News sentiment analysis for DOC

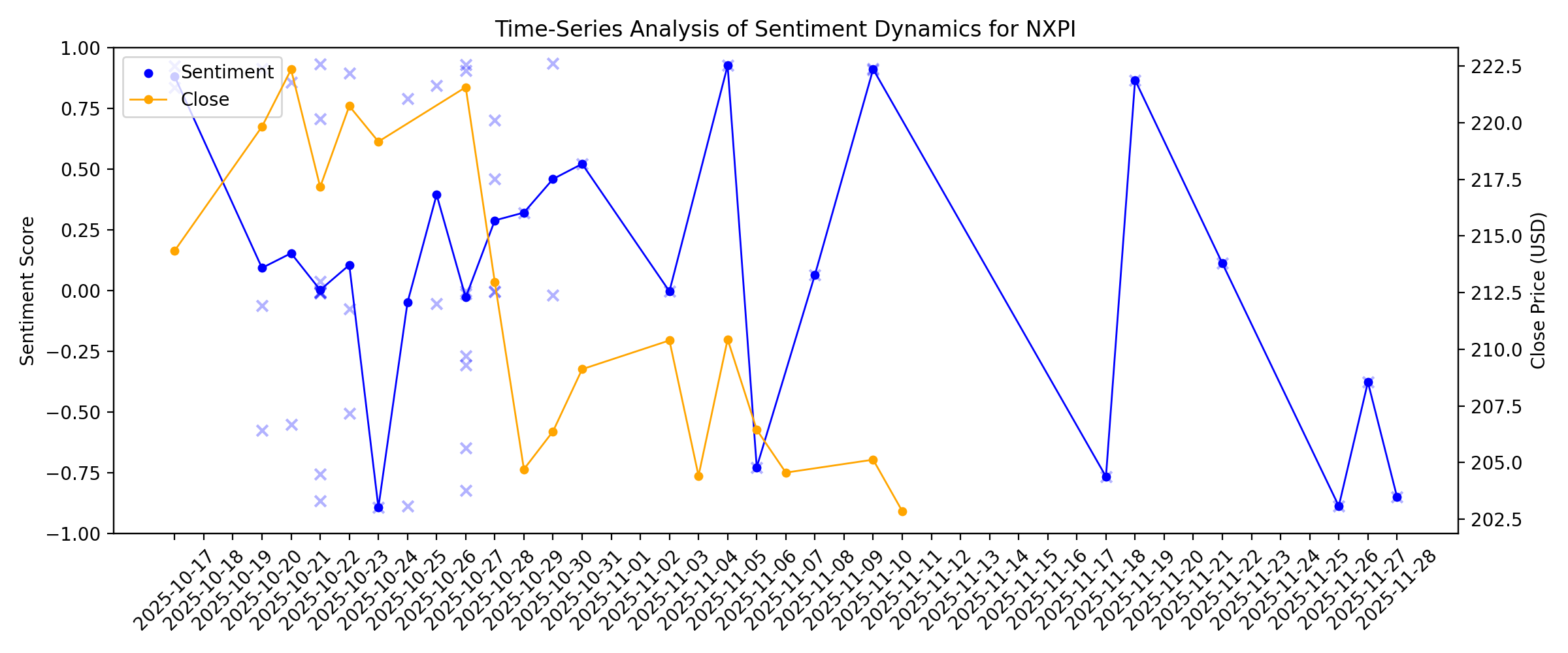

Sentiment chart

2026-01-14

A Look At Healthpeak Properties (DOC) Valuation After Recent Share Price Stabilisation

Description: Healthpeak Properties (DOC) has drawn fresh attention after recent trading, with the stock closing at US$17.26 and showing mixed performance over the past year, including a 6.5% year to date gain and a 9.2% decline over 1 year. See our latest analysis for Healthpeak Properties. The recent 1 day share price return of 1.89% and 30 day share price return of 3.6% suggest short term momentum is stabilising. In contrast, the 1 year total shareholder return of 9.17% and 5 year total shareholder...

Healthpeak Announces Transaction Activity Amounting $925 Million

Description: DOC reports $925M in deals, buying a South San Francisco campus for $600M and selling $325M of stabilized outpatient assets.

2026-01-13

2026-01-12

Healthpeak Properties Announces $925 Million of Transaction Activity

Description: DENVER, January 12, 2026--Healthpeak Properties, Inc. (NYSE: DOC), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, today announced recent transaction activity totaling approximately $925 million, reflecting continued execution on the Company’s capital allocation strategy.

2026-01-11

2026-01-10

2026-01-09

Healthpeak Properties Announces Fourth Quarter 2025 Earnings Release Date and Conference Call Details

Description: DENVER, January 09, 2026--Healthpeak Properties, Inc. (NYSE: DOC), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, is scheduled to report fourth quarter 2025 financial results after the close of trading on the New York Stock Exchange on Monday, February 2, 2026.

2026-01-08

Healthpeak Monetizes Senior Housing Assets Through Janus Living IPO

Description: DOC aims to unlock value in its senior housing platform by spinning out Janus Living via an IPO while retaining control and recurring management income.

2026-01-07

Is Healthpeak Properties (DOC) Now A Potential Opportunity After Recent Share Price Weakness

Description: If you are wondering whether Healthpeak Properties is attractively priced or just a value trap, you are in the right place. This article zooms in on what the current share price really implies. The stock last closed at US$16.50, with returns of 2.0% over 7 days, a 3.1% decline over 30 days, 1.9% year to date and an 11.4% decline over 1 year, which may have some investors reassessing both the risk and potential upside. Recent attention on Healthpeak has focused on how real estate investment...

Healthcare Realty Announces Chief Financial Officer Transition

Description: NASHVILLE, Tenn., Jan. 07, 2026 (GLOBE NEWSWIRE) -- Healthcare Realty Trust Incorporated (NYSE:HR) (“Healthcare Realty” or the “Company”) today announced the appointment of Daniel Gabbay as Executive Vice President and Chief Financial Officer (“CFO”). He will be based at the Company’s Nashville headquarters and assume his new role on January 12, 2026. Since 2024, Mr. Gabbay served as a Managing Director in the Real Estate Investment Banking Group of RBC Capital Markets (“RBC”), with primary cove

Healthpeak Properties Announces the Formation of a Pure-Play, RIDEA-Structured Publicly Traded Senior Housing REIT

Description: DENVER, January 07, 2026--Healthpeak Properties, Inc. (NYSE: DOC) ("Healthpeak"), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, today announced the formation and planned initial public offering ("IPO") of Janus Living, Inc. (collectively with its subsidiaries, "Janus Living"), a real estate investment trust ("REIT") dedicated to senior housing. Healthpeak will contribute its 34-community, 10,422-unit senior housing portfolio to Janus Living and wi

Healthpeak Properties Announces Confidential Submission of Draft Registration Statement by Janus Living, Inc.

Description: DENVER, January 07, 2026--Healthpeak Properties, Inc. (NYSE: DOC) ("Healthpeak") today announced that it has confidentially submitted a draft registration statement on Form S-11 to the United States Securities and Exchange Commission ("SEC") relating to the proposed initial public offering ("IPO") of shares of common stock of a newly formed company, Janus Living, Inc. ("Janus Living"), that intends to elect and qualify to be taxed as a real estate investment trust.

2026-01-06

2026-01-05

Healthpeak Properties Declares Monthly Common Stock Cash Dividends for the First Quarter of 2026

Description: DENVER, January 05, 2026--Healthpeak Properties, Inc. (NYSE: DOC), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, announced that on January 4, 2026, its Board of Directors declared a monthly common stock cash dividend of $0.10167 per share for the first quarter of 2026, payable on the payment dates set forth in the table below to stockholders of record as of the close of business on the corresponding record date in the table below. The monthly divi

Sabra Health Care REIT, Inc. Appoints Darrin Smith as Chief Investment Officer and Congratulates Talya Nevo-Hacohen on her Retirement

Description: TUSTIN, Calif., January 05, 2026--Sabra Health Care REIT, Inc. ("Sabra") (Nasdaq: SBRA) today announced that Darrin Smith has been appointed Sabra’s Chief Investment Officer, Secretary and Executive Vice President, effective January 1, 2026. Mr. Smith succeeds Talya Nevo-Hacohen, Sabra’s former Chief Investment Officer, Treasurer and Executive Vice President in connection with her retirement on December 31, 2025.

What You Need To Know Ahead of Healthpeak Properties’ Earnings Release

Description: Analysts remain cautiously optimistic on Healthpeak despite sector headwinds and recent stock underperformance.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

Why Investors Need to Take Advantage of These 2 Finance Stocks Now

Description: Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Does the Market Drop Make Healthpeak Properties a Long Term Opportunity in 2025?

Description: Wondering if Healthpeak Properties is starting to look like a bargain after a tough run, or if the market still sees more risk ahead? This breakdown will help you decide whether the current price really makes sense. The stock has slid about 3.8% over the last week and 9.2% over the past month, taking its year to date loss to roughly 20.7% and leaving it down about 30.1% over five years. That naturally raises the question of whether expectations have swung too far to the downside. Recent...

2025-12-19

2025-12-18

Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500?

Description: These dividend stocks' high yields could be tempting, but they come with catches.

2025-12-17

More Rate Cuts Are Coming in 2026: Grab These Safe 7% and 8% Dividend Stocks Now

Description: These five stocks yield 7% or more but are typically forgotten by growth and income investors. It might be time to take a closer look.

2025-12-16

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Allstate, Chubb Ltd., Eli Lilly, KLA Corp., Lockheed Martin, MongoDB, Roku, and More

Description: Pre-Market Stock Futures: The futures are trading lower after what started as a bounce-back Monday turned into a reversal Monday, as the AI/Datacenter rotation trade continues to gather steam during the last whole trading week of 2025. Stocks rallied Monday on the open as traders tried to inject some holiday spirit, but by 12 noon ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Allstate, Chubb Ltd., Eli Lilly, KLA Corp., Lockheed Martin, MongoDB, Roku, and More

2025-12-15

Is Healthpeak Properties Stock Underperforming the Dow?

Description: Despite trailing the Dow Jones Industrial Average in recent months, analysts remain reasonably upbeat about Healthpeak Properties’ long-term prospects.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

This Invesco ETF Pays a 4.71% Yield With 50 Low-Volatility Dividend Stocks (3x the S&P 500)

Description: Invesco High Dividend Low Volatility ETF (NYSEARCA:SPHD) generates its 4.71% yield – roughly three times the S&P 500’s current dividend – by holding a concentrated portfolio of 50 U.S. stocks selected for high dividend yields and low volatility. With $3.1 billion in assets and a reasonable 0.30% expense ratio, SPHD takes an equal-weight approach to ... This Invesco ETF Pays a 4.71% Yield With 50 Low-Volatility Dividend Stocks (3x the S&P 500)

2025-12-09

2025-12-08

2025-12-07

Got $2,000 to Invest in December? These Dividend Stocks Could Turn It into a Monthly Stream of Passive Income in 2026.

Description: These REITs can provide you with a bankable monthly income stream next year.

2025-12-06

2025-12-05

Is Healthpeak Properties Mispriced After 2025 Selloff and Portfolio Repositioning?

Description: Wondering if Healthpeak Properties is a quietly mispriced REIT or a value trap in plain sight? This article is going to break down what the current share price really implies. The stock has had a rough patch, with the share price down 6.8% over the last week and 15.6% year to date. That has many investors questioning whether the market is getting too pessimistic. Recently, the company has been in the spotlight for its ongoing portfolio repositioning toward higher quality healthcare assets...

Is Healthpeak Properties (DOC) Now Undervalued? A Fresh Look at the REIT’s Recent Share Price Weakness

Description: Healthpeak Properties (DOC) has quietly lagged the broader market this year, and that underperformance is catching the attention of value oriented investors. With the stock down about 15% year to date, the question is whether the current weakness offers a patient entry point. See our latest analysis for Healthpeak Properties. That slide has come as healthcare REITs digest higher rates and mixed tenant demand, with Healthpeak’s 1 year total shareholder return of about minus 15 percent...

2025-12-04

Wall Street Sees a 60% Upside to Healthpeak Properties (DOC)

Description: Healthpeak Properties, Inc. (NYSE:DOC) is one of the best high growth stocks to consider. As of December 1, the average price target for DOC suggests an upside of nearly 10%, however, the Street high suggests an upside of 60%. Previously, on November 25, Connor Siversky from Wells Fargo kept a Hold rating on Healthpeak, with […]

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

W.P. Carey (WPC) Up 1.7% Since Last Earnings Report: Can It Continue?

Description: W.P. Carey (WPC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

Why Is Alexandria Real Estate Equities (ARE) Down 16.4% Since Last Earnings Report?

Description: Alexandria Real Estate Equities (ARE) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-25

3 Best Monthly Paying Dividend Stocks in the S&P 500

Description: All of us could benefit from a little extra income every month, and many dividend investors look for passive income through dividend stocks. Retirees and beginner investors could use a little extra income regularly, and fortunately, there are several companies that reward investors with monthly dividends. The S&P 500 includes some of the leading companies ... 3 Best Monthly Paying Dividend Stocks in the S&P 500

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

A Look at Healthpeak Properties’s (DOC) Valuation Following Recent Share Price Decline

Description: Healthpeak Properties (DOC) shares have seen modest movement this week, declining just under 1% in recent trading. Investors are weighing the stock's valuation in light of healthcare REIT sector trends and recent performance data. See our latest analysis for Healthpeak Properties. Healthpeak Properties’ share price has faced some pressure lately, with a 1-day drop of 0.85% and a 1-month share price return of -9.45%, reflecting muted sentiment despite signs of stabilization in the healthcare...

Healthpeak Properties Stock: Is Wall Street Bullish or Bearish?

Description: Although Healthpeak Properties has underperformed relative to the broader market over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-11-04

3 High-Yield Monthly Dividend Stocks That Pay You Like Clockwork

Description: Most dividend checks arrive only four times a year, which means investors who live off the income are forced to budget every three months. This isn’t very natural, and you can break that cadence by buying into high-yield monthly dividend stocks like Healthpeak Properties (NYSE:DOC), Main Street Capital (NYSE:MAIN), and Stag Industrial (NYSE:STAG). They come ... 3 High-Yield Monthly Dividend Stocks That Pay You Like Clockwork

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

Ventas Q3 FFO and Revenues Beat Estimates, Same-Store Cash NOI Rises

Description: VTR posts strong Q3 results with higher FFO and revenues, fueled by gains in senior housing and outpatient medical portfolios.

Equinix Q3 AFFO Beats Estimates, Recurring Revenues Rise Y/Y

Description: EQIX's Q3 results reflect higher recurring revenues and adjusted EBITDA, driven by strong demand for digital infrastructure and services.

2025-10-29

2025-10-28

Welltower's Q3 FFO & Revenues Beat Estimates, Same Store NOI Rises

Description: WELL's Q3 FFO outshines estimates, driven by a rise in revenues. Same Store NOI improves year over year.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Healthpeak Properties (DOC): Profitability Forecasts and Value Narrative Shape Investor Expectations

Description: Healthpeak Properties (DOC) remains unprofitable but has steadily narrowed its losses over the past five years, reducing them by 6.3% per year. Looking ahead, earnings are forecast to surge by 42.86% annually with a path to profitability projected within the next three years. Revenue is expected to grow at 4% per year, trailing the broader US market rate. Investors are weighing these improving profit trends and a favorable Price-to-Sales ratio, suggesting potential value even as financial and...

Healthpeak Properties Inc (DOC) Q3 2025 Earnings Call Highlights: Strong Financial Performance ...

Description: Healthpeak Properties Inc (DOC) reports robust earnings and strategic advancements, while navigating occupancy and regulatory hurdles.

Healthpeak Q3 FFO Beats Estimates, Same-Store NOI Rises Y/Y

Description: DOC's third-quarter results reflect the continued strong performance of its high-quality outpatient medical and CCRC portfolios.

2025-10-23

Healthpeak (DOC) Reports Q3 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for Healthpeak (DOC) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Healthpeak (DOC) Beats Q3 FFO and Revenue Estimates

Description: Healthpeak (DOC) delivered FFO and revenue surprises of +2.22% and +1.42%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Healthpeak: Q3 Earnings Snapshot

Description: The results topped Wall Street expectations. The Denver-based real estate investment trust said it had funds from operations of $323.3 million, or 46 cents per share, in the period. The average estimate of five analysts surveyed by Zacks Investment Research was for funds from operations of 45 cents per share.

Healthpeak Properties Provides Strategic Initiatives Update and Reports Third Quarter 2025 Results

Description: DENVER, October 23, 2025--Healthpeak Properties, Inc. (NYSE: DOC), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, today provided a strategic initiatives update and announced results for the quarter ended September 30, 2025.

Has Healthpeak’s Recent Portfolio Realignment Changed the Outlook for Shares in 2025?

Description: Thinking about what to do with your Healthpeak Properties shares, or considering a first buy? You are not alone. Many investors are looking beyond short-term headlines, wanting to know what really drives this real estate investment trust’s value. Healthpeak’s recent stock movements offer an interesting story. Over the last week and month, the share price edged up 0.6%, which might seem modest, but that small uptick comes despite a challenging year; shares are still down -7.6% in 2024 and have...

2025-10-22

2025-10-21

What's in the Cards for Healthpeak Properties This Earnings Season?

Description: DOC's Q3 earnings are likely to be hurt by lower revenues and higher interest expenses amid an aging population.

Wall Street's Insights Into Key Metrics Ahead of Healthpeak (DOC) Q3 Earnings

Description: Beyond analysts' top-and-bottom-line estimates for Healthpeak (DOC), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.