News sentiment analysis for EOG

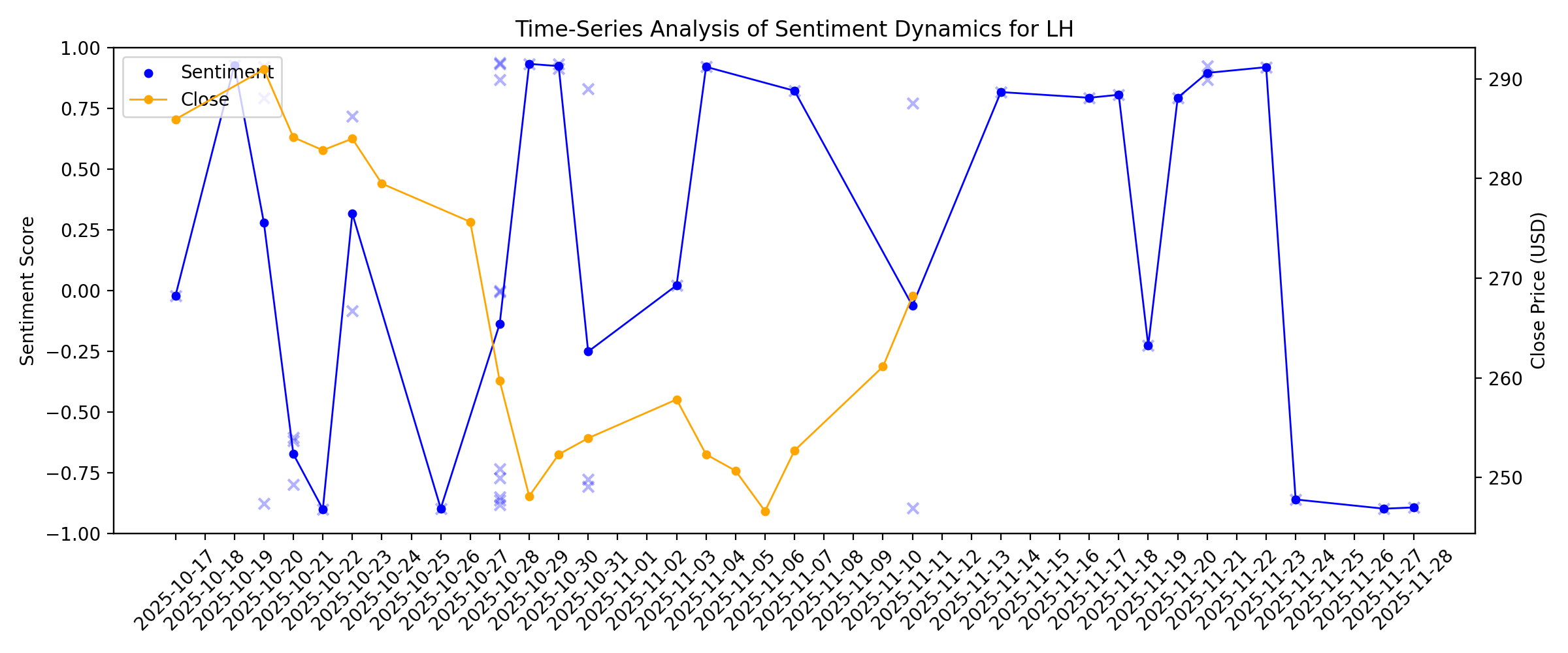

Sentiment chart

2026-01-14

2026-01-13

EOG Resources Schedules Conference Call and Webcast of Fourth Quarter and Full Year 2025 Results for February 25, 2026

Description: EOG Resources, Inc. (NYSE: EOG) (EOG) will host a conference call and webcast to discuss fourth quarter and full year 2025 results on Wednesday, February 25, 2026, at 9 a.m. Central time (10 a.m. Eastern time). Please visit the Investors/Events & Presentations page on the EOG website to access a live webcast of the conference call. If you are unable to listen to the live webcast, a replay will be available for one year.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

These 2 Oils-Energy Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

2026-01-08

EOG Resources (EOG) Price Target Cut by $18

Description: The share price of EOG Resources, Inc. (NYSE:EOG) fell by 2.34% between December 31, 2025, and January 7, 2026, putting it among the Energy Stocks that Lost the Most This Week. EOG Resources, Inc. (NYSE:EOG) is one of the largest crude oil and natural gas exploration and production companies in the United States, with proved reserves in […]

2026-01-07

Is EOG Resources (EOG) Now Attractive After Recent Share Price Weakness?

Description: If you are wondering whether EOG Resources at around US$105 is a bargain or a value trap, you are in the right place. The stock has been under pressure recently, with a 0.6% decline over the last week, a 6.4% decline over the last month, and a 14.8% decline over the last year, while the 5 year return sits at 114.0%. These moves have come alongside ongoing investor focus on energy producers and how they fit into portfolios, as commodity prices and capital allocation priorities remain in the...

Does EOG’s Ohio Fracking Incident Reframe Its Technology-Driven Safety and Efficiency Story (EOG)?

Description: In December 2025, an explosion and fire during hydraulic fracturing at an EOG Resources shale well pad in Carroll County, Ohio, was quickly contained to a vapor tank, with no injuries reported and the wellheads remaining intact. At the same time, EOG’s push to treat shale as a technology platform, emphasizing proprietary data, cost control, and lower emissions, has sharpened investor focus on how the company balances operational safety, efficiency, and environmental goals. We’ll now examine...

2026-01-06

2026-01-05

2026-01-04

Is the Options Market Predicting a Spike in EOG Resources Stock?

Description: Investors need to pay close attention to EOG Resources stock based on the movements in the options market lately.

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

Here’s What Wall Street Thinks About EOG Resources (EOG)

Description: EOG Resources, Inc. (NYSE:EOG) is one of the Best Affordable Stocks to Buy According to Analysts. On December 19, Gabriele Sorbara from Siebert Williams Shank & Co reiterated a Buy rating on EOG Resources, Inc. (NYSE:EOG) with a $150 price target. Earlier on December 17, analyst Josh Silverstein from UBS also reiterated a Buy rating […]

2025-12-27

Analyst Reduces Price Target on EOG Resources (EOG)

Description: EOG Resources, Inc. (NYSE:EOG) is included among the 12 Best Crude Oil Stocks to Buy for Dividends. EOG Resources, Inc. (NYSE:EOG) is one of the largest crude oil and natural gas exploration and production companies in the United States with proved reserves in the US and Trinidad. On December 17, Citi analyst Scott Gruber lowered […]

2025-12-26

2025-12-25

2025-12-24

How ExxonMobil Stays Resilient in a Soft Commodity Pricing Environment

Description: XOM leans on low-cost Permian and Guyana output, cost savings and an integrated model to stay profitable as oil prices soften.

3 Top Dividend Stocks To Consider

Description: As the U.S. stock market reaches new heights with the S&P 500 closing at a record high, investors are increasingly looking for stable income sources amidst buoyant economic growth and rising indices. In this environment, dividend stocks can offer a reliable stream of income, making them an attractive option for those seeking to capitalize on the current market momentum while potentially benefiting from consistent returns.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

UBS Anticipates Robust 2026 for EOG Resources (EOG) Driven by Improved Pricing and Cost Efficiency

Description: EOG Resources Inc. (NYSE:EOG) is one of the most profitable value stocks to invest in right now. On December 12, UBS analyst Josh Silverstein lowered the firm’s price target on EOG Resources to $141 from $144 and maintained a Buy rating on the shares. UBS predicts a robust 2026 for Energy after 3 years of […]

2025-12-18

EOG Resources (EOG) Is Down 6.3% After Expanding Credit Line And Adding Veteran CFO To Board

Description: Earlier in December 2025, EOG Resources expanded its financial flexibility with a new US$3.00 billion unsecured revolving credit facility maturing in 2030 and appointed veteran energy finance executive John D. Chandler to its board and audit committee. These moves, coming alongside a contained well pad explosion in Ohio that raised operational and ESG questions, highlight how EOG is bolstering governance and liquidity while managing on-the-ground risks. We’ll now assess how EOG’s larger...

EOG Resources (EOG) Valuation Check After Ohio Well Pad Explosion and 2026 Growth Plans

Description: EOG Resources, Inc. has been in the spotlight after an explosion at one of its Ohio shale well pads, but with no injuries or lasting asset damage, the bigger question is what this means for the stock. See our latest analysis for EOG Resources. The incident comes during a rough patch for sentiment, with the 7 day share price return of minus 6.3 percent and year to date share price return of minus 17.7 percent feeding into fading momentum, even though the 5 year total shareholder return of...

Can ExxonMobil Weather the Prevailing Softness in Oil Price?

Description: XOM faces pressure as WTI crude sinks near $56. However, its low debt and strong balance sheet might help it to endure weak oil prices.

Here’s What Analyst Think About EOG Resources (EOG)

Description: EOG Resources, Inc. (NYSE:EOG) is one of the Undervalued Stocks with Biggest Upside Potential. On December 15, Leo Mariani from Roth MKM reiterated a Hold rating on the stock with a $114 price target. Earlier on December 12, Josh Silverstein from UBS reiterated a Buy rating on EOG Resources, Inc. (NYSE:EOG), but lowered the price […]

2025-12-17

EOG Resources 2026 Outlook Backed by Encino Integration, Gas Cash Flow, UBS Says

Description: EOG Resources (EOG) is seen as well positioned heading into 2026, with catalysts from Encino integra

Harbour Energy Expands North Sea Footprint With $170M Acquisition

Description: HBRIY is buying most Waldorf subsidiaries for $170M, lifting its Catcher stake to 90% and adding production, reserves and tax benefits.

2025-12-16

EOG Resources to Present at Upcoming Conference

Description: EOG Resources, Inc. (NYSE: EOG) (EOG) is scheduled to present at the Goldman Sachs Energy, CleanTech and Utilities Conference at 9:15 a.m. Central time (10:15 a.m. Eastern time) on Wednesday, January 7. Ann Janssen, Executive Vice President and Chief Financial Officer, will present on behalf of EOG.

Sector Update: Energy Stocks Fall Late Afternoon

Description: Energy stocks declined late Tuesday afternoon with the NYSE Energy Sector Index falling 2.5% and the

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

EOG Resources Appoints John D. Chandler to Board of Directors

Description: EOG Resources, Inc. (EOG) today announced the appointment of John D. Chandler to its Board of Directors, effective December 10, 2025. Chandler served as Senior Vice President and Chief Financial Officer of The Williams Companies, Inc. (Williams), a publicly traded energy infrastructure provider focused on the gathering, processing, transportation and storage of natural gas, from 2017 until his retirement in 2022. Chandler also serves as a director of Matrix Services Company and LSB Industries, I

Returns On Capital Are Showing Encouraging Signs At EOG Resources (NYSE:EOG)

Description: What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically...

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Inside ExxonMobil's Balance Sheet: Key Takeaways for Investors

Description: XOM's strong balance sheet and low debt load highlight its resilience amid volatile energy markets and support its long-term strategy.

2025-12-03

EOG Resources (NYSE:EOG) shareholder returns have been strong, earning 166% in 5 years

Description: The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put...

2025-12-02

2025-12-01

Is EOG Resources Stock Underperforming the Nasdaq?

Description: EOG Resources’ stock has underperformed the Nasdaq over the past year, but analysts remain fairly bullish about its prospects.

2025-11-30

2025-11-29

2025-11-28

EOG Resources' Debt Refinancing May Change the Case for Investing in EOG (EOG)

Description: Earlier this month, EOG Resources completed a US$1 billion public debt offering, spanning senior notes due in 2031 and 2055, with proceeds designated to refinance and optimize near-term debt maturities. The multi-tranche issuance, supported by an expanded roster of co-lead underwriters, highlights EOG's focus on strengthening its financial position and maintaining flexibility for resilient shareholder returns. We'll examine how EOG Resources' move to bolster its balance sheet with new debt...

How New Analyst Insights Are Shaping the Story for EOG Resources

Description: The consensus analyst price target for EOG Resources has edged up slightly from $137.20 to $137.81, signaling evolving sentiment on the stock. This adjustment follows recent company guidance along with shifting perspectives among market analysts, who are considering both optimism about operational improvements and caution regarding broader risks. Stay tuned to see how investors and analysts track these ongoing shifts in EOG's narrative moving forward. Stay updated as the Fair Value for EOG...

How ExxonMobil Plans to Sustain Cash Flows Amid Softer Crude Prices

Description: XOM leans on low-cost Guyana and Permian assets to keep earnings and cash flows resilient even during a softer crude price environment.

A Look at EOG Resources’s Valuation Following Strong Q3 Results and $1 Billion Debt Offering

Description: EOG Resources (EOG) just completed a $1 billion debt securities offering and raised its free cash flow guidance after posting strong third-quarter results. This activity is getting the attention of many investors. See our latest analysis for EOG Resources. Following its recent $1 billion debt offering and upbeat quarterly results, EOG Resources has seen its share price recover modestly in the past month, even as energy sector volatility continues. While the 1-year total shareholder return...

2025-11-27

EOG Resources EOG Q3 2025 Earnings Call Transcript

Description: This transaction strengthens our portfolio, cementing a third high-return foundational asset, diversing our production base and accelerating our free cash flow generation potential even during a more dynamic commodity environment. For the third quarter 2025, oil, natural gas and NGL volumes exceeded the midpoints of our guidance, while capital expenditures, cash operating costs and DD&A all came in below guidance midpoints, resulting in $1.4 billion of free cash flow, $1.5 billion in net income and $1 billion of cash returned to shareholders through our regular dividend and share repurchases. Through the first 3 quarters of this year, we have committed to return nearly 90% of our estimated 2025 free cash flow, including $2.2 billion in regular dividends and $1.8 billion of share repurchases.

Wall Street Has a Mixed Opinion on EOG Resources (EOG), Here’s Why

Description: EOG Resources, Inc. (NYSE:EOG) is one of the Best Very Cheap Stocks to Invest In. On November 20, Devin McDermott from Morgan Stanley maintained a Hold rating on the stock, raising the price target from $136 to $138. Earlier, on November 18, Mark Lear from Piper Sandler had also maintained a Hold rating on EOG […]

2025-11-26

Piper Sandler Lowers EOG Price Target to $124, Maintains Neutral Rating

Description: EOG Resources, Inc. (NYSE:EOG) is included among the 15 Best Stocks to Buy for Medium Term. On November 18, Piper Sandler cut its price target on EOG Resources, Inc. (NYSE:EOG) to $124 from $129 and maintained a Neutral rating. The firm updated its exploration and production models following the Q3 results. According to the analyst, […]

2025-11-25

2025-11-24

Strong Cash Flow to Support EOG Resources’ (EOG) Robust Pipeline Amid Oil Supply Headwinds; RBC Capital Remains Bullish

Description: With significant hedge fund interest, EOG Resources, Inc. (NYSE:EOG) secures a spot on our list of the 12 best commodity stocks to buy right now. On November 11, 2025, EOG Resources, Inc. (NYSE:EOG) saw its price target maintained by RBC Capital at $145 with a “Buy” rating. This was followed by EOG Resources, Inc. (NYSE:EOG)’s […]

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Energy Leader WaterBridge Infrastructure Approaches First Buy Point As Public Company

Description: Energy leader WaterBridge stock is approaching its first buy point as a public company after a September initial public offering.

2025-11-13

Discover 3 Top Dividend Stocks For Your Portfolio

Description: In the wake of the recent U.S. government shutdown resolution, major stock indices like the Dow Jones and Nasdaq have experienced fluctuations, with technology shares leading declines. Amidst these market shifts, dividend stocks continue to attract investors seeking steady income streams and potential stability in uncertain economic conditions.

2025-11-12

2025-11-11

2025-11-10

APA Corporation Q3 Earnings Beat Estimates Despite Weak Oil Prices

Description: APA posts stronger-than-expected Q3 earnings as solid production and cost control offset weaker oil prices.

2025-11-09

EOG Resources, Inc. Just Recorded A 8.5% EPS Beat: Here's What Analysts Are Forecasting Next

Description: EOG Resources, Inc. ( NYSE:EOG ) defied analyst predictions to release its quarterly results, which were ahead of...

2025-11-08

EOG Resources Inc (EOG) Q3 2025 Earnings Call Highlights: Strong Cash Flow and Shareholder ...

Description: EOG Resources Inc (EOG) reports robust financial performance with $1.4 billion in free cash flow and $1 billion returned to shareholders, while navigating market oversupply and strategic acquisitions.

2025-11-07

EOG Resources (EOG): Assessing Valuation as Shares Show Modest Uptick After Recent Underperformance

Description: EOG Resources (EOG) saw a slight uptick in its stock price today, a change from recent trends where shares have lagged over the past month and quarter. Investors are watching closely to gauge what could drive the next move. See our latest analysis for EOG Resources. Zooming out, EOG Resources’ share price return has softened notably this year. This reflects both recent sector headwinds and a general cooling of momentum after years of robust performance. Despite a strong long-term record, the...

EOG Resources' Q3 Earnings Beat Estimates on Production

Description: EOG posts Q3 EPS of $2.71, topping estimates on strong output growth, though lower price realization weighs on revenue.

EOG Resources Insiders Sell US$1.7m Of Stock, Possibly Signalling Caution

Description: The fact that multiple EOG Resources, Inc. ( NYSE:EOG ) insiders offloaded a considerable amount of shares over the...

2025-11-06

EOG Resources (EOG) Surpasses Q3 Earnings Estimates

Description: EOG Resources (EOG) delivered earnings and revenue surprises of +11.52% and -1.70%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

EOG Resources: Q3 Earnings Snapshot

Description: On a per-share basis, the Houston-based company said it had net income of $2.70. Earnings, adjusted for non-recurring costs, were $2.71 per share. The results exceeded Wall Street expectations.

EOG Resources Reports Third Quarter 2025 Results

Description: EOG Resources, Inc. (EOG) today reported third quarter 2025 results. The attached supplemental financial tables and schedules for the reconciliation of non–GAAP measures to GAAP measures and related definitions and discussion, along with a related presentation, are also available on EOG's website at http://investors.eogresources.com/investors.

2025-11-05

HighPeak Energy, Inc. (HPK) Q3 Earnings and Revenues Lag Estimates

Description: HighPeak Energy (HPK) delivered earnings and revenue surprises of -62.50% and -8.39%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-11-04

California Resources Corporation (CRC) Surpasses Q3 Earnings Estimates

Description: California Resources (CRC) delivered earnings and revenue surprises of +11.45% and -2.74%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Is Wall Street Bullish or Bearish on EOG Resources Stock?

Description: Are Wall Street analysts predicting gains for energy company EOG Resources?

2025-11-03

2025-11-02

2025-11-01

2025-10-31

How Recent Analyst Shifts Are Reshaping the Story and Valuation for EOG Resources

Description: Analyst consensus for EOG Resources has shifted slightly, with the average fair value estimate nudging down from $139.17 to $137.13. This minor adjustment reflects a mix of optimistic views on EOG’s long-term potential alongside cautious concerns regarding near-term headwinds and valuation. Stay tuned to discover how you can keep ahead of evolving analyst perspectives and track the narrative as it develops. Analyst Price Targets don't always capture the full story. Head over to our Company...

EOG Poised to Report Q3 Earnings: Here's What You Need to Know

Description: EOG is set to post Q3 results on Nov. 6. Earnings are expected to have declined year over year despite strong production growth.

Investing in EOG Resources (NYSE:EOG) five years ago would have delivered you a 277% gain

Description: When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose...

2025-10-30

Analysts Estimate EOG Resources (EOG) to Report a Decline in Earnings: What to Look Out for

Description: EOG Resources (EOG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Piper Sandler Reduces PT on EOG Resources (EOG) Stock

Description: EOG Resources, Inc. (NYSE:EOG) is one of the Best Bargain Stocks to Buy in November. On October 21, Piper Sandler reduced the price target on the company’s stock to $129 from $136, while keeping a “Neutral” rating, as reported by The Fly. Heading into Q3 2025 earnings, the conversations around E&P are focused on improvement in intermediate-term oil […]

2025-10-29

Rising Phoenix Capital Announces Strategic Eagle Ford Acquisition and Final Placement for Maroon Bells Income Fund

Description: DALLAS, October 29, 2025--Rising Phoenix Capital, a Dallas-based investment firm specializing in oil and gas mineral royalties, today announced the acquisition of 249.05 net royalty acres (NRA) in the core of the Eagle Ford Shale, operated by EOG Resources Inc. and Lewis Energy Group. The acquisition marks the final placement for Maroon Bells LP, part of Rising Phoenix’s broader Income Strategy platform focused on acquiring producing mineral assets that generate steady, yield-driven returns. Wit

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Oil Rallies on Trump Sanctions. Traders See a Head-Fake.

Description: Oil prices were rallying Thursday after President Donald Trump imposed sanctions on Russian producers Rosneft and Lukoil. Brent crude futures, the international benchmark, rose 5.9% to $66.29 a barrel. West Texas Intermediate ( WTI ) was up 6.3% to $62.17 a barrel, its largest gain since June.

Do Analyst Updates and Portfolio Shifts Foreshadow a New Chapter for EOG Resources (EOG)?

Description: Several brokerage firms have recently updated their research on EOG Resources, maintaining neutral to positive ratings while revising key assumptions prior to the company's third-quarter earnings announcement. An institutional investor, Northside Capital Management, has reduced its EOG Resources holdings by around 30% as part of a broader adjustment in its energy sector exposure, reflecting ongoing portfolio rebalancing trends among large funds. We’ll consider how these analyst revisions and...

EOG Resources Earnings Preview: What to Expect

Description: Energy sector giant EOG Resources is gearing up to announce its Q3 results by early November, and analysts expect a notable double-digit drop in earnings.

2025-10-22

U.S. Upstream Oil & Gas Dealmaking Falls Again Amid Low Oil Prices

Description: Mergers and acquisitions in the U.S. upstream oil and gas sector fell for a third straight quarter, marking an end to blockbuster takeovers seen in recent years amid persistently low energy prices

Oil Stocks Look Shaky In Selloff. These Are 2 Potential Buys.

Description: Oil prices are in a rut, and could keep falling. Oil stocks have so far fared better, but the reality of a weak market may eventually catch up to them. Oil was rising on Wednesday, but has been in a gradual selloff for weeks, dropping about 20% for the year.

EOG Resources (EOG): Exploring Valuation After Recent Share Price Decline

Description: EOG Resources (EOG) shares have drifted lower over the past month, continuing a downward trend seen since the start of the year. The stock’s recent moves have investors reassessing EOG’s current valuation and longer-term growth outlook. See our latest analysis for EOG Resources. EOG’s share price has come under steady pressure, with a 14.97% decline year-to-date and a 12.28% total shareholder return loss over one year, hinting at fading momentum. While there is no dramatic news event driving...

2025-10-21

2025-10-20

2025-10-19

EOG Resources Inc. (EOG) is a ‘Buy’ on Encino Integration and Expansion Plans: UBS

Description: EOG Resources Inc. (NYSE:EOG) is one of the most profitable energy stocks to buy right now. On October 9, analysts at UBS reiterated a ‘Buy’ rating on the stock with a $144 price target following a tour of the company’s facilities in Ohio. Following the tour, the investment bank remains buoyed by the development of EOG’s […]