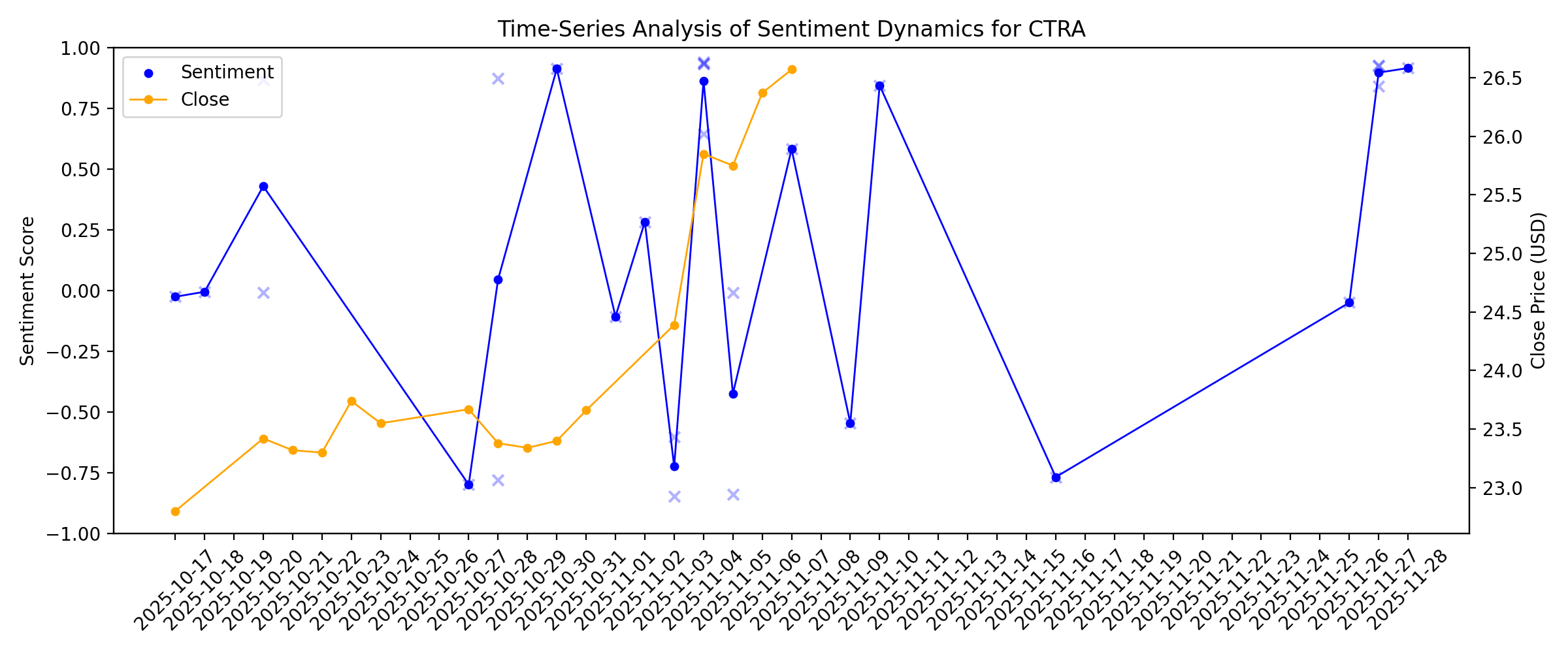

News sentiment analysis for CTRA

Sentiment chart

2026-01-14

Top Energy Stocks Poised for Gains: WarrenAI Highlights Value Opportunities

Description: Investing.com -- Energy stocks present compelling value opportunities according to recent analysis from WarrenAI, which identifies three standout performers with significant upside potential, strong cash flow yields, and high analyst conviction.

3 Dividend Stocks To Consider With Yields Up To 9.3%

Description: As the U.S. markets continue to reach new highs, shaking off concerns about a DOJ probe into Fed Chair Powell, investors are increasingly looking for stable income sources amidst economic uncertainties. In this environment, dividend stocks with attractive yields can offer a reliable stream of income while potentially benefiting from the market's upward momentum.

2026-01-13

2026-01-12

2026-01-11

2026-01-10

Is Coterra Energy (CTRA) Still Attractive After Recent Share Price Weakness?

Description: If you are looking at Coterra Energy and wondering whether the current share price still reflects good value, this article will walk through what the numbers actually say about the stock. The share price is at US$24.82, with a 7 day return of 6.7% decline, a 30 day return of 8.1% decline, a year to date return of 6.7% decline, and a 1 year return of 7.5% decline. The 3 year and 5 year returns sit at 10.7% and 68.6% respectively. Recent performance has kept Coterra Energy on the radar of...

Assessing Coterra Energy (CTRA) Valuation After Recent Short Term Share Price Weakness

Description: What the recent numbers say about Coterra Energy Coterra Energy (CTRA) has drawn attention after a period in which the stock showed a 2.3% decline over the past day and an 8.1% decline over the past month, prompting closer scrutiny from investors. See our latest analysis for Coterra Energy. The recent 1 day and 30 day share price returns of 2.32% and 8.14% declines respectively sit alongside a 9.10% 90 day share price return and a 68.60% five year total shareholder return. This suggests that...

2026-01-09

Coterra Energy (CTRA) Stock Declines While Market Improves: Some Information for Investors

Description: In the most recent trading session, Coterra Energy (CTRA) closed at $24.82, indicating a -2.32% shift from the previous trading day.

2026-01-08

APA Corp (APA) Jumps 8.5% on LNG Demand Growth, Colder Season

Description: We recently published Wall Street Can’t Keep up With These 10 Stocks on Fire. APA Corporation (NASDAQ:APA) was one of the top performers on Thursday. APA Corporation (NASDAQ:APA) grew its share prices by 8.47 percent on Thursday to close at $25.37 apiece as investors took heart from an investment firm’s bullish outlook for the overall […]

Zacks Industry Outlook Highlights Coterra Energy, Antero Resources, APA and W&T Offshore

Description: Coterra Energy and peers offer selective appeal as U.S. oil and gas producers navigate price volatility and lean on natural gas demand support.

2026-01-07

Are Select US E&P Stocks Worth a Look Amid Energy Swings?

Description: Following a careful analysis of the Zacks Oil and Gas - Exploration and Production - United States industry, we advise focusing on shares of CTRA, AR, APA and WTI.

Is Coterra (CTRA) Quietly Redefining Its Gas Strategy After the CFO’s Conference Comments?

Description: Coterra Energy’s Executive Vice President and CFO, Shane Young, recently spoke at the Goldman Sachs Energy, CleanTech & Utilities Conference in Miami, an event that was webcast live for investors. This appearance gives investors a timely chance to hear how management is thinking about natural gas price volatility and the company’s positioning across its core basins. We’ll now explore how the CFO’s conference appearance and comments on natural gas markets may influence Coterra Energy’s...

2026-01-06

2026-01-05

Coterra Energy to Participate at Upcoming Goldman Sachs Conference

Description: HOUSTON, January 05, 2026--Coterra Energy Inc. (NYSE: CTRA) ("Coterra" or the "Company") today announced that Shane Young, Executive Vice President & Chief Financial Officer, will participate in a panel discussion at the Goldman Sachs Energy, CleanTech & Utilities Conference. The panel discussion will begin at 3:00 PM ET on Tuesday, January 6, 2026.

Venezuela Fuels Broad Sector Rally But These Oil And Gas Plays Slide

Description: Venezuela news hit the stock market Monday, boosting many oil stocks, but several slid as natural gas prices sank.

Why Natural Gas Prices Are Slipping Despite Strong LNG Demand

Description: EQT, EXE and CTRA could see long-term gains even as natural gas prices slip on mild weather and strong U.S. output.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Coterra Energy (CTRA) Ascends While Market Falls: Some Facts to Note

Description: Coterra Energy (CTRA) concluded the recent trading session at $26.56, signifying a +1.37% move from its prior day's close.

What’s Driving Optimism Around Coterra Energy Inc. (CTRA)

Description: Coterra Energy Inc. (NYSE:CTRA) is among the ridiculously cheap stocks to buy now. As of December 26, Coterra Energy Inc. (NYSE:CTRA) has a rating of ‘Buy’ or equivalent from 79% of the analysts covering the stock. With a median price target of $33, the stock has an upside potential of 27.96%. On December 19, Mark […]

2025-12-29

Piper Sandler Says These 3 Energy Stocks Are Top Picks for 2026

Description: While the oil market can vary, much of that volatility tends to float on the surface – like oil on water. Underneath it, long-term trends – the currents in the water – are churning in the depths. Prices for hydrocarbon energy sources are tending downwards, facing pressures from a glut in global supplies, rising inventories, and lower-than-expected demand. The result: expectations of lower prices in 2026. Mark Lear, energy expert from Piper Sandler, has been watching the situation carefully in an

2025-12-28

Best Two Energy Stocks to Buy Now According to WarrenAI

Description: Investing.com -- Energy stocks continue to present compelling opportunities for investors seeking both growth and income potential, according to the latest rankings from WarrenAI. The analysis highlights two standout performers that offer different value propositions in today’s energy market.

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Is There Still Value in Coterra Energy After Its Strong Five Year Run?

Description: If you are wondering whether Coterra Energy still represents good value after its run over the last few years, or whether you might be late to the party, this breakdown will help you assess whether the current price makes sense. Even though the stock is up 9.8% over the last year and 100.6% over five years, recent returns have cooled, with the share price down 2.9% over the last week and 2.4% year to date. This can signal a reset in expectations or a potential fresh entry point. Recent...

Evaluating Coterra Energy (CTRA)’s Valuation After Strong Q3 2025 Beat and Upgraded Long-Term Outlook

Description: Coterra Energy (CTRA) is getting extra attention after a strong Q3 2025, where revenue, profit, and production topped expectations, and management raised full year output guidance across both oil and natural gas. See our latest analysis for Coterra Energy. Even with the latest close at $25.52 and a slightly negative year to date share price return, Coterra’s 90 day share price gain of 8.73 percent and 1 year total shareholder return of 9.8 percent suggest momentum is quietly rebuilding as...

Why a Big Storage Draw Failed to Lift Natural Gas Prices

Description: CTRA, EQT and EE could shine long term as natural gas prices slump despite a large storage draw and steady LNG demand.

2025-12-21

2025-12-20

2025-12-19

UBS Signals Major 2026 Turning Point for Coterra Energy (CTRA) Citing Operational Efficiency and Market Recovery

Description: Coterra Energy Inc. (NYSE:CTRA) is one of the most profitable value stocks to invest in right now. On December 12, UBS analyst Josh Silverstein raised the firm’s price target on Coterra Energy to $33 from $32 with a Buy rating on the shares. UBS is signaling a major turning point for the Energy sector in […]

2025-12-18

Natural Gas ETFs to Gain With Demand Expected to Rebound in 2026

Description: After a muted 2025, natural gas demand is projected to rebound in 2026, and these three ETFs offer diversified ways to position for the recovery.

2025-12-17

2025-12-16

2025-12-15

ProPetro Wins Coterra Microgrid Deal & Adds 190 MW of Orders

Description: PUMP wins a Coterra Energy microgrid contract, lifts contracted capacity above 220 MW and orders 190 MW more to fuel long-term growth.

2025-12-14

Will New Mexico Permian Microgrids Deal Shift Coterra Energy's (CTRA) Capital Efficiency Narrative?

Description: ProPetro Holding Corp. recently announced that its PROPWR division signed a contract with a Coterra Energy subsidiary to develop and power distributed microgrids across Coterra’s New Mexico Permian operations, with deployment and operations scheduled to start in early 2026. This microgrid deal underscores how Coterra is pairing its Permian growth with on-site, lower-emission power solutions that can improve operational reliability and cost control. We’ll examine how this New Mexico Permian...

2025-12-13

2025-12-12

Vinson & Elkins Advises Coterra Energy on Power Purchase Agreement with PROPWR

Description: By Exec Edge Editorial Staff Vinson & Elkins advised Coterra Energy Inc. on a behind-the-meter power purchase agreement with PROPWR, a subsidiary of ProPetro Holding Corp., to develop a distributed microgrid at Coterra’s production sites in the New Mexico portion of the Permian Basin. The Vinson & Elkins team was led by partner Mark Brasher […]

Sector Update: Energy Stocks Edge Higher Premarket Friday

Description: Energy stocks were edging higher premarket Friday, with the State Street Energy Select Sector SPDR E

PROPWR Secures Distributed Microgrid Contract With Coterra Energy and Adds 190 Megawatts in New Orders

Description: MIDLAND, Texas, December 12, 2025--PROPWR Secures Distributed Microgrid Contract With Coterra Energy and Adds 190 Megawatts in New Orders

2025-12-11

William Blair Highlights Coterra’s (CTRA) Multi-Basin Strength in New Coverage

Description: Coterra Energy Inc. (NYSE:CTRA) is included among the 11 Best Low Priced Dividend Stocks to Buy According to Analysts. On November 26, William Blair analyst Neal Dingmann initiated coverage on Coterra Energy Inc. (NYSE:CTRA) with an Outperform rating and a $37 price target. According to the firm, the company offers multi-basin exposure to the Permian […]

2025-12-10

Three Dividend Stocks To Enhance Your Portfolio

Description: As the U.S. market navigates mixed signals ahead of a crucial Federal Reserve decision on interest rates, investors are keenly observing how these changes might impact their portfolios. In such an environment, dividend stocks can offer a stable income stream and potential for growth, making them a valuable consideration for those looking to enhance their investment strategy amidst fluctuating economic conditions.

Why Is Venture Global (VG) Down 12% Since Last Earnings Report?

Description: Venture Global (VG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

How Is Coterra Energy's Stock Performance Compared to Other Oil & Gas E&P Stocks?

Description: Despite Coterra Energy’s underperformance compared to its industry peers over the past year, Wall Street analysts remain bullish about the stock’s prospects.

2025-12-09

5 Under $35 Dividend Stocks to Buy Now

Description: Dividend stocks are trusted among investors. They offer a secure income stream and a promising path for total return. Total return, a comprehensive measure of investment performance, includes interest, capital gains, dividends, and distributions realized over time. Let’s take a closer look at the concept of total return. Imagine you purchase a stock at $20 ... 5 Under $35 Dividend Stocks to Buy Now

2025-12-08

Why U.S. Natural Gas Prices Are Surging to Three-Year Highs

Description: CTRA, LNG, and WMB could benefit as U.S. natural gas futures soar past $5 on cold weather and record exports.

2025-12-07

2025-12-06

2025-12-05

Why Is Devon Energy (DVN) Up 16.3% Since Last Earnings Report?

Description: Devon Energy (DVN) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-04

Chord Energy Corporation (CHRD) Up 12.8% Since Last Earnings Report: Can It Continue?

Description: Chord Energy Corporation (CHRD) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

Why Is Cabot (CTRA) Up 2.1% Since Last Earnings Report?

Description: Cabot (CTRA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

UBS Highlights Coterra Energy’s (CTRA) Capital Efficiency, Boosts Price Target Amid Activist Attention

Description: Coterra Energy Inc. (NYSE:CTRA) ranks among the 9 hot energy stocks to buy. On November 24, UBS increased its price target for Coterra Energy Inc. (NYSE:CTRA) to $32 from $29, retaining a Buy rating on the energy company’s shares. The bank cited Coterra’s upgraded 2026 estimates, which indicate improved capital efficiency, as an important factor […]

2025-11-27

Has the Recent 11.5% Rally Changed the Opportunity in Coterra Energy?

Description: Curious if Coterra Energy could be a hidden gem for savvy investors? Let's cut through the noise and see what the numbers and the market are telling us about its value right now. The stock has seen some notable moves lately, climbing 2.4% over the last week and a solid 11.5% in the last month. This hints that investor sentiment and growth expectations might be shifting. Recent headlines have highlighted continued strategic investment in domestic energy infrastructure, which appears to have...

Coterra Energy (CTRA) Valuation in Focus After Analyst Upgrades Highlight Growth and Capital Strength

Description: Coterra Energy (NYSE:CTRA) has drawn renewed attention from investors after William Blair initiated coverage on the company, noting its operational efficiencies and disciplined approach to capital allocation. UBS also reinforced its positive outlook by highlighting Coterra’s production prospects and healthy balance sheet. See our latest analysis for Coterra Energy. Coterra’s steady improvement in capital efficiency, highlighted in recent sector reviews and analyst endorsements, has...

Analyst Optimism and Activist Scrutiny Might Change The Case For Investing In Coterra Energy (CTRA)

Description: In recent days, Coterra Energy drew a wave of positive analyst coverage highlighting its improved capital efficiency, operational discipline, and robust 2026 outlook, with several brokers commenting on the company's balance sheet strength and production profile across key U.S. basins. An interesting element from this coverage is the focus by activist investors on Coterra's corporate governance and capital allocation practices, raising attention to decisions that could influence the company's...

2025-11-26

Autodesk upgraded, Nio downgraded: Wall Street's top analyst calls

Description: Autodesk upgraded, Nio downgraded: Wall Street's top analyst calls

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

Jim Cramer on Coterra Energy: “This Stock’s Been Very Strong for the Past Couple Weeks”

Description: Coterra Energy Inc. (NYSE:CTRA) is one of the stocks Jim Cramer discussed recently. Cramer highlighted that the Charitable Trust sold its Coterra stock in August. The Mad Money host said: “After a brutal day for the market, I gotta talk about something that’s actually been working really well lately, Coterra Energy, the oil and gas […]

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Coterra Energy (CTRA) Shoots Up Despite Mixed Q3 Results

Description: The share price of Coterra Energy Inc. (NYSE:CTRA) surged by 12.3% between October 31 and November 7, 2025, putting it among the Energy Stocks that Gained the Most This Week. Coterra Energy Inc. (NYSE:CTRA) is a premier, diversified energy company that engages in the exploration, development, and production of oil, natural gas, and NGLs in […]

2025-11-09

TD Cowen Maintains Buy Rating on Coterra Energy (CTRA) Stock

Description: Coterra Energy Inc. (NYSE:CTRA) is one of the Best Low Priced Stocks to Buy According to Analysts. On November 3, David Deckelbaum from TD Cowen maintained a “Buy” rating on the company’s stock, with a price objective of $33.00. The analyst’s rating is backed by a combination of factors, including its pricing and financial performance. Despite Coterra Energy […]

2025-11-08

2025-11-07

3 Top Dividend Stocks To Enhance Your Portfolio

Description: As concerns about AI valuations and economic uncertainties weigh on the U.S. stock market, investors are turning their focus to more stable options. In such a climate, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive choice for enhancing your portfolio.

2025-11-06

2025-11-05

Coterra Q3 Earnings Miss Estimates, Revenues Beat, Expenses Rise Y/Y

Description: CTRA expects total production of 772-782 MBoepd, natural gas output of 2,925-2,965 MMcfpd and oil volumes in the range of 159-161 MBopd for 2025

S&P 500 Futures Dip as Economic Sentiment Sours

Description: The Morning Bull - US Market Morning Update Wednesday, Nov, 5 2025 US stock futures drift lower ahead of the open as investors grapple with a fresh dip in economic sentiment and wavering confidence around Federal Reserve rate cuts. An unexpected surge in crude oil inventories and dropping Treasury yields have heightened concerns about slowing growth and rising financial stress. This has put pressure on the broader market as investors weigh the odds of near-term turbulence. Today's volatility...

2025-11-04

Coterra Energy (CTRA) Profit Margins Improve, Reinforcing Bullish Narratives on Earnings Quality

Description: Coterra Energy (CTRA) delivered net profit margins of 24.4%, up from 23.4% a year ago, signaling increased profitability. The company’s earnings have grown at an 11.5% annual rate over the past five years, with a recent surge of 33% in the last year, outpacing historical averages. With ongoing profit and revenue growth and a price-to-earnings ratio below the sector average, investors are weighing concerns about dividend sustainability alongside improving fundamentals and strong valuation...

Coterra Energy Inc (CTRA) Q3 2025 Earnings Call Highlights: Strong Production and Strategic ...

Description: Coterra Energy Inc (CTRA) reports robust third-quarter results with increased production, strategic debt repayment, and a high-yield dividend, despite facing cost challenges.

Coterra Energy (CTRA): Assessing Valuation After Raised Production Guidance and Strong Q3 Performance

Description: Coterra Energy (CTRA) just lifted its full-year production guidance after posting solid third-quarter results. The company’s increased output, ongoing dividend payments, and continued share repurchases point to steady operational momentum for shareholders. See our latest analysis for Coterra Energy. Despite missing profit estimates due to softer oil prices, Coterra’s latest quarter featured a surge in production and another healthy dividend announcement. Over the past year, its total...

Kimmeridge Releases Letter to the Board of Coterra Energy Outlining Urgent Steps to Restore Governance and Unlock Shareholder Value

Description: Kimmeridge, a private investment firm focused on the energy sector and a significant shareholder of Coterra Energy (CTRA), today released an open letter to Coterra's Board of Directors calling for decisive action to address the Company's failures of governance and lack of strategic focus following the failed merger of Cabot Oil & Gas and Cimarex Energy.

2025-11-03

Cabot: Q3 Earnings Snapshot

Description: HOUSTON (AP) — Coterra Energy Inc. CTRA) on Monday reported third-quarter net income of $322 million. On a per-share basis, the Houston-based company said it had net income of 42 cents.

Coterra Energy Reports Third-Quarter 2025 Results, Announces Quarterly Dividend, and Provides Fourth-Quarter and Full Year 2025 Guidance Update

Description: HOUSTON, November 03, 2025--Coterra Energy Inc. (NYSE: CTRA) ("Coterra" or the "Company") today reported third-quarter 2025 financial and operating results and declared a quarterly dividend of $0.22 per share. Additionally, the Company provided fourth-quarter production and capital guidance and updated full-year 2025 guidance.

2025-11-02

Fed fallout, missing jobs numbers, and a busy earnings calendar: What to watch this week

Description: Markets look set to enter the fifth full week of a US government shutdown as investors parse Powell's comments, news of a trade deal between Washington and Beijing, and another mammoth week of earnings.

2025-11-01

How Shifting Analyst Views Are Changing the Story for Coterra Energy

Description: Coterra Energy's Fair Value Estimate has dipped slightly, moving from $32.29 to $31.96, according to the latest analyst reports. This adjustment comes amid a careful reassessment of industry trends, shifting commodity prices, and Coterra's evolving market strategy. Stay tuned to discover how you can remain informed as perspectives on Coterra continue to develop in the months ahead. Stay updated as the Fair Value for Coterra Energy shifts by adding it to your watchlist or portfolio...

2025-10-31

2025-10-30

Coterra Energy Stock: Analyst Estimates & Ratings

Description: Coterra Energy has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-10-29

2025-10-28

Coterra Energy (CTRA) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: In the closing of the recent trading day, Coterra Energy (CTRA) stood at $23.38, denoting a -1.23% move from the preceding trading day.

Analysts Estimate California Resources Corporation (CRC) to Report a Decline in Earnings: What to Look Out for

Description: California Resources (CRC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

Coterra Energy (CTRA) Reports Next Week: Wall Street Expects Earnings Growth

Description: Cabot (CTRA) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

UBS Cuts Coterra Energy (CTRA) Price Target, Keeps Buy Rating

Description: Coterra Energy Inc. (NYSE:CTRA) is one of the 11 Dirt Cheap Stocks to Buy According to Analysts. On October 14, UBS slightly reduced its price target on Coterra Energy Inc. (NYSE:CTRA) from $30 to $29 and kept a Buy rating. UBS analysts believe that Coterra Energy Inc. (NYSE:CTRA) had a challenging operational first half of […]

Coterra Energy (CTRA) Surpasses Market Returns: Some Facts Worth Knowing

Description: Coterra Energy (CTRA) closed the most recent trading day at $23.42, moving +2.72% from the previous trading session.

2025-10-19

2025-10-18

Does CTRA’s Recent Slump Present an Opportunity as Natural Gas Prices Stabilize?

Description: If you’re holding Coterra Energy shares or eyeing them for your watchlist, you’re probably wondering whether now is the moment to buy, hold, or walk away. The energy sector can be a rollercoaster, and Coterra is no exception. Despite a nearly flat 0.2% return over the past week, the stock is down 6.5% for the month and 12.8% year-to-date. It's clear that market sentiment has been shifting, with some of these dips influenced by changes in commodity prices and broader shifts in the outlook for...

2025-10-17

How Recent Developments Are Shaping The Investment Story For Coterra Energy

Description: Coterra Energy stock has recently seen its consensus analyst price target slightly decrease from $32.79 to $32.29, reflecting cautious optimism that is tempered by evolving market conditions. This change comes amid shifting analyst perspectives, with bulls citing long-term growth drivers in U.S. natural gas, while bears point to ongoing market oversupply concerns. Stay tuned to discover how investors can keep informed as Coterra’s narrative continues to develop in this dynamic landscape. What...