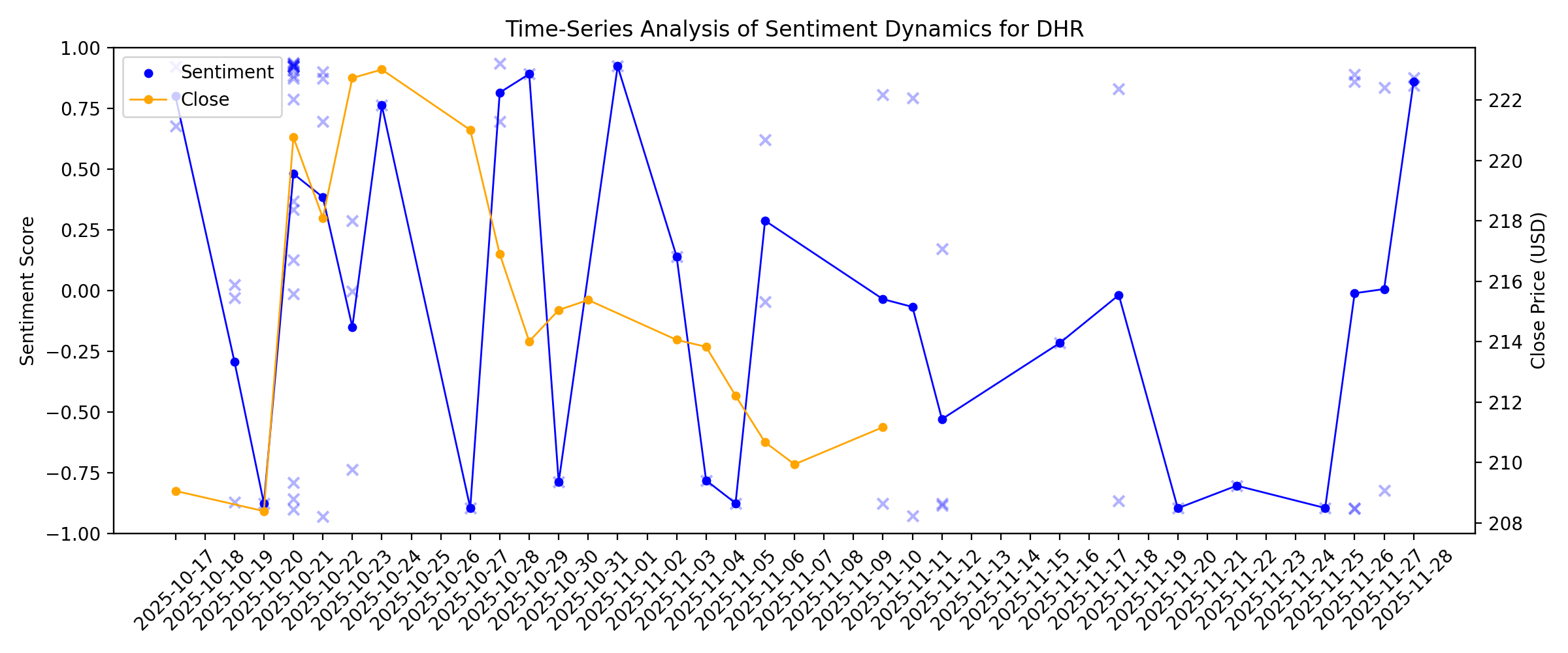

News sentiment analysis for DHR

Sentiment chart

2026-01-14

How Investors Are Reacting To Danaher (DHR) Upbeat 2025 Outlook And Growing Synthetic Biology Ambitions

Description: In early January 2026, Danaher announced ahead of the J.P. Morgan Healthcare Conference that it expects fourth-quarter 2025 revenue and full-year non-GAAP adjusted diluted EPS to finish toward the upper end of prior guidance, backed by solid bioprocessing, life sciences, and diagnostics performance. A separate update from Danaher company Integrated DNA Technologies highlighted a new collaboration with Ansa Biotechnologies, expanding access to longer, more complex DNA constructs and...

JPM26: Danaher positioned to improve patient diagnostics

Description: Danaher anticipates a strong 2026 due to its diagnostic portfolio being in highly attractive areas such as molecular testing, pathology and blood gas, and in core lab.

Integrated DNA Technologies Expands Synthetic Biology Portfolio with Ansa Biotechnologies’ Clonal DNA and XL Clonal DNA Products

Description: SUNNYVALE, Calif. & EMERYVILLE, Calif., January 14, 2026--IDT and Ansa are joining forces to empower customers with sequence-perfect constructs up to 50 kb, expanding IDT's synthetic biology portfolio.

Danaher (DHR) Rebounded on Accelerated Demand

Description: Mar Vista Investment Partners, LLC, an investment management company, released its “Mar Vista U.S. Quality Strategy” fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. US equities experienced a strong momentum in 2025 and marked their second consecutive year of double-digit gains. The market witnessed one of the fastest recoveries following its […]

2026-01-13

2026-01-12

CIO sees healthcare as a great potential investment in 2026

Description: <body><p>STORY: Ahlsten says healthcare stands out as an area where fundamentals remain attractive, even as much of the market's gains have been concentrated in a handful of large technology stocks.</p><p>"Health care has got great demographics behind it and double digit earnings growth for a lot of companies and importantly the valuations are reasonable," he says.</p><p>"Companies like Danaher and Thermo Fisher, Life Sciences, life sciences tools. We're going to see a lot of research coming out of all this innovation and technology, personalized medicine and we think those areas are poised to do very, very well in the years ahead."</p></body>

Danaher CEO to Comment on Financial Performance

Description: Danaher Corporation (NYSE: DHR) (the "Company") announced that its President and Chief Executive Officer, Rainer M. Blair, will comment tomorrow on the Company's fourth quarter 2025 performance in a presentation at the J.P. Morgan Healthcare Conference at 11:15 a.m. PT.

VieCure Raises $43 Million to Help Democratize Access to the Highest Caliber Cancer Care in Community Practices

Description: DENVER, January 12, 2026--VieCure Raises $43 Million to Help Democratize Access to the Highest Caliber Cancer Care in Community Practices

Possible Bearish Signals With Danaher Insiders Disposing Stock

Description: In the last year, many Danaher Corporation ( NYSE:DHR ) insiders sold a substantial stake in the company which may have...

2026-01-11

2026-01-10

2026-01-09

2026-01-08

This Stock Is Ready to Put Its Post-Covid Malaise Behind It

Description: With tariff rules finalized and inventories depleted, there’s light at the end of the tunnel for the medical and scientific tools manufacturer.

$443.6 Bn Microtome Global Market Trends, Opportunities and Strategies, 2019-2024, 2025-2029F, 2034F: Top 10 Players Hold 26.56% Share Led by Danaher, Thermo Fisher Scientific, and Sakura Finetek

Description: Key opportunities in the microtome market lie in expanding technical centers for innovation, focusing on next-gen microtomes and automation to enhance precision, and tapping into emerging markets. Growth is driven by disease diagnosis and drug discovery needs, with the accessories and fully automated segments showing promise. Microtome Market Microtome Market Dublin, Jan. 08, 2026 (GLOBE NEWSWIRE) -- The "Microtome Global Market Opportunities and Strategies to 2034" has been added to ResearchAnd

2026-01-07

Here's What to Expect From Danaher's Next Earnings Report

Description: Danaher will release its fourth-quarter earnings later this month, and analysts anticipate bottom-line to remain unchanged year over year.

Is Danaher (DHR) Pricing In Too Much Optimism After Recent Steady Share Performance

Description: If you are wondering whether Danaher is reasonably priced or carrying a premium right now, you are in the right place for a closer look at what the current share price might be implying. The stock last closed at US$236.59, with returns of 2.6% over 7 days, 4.6% over 30 days, 2.7% year to date and a 0.4% decline over 1 year. This gives you a mix of recent resilience and relatively flat longer term performance. Recent headlines around Danaher have largely focused on its role in life sciences...

2026-01-06

Assessing Danaher (DHR) Valuation After Recent Share Price Momentum And Modest Undervaluation Estimate

Description: With no single headline event driving attention today, Danaher (DHR) is drawing interest as a large healthcare equipment group with US$24.3b in revenue. The company spans biotechnology, life sciences, and diagnostics across multiple global end markets. See our latest analysis for Danaher. Danaher’s recent share price momentum, including a 15.43% 90 day share price return and 4.57% 30 day share price return to US$236.59, contrasts with a slightly negative 1 year total shareholder return. This...

Looking At The Narrative For Danaher (DHR) As Growth Expectations Reset

Description: What Changed In Danaher’s Price Target Danaher’s fair value estimate has shifted only slightly, moving from about US$258.09 to about US$259.23 per share, with the discount rate and key growth assumptions adjusted by very small amounts. This kind of fine tuning reflects how analysts are trying to balance a cautious view on revenue growth with ongoing confidence that the company can keep its story intact, even as opinions remain split. Continue with this article to see how you can keep on top...

2026-01-05

Danaher to Present at J.P. Morgan Healthcare Conference

Description: Danaher Corporation (NYSE: DHR) announced that its President and Chief Executive Officer, Rainer M. Blair, will be presenting at the J.P. Morgan Healthcare Conference in San Francisco, California on Tuesday, January 13, 2026 at 11:15 a.m. PT. The event will be simultaneously webcast and can be accessed on the "Investors" section of Danaher's website, www.danaher.com, under the subheading "Events & Presentations."

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Strength in Medical & Fluid Solutions Unit Drives Nordson: Can It Sustain?

Description: NDSN is gaining momentum as its Medical and Fluid Solutions segment delivers solid organic growth and margin expansion.

2025-12-30

Morgan Stanley Initiates Coverage Of Veracyte, Inc. (VCYT)

Description: Veracyte, Inc. (NASDAQ:VCYT) is among the 12 Best Genomics Stocks to Invest In. The Fly reported on December 2, 2025, that Morgan Stanley began covering Veracyte, Inc. (NASDAQ:VCYT) with an Underweight rating and a price target of $48, up from $40. According to the firm, the Life Science Tools and Diagnostics end markets are showing […]

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

The Bill Gates Portfolio: 3 Of His Ancor Holdings Every Investor Should Consider

Description: Microsoft (NASDAQ:MSFT) founder Bill gates is best-known for his founding of the most valuable company in the world (on multiple occasions, just not now). And rightfully so. That said, over the years, Bill Gates has adjusted his portfolio holdings, choosing to divest in a range of companies via his own personal portfolio but also via his ... The Bill Gates Portfolio: 3 Of His Ancor Holdings Every Investor Should Consider

2025-12-22

2025-12-21

Goldman Sachs and KeyBanc are Bullish on Danaher (DHR)

Description: Danaher Corporation (NYSE:DHR) is one of the 14 Best Large Cap Stocks to Invest In Now. On December 9, Goldman Sachs started covering Danaher Corporation (NYSE:DHR), giving the stock a Buy rating and setting the price target at $265. The research firm pointed to the company’s strong $6 billion bioprocessing franchise. Despite a currently muted […]

2025-12-20

Danaher (NYSE:DHR) shareholders have endured a 0.9% loss from investing in the stock three years ago

Description: While not a mind-blowing move, it is good to see that the Danaher Corporation ( NYSE:DHR ) share price has gained 16...

2025-12-19

2025-12-18

Will Strength in Biotechnology Unit Continue to Drive Danaher's Growth?

Description: DHR sees Biotechnology core revenues rise 6.5% in Q3 2025, fueled by bioprocessing demand, with approximately 5% growth expected in Q4.

2025-12-17

Danaher Schedules Fourth Quarter 2025 Earnings Conference Call

Description: Danaher Corporation (NYSE: DHR) announced that it will webcast its quarterly earnings conference call for the fourth quarter 2025 on Wednesday, January 28, 2026 beginning at 8:00 a.m. ET and lasting approximately one hour. During the call, the company will discuss its financial performance, as well as future expectations.

North America Poised for Highest Growth in Microplastic Analysis Market with 8.5% CAGR

Description: The global microplastic analysis market is set to grow from USD 266.9 million in 2025 to USD 383.1 million by 2030 at a CAGR of 7.5%. Growth is driven by increased research funding, rising proteomics research, and heightened awareness of microplastic pollution risks. The instruments segment will dominate the market in 2025, with substantial demand for reagents and consumables fueled by regulatory pressures. The water testing segment is experiencing rapid growth due to stricter water quality regu

2025-12-16

Is It Time To Consider Buying Danaher Corporation (NYSE:DHR)?

Description: Today we're going to take a look at the well-established Danaher Corporation ( NYSE:DHR ). The company's stock led the...

InnovAge (INNV) Moves 7.8% Higher: Will This Strength Last?

Description: InnovAge (INNV) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might help the stock continue moving higher in the near term.

Indicor Announces Leadership Transition

Description: Indicor, LLC ("Indicor" or "the Company") announced today that Doug Wright is stepping down as Chief Executive Officer and from the Company's Board of Directors. Mr. Wright will become CEO of ATS Corporation, a publicly-listed company headquartered in Canada that builds automation systems for a range of product categories. John Stroup, Chairman of Indicor, will serve as interim CEO effective immediately.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

Lateral Flow Assay Components Market to Hit USD 486.2 Million by 2030: Rising Prevalence of Infectious Diseases Drives Growth

Description: The global lateral flow assay (LFA) components market is poised for significant growth, projected to reach USD 486.2 million by 2030 from USD 392.4 million in 2025, with a CAGR of 4.4%. This expansion is driven by rising infectious diseases, demand for point-of-care testing, and home-based diagnostics. Sandwich assays dominate due to their high sensitivity and specificity in clinical settings. Medical device manufacturers lead market demand, while contract manufacturers grow, especially in Asia-

2025-12-11

2025-12-10

Is Danaher Stock Still Attractive After Its Recent 9.1% Price Jump?

Description: If you have been wondering whether Danaher at around $230 a share is a bargain in disguise or a quality name priced for perfection, you are not alone. This breakdown is designed to give you a clear, calm answer. Over the last month the stock has climbed about 9.1%, even though it is only up 0.3% year to date and is still roughly flat over three years. This tells us sentiment has shifted recently even if long term returns have been muted. That renewed interest has come as investors refocus on...

Should Goldman’s Bioprocessing Call and Dividend Steadiness Require Action From Danaher (DHR) Investors?

Description: Danaher Corporation recently announced that its board approved a regular quarterly cash dividend of US$0.32 per share, payable on January 30, 2026, to shareholders of record as of December 26, 2025. On the same day, Goldman Sachs began covering Danaher with a positive view on its bioprocessing and later-stage research exposure, highlighting how the company is positioned in parts of life sciences tools where demand appears to be improving. We’ll now examine how Goldman Sachs’ bullish...

2025-12-09

Danaher Announces Quarterly Dividend

Description: Danaher Corporation (NYSE: DHR) announced today that its Board of Directors has approved a regular quarterly cash dividend of $0.32 per share of its common stock, payable on January 30, 2026 to holders of record on December 26, 2025.

Goldman Sachs starts Life Sciences Tools coverage, rates these 3 stocks at Buy

Description: Investing.com -- Goldman Sachs has launched coverage of the Life Sciences Tools sector with a selective stance, arguing that the group should ultimately “return to their historic market growth rate of ~5%,” but only as certain end markets recover faster than others.

2025-12-08

Appointment of Francis Van Parys as Chief Executive Officer

Description: OXFORD, England, December 08, 2025--Oxford Nanopore Technologies, the company delivering a new generation of molecular sensing technology based on nanopores, today announces the appointment of Francis Van Parys as Chief Executive Officer ("CEO"). Francis will join the Company and the Board as an Executive Director on 2 March 2026.

2025-12-07

2025-12-06

2025-12-05

Morgan Stanley Ups the Ante on These 2 Life Science Tool Stocks

Description: The broad healthcare sector accounts for roughly one-fifth of the U.S. economy and continues to expand. While most attention tends to go to the direct-care segment, the life-sciences industry is an equally critical pillar of the system. It spans everything from laboratory services to drug discovery, and its research and development efforts are major drivers of progress in patient care. Grand View Research estimated the life sciences market at $167.82 billion worldwide in 2004, and expects it to

How New Signals Are Gradually Shifting the Narrative for Danaher

Description: Danaher’s valuation narrative has been nudged higher, with the fair value estimate edging up to about $255.67 from roughly $254.20 as analysts refine their long term growth and risk assumptions. While the discount rate has ticked up to around 8.00% and revenue growth expectations have slipped only marginally to nearly 5.47%, the Street’s tone has shifted to a more balanced, wait and see stance amid slower near term recovery in key end markets. Stay tuned to see how to track these subtle yet...

2025-12-04

Danaher Corporation (DHR): A Bull Case Theory

Description: We came across a bullish thesis on Danaher Corporation on Heavy Moat Investments’s Substack. In this article, we will summarize the bulls’ thesis on DHR. Danaher Corporation’s share was trading at $226.59 as of December 2nd. DHR’s trailing and forward P/E were 46.12 and 26.18 respectively according to Yahoo Finance. Danaher Corporation designs, manufactures, and markets professional, medical, […]

Danaher Stock Earns Relative Strength Rating Upgrade

Description: Danaher stock had its Relative Strength (RS) Rating upgraded from 68 to 72 Thursday — a welcome improvement, but still shy of the 80 or higher score you prefer to see. When To Sell Stocks To Lock In Profits And Minimize Losses IBD's unique rating tracks market leadership with a 1 (worst) to 99 (best) score.

Jim Cramer Says “Danaher’s Been Acting Much Better”

Description: Danaher Corporation (NYSE:DHR) is one of the stocks Jim Cramer recently discussed. Cramer noted that he still likes the stock for the Charitable Trust, as he said: “Now, first, there’s tried and true, but lately trying Danaher, DHR, a conglomerate that became more focused on life sciences diagnostics when it spun off its water and […]

2025-12-03

Brady Corporation elects Board of Directors and declares regular dividend to shareholders

Description: MILWAUKEE, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Brady Corporation (NYSE: BRC) (“Company”) announced that shareholders of the Company’s Class B Common Voting Stock have voted unanimously in favor of the election of the director nominees to a one-year term at the Company’s annual meeting of shareholders held today in Milwaukee. Elected to the Brady Corporation Board of Directors are: Patrick W. Allender, Executive Vice President and Chief Financial Officer (Retired), Danaher CorporationDr. David S. B

2025-12-02

2025-12-01

Danaher Corporation (NYSE:DHR) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Description: Most readers would already be aware that Danaher's (NYSE:DHR) stock increased significantly by 11% over the past three...

Buffer Preparation Market Trends & Forecasts Report 2025-2035 Featuring Asahi Kasei, Avantor, Canvax, Danaher, GE, HOPAX, Merck, Prepared Biologics, Sartorius, Sepragen, Thermo Fisher Scientific, ZETA

Description: Key opportunities in the buffer preparation market include expanding demand for advanced buffer systems in biopharma production, increasing preference for outsourcing to reduce costs, and growth potential in reusable equipment and liquid formulations. North America remains dominant, while Asia-Pacific exhibits high growth potential. Scale of Operation Scale of Operation Buffer Service Providers Buffer Service Providers Buffer Manufacturing Systems Buffer Manufacturing Systems Dublin, Dec. 01, 20

2025-11-30

2025-11-29

2025-11-28

North America Mass Spectrometry Market Report 2025-2033, Profiles of Agilent Technologies, Bruker, Danaher, Hitachi, JEOL, LECO, PerkinElmer, and Thermo Fisher Scientific

Description: The North America Mass Spectrometry Market is poised to surge from US$ 2.6 Billion in 2024 to US$ 4.87 Billion by 2033, driven by a 7.21% CAGR. Key growth areas include pharmaceutical, environmental analysis, and food safety sectors, powered by advancements in mass spectrometry technology enhancing sensitivity and precision. Major drivers include increased demand in the pharmaceutical and biotechnology sectors, advancements in hybrid and high-resolution technologies, and growing applications in

North America Nucleic Acid Amplification Testing Market Analysis Report 2025-2033 - Technological Advances, Rising Diagnostic Demand, and Widespread Applications

Description: The North American Nucleic Acid Amplification Testing (NAAT) market will reach $7.64 billion by 2033, growing from $3.28 billion in 2024 with a CAGR of 9.87%. Driven by technological advances, rising diagnostic demand, and widespread applications, NAAT proves critical in identifying infectious diseases and genetic mutations. Notably, innovation, automation, and government support bolster the market's expansion. Despite regulatory hurdles and high costs, ongoing collaborations aim to enhance affo

2025-11-27

Danaher (DHR) Q3 2025 Earnings Call Transcript

Description: With us today are Rainer Blair, our President and Chief Executive Officer; and Matt McGrew, our Executive Vice President and Chief Financial Officer. And with that, I'd like to turn the call over to Rainer.

Danaher (DHR): Evaluating the Stock’s Current Valuation After Recent Gains

Description: Danaher (DHR) stock has seen modest movement over the past month, gaining 3%. In contrast, the past three months marked a steadier 11% climb. Investors are weighing recent performance against the company’s longer-term trends. See our latest analysis for Danaher. Danaher's share price momentum has held up over the past quarter with a steady 11% gain, even as its 1-year total shareholder return remains slightly negative at -3.76%. This mix of recent strength and stagnant longer-term performance...

2025-11-26

DuPont Can Become a ‘Compounder.’ Why the Stock Could Gain 20%.

Description: Deutsche Bank analyst David Begleiter reiterated his Buy rating on the shares. His price target is $46

Revvity (RVTY) Up 9.5% Since Last Earnings Report: Can It Continue?

Description: Revvity (RVTY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Danaher Stock: Is DHR Underperforming the Healthcare Sector?

Description: Despite Danaher’s underperformance relative to the healthcare sector, Wall Street analysts remain strongly optimistic about the stock’s prospects.

US STD Diagnostics Market Forecast and Company Analysis 2025-2033 Featuring Abbott, F. Hoffmann-La Roche, Hologic, BD and Co, Danaher, Siemens, bioMerieux, Thermo Fisher Scientific, Qiagen, Bio-Rad

Description: The United States STD Diagnostics Market is set to grow from US$ 5.06 billion in 2024 to US$ 8.49 billion by 2033, achieving a CAGR of 5.91% from 2025 to 2033. Key growth drivers include rising STD prevalence, technological advancements, increased awareness, and supportive government initiatives. Rapid point-of-care tests and molecular diagnostics are gaining traction, while high costs and regulatory hurdles persist as challenges. Major markets like California, Texas, New York, and Florida lead

2025-11-25

DuPont Can Become a ‘Compounder.’ Why the Stock Could Gain 20%.

Description: Deutsche Bank analyst David Begleiter reiterated his Buy rating on the shares. His price target is $46

2025-11-24

2025-11-23

2025-11-22

Estimating The Fair Value Of Danaher Corporation (NYSE:DHR)

Description: Key Insights The projected fair value for Danaher is US$218 based on 2 Stage Free Cash Flow to Equity With US$227 share...

2025-11-21

2025-11-20

Danaher (DHR) Up 2% Since Last Earnings Report: Can It Continue?

Description: Danaher (DHR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-19

2025-11-18

Human Papilloma Virus (HPV) Test and Pap Smear/Test Market Research and Forecast Report 2025-2030, Competitive Analysis of Market leaders - Hologic, BD, Roche, QIAGEN, and Danaher

Description: The HPV testing and Pap test market is set to grow from USD 2.44 billion in 2025 to USD 3.94 billion by 2030, with a CAGR of 10.0%. This growth is fueled by increased awareness of cervical cancer and government-led screening initiatives. Consumables lead the market, driven by demand for reagents and collection kits essential for testing. While cervical cancer screening dominates, vaginal cancer screening is poised for rapid growth, aided by enhanced diagnostic capabilities. The Asia Pacific regi

Jim Cramer Says BillionToOne Has a “Fantastic Story” Within the Diagnostics Space

Description: BillionToOne, Inc. (NASDAQ:BLLN) is one of the stocks Jim Cramer expressed his thoughts on. Cramer noted that he is a “big fan” of the industry the company is a part of, as he stated: “Where do I come down on this thing? Honestly, I really like it. BillionToOne is playing in an industry that I’m […]

2025-11-17

2025-11-16

Shareholders 2.8% loss in Danaher (NYSE:DHR) partly attributable to the company's decline in earnings over past three years

Description: Many investors define successful investing as beating the market average over the long term. But if you try your hand...

2025-11-15

2025-11-14

2025-11-13

2025-11-12

SOLV vs. DHR: Which Stock Is the Better Value Option?

Description: SOLV vs. DHR: Which Stock Is the Better Value Option?

IDBS announces i3 2026-An exclusive customer and partner event on data management innovation in BioPharma

Description: Following the success of i3 2025, IDBS, a Danaher company and leading provider of cloud software for BioPharma companies, is excited to announce that its flagship customer and partner event, i3 2026, will take place in Boston, USA on May 18, 2026.

2 Healthcare Stocks for Individual Investors With a 40-Year Time Horizon

Description: If you have decades of investing runway left, consider these two top healthcare stocks.

2025-11-11

Danaher (DHR): Evaluating Valuation After Modest Share Price Rebound

Description: Danaher (DHR) shares have edged modestly higher over the past month, gaining about 7%. Investors seem to be weighing up recent performance and the company’s underlying growth trends as they look for clues about its outlook. See our latest analysis for Danaher. While Danaher has been clawing back some ground with a 6.6% share price gain over the last month, the bigger picture tells a more cautious story, with a one-year total shareholder return of -9.4%. Recent momentum suggests investors are...

Danaher to Present at Jefferies Global Healthcare Conference

Description: Danaher Corporation (NYSE: DHR) announced that President and Chief Executive Officer, Rainer M. Blair, will be presenting at the Jefferies Global Healthcare Conference in London, UK on Tuesday, November 18, 2025 at 11:00 a.m. GMT. The event will be simultaneously webcast on www.danaher.com.

2025-11-10

SOLV or DHR: Which Is the Better Value Stock Right Now?

Description: SOLV vs. DHR: Which Stock Is the Better Value Option?

Biopsy Devices Market: Key Players Analysis Recent Developments, Company Strategies, Sustainability Benchmarking, Product Launches, Key Persons, and Revenue Forecasts

Description: The Biopsy Devices market is projected to reach $4.02 billion by 2033, growing from $2.43 billion in 2024 at a CAGR of 5.75%. This growth is driven by personalized care demand, rising cancer cases, and minimally invasive treatments enhancing patient comfort. Key biopsy devices include needle, punch, and surgical tools for various medical needs. Advancements in biopsy technology ensure precise, early cancer detection and improved patient outcomes. Leading companies like Cardinal Health, Hologic,

2025-11-09

2025-11-08

2025-11-07

2025-11-06

1 Profitable Stock to Consider Right Now and 2 We Avoid

Description: Even if a company is profitable, it doesn’t always mean it’s a great investment. Some struggle to maintain growth, face looming threats, or fail to reinvest wisely, limiting their future potential.

Australia Dental Diagnostics and Surgical Equipment Market: Analysis of Key Trends and Innovations (2025-2033) Featuring Danaher, Straumann, Henry Schein and More

Description: Urban areas in states like New South Wales and Victoria lead the market, bolstered by strong infrastructure and investment in cutting-edge dental technologies. Recent developments see major companies like Danaher and Dentsply Sirona expanding their product offerings to cater to evolving market needs. Australian Dental Diagnostics and Surgical Equipment Market Australian Dental Diagnostics and Surgical Equipment Market Dublin, Nov. 06, 2025 (GLOBE NEWSWIRE) -- The "Australia Dental Diagnostics an

2025-11-05

Insiders At Danaher Sold US$380m In Stock, Alluding To Potential Weakness

Description: In the last year, many Danaher Corporation ( NYSE:DHR ) insiders sold a substantial stake in the company which may have...

2025-11-04

Tala Health raises $100 million seed round, as Ritankar Das seeks to build a holding company for the AI era

Description: Titan Holdings has launched a new operating company, Tala Health, Fortune has exclusively learned.

2025-11-03

HbA1c Testing Market Research Report 2025-2033, Profiles of Key Players - Danaher, F. Hoffmann-La Roche, Siemens, Abbott, Bio-Rad Laboratories, ARKRAY, Trinity Biotech, EKF Diagnostics

Description: The HbA1c testing market presents opportunities driven by rising Type 2 diabetes cases and advancements in testing technologies. Supportive healthcare initiatives and increased awareness enhance demand. Strategic insights, competitive analysis, and diverse applications across settings highlight key investment areas. HbA1c Testing Market HbA1c Testing Market Dublin, Nov. 03, 2025 (GLOBE NEWSWIRE) -- The "HbA1c Testing Market Size, Share, Growth, Trends and Forecast 2025-2033" report has been adde

2025-11-02

2025-11-01

Danaher Corporation's (NYSE:DHR) Has Performed Well But Fundamentals Look Varied: Is There A Clear Direction For The Stock?

Description: Danaher's (NYSE:DHR) stock is up by 9.3% over the past three months. Given that the stock prices usually follow...

2025-10-31

2025-10-30

The Richest 0.1% Are Buying These 3 Dividend Stocks Right Now

Description: When ultra-rich investors start coalescing into the same names or put an unusually large amount of money into a single stock, that should raise more interest. That’s exactly what we’re seeing with UnitedHealth (NYSE:UNH), Visa (NYSE:V), and Danaher (NYSE:DHR). These investors have far more resources than the average Joe. Perhaps, they know something about these ... The Richest 0.1% Are Buying These 3 Dividend Stocks Right Now

2025-10-29

Mexico Dental Implants Market Insights, Competition Analysis, and Growth Outlook (2025-2033) with Pricing Benchmarks - Featuring Danaher, Dentsply Sirona, Institut Straumann, Zimmer Biomet, Kyocera and More

Description: Mexican Dental Implant Market Mexican Dental Implant Market Dublin, Oct. 29, 2025 (GLOBE NEWSWIRE) -- The "Mexico Dental Implant Market Forecast & Trends 2025-2033" has been added to ResearchAndMarkets.com's offering. The Mexico Dental Implant Market is expected to reach US$ 161.02 million in 2033, from US$ 87.88 million in 2024, at a CAGR of 6.96% during the years 2025-2033. This market is expected to be pushed by growing dental tourism, rising incidence of oral diseases, growing geriatric popu

2025-10-28

Some Investors May Be Willing To Look Past Danaher's (NYSE:DHR) Soft Earnings

Description: Danaher Corporation's ( NYSE:DHR ) stock was strong despite it releasing a soft earnings report last week. Our analysis...

5 Must-Read Analyst Questions From Danaher’s Q3 Earnings Call

Description: Danaher’s third quarter was marked by solid execution across its core businesses, with management citing bioprocessing momentum and a stronger-than-anticipated performance in respiratory diagnostics as key drivers. CEO Rainer Blair highlighted that demand for monoclonal antibody production remained robust, propelling bioprocessing growth, while Cepheid’s respiratory testing revenues benefited from customers ordering earlier than usual. Management also pointed to disciplined cost management and o

2025-10-27

Unlocking Danaher (DHR) International Revenues: Trends, Surprises, and Prospects

Description: Explore Danaher's (DHR) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

2025-10-26

2025-10-25

2025-10-24

DHR Q3 2025 Deep Dive: Bioprocessing, Diagnostics, and Productivity Initiatives Amid Policy Shifts

Description: Diversified science and technology company Danaher (NYSE:DHR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.4% year on year to $6.05 billion. On the other hand, next quarter’s revenue guidance of $6.70 billion was less impressive, coming in 4.7% below analysts’ estimates. Its non-GAAP profit of $1.89 per share was 9.8% above analysts’ consensus estimates.

2025-10-23

Jim Cramer Says “Danaher Gave Us the Quarter We’ve Been Looking For”

Description: Danaher Corporation (NYSE:DHR) is one of the stocks Jim Cramer recently highlighted. Discussing the post-earnings rally of the stock, Cramer remarked: “Then there’s Danaher, DHR, the life sciences and diagnostic equipment company, which has been a huge disappointment for my Charitable Trust for so long. Not today, though. Today, Danaher gave us the quarter we’ve […]

Cell Culture Media Storage Containers Market Report 2025, with Profiles of Avantor, BD Biosciences, Celltreat Scientific Products, Corning, Danaher, DWK Life Sciences, Eppendorf, Euroclone, and More

Description: The demand for Cell Culture Media Storage Containers is rising due to biopharma growth, regenerative medicine, and eco-friendly trends. Opportunities lie in advanced, sustainable storage solutions, single-use systems, and automation for improved compliance and efficiency, driven by stricter GMP standards and bioprocessing needs. Cell Culture Media Storage Containers Market Cell Culture Media Storage Containers Market Dublin, Oct. 23, 2025 (GLOBE NEWSWIRE) -- The "Cell Culture Media Storage Conta

Danaher (DHR) Margin Declines to 14.4%, Challenging Bullish Growth Narratives

Description: Danaher (DHR) reported net profit margins of 14.4%, down from 16.6% a year ago, while earnings have declined at an average annual rate of 5.6% over the past five years. Despite this pullback, analysts expect Danaher's earnings to grow 16.72% annually, which is ahead of the broader US market’s projected 15.5% yearly growth. However, revenue growth forecasts lag at 5.2% per year compared to the market’s 10%. With no major or minor risks flagged in the current data, investors are weighing the...

2025-10-22

Why Analysts See the Danaher Story Shifting Amid Mixed Signals and Evolving Growth Forecasts

Description: Danaher's stock has seen its Fair Value Estimate increase to $247.30 from $244.50, even as growth projections become more mixed across the industry. Recent analyst commentary shows a split between optimism about stabilization within key segments and caution about the pace of recovery ahead. Stay tuned to learn how you can keep up with the evolving Danaher story as market views continue to shift. What Wall Street Has Been Saying 🐂 Bullish Takeaways BofA continues to rate Danaher as a Buy,...

Danaher (DHR) Jumps on Improved Q3 Earnings

Description: We recently published 10 Stocks Leaving Wall Street in the Dust. Danaher Corp. (NYSE:DHR) is one of the best performers on Tuesday. Danaher bounced back by 5.94 percent on Tuesday to close at $220.77 apiece after achieving an improved earnings performance in the third quarter of the year. In an updated report, Danaher Corp. (NYSE:DHR) […]

Company News for Oct 22, 2025

Description: Companies in The News Are: KO, DHR, RTX, VST

Jim Cramer Calls Danaher “Once Incredibly Well-Run Company”

Description: Danaher Corporation (NYSE:DHR) is one of the stocks in Jim Cramer’s recent game plan. Cramer showed slight optimism around the company’s upcoming earnings, as he remarked: “… and Charitable Trust club name Danaher, one of our biggest laggards, may report the first of many good quarters after a shocking multiple-year dry spell for this once […]

2025-10-21

Stocks to Watch Tuesday Recap: Warner Bros. Discovery, GM, GE Aerospace

Description: ↗️ Warner Bros. Discovery (WBD): The media company said it had begun reviewing strategic alternatives after being approached about potential deals. Shares jumped nearly 11%. ↗️ RTX (RTX): The defense company raised its annual forecast on high demand for munitions and missiles.

Danaher Surges Into Buy Zone As One Key Division Drives Growth

Description: Shares of Danaher surged Tuesday after the medical research company beat third-quarter forecasts on the back of its bioprocessing division.

Sector Update: Health Care Stocks Advance Late Afternoon

Description: Health care stocks rose late Tuesday afternoon, with the NYSE Health Care Index climbing 0.1% and th

Danaher Corp (DHR) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic Share ...

Description: Danaher Corp (DHR) reports robust Q3 performance with $6.1 billion in sales, a 10% increase in adjusted EPS, and a $2 billion share repurchase initiative.

Here's Why Shares in Danaher Got Boosted Higher Today

Description: The company's third-quarter earnings pleased investors.

Why Danaher (DHR) Stock Is Trading Up Today

Description: Shares of diversified science and technology company Danaher (NYSE:DHR) jumped 7.5% in the afternoon session after the company reported third-quarter 2025 financial results that surpassed analyst expectations for revenue and profit. Danaher announced revenue grew 4.4% from the previous year to $6.05 billion, ahead of the $6.01 billion consensus estimate. The company’s adjusted earnings per share also came in strong at $1.89, higher than the anticipated $1.72. The report was not entirely positive

Sector Update: Health Care Stocks Advance Tuesday Afternoon

Description: Health care stocks rose Tuesday afternoon, with the NYSE Health Care Index up 0.2% and the Health Ca

Danaher Third-Quarter Earnings Rise; Pharma R&D Spend Expected to Rebound

Description: The life sciences and diagnostics company posted sales of $6.05 billion and stands to benefit from an increase in pharmaceutical-research investment as tariff uncertainty eases.

Danaher Q3 Earnings Beat Estimates, Life Sciences Sales Up Y/Y

Description: DHR Q3 earnings and sales beat estimates, driven by solid segment growth and stronger operating margins.

Top Midday Stories: GM Shares Rise on Earnings Beat, Raised Guidance; Blackstone, TPG to Acquire Hologic

Description: The Dow Jones and the S&P 500 were up, while the Nasdaq Composite was flat in late-morning trading T

Danaher Beats Third-Quarter Estimates, Affirms 2025 Earrings Outlook

Description: Danaher's (DHR) fiscal third-quarter results came in stronger than Wall Street's forecasts, while th

Danaher (DHR) Reports Q3 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for Danaher (DHR) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Integrated DNA Technologies and Profluent Collaborate to Unlock New Frontier of AI-driven Protein Design

Description: REDWOOD CITY, Calif. & EMERYVILLE, Calif., October 21, 2025--Profluent Bio's AI-driven protein design and IDT’s enzymology and genomics expertise unite to explore new paths for developing novel enzyme variants.

Stocks Down Pre-Bell as Traders Digest US-Australia Critical Minerals Deal, Await Latest Earnings

Description: US equity futures were pointing lower on Tuesday as investors assess the critical minerals deal betw

Danaher (DHR) Q3 Earnings and Revenues Beat Estimates

Description: Danaher (DHR) delivered earnings and revenue surprises of +10.53% and +0.94%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Danaher beats Q3 forecasts, issues soft full-year profit outlook; shares slip

Description: Investing.com -- Danaher reported third-quarter results that topped analyst expectations, while its full-year profit outlook narrowly missed consensus estimates at the midpoint.

Danaher’s (NYSE:DHR) Q3 Sales Beat Estimates

Description: Diversified science and technology company Danaher (NYSE:DHR) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 4.4% year on year to $6.05 billion. On the other hand, next quarter’s revenue guidance of $6.70 billion was less impressive, coming in 4.7% below analysts’ estimates. Its non-GAAP profit of $1.89 per share was 9.8% above analysts’ consensus estimates.

Danaher: Q3 Earnings Snapshot

Description: On a per-share basis, the Washington-based company said it had profit of $1.27. Earnings, adjusted for one-time gains and costs, came to $1.89 per share. The results surpassed Wall Street expectations.

Danaher Reports Third Quarter 2025 Results

Description: Danaher Corporation (NYSE: DHR) (the "Company") today announced results for the quarter ended September 26, 2025.

2025-10-20

LH vs. DHR: Which Stock Is the Better Value Option?

Description: LH vs. DHR: Which Stock Is the Better Value Option?

2025-10-19

Danaher Earnings: What To Look For From DHR

Description: Diversified science and technology company Danaher (NYSE:DHR) will be announcing earnings results this Tuesday morning. Here’s what to expect.

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

Danaher (DHR): Assessing Valuation After Analyst Downgrade and Renewed Concerns Over Premium Price

Description: Danaher (DHR) drew renewed attention after a well-followed analyst at Rothschild & Co. Redburn shifted the stock rating from Buy to Hold, citing concerns about premium valuation, uncertainty regarding China’s recovery, and questions in the diagnostic segment. See our latest analysis for Danaher. Danaher shares have edged higher in recent weeks, but the positive momentum comes after a tough stretch, with its 1-year total shareholder return down over 23%. High-profile ratings changes and...

2025-10-18

2025-10-17

3 Industrials Stocks That Concern Us

Description: Whether you see them or not, industrials businesses play a crucial part in our daily activities. They are also bound to benefit from a friendlier regulatory environment with the Trump administration, and this excitement has led to a six-month gain of 38.5% for the sector - higher than the S&P 500’s 25.9% return.

Danaher Gears Up to Post Q3 Earnings: What Lies Ahead for the Stock?

Description: DHR gears up for Q3 results with steady earnings estimates and mixed segment trends across Life Sciences, Biotechnology and Diagnostics.