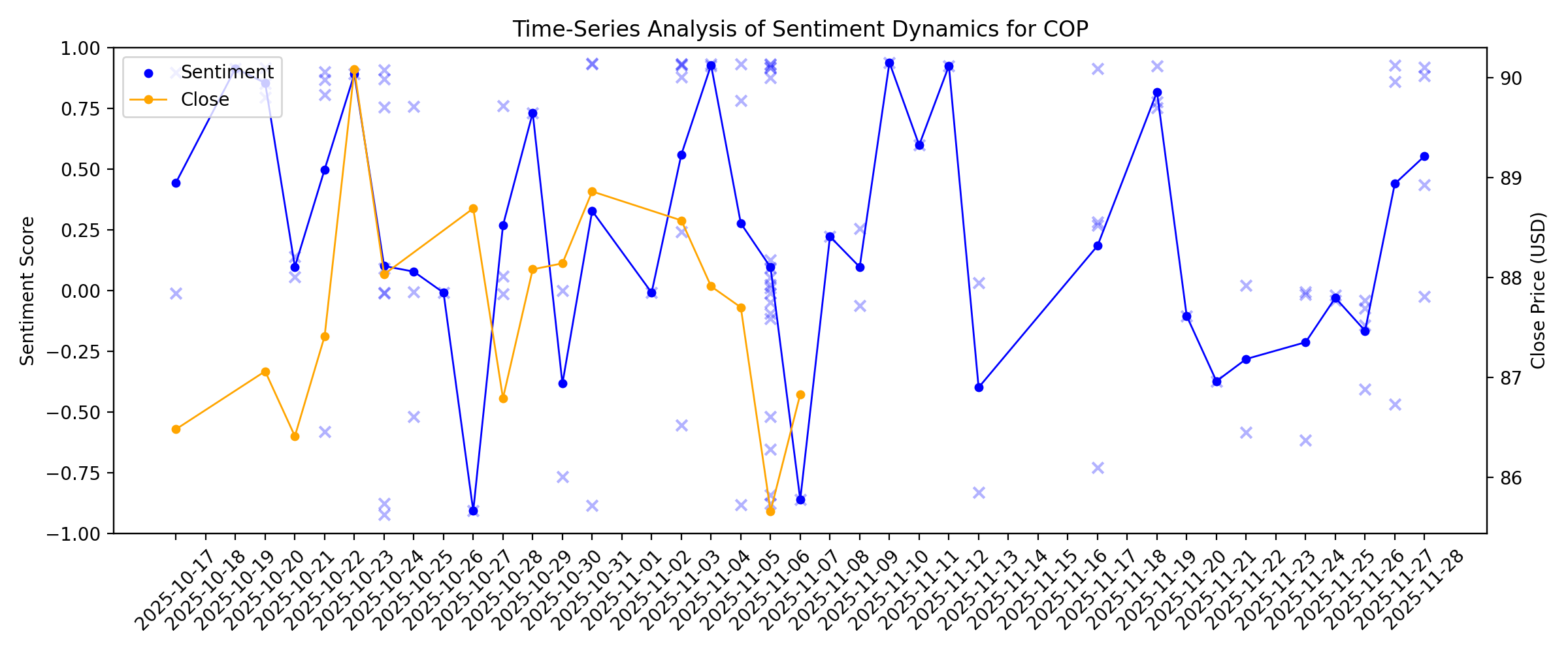

News sentiment analysis for COP

Sentiment chart

2026-01-14

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks were higher late Wednesday afternoon, with the NYSE Energy Sector Index rising 2.2%, a

ConocoPhillips Operational Strength Offsets Commodity Headwinds, UBS Says

Description: ConocoPhillips (COP) is expected to deliver another strong operational quarter in Q4, with volumes n

COP Encounters Probable Gas Across All Target Reservoirs in Australia

Description: ConocoPhillips hit probable gas in all three Waarre reservoirs at the Charlemont-1 well, delivering encouraging early results despite high-pressure delays.

ConocoPhillips Confirms Second Gas Discovery in Australia’s Otway Basin

Description: ConocoPhillips has confirmed a second natural gas discovery offshore Australia, strengthening the commercial case for further exploration in the Otway Basin

2026-01-13

Venezuelan Oil and the Limits of U.S. Refining Capacity

Description: Venezuelan crude is attractive to complex U.S. refiners with coking capacity, but only a subset of Gulf and East Coast plants can fully process the heavy, high-sulfur oil.

ConocoPhillips (COP) Price Target Lowered by $6

Description: ConocoPhillips (NYSE:COP) is included among the 10 High Yield Crude Oil Stocks to Buy After Trump’s Blitz in Venezuela. ConocoPhillips (NYSE:COP) is one of the world’s largest independent E&P companies based on oil and natural gas production and proved reserves. On January 8, Piper Sandler analyst Ryan Todd reduced the firm’s price target on ConocoPhillips […]

Oil Is Surging Over $60: Grab These Large Cap High-Yield Dividend Energy Giants Now

Description: Oil prices fell well below $60 per barrel recently before rallying back above that key level this week, initially driven lower by oversupply and weak demand. Global oil inventories had been rising, putting downward pressure on prices. At the same time, both OPEC+ and U.S. production were increasing amid relatively stable global oil demand, as ... Oil Is Surging Over $60: Grab These Large Cap High-Yield Dividend Energy Giants Now

Exxon Stock Hits Record High. Trump Spat Is Already Blowing Over.

Description: The president’s statement about Exxon is probably just the beginning of a long negotiation between the oil giants and the administration.

Trump Presses US Oil Giants To Pour $100 Billion Into Venezuela As Greenland Ambitions Rise

Description: On Friday, President Donald Trump urged U.S. oil industry leaders to commit $100 billion to rebuild Venezuela's shattered petroleum sector following the removal of Nicolás Maduro. Trump Makes Oil Investment Pitch As Venezuela Awaits Rebuild At a White House gathering with executives from Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), and other energy firms, Trump said Venezuela needs a dramatic overhaul. "American companies will have the opportunity to rebuild Venezuela’s

Oil Hits 7-Week High. Trump Tariffs Threat Sparks Concern Over Iran Supply.

Description: The price of oil hit its highest level since November after President Donald Trump said he would impose a 25% tariff on goods from countries “doing business” with Iran, in the wake of deadly protests in the Islamic Republic. Brent crude futures are trading at $64.19 a barrel, after jumping more than 3.9% over the previous five sessions. Elsewhere, West Texas Intermediate is up slightly at $59.81.

What You Need to Know for January 13, 2026

Description: 1. Fed Independence Under Fire The Justice Department’s criminal investigation into Fed Chair Jerome Powell escalated into an unprecedented institutional crisis, drawing condemnation from former Fed chairs Janet Yellen, Ben Bernanke, and Alan Greenspan. Powell called the probe, ostensibly focused on comments about a building renovation project, a “pretext” to win presidential influence over interest ... What You Need to Know for January 13, 2026

2026-01-12

Why Oil Majors Are Hesitant to Invest in Post-Maduro Venezuela

Description: Major U.S. oil and oilfield service companies are hesitant to re-enter Venezuela’s oil sector, despite the regime change, citing significant concerns over commercial frameworks, legal stability, and past asset seizures.

ConocoPhillips (COP) Stock Dips While Market Gains: Key Facts

Description: ConocoPhillips (COP) reached $95.5 at the closing of the latest trading day, reflecting a -2.06% change compared to its last close.

Trump Could Hand Chevron Another South American Win Over Exxon Mobil With Venezuela

Description: Trump said Sunday he could keep Exxon Mobil "out" of Venezuela, possibly setting up another South American win for Chevron.

Trump Dislikes Exxon’s Venezuela Foot-Dragging. There’s More to Come.

Description: The president’s statement about Exxon is probably just the beginning of a long negotiation between the oil giants and the administration.

KBR & Tecnicas Reunidas Win FEED Contract for Texas LNG Project

Description: KBR wins FEED work for a Texas Gulf Coast LNG export project with a path to EPC, lifting shares 0.4% in premarket trading today.

Zacks Market Edge Highlights: Exxon Mobil, Chevron and ConocoPhillips

Description: Exxon Mobil headlines a Zacks Market Edge debate as oil prices stay low and investors weigh whether big energy stocks are values or traps in 2026.

Sector Update: Energy Stocks Higher Pre-Bell Monday

Description: Energy stocks were mostly higher premarket Monday, with the State Street Energy Select Sector SPDR E

Here Are Monday’s Top Wall Street Analyst Research Calls: Airbnb, Akamai, Applied Materials, CoreWeave, CrowdStrike, Datadog, NetFlix, Snowflake, and More

Description: Pre-Market Stock Futures: The futures are trading lower on Monday morning after a strong finish to the week on Friday, completing a winning week for investors as all three of the major indices closed at all-time highs. The news that Jay Powell, the Chairman of the Federal Reserve, is under criminal investigation by the Department ... Here Are Monday’s Top Wall Street Analyst Research Calls: Airbnb, Akamai, Applied Materials, CoreWeave, CrowdStrike, Datadog, NetFlix, Snowflake, and More

Earnings Preview: What to Expect From ConocoPhillips' Report

Description: ConocoPhillips is set to report its fourth-quarter earnings next month, with analysts projecting a double-digit decrease in profit.

KBR Awarded FEED for Coastal Bend LNG Project

Description: HOUSTON, Jan. 12, 2026 (GLOBE NEWSWIRE) -- KBR (NYSE: KBR) has been awarded the front-end engineering design (FEED) contract for Coastal Bend’s planned natural gas liquefaction and export facility on the Texas Gulf Coast. The Coastal Bend LNG project will feature multiple liquefaction trains, cogeneration, LNG storage tanks, and export facilities. The project will utilize ConocoPhillips’ Optimized Cascade® Process (COP OCP) technology to help achieve Coastal Bend LNG’s goal of reducing greenhous

Coastal Bend LNG selects FEED partners for Texas Gulf Coast project

Description: KBR and Técnicas Reunidas will deliver the FEED for multiple large-scale liquefaction trains using ConocoPhillips’ OCP.

Trump's magic number in Venezuela is oil at $50 per barrel

Description: Trump's push to cut oil prices runs counter to the desire of the U.S. oil companies, which are struggling to maintain profits and shareholder dividends

Coastal Bend LNG Picks KBR, Técnicas Reunidas for Texas LNG FEED

Description: Coastal Bend LNG has selected KBR and Técnicas Reunidas to lead front-end engineering and design for a planned Texas LNG export facility, with a path to full EPC execution pending final investment approval.

Calculating The Intrinsic Value Of CompuGroup Medical SE & Co. KGaA (HMSE:COP)

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, CompuGroup Medical SE KGaA fair value estimate is €24.45...

Coastal Bend LNG Selects KBR and Técnicas Reunidas for FEED and EPC

Description: HOUSTON, January 12, 2026--Coastal Bend LNG today announced it has selected KBR, Inc. (NYSE: KBR) and Técnicas Reunidas (IBEXC: TRE) for the front-end engineering and design (FEED) of their planned natural gas liquefaction and export facility along the Texas Gulf Coast. Upon positive final investment decision, KBR and Técnicas Reunidas will proceed to execute the engineering, procurement, and construction (EPC) phase of the project.

2026-01-11

Trump ‘Inclined’ to Keep Exxon Out of Venezuela

Description: The president said he didn’t like comments from the company’s CEO during a meeting Friday at the White House.

How The Narrative Around ConocoPhillips (COP) Is Shifting With New Research And Cash Flow Concerns

Description: ConocoPhillips’ fair value estimate has been adjusted slightly, moving from about US$112.37 to roughly US$111.48, as recent research blends confidence in the company’s execution and balance sheet with more cautious views on crude pricing and near term cash flow. The core discount rate has been held steady at 6.956%, while modest tweaks to revenue growth assumptions, from 1.92% to 1.69%, reflect tempered expectations around demand and realizations that some firms are flagging. Stay tuned to...

2026-01-10

Trump Presses Oil Executives to Invest in Venezuela—but Gets Lukewarm Reception

Description: Exxon’s CEO says the South American country is currently “uninvestable” and plans to send a technical team to assess the situation.

An Oil Exec on ‘Landman,’ Venezuela, and Beating the S&P 500

Description: Mark Lashier, CEO of Phillips 66, also spoke about the energy company’s new directors and its relationship with the activist investor Elliott Management. The Houston-based oil and gas company Phillips 66 is named after the bygone era of early American automobiles that drove Route 66—and were fueled by Phillips Petroleum’s 66 octane gasoline. Phillips Petroleum later merged into ConocoPhillips When ConocoPhillips split in two in 2012, Phillips 66 was created.

2026-01-09

Trump to Big Oil: Spend $100 Billion in Venezuela. No Government Cash.

Description: President Donald Trump told big oil companies like Chevron Exxon Mobil and ConocoPhillips that he expects them to spend heavily to rebuild Venezuela’s oil industry, and that they shouldn’t expect financial support from the government. “The plan is for them to spend—meaning our giant oil companies will be spending at least $100 billion of their money, not the government’s money,” Trump said.

Trump pushes for $100 billion in oil investments in Venezuela while Exxon and others say it’s currently ‘uninvestable’ without major reforms

Description: Oil giants tell Trump they need stability and considerable legal and political reforms before investing big in Venezuela.

Trump urges US oil giants to repair Venezuela's 'rotting' energy industry

Description: By Jarrett Renshaw and Bo Erickson WASHINGTON, Jan 9 (Reuters) - U.S.

Trump Presses Oil Executives to Invest in Venezuela—but Gets Lukewarm Reception

Description: Exxon’s CEO says the South American country is currently “uninvestable” and plans to send a technical team to assess the situation.

ExxonMobil CEO calls Venezuela 'uninvestable'

Description: The meeting was the latest chapter in Trump's open-ended intervention in Venezuela, a South American nation he has said he wants to control for years

Trump meets with Big Oil execs to talk Venezuela investments

Description: President Trump met with Big Oil executives at the White House on Friday in the hopes of securing $100 billion to invest in and revive Venezuela's oil (CL=F, BZ=F) industry. This comes a week after the US invaded Venezuela and captured President Nicolás Maduro. Breaking News Reporter Jake Conley comes on Market Domination to review what was on the meeting's agenda and break down Trump's plans for Venezuelan oil. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

3 Oil Stocks to Start 2026: Values or Traps?

Description: With Venezuelan oil back in the spotlight, should you buy Exxon, Chevron or ConocoPhillips?

Trump Says Oil Majors Will Invest $100 Billion in Venezuela

Description: President Trump said early Friday that American oil companies would pour $100 billion of investment into Venezuela to jumpstart its oil industry. Trump's social-media post came hours before he is expected to meet representatives of Chevron, Exxon Mobil, ConocoPhillips and other oil companies at the White House to discuss investing in Venezuela.

US oil majors weigh plans to revitalise Venezuela’s energy sector

Description: ExxonMobil and ConocoPhillips previously operated in Venezuela but pulled out after Hugo Chávez’s nationalisation policies in the mid‑2000s.

Does ConocoPhillips (COP) Offer Value After Modest Share Gains And DCF Upside?

Description: If you are wondering whether ConocoPhillips is offering good value at its current share price, you are not alone. This article walks through what the numbers actually say about the stock. ConocoPhillips recently closed at US$98.72, with returns of 5.5% over the last 7 days, 5.7% over 30 days and 2.1% year to date, while the 1 year return sits at 0.5% and the 3 year return at a 9.4% decline. These moves come as investors continue to weigh sector wide factors such as energy prices, capital...

2026-01-08

Trump's Venezuela Meeting Is Shaping Up to Be a Who's Who of US Oil

Description: Nearly 20 oil executives, including veteran wildcatter Harold Hamm, are slated to meet President Donald Trump and top officials at the White House Friday as the administration pushes them to rebuild Venezuela’s battered energy sector. The scheduled lineup is a Who’s Who of American oil titans, with representatives from Chevron Corp., Exxon Mobil Corp., ConocoPhillips and other companies responding to Trump’s call to discuss potentially reviving Venezuela’s production, which has plummeted amid years of disrepair, fading investment and the exodus of foreign companies.

Venezuela: Trump's oil plans challenged by tight timeframe

Description: After capturing President Nicolás Maduro in the US invasion of Venezuela, the Trump administration has stated that it plans to be in control of Venezuelan oil (CL=F, BZ=F) sales "indefinitely." Council on Foreign Relations (CFR) senior fellow Rebecca Patterson comes on Market Domination to discuss the outlook on energy companies' investing into Venezuela's oil infrastructure and what it means for oil prices. Patterson was also the chief investment strategist for Bridgewater Associates and is currently active as the chair for the Council for Economic Education. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Trump to Meet With Chevron and Other Oil Companies on Venezuela. What We Know.

Description: Top oil companies will meet with President Donald Trump on Friday to discuss rebuilding Venezuela’s oil industry.

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks were higher late Thursday afternoon, with the NYSE Energy Sector Index rising 2.4% and

Oil Moves Higher as Traders Assess Iran Risks, Venezuela Outlook

Description: West Texas Intermediate rose 3.2% to settle below $58 a barrel. President Donald Trump threatened to hit Iran “hard” if the country’s government killed protesters amid an ongoing period of unrest. The confluence of bullish events arrived as traders were weighing the US’s efforts to control the Venezuelan oil industry.

Sector Update: Energy Stocks Climb in Afternoon Trading

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index rising 1.5% and the

Sector Update: Energy

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index rising 1.5% and the

Trump wants oil prices to hit $50 a barrel. The math doesn't work for the US oil industry.

Description: President Trump is targeting oil prices of $50 per barrel, a tough pill to swallow for the US energy industry.

How Chevron's Expanded Venezuela Oil License Boosts Its Global Play

Description: CVX's expanded Venezuela license can revive exports, reshape U.S. oil strategy and give the company a rare edge amid ongoing sanctions uncertainty.

Oil Prices Are Rising. What’s Lifting Crude After Its Two-Day Slump.

Description: Oil prices are rising after two days of falls. A bigger than-expected drawdown in U.S. crude inventories has amplified new developments in Venezuela. Brent crude has climbed 1.75% to $60.65 a barrel, while U.S. West Texas Intermediate crude was at $56.95 a barrel, up 1.73%.

Why These 3 Oil Stocks Surged After Venezuelan President Maduro's Capture

Description: Only a handful of oil companies benefited. Here's why, and why it may not last.

Market Chatter: Oil Companies Demanding US Government Guarantees Before Making Venezuela Investments

Description: US oil companies are requesting taxpayer-backed guarantees before investing in Venezuela, the Financ

Bernstein Trims Price Target on ConocoPhillips (COP) by $18

Description: ConocoPhillips (NYSE:COP) is included among the 10 Best Natural Gas Stocks to Buy Right Now. ConocoPhillips (NYSE:COP) is one of the world’s largest independent E&P companies based on oil and natural gas production and proved reserves. On January 5, Bernstein lowered its price target on ConocoPhillips (NYSE:COP) to $98 from $116, while keeping an ‘Outperform’ […]

2026-01-07

US says it needs to control Venezuelan oil sales indefinitely to drive change

Description: By Vallari Srivastava , Nathan Crooks and Jarrett Renshaw Jan 7 (Reuters) - The U.S. needs to control Venezuela's oil sales and revenue indefinitely to stabilize that country's economy, rebuild its

Venezuela oil debate reveals big mystery

Description: Ever since the Trump Administration sent armed forces to arrest Venezuelan President Nicolas Maduro last weekend, the energy industry has seemed excited that Venezuela may be open for business again. But not loudly. You don't see CEOs yelling, "I'm in on this!!" Maybe they fear new production will ...

Trump Sees an Oil Bonanza in Venezuela. Investors See Big Risks.

Description: American oil companies may find themselves stuck between an administration that needs their financial heft and expertise and investors who would rather they use them elsewhere.

Ghost Tanker Seized And Trump's 50-Million-Barrel Venezuela Oil Claim. But What Are Oil Stocks Doing?

Description: Venezuela will give the U.S. between 30 and 50 million barrels of oil, according to President Donald Trump.

2026-01-06

Trump Secures Venezuelan Oil—Bitcoin Next Target?

Description: Trump secures Venezuelan oil after Maduro's capture. Now speculation turns to Bitcoin—but seizing crypto requires keys, not force.

How Investors Are Reacting To ConocoPhillips (COP) Tying Venezuela Claims To New Oil Investment

Description: In early January 2026, U.S. officials told major oil companies that any recovery of assets nationalized in Venezuela nearly two decades ago would require fresh investment in the country’s oil sector, putting ConocoPhillips’ roughly US$12.00 billion in expropriation claims back in the spotlight. This push to link asset recovery with upfront capital spending raises complex questions for ConocoPhillips around legal outcomes, capital allocation, and exposure to Venezuela’s political and...

Trump and Oil Executives to Meet Friday to Talk About Venezuela

Description: The president has said American oil companies are likely to pour money into the South American country.

Venezuela’s Oil Comeback Could Put Energy Dividends at Risk

Description: Venezuela’s political shift has lifted energy stocks, but dividend investors may face higher risks as oil companies weigh costly reinvestment.

Trump says US to get 30 million to 50 million barrels of oil from Venezuela at market price

Description: President Donald Trump said Tuesday that Venezuela would be providing 30 million to 50 million barrels of oil to the U.S., and he pledged to use proceeds from the sale of this oil “to benefit the people” of both countries. The White House is organizing a meeting Friday with U.S. oil company executives to discuss Venezuela, which the Trump administration has been pressuring to open its vast-but-struggling oil industry more widely to American investment and know-how.

Will ConocoPhillips (COP) Beat Estimates Again in Its Next Earnings Report?

Description: ConocoPhillips (COP) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Burry Says Venezuela Oil Shift Could Pressure Russia's Energy Revenues

Description: Michael Burry argues rising Venezuelan oil output, backed by U.S. involvement, could weaken Russia's oil income over time.

Oil Stocks Lose Steam As Trump Signals U.S. Could Subsidize Venezuela Infrastructure Rebuild

Description: Venezuela continues to dominate the headlines but oil stocks appeared to lose steam in Tuesday's stock market.

How Much Oil Does Venezuela Really Have? For Chevron, the Truth Matters.

Description: Investors are raising doubts about how much oil Venezuela really has and whether it could be profitably extracted. Venezuela’s oil has long been tantalizing—and problematic. The term “proved reserves” represents oil deemed recoverable under certain technical and economic assumptions, but not necessarily oil that can be produced quickly or cheaply.

How to Boost Your Portfolio with Top Oils-Energy Stocks Set to Beat Earnings

Description: Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

Assessing ConocoPhillips (COP) Valuation After Recent Share Price Strength

Description: Why ConocoPhillips is on investors’ radar today ConocoPhillips (COP) is drawing attention after recent share price moves, with the stock up over the past week, month, and past 3 months, prompting investors to reassess its current valuation and fundamentals. See our latest analysis for ConocoPhillips. At a latest share price of US$99.20, ConocoPhillips has seen a 1 day share price return of 2.59% and a 30 day share price return of 5.88%. The 1 year total shareholder return of 0.95% contrasts...

Energy ETFs in Spotlight as Trump Vows to Control Venezuela's Oil

Description: Energy ETFs like XLE draw focus after Trump vows US control of Venezuela's oil, drawing attention to firms tied to the nation's vast reserves.

Trump’s Venezuela Action Is Boosting Oil Stocks. Why the Raid Was the Easy Part.

Description: Nvidia’s next major AI chip in full production, gold, silver prices rise, Novo Nordisk starts new front in weight-loss drug fight, and more news to start your day.

Trump administration sets meetings with oil firms on Venezuela: source

Description: <body><p>STORY: Donald Trump's administration is planning to meet with executives from U.S. oil companies later this week.</p><p>That's according to a Reuters source, who says the meetings are to discuss boosting Venezuelan oil production after U.S. forces ousted country leader Nicolas Maduro.</p><p>The administration is eyeing getting U.S. oil companies back into the South American nation, after its government took control of U.S.-led energy operations there nearly two decades ago. </p><p>The White House did not comment on the planned meetings.</p><p>But said it believed U.S. industry was ready to move into Venezuela.</p><p>The three biggest U.S. oil companies - Exxon Mobil, ConocoPhillips and Chevron - did not immediately respond to requests for comment.</p><p>According to four industry executives, the three firms have not yet had any conversations with the administration about Maduro's ouster.</p><p>That contradicts Trump's statements over the weekend.</p><p>The president said he had already held meetings with all the U.S. oil companies, both before and after Maduro was seized.</p><p>Trump also said that he expects the firms to spend billions of dollars to boost Venezuela's oil production.</p><p>But industry analysts say those plans will face challenges.</p><p>They cite lack of infrastructure, and deep uncertainty over the country’s political future and legal framework, as well as doubts over long-term U.S. policy.</p></body>

2026-01-05

Ties between California and Venezuela go back more than a century with Chevron

Description: Chevron, the oil giant founded and until recently headquartered in California, is the only foreign petroleum company still operating in Venezuela and its largest foreign investor.

Chevron Highlights Stocks to Consider if Venezuela's Oil Industry is Revived

Description: The energy sector is catching investors' attention as we begin 2026, with crude oil prices spiking following the capture and extradition of Venezuelan President Nicolas Maduro to the United States

WSJ Reporter on Why Venezuelan Oil Won't Flood Markets Anytime Soon

Description: Oil prices barely budged after the U.S. ousted Venezuela’s Nicolás Maduro and President Trump pledged billions to revive the country’s oil infrastructure. WSJ’s David Uberti breaks down the market reaction.

ConocoPhillips (COP) Outpaces Stock Market Gains: What You Should Know

Description: In the most recent trading session, ConocoPhillips (COP) closed at $99.2, indicating a +2.59% shift from the previous trading day.

Stock Market Today, Jan. 5: Dow Hits Record High on Energy Stocks Rally After Venezuela Developments

Description: Today, Jan. 5, 2026, energy giants and banks are steering Wall Street higher as traders frame Venezuela's turmoil as an investment opening.

Chevron, Halliburton, Other Energy Shares Gain on Venezuela Windfall Hopes

Description: There isn’t an easy path for U.S. companies to fulfill President Trump’s promise of overhauling Venezuela's energy infrastructure and reviving its key industry. But many oil-company shares are riding high nonetheless: Oil majors: Chevron (CVX): The one U.

Energy & Utilities Roundup: Market Talk

Description: Find insight on oil futures, Venezuela’s oil production and more in the latest Market Talks covering Energy and Utilities.

Dow Closes at New Peak as Oil Jumps Following US Military Action Against Venezuela

Description: The Dow Jones Industrial Average notched a fresh record high on Monday, with energy stocks leading t

Heard on the Street Recap: Gunboat Rally

Description: Energy and defense stocks rose after the U.S. ouster of Venezuela's president, Nicolás Maduro. Chevron, the last remaining U.S. oil major in Venezuela, gained, as did ConocoPhillips and Exxon Mobil. The prospect of greater geopolitical tensions lifted global defense stocks.

Stocks to Watch Recap: Chevron, Versant, Bed Bath, AMD

Description: ↗️ Trump Media (DJT): Shares in President Trump's social-media company rose 4.5% Monday. The U.S. ousted Venezuelan President Nicolás Maduro over the weekend and Trump pledged to dispatch U.S. drillers to revive Venezuela's crude output.

These Stocks Moved the Most Today: Chevron, Valero Energy, Comcast, Tesla, CoreWeave, IBM, Coinbase, and More

Description: Chevron, the last oil major still operating in Venezuela, surges following the U.S. capture of President Nicolás Maduro.

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks were higher late Monday afternoon, with the NYSE Energy Sector Index rising 1.3% and t

Why the stock market is 'shrugging off' Venezuelan leader Nicolás Maduro's capture

Description: Markets seem to be shrugging off the latest geopolitical tension at first blush.

Why Gold and Silver Are Getting a Boost From Arrest of Venezuela’s Maduro

Description: The U.S. ousting of Venezuela’s Nicolás Maduro, alongside threats of further gunboat diplomacy, are stoking demand for safe-haven assets.

Sector Update: Energy

Description: Energy stocks were higher late Monday afternoon, with the NYSE Energy Sector Index rising 1.4% and t

Why Big Oil has a long road ahead in Venezuela, the 'fallen angel of global crude markets'

Description: The US oil industry faces a long road ahead in Venezuela, with multiple headwinds in a potential rebuild of the country's oil industry.

Equities, Oil Prices Rise Intraday After US Captures Venezuelan President

Description: US benchmark equity indexes and oil prices rose after midday Monday as markets assessed the impact o

US Energy Secretary to discuss Venezuela oil revival with industry execs

Description: Investing.com -- US Energy Secretary Chris Wright plans to meet with oil industry executives this week to discuss revitalizing Venezuela’s energy sector following President Nicolás Maduro’s capture, according to a Bloomberg report Monday.

Sector Update: Energy Stocks Gain Monday Afternoon

Description: Energy stocks were higher Monday afternoon, with the NYSE Energy Sector Index rising 1.1% and the St

Trump's Venezuela project is a $100 billion headache for U.S. oil

Description: Immense hurdles remain, if Trump's oil spree in Venezuela materializes at all. The country's oil production is a shell of its former self

2026-01-04

Trump's plan to seize and revitalize Venezuela's oil industry faces major hurdles

Description: President Donald Trump's plan to take control of Venezuela's oil industry and ask American companies to revitalize it after capturing President Nicolás Maduro in a raid isn't likely to have a significant immediate impact on oil prices. Venezuela's oil industry is in disrepair after years of neglect and international sanctions, so it could take years and major investments before production can increase dramatically. “While many are reporting Venezuela’s oil infrastructure was unharmed by U.S. military actions, it has been decaying for many many years and will take time to rebuild,” said Patrick De Haan, who is the lead petroleum analyst at gasoline price tracker GasBuddy.

2026-01-03

Oil Market May Absorb Maduro Shock as Global Supplies Swell

Description: Venezuela’s oil infrastructure wasn’t affected after a series of US attacks in Caracas and other states, according to people with knowledge of the matter. While Venezuela was once an oil-producing powerhouse, its output has declined precipitously over the past two decades and now represents less than 1% of global supplies. President Donald Trump said during a press conference on Saturday that sanctions on Venezuela’s oil industry will remain in place and US oil companies will help rebuild infrastructure and revive output.

Chevron in Position on Venezuela's Oil Reserves

Description: Chevron is the only major U.S. company in Venezuela, and finds itself in prime position to deliver on President Trump’s pledge Saturday to rejuvenate the Latin American country’s oil business. The oil giant has spent years navigating the country’s political and economic turmoil while its rivals pulled out—or were kicked out of the country by Venezuelan dictators. Venezuela’s government says its proved oil reserves top 300 billion barrels, which, if true, would make its bounty the world’s largest, ahead of Saudi Arabia and Iran.

What Maduro’s Capture Means for Chevron Stock

Description: The company is the last U.S. oil major still operating in Venezuela, having maintained a continuous presence in the country since the early 20th century.

2026-01-02

2026-01-01

2025-12-31

Buckle And Two Other Top Dividend Stocks To Consider

Description: As the year comes to a close, major U.S. stock indexes like the Dow Jones, Nasdaq, and S&P 500 have experienced a mixed performance with recent declines but overall substantial gains for 2025. In this fluctuating market environment, dividend stocks can offer investors a sense of stability and potential income through regular payouts, making them an appealing option amidst broader market volatility.

COP's Australian Drilling Campaign Yields Unexpected Gas Encounter

Description: ConocoPhillips hits unexpected gas at Charlemont-1 in Australia's Otway Basin, pausing drilling amid high-pressure conditions at Waarre C.

2025-12-30

ConocoPhillips (COP) Increases Despite Market Slip: Here's What You Need to Know

Description: ConocoPhillips (COP) reached $94.1 at the closing of the latest trading day, reflecting a +1.59% change compared to its last close.

Big Energy Equals Big Dependable Dividends: 5 High-Yield Blue Chips to Buy for 2026

Description: These five big energy stocks make sense now, as they pay huge, dependable dividends and are rated Buy at major Wall Street firms.

2025-12-29

Trump, Zelensky Ukraine Talks End Without Peace Deal. What It Means for Oil and Energy Stocks.

Description: Talks between President Donald Trump and Ukrainian leader Volodymyr Zelenskyy failed to deliver major progress toward peace between Russia and Ukraine.

Can ExxonMobil Sail Through the Ongoing Weakness in Oil Prices?

Description: XOM faces pressure with WTI below $60, but low-cost Permian and Guyana assets, along with a strong balance sheet help cushion earnings

Banks Are Unanimously Bearish On Oil – Is It The Contrarian Opportunity For 2026?

Description: Oil is closing 2025 as one of the negative-performing assets. Despite starting the year with a rally, oil's movement soon became typical bear-market dynamics. Consistent price decline interrupted by volatile, sharp double-digit rallies. Still, even in that environment, oil majors saw significant performance discrepancies. ConocoPhillips (NYSE:COP) lost 8.3% year-to-date, while Exxon Mobil (NYSE:XOM) squeezed a double-digit gain of over 11%. Going into 2026, oil has become one of the most consens

EPD or COP: Which Energy Stock Looks Better Positioned for 2026?

Description: With oil prices seen falling in 2026, Enterprise Products' inflation-protected midstream model contrasts with ConocoPhillips' upstream exposure in a softer energy market.

2025-12-28

UBS Maintains A Buy Rating On ConocoPhillips (COP)

Description: ConocoPhillips (NYSE:COP) is among the Growth Stock Portfolio: 12 Stock Picks By Ken Fisher. On December 12, 2025, TheFly reported that UBS maintained a Buy rating and elevated its price goal for ConocoPhillips (NYSE:COP) from $117 to $120. As stated by the firm, the energy sector is set for a stronger 2026 after three years […]

2025-12-27

Here Are My Top 3 Energy Stocks to Buy Now

Description: These energy stocks could produce powerful total returns in the coming years.

US Lukoil Gas Station Owners Left in Limbo Over Russia Sanctions

Description: The Trump administration just weeks earlier had announced sanctions on two Russian oil giants, the latest measures designed to clamp down on Moscow’s crude sales and deprive the Kremlin of revenue it needs to wage its ongoing war in Ukraine. While the White House has temporarily exempted the gas stations from the sanctions, banks and credit-card companies have been spooked, in some cases forcing operators to accept cash only. Many are wondering how they’ll stay afloat under a tarnished corporate name, while uncertainty surrounds Lukoil’s efforts to meet an April deadline to offload the outlets.

Analyst Reiterates Buy Rating on ConocoPhillips (COP)

Description: ConocoPhillips (NYSE:COP) is included among the 12 Best Crude Oil Stocks to Buy for Dividends. ConocoPhillips (NYSE:COP) is one of the world’s largest independent E&P companies based on oil and natural gas production and proved reserves. On December 16, Jefferies reiterated its ‘Buy’ rating on ConocoPhillips (NYSE:COP) and assigned the stock a price target of […]

2025-12-26

Why Hold Strategy Is Apt for ConocoPhillips Stock Right Now

Description: COP's low-cost global assets, divestments and Marathon Oil deal support cash flows, but oil price pressure and Willow cost overruns argue for a hold.

2025-12-25

How Recent Developments Are Rewriting the Story for ConocoPhillips Stock

Description: ConocoPhillips’ latest price target was nudged slightly lower to about $112.37 as Wall Street analysts fine tuned their models for softer gas and NGL realizations within more conservative commodity assumptions. While several firms trimmed outer year growth expectations and cash flow forecasts, most continue to emphasize resilient production, healthy free cash flow potential, and disciplined capital returns as key supports for the long term story. Stay tuned to see how you can track these...

2025-12-24

ConocoPhillips (COP) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: ConocoPhillips (COP) reached $91.8 at the closing of the latest trading day, reflecting a -1% change compared to its last close.

How ExxonMobil Stays Resilient in a Soft Commodity Pricing Environment

Description: XOM leans on low-cost Permian and Guyana output, cost savings and an integrated model to stay profitable as oil prices soften.

Oil Prices Crashed This Year. Why the Stocks Have Held Up.

Description: For the first time this century, the stocks have risen in a year when the price of the commodity was down by more than 10%.

2025-12-23

Oil ETFs Rally Amid Intensifying U.S.-Venezuela Tension

Description: Oil ETFs are rallying as U.S.-Venezuela maritime clashes lift crude prices, adding a geopolitical risk premium.

3 US Integrated Energy Stocks to Watch Despite Industry Challenges

Description: Softer crude prices, slowing production growth and mounting renewable demand are making the prospects for the Zacks Oil & Gas US Integrated industry gloomy. ConocoPhillips (COP), Occidental (OXY) and National Fuel (NFG) are well-positioned to survive the challenges.

2025-12-22

If You Own Occidental Petroleum Stock, Take A Look At This Instead

Description: ConocoPhillips has a more impressive plan.

2025-12-21

The Returns On Capital At CompuGroup Medical SE KGaA (HMSE:COP) Don't Inspire Confidence

Description: What are the early trends we should look for to identify a stock that could multiply in value over the long term? In a...

2025-12-20

2025-12-19

1 High-Yield Dividend Stock I'd Buy Before ConocoPhillips in 2026

Description: The energy sector is beaten down due to lower oil prices.

ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?

Description: ConocoPhillips stock has a 3.6% annual yield and could be up to 18% undervalued. Another play here is to sell short out-of-the-money puts as an income play. For example, 5% OTM COP puts have a 1% monthly yield.

Subsea7 Secures EPCI Contract From ConocoPhillips Offshore Norway

Description: SUBCY lands an EPCI contract from COP for its Previously Produced Fields offshore Norway, covering subsea structures, umbilicals, risers and flowlines.

How ExxonMobil Survives Oil Price Cycles and Rewards Shareholders

Description: XOM has raised dividends for 43 years. It plans $20B buybacks in 2025 and leans on low-cost resources to manage oil price swings.

Subsea7 secures EPCI contract for PPF project offshore Norway

Description: Subsea7 will immediately start engineering and project management activities from its office in Norway.

2025-12-18

ConocoPhillips (COP) Stock Declines While Market Improves: Some Information for Investors

Description: In the most recent trading session, ConocoPhillips (COP) closed at $92.23, indicating a -2.87% shift from the previous trading day.

Is ConocoPhillips Still Attractively Priced After Its Multi Year Share Price Surge?

Description: If you are wondering whether ConocoPhillips is still good value after its big multi year run, you are not alone, and this article will unpack what the current price is really baking in. The stock has slipped about 1.9% over the last week but is still up roughly 7.0% over the past month, a reminder that sentiment around COP can change quickly even while the 5 year return sits near 183.7%. Recent moves in the share price have come as investors digest shifting oil price expectations and ongoing...

ConocoPhillips to hold fourth-quarter earnings conference call on Thursday, Feb. 5

Description: HOUSTON, December 18, 2025--ConocoPhillips will host a conference call webcast on Thursday, Feb. 5 to discuss fourth-quarter 2025 financial and operating results.

Subsea 7 - Awarded contract offshore Norway

Description: Luxembourg – 18 December 2025 - Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) today announced the award of a large1 contract by ConocoPhillips Skandinavia AS (ConocoPhillips) for the Previously Produced Fields (PPF) development, offshore Norway. Subsea7’s scope covers engineering, procurement, construction and installation (EPCI) of subsea structures, umbilicals, risers and flowlines (SURF). It follows the award on 19 May 20252 of a contract for front-end engineering and design that finalised the

2025-12-17

BP Turns to Outsider as Next CEO

Description: BP said Chief Executive Murray Auchincloss is stepping down after less than two years at the helm of the oil major and named an outsider as his successor. The London-based company is turning to Meg O’Neill, who is resigning from her role leading Woodside Energy as its next CEO. With O’Neill’s appointment, BP is breaking with its longstanding tradition to promote CEOs from within its own ranks.

Harbour Energy Expands North Sea Footprint With $170M Acquisition

Description: HBRIY is buying most Waldorf subsidiaries for $170M, lifting its Catcher stake to 90% and adding production, reserves and tax benefits.

The 2025 Energy Resurgence: 3 ETFs to Watch Before the Year Ends

Description: Energy rebounds in 2025 as electrification and AI demand lift the sector. ETFs like VDE offer broad exposure to this revival.

2025-12-16

2025-12-15

2025-12-14

3 Reasons to Buy ConocoPhillips Stock Like There's No Tomorrow

Description: ConocoPhillips offers income and growth backed by one of the lowest risk profiles in the oil patch.

Trump's Fed pick comes into focus, economic data backlog clears: What to watch this week

Description: With the December Fed meeting in the rear view, investor attention will turn toward Fed chair nomination drama and the potential for a Santa rally (or not)

ConocoPhillips (COP) Valuation Check as Shares Grind Higher but Trail Over the Past Year

Description: What the latest move in ConocoPhillips stock might be telling investors ConocoPhillips (COP) has been quietly grinding higher, with shares up about 5% over the past month even as the stock is still slightly negative over the past year. That mix of short term momentum and longer term underperformance sets up an interesting question for investors, especially with steady revenue and net income growth suggesting that fundamentals may be improving faster than the share price. See our latest...

2025-12-13

How strong is U.S. shale for 2026?

Description: Investing.com -- U.S. shale is heading into 2026 with steadier momentum than many expected, with Jefferies’ latest supply checks pointing to modest growth rather than the declines implied by government forecasts.

2025-12-12

ConocoPhillips (COP) Suffers a Larger Drop Than the General Market: Key Insights

Description: In the most recent trading session, ConocoPhillips (COP) closed at $95.54, indicating a -1.21% shift from the previous trading day.

The Best Dividend ETF for Right Now—and 2026

Description: The performance of dividend funds is similar. The stock market has returned more than 18% so far this year, including dividends. The fact that the rally is led by fast-growing tech companies makes it hard for dividend stocks, dedicated to handing cash back to investors, to keep up.

ExxonMobil Accelerates Permian Growth, Aims for 2.3M Barrels by 2030

Description: XOM lifts Permian growth with new proppant tech and fresh Midland acreage as it works toward 2.3M barrels a day by 2030.

2025-12-11

Top 5 Stocks Impacted by Potential Armed Conflict With Venezuela

Description: The United States has assembled its largest military presence in the Caribbean since 1989, with more than 15,000 troops deployed near Venezuela. Following the December 10 seizure of a Venezuelan oil tanker and ongoing strikes on alleged drug-smuggling boats, $36 million in trading volume on prediction markets tracking US-Venezuela military engagement signals serious investor concern ... Top 5 Stocks Impacted by Potential Armed Conflict With Venezuela

Wall Street Cautious on ConocoPhillips (COP), Here’s Why

Description: ConocoPhillips (NYSE:COP) is one of the Cheap NYSE Stocks to Buy Now. Wall Street has a cautious outlook on ConocoPhillips (NYSE:COP), mainly due to the supply-side risks facing the oil and liquids sector. On December 8, Arun Jayaram from J.P. Morgan lowered the firm’s price target on the stock from $112 to $102 and maintained […]

Why XOM's Permian & Guyana Operations Could Drive Long-Term Returns

Description: ExxonMobil's record Permian and Guyana output, reinforced by new Midland acreage, signals strong long-term upstream momentum.

Recent uptick might appease ConocoPhillips (NYSE:COP) institutional owners after losing 2.0% over the past year

Description: Key Insights Institutions' substantial holdings in ConocoPhillips implies that they have significant influence over the...

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

BMO Launches New CDRs With Exposure to U.S. Stocks Including Apollo Global Management, ConocoPhillips, Northrop Grumman, Home Depot and Vistra

Description: Bank of Montreal (BMO) announced five new Canadian depositary receipts (CDRs) will begin trading on the Cboe Canada exchange today. The initial offering of these new CDRs has closed.

2025-12-04

Does ConocoPhillips’ Recent Share Rebound Signal a Mispriced Opportunity in 2025?

Description: Wondering if ConocoPhillips is quietly turning into a bargain, or if the market already priced in all the good news? Let us unpack what the latest moves really say about value before we dive into the hard numbers. Over the last week the stock has climbed 5.4%, adding to a 3.7% gain over 30 days, even though it is still down 8.3% year to date and 8.2% over the past year, after a 157.4% increase over five years. That mix of short term strength and longer term consolidation is the kind of setup...

EIA's Forecast for Alaska's Oil Boom to Power Energy ETFs

Description: Alaska's projected 13% oil surge in 2026 fuels a powerful tailwind for energy ETFs heavily exposed to COP and XOM.

Evaluating ConocoPhillips (COP) Stock's Actual Performance

Description: Oil prices aren't the only factor impacting ConocoPhillips' stock returns.

2025-12-03

National Petroleum Council Urges Priority Reforms to Strengthen Electricity Delivery & Energy Reliability

Description: National Petroleum Council (NPC) Chair and Williams Executive Chairman Alan Armstrong today announced the release of the first two reports in the NPC's Future Energy Systems series requested by U.S. Secretary of Energy Chris Wright in June to address unprecedented energy demand growth. Made up of more than 200 experts, the Council provided dozens of concrete policy recommendations for immediate federal action, including reforms to streamline federal permitting, improved coordination between natu

2025-12-02

Top Research Reports for Apple, Tesla & Micron Technology

Description: Apple's strong Services growth, over 1B paid subscribers and the new iPhone 17 lineup shape upbeat sales expectations despite margin pressures.

3 Reliable Dividend Stocks To Consider With Up To 9.9% Yield

Description: As the U.S. stock market faces a downturn with major indices like the Dow Jones and S&P 500 closing lower amid risk-off sentiment, investors are increasingly seeking stability through dividend stocks. In this environment, reliable dividend-paying companies can offer a steady income stream, making them an attractive option for those looking to balance their portfolios against market volatility.

2025-12-01

XOM's Upstream Advantage: The Growth Story Investors Shouldn't Ignore

Description: ExxonMobil's record Permian and Guyana output, plus new Midland acreage, underscores its strengthening upstream growth story.

Aker Solutions secures field service contract from ConocoPhillips

Description: The agreement includes options for two additional three-year extensions.

2025-11-30

CompuGroup Medical SE KGaA (HMSE:COP) shareholders have endured a 69% loss from investing in the stock five years ago

Description: Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high...

2025-11-29

2025-11-28

How Analyst Opinions Are Shaping the Changing Story for ConocoPhillips

Description: ConocoPhillips has seen its fair value estimate decrease slightly, with the target moving from $113.54 to $112.91 per share. This update comes amid a blend of optimism and caution from recent analyst commentary, reflecting both the company's promising long-term prospects and some near-term sector challenges. Stay tuned to discover how ongoing research and updates can help keep you informed as the narrative around ConocoPhillips continues to evolve. Stay updated as the Fair Value for...

How ExxonMobil Plans to Sustain Cash Flows Amid Softer Crude Prices

Description: XOM leans on low-cost Guyana and Permian assets to keep earnings and cash flows resilient even during a softer crude price environment.

Aker Solutions awarded substantial M&M contract by ConocoPhillips

Description: Aker Solutions has signed a six-year frame agreement with ConocoPhillips Skandinavia AS (ConocoPhillips), which includes an option to extend the contract for up to two additional three-year periods.

Wolfe Research Highlights ConocoPhillips’ (COP) Asset Sales, Anadarko Acquisition, and Future Cash Flow

Description: ConocoPhillips (NYSE:COP) ranks among the 9 hot energy stocks to buy. On November 6, Wolfe Research reaffirmed its Outperform rating on ConocoPhillips (NYSE:COP) and increased its price target to $131 from $130. The change comes after ConocoPhillips announced an 8% dividend raise, which Wolfe Research characterizes as a possible trigger for the market to recognize […]

2025-11-27

ConocoPhillips (COP) Inks MOU to Pursue Natural Gas Opportunities in Syria

Description: ConocoPhillips (NYSE:COP) is an affordable blue-chip stock to buy. On November 18, ConocoPhillips (NYSE:COP), in partnership with Novatera and Syrian Petroleum Company, inked a memorandum of understanding focusing on opportunities in the natural gas sector. The agreement paves the way for ConocoPhillips to pursue opportunities to develop existing gas fields in Syria and to explore […]

Piper Sandler Maintains a Buy on ConocoPhillips (COP), Keeps the PT

Description: ConocoPhillips (NYSE:COP) is one of the Best Very Cheap Stocks to Invest In. On November 24, Ryan Todd from Piper Sandler reiterated a Buy rating on ConocoPhillips (NYSE:COP) with a $115 price target. Earlier, Devin McDermott from Morgan Stanley had also reiterated a Buy rating on the stock but lowered the price target from $122 […]

How Is ConocoPhillips’s Stock Performance Compared to Other Oil & Gas E&P Stocks?

Description: ConocoPhillips has underperformed the oil & gas E&P peers over the past year, but analysts remain highly optimistic about the company’s future growth potential.

2025-11-26

Morgan Stanley Reiterates a Buy Rating on ConocoPhillips (COP)

Description: ConocoPhillips (NYSE:COP) is one of the best large cap stocks to invest in for the long term. Morgan Stanley analyst Devin McDermott reiterated a Buy rating on ConocoPhillips (NYSE:COP) on November 20, setting a $117 price target. The rating update followed the company’s fiscal Q3 2025 earnings release on November 6, with reported earnings per […]

ConocoPhillips or ExxonMobil: Which Oil Major Looks Stronger Today?

Description: XOM's integrated strength and low-cost assets contrast with COP's upstream focus as investors weigh stability versus risk.

Layoffs are piling up, raising worker anxiety. Here are some companies that have cut jobs recently

Description: It’s a tough time to be looking for a job. Amid wider economic uncertainty, some analysts have said that businesses are at a “no-hire, no fire” standstill. Others cite corporate restructuring more broadly — or are redirecting money to artificial intelligence.

UBS Cautious on ConocoPhillips (COP) Amid Increased Willow Project Cost Estimates, Maintains ‘Buy’ Rating

Description: ConocoPhillips (NYSE:COP) is one of the most undervalued NYSE stocks to buy right now. On November 12, UBS lowered the firm’s price target on ConocoPhillips to $117 from $122 and kept a Buy rating on the shares. Despite the financial challenges faced by the company associated with the Willow CapEx, UBS kept its optimistic forecast […]

2025-11-25

Ceasefire Speculation Tests Oil’s Floor

Description: Media reports that the Trump administration is inching ever closer to a comprehensive peace deal between Russia and Ukraine has exerted additional pressure on crude prices

UBS Cautious on ConocoPhillips (COP) Amid Increased Willow Project Cost Estimates, Maintains ‘Buy’ Rating

Description: ConocoPhillips (NYSE:COP) is one of the most undervalued NYSE stocks to buy right now. On November 12, UBS lowered the firm’s price target on ConocoPhillips to $117 from $122 and kept a Buy rating on the shares. Despite the financial challenges faced by the company associated with the Willow CapEx, UBS kept its optimistic forecast […]

2025-11-24

UBS Remains Bullish on ConocoPhillips (COP) Amid Cost Pressures and Softer 2026 Oil Volume Outlook

Description: ConocoPhillips (NYSE:COP) is one of the 12 best commodity stocks to buy right now. On November 12, 2025, UBS reduced its price target on ConocoPhillips (NYSE:COP) from $122 to $117, reiterating a “Buy” rating. The investment firm cites cost pressures from the Willow project, which are evident from the $1-$1.5 billion capital expenditure increase for […]

What Every ConocoPhillips Investor Should Know Before Buying

Description: ConocoPhillips is a unique oil and gas company.

ConocoPhillips (COP): Valuation Insights as Shares Lag Energy Sector

Description: ConocoPhillips (COP) shares have edged lower by roughly 1% over the past week. Investors are keeping an eye on the stock’s performance, particularly with ongoing shifts in energy markets and recent pressure on oil prices. See our latest analysis for ConocoPhillips. After a tough few months for energy stocks, ConocoPhillips has seen its share price slip about 13% year-to-date, with the latest move reflecting continued softness in oil prices and a wider market rotation out of energy. Over the...

2025-11-23

2025-11-22

Australia: A Global LNG Power Facing Local Shortages

Description: Australia remains the world’s third-largest LNG exporter, but domestic gas output has plateaued at around 13 million m³/month since 2021.

3 Dividend Stocks to Hold for the Next 5 Years

Description: These companies have lots of visibility into their growth over the next several years.

2025-11-21

ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could be 24% Undervalued

Description: ConocoPhillips Inc. raised its dividend by 7.7%, giving COP stock a 3.84% annual yield. That is well over its historical average, implying COP could be worth 24% more. One way to play it is to short out-of-the-money put options.

2025-11-20

Building a Robust Practice in Small-Town America

Description: Next-gen financial advisor Heather Robison teamed up with her mother to grow a $460 million business in Oklahoma using tax planning as a differentiator.

2025-11-19

The Bull Case For ConocoPhillips (COP) Could Change Following Dividend Hike and Raised Production Outlook

Description: In early November 2025, ConocoPhillips reported third-quarter results with US$15.03 billion in sales, raised its production guidance, increased its quarterly dividend by 8% to US$0.84 per share, and continued share repurchases totaling over US$1.27 billion for the quarter. Management's decision to both boost the dividend and raise production forecasts highlights clear confidence in ongoing cash generation and operational momentum. We'll explore how the company's higher production guidance...

EIA sees Alaska 2026 oil production highest since 2018

Description: Investing.com -- Alaska’s crude oil production is forecast to hit 477,000 barrels per day (bpd) in 2026, reaching its highest level since 2018, according to the U.S. Energy Information Administration (EIA).

Syrian Petroleum Company signs MoU to boost gas sector

Description: The agreement involves upgrading current gas fields and exploring new reserves with improved technical standards.

2025-11-18

2025-11-17

ConocoPhillips and partners find gas in exploration well in Otway Basin

Description: Wireline logging indicated the presence of gas in both the primary Waarre A and secondary Waarre C sandstones.

COP's Essington-1 Well Confirms Gas Presence Offshore Australia

Description: ConocoPhillips' Essington-1 well confirms gas offshore Australia as the exploration campaign advances to a second well.

ConocoPhillips Insiders Added US$2.26m Of Stock To Their Holdings

Description: Multiple insiders secured a larger position in ConocoPhillips ( NYSE:COP ) shares over the last 12 months. This is...

ConocoPhillips Hits New Gas Discovery in Australia’s Otway Basin

Description: ConocoPhillips has made a promising natural gas discovery in Australia’s Otway Basin, marking the region’s first find since 2021 and raising new questions around future domestic gas supply obligations.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

What Recent Analyst Updates Mean for the Changing Story Behind ConocoPhillips

Description: ConocoPhillips’ consensus analyst price target has edged down slightly, moving from $113.78 to $113.54. This reflects ongoing analyst reassessment after recent earnings and sector-wide developments. While confidence remains in the company’s overall strategy, shifting expectations around revenue growth and market conditions have led to this modest revision. Investors should follow closely as the narrative around ConocoPhillips evolves and new forecasts emerge, shaping opportunities in real...

Petronas signs MoUs to advance seismic imaging and AI initiatives

Description: The MoUs involve organisations such as Beicip-Franlab, ConocoPhillips, Eliis, Microsoft, PTTEP, Shell, SLB and TotalEnergies.

2025-11-12

COP Rises 4% Since Q3 Earnings Beat Driven by Upstream Outperformance

Description: ConocoPhillips surges since Q3 earnings beat, powered by stronger-than-expected upstream production across key U.S. basins.

2025-11-11

Why ConocoPhillips Stock Popped Today

Description: Conoco stock isn't cheap yet, but higher oil prices could help.

2025-11-10

APA Corporation Q3 Earnings Beat Estimates Despite Weak Oil Prices

Description: APA posts stronger-than-expected Q3 earnings as solid production and cost control offset weaker oil prices.

2025-11-09

This Top Oil Stock Expects to Deliver Steadily Rising Free Cash Flow Before Hitting a Gusher in 2029

Description: ConocoPhillips is ramping up its money-printing machine.

Is There Now An Opportunity In CompuGroup Medical SE & Co. KGaA (HMSE:COP)?

Description: CompuGroup Medical SE & Co. KGaA ( HMSE:COP ), is not the largest company out there, but it had a relatively subdued...

2025-11-08

ConocoPhillips (COP): Valuation Update Following Dividend Hike and Raised Production Guidance

Description: ConocoPhillips (COP) just posted quarterly results that surpassed analyst estimates, due to higher oil and gas production as well as effective cost controls. The company also raised its full-year production guidance and increased its quarterly dividend by 8%. See our latest analysis for ConocoPhillips. Despite the solid operational results and dividend boost, ConocoPhillips’ share price has struggled to find momentum this year, with a year-to-date share price return of -13.2% and a 1-year...

2025-11-07

ConocoPhillips increases dividend for Q3 2025 amid higher project costs

Description: The US-based company reported net income of $1.7bn for Q3 2025.

2025-11-06

ConocoPhillips Lifts Dividend 8% and Raises 2025 Output

Description: ConocoPhillips reported Q3 results, increased its base dividend, and issued initial 2026 spending and cost guidance.

ConocoPhillips (COP) Q3 2025 Earnings Call Highlights: Strong Production and Raised Guidance ...

Description: ConocoPhillips (COP) exceeds production expectations and raises full-year guidance, despite increased costs for the Willow Project.

ConocoPhillips Q3 2025 Earnings Transcript

Description: Ryan Lance: Thanks, Guy, and thank you to everyone for joining our third quarter 2025 earnings conference call. On the back of this strong performance, we raised our full-year production guidance and we have reduced our adjusted operating cost guidance for the second time this year.

COP Beats Q3 Earnings Estimates, Hikes '25 Production Guidance

Description: ConocoPhillips tops Q3 earnings and revenue estimates as global production jumps despite falling realized prices and rising costs.

Earnings Data Deluge

Description: Earnings Data Deluge.

ConocoPhillips Raises Dividend 8% Despite Net Income Sliding 17%

Description: ConocoPhillips (NYSE: COP) beat adjusted earnings expectations in the third quarter, delivering $1.61 per share versus the $1.41 consensus. Revenue climbed to $15.52 billion, topping the $14.63 billion estimate. Yet the stock opened lower at $88.61 as investors weighed the results against a sharply lower reported EPS figure and the persistent headwind of declining ... ConocoPhillips Raises Dividend 8% Despite Net Income Sliding 17%

Pre-Markets Improve on Big Earnings Morning

Description: One might say the relative volatility we started seeing in early October has continued into this month as well.

ConocoPhillips Boosts Dividend After Strong Third Quarter Earnings Beat

Description: ConocoPhillips reported better-than-expected third-quarter adjusted earnings of $1.61 per share and announced an 8% increase to its quarterly dividend, while also providing preliminary 2026 guidance.

SoftBank & Marvell, Duolingo stock plunges, ConocoPhillips earnings

Description: There are a number of stocks on the move on Thursday, Nov. 6. Marvell (MRVL) shares are rising on a Bloomberg report that SoftBank (9984.T) weighed a bid for the tech company. Duolingo's (DUOL) stock is cratering following its third quarter earnings report and fourth quarter guidance. ConocoPhillips (COP) reported third quarter earnings that topped estimates. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

Sector Update: Energy Stocks Advance Premarket Thursday

Description: Energy stocks were advancing premarket Thursday, with The Energy Select Sector SPDR Fund (XLE) 0.3%

ConocoPhillips (COP) Surpasses Q3 Earnings and Revenue Estimates

Description: ConocoPhillips (COP) delivered earnings and revenue surprises of +15.00% and +6.02%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Shell, Mitsubishi invest $17M in hybrid direct air capture startup

Description: DAC developer Avnos will use the funding to build its first commercial-scale facility for its technology that pulls CO2 and water from the atmosphere.

Stocks Mostly Up Pre-Bell as Traders Assess Supreme Court Hearing on Trump Tariffs

Description: US equity markets were mostly pointing higher before Thursday's opening bell as investors assess the

ConocoPhillips: Q3 Earnings Snapshot

Description: HOUSTON (AP) — ConocoPhillips (COP) on Thursday reported third-quarter net income of $1.73 billion. On a per-share basis, the Houston-based company said it had net income of $1.38. Earnings, adjusted for non-recurring costs, were $1.61 per share.

ConocoPhillips announces third-quarter 2025 results; increases quarterly ordinary dividend by 8% and announces preliminary 2026 guidance

Description: HOUSTON, November 06, 2025--ConocoPhillips today reported third-quarter 2025 earnings of $1.7 billion, or $1.38 per share.

Tech-Calm, DC Shutdown, Tariff Views Cap Wall Street Pre-Bell; Asia Up, Europe Off

Description: Wall Street futures pointed sideways pre-bell as tech-sector values largely stabilized, and as trade

Global Markets Stabilize After AI Stocks Reverse Losses

Description: U.S. stock futures edged slightly lower early in European business hours, but Asian shares closed higher, tracking the overnight action on Wall Street, while moves in Europe were muted.

Musk Pay Vote, Airbnb Earnings, Bank of England Rate Decision: Still to Come This Week

Description: All eyes are on the government shutdown, now the longest on record. Several lawmakers have expressed optimism that the shutdown will end this weekend if talks progress. Meanwhile, investors will dig into a batch of earnings, and Tesla is due to reveal how shareholders voted on CEO Elon Musk’s $1 trillion pay package.

2025-11-05

Does ConocoPhillips' Australian Drilling Deal Signal a Turning Point for Transocean's (RIG) Growth Ambitions?

Description: ConocoPhillips recently announced that it has commenced drilling the Essington-1 exploration well offshore Australia using a Transocean rig, targeting substantial natural gas resources as part of the Otway Exploration Drilling Program. This operational development highlights Transocean's expanding presence in key international exploration projects and underscores the importance of contract wins in strengthening its business pipeline. We'll examine how Transocean’s new Australian drilling...

Tesla shareholder vote, Fed talk, mortgage rates: What to Watch

Description: Asking for a Trend host Josh Lipton takes a look at the top stories for investors to watch on Thursday, Nov. 6. Tesla (TSLA) is having its shareholder meeting, where investors will decide whether to award Tesla CEO Elon Musk with a $1 trillion pay package. AstraZeneca (AZN), ConocoPhilips (COP), and Warner Bros. Discovery (WBD) post earnings results in the morning. Airbnb (ABNB), Take-Two (TTWO), and Affirm (AFRM) will report in the afternoon. There will be lots of commentary from Federal Reserve officials, including from Cleveland Fed President Beth Hammack and Fed Governor Christopher Waller. Weekly mortgage rates data from Freddie Mac (FMCC) will also be released. To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend.

Earnings live: Snap stock soars, DoorDash and Duolingo plunge in post-earnings swoon

Description: Third quarter earnings season is in full swing, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

2025-11-04

Earnings live: Pinterest stock tanks, AMD and Supermicro falter, Rivian pops amid flurry of Q3 reports

Description: Third quarter earnings season is in full swing, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

Are Wall Street Analysts Bullish on ConocoPhillips Stock?

Description: ConocoPhillips has lagged both the broader market over the past year, yet analysts continue to express confidence in the company’s longer-term growth outlook.

2025-11-03

TMX Opens Asia Route As Canadian Crude Discounts Narrow

Description: Canadian oil prices are surging due to robust demand from China, narrowed crude discounts, and increased efficiency from automation and cost discipline in the oil sands sector.

Earnings live: Palantir stock rises modestly on strong results, Hims & Hers stock surges

Description: Third quarter earnings season is in full swing, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

OPEC+ Gave In: Grab These Large Cap High-Yield Dividend Energy Giants Now

Description: With oil prices reaching levels not seen since 2021, it makes sense for investors to consider the largest and most established mega-cap integrated leaders.

ConocoPhillips starts exploration in Australia’s Otway Basin

Description: This drilling, part of the OEDP, aims to explore natural gas reserves for the East Coast market.

Earnings Lift Wall Street Higher Pre-Bell; Asia, Europe Up

Description: Wall Street futures pointed moderately higher pre-bell as traders digested a positive earnings repor

Is ConocoPhillips a GARP Stock Opportunity for 2025 and Beyond

Description: Strong cash returns, efficiency gains, and fair valuation make ConocoPhillips a standout GARP stock after its Q2 2025 results.

2025-11-02

How Are Lowered Earnings Expectations Shaping ConocoPhillips’ (COP) Long-Term Growth Narrative?

Description: ConocoPhillips is set to release its quarterly earnings report on November 6, 2025, with analysts estimating earnings per share will decline year-over-year even as revenue increases nearly 8% compared to the same period last year. Downward revisions in consensus earnings estimates over the past month reflect growing caution among analysts about the company's near-term performance ahead of its earnings release. We’ll explore how these lowered earnings expectations ahead of the upcoming report...

2025-11-01

2025-10-31

SNAP benefits expire, open enrollment, earnings: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come throughout next week, including: — The nearing expiration of SNAP benefits funding (Supplemental Nutrition Assistance Program) as a federal judge orders the Trump administration to continue funding the program. — Earnings results from Berkshire Hathaway (BRK-A, BRK-B) this Saturday and quarterly results from companies like Palantir Technologies (PLTR), Advanced Micro Devices (AMD), Qualcomm (QCOM), and McDonald's (MCD) throughout the rest of the week — The beginning of open enrollment for health insurance coverage. — Economic commentary from a handful of Federal Reserve officials. — Tesla's (TSLA) shareholder meeting, where investors will vote on CEO Elon Musk's $1 trillion executive pay package. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Earnings live: Amazon stock soars, Apple pares gains with earnings from AI players to come

Description: Third quarter earnings season is ramping up, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

COP Poised to Report Q3 Earnings: Here's What You Need to Know

Description: ConocoPhillips is set to post Q3 results on Nov. 6, with stronger output expected despite lower year-over-year oil prices.

2025-10-30

Analysts Estimate ConocoPhillips (COP) to Report a Decline in Earnings: What to Look Out for

Description: ConocoPhillips (COP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Morgan Stanley Reduces PT on ConocoPhillips (COP) Stock

Description: ConocoPhillips (NYSE:COP) is one of the Best Bargain Stocks to Buy in November. On October 14, Morgan Stanley analyst Devin McDermott reduced the price objective on the company’s stock to $122 from $123, while keeping an “Overweight” rating. Notably, the firm anticipates clean Q3 operational updates. That being said, the firm also believes that the cash […]

2025-10-29

Three Dividend Stocks To Enhance Your Portfolio

Description: As major U.S. stock indexes reach new heights, bolstered by significant events such as Nvidia's unprecedented $5 trillion market cap and anticipation surrounding the Federal Reserve's interest rate decisions, investors are keenly evaluating their portfolios amidst these dynamic market conditions. In this environment, dividend stocks can offer a strategic advantage by providing consistent income streams and potential stability against market volatility.

2025-10-28

ConocoPhillips (COP) Stock Declines While Market Improves: Some Information for Investors

Description: In the most recent trading session, ConocoPhillips (COP) closed at $86.79, indicating a -2.14% shift from the previous trading day.

Layoffs are piling up, raising worker anxiety. Here are some companies that have cut jobs recently

Description: Others cite corporate restructuring more broadly — or, as seen with big names like Amazon, are redirecting money to investments like artificial intelligence. In such cases, “it’s not so much AI directly taking jobs, but AI’s appetite for cash that might be taking jobs," said Jason Schloetzer, professor business administration at Georgetown University’s McDonough School. Federal employees have encountered additional doses of uncertainty, impacting worker sentiment around the job market overall.

Is There an Opportunity in ConocoPhillips After Share Price Drop in 2025?

Description: If you hold ConocoPhillips stock, or are thinking about adding it to your portfolio, you are not alone in scoping out what’s behind the recent price shifts. ConocoPhillips closed at $88.69, working its way back up with a 1.9% return over the past week, but still down nearly 10% for the past month and off more than 11% year to date. That drawdown echoes the broader energy sector’s volatility. If you zoom out, the five-year chart still boasts a jaw-dropping 248.0% gain. Clearly, fortunes have...

2025-10-27

Better Dividend Stock: Chevron vs. ConocoPhillips

Description: If you are looking for an energy-related dividend stock you'll need to consider what's most important: energy or dividends.

2025-10-26

Shale Giants Slash Thousands of Jobs as Lower Prices Bite

Description: U.S. oil majors, including ConocoPhillips, Chevron, and ExxonMobil, are cutting jobs substantially in 2025 to reduce costs amid lower oil prices.

2025-10-25

1 Magnificent Oil Stock Down 18% to Buy and Hold Forever

Description: ConocoPhillips is about to enter a multiyear free-cash-flow growth phase.

Trump Refilling Strategic Petroleum Reserve – Big Oil Could Benefit

Description: The U.S. Strategic Petroleum Reserve (SPR) was created in 1975 by the Energy Policy and Conservation Act, signed into law by President Gerald Ford. It was established in response to the 1973-1974 oil embargo, which highlighted the U.S. economy’s vulnerability to oil supply disruptions. Those who were around at the time, like your author, witnessed ... Trump Refilling Strategic Petroleum Reserve – Big Oil Could Benefit

A Fresh Look at ConocoPhillips Valuation After Announcing Major Workforce Cuts and Recent Profit Decline

Description: ConocoPhillips (NYSE:COP) is preparing for significant workforce reductions, announcing plans to cut its global headcount by 20% to 25% before year-end. The initiative begins with layoffs at its Canadian operations in early November, following a dip in recent profits and placing renewed focus on capital efficiency. See our latest analysis for ConocoPhillips. The restructuring news has landed during a challenging period for ConocoPhillips shareholders. The company’s share price dropped 2.28%...

2025-10-24

Sector Update: Energy Stocks Decline Late Afternoon

Description: Energy stocks fell late Friday afternoon, with the NYSE Energy Sector Index down 0.6% and the Energy

Sector Update: Energy Stocks Decline in Afternoon Trading

Description: Energy stocks fell Friday afternoon with the NYSE Energy Sector Index dropping 0.4% and the Energy S

Update: Market Chatter: ConocoPhillips to Lay Off Workers in Canada Starting November

Description: (Updates to include a statement from a ConocoPhillips spokesperson in the last paragraph.) Conoc

EPD Poised to Report Q3 Earnings: Here's What You Need to Know

Description: Enterprise Products readies its Q3 2025 report as stable pipeline revenues and higher gas margins meet expectations for softer overall sales.

Phillips 66 Set to Report Q3 Earnings: Here's What You Need to Know

Description: PSX gears up for Q3 results as softer crude prices and steady midstream income shape expectations for its refining-driven performance.

NCSM Poised to Report Q3 Earnings: Here's What You Need to Know

Description: NCS Multistage Holdings readies Q3 2025 report after a strong prior beat, but softer oil prices may weigh on results.

Sector Update: Energy Stocks Edge Higher Premarket Friday

Description: Energy stocks were edging higher premarket Friday, with The Energy Select Sector SPDR Fund (XLE) adv

Here is What to Know Beyond Why ConocoPhillips (COP) is a Trending Stock

Description: Zacks.com users have recently been watching ConocoPhillips (COP) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2025-10-23

Wall Street climbs to the cusp of records as oil prices jump

Description: U.S. stocks rose to the cusp of their records on Thursday, as oil prices jumped after President Donald Trump announced “massive” new sanctions on Russia’s crude industry. Companies in the oil and gas business led the way, including gains of 1.1% for Exxon Mobil, 3.1% for ConocoPhillips and 3.4% for Diamondback Energy. The hope is to convince Russia’s president, Vladimir Putin, to end the brutal war with Ukraine, and sanctions could constrict the global flow of oil.

2025-10-22

Susquehanna Maintains a Buy Rating on ConocoPhillips (COP)