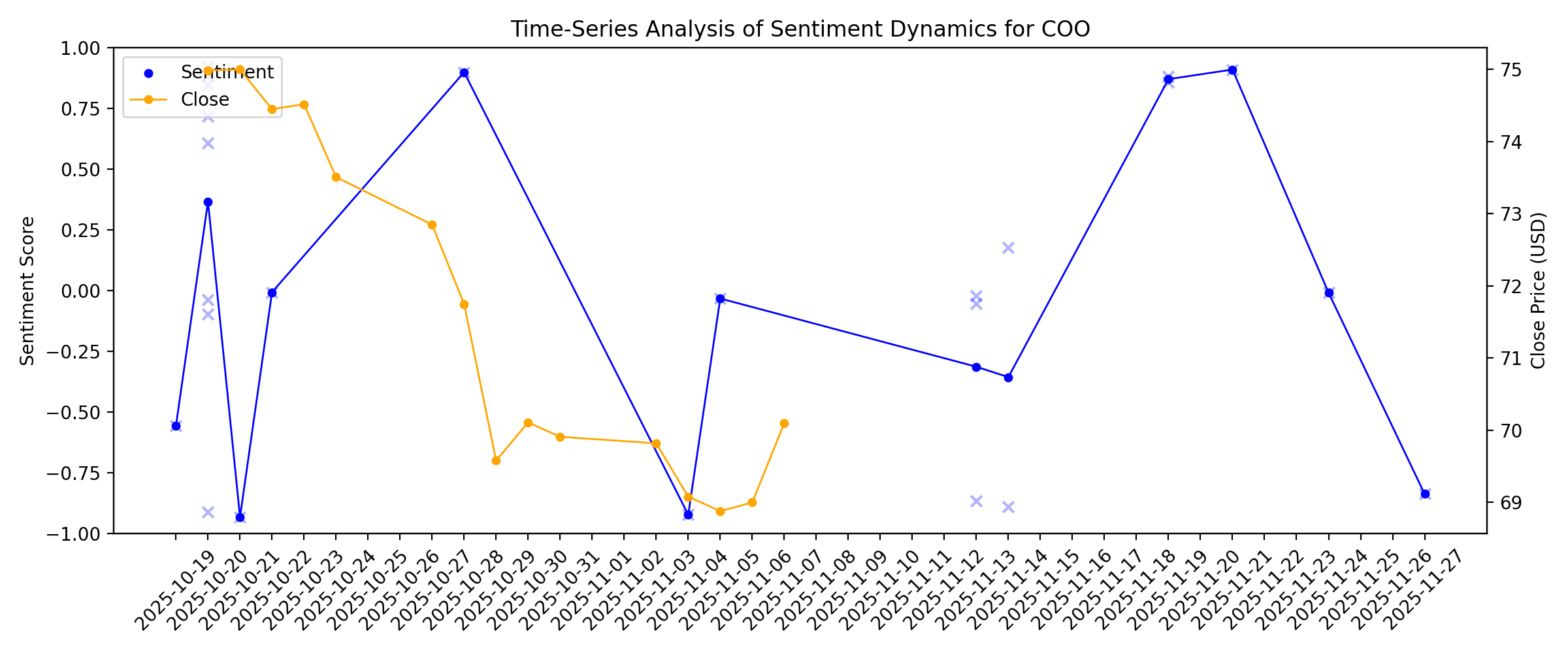

News sentiment analysis for COO

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

40 stocks likely to outperform in 2026: Boyar pres. explains

Description: Boyar Research is out with its "Forgotten Forty" list, comprising 40 overlooked stocks that are most likely to outperform this year. Boyar Research president, Jonathan Boyar, joins Market Catalysts host Julie Hyman to discuss a few of the names and explain why he sees upside in 2026. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

The Returns At Cooper Companies (NASDAQ:COO) Aren't Growing

Description: There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a...

2025-12-31

What Makes The Cooper Companies (COO) an Investment Bet?

Description: Diamond Hill Capital, an investment management company, released its “Mid Cap Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Markets continued their rally in the third quarter, with US stocks gaining over 8% as measured by the Russell 3000 Index. Small-cap stocks experienced the strongest quarterly performance, rising by […]

2025-12-30

Reasons to Add Cooper Companies Stock to Your Portfolio Now

Description: COO's revenues are showing strong growth as MyDay and MiSight drive momentum, while restructuring savings and buybacks bolster long-term upside despite near-term risks.

2025-12-29

CooperCompanies to Present at the J.P. Morgan Healthcare Conference

Description: SAN RAMON, Calif., Dec. 29, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today it will participate at the J.P. Morgan Healthcare Conference on Wednesday, January 14, 2026. Al White, President and CEO, will represent the Company in a session scheduled to begin at 5:15pm ET. A live and archived webcast of the event, where applicable, will be available on the CooperCompanies’ website at http://investor.coopercos.com. About CooperCompaniesCooper

2025-12-28

2025-12-27

2025-12-26

COO vs. MMSI: Which Stock Is the Better Value Option?

Description: COO vs. MMSI: Which Stock Is the Better Value Option?

2025-12-25

2025-12-24

2025-12-23

CooperCompanies Appoints Walter M Rosebrough, Jr. to its Board of Directors

Description: Enters into Cooperation Agreement with Browning WestSAN RAMON, Calif., Dec. 23, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today that the Company’s Board of Directors (the “Board”) has appointed Walter (Walt) M Rosebrough, Jr. as an independent director, effective as of January 3, 2026. In connection with this appointment, the Company also has entered into a cooperation agreement (the “Cooperation Agreement”) with Browning West, LP. (“Brow

2025-12-22

2025-12-21

2025-12-20

2025-12-19

The Cooper Companies (COO)'s Technical Outlook is Bright After Key Golden Cross

Description: When a stock experiences a golden cross technical event, good things could be on the horizon. How should investors react?

2025-12-18

Taking Stock of Cooper Companies (COO) Valuation After CEO’s Continued Insider Share Purchases

Description: Cooper Companies (COO) just got a fresh signal from the inside, as CooperVision President and CEO White Albert G III bought another 10,000 shares, extending a year long streak of insider purchases without sales. See our latest analysis for Cooper Companies. That insider buying comes on the heels of steady execution and board level changes, including a strategic review and fresh 2026 guidance. The stock has posted a strong 90 day share price return of 22.7%, even as the 1 year total...

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Is The Cooper Companies Stock Underperforming the Nasdaq?

Description: Even though The Cooper Companies has underperformed the broader Nasdaq Composite over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

5 Insightful Analyst Questions From CooperCompanies’s Q3 Earnings Call

Description: CooperCompanies delivered a third quarter that met market expectations, with management highlighting robust execution in its premium daily contact lens portfolio and steady contract wins in both private label and branded products. CEO Al White attributed the performance to the global rollout of the MyDay lens line, stating, “Momentum is robust, we’re seeing increasing bidding activity with especially strong interest in our premium comfort MyDay Energous lens.” Despite ongoing softness in the Asi

2025-12-10

COO or MMSI: Which Is the Better Value Stock Right Now?

Description: COO vs. MMSI: Which Stock Is the Better Value Option?

2025-12-09

2025-12-08

Does Cooper Companies Recent Rebound Reflect Its True Value In 2025?

Description: If you are wondering whether Cooper Companies is a quietly mispriced opportunity or a potential value trap, you are not alone. That is exactly what we are going to unpack here. The stock has bounced about 0.8% over the last week and 11.3% over the past month. However, that is still against a backdrop of a -13.9% return year to date and -21.4% over the last year. Recent headlines have focused on Cooper Companies strategic positioning in specialty contact lenses and women’s health, along with...

Why The Cooper Companies (COO) is a Top Value Stock for the Long-Term

Description: Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

The Cooper Companies (COO) International Revenue Performance Explored

Description: Evaluate The Cooper Companies' (COO) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

2025-12-07

2025-12-06

2025-12-05

CooperCompanies (COO) Stock Trades Up, Here Is Why

Description: Shares of medical device company CooperCompanies (NASDAQ:COO) jumped 7.6% in the morning session after the company reported third-quarter 2025 results that beat profit expectations and provided an upbeat earnings forecast for the upcoming fiscal year. For the quarter, revenue grew 4.6% year-over-year to $1.07 billion, meeting Wall Street's estimates, while adjusted earnings per share of $1.15 came in 3.2% ahead of consensus. The company's organic revenue, which filters out currency changes and a

COO Gains as Q4 Earnings & Sales Beat Estimates, MyDay Adoption Rises

Description: COO jumps after Q4 earnings and sales top estimates, powered by rising MyDay demand and strong MiSight momentum.

Exchange-Traded Funds, Equity Futures Higher Pre-Bell Friday Ahead of Key Inflation Report

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was up 0.2% and the actively trad

COO Q3 Deep Dive: Product Momentum and Strategic Review Shape Outlook

Description: Medical device company CooperCompanies (NASDAQ:COO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4.6% year on year to $1.07 billion. The company expects next quarter’s revenue to be around $1.02 billion, coming in 0.6% above analysts’ estimates. Its non-GAAP profit of $1.15 per share was 3.2% above analysts’ consensus estimates.

The Cooper Companies Inc (COO) Q4 2025 Earnings Call Highlights: Record Revenue and Strategic ...

Description: The Cooper Companies Inc (COO) reports a strong quarter with record revenue, robust free cash flow, and strategic initiatives to enhance shareholder value.

2025-12-04

The Bull Case For Cooper Companies (COO) Could Change Following Strategic Review, Softer Earnings And New Chair Transition

Description: The Cooper Companies has reported past fourth-quarter and full-year 2025 results showing sales rising to US$1,065.2 million and US$4,092.4 million respectively, while net income and diluted EPS from continuing operations declined year over year, alongside issuing fiscal 2026 revenue guidance and announcing a Board chair transition to Colleen Jay. Alongside these results, the company’s Board has launched a formal strategic review to explore ways to enhance long-term shareholder value,...

The Cooper Companies (COO) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: The headline numbers for The Cooper Companies (COO) give insight into how the company performed in the quarter ended October 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

The Cooper Companies (COO) Q4 Earnings and Revenues Surpass Estimates

Description: The Cooper Companies (COO) delivered earnings and revenue surprises of +3.60% and +0.45%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

CooperCompanies (NASDAQ:COO) Reports Q3 CY2025 In Line With Expectations, Stock Soars

Description: Medical device company CooperCompanies (NASDAQ:COO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4.6% year on year to $1.07 billion. The company expects next quarter’s revenue to be around $1.02 billion, coming in 0.6% above analysts’ estimates. Its non-GAAP profit of $1.15 per share was 3.2% above analysts’ consensus estimates.

CooperCompanies Announces New Chair of the Board and Strategic Review

Description: SAN RAMON, Calif., Dec. 04, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today that its Board of Directors has appointed Colleen Jay to succeed current Chair Robert Weiss, effective January 2, 2026. Mr. Weiss will remain on the Board and stand for reelection for the upcoming year, marking his final term. The Company also announced a formal strategic review aimed at identifying opportunities to enhance long-term shareholder value. “Bob’s visi

CooperCompanies Announces Fourth Quarter and Full Year 2025 Results

Description: SAN RAMON, Calif., Dec. 04, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading global medical device company, announced today financial results for its fiscal fourth quarter and full year ended October 31, 2025. Fourth quarter 2025 revenue of $1,065.2 million, up 5%, or up 3% organically. Fiscal year 2025 revenue of $4.1 billion, up 5%, or up 4% organically.Fourth quarter 2025 GAAP diluted earnings per share (EPS) of $0.43, down 27%. Fiscal 2025 GAAP diluted EPS of $1.87, down 4%.

2025-12-03

HealthEquity (HQY) Tops Q3 Earnings and Revenue Estimates

Description: HealthEquity (HQY) delivered earnings and revenue surprises of +12.22% and +0.69%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Cooper Companies to Post Q4 Earnings: What's in Store for the Stock?

Description: COO is set to post Q4 earnings as MyDAY momentum offsets Clariti and APAC softness, with revenues and earnings expected to rise.

2025-12-02

What To Expect From CooperCompanies’s (COO) Q3 Earnings

Description: Medical device company CooperCompanies (NASDAQ:COO) will be announcing earnings results this Thursday afternoon. Here’s what you need to know.

2025-12-01

Curious about The Cooper Companies (COO) Q4 Performance? Explore Wall Street Estimates for Key Metrics

Description: Evaluate the expected performance of The Cooper Companies (COO) for the quarter ended October 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

A Fresh Look at Cooper Companies (COO) Valuation Following Activist Board Challenge and Structural Reform Proposals

Description: Cooper Companies (COO) is in the spotlight after Browning West LP delivered a letter to the board highlighting years of underperformance and presenting recommendations to unlock value for shareholders. The activist’s proposals immediately caught market attention. See our latest analysis for Cooper Companies. Cooper Companies’ share price has climbed 19.3% over the past 90 days, fueled in part by Browning West’s activist campaign and speculation about strategic changes. However, its total...

1 Profitable Stock to Own for Decades and 2 We Find Risky

Description: While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

CooperVision Opens Regional Service Centre in partnership with CEVA Logistics to Accelerate Asia Pacific Growth.

Description: CooperVision Asia Pacific, in collaboration with CEVA Logistics, has opened a new Regional Service Centre in Singapore, marking a significant milestone in both companies' commitment to enhance supply chain and logistics capabilities across the Asia Pacific region.

2025-11-30

Stocks drift back towards record highs as the final month of 2025 gets underway: What to watch this week

Description: As the market moves into December, investors will be watching for Fed updates and a steadier performance environment than they got in November.

2025-11-29

2025-11-28

2025-11-27

The Cooper Companies (COO) Earnings Expected to Grow: Should You Buy?

Description: The Cooper Companies (COO) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-11-26

2025-11-25

2025-11-24

Is Cooper Companies a Bargain After 16% Drop in 2025?

Description: Wondering if Cooper Companies stock is a hidden bargain or too expensive in today’s market? Let’s break down what’s really happening beneath the surface. Shares have climbed 6.5% over the past week and 3.3% in the last month, but are still down 16.2% year-to-date and 25.8% over the past year. This signals shifting sentiment and ongoing uncertainty. There have been no headline-making events in recent weeks. However, recent news has focused on changing industry dynamics and evolving investor...

2025-11-23

2025-11-22

2025-11-21

CooperCompanies, iRhythm, Baxter, Omnicell, and Neogen Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

2025-11-20

2025-11-19

Browning West Delivers Letter to The Cooper Companies Board of Directors

Description: Cooper's Lack of Strategic Focus, Misaligned Incentives, and Inadequate Board Oversight Have Led to Meaningful Underperformance Current Corporate Structure Obscures Value of Both CooperVision and CooperSurgical; Refocus as a Pure Play Vision Care Company Under a Refreshed Board May Lead to More Than a Doubling of Cooper's Stock Price Urges Cooper's Board to Appoint Browning West’s Highly Skilled Director Candidates Who Will Improve the Company’s Operating Plans Including Capital Allocation, Over

Cooper Companies Stock: Analyst Estimates & Ratings

Description: While Cooper Companies has underperformed relative to the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Jana Partners' Strategic Move: Significant Addition of The Cooper Companies Inc

Description: Exploring Jana Partners (Trades, Portfolio)' Latest 13F Filing and Investment Strategy

Cooper Companies (COO): Assessing Valuation as Shares Lag Behind Analyst Targets

Description: Cooper Companies (COO) stock has experienced some ups and downs lately, with shares dipping slightly by 1% on the most recent trading day. Over the past month, however, the stock has managed to edge up by about 1%. See our latest analysis for Cooper Companies. After a volatile stretch, Cooper Companies' share price currently sits at $71.75, well below where it started the year. This reflects a year-to-date share price return of -20.86%. While recent momentum has been tepid, with small...

2025-11-13

Aytu BioPharma Inc. (AYTU) Reports Q1 Loss, Tops Revenue Estimates

Description: Aytu BioPharma (AYTU) delivered earnings and revenue surprises of -33.33% and +10.05%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Nike upgraded, Dollar Tree downgraded: Wall Street's top analyst calls

Description: Nike upgraded, Dollar Tree downgraded: Wall Street's top analyst calls

Here Are Thursday’s Top Wall Street Analyst Research Calls: AbbVie, AppLovin, Autozone, Booking Holdings, CoreWeave, DoorDash, and More

Description: Pre-Market Stock Futures: The stock futures are trading lower on Thursday, following another incredible day for the Dow Jones Industrials, while the rotation out of the NASDAQ and into technology is still gaining traction. The DJIA posted a record all-time high, closing at 48,254, up another 327 points or 0.68%. The S&P 500 just barely ... Here Are Thursday’s Top Wall Street Analyst Research Calls: AbbVie, AppLovin, Autozone, Booking Holdings, CoreWeave, DoorDash, and More

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

Is The Market Rewarding The Cooper Companies, Inc. (NASDAQ:COO) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

Description: With its stock down 3.7% over the past week, it is easy to disregard Cooper Companies (NASDAQ:COO). We, however decided...

2025-11-04

CooperCompanies Announces Release Date for Fourth Quarter and Full Year 2025

Description: SAN RAMON, Calif., Nov. 04, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today it will report fourth quarter and full year 2025 financial results on Thursday, December 4, 2025, at 4:15 PM ET. Following the release, the Company will host a conference call at 5:00 PM ET to discuss the results and current corporate developments. The dial-in number for the call is 800-715-9871 and the conference ID is 2700541. A simultaneous audio webcast and su

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

What to Expect From Cooper Companies’ Next Quarterly Earnings Report

Description: The Cooper Companies is expected to release its fourth-quarter earnings by early December, and analysts anticipate mid-single-digit growth in earnings.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

Weighing Cooper Companies After a Volatile Year and Recent Gains of 10%

Description: If you are eyeing Cooper Companies and wondering whether now is the time to jump in or sit tight, you are definitely not alone. The stock has taken investors on quite a ride recently, with gains of 5.3% over the last week and an impressive 10.0% return over the past month. Yet, zoom out and the picture changes. Year-to-date, the stock is down 17.3%, and over the past year, it is off by a notable 29.1%. Even its five-year return stands at -13.3%, reminding us that the path has not been smooth...

2025-10-21

Company News for Oct 21, 2025

Description: Companies in The News Are: SMMT, CLF, LHX, COO

2025-10-20

Stocks to Watch Monday: Amazon, Zions Bancorp, Kering

Description: 🔎 A widespread outage linked to Amazon's (AMZN) Amazon Web Services hit many companies early Monday. Coinbase (COIN) and Robinhood (HOOD) were among those whose services were affected. Many services were restored as Amazon worked to address the issue.

Sector Update: Health Care Stocks Advance Late Afternoon

Description: Health care stocks rose late Monday afternoon, with the NYSE Health Care Index and the Health Care S

Sector Update: Health Care Stocks Advance Monday Afternoon

Description: Health care stocks rose Monday afternoon, with the NYSE Health Care Index up 0.9% and the Health Car

Bausch + Lomb (BLCO) Stock Is Up, What You Need To Know

Description: Shares of eyecare company Bausch + Lomb (NYSE:BLCO) jumped 3.1% in the morning session after reports revealed an activist investor, Jana Partners, took a stake in competitor Cooper Companies and was pushing for a potential merger of Cooper's contact-lens business with Bausch + Lomb.

5 Things to Know Before the Stock Market Opens

Description: News of the day for Oct. 20, 2025

Cooper Cos. Stock Rises as Report Says Activist Investor Takes Stake

Description: Shares of Cooper Cos. rose Monday following a report that said an activist investor planned to drive changes at the struggling medical device maker. Activist investor Jana Partners has built a stake in Cooper and plans to push for strategic alternatives, The Wall Street Journal reported, citing people familiar with the matter. Jana may seek a deal to combine Cooper’s contact-lens segment with competitor Bausch + Lomb the report said.

Activist Jana Pushes Big Contact-Lens Combination of Cooper and Bausch + Lomb

Description: Activist investor Jana Partners has built a stake in Cooper Cos. and plans to push for strategic alternatives, including a potential deal to combine its contact-lens unit with rival Bausch + Lomb according to people familiar with the matter. Jana also plans to push Cooper to make other changes that could help lift shares, including through improving capital allocation and returns, the people said. The global medical-device manufacturer makes contact lenses and vision-care products through its CooperVision segment and provides products and services for women’s health and fertility through CooperSurgical.

Market Chatter: Cooper Companies Faces Activist Pressure Over Strategy as Jana Partners Builds Stake

Description: Cooper (COO) is under pressure from activist investor Jana Partners, which has built a stake in the

2025-10-19

Activist Jana Takes Stake in Cooper, a Maker of Medical Devices

Description: Bausch + Lomb is seen as a potential buyer for the contact-lens unit and the CEO said he would be interested.