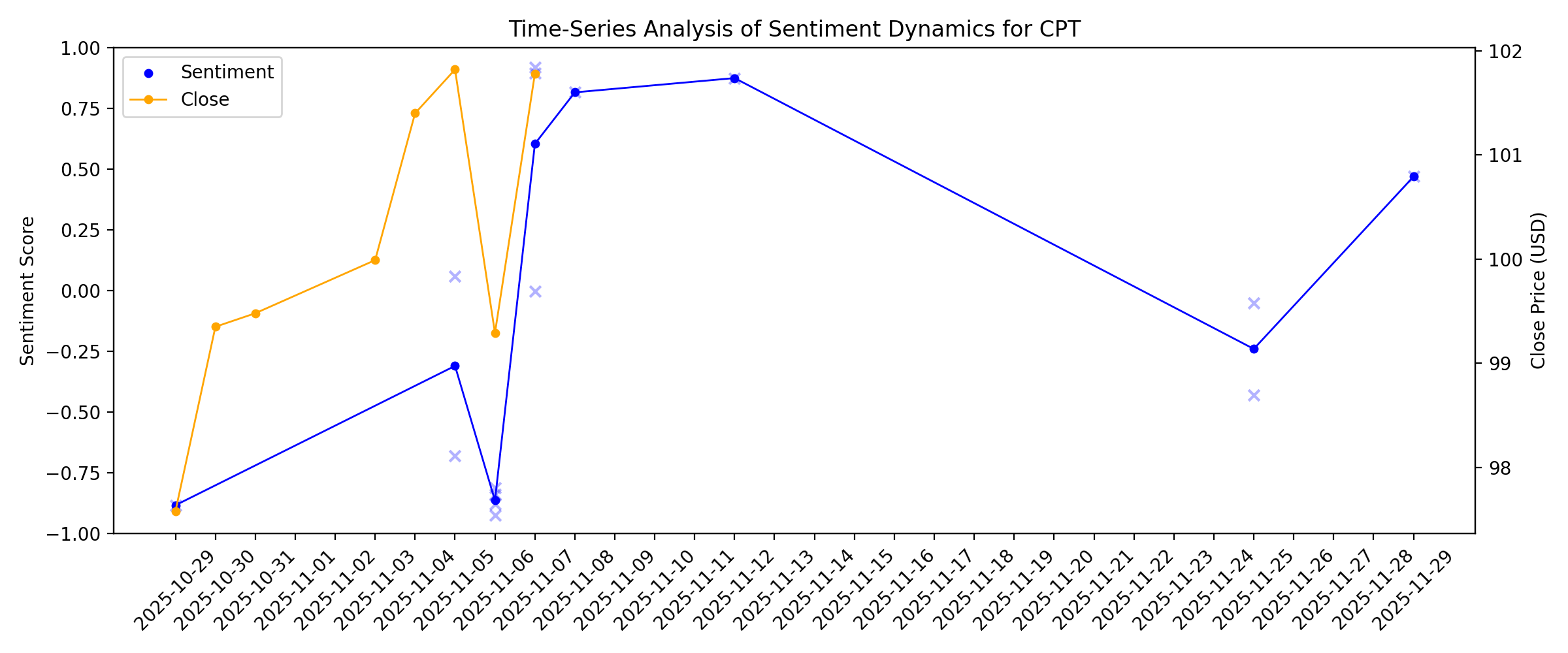

News sentiment analysis for CPT

Sentiment chart

2026-01-14

2026-01-13

What to Expect From Camden Property Trust’s Q4 2025 Earnings Report

Description: Here is what analysts expect from Camden ahead of its Q4 earnings, given the stock’s underperformance relative to the market.

2026-01-12

Camden Property Trust Announces Fourth Quarter 2025 Earnings Release and Conference Call Dates

Description: HOUSTON, January 12, 2026--Camden Property Trust (NYSE:CPT) (the "Company") announced today that its fourth quarter 2025 earnings will be released after the market closes on Thursday, February 5, 2026. Management will host a conference call on the following day, Friday, February 6, 2026, at 10:00 AM Central Time.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Camden Stock Rallies 7.3% in Three Months: Will It Continue to Gain?

Description: CPT shares rise 7.3% in three months as strong renter demand, tech-driven margins and a solid pipeline support growth in high-growth U.S. markets.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

3 Residential REITs to Consider for Steady Income in 2026

Description: U.S. rents and occupancy slip in November 2025. However, easing supply and solid demand could support residential REITs like ESS, UDR & CPT by 2026.

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Camden Property Trust (CPT): Reassessing Valuation After a Recent Share Price Rebound

Description: Camden Property Trust (CPT) has quietly strung together a positive run, with the stock up about 6% over the past month but still slightly negative year to date, creating an interesting reset point. See our latest analysis for Camden Property Trust. The recent rebound, including a solid 30 day share price return, has only partially offset this year’s weakness. At the same time, a respectable five year total shareholder return suggests longer term holders have still been rewarded, which hints...

2025-12-18

Does Camden’s NYSE Texas Listing Sharpen Its Sun Belt Multifamily Edge for Investors in CPT?

Description: Earlier this week, Camden Property Trust announced that its common stock is now dual‑listed on NYSE Texas while retaining its primary New York Stock Exchange listing under the ticker “CPT,” emphasizing its Texas heritage and multifamily housing focus. This move could broaden Camden’s visibility among Texas-focused investors and underline the importance of its core Sun Belt apartment portfolio within a pro-growth, business-friendly region. We’ll now examine how Camden’s new NYSE Texas dual...

Camden Property Trust Announces Dual Listing on NYSE Texas

Description: HOUSTON, December 18, 2025--Camden Property Trust (NYSE:CPT) (the "Company") announced today the dual listing of its common stock on NYSE Texas, the newly launched, fully electronic equities exchange headquartered in Dallas, Texas. The Company will maintain its primary listing on the New York Stock Exchange and trade under the same ticker symbol "CPT" on NYSE Texas.

2025-12-17

2025-12-16

Is Camden Property Trust Stock Underperforming the Nasdaq?

Description: Camden Property Trust has notably underperformed the Nasdaq Composite over the past year, yet analysts remain moderately bullish on the stock’s prospects.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

Camden Property Trust Announces Fourth Quarter 2025 Dividend

Description: HOUSTON, December 03, 2025--The Board of Trust Managers of Camden Property Trust (NYSE:CPT) (the "Company") declared a fourth quarter cash dividend of $1.05 per share to holders of record as of December 17, 2025 of its Common Shares of Beneficial Interest. The dividend is to be paid on January 16, 2026.

2025-12-02

Is Camden Property Trust (CPT) One of the Best Dividend Stocks in the Real Estate Sector?

Description: Camden Property Trust (NYSE:CPT) is one of the best dividend stocks in the real estate sector. On November 26, Wells Fargo analyst James Feldman assigned an Equal Weight rating on CPT and trimmed the price target from $111 to $110. Separately, the company reported its financial results for Q3 2025 on November 6. During the […]

2025-12-01

2025-11-30

2025-11-29

Looking at the Narrative for Camden Property Trust After Analysts Adjust Outlook and Guidance

Description: Camden Property Trust has seen its fair value estimate trimmed from $120.90 to $117.11, with a slight increase in its discount rate from 7.14% to 7.17%. This adjustment reflects analysts' careful balancing of the company’s solid core performance against ongoing economic uncertainties. Stay tuned to find out how you can keep informed about evolving analyst perspectives as Camden's narrative continues to develop. Stay updated as the Fair Value for Camden Property Trust shifts by adding it to...

2025-11-28

2025-11-27

2025-11-26

2025-11-25

Brinker upgraded, Coinbase downgraded: Wall Street's top analyst calls

Description: Brinker upgraded, Coinbase downgraded: Wall Street's top analyst calls

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, ServiceNow and More

Description: Pre-Market Stock Futures: The futures are lower on Tuesday after traders kicked off the holiday-shortened trading week with a massive Monday rally, with all major indices finishing the day higher. A combination of an oversold market, a big bounce-back rally on Friday that saw follow-through on Monday, and some positive AI/Data Center/Hyperscaler commentary to help ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, Serv

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Camden Property Trust Stock: Is Wall Street Bullish or Bearish?

Description: Despite Camden Property Trust’s underperformance relative to the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-11

2025-11-10

2025-11-09

2025-11-08

Camden Property Trust (CPT) Q3 2025 Earnings Call Highlights: Strong Demand and Strategic ...

Description: Camden Property Trust (CPT) reports robust apartment demand and strategic share repurchases, while navigating lease rate declines and market competition.

2025-11-07

Camden Property Trust (CPT): Is the Current Valuation an Opportunity for Investors?

Description: Camden Property Trust (CPT) shares have slid in recent trading, with the stock down 2% over the past day and 6% in the past 3 months. Investors appear to be weighing recent performance against the company’s longer-term fundamentals. See our latest analysis for Camden Property Trust. Camden Property Trust has seen momentum fade over the past year, with a 13.42% year-to-date share price decline and a one-year total shareholder return of -13.16%. Although there has been a modest long-term gain...

Camden beats FFO expectations in Q3

Description: Strong expense performance led the REIT to raise its core funds from operations per share outlook by $0.04 at the midpoint.

Camden's Q3 FFO Beat, Revenues Up Y/Y, '25 View Raised

Description: CPT's Q3 FFO beat is a result of higher lease rates and same-property revenues, though rising interest costs trim growth.

2025-11-06

Camden (CPT) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for Camden (CPT) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Camden (CPT) Tops Q3 FFO Estimates

Description: Camden (CPT) delivered FFO and revenue surprises of +0.59% and -0.93%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Camden: Q3 Earnings Snapshot

Description: The Houston-based real estate investment trust said it had funds from operations of $186.8 million, or $1.70 per share, in the period. The average estimate of eight analysts surveyed by Zacks Investment Research was for funds from operations of $1.69 per share. Funds from operations is a closely watched measure in the REIT industry.

Camden Property Trust Announces Third Quarter 2025 Operating Results

Description: HOUSTON, November 06, 2025--Camden Property Trust (NYSE:CPT) (the "Company") announced today operating results for the three and nine months ended September 30, 2025. Net Income Attributable to Common Shareholders ("EPS"), Funds from Operations ("FFO"), Core Funds from Operations ("Core FFO"), and Core Adjusted Funds from Operations ("Core AFFO") for the three and nine months ended September 30, 2025 are detailed below. A reconciliation of EPS to FFO, Core FFO, and Core AFFO is included in the f

2025-11-05

What to Expect From Camden Property Stock in Q3 Earnings?

Description: CPT's Q3 results may show higher revenues but a dip in FFO as new supply pressures rental growth.

Camden (CPT) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Description: Besides Wall Street's top-and-bottom-line estimates for Camden (CPT), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

American Homes 4 Rent (AMH) Q3 FFO and Revenues Surpass Estimates

Description: American Homes 4 Rent (AMH) delivered FFO and revenue surprises of +2.17% and +0.73%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?