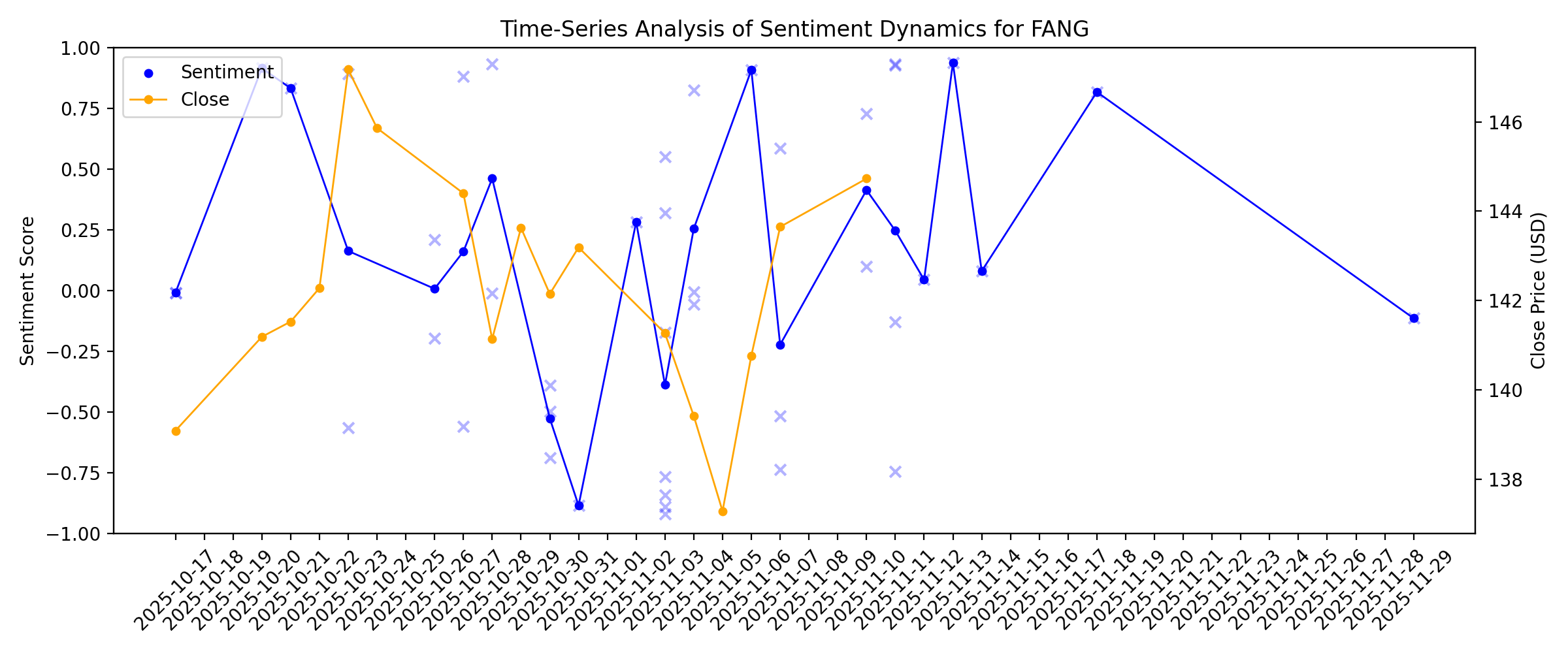

News sentiment analysis for FANG

Sentiment chart

2026-01-14

Bernstein Reduces Firm’s PT Diamondback Energy (FANG) Stock

Description: Diamondback Energy, Inc. (NASDAQ:FANG) is one of the Best Fundamental Stocks to Buy According to Analysts. On January 5, Bernstein reduced the firm’s price objective on the company’s stock to $190 from $199, while keeping an “Outperform” rating, as reported by The Fly. The firm starts 2026 by having a balanced view of oil. It expects choppiness in the […]

2026-01-13

Diamondback Energy (FANG) Gains As Market Dips: What You Should Know

Description: In the closing of the recent trading day, Diamondback Energy (FANG) stood at $151.21, denoting a +2.47% move from the preceding trading day.

Diamondback Energy Braces for Q4 Earnings Hit as Oil Prices Slide

Description: FANG signals weaker fourth-quarter pricing as oil and gas realizations fall, adding pressure on earnings across the U.S. shale sector.

2026-01-12

Diamondback Energy's (NASDAQ:FANG) investors will be pleased with their stellar 207% return over the last five years

Description: When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far...

2026-01-11

2026-01-10

5 Energy Stocks That Could Double in 2026

Description: Energy stocks delivered mixed results in 2025. As 2026 begins, several names stand out for their analyst upside targets, operational momentum, and improving fundamentals. The following five stocks offer compelling cases for significant appreciation based on current valuations, growth trajectories, and sector positioning. 5. Weatherford International Leads With Momentum and Margin Expansion Weatherford International (NASDAQ:WFRD) ... 5 Energy Stocks That Could Double in 2026

2026-01-09

2026-01-08

Analyst Trims Diamondback Energy (FANG) Price Target by $2, Keeps ‘Buy’ Rating

Description: The share price of Diamondback Energy, Inc. (NASDAQ:FANG) fell by 6.57% between December 31, 2025, and January 7, 2026, putting it among the Energy Stocks that Lost the Most This Week. Diamondback Energy, Inc. (NASDAQ:FANG) is an independent oil and natural gas company, focused on the acquisition, development, exploration, and exploitation of unconventional, onshore oil and natural […]

Trump wants oil prices to hit $50 a barrel. The math doesn't work for the US oil industry.

Description: President Trump is targeting oil prices of $50 per barrel, a tough pill to swallow for the US energy industry.

Should Weakness in Diamondback Energy, Inc.'s (NASDAQ:FANG) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

Description: With its stock down 11% over the past month, it is easy to disregard Diamondback Energy (NASDAQ:FANG). But if you pay...

2026-01-07

Diamondback Energy, Inc. Schedules Fourth Quarter 2025 Conference Call for February 24, 2026

Description: MIDLAND, Texas, Jan. 07, 2026 (GLOBE NEWSWIRE) -- Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback”), today announced that it plans to release fourth quarter 2025 financial results on February 23, 2026 after the market closes. In connection with the earnings release, Diamondback will host a conference call and webcast for investors and analysts to discuss its results for the fourth quarter of 2025 on Tuesday, February 24, 2026 at 8:00 a.m. CT. Access to the live webcast, and replay which wi

Viper Energy, Inc., a Subsidiary of Diamondback Energy, Inc., Schedules Fourth Quarter 2025 Conference Call for February 24, 2026

Description: MIDLAND, Texas, Jan. 07, 2026 (GLOBE NEWSWIRE) -- Viper Energy, Inc. (NASDAQ: VNOM) (“Viper”), a subsidiary of Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback”), today announced that it plans to release fourth quarter 2025 financial results on February 23, 2026 after the market closes. In connection with the earnings release, Viper will host a conference call and webcast for investors and analysts to discuss its results for the fourth quarter of 2025 on Tuesday, February 24, 2026 at 10:00

2026-01-06

The Venezuela News Lifted Some Oil Stocks. The Losers May Be Better Bets.

Description: U.S. shale producers took hits on Monday. Snapping up shares could pay off, but there are clear risks.

2026-01-05

Diamondback Energy (FANG) Stock Dips While Market Gains: Key Facts

Description: Diamondback Energy (FANG) closed at $146.99 in the latest trading session, marking a -3.51% move from the prior day.

Venezuela Fuels Broad Sector Rally But These Oil And Gas Plays Slide

Description: Venezuela news hit the stock market Monday, boosting many oil stocks, but several slid as natural gas prices sank.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

Diamondback Energy Insiders Sold US$365m Of Shares Suggesting Hesitancy

Description: The fact that multiple Diamondback Energy, Inc. ( NASDAQ:FANG ) insiders offloaded a considerable amount of shares over...

2025-12-31

2025-12-30

Diamondback Energy (FANG) Increases Despite Market Slip: Here's What You Need to Know

Description: Diamondback Energy (FANG) concluded the recent trading session at $151.25, signifying a +1.8% move from its prior day's close.

Stocks to Watch Tuesday: Boeing, Meta, Applied Digital, Pop Mart

Description: ↗️ Applied Digital (APLD): The artificial-intelligence infrastructure provider plans to spin out its cloud business and combine it with EKSO Bionics (EKSO). Shares in Applied Digital closed down 2.9%, while EKSO shares surged 94%.

Company News for Dec 30, 2025

Description: Companies In The Article Are:DBRG,RARE,FANG,NEM

2025-12-29

Stocks to Watch Monday Recap: Lululemon, Newmont, DigitalBridge

Description: 🔎 Lululemon (LULU): The sports-clothes maker's founder, Chip Wilson, is launching a proxy fight to remake the company’s board while Lululemon searches for a new CEO. Shares advanced 1.7%, bucking the downward trend in stocks.

Piper Sandler Says These 3 Energy Stocks Are Top Picks for 2026

Description: While the oil market can vary, much of that volatility tends to float on the surface – like oil on water. Underneath it, long-term trends – the currents in the water – are churning in the depths. Prices for hydrocarbon energy sources are tending downwards, facing pressures from a glut in global supplies, rising inventories, and lower-than-expected demand. The result: expectations of lower prices in 2026. Mark Lear, energy expert from Piper Sandler, has been watching the situation carefully in an

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Permian Operations to Drive Resilience for These 3 Oil Stocks in 2026

Description: Diamondback Energy, Exxon Mobil and Chevron leverage low-cost Permian operations, helping them stay resilient even as oil prices soften heading into 2026.

2025-12-21

2025-12-20

2025-12-19

UBS Believes Diamondback Energy (FANG) is Poised for a 2026 Breakout Following Period of Stagnation

Description: Diamondback Energy Inc. (NASDAQ:FANG) is one of the most profitable value stocks to invest in right now. On December 12, UBS raised the firm’s price target on Diamondback Energy to $194 from $174 and kept a Buy rating on the shares. Following three years of stagnant performance, the Energy sector is poised for a breakout […]

Evaluating Diamondback Energy (FANG) After Its Recent Pullback: Is the Stock Undervalued?

Description: Diamondback Energy (FANG) has been drifting lower lately, with the stock off about 5% over the past week and roughly flat over the past year, even as its multi year performance still looks strong. See our latest analysis for Diamondback Energy. The recent pullback, including a 4.6% one day share price decline to about $147, looks more like cooling momentum after a strong multi year total shareholder return near 276 percent instead of a decisive shift in the long term story. If Diamondback’s...

2025-12-18

Does Diamondback Energy’s 2025 Valuation Reflect Its Cash Flow Strength After Recent Share Price Pullback?

Description: Wondering if Diamondback Energy is a bargain or a value trap at around $147 a share? You are not alone. This breakdown is designed to give you a clear, valuation first answer. The stock is down 6.4% over the last week, 1.7% over the past month, and 11.9% year to date, but longer term shareholders are still sitting on gains of 25.4% over 3 years and 276.3% over 5 years. Recent headlines have focused on Diamondback's ongoing capital discipline and shareholder return strategy, including...

2025-12-17

Conduit Power to Develop 200 MW of Distributed Generation in ERCOT; Secures Diamondback Energy and Granite Ridge Resources as Financial Partners

Description: HOUSTON, December 17, 2025--Conduit Power, LLC ("Conduit") has entered into financial agreements with Diamondback Energy, Inc. (NASDAQ: FANG) ("Diamondback") and Granite Ridge Resources (NYSE: GRNT) ("Granite Ridge") related to Conduit’s development of 200 megawatts ("200 MWs") of new natural gas power generation assets for the sale of energy and ancillary services to the Electric Reliability Council of Texas ("ERCOT"), Texas’s largest power grid operator.

2025-12-16

Stock Market Today, Dec. 16: Energy Stocks Slide as Oil Drops to Multi-Year Lows

Description: On Dec. 16, 2025, oil’s slide to multi‑year lows rattled energy leaders and helped pull major U.S. benchmarks off recent highs.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

Wall Street Bullish on Diamondback Energy (FANG), Since Q3 2025 Results

Description: Diamondback Energy, Inc. (NASDAQ:FANG) is one of the Cheap NASDAQ Stocks to Buy Now. On December 2, Neil Mehta from Goldman Sachs reiterated a Buy rating on Diamondback Energy, Inc. (NASDAQ:FANG) with a $179 price target. On the same day, UBS reiterated a Buy rating on the stock with a price target of $174. Wall […]

2025-12-08

Morgan Stanley Keeps Diamondback (FANG) Overweight as 2025 Guidance Comes Into Focus

Description: Diamondback Energy, Inc. (NASDAQ:FANG) is included among the 14 Best US Stocks to Buy for Long Term. On November 20, Morgan Stanley analyst Devin McDermott trimmed the firm’s price target on Diamondback Energy, Inc. (NASDAQ:FANG) to $183 from $184, while maintaining an Overweight rating on the shares. The update is part of the firm’s coverage […]

2025-12-07

2025-12-06

Diamondback Energy, Inc.'s (NASDAQ:FANG) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Description: Diamondback Energy (NASDAQ:FANG) has had a great run on the share market with its stock up by a significant 16% over...

2025-12-05

How Is Diamondback Energy's Stock Performance Compared to Other Energy Stocks?

Description: Diamondback Energy has notably lagged behind other energy stocks over the past year, but analysts remain strongly bullish on the stock’s prospects.

2025-12-04

2025-12-03

Why Is Diamondback (FANG) Up 11.9% Since Last Earnings Report?

Description: Diamondback (FANG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Diamondback Energy Insiders Sold US$8.5m Of Shares Suggesting Hesitancy

Description: Many Diamondback Energy, Inc. ( NASDAQ:FANG ) insiders ditched their stock over the past year, which may be of interest...

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

The Best Energy Stock to Hold in Uncertain Times

Description: This dividend-paying oil producer appears to be an excellent value on a risk-reward basis.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Does Diamondback Energy’s Recent Acquisitions Signal a Rare Opportunity After 13% Slide in 2025?

Description: Wondering if Diamondback Energy is a hidden gem or just another oil stock? Let’s dig into whether its recent price makes it a smart pick for your portfolio. Shares have bounced up 2.6% in the past week, nudging higher by 1.8% over the last month. However, they are still down 13.4% year-to-date and 18.6% since this time last year. Recent headlines have spotlighted Diamondback’s strategic acquisitions and solid production updates, bringing renewed attention from both investors and analysts...

2025-11-13

Why Diamondback Energy (FANG) Is Up 6.5% After Q3 Earnings Beat and Higher Dividend Announcement

Description: Diamondback Energy reported significantly higher third-quarter revenue and net income for 2025, updated full-year production guidance upward, raised its cash dividend, and completed substantial share buybacks through the end of September. This combination of robust operational results and increased shareholder returns highlights Diamondback Energy’s financial strength and ongoing capital return focus. Next, we’ll explore how the improved production outlook and higher dividend reshape the...

2025-11-12

Are Wall Street Analysts Bullish on Diamondback Energy Stock?

Description: Despite Diamondback Energy's underperformance relative to the S&P 500 Index over the past year, Wall Street analysts remain bullish about the stock’s prospects.

2025-11-11

Viper Energy Q3 Earnings Beat Estimates on Higher Production

Description: VNOM's Q3 earnings beat estimates as surging oil-equivalent production offset lower realized prices and higher expenses.

Diamondback Energy Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: FANG tops Q3 earnings and revenue estimates on stronger output and lower costs, while lifting 2025 production guidance.

Is Diamondback Energy Stock a Buy on the Dip?

Description: This oil exploitation and production stock appears to be a great value on a risk-reward basis.

Diamondback (FANG) Reports Q3 Earnings: What Key Metrics Have to Say

Description: While the top- and bottom-line numbers for Diamondback (FANG) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

2025-11-10

A Fresh Look at Diamondback Energy (FANG) Valuation After Strong Q3 Results and Updated Guidance

Description: Diamondback Energy (FANG) sparked attention with its third-quarter earnings, unveiling sharp gains in both revenue and net income compared to last year. The company also announced higher production targets and reaffirmed its dividend and buyback plan. See our latest analysis for Diamondback Energy. Fuelled by strong earnings and a ramp-up in production, Diamondback Energy’s share price has inched up about 2% in the past month, but it is still trading 14% lower year-to-date. While recent...

Stock Market News for Nov 10, 2025

Description: Wall Street closed mixed on Friday, pulled up by consumer and energy stocks.

2025-11-09

2025-11-08

2025-11-07

“Buy, Buy, Buy”: Jim Cramer’s 3 Favorite Dividend Stocks Right Now

Description: As one of the pre-eminent voices on CBNC, when Jim Cramer talks, the market and investor world listens. “Mad Money” has helped propel Cramer into the stratosphere of legendary talking heads in the stock market, and he’s guided his legion of followers through bear and bullish markets time and time again. It’s for this reason ... “Buy, Buy, Buy”: Jim Cramer’s 3 Favorite Dividend Stocks Right Now

What's the Deal With Diamondback Energy Stock Right Now?

Description: Diamondback Energy has been dealing with the impact of lower crude oil prices.

EPIC Successfully Completes Sale of EPIC Crude to Plains All American

Description: HOUSTON, November 07, 2025--EPIC Midstream Holdings ("EPIC") announced that it has completed the sale of its 45% operated interest in EPIC Crude Holdings, LP ("EPIC Crude") to Plains All American Pipeline (NASDAQ: PAA)("Plains"). Plains had already completed the purchase of 55% of EPIC Crude’s non-operated interest from Diamondback Energy (NASDAQ: FANG) and Kinetik Holdings, Inc (NYSE: KNTK). EPIC Crude owns long haul crude oil pipelines and associated oil terminal/logistics facilities that serv

2025-11-06

Results: Diamondback Energy, Inc. Beat Earnings Expectations And Analysts Now Have New Forecasts

Description: A week ago, Diamondback Energy, Inc. ( NASDAQ:FANG ) came out with a strong set of third-quarter numbers that could...

2025-11-05

2025-11-04

Diamondback Energy (FANG) Margin Drops to 28.1%, Testing Optimistic Profitability Narratives

Description: Diamondback Energy (FANG) reported net profit margins of 28.1%, down from 35% a year ago, with earnings growing 30.4% year over year. This is a step below its 5-year average growth of 42.3% per year. Both revenue and earnings are projected to decline slightly at -0.2% and -0.1% per year, respectively, over the next three years. Despite these headwinds, Diamondback trades at a price-to-earnings ratio of 9.7x, well below the peer and industry averages. This valuation may help shape investor...

Diamondback Energy Inc (FANG) Q3 2025 Earnings Call Highlights: Strong Capital Discipline Amid ...

Description: Diamondback Energy Inc (FANG) showcases robust free cash flow growth and strategic asset integration while navigating macroeconomic uncertainties and cost pressures.

Why Analysts See Diamondback Energy’s Outlook Shifting Amid Evolving Market and Operational Changes

Description: Diamondback Energy stock has seen its consensus analyst price target decrease marginally from $178.54 to $178.31, reflecting a cautious shift in market sentiment. This adjustment comes as analysts consider both strong operational performance and ongoing macroeconomic uncertainties. Stay tuned to discover how investors can monitor these evolving perspectives and stay informed about future developments in Diamondback Energy’s story. Analyst Price Targets don't always capture the full story...

2025-11-03

Viper Energy (VNOM) – One of the Best High Yield Energy Stocks to Buy Now

Description: Viper Energy, Inc. (NASDAQ:VNOM) is included among the 11 Best High Yield Energy Stocks to Buy Now. Viper Energy, Inc. (NASDAQ:VNOM) is a publicly traded Delaware corporation focused on owning and acquiring mineral and royalty interests, primarily in the Permian Basin. On October 23, Jefferies analyst John Edelman initiated coverage of Viper Energy, Inc. (NASDAQ:VNOM) […]

Diamondback Energy Profit, Revenue Jump as Oil Production Rises

Description: The oil and natural gas company posted a profit of $1.02 billion in the third quarter, compared with $659 million a year earlier.

Diamondback: Q3 Earnings Snapshot

Description: MIDLAND, Texas (AP) — Diamondback Energy Inc. FANG) on Monday reported third-quarter net income of $1.02 billion. On a per-share basis, the Midland, Texas-based company said it had net income of $3.51.

Diamondback Energy, Inc. Announces Third Quarter 2025 Financial and Operating Results

Description: MIDLAND, Texas, Nov. 03, 2025 (GLOBE NEWSWIRE) -- Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback,” “we,” “our” or the “Company”) today announced financial and operating results for the third quarter ended September 30, 2025. THIRD QUARTER 2025 HIGHLIGHTS Average oil production of 503.8 MBO/d (942.9 MBOE/d)Net cash provided by operating activities of $2.4 billion; Operating Cash Flow Before Working Capital Changes1 of $2.5 billionCash capital expenditures of $774 millionFree Cash Flow1 of

Viper Energy, Inc., a Subsidiary of Diamondback Energy, Inc., Reports Third Quarter 2025 Financial and Operating Results; Announces Divestiture of Non-Permian Assets

Description: MIDLAND, Texas, Nov. 03, 2025 (GLOBE NEWSWIRE) -- Viper Energy, Inc. (NASDAQ:VNOM) (“Viper,” “we,” “our” or the “Company”), a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG) (“Diamondback”), today announced financial and operating results for the third quarter ended September 30, 2025. THIRD QUARTER HIGHLIGHTS Q3 2025 average production of 56,087 bo/d (108,859 boe/d)Q3 2025 consolidated net loss (including non-controlling interest) of $197 million; net loss attributable to Viper of $77 mill

Letter to Stockholders Issued by Diamondback Energy, Inc.

Description: MIDLAND, Texas, Nov. 03, 2025 (GLOBE NEWSWIRE) -- Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback”). Diamondback Stockholders, This letter is meant to be a supplement to our earnings release and is being furnished to the Securities and Exchange Commission (SEC) and released to our stockholders simultaneously with our earnings release. Please see the information regarding forward-looking statements and non-GAAP financial information included at the end of this letter. Macro UpdateA couple o

Diamondback Energy, Inc.'s (NASDAQ:FANG) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Description: It is hard to get excited after looking at Diamondback Energy's (NASDAQ:FANG) recent performance, when its stock has...

2025-11-02

Fed fallout, missing jobs numbers, and a busy earnings calendar: What to watch this week

Description: Markets look set to enter the fifth full week of a US government shutdown as investors parse Powell's comments, news of a trade deal between Washington and Beijing, and another mammoth week of earnings.

2025-11-01

2025-10-31

SNAP benefits expire, open enrollment, earnings: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come throughout next week, including: — The nearing expiration of SNAP benefits funding (Supplemental Nutrition Assistance Program) as a federal judge orders the Trump administration to continue funding the program. — Earnings results from Berkshire Hathaway (BRK-A, BRK-B) this Saturday and quarterly results from companies like Palantir Technologies (PLTR), Advanced Micro Devices (AMD), Qualcomm (QCOM), and McDonald's (MCD) throughout the rest of the week — The beginning of open enrollment for health insurance coverage. — Economic commentary from a handful of Federal Reserve officials. — Tesla's (TSLA) shareholder meeting, where investors will vote on CEO Elon Musk's $1 trillion executive pay package. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

2025-10-30

Susquehanna Lifts Diamondback Energy’s (FANG) Price Target to $188

Description: Diamondback Energy, Inc. (NASDAQ:FANG) is included among the 15 Dividend Growth Stocks with the Highest Growth Rates. Diamondback Energy, Inc. (NASDAQ:FANG) is an independent oil and gas producer with operations focused in the Permian Basin, a region spanning Texas and New Mexico known for its rich shale resources. The company specializes in extracting oil and […]

Unlocking Q3 Potential of Diamondback (FANG): Exploring Wall Street Estimates for Key Metrics

Description: Besides Wall Street's top-and-bottom-line estimates for Diamondback (FANG), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

Did Diamondback Energy's (FANG) Move Toward AI Power Shift Its Investment Narrative?

Description: In recent months, Diamondback Energy and other Texas oil and gas companies have begun pivoting toward powering AI-driven data centers as drilling activity in the Texas shale region slows and the state’s oil rig count reaches its lowest point in nearly four years. This shift highlights the intersection of energy supply and technology demand, with Diamondback adapting its business model to capture new opportunities arising from growing electricity needs in the AI sector. Let’s explore how...

2025-10-29

2025-10-28

Texas is facing a 'broken' shale industry. AI's power needs could be a lifeline.

Description: The oil and gas sector in Texas is struggling. Skyrocketing power demands of the data center boom could be a lifeline.

Will Diamondback's Permian Scale Drive Q3 Earnings Beat?

Description: FANG's expanded Permian footprint and surging output could set the stage for a stronger third-quarter earnings performance.

2025-10-27

Diamondback Energy (FANG) Stock Sinks As Market Gains: What You Should Know

Description: In the closing of the recent trading day, Diamondback Energy (FANG) stood at $144.4, denoting a -1% move from the preceding trading day.

Diamondback Energy (FANG) Expected to Beat Earnings Estimates: Should You Buy?

Description: Diamondback (FANG) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-26

Morgan Stanley Maintains a Buy on Diamondback Energy (FANG), Keeps the PT

Description: Diamondback Energy, Inc. (NASDAQ:FANG) is one of the Most Undervalued Long Term Stocks to Buy Right Now. On October 21, Devin McDermott from Morgan Stanley maintained a Buy rating on Diamondback Energy, Inc. (NASDAQ:FANG) with a price target of $184. In addition, on October 20, Charles Minervino from Susquehanna raised the firm’s price target on […]

Diamondback Energy (FANG): Evaluating Valuation After Recent Share Price Swings

Description: Diamondback Energy (FANG) stock has experienced mild swings over the past week, catching some attention from investors. While the company’s revenue and net income are both trending higher, the stock’s year-to-date performance remains under pressure. See our latest analysis for Diamondback Energy. Diamondback Energy’s 4.9% 7-day share price return has given investors something to cheer about after recent sluggishness, but lingering year-to-date pressure and an 18.8% drop in total shareholder...

2025-10-25

2025-10-24

2025-10-23

These 2 Oils-Energy Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Wall Street climbs to the cusp of records as oil prices jump

Description: U.S. stocks rose to the cusp of their records on Thursday, as oil prices jumped after President Donald Trump announced “massive” new sanctions on Russia’s crude industry. Companies in the oil and gas business led the way, including gains of 1.1% for Exxon Mobil, 3.1% for ConocoPhillips and 3.4% for Diamondback Energy. The hope is to convince Russia’s president, Vladimir Putin, to end the brutal war with Ukraine, and sanctions could constrict the global flow of oil.

2025-10-22

2025-10-21

Will Diamondback (FANG) Beat Estimates Again in Its Next Earnings Report?

Description: Diamondback (FANG) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2025-10-20

Diamondback Energy (FANG) Laps the Stock Market: Here's Why

Description: Diamondback Energy (FANG) concluded the recent trading session at $141.19, signifying a +1.51% move from its prior day's close.

2025-10-19

2025-10-18

2025-10-17

Is There Opportunity in Diamondback Energy After Viper Considers Sale of Non-Permian Assets?

Description: Thinking about what to do with Diamondback Energy stock? You are definitely not alone. With oil prices in flux and the energy sector always making headlines, it makes sense to take a closer look at what is driving Diamondback’s numbers and, more importantly, whether the current price is giving you a deal or setting you up for disappointment. Let us set the stage by looking at how the stock has behaved lately. Over the last week, shares have dipped by 3.3% to close at $139.44, showing some...

Exchange-Traded Funds, Equity Futures Lower Pre-Bell Friday Amid Regional Bank Woes

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.2% and the actively tr