher revenues on the back of upbeat rate and announces merger agreement with Essential Utilities.

IDACORP Q3 Earnings Beat Estimates, Revenues Miss, '25 EPS View Raised

Description: IDA posts higher Q3 earnings despite a revenue dip, lifting its 2025 EPS outlook on customer growth and rate gains.

Xcel Energy Q3 Earnings and Sales Lag Estimates, 2026 EPS Initiated

Description: XEL's third-quarter earnings miss estimates despite higher segment revenues, as costs and interest expenses weigh on results.

CMS Energy Q3 Earnings Beat Estimates, Revenues Increase Y/Y

Description: CMS posts strong Q3 results with higher y/y earnings and revenue beat, boosting its 2025 outlook and setting fresh 2026 guidance.

DTE Energy's Q3 Earnings Beat Estimates, Increase Year Over Year

Description: DTE posts a Q3 EPS beat on strong electric segment results and continued infrastructure investments driving cleaner, reliable power.

Buy 4 Low-Beta Defensive Stocks Despite Federal Reserve's Rate Cut

Description: After the Fed's rate cut fails to lift markets, defensive low-beta picks like ATO, CNP, DUK and SCI offer stability amid volatility.

2025-10-29

NiSource Q3 Earnings Lag Estimates, Revenues Rise Y/Y, Capex Up

Description: NiSource's third-quarter EPS misses estimates despite higher revenues. The utility boosts its long-term capex to $28 billion through 2030.

Entergy's Q3 Earnings Surpass Estimates, Revenues Improve Y/Y

Description: ETR delivers a solid Q3, with higher revenues and improved cash flow offsetting expense pressures and narrowing guidance.

Edison International Q3 Earnings Top Estimates, Revenues Increase Y/Y

Description: EIX posts a strong third quarter as revenue gains, lower O&M costs, and a key rate decision boost earnings growth.

2025-10-28

The CenterPoint Energy, Inc. (NYSE:CNP) Third-Quarter Results Are Out And Analysts Have Published New Forecasts

Description: CenterPoint Energy, Inc. ( NYSE:CNP ) last week reported its latest quarterly results, which makes it a good time for...

2025-10-27

Is CenterPoint Energy (CNP) Outperforming Other Utilities Stocks This Year?

Description: Here is how CenterPoint Energy (CNP) and IdaCorp (IDA) have performed compared to their sector so far this year.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

CenterPoint Energy (CNP): Is the Stock’s Robust Run Still Leaving Room for Upside?

Description: CenterPoint Energy (CNP) has quietly delivered a steady performance over the past year, posting gains that outpaced the broader utility sector. Investors who are watching for consistent dividend payers might find recent market action worth a closer look. See our latest analysis for CenterPoint Energy. After a stretch of solid performance, CenterPoint Energy’s share price currently sits at $39.60, with momentum building over the year as reflected by a sharp 25.75% year-to-date share price...

CenterPoint Energy Inc (CNP) Q3 2025 Earnings Call Highlights: Robust Growth and Strategic ...

Description: CenterPoint Energy Inc (CNP) reports a 60% increase in non-GAAP EPS and outlines ambitious growth plans fueled by strategic asset sales and capital investments.

CenterPoint Energy Q3 Earnings Beat Estimates, Revenues Improve Y/Y

Description: CNP posts a strong Q3 with earnings and revenues beating estimates, driven by higher operating income and solid cash flow.

CenterPoint (CNP) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for CenterPoint (CNP) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Utility ETFs in the Spotlight as Q3 Earnings Season Kicks Off

Description: AI-driven power demand and solid Q3 earnings from utilities like FE put ETFs such as XLU, VPU and IDU in focus.

CenterPoint Energy (CNP) Q3 Earnings and Revenues Beat Estimates

Description: CenterPoint (CNP) delivered earnings and revenue surprises of +8.70% and +1.87%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

CenterPoint Energy reports strong Q3 2025 results; reiterates 2025 and 2026 full year guidance

Description: HOUSTON, October 23, 2025--CenterPoint Energy, Inc. (NYSE: CNP) or "CenterPoint" today reported net income of $293 million, or $0.45 per diluted share on a GAAP basis for the third quarter of 2025, compared to $0.30 per diluted share in the comparable period of 2024.

CenterPoint: Q3 Earnings Snapshot

Description: HOUSTON (AP) — CenterPoint Energy Inc. CNP) on Thursday reported third-quarter net income of $293 million. On a per-share basis, the Houston-based company said it had net income of 45 cents.

Houston peak load to grow nearly 50% in 6 years: CenterPoint

Description: Industrial growth and the rise of data centers are fueling CenterPoint Energy's outlook and a $65 billion spending plan.

CenterPoint to sell Ohio gas business to National Fuel for $2.62bn

Description: The transaction involves approximately 5,900 miles (9,495km) of pipeline in Ohio, US, servicing around 335,000 customers.

2025-10-22

CenterPoint Energy to sell Dayton natural gas business for more than $2.6 billion

Description: Oct. 22—CenterPoint Energy announced Tuesday the sale of its Ohio natural gas distribution business, Vectren Energy Delivery of Ohio, to National Fuel Gas Company for a little more than $2.6 billion. The assets include approximately 5,900 miles of transmission and distribution pipeline in Ohio serving approximately 335,000 metered customers in all or parts of Montgomery, Warren, Clark, ...

2025-10-21

Sector Update: Energy Stocks Decline Late Afternoon

Description: Energy stocks fell late Tuesday afternoon with the NYSE Energy Sector Index decreasing 0.4% and the

CenterPoint Energy to sell Dayton natural gas business for more than $2.6 billion

Description: Oct. 21—CenterPoint Energy today announced the sale of its Ohio natural gas distribution business, Vectren Energy Delivery of Ohio, to National Fuel Gas Company for a little more than $2.6 billion. The assets include approximately 5,900 miles of transmission and distribution pipeline in Ohio serving approximately 335,000 metered customers in the Dayton region. The company's sales price is ...

Sector Update: Energy Stocks Softer Tuesday Afternoon

Description: Energy stocks edged down Tuesday afternoon, with the NYSE Energy Sector Index easing 0.2% and the En

NextEra Energy (NEE) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: NextEra (NEE) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Sector Update: Energy Stocks Rise Premarket Tuesday

Description: Energy stocks were rising premarket Tuesday, with the Energy Select Sector SPDR Fund (XLE) advancing

CenterPoint (CNP) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for CenterPoint (CNP), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

CenterPoint Energy to Post Q3 Earnings: What's in Store for the Stock?

Description: CNP's Q3 results may reflect stronger infrastructure, rising demand, and cost pressures ahead of its quarterly release on Oct. 23.

CenterPoint Energy to Sell Ohio Gas Distribution Unit for $2.62 Billion

Description: CenterPoint Energy has agreed to sell its natural gas local distribution business in Ohio to National Fuel Gas for $2.62 billion.

National Fuel to Acquire CenterPoint’s Ohio Natural Gas Utility Business

Description: Acquisition Will Significantly Expand the Company’s Regulated Assets, Increasing Scale and Adding Cash Flow Diversity in an Attractive Regulatory JurisdictionWILLIAMSVILLE, N.Y., Oct. 21, 2025 (GLOBE NEWSWIRE) -- National Fuel Gas Company ("National Fuel" or the "Company") (NYSE: NFG) today announced it has entered into a definitive agreement with CenterPoint Energy Resources Corp. (“CERC”), a subsidiary of CenterPoint Energy, Inc. (NYSE: CNP) (“CenterPoint”) to acquire CenterPoint’s Ohio natura

CenterPoint Energy announces sale of its Ohio Natural Gas Business to National Fuel Gas Company for $2.62 billion

Description: HOUSTON, October 21, 2025--CenterPoint Energy, Inc. (NYSE: CNP) ("CenterPoint" or the "Company") today announced the sale of its Ohio natural gas Local Distribution Company (LDC) business, Vectren Energy Delivery of Ohio, LLC, to National Fuel Gas Company (NYSE: NFG), a diversified energy company headquartered in Western New York, for $2.62 billion. The assets include approximately 5,900 miles of transmission and distribution pipeline in Ohio serving approximately 335,000 metered customers.

2025-10-20

How the Narrative Around CenterPoint Energy Is Shifting After Recent Analyst Updates

Description: CenterPoint Energy's consensus analyst price target has seen a modest increase, rising from $40.85 to $41.57 in the latest updates. This shift comes as analysts weigh a blend of new expansion plans, enhanced earnings guidance, and sector momentum, all considered against a backdrop of steady risk assumptions. Stay tuned to discover how investors and observers can remain informed as the narrative around CenterPoint Energy continues to evolve. What Wall Street Has Been Saying Recent analyst...

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.