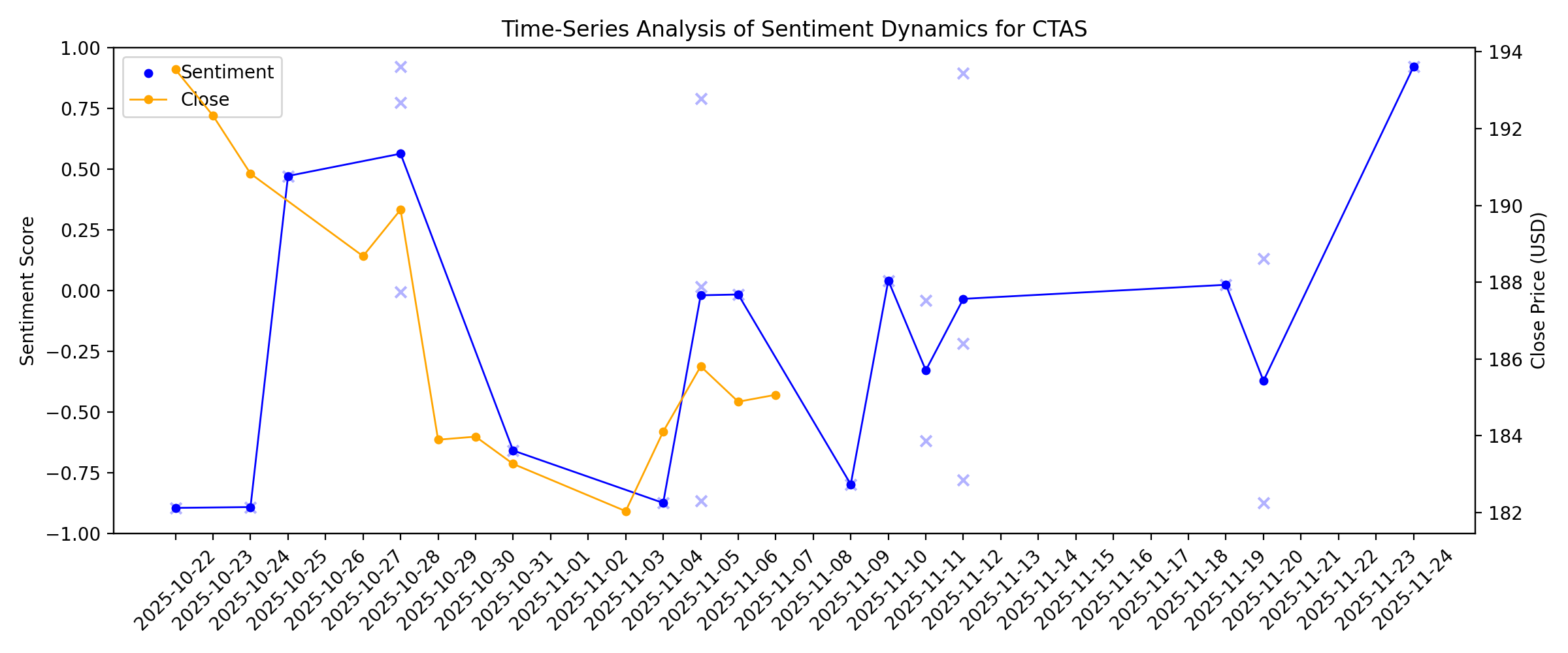

News sentiment analysis for CTAS

Sentiment chart

2026-01-14

Uber initiated, Rivian downgraded: Wall Street's top analyst calls

Description: Uber initiated, Rivian downgraded: Wall Street's top analyst calls

2026-01-13

2026-01-12

2026-01-11

2026-01-10

Cintas-UniFirst Proposed Merger Update: Uniform Bright Launches Independent Expert Review of Antitrust Review Considerations

Description: Review will evaluate localized route-market competition considerations and compile materials for potential submission through established FTC/DOJ public processes if the proposal advances. RIVERSIDE, CA / ACCESS Newswire / January 10, 2026 / Uniform ...

2026-01-09

UniFirst (UNF) Valuation Check After Q1 Earnings Miss Guidance Reaffirmation And Ongoing Share Buybacks

Description: UniFirst (UNF) shares are in focus after the company reported fiscal first quarter results showing 2.7% revenue growth, softer profitability tied to planned investments, and reiterated full year guidance alongside ongoing share repurchases. See our latest analysis for UniFirst. The results and reiterated guidance come after a strong recent run in the shares, with a 30 day share price return of 12.31% and a 90 day share price return of 28.30%. This has occurred even though the 1 year total...

2026-01-08

1 Consumer Goods Stock I'd Buy Before CTAS in 2026

Description: Cintas has a diversified customer base but didn't perform well in the stock market last year.

Forbes Names Cintas to 2026 America’s Best-in-State Companies List

Description: CINCINNATI, January 08, 2026--Forbes evaluated company size data along with ratings and reviews from both customers and employees

2026-01-07

Citi Raises Cintas (CTAS) Target but Keeps Sell Rating

Description: Cintas Corporation (NASDAQ:CTAS) is included among the 14 Best Dividend Growth Stocks to Buy and Hold in 2026. On December 22, Citi raised its price target on Cintas Corporation (NASDAQ:CTAS) to $181 from $176 and kept a Sell rating on the shares. That same day, the Wall Street Journal reported that Cintas Corporation (NASDAQ:CTAS) had […]

UniFirst Maintains Outlook; Fiscal First-Quarter Earnings Decline

Description: UniFirst (UNF) reiterated its full-year outlook on Wednesday even as the uniform rental company's fi

2026-01-06

Did Strong Quarterly Beat and Efficiency Gains Just Shift Cintas' (CTAS) Investment Narrative?

Description: Cintas recently reported past quarterly results that exceeded Wall Street expectations, showing solid performance across its uniform rental, facility services, and safety businesses, supported by efficiency gains and strong customer relationships. This performance reinforced Cintas’ reputation as a resilient, high-quality service provider whose recurring revenue model can appeal to investors even at premium valuations. Now we’ll examine how Cintas’ better-than-expected earnings and...

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Robo-Taxis and Home Runs? 40 ’Forgotten’ Stocks for 2026.

Description: Uber Technologies and the Braves are on the latest Forgotten Forty list of value stocks from John Boyar.

2025-12-30

2025-12-29

Tech Stocks Aren't Always The Answer

Description: While not flashy by nature, non-tech companies also deliver big gains. Sometimes, 'boring' businesses are better.

Jim Cramer Discusses Cintas’ (CTAS) Latest Offer for UniFirst

Description: We recently published 10 Stocks Jim Cramer Discussed. Cintas Corporation (NASDAQ:CTAS) is one of the stocks on Jim Cramer discussed. Cintas Corporation (NASDAQ:CTAS) is a specialty business service firm that deals primarily in uniforms. The firm was at the center of media attention earlier this week after it announced its intent to acquire uniform company UniFirst […]

Jim Cramer Discusses UniFirst (UNF) Being Targeted by Another Offer From Cintas

Description: We recently published 10 Stocks Jim Cramer Discussed. UniFirst Corporation (NYSE:UNF) is one of the stocks on Jim Cramer discussed. UniFirst Corporation (NYSE:UNF) is a uniform company facing another bid to be acquired by Cintas. On December 22nd, Cintas announced that it had made a $5.2 billion offer to acquire the firm. It is the third […]

2025-12-28

Jim Cramer Highlights Cintas’ Attempts to Buy UniFirst

Description: Cintas Corporation (NASDAQ:CTAS) is one of the stocks Jim Cramer shared his take on. Cramer noted the company’s interest in buying UniFirst, as he said: “Then there’s a whole ‘nother template, Cintas trying to buy UniFirst, an ongoing saga that has the number one uniform retail company, Cintas, trying to acquire the number three player […]

2025-12-27

2025-12-26

2025-12-25

5 Insightful Analyst Questions From Cintas’s Q4 Earnings Call

Description: Cintas delivered fourth-quarter results that were in line with Wall Street’s expectations, posting steady revenue growth across its core businesses. Management credited strong execution in its route-based businesses, with CEO Todd Schneider highlighting, "Each of our three route-based businesses had strong revenue growth in the quarter." The company’s focus on operational efficiency, supply chain management, and customer retention supported healthy margins despite a competitive environment. Mana

2025-12-24

2025-12-23

S&P Futures Muted With U.S. GDP Data in Focus

Description: March S&P 500 E-Mini futures (ESH26) are trending down -0.04% this morning, steadying after a three-day rally as investors await a trio of reports delayed by the government shutdown, with a particular focus on the initial estimate of third-quarter GDP.

2025-12-22

Why Unifirst Stock Crushed the Market Today

Description: The uniform and workwear company might end up in the portfolio of a major business in its specialized field.

Why a Uniform Maker's Stock Soared 16% Monday

Description: Cintas made another bid for rival uniform and business supplies provider UniFirst, sending its shares soaring Monday.

Stocks to Watch Monday Recap: Tesla, Rocket Lab, UniFirst, Clearwater Analytics

Description: ↗️ Tesla (TSLA): The electric-vehicle maker won a yearslong legal battle in Delaware over a record-breaking 2018 pay package for Elon Musk. Shares rose 1.6% Monday. ↗️ Rocket Lab (RKLB): Shares jumped 10%, building on the previous session's rally.

Wall Street Advances as Holiday-Shortened Trading Week Begins; Gold, Silver Hit Record Highs

Description: US equities rose Monday, extending their gains to a third consecutive session at the start of a holi

Sector Update: Consumer Stocks Mixed Late Afternoon

Description: Consumer stocks were mixed late Monday afternoon, with the State Street Consumer Staples Select Sect

UniFirst (UNF) Stock Trades Up, Here Is Why

Description: Shares of workplace uniform provider UniFirst (NYSE:UNF) jumped 18.4% in the afternoon session after the company confirmed it had received an unsolicited, non-binding acquisition proposal from Cintas Corporation for $275.00 per share in cash.

Equity Markets Rise Intraday; Gold, Silver Reach New Highs

Description: US benchmark equity indexes were higher after midday Monday, while gold and silver prices hit new hi

Sector Update: Consumer Stocks Mixed Monday Afternoon

Description: Consumer stocks were mixed Monday afternoon, with the State Street Consumer Staples Select Sector SP

Boyar Value Group Urges UniFirst Board to Immediately Initiate Strategic Review Following 60%+ Premium Offer

Description: WILMINGTON, Mass., December 22, 2025--The following is a letter from the Boyar Value Group to the Board of Directors of UniFirst Corporation:

Top Midday Stories: Nvidia Said to Start H200 Shipments to China by Mid-February; Alphabet to Buy Intersect for $4.75 Billion

Description: All three major US stock indexes were up in late-morning trading Monday to kick off a shortened trad

Cintas Isn’t Taking Years of No for an Answer, Makes Fresh Bid for UniFirst

Description: After multiple rejections over the years, Cintas is offering a $350 million payment if the deal is rejected to sweeten the pot.

Cintas Reiterates $275-Per-Share Bid to Acquire UniFirst

Description: Cintas (CTAS) said Monday that it remains interested in acquiring smaller uniform rental company Uni

UniFirst Confirms Receipt of Unsolicited, Non-Binding Proposal from Cintas Corporation

Description: WILMINGTON, Mass., Dec. 22, 2025 (GLOBE NEWSWIRE) -- UniFirst Corporation (the “Company” or “UniFirst”) (NYSE: UNF) today confirmed it received an unsolicited, non-binding proposal from Cintas Corporation (“Cintas”) (NASDAQ: CTAS) to acquire all the outstanding UniFirst common and Class B shares for $275.00 per share in cash on December 12, 2025.Upon receipt of Cintas’ proposal, the UniFirst Board of Directors engaged independent financial and legal advisors. Consistent with its fiduciary duties

Tesla, UniFirst, Clearwater jump premarket; Honeywell slips

Description: Investing.com -- U.S. equity-index futures rose ahead of the open as investors showed renewed appetite for technology stocks. Contracts on the S&P 500 Index were up 0.4% at 6:20 in New York, while Nasdaq 100 futures gained 0.5%. Here are some of the biggest U.S. movers before the bell: • Tesla (NASDAQ:TSLA) rose 1.3% after a Delaware Supreme Court ruling restored Elon Musk’s 2018 chief executive compensation plan, ending a years-long legal battle over the record-setting award. • Unifirst (NYSE:U

Cintas Proposes to Acquire UniFirst for $275.00 Per Share in Cash

Description: CINCINNATI, December 22, 2025--Cintas Corporation (Nasdaq: CTAS) today announced that it submitted a proposal to the Board of Directors of UniFirst Corporation (NYSE: UNF) to acquire all outstanding common and class B shares of UniFirst for $275.00 per share (the "Proposal") in cash. The Proposal, which was delivered to the UniFirst Board on December 12, 2025, implies a total value for UniFirst of approximately $5.2 billion and offers UniFirst shareholders a 64% premium to UniFirst’s ninety-day

2025-12-21

2025-12-20

2025-12-19

Cintas' Q2 Earnings Surpass Estimates, Revenues Increase Y/Y

Description: CTAS beats Q2 earnings and revenue estimates, lifts FY26 guidance and delivers solid organic growth despite higher operating costs.

Cintas Guidance Implies Moderating Revenue Growth in Fiscal H2 2026, RBC Says

Description: Cintas' (CTAS) guidance implies revenue growth will moderate in fiscal H2 2026, but the company has

CTAS Q4 Deep Dive: Margin Discipline and Vertical Growth Drive Steady Performance

Description: Uniform and facility services provider Cintas (NASDAQ:CTAS) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9.3% year on year to $2.8 billion. The company expects the full year’s revenue to be around $11.19 billion, close to analysts’ estimates. Its GAAP profit of $1.22 per share was 2% above analysts’ consensus estimates.

2025-12-18

Cintas Corp (CTAS) Q2 2026 Earnings Call Highlights: Record Revenue and Operating Margin ...

Description: Cintas Corp (CTAS) reports a 9.3% revenue increase and all-time high operating margin, while navigating economic challenges and strategic growth opportunities.

Sector Update: Consumer Stocks Mixed Late Afternoon

Description: Consumer stocks were mixed late Thursday afternoon, with the State Street Consumer Staples Select Se

Cintas (CTAS) Valuation Check After Recent Pullback From Earlier Highs

Description: Cintas (CTAS) has quietly edged higher over the past month, even as the stock remains below its highs from earlier this year. That mix of modest momentum and recent pullback sets up an interesting valuation check. See our latest analysis for Cintas. Zooming out, Cintas has eased off its recent peak, with a 90 day share price return of negative 6.08 percent. This comes even though the latest share price sits at 187.37 dollars and the five year total shareholder return remains robust. If Cintas...

Cintas Raises Full-Year Guidance as Second-Quarter Results Top Views

Description: Cintas (CTAS) lifted its full-year outlook on Thursday as the uniform supplier's fiscal second-quart

Why Cintas Stock Is Rising Today

Description: Cintas continues to prove why it is one of the best compounders on the market, following its excellent second-quarter earnings.

Stock Market Live December 18: A Cool Inflation Report Heats Up the S&P 500 (VOO)

Description: This article will be updated throughout the day, so check back often for more daily updates. Inflation grew much more slowly than expected last month, as revealed in a just-released Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics. November’s inflation rate was only 2.7%, not the 3.1% predicted by economists. “Core” ... Stock Market Live December 18: A Cool Inflation Report Heats Up the S&P 500 (VOO)

Cintas (CTAS) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for Cintas (CTAS) give a sense of how its business performed in the quarter ended November 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Cintas (CTAS) Q2 Earnings and Revenues Beat Estimates

Description: Cintas (CTAS) delivered earnings and revenue surprises of +1.68% and +1.46%, respectively, for the quarter ended November 2025. Do the numbers hold clues to what lies ahead for the stock?

Cintas (NASDAQ:CTAS) Exceeds Q4 CY2025 Expectations

Description: Uniform and facility services provider Cintas (NASDAQ:CTAS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.3% year on year to $2.8 billion. The company expects the full year’s revenue to be around $11.19 billion, close to analysts’ estimates. Its GAAP profit of $1.21 per share was 1.3% above analysts’ consensus estimates.

Cintas: Fiscal Q2 Earnings Snapshot

Description: CINCINNATI (AP) — Cintas Corp. CTAS) on Thursday reported fiscal second-quarter profit of $495.3 million. On a per-share basis, the Cincinnati-based company said it had net income of $1.21.

Cintas Corporation Announces Fiscal 2026 Second Quarter Results

Description: CINCINNATI, December 18, 2025--Cintas Corporation (Nasdaq: CTAS) today reported results for its fiscal 2026 second quarter ended November 30, 2025. Revenue for the second quarter of fiscal 2026 was $2.80 billion compared to $2.56 billion in last year’s second quarter, an increase of 9.3%. Revenue growth in the quarter was positively impacted by 0.7% due to acquisitions. The organic revenue growth rate for the second quarter of fiscal 2026, which adjusts for the impacts of acquisitions and foreig

Stocks Gain Pre-Bell Ahead of Key Inflation Report

Description: US equity markets were trending higher before the opening bell Thursday as traders await a key infla

US Futures Track Higher Premarket Thursday as Tech Stocks Stabilize Ahead of CPI Data

Description: US futures were tracking higher hours before Thursday's market open, as technology stocks stabilize

How Investors May Respond To UniFirst (UNF) Shareholder Revolt And Activist-Backed Strategic Review

Description: In December 2025, activist investor Engine Capital, backed by proxy advisors ISS, Glass Lewis, and Egan-Jones, won majority common-shareholder support for its director nominees at UniFirst’s contested annual meeting, intensifying pressure on the board over governance, leadership succession, and calls for a strategic review that could include a potential sale. The unusually broad backing for Engine’s campaign, alongside public criticism from institutions like River Road and Boyar Value Group,...

2025-12-17

Cintas' Q2 2026 Earnings: What to Expect

Description: Cintas is expected to announce its second-quarter results tomorrow, and analysts forecast a single-digit growth in the company’s bottom-line figure.

2025-12-16

Duluth Holdings (DLTH) Reports Q3 Loss, Misses Revenue Estimates

Description: Duluth Holdings (DLTH) delivered earnings and revenue surprises of +58.93% and -2.98%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Has Cintas Shares’ Long Run Left Limited Upside After 5 Year 126.8% Surge?

Description: Wondering if Cintas is still worth buying at today’s price, or if the big gains are mostly behind it? Let’s break down what the market is really paying for here. The stock has inched up 2.9% over the last week and 0.9% over the last month, and is up 3.5% year to date, even though it is still down 8.8% over the past year after a huge 74.4% 3 year and 126.8% 5 year run. Recent headlines have focused on Cintas as a steady compounder in the business services space, frequently cited for its...

2025-12-15

Jim Cramer on Cintas: “That’s a Terrific Barometer of the Mood of Small Business”

Description: Cintas Corporation (NASDAQ:CTAS) is one of the stocks on Jim Cramer’s game plan this week. Cramer highlighted the importance of the stock for small businesses, as he said: “Next up, I like Thursday… Cintas, the uniform and safety equipment supplier, reports too. That’s a terrific barometer of the mood of small business.” Cintas Corporation (NASDAQ:CTAS) […]

Equities Fall Ahead of November Employment Report

Description: US stocks started the week lower as investors awaited key economic data to be released later this we

Equities Fall Intraday Ahead of This Week's Key Data

Description: US benchmark equity indexes were lower intraday ahead of this week's key economic data, including re

How Recent Analyst Shifts Are Shaping The Story Behind Cintas’s Valuation

Description: Cintas stock’s latest narrative update keeps fair value unchanged at $214.88 per share, even as small tweaks to the discount rate and long term revenue growth assumptions reflect a slightly more optimistic view of its resilience and expansion potential. These fine tuned inputs mirror a Wall Street debate that balances confidence in Cintas as a high quality compounder with caution around how macro trends could affect future returns. Stay tuned to see how you can track these incremental...

Cintas (CTAS) Q2 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Description: Get a deeper insight into the potential performance of Cintas (CTAS) for the quarter ended November 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Employment, Industry Pricing, And Costing Challenges Hit Cintas Corp (CTAS) in Q3

Description: TimesSquare Capital Management, an equity investment management company, released its “U.S. Focus Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the third quarter, all the major asset classes posted positive returns except fixed income assets outside the US. The strategy returned 4.00% (gross) and 3.78% (net) compared […]

Stocks Rise Pre-Bell as Traders Await Key Inflation, Labor Data

Description: The benchmark US stock measures were pointing higher before the opening bell Monday, ahead of a busy

2025-12-14

Trump's Fed pick comes into focus, economic data backlog clears: What to watch this week

Description: With the December Fed meeting in the rear view, investor attention will turn toward Fed chair nomination drama and the potential for a Santa rally (or not)

Does Forbes ‘Best Companies’ Nod Really Strengthen Cintas’ Culture-Driven Edge for Investors (CTAS)?

Description: Cintas was recently recognized by Forbes as one of America’s Best Companies in 2026, highlighting customer and employee-partner satisfaction, financial strength, and overall corporate excellence. This first-time inclusion underscores how Cintas’ culture and operational discipline are resonating externally, reinforcing perceptions of a well-run, resilient service provider. We’ll now examine how this Forbes recognition for overall corporate excellence may influence Cintas’ existing investment...

Will Adding Cintas CEO Todd Schneider to the Board Shift PPG Industries' (PPG) Governance Priorities?

Description: PPG Industries has elected Todd M. Schneider, president and CEO of Cintas, to its board of directors effective January 14, 2026, where he will serve on the Nominating and Governance and Sustainability and Innovation committees. This board appointment introduces service-focused leadership and operational expertise from outside the chemicals sector, potentially influencing how PPG balances governance, sustainability, and growth priorities. We’ll now examine how adding Schneider’s governance...

2025-12-13

2025-12-12

Will Cintas (CTAS) Beat Estimates Again in Its Next Earnings Report?

Description: Cintas (CTAS) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2025-12-11

Lululemon (LULU) Tops Q3 Earnings and Revenue Estimates

Description: Lululemon (LULU) delivered earnings and revenue surprises of +16.67% and +3.40%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Todd M. Schneider joins PPG board of directors

Description: PITTSBURGH, December 11, 2025--PPG (NYSE:PPG) today announced that Todd M. Schneider, president and chief executive officer of Cintas, has been elected to join PPG’s board of directors, effective Jan. 14, 2026. Schneider will serve on the Nominating and Governance and Sustainability and Innovation committees of PPG’s board.

2025-12-10

Cintas Recognized as One of America’s Best Companies by Forbes

Description: CINCINNATI, December 10, 2025--The organization makes its debut on the list for its outstanding performance in several categories, including overall corporate excellence.

2025-12-09

2025-12-08

ISS Recommends UniFirst Shareholders Vote "FOR" Engine Capital’s New Director Candidates at 2026 Annual Meeting

Description: NEW YORK, December 08, 2025--Engine Capital LP (together with its affiliates, "Engine" or "we"), which owns approximately 3.2% of the outstanding shares of common stock of UniFirst Corporation (NYSE: UNF) ("UniFirst" or the "Company"), today announced that Institutional Shareholder Services Inc. ("ISS"), a leading independent proxy advisory firm, has recommended that UniFirst shareholders send a clear message to the Company’s Board of Directors (the "Board") that the status quo is untenable by v

UniFirst (UNF) Valuation Check as Activist Campaign Escalates After Rejected Cintas Offer

Description: UniFirst (UNF) is suddenly in the spotlight after major shareholders escalated a campaign against the board for rejecting Cintas’s $275 per share offer and resisting a broader strategic review process. See our latest analysis for UniFirst. The activism flare up has landed on top of a sharp re rating in the share price, with a 1 month share price return of nearly 20 percent but a 1 year total shareholder return still in negative territory. This suggests that momentum is picking up from a low...

2025-12-07

2025-12-06

2025-12-05

River Road Asset Management Addresses UniFirst Board Regarding Shareholder Concerns

Description: LOUISVILLE, Ky., Dec. 05, 2025 (GLOBE NEWSWIRE) -- River Road Asset Management LLC (“River Road”), on behalf of its clients, owns approximately 881,000 Class A common shares of UniFirst (UNF), which represents 6.0% of the Class A shares and a 4.9% total ownership interest in the company. River Road is a value-oriented institutional equity manager with over $10 billion in total assets under management. We have been patient UniFirst shareholders since 2010. This year, River Road has been profoundl

2025-12-04

Cintas Corporation Announces Webcast for Second Quarter Fiscal Year 2026 Results

Description: CINCINNATI, December 04, 2025--Cintas Corporation (Nasdaq: CTAS) today announced that it will release fiscal year 2026 second quarter results on Thursday, December 18, 2025. The Company will conduct a conference call to address the financial results. A live webcast of the call will be available to individual investors and the public beginning at 10:00 a.m., Eastern Time, on Thursday, December 18, 2025.

Boyar Value Group Urges UniFirst Board to Initiate a Strategic Review Following Rejection of Multiple Credible Acquisition Offers

Description: NEW YORK, December 04, 2025--Boyar Value Group calls on UniFirst to run a strategic review after the Board declined multiple acquisition offers, raising fiduciary concerns.

2025-12-03

2025-12-02

Cintas (CTAS): Exploring Valuation Signals After Recent Share Price Cooldown

Description: Cintas (CTAS) stock has moved modestly over the past month, reflecting a landscape where investors remain attentive to the company’s fundamentals and long-term growth record. The share price recently closed at $185.43. See our latest analysis for Cintas. After a robust multiyear run, Cintas has entered a patchier phase, with momentum cooling recently as investors balance impressive long-term growth against short-term return challenges. The stock’s one-year total shareholder return is down...

2025-12-01

Cintas Stock: Is CTAS Underperforming the Industrial Sector?

Description: Cintas has underperformed the Industrial sector over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

Cintas Stock: Analyst Estimates & Ratings

Description: Cintas has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

KTB or CTAS: Which Is the Better Value Stock Right Now?

Description: KTB vs. CTAS: Which Stock Is the Better Value Option?

Janitorial Services Market Analysis Report 2025-2030, Competitive Analysis of ABM, Sodexo, ISS, Compass, Cintas, OCS, ServiceMaster, Anago Cleaning Systems, Vanguard, and Jani-King

Description: The janitorial services market is driven by heightened hygiene awareness post-COVID-19, rising commercial spaces, eco-friendly cleaning demand, and tech innovations. Rapid growth in Asia-Pacific and mature demand in North America, with businesses benefiting from cost-effective, outsourced, professional services.Dublin, Nov. 20, 2025 (GLOBE NEWSWIRE) -- The "Janitorial Services Market With Impact Analysis of US Tariffs (2025 Edition)" report has been added to ResearchAndMarkets.com's offering.One

2025-11-19

Should You Consider Cintas After Its Recent 15% Pullback?

Description: If you have ever wondered whether Cintas stock is a smart buy at today's prices, you are not alone. Investors are always searching for signals that set a company apart in a pricey market. Cintas has delivered an impressive 113.6% return over the past five years, but the past year saw a decline of 15.2%. This is a reminder that sentiment can shift quickly even for well-known names. One major driver of the stock's recent movements was market-wide discussion around inflation impacting costs for...

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Carvana initiated, AT upgraded: Wall Street's top analyst calls

Description: Carvana initiated, AT upgraded: Wall Street's top analyst calls

DraftKings downgraded, Instacart upgraded: Wall Street’s top analyst calls

Description: The most talked about and market moving research calls around Wall Street are now in one place. Here are today’s research calls that investors need to know, as compiled by The Fly. Top 5 Upgrades: BMO Capital upgraded Instacart (CART) to Outperform from Market Perform with an unchanged price target of $58. The company reported “solid” Q3 results and trades at an attractive valuation, the firm tells investors in a research note. Mizuho upgraded Qorvo (QRVO) to Neutral from Underperform with a pri

Here Are Wednesday’s Top Wall Street Analyst Research Calls: AT&T, Beyond Meat, Carvana, Fortinet, Snowflake, Waste Managment and More

Description: Pre-Market Stock Futures: The futures are trading higher as we reach the midpoint of the trading week. The Dow Jones Industrial Average posted a stellar day on Tuesday, rising 1.20% to close at a record high of 47,927, while the S&P 500 also finished the session higher, rising 0.28% to close at 6,846. The big ... Here Are Wednesday’s Top Wall Street Analyst Research Calls: AT&T, Beyond Meat, Carvana, Fortinet, Snowflake, Waste Managment and More

2025-11-11

DraftKings downgraded, Instacart upgraded: Wall Street's top analyst calls

Description: DraftKings downgraded, Instacart upgraded: Wall Street's top analyst calls

Here are Tuesday’s Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

Description: Pre-Market Stock Futures: The futures are trading mixed after a massive bounce-back rally on Monday across Wall Street, which saw all the major indices trade higher, with the NASDAQ closing up 2.27% at 23,554. In comparison, the S&P 500 saw a hefty 1.54% gain to close at 6,832, and the venerable Dow Jones Industrial Average ... Here are Tuesday’s Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

2025-11-10

A Fresh Look at Cintas (CTAS) Valuation After New Buyback and Dividend Affirmation

Description: Cintas (CTAS) has just revealed a fresh share repurchase program and reaffirmed its regular dividend, giving investors two reasons to take notice. Both moves highlight management’s focus on rewarding shareholders and demonstrate ongoing business strength. See our latest analysis for Cintas. Cintas shares have shown steady resilience, with a year-to-date share price return of 1.6% despite some turbulence over the past quarter. While the recent 12-month total shareholder return is down 16.8%,...

2025-11-09

3 Brilliant Dividend Growth Stocks to Buy Now and Hold for the Long Term

Description: If you are looking for dividends to keep you ahead of the ravages of inflation, this trio will be right up your alley.

2025-11-08

2025-11-07

2025-11-06

Jobs Are Disappearing Fast. These Stocks Are Getting Crushed

Description: Staffing and other labor-market related companies like ADP, Kelly Services, Manpower, Paychex and Robert Half are getting hit.

2025-11-05

Is It Time to Reassess Cintas After 9% Drop This Month?

Description: Wondering if Cintas is a bargain right now? You are not alone, as investors try to assess whether the current price makes sense for such a well-known name in business services. In the past week, Cintas shares slid 3.0%, adding up to a 9.1% drop over the last month and a 1.1% gain year-to-date. Still, shares are up an impressive 114.4% over five years. Several factors have influenced these moves, including shifting sentiment among institutional investors, renewed industry chatter about the...

Public Sector Fleets Can Now Purchase Motiv Electric Trucks via National Auto Fleet Group

Description: National Auto Fleet Group’s partnership with Motiv Unlocks Access to Streamlined Purchase Process Public Sector Fleets Now Have Streamlined Access to Electric Work Trucks National Auto Fleet Group (NAFG) has partnered with Motiv Electric Trucks to expand access to its Class 4-6 electric step vans, buses and trucks among public sector fleets across the United States. NAFG holds a Sourcewell contract, which enables public sector access to pre-negotiated prices and a streamlined procurement process

Alight Reports Third Quarter 2025 Results

Description: CHICAGO, November 05, 2025--Alight, Inc. (NYSE: ALIT), a leading cloud-based human capital and technology-enabled services provider, today reported results for the third quarter ended September 30, 2025.

2025-11-04

KTB vs. CTAS: Which Stock Is the Better Value Option?

Description: KTB vs. CTAS: Which Stock Is the Better Value Option?

2025-11-03

2025-11-02

2025-11-01

2025-10-31

1 High-Flying Stock for Long-Term Investors and 2 We Turn Down

Description: "You get what you pay for" often applies to expensive stocks with best-in-class business models and execution. While their quality can sometimes justify the premium, they typically experience elevated volatility during market downturns when expectations change.

2025-10-30

2025-10-29

2025-10-28

Cintas Corporation Announces Quarterly Cash Dividend and New $1.0 Billion Stock Buyback Authorization

Description: CINCINNATI, October 28, 2025--Cintas Corporation (Nasdaq: CTAS) announced that the Company’s Board of Directors approved a quarterly cash dividend of $0.45 per share of common stock payable on December 15, 2025, to shareholders of record at the close of business on November 14, 2025. Cintas has a strong record of returning capital to its shareholders and has consistently raised its dividend each year since Cintas’ initial public offering 42 years ago in 1983.

Renaissance Large Cap Growth Strategy Sold Cintas (CTAS) Due to Decline in Fundamentals

Description: Renaissance Investment Management, an investment management company, released its Q3 2025 “Large Cap Growth Strategy” investor letter. A copy of the letter can be downloaded here. Stock prices continued to rally in the third quarter, with the S&P 500 climbing to all-time highs during September. The Russell 1000 Growth returned 10.5% and the S&P 500 […]

3 Big Reasons to Love Cintas (CTAS)

Description: Over the last six months, Cintas’s shares have sunk to $188.41, producing a disappointing 9.5% loss - a stark contrast to the S&P 500’s 24.4% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

2025-10-27

2025-10-26

2025-10-25

Cintas (CTAS): Exploring Valuation After Recent Momentum Shift in Industrial Stocks

Description: Cintas (CTAS) shares have had an interesting run lately, with investors keeping an eye on recent performance in the industrials sector. The company’s movements this month seem to be drawing attention for their potential implications in a shifting economic environment. See our latest analysis for Cintas. Cintas’s share price has cooled off recently, losing nearly 15% over the past three months. However, the bigger picture remains impressive, with a 156% total shareholder return over five...

2025-10-24

Cintas (CTAS) Down 4.8% Since Last Earnings Report: Can It Rebound?

Description: Cintas (CTAS) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-10-23

2025-10-22

Cintas Corporation to Participate in Upcoming Investor Conference

Description: CINCINNATI, October 22, 2025--Cintas Corporation (Nasdaq: CTAS) announced that its Executive Vice President and Chief Financial Officer, Scott Garula, Vice President and Treasurer - Investor Relations, Jared Mattingley and Executive Vice President and Chief Operating Officer, Jim Rozakis, will participate in the upcoming J.P. Morgan Ultimate Services Investor Conference in New York City, NY on Tuesday, November 18, 2025. Cintas management will participate in a fireside chat and will be available