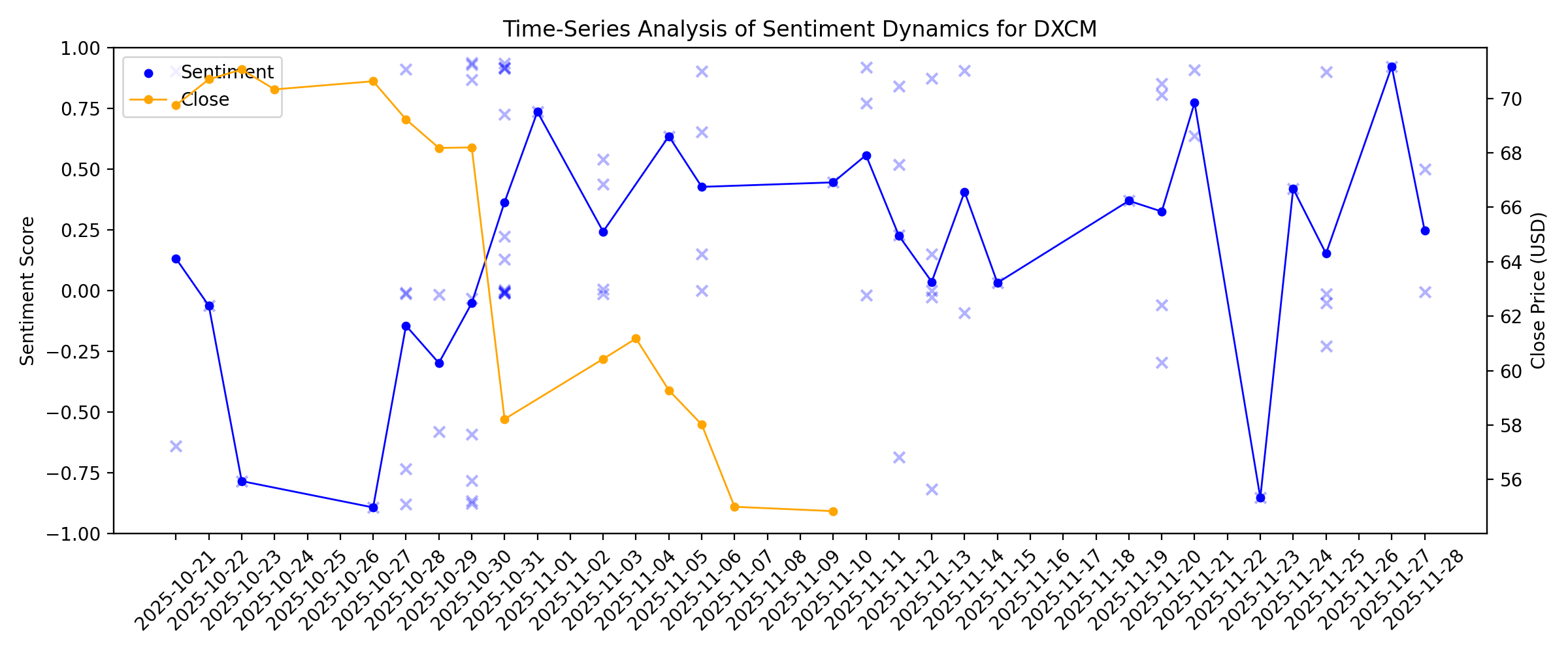

News sentiment analysis for DXCM

Sentiment chart

2026-01-14

DexCom (DXCM) Releases Preliminary, Unaudited Results for Q4 2025

Description: DexCom, Inc. (NASDAQ:DXCM) is one of the Best Fundamental Stocks to Buy According to Analysts. On January 12, the company released its preliminary, unaudited results for Q4 2025, with total revenue coming at ~$1.260 billion, reflecting an increase of 13% YoY. Notably, the US revenue is projected to be ~$892 million, demonstrating 11% growth compared to […]

2026-01-13

How Investors May Respond To DexCom (DXCM) Strong 2025 Revenue Beat And 2026 Growth Outlook

Description: DexCom recently reported preliminary, unaudited results showing fourth-quarter 2025 revenue of about US$1.26 billion and full-year 2025 revenue of roughly US$4.66 billion, both rising at double-digit rates from 2024 while reiterating its margin guidance. The company also issued 2026 revenue guidance of US$5.16 billion to US$5.25 billion, tying expected growth to higher sensor volumes, the Stelo rollout, and further international expansion, even as some analysts highlight intensifying...

Is DexCom (DXCM) Pricing Justified After Recent Multi Year Share Price Weakness

Description: Wondering whether DexCom's current share price lines up with its underlying worth, or if the market is missing something important about this glucose monitoring specialist? DexCom shares last closed at US$70.25, with returns of 0.5% over 7 days, 4.9% over 30 days, 5.6% year to date, but an 11.3% decline over 1 year, a 35.9% decline over 3 years and a 21.4% decline over 5 years, which can change how investors think about both risk and opportunity. Recent coverage of DexCom has focused on its...

JPM26: Dexcom’s new CEO eyes international CGM markets for 2026 growth

Description: Dexcom achieved FY25 revenues of around $4.66bn, corresponding to a 16% uplift over FY24.

2026-01-12

US Equity Markets Up Amid Rise in Precious Metals

Description: Major US equity indexes closed higher Monday, with the S&P 500 hitting a new all-time high, while pr

Why This Medical Device Company Is the Top Stock in the S&P 500 Today

Description: DexCom stock rose sharply Monday after the maker of glucose monitors reported better-than-expected preliminary results for the fourth quarter. DexCom posted total revenue of around $1.26 billion for the quarter, up 13% from a year prior and above analysts’ consensus estimate of $1.24 billion. The company also reiterated its guidance for 2025 adjusted gross profit margin of 61%.

Dexcom Reports Preliminary, Unaudited Results for the Fourth Quarter and Fiscal Year 2025 and Initial 2026 Outlook

Description: SAN DIEGO, January 12, 2026--Dexcom Reports Preliminary, Unaudited Results for the Fourth Quarter and Fiscal Year 2025 and Initial 2026 Outlook

2026-01-11

2026-01-10

2026-01-09

2026-01-08

DexCom (DXCM) Stock Trades Down, Here Is Why

Description: Shares of medical device company DexCom (NASDAQ:DXCM) fell 2.6% in the morning session after analysts at Piper Sandler and Bernstein lowered their price targets on the stock, citing concerns over the company's growth prospects and valuation.

2026-01-07

Dexcom Enters Next Era of Continued Innovation With Jake Leach as President and Chief Executive Officer

Description: SAN DIEGO, January 07, 2026--DexCom, Inc. (Nasdaq:DXCM), the global leader in glucose biosensing, is ushering in the next era of transformative, customer-driven innovation under the leadership of President and CEO Jake Leach, who assumed his expanded responsibilities on Jan. 1.

2026-01-06

2026-01-05

Assessing DexCom (DXCM) Valuation As Shares Lag Over The Past Year

Description: DexCom overview and recent share performance DexCom (DXCM) has drawn fresh attention as investors reassess its continuous glucose monitoring business and recent share performance, with the stock last closing at $66.54 after mixed short term and longer term returns. See our latest analysis for DexCom. At a share price of $66.54, DexCom’s 1 month share price return of 1.60% contrasts with a 1 year total shareholder return decline of 16.70%. This suggests momentum has been fading even as...

2026-01-04

DexCom, Inc.'s (NASDAQ:DXCM) Stock Been Rising: Are Strong Financials Guiding The Market?

Description: DexCom's (NASDAQ:DXCM) stock is up by 1.6% over the past month. Since the market usually pay for a company’s long-term...

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2 Growth Stocks to Buy For 2026 and Beyond

Description: Neither had a great year in 2025, but the future is looking bright.

3 Stocks Likely to Gain From Rising HSA Contribution & Medicare Premium

Description: Rising HSA limits and higher Medicare premiums in 2026 could lift demand for chronic care devices from DexCom, ResMed and Masimo.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Description: As the United States market kicks off a holiday-shortened week, major stock indexes like the S&P 500, Nasdaq, and Dow Jones Industrial Average have shown gains, buoyed by advances in tech shares and record highs in gold and silver. Amidst this positive momentum, investors are keenly focused on identifying stocks that may be trading below their intrinsic value, presenting potential opportunities for those looking to capitalize on undervalued assets.

Morgan Stanley Upgrades DexCom (DXCM), Cites Undervalued Recovery and G7 Margin Potential

Description: DexCom Inc. (NASDAQ:DXCM) is one of the best growth stocks to buy in 2026. On December 2, Morgan Stanley upgraded DexCom to Overweight from Equal Weight with a price target of $75, which was up from $63. The firm noted that the company is overcoming recent operational hurdles while its stock remains at historical lows. […]

Undervalued Equities That May Offer Value In December 2025

Description: As the U.S. stock market experiences a resurgence with major indexes posting gains, driven by a rally in tech stocks, investors are increasingly looking for opportunities that may be undervalued. In this environment of renewed risk appetite and shifting sector performances, identifying stocks that offer strong fundamentals at attractive valuations becomes crucial for those seeking potential value in their portfolios.

Medtronic’s diabetes spinoff MiniMed files for IPO

Description: MiniMed is pitching the breadth of its portfolio as an advantage over more focused rivals such as Dexcom and Insulet.

2025-12-21

2025-12-20

2025-12-19

3 Stocks Estimated To Be Undervalued By Up To 48.3%

Description: As the U.S. stock market experiences a resurgence, with major indices like the Nasdaq and S&P 500 seeing notable gains driven by tech shares, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential growth while maintaining a balanced portfolio amidst shifting market dynamics.

Why Jabil (JBL) Stock Is Trading Up Today

Description: Shares of electronics manufacturing services provider Jabil (NYSE:JBL) jumped 3.5% in the morning session after an analyst reiterated a Strong Buy rating on the stock, coupled with the company's forecast for strong annual results. Investment firm Raymond James reaffirmed its positive stance and directly addressed market rumors, stating that claims of Jabil losing business with client Dexcom were "categorically NOT happening." This statement appeared to boost investor confidence.

3 Stocks Estimated To Trade At Discounts Of Up To 49.7%

Description: As the U.S. stock market experiences a notable downturn, with major indexes like the S&P 500 and Dow Jones Industrial Average posting consecutive losses amid tech sector retreats and AI bubble concerns, investors are increasingly on the lookout for opportunities in undervalued stocks. In such turbulent times, identifying stocks that are trading at significant discounts can offer potential value, especially when broader market conditions have led to price corrections across various sectors.

2025-12-18

Investors in DexCom (NASDAQ:DXCM) have unfortunately lost 43% over the last three years

Description: DexCom, Inc. ( NASDAQ:DXCM ) shareholders should be happy to see the share price up 12% in the last month. But that...

December 2025's Stock Selections Estimated To Be Priced Below Fair Value

Description: As the U.S. stock market rebounds with major indices like the Dow Jones and S&P 500 poised to break their recent losing streaks, investors are closely monitoring inflation trends that have come in lower than expected. In this environment of fluctuating economic indicators, identifying stocks that may be undervalued can offer potential opportunities for those looking to capitalize on discrepancies between current prices and perceived fair value.

DexCom (DXCM) Fell Due to Modest Guidance

Description: Brown Advisory, an investment management company, released its “Brown Advisory Mid-Cap Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy underperformed its benchmark, the Russell Midcap® Growth Index, in the third quarter of 2025, which increased approximately 3%. In addition, please check the fund’s top five holdings […]

3 Stocks Estimated To Be Up To 36.7% Below Intrinsic Value Offering Potential Opportunities

Description: In recent market developments, the S&P 500 and Dow Jones Industrial Average have experienced declines following a surprising rise in unemployment, while the Nasdaq managed to tick higher, breaking its losing streak. Amid these mixed signals from major indices and economic indicators, investors may find opportunities in stocks that are perceived to be undervalued relative to their intrinsic value. Identifying such stocks requires careful analysis of financial health and growth potential within...

2025-12-17

December 2025's Top Stocks Estimated Below Intrinsic Value

Description: As December 2025 unfolds, the U.S. stock market faces a challenging period with major indices like the S&P 500 and Dow Jones Industrial Average experiencing consecutive declines amid AI bubble concerns and rising unemployment rates. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value relative to their intrinsic worth.

Here's Why You Should Hold DexCom Stock in Your Portfolio for Now

Description: DXCM's strong Q3 growth, expanding CGM coverage and innovation-driven momentum position it for sustained adoption despite rising competition.

3 Stocks Estimated To Be Trading At Discounts Of 23.8% To 35.3%

Description: As the United States stock market grapples with concerns over an AI bubble and fluctuating major indexes, investors are keenly observing economic indicators like the upcoming jobs report to gauge future market directions. In this environment of uncertainty, identifying stocks that are potentially undervalued can offer opportunities for those looking to capitalize on price discrepancies; such stocks may be trading at significant discounts relative to their intrinsic value, providing a...

Blood Glucose Monitor Market Set to Reach USD 25.4 Billion by 2030 with a CAGR of 9.1%

Description: The global blood glucose monitor market is set to expand from USD 16.5 billion in 2025 to USD 25.4 billion by 2030, growing at a CAGR of 9.1%. This growth is fueled by the increasing prevalence of diabetes, a rising geriatric population, and enhanced self-monitoring awareness. Technological advancements in continuous glucose monitoring (CGM), smartphone integration, and AI data analytics have boosted accuracy and patient engagement. The self-monitoring blood glucose systems segment leads in mark

2025-12-16

Discover December 2025's Top Stocks Estimated Below Intrinsic Value

Description: As the U.S. stock market experiences a retreat following delayed jobs data and higher-than-expected unemployment rates, investors are closely monitoring economic indicators and Federal Reserve decisions for future guidance. In such an environment, identifying stocks trading below their intrinsic value can present opportunities for those looking to invest wisely amid market fluctuations.

3 Stocks Estimated To Be Trading At Discounts Of Up To 21.1%

Description: As concerns about an AI bubble continue to weigh on technology stocks, major U.S. indexes have recently closed lower, reflecting investor caution amid looming economic indicators such as the upcoming jobs report. In this climate of uncertainty, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential market inefficiencies and secure positions in companies trading at discounts.

2025-12-15

2025-12-14

2025-12-13

Jim Cramer on DexCom: “It’s Too Rich a Stock”

Description: DexCom, Inc. (NASDAQ:DXCM) is one of the stocks on Jim Cramer’s radar recently. A caller asked if they should buy, sell, or hold the stock during the lightning round. In response, Cramer said: “You know, it’s too rich a stock, and I do think the GLP-1s are going to have such a dramatic effect on […]

2025-12-12

2025-12-11

2025-12-10

DLocal And 2 Other Stocks That May Be Priced Below Intrinsic Value

Description: As the United States market remains mixed ahead of a highly anticipated Federal Reserve decision on interest rates, investors are keenly observing how these shifts might impact stock valuations. In this environment, identifying stocks that may be priced below their intrinsic value can offer opportunities for those looking to capitalize on potential market inefficiencies.

3 Prominent Stocks Estimated To Be Trading At Up To 38.4% Below Intrinsic Value

Description: As U.S. investors keenly await the Federal Reserve's decision on interest rates, major indices like the S&P 500 have recently pulled back after nearing record highs, reflecting a cautious market sentiment. In such an environment, identifying stocks trading below their intrinsic value can present opportunities for those looking to capitalize on potential undervaluation amidst broader economic uncertainties.

2025-12-09

3 Stocks Estimated To Be Undervalued In December 2025

Description: As the Federal Reserve meeting unfolds and major indices like the Dow Jones, S&P 500, and Nasdaq show modest gains, investors are keenly observing how potential interest rate cuts might influence market dynamics. In this environment of cautious optimism and strategic shifts, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

3 Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 46.3%

Description: As the U.S. stock market navigates a period of uncertainty with investors closely watching the Federal Reserve's upcoming decision on interest rates, major indices like the S&P 500 have recently pulled back after nearing record highs. In this environment, identifying stocks trading below their intrinsic value can be particularly appealing to investors seeking potential opportunities amidst broader market fluctuations.

2025-12-08

Discover 3 Stocks Priced Below Estimated Value

Description: As the U.S. stock market navigates a period of volatility with major indices like the Dow Jones and S&P 500 experiencing fluctuations ahead of a critical Federal Reserve decision on interest rates, investors are keenly watching for opportunities amidst these shifts. In this environment, identifying stocks that are priced below their estimated value can offer potential advantages, as they may present opportunities for growth when market conditions stabilize or improve.

Freshworks And Two More Stocks Estimated To Be Trading Below Fair Value

Description: As U.S. stocks rise on hopes of a Federal Reserve rate cut, the market's attention is keenly focused on inflation data and major corporate deals like Netflix's acquisition of Warner Bros. Discovery. In such an environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities, as these stocks may offer significant value relative to their current market prices amidst shifting economic conditions.

2025-12-07

2025-12-06

2025-12-05

Three Stocks Estimated To Be Trading Below Intrinsic Value In December 2025

Description: As the U.S. stock market experiences a modest uptick following key inflation data, major indices like the Dow Jones and S&P 500 are nearing all-time highs, reflecting investor optimism despite recent economic uncertainties. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets amid fluctuating market conditions.

Three Stocks That Could Be Undervalued By Market Estimates In December 2025

Description: As we enter December 2025, the U.S. stock market presents a mixed picture with major indices like the Dow and S&P 500 hovering near all-time highs while investors closely monitor upcoming inflation data that could influence Federal Reserve decisions on interest rates. In this environment, identifying undervalued stocks requires careful consideration of market dynamics and economic indicators, as these factors can reveal opportunities where current valuations may not fully reflect a company's...

2025-12-04

Three Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Description: As the Dow Jones and S&P 500 approach record highs, investors are closely watching market movements amidst expectations of a potential interest rate cut by the Federal Reserve. In this environment, identifying stocks that may be trading below their intrinsic value can offer opportunities for those seeking to capitalize on market inefficiencies.

Listening to Healthcare Professionals: Dexcom Launches New Education Offering, Dexcom Academy

Description: EDINBURGH, Scotland, December 04, 2025--DexCom, Inc. (NASDAQ:DXCM), a global leader in real-time continuous glucose monitoring (CGM) for people with diabetes, today announced the launch of Dexcom Academy, a new personalised learning platform created with healthcare professionals (HCPs) and for healthcare professionals. The platform is now available in Belgium, Germany, the Kingdom of Saudi Arabia, the Netherlands, and Spain with further EMEA country launches planned for 2026.

3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Description: As major U.S. stock indexes continue to rise, with the Dow Jones Industrial Average nearing a record high despite recent employment concerns, investors are actively seeking opportunities in an evolving market landscape. In this environment, identifying stocks that may be trading below their intrinsic value can offer potential for growth and stability amidst fluctuating economic indicators.

2025-12-03

3 Stocks Estimated To Be Trading At Up To 43.6% Below Intrinsic Value

Description: In recent sessions, major U.S. stock indexes have shown resilience, rising despite initial declines due to disappointing private payroll data and adjustments in tech sector sales strategies. As investors navigate these fluctuating conditions, identifying stocks trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Is DexCom Stock Underperforming the S&P 500?

Description: DexCom has considerably underperformed the S&P 500 over the past year, but analysts are highly optimistic about the stock’s prospects.

Lyft And 2 Other Stocks That May Be Trading Below Fair Value Estimates

Description: As of early December 2025, U.S. markets have shown resilience with major indexes closing higher amid a rebound in tech and crypto-related stocks. This environment presents opportunities for investors to explore stocks that may be trading below their fair value estimates, such as Lyft and others, by focusing on fundamental strengths and market positioning amidst the current economic landscape.

2025-12-02

Chagee Holdings And 2 Other Stocks That May Be Priced Below Estimated Value

Description: As the U.S. stock market experiences slight gains following a pause in its recent upward streak, investors are closely watching the tech and crypto sectors for signs of recovery amid fluctuating sentiment. In this environment, identifying undervalued stocks can be particularly appealing for those looking to capitalize on potential market inefficiencies, with Chagee Holdings and two other companies potentially offering such opportunities.

DexCom Stock Upgraded. How the Glucose Monitor Maker Is ‘Turning a Corner.’

Description: DexCom has had a rough ride this year. The medical technology company is grappling with concerns about its slowing growth and allegations of faulty blood glucose monitors. Morgan Stanley analyst Patrick Wood upgraded the stock to Overweight from Equal Weight on Tuesday, citing a favorable risk/reward balance moving out of a challenging year for the maker of continuous glucose monitors.

Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

Description: Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Description: As December 2025 begins, the U.S. stock market faces a pullback with major indices like the Dow Jones, S&P 500, and Nasdaq closing lower amid a risk-off sentiment affecting big tech and crypto-tied shares. In such an environment, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on mispricings in the market.

2025-12-01

3 Prominent Stocks Estimated To Be Undervalued By At Least 40.2%

Description: As December begins, major U.S. stock indexes have slipped, with big tech and crypto-tied shares experiencing declines amid a risk-off sentiment in the market. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities that may arise from current market fluctuations.

Spotlight On Alnylam Pharmaceuticals And 2 Other Stocks Possibly Trading Below Fair Value

Description: As the U.S. stock market wraps up a strong week, with major indices like the S&P 500 and Dow Jones Industrial Average extending their winning streaks, investors are keenly observing opportunities amid fluctuating tech performances and economic shifts. Despite the Nasdaq's recent monthly dip, this environment presents a chance to explore stocks potentially trading below their fair value, such as Alnylam Pharmaceuticals, which may offer intriguing prospects for those seeking undervalued...

2025-11-30

2025-11-29

2025-11-28

Does DexCom’s Recent 5% Jump Signal a Real Value Opportunity for 2025?

Description: Wondering if DexCom stock is a hidden bargain or just riding a wave? You are not alone, and today's market swings only add to the intrigue. DexCom shares have jumped 5.4% over the past week even after dropping 6.9% in the last month, and are down 19.1% year-to-date. Recently, the stock has moved in response to industry-wide buzz around new diabetes technology and updates from competitors that are reshaping investor sentiment. Headlines have highlighted both innovation and competitive...

How Investors May Respond To DexCom (DXCM) Balancing Innovative Diabetes Tech Launches With Legal and Regulatory Challenges

Description: DexCom recently announced the upcoming U.S. launch of its G7 15 Day Continuous Glucose Monitoring system and received FDA clearance for its Smart Basal insulin dosing optimizer, both targeting improved accuracy and convenience for diabetes management in adults. These product advancements arrive as DexCom faces multiple class action lawsuits and regulatory scrutiny related to alleged unauthorized design changes in its G6 and G7 devices, raising questions about reliability and company...

2025-11-27

Here’s Why Dexcom (DXCM) Traded Down in Q3

Description: Sands Capital, an investment management company, released its “Sands Capital Select Growth Strategy” Q3 2025 investor letter. A copy of the letter can be downloaded here. U.S. large-cap growth equities continued to recover from a sharp sell-off in early April. Strong corporate earnings, investor enthusiasm around artificial intelligence (AI), and growing expectations for Federal Reserve […]

2025-11-26

2025-11-25

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, ServiceNow and More

Description: Pre-Market Stock Futures: The futures are lower on Tuesday after traders kicked off the holiday-shortened trading week with a massive Monday rally, with all major indices finishing the day higher. A combination of an oversold market, a big bounce-back rally on Friday that saw follow-through on Monday, and some positive AI/Data Center/Hyperscaler commentary to help ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Applied Materials, CDW, Exact Sciences, Harley-Davidson, Oshkosh, Serv

GlucoGuard a Division of American Diversified Holdings (ADHC) Successfully Submits Level 2 App Integration Through Dexcom's Developer Partner Program

Description: Del Mar, California--(Newsfile Corp. - November 25, 2025) - American Diversified Holdings Corporation (OTCID: ADHC) announced today that GlucoGuard has completed the Level 2 App integration through DEXCOM's Developer Program. The project development is in conjunction with UC Irvine's MADO program through the California Institute for Telecommunications and Information Technology (CALIT2a).The Dexcom Developer Program is a partnership program that allows developers to access Dexcom API and...

Morgan Stanley, Truist Cautious on DexCom (DXCM) Cites Weaker Gross Margins, Modest Q3 Beat

Description: DexCom Inc. (NASDAQ:DXCM) is one of the best QQQ stocks to buy according to Wall Street analysts. On November 10, Morgan Stanley cut the price target on DexCom to $63 from $89, while maintaining an Overweight rating on the shares. Additionally, on November 3, Truist also lowered the firm’s price target on DexCom to $82 […]

Carillon Eagle Mid Cap Growth Fund’s Views on Dexcom (DXCM)

Description: Carillon Tower Advisers, an investment management company, released its “Carillon Eagle Mid Cap Growth Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the third quarter, the equity markets continued their rally, fueled by enthusiasm for AI, limited evidence of inflationary effects from tariffs, and expectations for further interest […]

2025-11-24

Elanco, AMN Healthcare Services, Brookdale, DexCom, and Addus HomeCare Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after reports revealed the Trump administration considered extending the Affordable Care Act (ACA) subsidies.

2025-11-23

2 Healthcare Stocks For Beginner Investors With a 30-Year Time Horizon

Description: If you're investing for the next 30 years, don't overlook these top stocks.

2025-11-22

2025-11-21

AbbVie, Biogen, BioMarin Pharmaceutical, DexCom, and Abbott Laboratories Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

Top 2 Healthcare Stocks Every New Investor Should Know

Description: These healthcare stocks have long-term and profitable growth runways.

2025-11-20

Dexcom (DXCM) Valuation: Assessing Upside After FDA Clearance of Smart Basal Diabetes Device

Description: DexCom (DXCM) just received FDA clearance for Smart Basal, a new device designed to help adults with Type 2 diabetes optimize their insulin dosing using personalized, real-time sensor data. This notable step forward signals a new phase for the company. See our latest analysis for DexCom. While the FDA clearance for Smart Basal is a milestone, DexCom’s recent stock performance has yet to reflect renewed optimism. The share price sits at $59.73 after a one-year total shareholder return of...

DXCM Stock Falls Despite FDA Clearance for Dexcom Smart Basal

Description: DexCom receives FDA clearance for DexCom Smart Basal titration software module, which optimizes basal insulin dose in type 2 diabetes patients by integrating with the G7 15 day sensor.

Dexcom G7 15 Day Continuous Glucose Monitoring System to Launch on Dec. 1 in the United States

Description: SAN DIEGO, November 20, 2025--DexCom, Inc. (NASDAQ:DXCM), the global leader in glucose biosensing, announced today the Dexcom G7 15 Day Continuous Glucose Monitoring (CGM) System for people over the age of 18 with diabetes will launch in the United States on Dec. 1. At initial launch, Dexcom G7 15 Day will be available for users who receive their Dexcom CGM through DME providers. G7 15 Day will also be covered for Medicare beneficiaries and has met the category requirements for therapeutic CGM s

Diabetes Care Devices Markets, 2023-2024 & 2025-2033 with Abbott, Dexcom, Medtronic, Roche, Ascensia, LifeScan, Novo Nordisk, Eli Lilly, and Sanofi Leading

Description: The diabetes care devices market is driven by rising diabetes cases and demand for advanced monitoring and insulin solutions. Opportunities lie in emerging markets where lifestyle shifts increase diabetes rates, along with innovations like AI analytics and connected devices accelerating personalized care.Dublin, Nov. 20, 2025 (GLOBE NEWSWIRE) -- The "Diabetes Care Devices Market Size, Market Share, Application Analysis, Regional Outlook, Growth Trends, Key Players, Competitive Strategies and For

2025-11-19

Dexcom Smart Basal Receives FDA Clearance Becoming the First and Only CGM-integrated Basal Insulin Dosing Optimizer for Type 2 Diabetes

Description: SAN DIEGO, November 19, 2025--DexCom, Inc. (NASDAQ: DXCM), the global leader in glucose biosensing, announced today the FDA has cleared Dexcom Smart Basal, the first and only CGM-integrated basal insulin dosing optimizer designed for adults with Type 2 diabetes on glargine U-100 long-acting insulin therapy.1 Dexcom Smart Basal will use Dexcom G7 15 Day sensor data and logged doses to calculate personalized daily recommendations to guide users towards a more effective long-acting insulin dose, as

2025-11-18

2025-11-17

2025-11-16

2025-11-15

How Recent Developments Are Reshaping the DexCom Investment Story

Description: DexCom's stock narrative has shifted as analysts lower their fair value estimate from $98.40 to $84.96, marking a significant downward revision in the price target. This adjustment is primarily driven by a modest increase in the discount rate and more cautious revenue growth projections. The revision reflects tempered optimism following the company's latest guidance and earnings results. Stay tuned to learn how you can stay informed on future updates and shifts in DexCom's valuation narrative...

2025-11-14

Aristotle Atlantic’s Core Equity Strategy Initiated a Position in Dexcom (DXCM) Backed by Its Robust Financial Stability

Description: Aristotle Atlantic Partners, LLC, an investment advisor, released its “Core Equity Strategy” third-quarter 2025 investor letter. The letter highlighted the market review, quarterly performance, and attribution analysis. A copy of the letter can be downloaded here. In the quarter, the US equity market rallied, with the S&P 500 Index reaching 8.12%. Bonds also finished higher in […]

Dexcom Reveals Global Diabetes Advocates: New Voices for Diabetes Awareness This World Diabetes Day

Description: SAN DIEGO, November 14, 2025--DexCom, Inc. (NASDAQ: DXCM), the global leader in glucose biosensing, today unveiled 16 new diabetes advocates to represent people living with diabetes globally as part of Dexcom’s World Diabetes Day campaign.

2025-11-13

Frank Sands Reduces Stake in DexCom Inc by 50.4%, Impacting Portfolio by -1.25%

Description: Insightful Analysis of Frank Sands (Trades, Portfolio)' Third Quarter 2025 13F Filing

The Wild Ride That Sent IBD Stock Of The Day Insulet Into An Early Breakout

Description: Insulet is Thursday's IBD Stock Of The Day. After a wild post-earnings reaction, Insulet stock is in a consolidation with an early entry.

Legal and Regulatory Scrutiny Over Device Changes Might Change the Case for Investing in DexCom (DXCM)

Description: Recently, multiple class action lawsuits were filed against DexCom, Inc. after reports surfaced alleging the company made unauthorized design changes to its G6 and G7 continuous glucose monitoring devices, resulting in potential reliability and safety issues and prompting regulatory scrutiny, including a warning letter from the FDA. This legal and regulatory attention grew after reports linked the device changes to health risks, hospitalizations, and deaths, prompting intensified market...

DexCom Stock: Is Wall Street Bullish or Bearish?

Description: Although DexCom stock has trailed the broader market over the past year, analysts remain bullish about its prospects.

Is It Time to Revisit DexCom After Latest Innovation Headlines?

Description: Ever wondered if DexCom is now a bargain or still priced for perfection? Let's get under the hood to see if the recent headlines match up with what the numbers are really saying. The stock has seen mixed momentum lately, climbing just 0.6% over the past week but still down 24.1% year-to-date and 17.8% in the past twelve months. This performance has put value-focused investors on alert. Recent news around DexCom's continued innovation in glucose monitoring technology has kept the company in...

2025-11-12

Whoop Is Considering Going Public in the Next Two Years, CEO Says

Description: Founder and Chief Executive Officer Will Ahmed said the business is well-positioned for an IPO now that it’s broadened its portfolio to include proprietary technology, hardware, software, analytics and other items, such as accessories and apparel. While Ahmed has previously said Whoop is likely to go public, he hadn’t shared when that might happen. “We like to build things ourselves and we really want to build this home of health for our members,” he added.

Big Insider Purchases by Carl Icahn, Mario Gabelli, and Others

Description: In the past week or so, renowned investors Carl Icahn and Mario Gabelli led some huge insider buying. These were not the only notable purchases though.

Carrot Partners with ŌURA and Dexcom to Deliver Deeper Insights and Experiences for Members on Fertility, Family-Building, and Hormonal Health Journeys

Description: Carrot today announced a partnership with ŌURA, the world's leading smart ring, and Dexcom, the global leader in glucose biosensing, to empower members with actionable, personalized insights that support fertility and family-building goals through the metabolic-fertility program, Sprints. This collaboration combines Carrot's clinical expertise with advanced insights from ŌURA and Stelo by Dexcom, the first FDA-cleared glucose biosensor available without a prescription in the United States, empow

DexCom Stock Just Fell to a 5-Year Low. Is It a No-Brainer Buy at This Price?

Description: DexCom's growth rate has been improving, but that hasn't been enough of a reason for investors to buy up the stock.

2025-11-11

Bio-Techne, Tandem Diabetes, Align Technology, DexCom, and Teleflex Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after the market experienced a sharp sector rotation, as investors fled growth-oriented technology stocks and piled into value-oriented names amid growing valuation concerns.

Here's Why You Should Hold DexCom Stock in Your Portfolio for Now

Description: DXCM's strong Q3 growth, expanding CGM coverage and innovation-driven momentum position it for sustained adoption despite rising competition.

1 Spectacular Growth Stock Down 20% to Buy Right Now, According to Wall Street

Description: Shares are near their lowest levels in five years.

2025-11-10

Patient Monitoring Devices Market to be Worth $118.21 Billion by 2033 at CAGR of 10.21% - Grand View Research, Inc.

Description: The global patient monitoring devices market size is expected to reach USD 118.21 billion by 2033, registering a CAGR of 10.21% from 2025 to 2033, according to a new report by Grand View Research, Inc. This expansion is fundamentally driven by the increasing need to measure and display vital biometric data. This demand stems from three primary factors: the growing geriatric population and rising prevalence of chronic conditions like cardiovascular disease and diabetes, which require continuous m

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Québec Expands Access to Dexcom CGM under the Régie de l'assurance maladie du Québec (RAMQ)

Description: MONTREAL, November 07, 2025--Dexcom, Inc. (NASDAQ: DXCM), a global leader in glucose biosensing, applauds the Québec government for its recent decision to expand coverage of Dexcom Continuous Glucose Monitoring (CGM) Systems under the Régie de l’assurance maladie du Québec (RAMQ) for eligible Québecers aged 18 and older living with type 2 diabetes who are treated with intensive insulin therapy (IIT)*.

DexCom (DXCM): Assessing Valuation After Surge in Lawsuits Over Device Safety and Reliability

Description: DexCom (DXCM) is under the spotlight after several class action lawsuits were filed claiming the company made unauthorized changes to its G6 and G7 glucose monitoring devices. These changes could potentially impact their reliability and safety. See our latest analysis for DexCom. DexCom’s recent tumble, including a 13% share price drop over the past week and a 24% year-to-date decline, follows mounting legal challenges and persistent questions about product reliability. Even with strong...

We Like DexCom's (NASDAQ:DXCM) Earnings For More Than Just Statutory Profit

Description: The stock was sluggish on the back of DexCom, Inc.'s ( NASDAQ:DXCM ) recent earnings report. We have done some...

The 5 Most Interesting Analyst Questions From DexCom’s Q3 Earnings Call

Description: DexCom's third quarter was met with a negative market reaction despite outpacing Wall Street’s revenue and adjusted EPS expectations. Management attributed quarterly growth to increased continuous glucose monitoring (CGM) adoption among people with type 2 diabetes, particularly following expanded insurance coverage and deeper reach into primary care. Interim CEO Jacob Leach emphasized the impact of new product features and improved access, but also acknowledged lingering manufacturing and sensor

2025-11-05

3 Nasdaq 100 Stocks Worth Investigating

Description: The Nasdaq 100 (^NDX) is where investors find some of the most innovative and disruptive companies shaping the future. A select few continue to execute at a high level, growing their market dominance and delivering strong returns.

2025-11-04

2025-11-03

Stock Market Today: Indexes End Mixed, But Palantir Pops; This Tech Stock Drops Amid AMD Lawsuit (Live Coverage)

Description: The Dow Jones index fell but Amazon surged on deal with OpenAI. Kimberly-Clark plunged on the stock market today. Palantir popped.

DexCom (DXCM) Stock Is Up, What You Need To Know

Description: Shares of medical device company DexCom (NASDAQ:DXCM) jumped 3.7% in the afternoon session after it rebounded from a steep sell-off that was triggered by its long-term revenue growth outlook. The stock had previously plunged more than 14% after the company's interim CEO stated during its third-quarter earnings call that revenue growth for 2026 could fall short of analyst expectations. This cautious forecast overshadowed an otherwise strong report, in which the company beat third-quarter earnings

3 Stocks Including FinWise Bancorp Estimated To Be Priced Below Intrinsic Value

Description: As the United States stock market experiences a period of gains with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly increases, investors are keenly observing opportunities that may be priced below their intrinsic value. In such an environment, identifying stocks that appear undervalued can be crucial for those looking to capitalize on potential market inefficiencies and enhance portfolio performance.

November 2025's Stocks That May Be Trading Below Estimated Value

Description: As of the end of October 2025, U.S. stock markets have shown resilience, with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid gains for both the week and month. In this environment of growth and recovery, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on potential market inefficiencies.

2025-11-02

2025-11-01

DexCom (DXCM): Net Margin Slides to 13.3%, Testing Bulls’ Profitability Narratives

Description: DexCom (DXCM) is forecasting robust earnings growth of 19.2% per year and revenue growth of 11.8% per year. Both figures outpace the broader US market’s revenue growth forecast of 10.4%. Over the past five years, earnings have grown at an annual rate of 10.9%, but the most recent net profit margin declined to 13.3% from 16.9% a year earlier. With no major risks flagged and solid projections for both profits and revenues, the stage is set for positive investor sentiment around DexCom’s latest...

2025-10-31

Closing Bell Movers: Amazon soars to all-time highs on earnings

Description: In the opening hour of the evening session, U.S. equity futures are notably higher, with S&P 500 up 0.5% and Nasdaq 100 contracts up 1.0%. In commodities, WTI Crude Oil is little changed just above $60 per barrel while precious metals are stronger for the 3rd day in a row – Gold is above $4,040 and Silver is approaching $49 per ounce. A strong slate of quarterly Tech results are helping stock futures restore positive sentiment in the segment that was wounded on Thursday by more dubious results o

S&P 500 Gains and Losses Today: Amazon Stock Surges as Cloud Business Boosts Earnings; DexCom Drops

Description: The world's largest online retailer got a lift from its booming cloud computing business on Friday, Oct. 31, 2025, while a soft sales outlook weighed on a medical device firm's stock.

Why Tandem Diabetes (TNDM) Shares Are Getting Obliterated Today

Description: Shares of diabetes technology company Tandem Diabetes Care (NASDAQ:TNDM) fell 6% in the afternoon session after investor concerns were sparked by a disappointing financial outlook from peer DexCom. DexCom, a major company in the glucose monitoring market, reported its third-quarter financial results. Although the company's earnings and revenue surpassed targets, its stock fell sharply by around 11% to 12%. The drop was triggered after company executives provided a growth forecast for 2026 that m

US Equity Markets Close Higher as Amazon Surges on Strong Q3 Results

Description: US equity indexes closed higher on Friday, bolstered by a surge in Amazon.com's (AMZN) shares follow

These Stocks Moved the Most Today: Amazon, Nvidia, Apple, Netflix, Exxon, DexCom, Coinbase, Reddit, Newell Brands, and More

Description: iPhone maker Apple and cloud-computing and online retailing giant Amazon post better-than-expected earnings.

Dexcom Stock, Down 15%, Is Haunted By Its 'Surprisingly Cautious' Outlook

Description: Dexcom's solid third-quarter report was overshadowed Friday by its "surprisingly cautious" outlook, and Dexcom stock tumbled.

DexCom Stock Falls Despite Q3 Earnings Beat, 2025 Revenue View Raised

Description: DXCM posts double-digit Q3 growth and raises 2025 revenue outlook, but shares tumble despite strong CGM momentum and innovation updates.

Why DexCom (DXCM) Stock Is Falling Today

Description: Shares of medical device company DexCom (NASDAQ:DXCM) fell 14.8% in the afternoon session after the company reported underwhelming earnings.

DexCom Shares Fall After Price Target Cuts Following Q3 Results

Description: DexCom (DXCM) shares fell nearly 15% in recent Friday trading after multiple brokerages trimmed thei

Why DexCom Stock Is Crashing Today

Description: The diabetes equipment provider had a strong quarter, but next year is looking weaker than expected.

DexCom Stock Is the Worst Performer in the S&P 500. Here’s Why.

Description: DexCom may be a major player in the market for continuous glucose monitors, but that doesn’t means it’s shielded from concerns over slower-than-expected growth. Interim CEO Jake Leach indicated on DexCom’s third-quarter earnings call Thursday that 2026 revenue growth could miss analysts’ forecasts. While growth is expected to be “certainly in that double-digit range,” Leach said, “the top end of our range is probably slightly below where the Street is today for our base case.”

DXCM Q3 Deep Dive: Margin Pressures Offset Strong Diabetes Access and Product Expansion

Description: Medical device company DexCom (NASDAQ:DXCM) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 21.6% year on year to $1.21 billion. The company expects the full year’s revenue to be around $4.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.61 per share was 7.5% above analysts’ consensus estimates.

Dexcom execs say company has fixed G7 quality problems

Description: After dealing with a deployment issue with glucose monitors earlier this year, interim CEO Jake Leach said improving customer service has also been a focus for the company.

2025-10-30

DexCom Inc (DXCM) Q3 2025 Earnings Call Highlights: Record Revenue Growth and Strategic Innovations

Description: DexCom Inc (DXCM) reports a robust 22% increase in worldwide revenue, driven by expanded CGM access and strategic market advancements.

DexCom (DXCM) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for DexCom (DXCM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

DexCom (DXCM) Surpasses Q3 Earnings and Revenue Estimates

Description: DexCom (DXCM) delivered earnings and revenue surprises of +7.02% and +2.72%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

DexCom (NASDAQ:DXCM) Beats Q3 Sales Expectations But Stock Drops

Description: Medical device company DexCom (NASDAQ:DXCM) announced better-than-expected revenue in Q3 CY2025, with sales up 21.6% year on year to $1.21 billion. The company expects the full year’s revenue to be around $4.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.61 per share was 7.5% above analysts’ consensus estimates.

DexCom: Q3 Earnings Snapshot

Description: The San Diego-based company said it had net income of 70 cents per share. Earnings, adjusted for non-recurring gains, were 61 cents per share. The results surpassed Wall Street expectations.

Dexcom Reports Third Quarter 2025 Financial Results and Updates Full Year 2025 Guidance

Description: SAN DIEGO, October 30, 2025--Dexcom Reports Third Quarter 2025 Financial Results and Updates Full Year 2025 Guidance

Truist Lowers DexCom (DXCM) PT to $94 Ahead of Q3 MedTech Sector Preview, Maintains Buy Rating

Description: DexCom Inc. (NASDAQ:DXCM) is one of the best NASDAQ growth stocks to buy for the next 5 years. On October 15, Truist analyst Richard Newitter lowered the firm’s price target on DexCom to $94 from $102 with a Buy rating on the shares as part of the firm’s broader research note previewing Q3 2025 results […]

Should You Buy DexCom Stock Before Oct. 31?

Description: The company hasn't had a great year. Is it about to turn things around?

2025-10-29

Is DexCom Trading Below Fair Value After a 41.8% Three Year Drop?

Description: Thinking about buying or holding DexCom stock? You’re not alone. Whether you’re a long-term investor or just looking for a timely healthcare pick, DexCom probably caught your attention for its role in continuous glucose monitoring, but its recent price moves might have you wondering if now is the best time to act. Shares closed at $69.23 recently, and the ride has been anything but smooth. In the past seven days, the stock slipped by 0.7%, recovering 3.2% over the last month. Yet DexCom still...

Insights Into DexCom (DXCM) Q3: Wall Street Projections for Key Metrics

Description: Beyond analysts' top-and-bottom-line estimates for DexCom (DXCM), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.

2025-10-28

DexCom (DXCM) Reports Earnings Tomorrow: What To Expect

Description: Medical device company DexCom (NASDAQ:DXCM) will be reporting results this Thursday after market close. Here’s what you need to know.

Sector Update: Health Care Stocks Retreat Tuesday Afternoon

Description: Health care stocks declined Tuesday afternoon, with the NYSE Health Care Index shedding 0.5% and the

DexCom Shares Fall After Hunterbrook Report on Incidents Related to G7 Glucose Monitor

Description: DexCom (DXCM) shares were down over 2% in recent Tuesday trading after Hunterbrook issued a report a

Can Dexcom Deliver Strong Q3 Earnings on Stelo Gains and G7 Adoption?

Description: DXCM's Q3 results are likely to benefit from rising G7 use, early Stelo traction and expanding access across Type 2 diabetes markets.

ViCentra Strengthens Leadership Team to Accelerate Growth

Description: ViCentra, a European medical device company redefining insulin delivery for people with diabetes with the Kaleido insulin patch pump system, today announced two strategic senior leadership appointments following the company's recent $85 million Series D financing. Karen Baxter, former Vice President & General Manager at Dexcom, joins as Senior Vice President of Sales, Europe, and Jay Little, a long-time commercialization and market access executive at Medtronic Diabetes, takes on the newly creat

2025-10-27

Dexcom Appoints Euan Ashley to Board of Directors

Description: SAN DIEGO, October 27, 2025--Dexcom Appoints Euan Ashley to Board of Directors

2025-10-26

2025-10-25

2025-10-24

2025-10-23

DexCom (DXCM) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: DexCom (DXCM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-22

DexCom, Inc. (DXCM): A Bear Case Theory

Description: We came across a bearish thesis on DexCom, Inc. on Hunterbrook’s Substack. In this article, we will summarize the bulls’ thesis on DXCM. DexCom, Inc.’s share was trading at $65.41 as of October 15th. DXCM’s trailing and forward P/E were 46.79 and 25.64 respectively according to Yahoo Finance. Hunterbrook Media’s investigation reveals severe safety, operational, and financial concerns at […]

2025-10-21

DexCom Inc. (DXCM): 2025 Product Pipeline and Strategy Analysis Report

Description: Dublin, Oct. 21, 2025 (GLOBE NEWSWIRE) -- The "DexCom Inc (DXCM) - Product Pipeline Analysis, 2025 Update" has been added to ResearchAndMarkets.com's offering. This analytical report serves as a pivotal resource for detailed insights into Dexcom's expansive pipeline, fostering robust data-driven decision-making and strategic competitive positioning. It offers comprehensive intelligence on Dexcom's portfolio, pivotal products, and emerging brands. Report Scope: Comprehensive company profile analy

Stifel resumes coverage on medtech names, sees long-term diabetes devices growth

Description: Investing.com -- Stifel has resumed coverage of several medtech companies, citing steady adoption of continuous glucose monitors (CGMs) and insulin pumps as key drivers for growth.