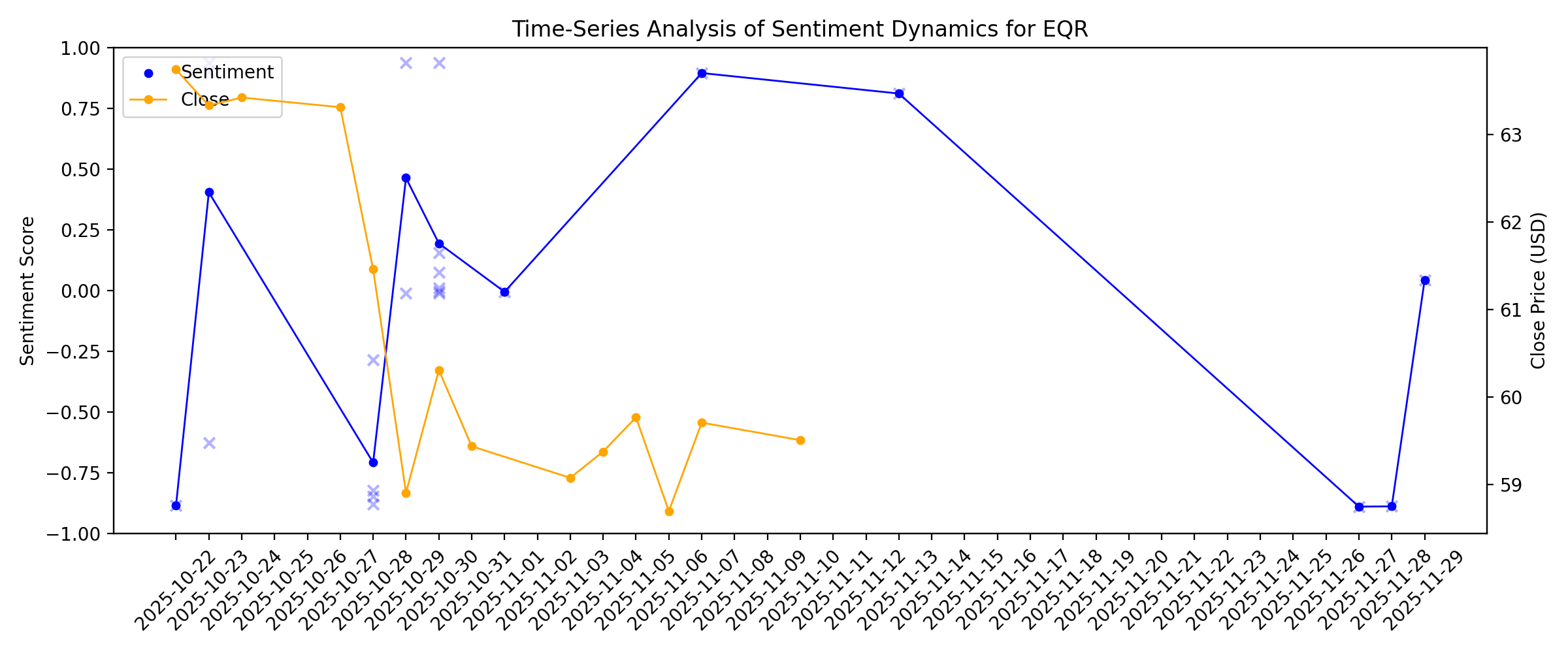

News sentiment analysis for EQR

Sentiment chart

2026-01-14

Equity Residential price target raised to $78 from $77 at Barclays

Description: Barclays analyst Richard Hightower raised the firm’s price target on Equity Residential (EQR) to $78 from $77 and keeps an Overweight rating on the shares. The firm adjusted ratings and targets in the real estate investment trust group as part of its 2026 outlook. It sees the most upside in apartments, storage, and single family rentals in 2026, and is least positive on cold storage and retail. Barclays remains Neutral on REITs overall for 2026,Claim 70% Off TipRanks PremiumUnlock hedge fund-lev

2026-01-13

Equity Residential Announces Fourth Quarter 2025 Earnings Release Date

Description: CHICAGO, January 13, 2026--Equity Residential (NYSE: EQR) today announced that the Company will release its fourth quarter 2025 operating results on Thursday, February 5, 2026, after the close of market and host a conference call to discuss those results on Friday, February 6, 2026, at 9:00 am Central. The conference call will be available via webcast on the Investor section of www.equityapartments.com.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

The most active multifamily firms to end 2025

Description: JRK bought a portfolio from EQR, while Bell and Aimco closed out the year with multiple-asset deals.

2026-01-07

2026-01-06

2026-01-05

What to Expect From Equity Residential’s Q4 2025 Earnings Report

Description: Equity Residential’s Q4 earnings is drawing significant investor attention, with analysts expressing a generally positive outlook on its stock performance.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Equity Residential (EQR): Assessing Valuation After a Recent Pullback in Share Price

Description: Equity Residential (EQR) has been drifting quietly this month, so it is a good moment to step back and ask what the recent pullback and mixed growth numbers really imply for long term investors. See our latest analysis for Equity Residential. Despite the recent wobble, with a 1 day share price return of minus 1.16 percent and the stock now at 61.37 dollars, Equity Residential’s 1 year total shareholder return of minus 10.48 percent contrasts with a solid 5 year total shareholder return of...

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Regency Centers Elects Mark J. Parrell to Board of Directors

Description: JACKSONVILLE, Fla., Dec. 16, 2025 (GLOBE NEWSWIRE) -- Regency Centers Corporation (“Regency Centers” or “Regency”) (Nasdaq: REG) today announced the election of Mark J. Parrell to its Board of Directors (the “Board”), effective January 1, 2026. With the addition of Mr. Parrell as an independent director, Regency will expand the size of its Board to twelve directors. “We are delighted to welcome Mark to our Board,” said Martin E. “Hap” Stein, Jr., Executive Chair of Regency Centers. “His proven l

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Equity Residential Declares Fourth Quarter Dividends

Description: CHICAGO, December 11, 2025--Equity Residential (NYSE: EQR) today announced that its Board of Trustees declared quarterly dividends on the Company’s common and preferred shares. A regular common share dividend for the fourth quarter of $0.6925 per share will be paid on January 16, 2026 to shareholders of record on January 2, 2026.

2025-12-10

2025-12-09

Is Equity Residential Stock Underperforming the Nasdaq?

Description: Although Equity Residential has underperformed the Nasdaq recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

How To Put $100 In Your Retirement Fund Each Month With Equity Residential Stock

Description: Equity Residential (NYSE:EQR) is a real estate investment trust that acquires, develops, and manages apartment properties in major U.S. urban and suburban markets. It will report its Q4 2025 earnings on Feb. 2. Wall Street analysts expect the company ...

2025-12-01

2025-11-30

2025-11-29

Is There an Opportunity in Equity Residential After Shares Rise 4.8% This Month?

Description: Wondering if Equity Residential is a hidden bargain or just another real estate stock? Let's take a closer look at what the market and the numbers are actually saying. The stock has seen a recent uptick, rising 2.0% over the last week and 4.8% over the past month, though it is still down 11.9% year-to-date and 16.2% over the past year. Many investors are watching closely as news emerges about shifting rental demand in major urban centers and changing interest rate expectations. Both factors...

2025-11-28

Mid-America Apartment Communities (MAA) Up 5.2% Since Last Earnings Report: Can It Continue?

Description: Mid-America Apartment Communities (MAA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

Equity Residential (EQR) Up 4.5% Since Last Earnings Report: Can It Continue?

Description: Equity Residential (EQR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Are Wall Street Analysts Predicting Equity Residential Stock Will Climb or Sink?

Description: Equity Residential has notably underperformed the broader market over the past year, yet analysts remain optimistic about the stock’s prospects.

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Camden's Q3 FFO Beat, Revenues Up Y/Y, '25 View Raised

Description: CPT's Q3 FFO beat is a result of higher lease rates and same-property revenues, though rising interest costs trim growth.

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

Equity Residential (EQR): Exploring Valuation After Recent Weakness in Share Price

Description: Equity Residential (EQR) has moved quietly over the past week, with shares slipping around 6% during that stretch. For investors tracking U.S. real estate stocks, EQR’s price action may prompt a closer look at what is driving recent sentiment. See our latest analysis for Equity Residential. Equity Residential’s recent downward trend, with the share price slipping over 7% in the past month and sitting at $59.44, reflects some fading momentum for REITs as investors weigh growth prospects and...

2025-10-31

2025-10-30

Equity Residential (EQR) Q3 2025 Earnings Call Highlights: Navigating Market Challenges with ...

Description: Equity Residential (EQR) reports record resident retention and strategic stock repurchases amid market headwinds and revised guidance.

AvalonBay Q3 FFO & Revenues Miss Estimates, '25 Outlook Lowered

Description: AVB's Q3 results fall short of estimates, prompting the REIT to trim its 2025 outlook despite steady rent and occupancy gains.

UDR's Q3 FFOA Beats Estimates, Revenues & Same-Store NOI Grow

Description: UDR posts higher Q3 FFOA and raises full-year guidance, fueled by rent growth and resilient same-store NOI performance.

Mid-America Apartment's Q3 FFO & Revenues Lag Estimates, Rent Declines

Description: MAA's Q3 results highlight a slight FFO miss and softer same-store revenues, but low resident turnover and active development plans support stability.

One-Off Gain Drives Profit Margin Higher at Equity Residential (EQR), Raising Quality Concerns

Description: Equity Residential (EQR) delivered a profit margin of 37.5%, increasing from 31.5% a year ago, as earnings grew 24.8% year over year. This growth far outpaces its 5-year average of just 0.7% per year. While revenue is projected to rise at 4.2% per year, which lags the broader US market's expected 10.2% annual growth, analysts see earnings declining at a pace of -17.9% per year over the next three years. The company now trades at a Price-To-Earnings Ratio of 19.4x, which is well below both...

How the Narrative Around Equity Residential Shares Is Shifting After Recent Sector Developments

Description: Equity Residential's fair value estimate was recently lowered slightly, moving from $73.80 to $73.35 per share following new analysis that reflects updated outlooks. The discount rate rose only fractionally, indicating a minor adjustment in risk perceptions among analysts. With sentiment shifting across the apartment REIT sector, readers will want to follow along to see how changing analyst narratives might shape future expectations for Equity Residential. Analyst Price Targets don't always...

2025-10-29

Equity Residential Q3 FFO Meets Estimates, Rental Income Rises Y/Y

Description: EQR posts solid Q3 results with FFO up 4.1% year over year and rental income surpassing estimates, driven by higher occupancy and rents.

EQR sees September slowdown in traffic

Description: The REIT saw foot traffic weaken amid heavy supply in many markets, per Equity Residential’s third-quarter earnings call.

2025-10-28

Equity Residential (EQR) Reports Q3 Earnings: What Key Metrics Have to Say

Description: The headline numbers for Equity Residential (EQR) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Equity Residential (EQR) Meets Q3 FFO Estimates

Description: Equity Residential (EQR) delivered FFO and revenue surprises of 0.00% and +0.13%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Equity Residential: Q3 Earnings Snapshot

Description: The Chicago-based real estate investment trust said it had funds from operations of $399.2 million, or $1.02 per share, in the period. The average estimate of 10 analysts surveyed by Zacks Investment Research was for funds from operations of $1.02 per share. Funds from operations is a closely watched measure in the REIT industry.

Equity Residential Reports Third Quarter 2025 Results

Description: CHICAGO, October 28, 2025--Equity Residential (NYSE: EQR) today reported results for the quarter and nine months ended September 30, 2025.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Equity Residential Issues 2025 Corporate Responsibility Report

Description: CHICAGO, October 23, 2025--Equity Residential (NYSE: EQR), a recognized leader in corporate responsibility, today announced the publication of its 2025 Corporate Responsibility report. The report describes the Company’s strategies around sustainability, employee development, customer engagement, community service and governance as well as its goals and achievements in these areas.

What's in Store for Equity Residential Stock in Q3 Earnings?

Description: EQR's Q3 results are expected to show gains in revenues and FFO per share, driven by steady occupancy and portfolio diversity in a cooling rental market.

How Investors May Respond To Equity Residential (EQR) Analyst Upgrade Highlighting Yield and Value Potential

Description: Earlier this week, Equity Residential received a prominent analyst upgrade to "Strong Buy," citing the company's rare value and upside potential in a market seen as overvalued, with strengths including strong apartment demand and a diversified coastal and Sunbelt presence. A unique aspect highlighted is Equity Residential’s historically high 4.5% yield, which, coupled with resilient leasing spreads, supports expectations for ongoing steady growth and capital appreciation potential through...

2025-10-22

Veris Residential (VRE) Surpasses Q3 FFO Estimates

Description: Veris (VRE) delivered FFO and revenue surprises of +33.33% and -2.06%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?