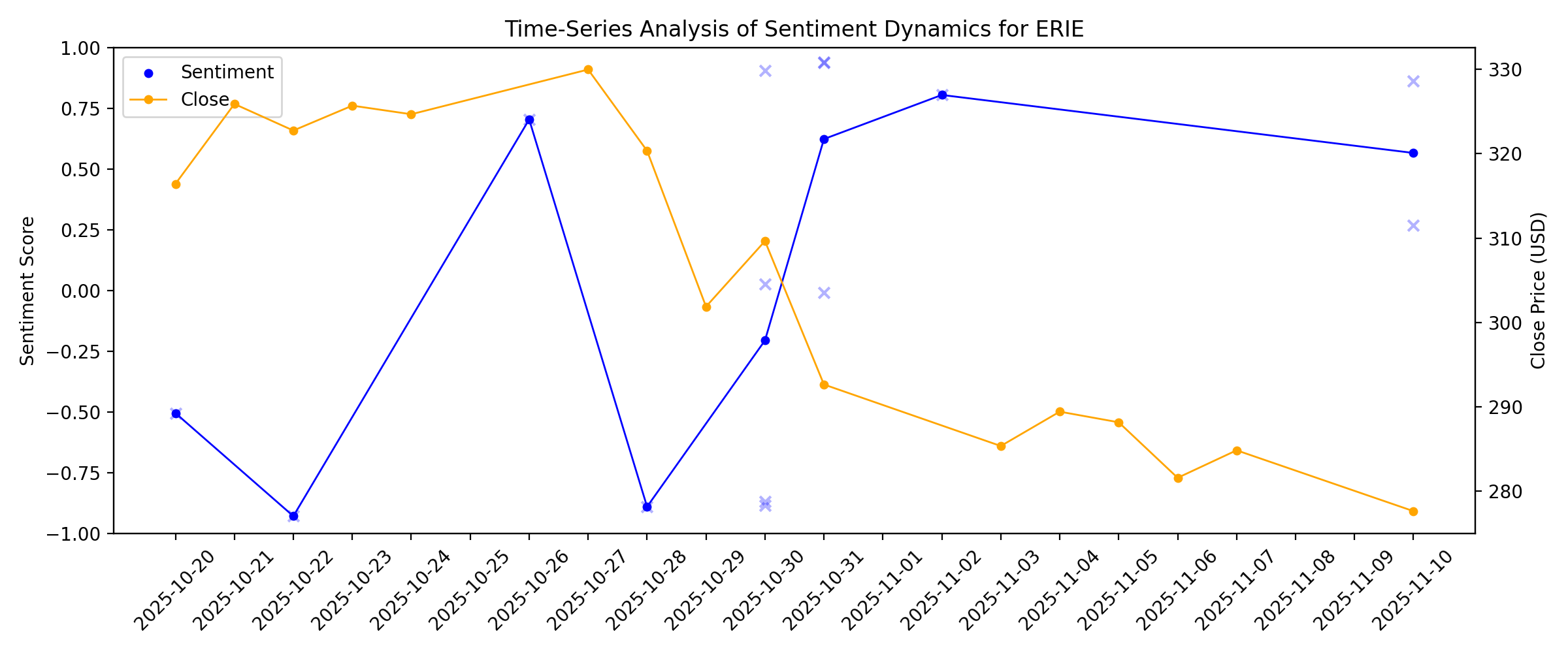

News sentiment analysis for ERIE

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Income Investors Can Trust Erie Indemnity’s Fortress Balance Sheet and Low Payout

Description: Erie Indemnity (NASDAQ:ERIE) operates as the management company for Erie Insurance Exchange, one of the nation’s largest property and casualty insurers. The company just raised its dividend 7.1% despite the stock falling nearly 30% in 2025. Can Erie Indemnity afford to keep paying shareholders? I think so, and here’s why: Metric Value Annual Dividend $5.46 ... Income Investors Can Trust Erie Indemnity’s Fortress Balance Sheet and Low Payout

2025-12-18

2025-12-17

2025-12-16

Erie Indemnity (NASDAQ:ERIE) Will Pay A Larger Dividend Than Last Year At $1.46

Description: Erie Indemnity Company's ( NASDAQ:ERIE ) dividend will be increasing from last year's payment of the same period to...

2025-12-15

Does Erie Indemnity’s 30% Slide in 2024 Create a Long Term Opportunity?

Description: If you are wondering whether Erie Indemnity at around $287 a share is a beaten-down opportunity or a value trap, you are not alone. That is exactly what this breakdown is going to unpack. After sliding 3.1% over the last week and sitting roughly 30.7% lower than a year ago, the stock has given back a lot of its earlier gains, even though it is still up 27.0% over five years. Much of this shift in sentiment has been tied to evolving views on the insurance sector and how investors are weighing...

2025-12-14

2025-12-13

2025-12-12

Is Erie Indemnity Stock Underperforming the S&P 500?

Description: While Erie Indemnity has lagged behind the S&P 500 Index over the past year, analysts are moderately optimistic about the stock’s prospects.

2025-12-11

Erie Indemnity Approves Management Fee Rate and Dividend Increase, Declares Regular Dividends

Description: At its regular meeting held Dec. 9, 2025, the Board of Directors of Erie Indemnity Company (NASDAQ: ERIE) set the management fee rate charged to Erie Insurance Exchange, approved an increase in shareholder dividends and declared the regular quarterly dividend. Erie Indemnity Company has paid regular shareholder dividends since 1933.

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

A Look at Erie Indemnity’s (ERIE) Valuation Following Strong Q3 Results and Earnings Growth

Description: Erie Indemnity (ERIE) just posted its third quarter earnings, highlighting increases in both revenue and net income compared to last year. The latest results point to ongoing improvements across the business. See our latest analysis for Erie Indemnity. Despite posting stronger revenue and profits this quarter, Erie Indemnity's share price has pulled back. It is now sitting at $277.63 after a 14.4% drop over the past month and a 32.2% year-to-date decline. The one-year total shareholder return...

Is Wall Street Bullish or Bearish on Erie Indemnity Stock?

Description: Even though Erie Indemnity has lagged behind the broader market over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

Erie Indemnity (ERIE) Q3 2025 Earnings Transcript

Description: Need a quote from a Motley Fool analyst? As we start today's call, I want to share an important update regarding our financial strength rating. In September, AM Best adjusted the financial strength rating of the property casualty members of Erie Insurance Group from A+ Superior to A Excellent.

2025-11-01

2025-10-31

Erie Indemnity (ERIE) Margin Gain Reinforces Defensive Stock Narrative Despite Premium Valuation

Description: Erie Indemnity (ERIE) reported EPS growth of 19.5% per year on average over the past five years and posted 15.9% earnings growth for the current year. The company’s net profit margin improved to 16%, up from 15.2% a year ago, with earnings quality rated as high. These results underline steady profitability, though both profit and revenue growth are running behind broader US market expectations. See our full analysis for Erie Indemnity. Next, we will see how these results measure up against...

Erie Indemnity Co (ERIE) Q3 2025 Earnings Call Highlights: Strong Income Growth Amidst Weather ...

Description: Erie Indemnity Co (ERIE) reports a 14% increase in net income despite facing profitability challenges from severe weather events.

Why Erie Indemnity (ERIE) Shares Are Trading Lower Today

Description: Shares of insurance management company Erie Indemnity (NASDAQ:ERIE) fell 6.6% in the afternoon session after the company reported mixed third-quarter financial results that saw profits beat expectations while revenue fell short.

2025-10-30

Erie Indemnity (ERIE) Q3 Earnings Surpass Estimates

Description: Erie Indemnity (ERIE) delivered earnings and revenue surprises of +3.86% and -1.64%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Erie Indemnity (NASDAQ:ERIE) Misses Q3 Revenue Estimates

Description: Insurance management company Erie Indemnity (NASDAQ:ERIE) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 6.7% year on year to $1.07 billion. Its GAAP profit of $3.50 per share was 3.9% above analysts’ consensus estimates.

Erie Indemnity: Q3 Earnings Snapshot

Description: ERIE, Pa. AP) — Erie Indemnity Co. (ERIE) on Thursday reported profit of $182.9 million in its third quarter. On a per-share basis, the Erie, Pennsylvania-based company said it had profit of $3.50.

Erie Indemnity Reports Third Quarter 2025 Results

Description: Erie Indemnity Company (NASDAQ: ERIE) today announced financial results for the quarter and nine months ending September 30, 2025. Net income was $182.9 million, or $3.50 per diluted share, in the third quarter of 2025, compared to $159.8 million, or $3.06 per diluted share, in the third quarter of 2024. Net income was $496.0 million, or $9.48 per diluted share, in the first nine months of 2025, compared to $448.3 million, or $8.57 per diluted share, in the first nine months of 2024.

2025-10-29

2025-10-28

Erie Indemnity (ERIE) To Report Earnings Tomorrow: Here Is What To Expect

Description: Insurance management company Erie Indemnity (NASDAQ:ERIE) will be reporting results this Thursday after the bell. Here’s what investors should know.

2025-10-27

2025-10-26

How Will Insurance Regulation News Impact Erie Indemnity’s 2025 Valuation?

Description: Thinking about what to do with your Erie Indemnity shares or pondering if now is the moment to jump in? You are far from alone. This is a company that longtime investors know well, but given its dramatic price swings over recent months, everyone is taking another look. After five years of impressive gains, climbing over 53.8%, 2024 has brought a sharp shift. The last week shows some green, with a 2.5% rise, and the last month is not far behind at 2.7%. However, when looking at the year as a...

2025-10-25

2025-10-24

2025-10-23

2025-10-22

Erie Indemnity to host third quarter 2025 pre-recorded conference call and webcast

Description: Erie Indemnity Company (NASDAQ: ERIE) will host a pre-recorded audio webcast with the financial community providing financial results for the third quarter on Friday, October 31st, at 10 a.m. Eastern Time. Erie Indemnity will issue a press release reporting its results after the close of the market on Thursday, October 30th.

2025-10-21

2025-10-20

2 Mid-Cap Stocks to Consider Right Now and 1 That Underwhelm

Description: Mid-cap stocks have the best odds of scaling into $100 billion corporations thanks to their tested business models and large addressable markets. But the many opportunities in front of them attract significant competition, spanning from industry behemoths with seemingly infinite resources to small, nimble players with chips on their shoulders.