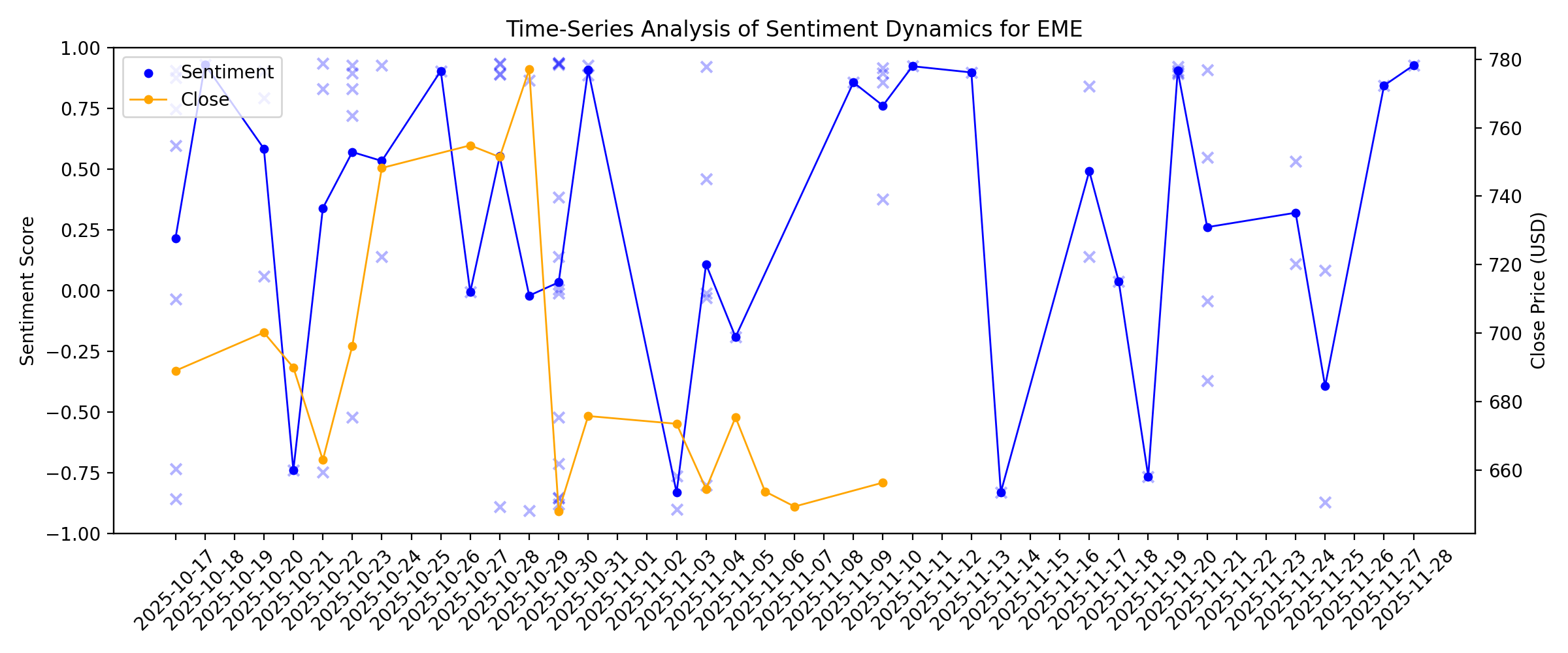

News sentiment analysis for EME

Sentiment chart

2026-01-14

Is Sterling's Project Selection Enough to Drive Superior Returns?

Description: STRL's shift to high-value, mission-critical projects is lifting margins, cash flow and returns. Can disciplined bidding sustain outperformance?

Is Emcor Group (EME) a Buy as Wall Street Analysts Look Optimistic?

Description: The average brokerage recommendation (ABR) for Emcor Group (EME) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2026-01-13

EMCOR's Record Backlog: A Growth Catalyst or Execution Challenge?

Description: Can EME's record backlog translate into sustained margin-led growth, or will execution risks test its ability to deliver in 2026 and beyond?

2026-01-12

Emcor Group (EME) Beats Stock Market Upswing: What Investors Need to Know

Description: Emcor Group (EME) reached $660.65 at the closing of the latest trading day, reflecting a +2.23% change compared to its last close.

Investors Heavily Search EMCOR Group, Inc. (EME): Here is What You Need to Know

Description: Zacks.com users have recently been watching Emcor Group (EME) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Will Dycom's Pricing Discipline Drive Stronger Margins in FY27?

Description: Can DY's pricing discipline and strong backlog sustain margin expansion as BEAD funding and fiber demand accelerate?

2026-01-11

Is EMCOR Group (EME) Still Attractively Priced After A 6x Five Year Share Price Surge

Description: If you are wondering whether EMCOR Group's current share price lines up with its underlying worth, you are not alone. This article is designed to help you think that through clearly. EMCOR's stock last closed at US$646.27, with returns of 1.2% over the past week, 3.6% over the past month, 1.2% year to date, 38.6% over the past year, and a very large return over the past 5 years that is close to 6x. These moves have kept EMCOR on many investors' radars, especially as the company continues to...

2026-01-10

2026-01-09

Is Sterling's E-Infrastructure Segment the Real Growth Star?

Description: STRL's E-Infrastructure segment drives outsized growth as data center demand lifts revenue, backlog and visibility.

2026-01-08

EMCOR Stock Trading at a Premium: Should You Buy, Hold or Fold?

Description: Is EME's premium valuation justified by strong construction demand, record backlog and disciplined execution, or do risks outweigh the upside?

Quanta Stock Trading at a Premium: Should You Buy, Hold or Fold?

Description: Is PWR worth its premium valuation as record backlog, power demand and execution discipline drive long-term growth?

Does EMCOR Group’s Higher Dividend Signal Durable Cash Generation or Fewer Reinvestment Opportunities for EME?

Description: In early January 2026, EMCOR Group’s board approved a regular quarterly cash dividend of US$0.40 per share, payable on January 30 to shareholders of record as of January 14, marking a sharp increase from the prior US$0.25 payout. This higher dividend, building on 15 years of uninterrupted payments and five consecutive years of increases, highlights EMCOR’s emphasis on returning cash to shareholders alongside its core specialty construction and services operations. We’ll now examine how this...

2026-01-07

A Look At EMCOR Group (EME) Valuation After Strong Multi Year Shareholder Returns

Description: Without a specific news event driving attention, EMCOR Group (EME) is drawing interest as investors consider how its recent share performance, profitability metrics, and business scale might align with their broader portfolio objectives. See our latest analysis for EMCOR Group. At a share price of $655.94, EMCOR Group has a 7 day share price return of 6.3% and a year to date share price return of 2.7%. Its 1 year total shareholder return of 39.8% and very large 5 year total shareholder return...

Dycom Trades at a Premium: Should Investors Buy the Stock or Wait?

Description: Is DY's premium valuation justified as fiber demand, BEAD funding and data center builds fuel sustained growth momentum?

2026-01-06

Comfort Systems Stock Trading at a Premium: Buy, Hold or Fold?

Description: Is FIX's premium valuation justified by AI-driven backlog growth, margin expansion and strong cash returns to shareholders?

Is EMCOR's Strong Cash Flow Fueling a Bigger M&A Pipeline?

Description: Is EME's growing cash flow setting the stage for a larger M&A push as AI-driven infrastructure demand accelerates?

2026-01-05

Emcor Group (EME) Outpaces Stock Market Gains: What You Should Know

Description: Emcor Group (EME) concluded the recent trading session at $653.57, signifying a +2.34% move from its prior day's close.

Is Comfort Systems Redefining Construction With Robots and AI?

Description: Is FIX redefining construction by using automation, analytics and AI-driven workflows to lift margins and productivity?

2026-01-04

2026-01-03

Investors in EMCOR Group (NYSE:EME) have seen incredible returns of 557% over the past five years

Description: We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can...

2026-01-02

Why EMCOR (EME) Stock Is Trading Up Today

Description: Shares of specialty construction contractor company EMCOR (NYSE:EME) jumped 3.8% in the afternoon session after its Board of Directors declared a significant increase in the company's regular quarterly cash dividend.

EMCOR Group, Inc. Declares Regular Quarterly Dividend

Description: NORWALK, Conn., January 02, 2026--EMCOR Group, Inc. (NYSE: EME) today announced that its Board of Directors has declared a regular quarterly cash dividend of $0.40 per common share. The dividend will be paid on January 30, 2026 to stockholders of record as of January 14, 2026.

2026-01-01

2025-12-31

Can EMCOR's Disciplined Acquisition Strategy Extend Growth Into 2026?

Description: EME's disciplined acquisition strategy emphasizes targeted deals that expand capabilities and markets, positioning it to extend growth into 2026.

2025-12-30

Here is What to Know Beyond Why EMCOR Group, Inc. (EME) is a Trending Stock

Description: Recently, Zacks.com users have been paying close attention to Emcor Group (EME). This makes it worthwhile to examine what the stock has in store.

AI Trade’s Next Leg Is All About Tech’s ‘Pick-and-Shovel’ Stocks

Description: Data storage companies dominated the S&P 500 Index in 2025, with Sandisk Corp. shares soaring almost 580% to make them the benchmark’s best performer, with Western Digital Corp. in second and Seagate Technology Holdings Plc in fourth. Meanwhile, AI-linked power providers and cable and fiber producers such as Amphenol Corp., Corning Inc., NRG Energy Inc. and GE Vernova Inc. were among the Top 25.

2025-12-29

Brokers Suggest Investing in Emcor Group (EME): Read This Before Placing a Bet

Description: Based on the average brokerage recommendation (ABR), Emcor Group (EME) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2025-12-28

2025-12-27

2025-12-26

Is Quanta the Biggest Winner From Data Center Power Demand?

Description: Is PWR the biggest beneficiary of surging data center power demand as utilities, grid infrastructure and storage build ramps?

Can EMCOR RPOs Support Stable Revenue Visibility Heading Into 2026?

Description: EME's record $12.61B RPO base, fueled by network, healthcare and manufacturing projects, boosts revenue visibility as the company looks toward 2026.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Assessing EMCOR Group’s valuation after a strong year-to-date run and recent share price pullback

Description: EMCOR Group (EME) has been quietly grinding higher this year, and the stock’s pullback over the past week has some investors asking whether this is a normal breather or an early warning sign. See our latest analysis for EMCOR Group. The latest dip sits against a powerful backdrop, with EMCOR’s 33.6% year to date share price return and exceptional multi year total shareholder returns suggesting that long term momentum is still very much intact. If this kind of steady compounding appeals, it...

2025-12-19

EMCOR Group, Inc. (EME) is Attracting Investor Attention: Here is What You Should Know

Description: Emcor Group (EME) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-18

Great Lakes Dredge & Dock Stock Climbs 12% in a Month: Buy or Fold?

Description: GLDD shares are up 12.3% in a month as backlog growth, disciplined bidding, fleet upgrades and margin gains support long-term scaling.

EMCOR Group, Inc. Announces Dividend Increase and Increase in Share Repurchase Authorization

Description: NORWALK, Conn., December 18, 2025--EMCOR Group, Inc. (NYSE: EME) today announced that its Board of Directors (the "Board") has approved an increase to the Company’s regular quarterly dividend to $0.40 per share from $0.25 per share. The Board expects to declare this cash dividend starting in the first quarter of 2026.

2025-12-17

Can EMCOR Maintain Its 9.1% Margin Streak as Data Centers Explode?

Description: EME's improving margin streak is being tested as data center demand reshapes backlog, execution discipline and operating leverage.

Has EMCOR’s 2025 Surge Gone Too Far or Do Cash Flows Suggest More Upside?

Description: Wondering if EMCOR Group is still good value after its huge run, or if the best days are already priced in, you are not alone. The stock has climbed 36.5% year to date and 329.7% over 3 years, while even the last month saw a steady 0.8% rise off a recent close around $624.56. Much of this strength has been underpinned by ongoing infrastructure spending, a solid backlog in mechanical and electrical projects, and steady contract wins in areas like data centers and mission critical facilities...

2025-12-16

The Top Ranked AI Stock that Isn't an AI Stock (FIX)

Description: Comfort Systems stock has been on fire during the AI boom, one of a handful of unexpected beneficiaries

EMCOR vs. Quanta: Which Construction Stock Has More Upside in 2026?

Description: Which company is better positioned for upside in 2026 as EME and PWR ride strong infrastructure, data center and grid demand?

EVgo Accelerates Network Expansion with Domestically Made Prefabricated Charging Skids

Description: More than 40% of EVgo stations deployed in 2025 leverage the prefabrication approach, supporting domestic manufacturing while reducing installation time and cost EVgo Accelerates Network Expansion with Domestically Made Prefabricated Charging Skids More than 40% of EVgo stations deployed in 2025 leverage the prefabrication approach, supporting domestic manufacturing while reducing installation time and cost LOS ANGELES, Dec. 16, 2025 (GLOBE NEWSWIRE) -- EVgo Inc. (NASDAQ: EVGO) (“EVgo” or the “C

The Zacks Analyst Blog Sterling, MasTec, EMCOR and Jacobs

Description: Sterling Infrastructure leads four construction stocks gaining momentum as record backlogs and infrastructure spending fuel growth into 2026.

Is EMCOR Group Stock Outperforming the S&P 500?

Description: EMCOR Group has significantly outperformed the S&P 500 over the past year, and analysts remain moderately bullish on the stock’s prospects.

2025-12-15

4 Construction Stocks Gaining Momentum Heading Into 2026

Description: STRL, MTZ, EME and J are riding a wave of infrastructure spending, backlog growth and rising earnings into 2026.

What Makes EMCOR (EME) an Investment Choice?

Description: TimesSquare Capital Management, an equity investment management company, released its “U.S. Focus Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the third quarter, all the major asset classes posted positive returns except fixed income assets outside the US. The strategy returned 4.00% (gross) and 3.78% (net) compared […]

2025-12-14

Is EMCOR’s Earnings Revisions And Lower P/E Multiple Altering The Investment Case For EMCOR Group (EME)?

Description: In recent days, EMCOR Group has drawn attention as analysts highlighted its lower price-to-earnings ratio versus Construction & Engineering peers alongside fresh coverage of its role as a major mechanical and electrical construction and building services provider. At the same time, upward earnings estimate revisions and a strong third-party growth rating have sharpened the focus on whether EMCOR’s comparatively modest valuation fully reflects its earnings outlook. Now we’ll examine how the...

2025-12-13

2025-12-12

2025-12-11

November’s Infrastructure Winner: The $43B Company Beating Industry Titans on Every Metric

Description: Infrastructure stocks delivered mixed signals in Q3 2025, with companies navigating margin pressures, strong demand dynamics, and varying operational efficiency. This ranking evaluates the sector’s leaders based on revenue growth, profitability margins, EBITDA performance, and strategic positioning heading into 2026. 5. Caterpillar Inc. (CAT) The world’s largest construction equipment manufacturer generated $17.64 billion in Q3 ... November’s Infrastructure Winner: The $43B Company Beating Indus

Wall Street Bulls Look Optimistic About Emcor Group (EME): Should You Buy?

Description: Based on the average brokerage recommendation (ABR), Emcor Group (EME) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2025-12-10

Can EMCOR Extend Its Run of High Single-Digit Organic Growth?

Description: With record RPOs and surging data-center demand, can EME keep delivering high single-digit organic growth despite premium valuation and rising competition?

2025-12-09

2025-12-08

EMCOR Group, Inc. (EME) is Attracting Investor Attention: Here is What You Should Know

Description: Recently, Zacks.com users have been paying close attention to Emcor Group (EME). This makes it worthwhile to examine what the stock has in store.

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Assessing EMCOR Group’s (EME) Valuation After a Recent 9% Pullback in the Share Price

Description: EMCOR Group (EME) has quietly pulled back about 9% over the past month, even after strong multi year returns and solid earnings growth. That combination is drawing fresh attention from valuation focused investors. See our latest analysis for EMCOR Group. The recent 9% 1 month share price pullback comes after a powerful run. The stock is still showing a strong year to date share price gain and exceptional multi year total shareholder returns, suggesting momentum is cooling but the longer term...

EMCOR Stock Dips 9% in a Month: Should Investors Hold or Fold?

Description: EME faces margin and timing headwinds, yet data center demand and acquisitions continue to reinforce its long-term positioning.

2025-12-03

Is EMCOR Group (EME) Outperforming Other Construction Stocks This Year?

Description: Here is how Emcor Group (EME) and Comfort Systems (FIX) have performed compared to their sector so far this year.

Comfort Systems Climbs 29% in 3 Months: Should You Buy the Surge?

Description: Can FIX's data-center surge, massive backlog and strong liquidity keep powering further, even as its premium valuation stretches expectations?

OCS completes acquisition of EMCOR UK, creating one of the largest hard services-led FM providers in the UK

Description: OCS and EMCOR UK Leadership Teams - Stronger Together Senior leaders from OCS and EMCOR UK at the OCS UK headquarters to mark the completion of the acquisition. OCS and EMCOR UK Leadership Rob Legge, Daniel Dickson and Cheryl McCall Left to right: Rob Legge, Group Chief Executive Officer of OCS; Cheryl McCall, Chief Executive Officer of EMCOR UK; and Daniel Dickson, UK and Ireland CEO of OCS. Photographed at the OCS UK headquarters following completion of the acquisition EMCOR UK by OCS.. Ipswic

2025-12-02

2025-12-01

EMCOR Group, Inc. Completes Sale of EMCOR UK to OCS Group UK Limited

Description: NORWALK, Conn., December 01, 2025--EMCOR Group, Inc. ("EMCOR" or the "Company") (NYSE: EME) today announced that it has completed its previously announced sale of EMCOR Group (UK) plc ("EMCOR UK") to OCS Group UK Limited ("OCS") for a total enterprise value of approximately £190 million, equivalent to approximately $250 million at current exchange rates.

2025-11-30

2025-11-29

2025-11-28

All You Need to Know About Emcor Group (EME) Rating Upgrade to Buy

Description: Emcor Group (EME) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-11-27

Is EMCOR Group Attractively Priced After Recent 19% Share Price Drop?

Description: Wondering if EMCOR Group stock is fairly priced, overhyped, or a hidden bargain? Let's break down what matters most for anyone thinking about value. Although shares are up an impressive 33.5% year-to-date and have soared 623.0% in the past five years, the last 30 days have seen a sharp 19.1% pullback, which may indicate shifting investor sentiment. Investors are watching EMCOR Group closely after recent headlines highlighted the company's expanding presence in government services and...

2025-11-26

2025-11-25

Comfort Systems vs. EMCOR: Which Infrastructure Stock is Leading Now?

Description: Is FIX's surge in data-center demand and record backlog enough to outpace EME's U.S. refocus and rising RPO momentum?

EMCOR Group, Inc. (EME) Is a Trending Stock: Facts to Know Before Betting on It

Description: Emcor Group (EME) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-11-24

Will EMCOR's U.K. Exit Unlock Faster Growth Across the Core US?

Description: Will EME's exit from the UK free up capital and focus needed to accelerate growth across its high-margin, fast-expanding U.S. infrastructure markets?

Emcor Group (EME) Could Find a Support Soon, Here's Why You Should Buy the Stock Now

Description: After losing some value lately, a hammer chart pattern has been formed for Emcor Group (EME), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term.

2025-11-23

2025-11-22

2025-11-21

How Recent Developments Are Shaping the EMCOR Group Investment Story

Description: EMCOR Group’s price target narrative remains largely steady, with the Fair Value Estimate holding firm at $758.50 per share following adjustments to growth and risk factors. The slight increase in the discount rate reflects an updated risk assessment, while revenue growth projections have also risen. Stay tuned to discover how you can monitor these evolving outlooks and understand the factors shaping EMCOR’s future performance. Analyst Price Targets don't always capture the full story. Head...

EMCOR Stock Down 10% Post Q3 Results: Should You Buy the Dip?

Description: Is EME's post-third-quarter pullback a buying opportunity as rising EPS, strong construction demand and record RPOs underscore its momentum?

MasTec Stock Down 8% Post Q3 Earnings: Should You Buy the Dip or Fold?

Description: Can MTZ's strong renewables momentum and pipeline rebound outweigh project delays and cost pressures that continue to cloud its near-term outlook?

1 S&P 500 Stock to Own for Decades and 2 We Brush Off

Description: The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning. Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

2025-11-20

Is MasTec's 15% Pipeline Margin Just the Start of a Rebound?

Description: Is MTZ's sharp jump to a 15.4% pipeline margin signaling the start of a sustained rebound fueled by record backlog and rising midstream demand?

Will Comfort Systems' Growing Technology Exposure Support an Edge?

Description: FIX's expanding technology work, record backlog and strong data-center demand highlight its growing momentum and long-term opportunity.

Buy 5 Non-Tech Giants That Have Surged on AI Data Center Boom for 2026

Description: FIX, VRT, MIR, BWXT and EME have surged in 2025 and are set to gain further from the accelerating AI-fueled data center boom in 2026.

Are Wall Street Analysts Bullish on EMCOR Group Stock?

Description: As EMCOR Group has outpaced the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-19

Wall Street Analysts Think Emcor Group (EME) Is a Good Investment: Is It?

Description: The average brokerage recommendation (ABR) for Emcor Group (EME) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2025-11-18

Revisiting EMCOR Group (EME) Valuation After 11% Pullback and Strong Year-to-Date Gains

Description: EMCOR Group (EME) has quietly caught some attention among investors lately, especially as its stock has retraced over the past month, dipping 11% from recent highs. This move follows a stretch of gains since the start of the year. See our latest analysis for EMCOR Group. While EMCOR Group's 11% pullback this month has grabbed headlines, it comes after a powerful run with solid momentum year-to-date. The stock’s 34.3% year-to-date share price return and 19.8% total shareholder return over the...

2025-11-17

Are Construction Stocks Lagging EMCOR Group (EME) This Year?

Description: Here is how Emcor Group (EME) and Comfort Systems (FIX) have performed compared to their sector so far this year.

Will EMCOR's Industrial Services Rebound in 2026 as Delays Clear?

Description: EME eyes a 2026 rebound as delayed turnaround work returns to its Industrial Services segment.

2025-11-16

2025-11-15

2025-11-14

Investors Heavily Search EMCOR Group, Inc. (EME): Here is What You Need to Know

Description: Emcor Group (EME) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-11-13

Will Data Center Infrastructure Expansion Support Quanta's Growth?

Description: PWR is seeing rising data center demand push backlog growth and expand the platform's role in fast power infrastructure work.

2025-11-12

2025-11-11

Will Rising Data Center Construction Continue to Lift EMCOR's RPOs?

Description: EME is seeing strong momentum as rising data center construction fuels RPOs' growth and future revenue visibility.

2025-11-10

Comfort Systems Stock Up 16% Since Q3 Earnings: Right Time to Buy Yet?

Description: Can FIX keep up its hot streak as record backlog, acquisitions and Fed tailwinds fuel momentum?

Will Sterling's 125% Data Centre Growth Extend Into 2026?

Description: STRL's surging 125% data center revenues and deep project pipeline signal strong momentum extending into 2026.

What Recent Acquisition Activity Means for EMCOR Group’s True Value in 2025

Description: Curious whether EMCOR Group is a hidden gem or potentially overpriced? Let’s dive into what the numbers and recent news say about its true value. The stock has powered ahead by 41.9% year-to-date and 678.7% over the past five years, but has pulled back slightly in the last week and month, with returns of -3.6% and -2.2% respectively. Recent headlines highlight EMCOR’s continued expansion through strategic acquisitions and new project wins. Both of these factors are helping shape investor...

Did EMCOR Group's (EME) Raised Guidance and U.K. Exit Just Shift Its Investment Narrative?

Description: EMCOR Group reported strong third quarter 2025 results with sales of US$4.3 billion and net income of US$295.37 million, also raising its full-year revenue guidance to US$16.7 billion to US$16.8 billion. This performance highlights the company’s focus on U.S. core markets and commitment to organic growth and M&A, following the announced sale of its U.K. business. We'll examine how EMCOR Group’s raised full-year revenue guidance may influence its long-term growth outlook and investment...

2025-11-09

Meet the Newest Addition to the S&P 500. The Stock Has Soared 200% Since Early Last Year, and Is Still a Buy Right Now, According to 1 Wall Street Analyst.

Description: This new S&P 500 stock has been a multibagger and has compelling growth prospects.

2025-11-08

2025-11-07

2025-11-06

2025-11-05

Can Comfort Systems Keep Its Record $9.38B Backlog Momentum Going?

Description: Can FIX sustain its record $9.4 billion backlog as data center demand and acquisitions power growth?

2025-11-04

AAON, EMCOR, Caterpillar, WESCO, and Quanex Stocks Trade Down, What You Need To Know

Description: A number of stocks fell in the morning session after markets became increasingly wary of high valuations following a significant AI-driven rally.

A Fresh Look at EMCOR Group (EME) Valuation as Shares Outperform This Year

Description: EMCOR Group (EME) stock has been on the move lately, drawing attention from investors curious about its recent performance. With a nearly 5% year-to-date gain and strong 1-year returns, many are taking a closer look at what is driving the momentum. See our latest analysis for EMCOR Group. EMCOR Group's share price has surged this year thanks to consistent execution and solid earnings. With a year-to-date share price return of 47% and a remarkable 46% total shareholder return over the past...

Insiders Find Solace Selling US$5.3m In Stock With EMCOR Group's Price Down 11%

Description: Insiders seem to have made the most of their holdings by selling US$5.3m worth of EMCOR Group, Inc. ( NYSE:EME ) stock...

2 Cash-Heavy Stocks with Exciting Potential and 1 We Brush Off

Description: A surplus of cash can mean financial stability, but it can also indicate a reluctance (or inability) to invest in growth. Some of these companies also face challenges like stagnating revenue, declining market share, or limited scalability.

How MEP contractor Comfort Systems USA leveraged Lego-like model to drive 15x growth

Description: The company’s investment in volumetric modular construction capabilities makes it a go-to mechanical contractor for companies racing to build data centers or reshore manufacturing.

2025-11-03

Analyst Says Emcor (EME) is a Top Stock with ‘Plenty’ of Upside Potential

Description: We recently published Top Analyst Calls: 8 Stocks to Buy and Sell. EMCOR Group, Inc. (NYSE:EME) is one of the top analyst calls. Kevin Simpson, Capital Wealth Planning founder and CIO, explained in a recent program on CNBC why he likes Emcor. “We look at Emcor as a pick and shovel for the infrastructure electrification. […]

EMCOR Group, Inc. Announces Participation in Upcoming Investor Events

Description: NORWALK, Conn., November 03, 2025--EMCOR Group, Inc. (NYSE: EME) announced today that Tony Guzzi, Chairman, President, and Chief Executive Officer, Jason Nalbandian, Senior Vice President and Chief Financial Officer, and Lucas Sullivan, Director, Financial Planning & Analysis, will participate in the following investor events.

2025-11-02

2025-11-01

2025-10-31

EMCOR (EME) Stock Is Up, What You Need To Know

Description: Shares of specialty construction contractor company EMCOR (NYSE:EME) jumped 3.2% in the afternoon session after market optimism improved following the company's third-quarter 2025 results that surpassed analyst expectations and raised its full-year outlook.

Primoris Services to Report Q3 Earnings: Buy, Hold or Fold the Stock?

Description: Can PRIM sustain its record momentum as renewables and data center demand power third-quarter growth?

2025-10-30

EMCOR Group (EME) Margin Improvement Reinforces Bullish Narratives on Earnings Quality and Valuation

Description: EMCOR Group (EME) posted strong earnings momentum, with annual earnings forecasted to grow 10.47% per year and revenue expected to rise by 8.8% annually. Net profit margin improved to 7.1%, up from 6% last year, while five-year average annual earnings growth hit an impressive 36.9%, with the latest annual growth at 33.9%. These results, combined with favorable valuation metrics and robust profitability, have underscored the company’s track record and reward factors for investors reviewing the...

EMCOR Group Inc (EME) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic ...

Description: EMCOR Group Inc (EME) reports a robust 16.4% revenue increase and strategic acquisitions, despite challenges in the Industrial Services segment.

Why Emcor Group Plunged Today

Description: Despite terrific top-line growth, Emcor's guidance wasn't enough to live up to lofty expectations.

Why EMCOR (EME) Shares Are Getting Obliterated Today

Description: Shares of specialty construction contractor company EMCOR (NYSE:EME) fell 13.8% in the morning session after the company reported strong third-quarter results but provided a full-year revenue forecast that failed to impress investors. The specialty construction contractor posted third-quarter revenues of $4.30 billion, a 16.4% increase from the same period in the previous year. Earnings per share also grew, reaching $6.57. While these results were slightly ahead of Wall Street's expectations, th

EMCOR Group (EME) Q3 2025 Earnings Call Transcript

Description: Lucas Sullivan: Thank you, Chris. With me today are Tony Guzzi, our Chairman President, and Chief Executive Officer Jason Nalbandian, Senior Vice President and EMCOR's Chief Financial Officer, and Maxine Maurizio, Executive Vice President, Chief Administrative Officer and General Counsel.

EMCOR Q3 Earnings Miss Estimates, RPOs Increase Y/Y, Stock Up

Description: EME posts higher third-quarter 2025 revenues and earnings year over year despite missing estimates, with record RPOs driving a 2.4% stock gain.

Under The Bonnet, EMCOR Group's (NYSE:EME) Returns Look Impressive

Description: Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach...

Is EMCOR Group (EME) Stock Outpacing Its Construction Peers This Year?

Description: Here is how Emcor Group (EME) and Comfort Systems (FIX) have performed compared to their sector so far this year.

Emcor Group (EME) Q3 Earnings and Revenues Lag Estimates

Description: Emcor Group (EME) delivered earnings and revenue surprises of -1.20% and -0.37%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

If You Invested $1000 in Emcor Group a Decade Ago, This is How Much It'd Be Worth Now

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

EMCOR (NYSE:EME) Reports Q3 In Line With Expectations But Stock Drops 13.5%

Description: Specialty construction contractor company EMCOR (NYSE:EME) met Wall Streets revenue expectations in Q3 CY2025, with sales up 16.4% year on year to $4.30 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $16.75 billion at the midpoint. Its GAAP profit of $6.57 per share was 0.7% above analysts’ consensus estimates.

Emcor Group: Q3 Earnings Snapshot

Description: EME) on Thursday reported third-quarter earnings of $295.4 million. The Norwalk, Connecticut-based company said it had net income of $6.57 per share. The results fell short of Wall Street expectations.

EMCOR Group, Inc. Reports Third Quarter 2025 Results

Description: NORWALK, Conn., October 30, 2025--EMCOR Group, Inc. (NYSE: EME) today reported results for the quarter ended September 30, 2025.

2025-10-29

5 Construction Stocks Set to Carve a Beat in This Earnings Season

Description: Data center and power demand, along with mission-critical projects, give these construction stocks, like MasTec, AAON, Vulcan, Johnson and EMCOR, an edge.

Pat Roche Elected to The EMCOR Group, Inc. Board of Directors

Description: NORWALK, Conn., October 29, 2025--EMCOR Group, Inc. (the "Company") (NYSE: EME) announced today the election of Pat Roche to the Company’s Board of Directors, effective October 27, 2025.

2025-10-28

Earnings To Watch: EMCOR (EME) Reports Q3 Results Tomorrow

Description: Specialty construction contractor company EMCOR (NYSE:EME) will be reporting earnings this Thursday before market hours. Here’s what investors should know.

Quanta is Set to Report Q3 Earnings: Here's What Investors Must Know

Description: Will PWR's robust grid and renewables momentum help it power past third-quarter estimates once again?

EMCOR Before Q3 Earnings: Buy, Sell or Hold the Stock?

Description: EME's record backlog, rising margins, and raised EPS guidance set the stage for a closely watched Q3 report.

Quanta to Report Q3 Earnings: What Investors Should Know?

Description: PWR gears up to report Q3 earnings, with strong infrastructure tailwinds and double-digit revenue growth expected.

Vulcan Materials to Report Q3 Earnings: What Should Investors Watch?

Description: VMC's third-quarter results may see a rebound from weather-hit quarters, powered by strong infrastructure demand and pricing gains.

2025-10-27

Masco Gears Up for Q3 Earnings: What's in the Offing for the Stock?

Description: MAS' third-quarter results are expected to show weaker sales and margins as soft DIY demand and tariff costs weigh on performance.

2025-10-26

EMCOR Group (EME) Is Up 8.6% After Peer Strength and Easing Inflation Fuel Sector Optimism

Description: Earlier this week, EMCOR Group gained attention after peer Comfort Systems reported strong third-quarter results and broader market optimism increased following cooler inflation data. This confluence of upbeat sector news and macroeconomic signals has reinforced investor interest in specialty contractors with diversified project backlogs like EMCOR. We'll explore how robust peer performance and improving macroeconomic indicators intersect with EMCOR Group's projected earnings and revenue...

2025-10-25

2025-10-24

Why Is EMCOR (EME) Stock Soaring Today

Description: Shares of specialty construction contractor company EMCOR (NYSE:EME) jumped 7.8% in the afternoon session after peer, Comfort Systems, posted strong third-quarter 2025 results that surpassed analyst expectations on both revenue and profit, driven by a record backlog.

Here's What Investors Must Know Ahead of D.R. Horton's Q4 Earnings

Description: DHI gears up to report fourth-quarter results as affordability hurdles, mortgage rates and margin pressure weigh on expectations.

2025-10-23

Are Tariffs Still a Threat to Primoris' Renewables Momentum?

Description: Can PRIM sustain its growth momentum in renewables and infrastructure amid tariff headwinds?

Will Sterling's Expanding Margins Hold as Data Center Demand Surges?

Description: STRL's expanding data center pipeline and stronger project execution are fueling margin gains and steady growth.

Emcor Group (EME) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Emcor Group (EME) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Zacks Industry Outlook Highlights EMCOR, MasTec and Dycom Industries

Description: EME, MTZ, and DY are thriving amid a historic infrastructure boom, data center demand, and strong industry earnings momentum.

What Recent Analyst Upgrades Reveal About EMCOR’s Evolving Story

Description: EMCOR Group’s stock price target was recently raised modestly, with analysts increasing their consensus fair value estimate from $711.67 to $716.00. This adjustment comes as sentiment grows more positive and is supported by EMCOR’s strong execution and strategic positioning in U.S. industrial reshoring trends. Stay tuned to discover how you can follow future developments and remain informed as the narrative around EMCOR Group continues to evolve. What Wall Street Has Been Saying Recent...

2025-10-22

3 Heavy Construction Stocks to Buy From Infrastructure Upswing

Description: Growth across the telecommunications, transmission, data center, renewable energy and power generation businesses is set to benefit EME, MTZ and DY in the Zacks Building Products - Heavy Construction industry.

Comfort Systems Stock Before Q3 Earnings: Buy Now or Wait for Results?

Description: FIX approaches its third-quarter earnings on the back of strong demand, expanding backlog and robust project execution.

EMCOR vs. Jacobs: Which Engineering Stock Is a Better Buy Now?

Description: Which engineering stock is the better buy now-EMCOR with record growth or Jacobs with steady digital-driven gains?

2025-10-21

ASML Stock, Another Chip Play, Near Highs On Robust Relative Strength

Description: ASML stock is extended from the buy zone of a base, but shares also show a second buy point. A building services stock is in a buy zone.

2025-10-20

Emcor Group (EME) Exceeds Market Returns: Some Facts to Consider

Description: Emcor Group (EME) closed at $700.18 in the latest trading session, marking a +1.62% move from the prior day.

Top Research Reports for AstraZeneca, RTX & Applied Materials

Description: AstraZeneca, RTX, and Applied Materials stand out in today's Zacks Research Daily with strong performance drivers and key growth catalysts.

PulteGroup to Report Q3 Earnings: What's in Store for This Homebuilder?

Description: PHM gears up to report Q3 results as affordability hurdles, mortgage rates and margin pressure weigh on expectations.

2025-10-19

2025-10-18

Evaluating EMCOR Group (EME) Valuation as Analyst Optimism Grows on Solid Earnings Momentum

Description: EMCOR Group (EME) has caught investor attention lately, as recent analyst outlooks highlight the company's solid earnings momentum and consistent estimate revisions. This trend is supported by positive sentiment around earnings fundamentals. See our latest analysis for EMCOR Group. EMCOR Group’s share price has enjoyed strong momentum this year, with a year-to-date gain of over 50% and a 1-year total shareholder return of 52%. Investors appear to be responding to the company’s robust revenue...

2025-10-17

These Two Names Power Up To Buy Zones. Shopify Stock Rebounds.

Description: Shopify stock is back in a buy zone after testing a key moving average. Two power stocks reached new highs and hit buy points.

AI Data Center Play Emcor Actionable Now As Stock Trades In Buy Zone

Description: Artificial intelligence data center play Emcor stock is actionable now after last week's breakout.

Comfort Systems Stock: Buy, Hold or Sell at Premium Valuation?

Description: Is FIX's premium valuation still justified after a 97.8% rally and record $8.12B backlog growth?

Here's Why Emcor Group (EME) is a Strong Growth Stock

Description: Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Is It Worth Investing in Emcor Group (EME) Based on Wall Street's Bullish Views?

Description: Based on the average brokerage recommendation (ABR), Emcor Group (EME) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

Is EMCOR Group’s Rally Justified After 50% Surge and Record Project Backlog in 2025?

Description: If you’ve been eyeing EMCOR Group’s stock lately and wondering if there’s still room left to run, you’re in good company. With the share price closing at $687.22 and a stunning 50.2% gain year-to-date, EMCOR’s performance is turning heads even among seasoned investors. Over the last five years, the stock has climbed an incredible 892.9%, far outpacing most of its peers and making even cautious investors do a double take. In just the past month, the stock added 11.0%, and its steady progress,...

1 Volatile Stock Worth Your Attention and 2 We Turn Down

Description: Volatility cuts both ways - while it creates opportunities, it also increases risk, making sharp declines just as likely as big gains. This unpredictability can shake out even the most experienced investors.