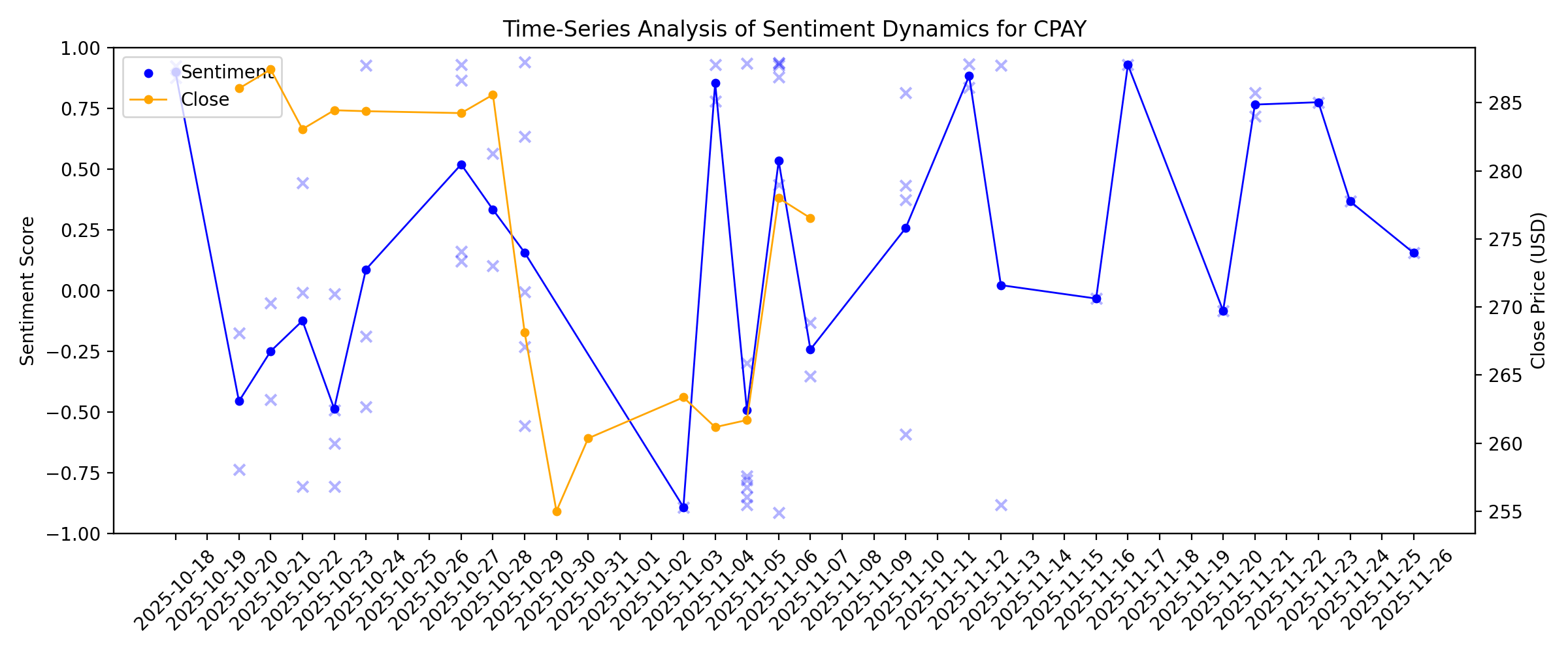

News sentiment analysis for CPAY

Sentiment chart

2026-01-14

2026-01-13

Trump attack on Fed ripples through financial markets

Description: Karl Schamotta Chief Market Strategist at Corpay speaks to Financial Post's Larysa Harapyn about Donald Trump administration’s latest escalation of attacks on the Federal Reserve and what it means for the U.S. dollar and economy.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Is Corpay’s (CPAY) Insider Buying and Earnings Beat Signaling Undervalued Payment Platform Potential?

Description: In recent days, Corpay reported third-quarter adjusted earnings above analyst expectations with revenue in line, while director Stull Steven T. purchased US$2.50 million of company shares, events that occurred prior to today. This combination of an earnings beat and insider buying has reignited interest in whether Corpay’s current valuation fully reflects its business prospects. Next, we’ll examine how Corpay’s stronger-than-expected quarterly earnings may influence the existing investment...

Is Corpay (CPAY) Still Attractive After Recent Share Rebound And Mastercard Stake News

Description: If you are wondering whether Corpay's current share price reflects its true worth, this article will walk through what the numbers suggest and where the value questions really sit. The stock most recently closed at US$331.41, with returns of 10.1% over 7 days and 10.4% over the past month, while the 1 year return sits at a 7.3% decline and the 3 year return at 70.4%. That mix of short term strength and weaker 1 year return, alongside a 70.4% return over 3 years, has put the spotlight on...

Corpay's Quarterly Earnings Preview: What You Need to Know

Description: Corpay will release its fourth-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

2026-01-08

Sixth Street Specialty Lending, SoFi, Corpay, EVERTEC, and Oaktree Specialty Lending Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investors rotated out of tech names to capitalize on attractive relative valuations.

FTC charges against fuel card provider Corpay held up on federal appeal

Description: A Corpay appeal of a lower court ruling on deceptive practices was swatted away by a 3-judge panel. The post FTC charges against fuel card provider Corpay held up on federal appeal appeared first on FreightWaves.

2026-01-07

A Look At Corpay (CPAY) Valuation After Q3 Beat And Insider Share Purchase

Description: Corpay (CPAY) is back on investors' radar after third quarter adjusted earnings and revenue came in ahead of consensus estimates, alongside a US$2.5 million insider share purchase by director Stull Steven T. See our latest analysis for Corpay. Corpay's recent third quarter beat and insider buying come after a solid run in the share price, with a 7 day share price return of 6.5% and a 90 day share price return of 10.2%. This comes even as the 1 year total shareholder return is down 10.3%,...

3 Stocks Estimated To Be Up To 49.5% Below Intrinsic Value Offering Investment Potential

Description: As the U.S. stock market experiences mixed movements, with major indices like the Dow Jones and S&P 500 setting fresh all-time highs, investors are navigating a landscape marked by geopolitical developments and fluctuating oil prices. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential investment opportunities for those looking to capitalize on market inefficiencies amidst these dynamic conditions.

What Makes Corpay (CPAY) an Attractive Investment?

Description: Vltava Fund, an investment management company, recently released its fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the letter, the author shared his insights on investing that he learned from his recent travels. He shared three main lessons in the letter. In addition, please check the fund’s top five […]

Billionaires Start 2026 With Huge Insider Buys

Description: Under Armour, W.R. Berkley, and Gabelli Healthcare & WellnessRx Trust have seen some huge insider purchases, and there were some other notable insider purchases as well.

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Corpay Stock Gains 7% in 3 Months: Here's What You Should Know

Description: CPAY is outperforming its industry with strong recent gains, double-digit earnings growth forecasts and a deal-driven strategy expanding its global payment reach.

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Accenture Earnings Beat Estimates in Q1, Revenues Increase Y/Y

Description: ACN tops 1Q26 earnings and revenue estimates as bookings rise in the double digits, while managed services strength offsets mixed consulting results.

How Mastercard’s $300M Stake and Partnership Highlights Corpay’s Corporate Payments Expansion

Description: Corpay, Inc. (NYSE:CPAY) is one of the best FinTech stocks to buy in 2026. On December 8, 2025, Corpay said it completed Mastercard’s $300 million minority investment in Corpay’s cross-border business, a transaction that values that unit at roughly $13 billion. The company framed the close as the follow-through to the deal Mastercard announced earlier […]

2025-12-17

2025-12-16

2025-12-15

2025-12-14

The Bull Case For Corpay (CPAY) Could Change Following Mastercard’s New 2.3% Strategic Stake – Learn Why

Description: On December 8, 2025, Corpay, Inc. closed a private placement in which it issued new shares for gross proceeds of US$300,000,000, with Mastercard acquiring an approximately 2.3% stake in the payments company. This move brings a global card-network heavyweight onto Corpay’s cap table, signalling external confidence in its cross-border and corporate payments capabilities at a time when the firm is already working to deepen its role in emerging payment ecosystems. Against this backdrop, we’ll...

2025-12-13

2025-12-12

2025-12-11

Corpay Stock: Is CPAY Underperforming the Technology Sector?

Description: Corpay has underperformed the Technology sector over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-12-10

Green Dot (GDOT) Up 15.2% Since Last Earnings Report: Can It Continue?

Description: Green Dot (GDOT) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-09

Finance Leaders Anticipate Rising Volatility but Reveal Uneven Preparedness as 2026 Approaches, Alpha Group Research Finds

Description: LONDON, December 09, 2025--Senior finance leaders are preparing for a year of heightened foreign exchange volatility and liquidity pressure in 2026, yet many acknowledge their organisations are not fully equipped to manage the challenges ahead, according to new research from Alpha Group, a Corpay, Inc. company.

2025-12-08

Corpay Completes Mastercard’s Minority Investment in Cross-Border Business

Description: ATLANTA, December 08, 2025--Corpay, Inc. (NYSE: CPAY), the corporate payments company, today announced that it has completed Mastercard’s (NYSE: MA) $300 million minority investment into Corpay’s cross-border business.

Freshworks And Two More Stocks Estimated To Be Trading Below Fair Value

Description: As U.S. stocks rise on hopes of a Federal Reserve rate cut, the market's attention is keenly focused on inflation data and major corporate deals like Netflix's acquisition of Warner Bros. Discovery. In such an environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities, as these stocks may offer significant value relative to their current market prices amidst shifting economic conditions.

2025-12-07

Corpay (CPAY): Revisiting Valuation After a 12% One-Month Share Price Rebound

Description: Why Corpay Stock Is Back on Traders Radar Corpay (CPAY) has quietly bounced about 12% over the past month after a tough year, putting it back in focus for investors who are trying to gauge whether this payments platform is resetting or just catching its breath. See our latest analysis for Corpay. That recent 1 day share price return of 4.46 percent and 1 month share price return of 12.34 percent looks more like traders re rating Corpay after a tough year, even though the 1 year total...

Assessing Corpay’s Valuation After Recent Share Price Rebound in 2025

Description: If you have been wondering whether Corpay at around $310 a share is a bargain or a value trap, you are not alone. This breakdown is designed to give you a clear, no jargon view of what you might really be buying. The stock has bounced recently, up about 5.0% over the last week and 12.3% over the past month, even though it is still down roughly 8.6% year to date and about 15.1% over the last year after a strong 69.3% run over three years. Behind those moves, investors have been reacting to...

2025-12-06

2025-12-05

Corpay, Inc. (CPAY): A Bull Case Theory

Description: We came across a bullish thesis on Corpay, Inc. on Valueinvestorsclub.com by JohnnyFinance. In this article, we will summarize the bulls’ thesis on CPAY. Corpay, Inc.’s share was trading at $296.27 as of December 1st. CPAY’s trailing andforward P/E were 20.13 and 12.02 respectively according to Yahoo Finance. Corpay, Inc. (NYSE: CPAY), formerly Fleetcor, is a leading B2B payments […]

Are Buyouts and Partnerships Powering Mastercard's Long-Term Growth?

Description: MA's aggressive acquisitions and global partnerships are fueling its shift beyond cards into digital finance infrastructure.

Corpay Entering 2026 With Multiple Growth Supports, Oppenheimer Says

Description: Corpay (CPAY) is entering 2026 with multiple growth supports, while currently trading at a discount

Corpay (CPAY) Up 7% Since Last Earnings Report: Can It Continue?

Description: Corpay (CPAY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

CoreWeave initiated, Unity upgraded: Wall Street's top analyst calls

Description: CoreWeave initiated, Unity upgraded: Wall Street's top analyst calls

Corpay to Participate at the Raymond James TMT and Consumer Conference

Description: ATLANTA, December 05, 2025--Corpay, Inc., (NYSE: CPAY), the corporate payments company, today announced that the Company will be attending the Raymond James TMT and Consumer Conference on Tuesday, December 9, 2025 in New York, NY. Management will participate in a fireside chat beginning at 8:40 AM ET.

2025-12-04

2025-12-03

2025-12-02

Is OppFi's Operational Efficiency Essential for Profitability?

Description: OPFI's tech-driven automation cuts costs and lifts Q3 profitability, with rising approvals powering stronger full-year income guidance.

2025-12-01

How Recent Developments Are Shaping the Corpay Investment Story

Description: Corpay’s consensus analyst price target has inched upward, rising to $351.25 from $350.00, as experts fine-tune their valuation models in response to recent developments. This subtle shift follows a period in which analysts have weighed solid company performance against ongoing uncertainties in the broader market. Stay tuned to find out how investors can stay ahead as new insights continue to shape the narrative around Corpay stock. Stay updated as the Fair Value for Corpay shifts by adding...

CPAY vs. MA: Which Stock Should Value Investors Buy Now?

Description: CPAY vs. MA: Which Stock Is the Better Value Option?

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Executive Shuffle: DailyPay, Adyen, Lightspeed

Description: Payments companies and industry organizations alike tapped new executives to cultivate new relationships in their ecosystems.

2025-11-25

2025-11-24

Corpay Cross-Border Launches USCIS Navigator

Description: TORONTO, November 24, 2025--Corpay, Inc. (NYSE: CPAY), a global leader in corporate payments, today announced the launch of USCIS Navigator, an automated payment solution designed to help U.S. immigration law firms securely and efficiently process payments to the U.S. Citizenship and Immigration Services (USCIS).

2025-11-23

Assessing Corpay (CPAY) Valuation Following Recent Share Price Stabilization

Description: Corpay (NYSE:CPAY) stock has caught the attention of investors after its latest movement, leading to renewed conversations about its long-term trajectory. While shares have dipped over the past 3 months, underlying growth figures remain visible. See our latest analysis for Corpay. After a brisk sell-off earlier this quarter, Corpay’s share price has stabilized somewhat, closing at $288.82 while posting a modest 1.6% one-month gain. However, momentum is still trying to recover, and the...

2025-11-22

2025-11-21

Synchrony Financial, Corpay, and LendingClub Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investors grew more optimistic about a potential Federal Reserve interest rate cut in December.

Are Wall Street Analysts Predicting Corpay Stock Will Climb or Sink?

Description: Even though Corpay has lagged behind the broader market over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-11-20

1 Mid-Cap Stock Worth Investigating and 2 We Ignore

Description: Mid-cap stocks often strike the right balance between having proven business models and market opportunities that can support $100 billion corporations. However, they face intense competition from scaled industry giants and can be disrupted by new innovative players vying for a slice of the pie.

2025-11-19

2025-11-18

2025-11-17

OppFi's Adjusted EPS Guidance for 2025 Raised Again: Can it Deliver?

Description: OPFI raises its 2025 EPS outlook after strong quarterly gains, improved credit trends and confidence in Model 6's predictive power.

2025-11-16

What Catalysts Are Shaping the Evolving Narrative for Corpay?

Description: Corpay's stock outlook has seen a recalibrated price target, lowered from $368.50 to $350.00 as analysts adopt a more cautious stance. This adjustment comes with a slight decrease in the applied discount rate and a raised revenue growth forecast, reflecting both healthy company performance and ongoing market uncertainties. Stay tuned to find out how you can keep ahead of the latest shifts in Corpay's story as the narrative continues to evolve. Analyst Price Targets don't always capture the...

2025-11-15

2025-11-14

2025-11-13

What Makes Corpay (CPAY) a New Buy Stock

Description: Corpay (CPAY) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

CPAY or MA: Which Is the Better Value Stock Right Now?

Description: CPAY vs. MA: Which Stock Is the Better Value Option?

2025-11-12

Corpay Cross-Border Named the Official FX Partner for BLAST

Description: TORONTO, November 12, 2025--Corpay, Inc.* (NYSE: CPAY), a global leader in corporate payments, today announced that its Cross-Border business has entered into a multi-year agreement with the BLAST, a global competitive entertainment company with a mission to bring mega entertainment to the world, taking esports, gaming and other new competitive formats to the next level. Under the agreement, Corpay will serve as their Official Foreign Exchange Partner.

5 Insightful Analyst Questions From Corpay’s Q3 Earnings Call

Description: Corpay’s third quarter results were well received by the market, reflecting solid execution across its core business lines. Management pointed to double-digit organic revenue growth in both Corporate Payments and Vehicle Payments, underpinned by higher transaction volumes and improved client retention. CEO Ronald Clarke highlighted the acceleration in U.S. vehicle payments and robust sales performance as key contributors, noting, “All of the businesses finished in line or better than our expecta

2025-11-11

2025-11-10

Old National Bancorp And 2 Other Stocks Estimated To Be Priced Below Intrinsic Value

Description: As the major U.S. stock indexes bounce back from a challenging week, buoyed by optimism over a potential resolution to the prolonged government shutdown, investors are keenly eyeing opportunities that may be priced below their intrinsic value. In such market conditions, identifying stocks that are undervalued can offer significant potential for growth, making it crucial to focus on companies with strong fundamentals and resilience amidst economic uncertainties.

OppFi Jumps 46% in a Year: Should You Buy the Stock Right Now?

Description: Can OPFI's AI-powered strategy and bold profit upgrades keep fueling its momentum?

Corpay (CPAY) Slipped on Investors’ Concerns

Description: Pelican Bay Capital Management, an investment management company, released its third-quarter 2025 investor letter. A copy of the same can be downloaded here. PBCM Concentrated Value Strategy returned 7.8% in the quarter, compared to a 5.3% return for the Russell 1000 Value Index. YTD, the fund returned 11.2% compared to 11.6% for the index. In addition, […]

Three Companies That May Be Priced Below Their Estimated Value

Description: In the midst of a challenging period for U.S. markets, with the Nasdaq experiencing its worst week since 'Liberation Day' and ongoing concerns about tech stock valuations, investors are keenly observing opportunities that may arise from these fluctuations. Identifying undervalued stocks can be crucial in such volatile times, as they may offer potential value when broader market sentiment is cautious or uncertain.

2025-11-09

2025-11-08

2025-11-07

November 2025's Top Stocks Priced Below Estimated Value

Description: As the U.S. stock market navigates a challenging landscape with tech stocks under pressure and major indices experiencing significant losses, investors are keenly observing economic indicators like labor market data and Federal Reserve interest rate decisions. In this environment, identifying undervalued stocks becomes crucial as they may offer potential opportunities for growth amidst broader market volatility.

3 Stocks Estimated To Be Undervalued By Up To 48.9%

Description: As the U.S. stock market grapples with renewed concerns over AI valuations and a record-breaking government shutdown, major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average have recently closed lower. Amidst this volatility, investors are increasingly seeking opportunities in stocks that appear undervalued based on their intrinsic value relative to current market prices. Identifying such stocks requires careful consideration of financial health, growth potential, and market...

2025-11-06

Why Corpay (CPAY) Is Up 9.0% After Raising 2025 Outlook and Completing Key Acquisitions

Description: Corpay Inc. recently reported strong third quarter 2025 results, highlighted by a 14% rise in sales to US$1.17 billion, year-over-year net income growth, and an updated full-year outlook following the completion of the Alpha and AvidXchange acquisitions. A key insight is Corpay’s plan to actively pursue additional M&A opportunities and share repurchases while maintaining its leverage target, supported by increased financing capacity and robust operational performance. We’ll explore how...

Corpay to Participate in Upcoming Investor Conferences

Description: ATLANTA, November 06, 2025--Corpay, Inc., (NYSE: CPAY), the corporate payments company, today announced that the Company will participate in the following investor conferences:

Corpay Earnings Beat Estimates in Q3, Revenues Increase 14% Y/Y

Description: CPAY posts strong third-quarter 2025 results, with revenues and earnings topping estimates, supported by gains in vehicle and corporate payments.

Corpay (CPAY): Assessing Valuation After Recent Share Price Swings

Description: Corpay (NYSE:CPAY) has been on the radar lately, with shares experiencing some swings over the past month. Investors are watching closely to see how recent movements might reflect its underlying business performance. See our latest analysis for Corpay. After a rough stretch in 2024 has weighed on Corpay’s share price, recent volatility points to shifting sentiment among investors. The stock trades at $261.69, reflecting a year-to-date share price return of -23.02%. Its three-year total...

CPAY Q3 Deep Dive: Corporate Payments and Vehicle Segments Drive Strong Momentum

Description: Business payments company Corpay (NYSE:CPAY) announced better-than-expected revenue in Q3 CY2025, with sales up 13.9% year on year to $1.17 billion. The company’s full-year revenue guidance of $4.52 billion at the midpoint came in 1.3% above analysts’ estimates. Its non-GAAP profit of $5.70 per share was 1% above analysts’ consensus estimates.

Corpay Inc (CPAY) Q3 2025 Earnings Call Highlights: Strong Revenue and EPS Growth Amid ...

Description: Corpay Inc (CPAY) reports robust Q3 2025 performance with 14% revenue growth and optimistic outlook for future quarters.

2025-11-05

Corpay (CPAY) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for Corpay (CPAY) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Corpay (CPAY) Surpasses Q3 Earnings and Revenue Estimates

Description: Corpay (CPAY) delivered earnings and revenue surprises of +1.24% and +0.58%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Corpay’s (NYSE:CPAY) Q3 Sales Beat Estimates

Description: Business payments company Corpay (NYSE:CPAY) announced better-than-expected revenue in Q3 CY2025, with sales up 13.9% year on year to $1.17 billion. The company’s full-year revenue guidance of $4.52 billion at the midpoint came in 1.3% above analysts’ estimates. Its non-GAAP profit of $5.70 per share was 1% above analysts’ consensus estimates.

Corpay: Q3 Earnings Snapshot

Description: ATLANTA (AP) — Corpay, Inc. CPAY) on Wednesday reported third-quarter profit of $277.9 million. The Atlanta-based company said it had profit of $3.91 per share.

Corpay Reports Third Quarter Financial Results

Description: ATLANTA, November 05, 2025--Corpay, Inc. (NYSE: CPAY), the corporate payments company, today reported financial results for its third quarter ended September 30, 2025.

Corpay Completes $2.4 Billion Cross Border Payments Acquisition

Description: ATLANTA, November 05, 2025--Corpay, Inc. (NYSE: CPAY), the corporate payments company, completed the acquisition of Alpha Group International plc (LSE: ALPH), a B2B cross border FX solutions and global bank accounts provider to corporations and investment funds in the UK and Europe.

Exclusive-Financial software provider OneStream explores sale after share price drop, sources say

Description: (Reuters) -Financial software maker OneStream is exploring strategic options including a possible sale, less than 18 months after its stock market debut, according to three people familiar with the matter. OneStream has been working with investment bankers at JPMorgan Chase on its options, the sources said, noting that deliberations are at an early stage and there is no guarantee of any transaction involving the company. Private equity firms including Blackstone and Hg are among the names that the sources said have been studying possible bids for OneStream in recent weeks.

2025-11-04

Global Payments Q3 Earnings Beat on Merchant Solutions Strength

Description: GPN tops Q3 earnings and revenue estimates as Merchant and Issuer Solutions drive growth and margins expand.

Corpay and National Hockey League Announce Multiyear North American Partnership

Description: TORONTO & NEW YORK, November 04, 2025--Corpay, Inc.* (NYSE: CPAY), a global leader in corporate payments and the National Hockey League (NHL®) today announced a multiyear North American partnership, naming Corpay’s Cross-Border business the Official Foreign Exchange (FX) Provider of the NHL.

2025-11-03

Corpay (CPAY) Q3 Earnings Report Preview: What To Look For

Description: Business payments company Corpay (NYSE:CPAY) will be reporting results this Wednesday after the bell. Here’s what to expect.

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

Why Corpay (CPAY) Stock Is Nosediving

Description: Shares of business payments company Corpay (NYSE:CPAY) fell 5.3% in the afternoon session after peer company Fiserv reported mixed third-quarter results that showed weakness in a key business area.

ImmunityBio And 2 Other Stocks That May Be Priced Below Their Estimated Worth

Description: As major U.S. stock indexes continue to set new records, driven by significant developments in tech and anticipation of Federal Reserve decisions, investors are keenly observing the market for potential opportunities. In such an environment, identifying stocks that may be priced below their estimated worth can offer intriguing prospects for those looking to capitalize on market dynamics.

Visa Q4 Earnings Beat Estimates on Processed Transactions

Description: V's Q4 earnings and revenues top estimates as processed transactions and cross-border volumes surge despite higher costs.

Corpay (CPAY) Earnings Expected to Grow: Should You Buy?

Description: Corpay (CPAY) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Discover October 2025 Stocks That May Be Trading Below Estimated Value

Description: As of late October 2025, major U.S. stock indexes have been reaching new record highs, buoyed by strong corporate earnings and optimism surrounding potential trade agreements between the U.S. and China. Amid this robust market environment, identifying stocks that may be trading below their estimated value can offer intriguing opportunities for investors looking to capitalize on potential mispricings in a thriving economy.

2025-10-28

3 Stocks Estimated To Be Up To 34.7% Below Their Intrinsic Value

Description: As major stock indexes in the United States continue to set fresh records, buoyed by optimism surrounding U.S.-China trade talks and anticipated Federal Reserve rate cuts, investors are keenly watching for opportunities that may still offer substantial value. In this environment of soaring indices, identifying stocks that are potentially undervalued can be crucial for those looking to maximize their investment potential.

3 Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 46.9%

Description: As major U.S. stock indexes reach record highs fueled by optimism over U.S.-China trade discussions and expectations of a Federal Reserve rate cut, investors are increasingly on the lookout for opportunities to capitalize on undervalued stocks. In this buoyant market environment, identifying stocks trading below their intrinsic value can offer potential for growth, making them an attractive consideration for those seeking to enhance their investment portfolios.

2025-10-27

How Should You Play OppFi Stock Ahead of Q3 Earnings Release?

Description: As OPFI readies third-quarter 2025 results, investors eye its AI-powered lending gains, lower charge-offs and strong liquidity footing.

3 Stocks Estimated To Be Undervalued By Up To 48.5%

Description: As U.S. stock indices reach new heights, driven by optimism surrounding U.S.-China trade talks and strong corporate earnings, investors are keenly observing the potential impacts of these developments on market valuations. In this environment of record-setting highs, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer attractive entry points relative to their intrinsic value.

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 35.5%

Description: As the United States stock market reaches record highs, buoyed by a tame inflation report and expectations of an interest rate cut, investors are keenly eyeing opportunities to capitalize on this favorable environment. In such a climate, identifying stocks that may be trading below their intrinsic value can offer potential long-term benefits, as these undervalued assets might provide room for growth when the broader market conditions align positively.

3 Stocks Estimated To Be 24.1% To 35.5% Below Intrinsic Value

Description: As the United States stock market hits record highs, driven by a tame inflation reading and expectations of a Federal Reserve rate cut, investors are keenly eyeing opportunities for value amidst the bullish sentiment. In such an environment, identifying stocks that are estimated to be significantly below their intrinsic value can offer potential for long-term growth and portfolio diversification.

2025-10-26

2025-10-25

2025-10-24

Discovering 3 Stocks That May Be Priced Below Their Estimated Value

Description: With the Dow Jones Industrial Average, S&P 500, and Nasdaq recently reaching new all-time highs following a cooler-than-expected inflation report, investors are keenly observing market dynamics as the Federal Reserve considers its next interest rate move. In such an environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Corpay's Q3 2025 Earnings: What to Expect

Description: Corpay is expected to announce its third-quarter results next month, and analysts project a double-digit earnings growth.

3 Stocks Estimated To Be Undervalued By Up To 29.8%

Description: As major U.S. stock indexes recently ended lower amidst ongoing earnings reports and renewed U.S.-China trade tensions, investors are keenly observing market fluctuations for potential opportunities. In such an environment, identifying undervalued stocks can be a strategic approach, as these equities might offer a margin of safety and potential for appreciation when market conditions stabilize or improve.

2025-10-23

Three Stocks Priced Below Estimated Value In October 2025

Description: As the United States market experiences fluctuations driven by trade news with China and a surge in oil prices, investors are keenly observing how these factors influence major indices like the Dow Jones, S&P 500, and Nasdaq. In such a dynamic environment, identifying stocks that are priced below their estimated value can offer potential opportunities for investors looking to navigate through current economic uncertainties.

Here's Why Corpay (CPAY) is a Strong Growth Stock

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

3 Stocks Possibly Trading At Up To 49.5% Below Intrinsic Value Estimates

Description: As major stock indexes in the United States recently ended lower due to ongoing U.S.-China trade tensions and mixed earnings reports, investors are keenly observing potential opportunities within the market. In such a climate, identifying stocks that are possibly trading below their intrinsic value can be particularly appealing, as they may offer a margin of safety amid broader market uncertainties.

1 of Wall Street’s Favorite Stock Worth Your Attention and 2 We Ignore

Description: Wall Street has set ambitious price targets for the stocks in this article. While this suggests attractive upside potential, it’s important to remain skeptical because analysts face institutional pressures that can sometimes lead to overly optimistic forecasts.

2025-10-22

ManpowerGroup Stock Declines 3.2% Since Q3 Earnings Beat

Description: MAN posts solid Q3 beats on earnings and revenues, but shares slide as investors remain cautious despite improved regional performance.

Can a Rich Partner Base and USDC Adoption Push Circle Stock Higher?

Description: Growing USDC adoption and new partnerships strengthen CRCL's long-term outlook, but stretched valuation and stiff competition weigh on near-term prospects.

Here's Why Corpay (CPAY) is a Strong Value Stock

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

2025-10-21

3 Stocks Estimated To Be Undervalued In October 2025

Description: As the Dow Jones Industrial Average reaches an all-time high amidst a flurry of corporate earnings reports, investors are keenly observing the broader U.S. market's performance against a backdrop of ongoing government shutdown and trade discussions with China. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential opportunities that may arise from discrepancies between current stock prices and their intrinsic value.

Uncovering 3 Stocks Including Palo Alto Networks That May Be Trading Below Intrinsic Value Estimates

Description: As the U.S. stock market begins the week on a high note, buoyed by gains across major indices and ongoing developments in trade and inflation data, investors are keenly observing opportunities amid economic uncertainties like the prolonged government shutdown. In this environment, identifying stocks that may be trading below their intrinsic value can offer potential for growth, making it crucial to consider factors such as financial health and market position when evaluating investment...

2025-10-20

Is Corpay, Inc. (CPAY) Stock Undervalued Right Now?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

October 2025's Noteworthy Stocks Estimated Below Their Intrinsic Value

Description: As the U.S. stock market concludes a volatile week with major indices posting gains, investors are navigating through concerns about banking sector health and trade tensions with China. In this environment, identifying stocks that are potentially undervalued can offer opportunities for those looking to capitalize on discrepancies between market prices and intrinsic values.

2025-10-19

2025-10-18

Corpay Partnership Could Be a Game Changer for NCR Voyix (VYX) in Fleet Payments

Description: NCR Voyix Corporation and Corpay, Inc. recently announced a partnership to enable Corpay payment acceptance for commercial fuel transactions at NCR Voyix's cloud-native POS systems across more than 18,000 U.S. fuel stations, with rollout aligned to new commercial solution launches in 2026. This direct integration of Corpay's Comdata system via the Voyix Connect payment gateway could strengthen NCR Voyix's presence in fleet payment processing and expand its service offering for trucking...

Jefferies, Credit Acceptance, Capital One, Bread Financial, and Corpay Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after conciliatory remarks from President Trump regarding the trade conflict with Beijing helped stabilize markets. Investor anxiety on Wall Street eased after Trump called his previous threats of 100% tariffs on Chinese goods "unsustainable." This shift in tone provided a significant boost to overall market sentiment, leading to a broad-based rally in stocks. The easing of trade war fears created a more favorable environment for equities across