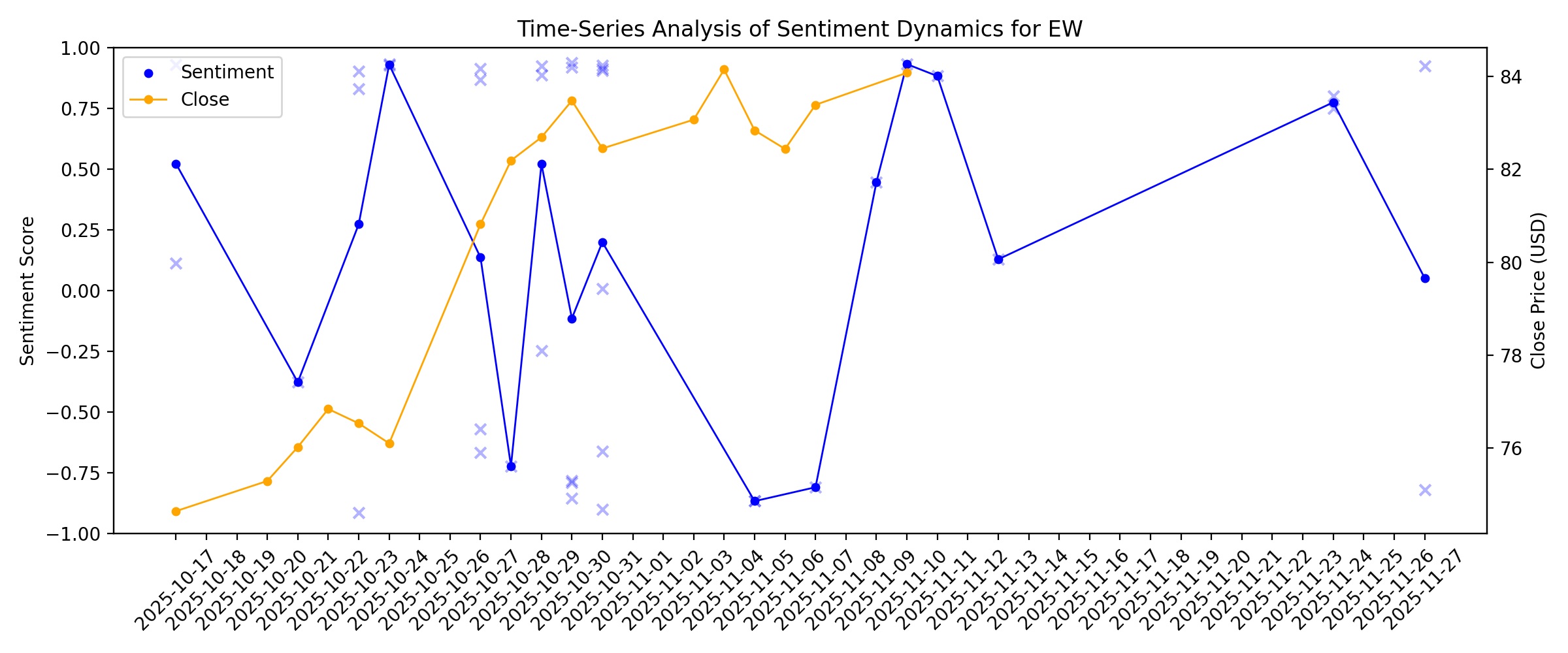

News sentiment analysis for EW

Sentiment chart

2026-01-14

Edwards Lifesciences (EW) Valuation Check As Recent Share Momentum Meets Premium P/E Pricing

Description: With no single headline event in focus, Edwards Lifesciences (EW) is drawing attention for its recent share performance and financial profile, prompting investors to reassess how its current valuation lines up with fundamentals. See our latest analysis for Edwards Lifesciences. At a share price of $83.10, Edwards Lifesciences has seen short term pressure, including a 1-day share price return decline of 0.88%. By contrast, a 90-day share price return of 14.38% and a 1-year total shareholder...

JPM26: Edwards Lifesciences targets 10% growth in 2026

Description: Edwards cited broader TAVR treatment populations and ongoing evidence generation as key growth drivers for the new year.

Is it Apt to Hold Edwards Lifesciences Stock in Your Portfolio Now?

Description: EW benefits from strong TAVR and TMTT momentum, but macro pressures and FX headwinds cloud the near-term outlook.

2026-01-13

What to Expect From Edwards Lifesciences' Q4 2025 Earnings Report

Description: Edwards Lifesciences is expected to announce its fiscal fourth-quarter earnings soon, and analysts project a single-digit earnings growth.

2026-01-12

Edwards’ JenaValve acquisition nixed as FTC injunction approved by court

Description: The FTC sued Edwards in August 2025, citing competition concerns in the nascent TAVR-AR market amid a potential deal for JenaValve.

Edwards calls off JenaValve buyout after court halts deal

Description: Edwards terminated the deal after the Federal Trade Commission moved to block the acquisition due to anticompetitive concerns.

Global Undervalued Small Caps With Insider Buying Insights

Description: As global markets kicked off the year with a strong rally, small-cap stocks have notably outperformed their large-cap counterparts, driven by investor optimism and strategic policy announcements. The Russell 2000 Index surged by 5.73%, highlighting the potential opportunities within smaller companies even as broader economic indicators show mixed signals, such as U.S. labor market weaknesses and persistent manufacturing challenges. In this dynamic environment, identifying promising small-cap...

2026-01-11

2026-01-10

2026-01-09

Edwards Comments on JenaValve Acquisition

Description: IRVINE, Calif., January 09, 2026--Edwards Lifesciences (NYSE: EW) today announced that the U.S. District Court for the District of Columbia has granted the motion from the U.S. Federal Trade Commission (FTC) for an injunction blocking the company’s proposed acquisition of JenaValve Technology. As a result, Edwards will not acquire JenaValve.

2026-01-08

Investing in Edwards Lifesciences (NYSE:EW) a year ago would have delivered you a 14% gain

Description: On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to...

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

EW Wins FDA Approval for SAPIEN M3 as First Transseptal TMVR Therapy

Description: Edwards Lifesciences wins FDA approval for SAPIEN M3, the first transseptal TMVR, expanding minimally invasive options for high-risk mitral regurgitation patients.

2025-12-25

2025-12-24

How Well Is Boston Scientific Placed for Long-Term Endoscopy Growth?

Description: BSX's Endoscopy unit targets an $8B market, spanning pancreaticobiliary, surgery and obesity, with plans to outgrow the market.

Edwards Lifesciences (EW): Assessing Valuation After Recent Share Price Strength

Description: Edwards Lifesciences (EW) has been quietly rewarding patient investors, with shares up about 15% over the past 3 months and roughly 19% year to date, outpacing many large-cap healthcare peers. See our latest analysis for Edwards Lifesciences. At around $86.23 per share, Edwards Lifesciences has seen its recent share price returns strengthen, with the solid 90 day share price return hinting that investors are growing more comfortable with its growth profile despite a softer 5 year total...

2025-12-23

The Zacks Analyst Blog Highlights Cardinal Health, Medtronic, Intuitive Surgical and Edwards Lifesciences

Description: Cardinal Health leads Zacks' list of large-cap MedTech stocks as AI adoption, robotics and rising procedure volumes set up continued gains in 2026.

FDA Approves Edwards Lifesciences' SAPIEN M3 Mitral Valve Replacement System as First Transseptal Transcatheter Therapy

Description: IRVINE, Calif., December 23, 2025--Edwards Lifesciences (NYSE: EW) today announced the company’s SAPIEN M3 mitral valve replacement system is the first transcatheter therapy utilizing a transseptal approach to receive U.S. Food and Drug Administration (FDA) approval for the treatment of mitral regurgitation (MR). The SAPIEN M3 transcatheter mitral valve replacement (TMVR) system is indicated for the treatment of symptomatic moderate-to-severe or severe MR in patients who are deemed unsuitable fo

2025-12-22

4 Large-Cap MedTech Stocks to Keep Winning Streaks Alive in 2026

Description: Four large-cap MedTech leaders, MDT, ISRG, CAH, EW, appear well-positioned to extend their winning streaks in 2026 on resilient procedure demand and innovation.

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Edwards Lifesciences to Present at the 44th Annual J.P. Morgan Healthcare Conference

Description: IRVINE, Calif., December 18, 2025--Edwards Lifesciences Corporation (NYSE: EW) today announced it will participate in the J.P. Morgan Healthcare Conference on Monday, Jan. 12, 2026.

2025-12-17

2025-12-16

2025-12-15

2025-12-14

Is There Now An Opportunity In Edwards Lifesciences Corporation (NYSE:EW)?

Description: Today we're going to take a look at the well-established Edwards Lifesciences Corporation ( NYSE:EW ). The company's...

2025-12-13

2025-12-12

Exploring Global Markets With 3 Undervalued Small Caps And Insider Activity

Description: As global markets navigate the anticipation of an interest rate cut from the Federal Reserve, small-cap stocks have shown resilience, with the Russell 2000 Index advancing amid a backdrop of mixed economic indicators. In this environment, identifying promising small-cap companies often involves looking at those with strong fundamentals and potential growth drivers that align well with current market conditions.

2025-12-11

Should You Continue to Hold EW Stock in Your Portfolio?

Description: Edwards Lifesciences leans on growth in Surgical Structural Heart, TAVR and TMTT, though macro pressures and litigation continue to weigh on margins.

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Will Edwards Lifesciences’ (EW) Upgraded 2025–2026 Outlook Reshape Its Long-Term Growth Narrative?

Description: Edwards Lifesciences’ recent Investor Day outlined upgraded 2025 revenue growth expectations of about 9%–10% and introduced 2026 adjusted EPS guidance of US$2.80–US$2.95, alongside anticipated constant-currency sales growth of 8%–10%. The company underscored its transcatheter aortic valve replacement franchise as a central growth engine, reinforcing confidence in long-term opportunities despite tariff headwinds, competitive pressures, and acquisition-related earnings dilution risks. We’ll...

Sector Update: Health Care Stocks Lower Late Afternoon

Description: Health care stocks declined late Friday afternoon, with the NYSE Health Care Index falling 0.3% and

Edwards Lifesciences (EW): Reassessing Valuation After Upbeat 2025–2026 Outlook and TAVR Growth Signals

Description: Edwards Lifesciences (EW) used its annual investor day to lift its 2025 revenue outlook and lay out fresh 2026 guidance, reinforcing the case that its TAVR franchise is still doing the heavy lifting. See our latest analysis for Edwards Lifesciences. The guidance bump comes after a strong third quarter and upbeat TAVR data, and the market has taken notice, with an 18.17% year to date share price return and a 1 year total shareholder return of 18.43%, signaling that momentum is building...

Edwards Lifesciences' Long-term Business Outlook Appears Achievable, RBC Says

Description: Edwards Lifesciences (EW) reiterated its long-term business outlook on a growing portfolio of struct

2025-12-04

Edwards Lifesciences Reaffirms Strategy for Sustainable, Differentiated Growth at Annual Investor Conference

Description: IRVINE, Calif., December 04, 2025--Edwards Lifesciences (NYSE: EW) will outline its patient-focused strategy and share financial guidance during its annual investor conference. Entering 2026 with momentum for sustainable differentiated growth, Edwards is uniquely positioned with leading therapies across its core structural heart innovations for patients with aortic stenosis (AS), mitral regurgitation (MR), tricuspid regurgitation (TR) and pulmonic diseases, and expanding into emerging opportunit

2025-12-03

Cooper Companies to Post Q4 Earnings: What's in Store for the Stock?

Description: COO is set to post Q4 earnings as MyDAY momentum offsets Clariti and APAC softness, with revenues and earnings expected to rise.

2025-12-02

How Is Edwards Lifesciences’ Stock Performance Compared to Other Medical Device Stocks?

Description: Edwards Lifesciences has notably outperformed the broader market over the past year, and analysts remain bullish on the stock’s prospects.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Edwards Lifesciences (EW) Earnings Transcript

Description: Bernard Zovighian: Thank you, Mark and welcome everyone. This strong Q3 results represent another quarter of double-digit sales growth. Sales in the quarter grew 12.6% to $1.55 billion driven by our comprehensive portfolio across multiple therapeutic areas, aortic, pulmonic, mitral and tricuspid as well and -- as well as an established presence in countries around the world.

Edwards Lifesciences' (NYSE:EW) investors will be pleased with their 20% return over the last year

Description: If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost...

2025-11-26

2025-11-25

2025-11-24

Indian MedTech Company Makes a Global Mark at PCR London Valves 2025

Description: Underscoring India's rising influence in global cardiovascular innovation, Meril Life Sciences presented the one-year outcomes from the pivotal LANDMARK Randomized Controlled Trial (RCT) during the Late-Breaking Trial sessions at PCR London Valves 2025, one of the world's most respected structural heart conferences. This milestone marks a significant moment for Indian MedTech, as the indigenous, balloon-expandable Myval THV series is directly compared with leading international transcatheter val

BSX vs. EW: Which Heart Device Stock Is the Smarter Investment Now?

Description: Boston Scientific's EP breadth, WATCHMAN momentum and acquisitions give it an edge over Edwards in cardiovascular devices.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Exploring 3 Undervalued Small Caps In Global With Insider Buying

Description: As global markets grapple with a range of challenges, including a record U.S. federal government shutdown and declining consumer sentiment, small-cap stocks have been under particular scrutiny amid these turbulent conditions. With the S&P 600 for small-cap stocks experiencing fluctuations, investors are increasingly looking at companies where insider buying may indicate confidence in long-term prospects despite broader market uncertainties. In such an environment, identifying stocks that show...

2025-11-12

2025-11-11

Edwards Lifesciences Stock: Is Wall Street Bullish or Bearish?

Description: Although Edwards Lifesciences has outpaced the broader market over the past year, analysts remain measured in their expectations, maintaining a cautiously optimistic view as they look for continued execution and sustained growth drivers.

2025-11-10

Edwards Lifesciences (EW): Exploring Valuation as Earnings Upgrades and Guidance Fuel Options Market Volatility

Description: Edwards Lifesciences (EW) shares have drawn fresh attention as heightened implied volatility in the options market coincides with upgraded earnings estimates and increased full-year sales growth guidance. This signals increased anticipation ahead of upcoming earnings. See our latest analysis for Edwards Lifesciences. Edwards Lifesciences has enjoyed a solid stretch, with a 13.71% one-month share price return and a 15.83% gain year-to-date, further buoyed by upbeat earnings, a CFO transition...

2025-11-09

Edwards Champions American Heart Association Initiative to Reduce Deaths, Improve Care for Patients With Heart Valve Disease

Description: NEW ORLEANS, November 09, 2025--Edwards Lifesciences (NYSE: EW) today announced its founding sponsorship of the American Heart Association’s Heart Valve Initiative, a national effort to improve care and outcomes for the more than 28 million people living with heart valve disease worldwide. In the U.S. alone, valve disease contributes to more than 60,000 deaths annually, many driven by delayed diagnosis or treatment.

2025-11-08

2025-11-07

Top Analyst Reports for JPMorgan Chase, Salesforce & Arista Networks

Description: JPMorgan Chase, Salesforce and Arista Networks headline new analyst reports highlighting growth drivers, cost pressures and competitive dynamics.

2025-11-06

2025-11-05

Do Options Traders Know Something About Edwards Lifesciences Stock We Don't?

Description: Investors need to pay close attention to EW stock based on the movements in the options market lately.

Is the Options Market Predicting a Spike in Edwards Lifesciences Stock?

Description: Investors need to pay close attention to EW stock based on the movements in the options market lately.

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Closing Bell Movers: Amazon soars to all-time highs on earnings

Description: In the opening hour of the evening session, U.S. equity futures are notably higher, with S&P 500 up 0.5% and Nasdaq 100 contracts up 1.0%. In commodities, WTI Crude Oil is little changed just above $60 per barrel while precious metals are stronger for the 3rd day in a row – Gold is above $4,040 and Silver is approaching $49 per ounce. A strong slate of quarterly Tech results are helping stock futures restore positive sentiment in the segment that was wounded on Thursday by more dubious results o

The 'Halo Effect' Bolstering Edwards Lifesciences' Biggest Moneymaker

Description: Edwards Lifesciences stock fell Friday, though the medtech company boosted its 2025 outlook after beating quarterly calls.

Edwards CFO Scott Ullem to exit post

Description: Ullem, who has held the position for more than a decade, will transition to an advisory role after his replacement is named by mid-2026.

Demographic Megatrend: Stocks Poised to Benefit From Global Aging

Description: Global aging is reshaping healthcare demand. Discover how AbbVie, Amgen, Boston Scientific and Edwards are positioned to gain from this powerful megatrend.

EW Stock Gains on Q3 Earnings and Revenue Beat, Margins Crash

Description: Edwards Lifesciences Q3 earnings and sales beat estimates on robust TAVR and TMTT growth, though margins take a sharp hit.

Edwards boosts FY25 outlook after Q3 surpasses expectations

Description: Edwards Q3 2025 revenues grew to $1.55bn, reflecting an uplift of 14.7% from around $1.35bn in Q3 2024.

2025-10-30

Edwards Lifesciences Corp (EW) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and ...

Description: Edwards Lifesciences Corp (EW) reports a 12.6% revenue increase and raises full-year sales and EPS guidance, showcasing robust performance across therapeutic areas.

Edwards Lifesciences (EW) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: Although the revenue and EPS for Edwards Lifesciences (EW) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Edwards Jumps On Beat-And-Raise, Announces CFO Transition

Description: Edwards Lifesciences stock jumped late Thursday after the medtech company boosted its 2025 outlook after beating quarterly calls.

Edwards Lifesciences Announces CFO Transition Plan

Description: IRVINE, Calif., October 30, 2025--Edwards Lifesciences (NYSE: EW) today announced that Scott Ullem, the company’s chief financial officer, has decided to transition from his role by midyear 2026. While the company initiates a selection process to appoint a new CFO, this planned transition will enable continuity and a smooth transfer of responsibilities. Following the appointment of a new CFO, Ullem will continue in an advisory role.

Edwards Lifesciences Reports Third Quarter Results

Description: IRVINE, Calif., October 30, 2025--Edwards Lifesciences (NYSE: EW) today reported financial results for the quarter ended September 30, 2025.

2025-10-29

Why Edwards Lifesciences (EW) Is Up 7.6% After Positive Long-Term Data for SAPIEN Valve Platform

Description: In recent days, Edwards Lifesciences announced positive long-term clinical trial results for its SAPIEN TAVR technology and successful patient outcomes from real-world data on the SAPIEN M3 and EVOQUE valve systems at the annual TCT symposium. These data highlighted superior valve performance, durability, and quality-of-life improvements for patients with mitral and tricuspid valve disease, supporting Edwards’ leadership in structural heart therapies. The simultaneous presentation of...

Why Analysts Say Edwards Lifesciences Story Is Evolving With New Data and Market Shifts

Description: Edwards Lifesciences has seen its consensus analyst price target inch higher, rising from $87.73 to $88.83 as market sentiment improves. This slight increase is supported by a mix of optimism and caution in recent analyst commentaries, driven by promising clinical data and evolving market expectations. Stay tuned to learn how you can stay ahead of shifts in the Edwards Lifesciences narrative as new information becomes available. What Wall Street Has Been Saying 🐂 Bullish Takeaways Jefferies...

Skyworks upgraded, UnitedHealth downgraded: Wall Street's top analyst calls

Description: Skyworks upgraded, UnitedHealth downgraded: Wall Street's top analyst calls

2025-10-28

Exploring Analyst Estimates for Edwards Lifesciences (EW) Q3 Earnings, Beyond Revenue and EPS

Description: Besides Wall Street's top-and-bottom-line estimates for Edwards Lifesciences (EW), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

2025-10-27

Successful Patient Outcomes Demonstrated With Edwards’ SAPIEN M3 and EVOQUE Systems, New Data Presented at TCT 2025

Description: SAN FRANCISCO, October 27, 2025--Edwards Lifesciences (NYSE: EW) today announced data demonstrating successful patient outcomes supporting its portfolio of mitral and tricuspid therapies. One-year data from the ENCIRCLE single-arm pivotal trial achieved all primary and secondary endpoints for safety and effectiveness, with outcomes simultaneously published in The Lancet. Thirty-day data from the EVOQUE system STS/ACC TVT Registry, the largest real-world transcatheter tricuspid valve replacement

Edwards SAPIEN 3 TAVR Delivers Proven Long-term Benefits and Valve Performance, New Data Presented at TCT 2025

Description: SAN FRANCISCO, October 27, 2025--Edwards Lifesciences (NYSE: EW) today announced seven-year data from the PARTNER 3 trial, reaffirming the early and sustained patient benefits of Edwards TAVR. The data, which showed superior clinical outcomes at one year, also demonstrate excellent long-term valve performance and durability. Separately, 10-year results from PARTNER 2 intermediate risk studies reinforce Edwards’ leadership in setting the standard for lasting valve performance and excellent patien

Idexx Laboratories (IDXX) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Idexx (IDXX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Cardiovascular Repair & Reconstruction Devices - Global Market Forecast (2025-2032) Featuring Profiles of Medtronic, Edwards Lifesciences, Abbott Labs, Boston Scientific, Terumo and More

Description: The cardiovascular repair market is fueled by an aging population, technological advancements, and the rise in comorbidities. Opportunities lie in innovative, minimally invasive devices, value-based contracting, and regional market dynamics. Emphasizing personalized, data-driven solutions and supply chain resilience is crucial for growth. Cardiovascular Repair & Reconstruction Devices Market Cardiovascular Repair & Reconstruction Devices Market Dublin, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The "Card

2025-10-26

2025-10-25

2025-10-24

Edwards Lifesciences (EW): Revisiting Valuation and Growth Potential After Recent Share Price Swings

Description: Edwards Lifesciences (EW) shares have experienced movement recently, drawing interest from investors tracking shifts in the medical device sector. The company’s recent performance presents a useful opportunity to revisit its fundamentals, market position, and potential outlook. See our latest analysis for Edwards Lifesciences. After some recent ups and downs, Edwards Lifesciences’ share price has advanced 4.84% year-to-date. The one-year total shareholder return is 9.69%. While short-term...

Will SYK's Q3 Results Reflect MedSurg Strength & Rebound in Orthopaedics?

Description: Stryker's Q3 results are expected to highlight MedSurg strength and solid robotics-led growth in Orthopaedics, partly offset by tariff headwinds.

2025-10-23

Will RVTY Q3 Earnings Reflect Segmental Strength Amid Rising Demand?

Description: RVTY's third-quarter results are likely to reflect strong performance in the Life Sciences segment. However, the Diagnostic segment is set to face challenges in China.

Edwards Lifesciences to Host Earnings Conference Call on October 30, 2025

Description: IRVINE, Calif., October 23, 2025--Edwards Lifesciences (NYSE: EW) plans to announce its operating results for the quarter ended September 30, 2025 after the market closes on Thursday October 30, 2025, and will host a conference call at 5:00 p.m. ET that day to discuss those results.

GCC $1.25+ Bn Catheter Market Growth Trends and Forecast to 2033 Featuring Abbott, Edwards Lifesciences, BD and Co, Boston Scientific, Medtronic, Johnson & Johnson, Stryker, Teleflex

Description: The GCC catheter market is projected to grow from USD 579.83 million in 2024 to USD 1.28 billion by 2033, with a CAGR of 9.21% from 2025 to 2033. This growth is driven by an increase in chronic diseases, surgical procedures, and advanced healthcare infrastructure across GCC countries. The demand for minimally invasive treatments and the aging population further bolster market expansion. Key sectors such as cardiovascular, microcatheters, and intermittent catheters are witnessing significant grow

2025-10-22

2025-10-21

Piper Sandler Maintains Overweight on Edwards Lifesciences (EW) Ahead of PARTNER 3 7-Year Results

Description: Edwards Lifesciences Corporation (NYSE:EW) ranks among the best medical device stocks to invest in. Piper Sandler maintained its Overweight rating and $90 price target for Edwards Lifesciences Corporation (NYSE:EW) on October 7, ahead of the expected 7-year findings from Edwards’ PARTNER 3 study, which is set to be presented on October 27 at the Transcatheter […]

2025-10-20

2025-10-19

2025-10-18

2025-10-17

WST Q3 Earnings Preview: Can GLP-1 Momentum Outweigh Margin Pressure?

Description: West Pharma's Q3 numbers hinge on robust GLP-1 and biologics demand, but labor constraints, tariffs, and plant shutdowns could test its margin resilience.

Robust TAVR Growth to Drive Edwards Lifesciences' Q3 Earnings

Description: Strong TAVR demand and expanding valve therapies are set to power EW's Q3 results despite lower EPS estimates.