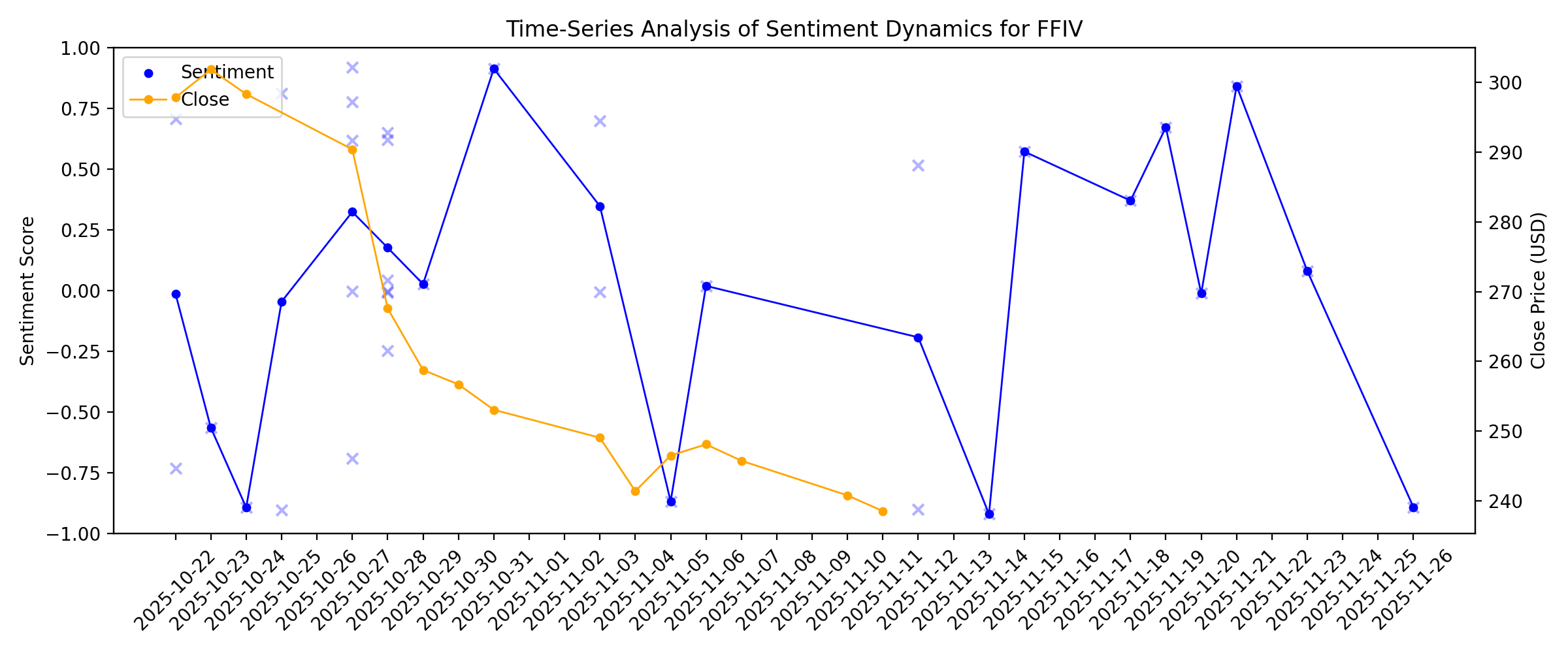

News sentiment analysis for FFIV

Sentiment chart

2026-01-14

F5 Accelerates AI Security With Integrated Runtime Protection for Enterprise AI at Scale

Description: SEATTLE, January 14, 2026--F5 (NASDAQ: FFIV) today announced general availability of F5 AI Guardrails and F5 AI Red Team, two industry-leading solutions that secure mission-critical enterprise AI systems. With these releases, F5 is the only vendor providing a comprehensive end-to-end lifecycle approach to AI runtime security, including enhanced ability to connect and protect AI agents with both out-of-the-box and custom guardrails.

2026-01-13

Allot Rises 21% in 6 Months: Should You Buy the Stock Right Now?

Description: ALLT shares climb 20.6% in six months as surging SECaaS adoption, raised guidance and improving recurring revenue strengthen Allot's growth outlook.

F5 NGINXaaS for Google Cloud Advances Cloud-Native Application Delivery and Security

Description: SEATTLE, January 13, 2026--F5 (NASDAQ: FFIV) today announced the launch of F5 NGINXaaS for Google Cloud, a fully managed, cloud-native application delivery-as-a-service solution. Developed in collaboration with Google Cloud, this innovative offering addresses the complex challenges of delivering modern and containerized applications by consolidating load balancing, security, and observability into a unified solution, helping enterprises eliminate tool sprawl, simplify operations, and reduce cost

2026-01-12

RBC Sees Opportunity in F5 Inc. (FFIV) After the Breach-Driven Pullback. Here’s Why

Description: F5 Inc. (NASDAQ:FFIV) is among the best software infrastructure stocks to buy according to hedge funds. On January 5, RBC Capital Markets upgraded F5 to Outperform from Sector Perform and raised its price target to $325 from $315, implying a further 27% upside potential. This upgrade came after substantial erosion in the stock’s value over the […]

2026-01-11

2026-01-10

2026-01-09

2026-01-08

CrowdStrike Trades at Premium Valuation: Buy, Sell or Hold the Stock?

Description: CRWD trades at a rich valuation as growth slows, but Falcon Flex momentum and expanding partnerships keep the hold case intact.

What Could Shift The Evolving F5 (FFIV) Narrative After Breach And Softer FY26 Outlook

Description: F5’s fair value estimate has been nudged higher from US$287.50 to US$290.30 per share, reflecting slightly updated revenue growth and discount rate assumptions that keep the overall view close to where it was. This refined price target sits against a mixed backdrop, with recent Street commentary balancing concerns around the security breach and softer FY26 guidance against reports of solid recent execution and deal timing rather than outright loss. Stay with this article to see how you can...

Assessing F5 (FFIV) Valuation After RBC Capital Upgrade And Easing Security Breach Concerns

Description: RBC Capital’s upgrade of F5 (FFIV) has put fresh attention on the stock, after concerns tied to the October 2025 security incident and related class action lawsuits pressured sentiment in recent months. See our latest analysis for F5. Even after the October 2025 security incident and subsequent class action filings, the recent RBC Capital upgrade comes as F5’s 7-day share price return of about 5% contrasts with a 90-day share price decline of roughly 22%. At the same time, its 3-year total...

2026-01-07

F5 to Report First Quarter Fiscal Year 2026 Financial Results

Description: SEATTLE, January 07, 2026--F5, Inc. (NASDAQ: FFIV), the global leader in delivering and securing every app and API, announced it will report its first quarter fiscal year 2026 financial results on Tuesday, January 27, 2026, following the market close. F5 will host a live webcast to discuss its results with investors and analysts beginning at 4:30 p.m. ET on January 27, 2026.

2026-01-06

FIVN vs. FFIV: Which Stock Is the Better Value Option?

Description: FIVN vs. FFIV: Which Stock Is the Better Value Option?

Can Allot's Strong SECaaS Momentum Fuel Continued ARR Growth?

Description: ALLT's SECaaS ARR surges about 60% as telecom adoption accelerates, raising hopes for more predictable growth ahead.

2026-01-05

ZoomInfo, Upstart, F5, Marqeta, and Upland Software Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investor attention turned to the annual CES 2026 technology conference in Las Vegas, with artificial intelligence emerging as a central theme.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Is There Now An Opportunity In F5, Inc. (NASDAQ:FFIV)?

Description: Let's talk about the popular F5, Inc. ( NASDAQ:FFIV ). The company's shares saw a double-digit share price rise of over...

2025-12-29

2025-12-28

Jim Cramer on NetApp: “I Think It’s an Okay Company”

Description: NetApp, Inc. (NASDAQ:NTAP) is one of the stocks Jim Cramer shared his take on. Noting that they have owned the stock for the past 25 years, a caller asked if they should continue to hold it, and Cramer commented: “Well, you know, I think it’s an okay company. It’s storage management. That’s a good business. […]

2025-12-27

2025-12-26

2025-12-25

2025-12-24

F5's Quarterly Earnings Preview: What You Need to Know

Description: F5 will release its first-quarter earnings soon, and analysts anticipate a high single-digit profit dip.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

FIVN or FFIV: Which Is the Better Value Stock Right Now?

Description: FIVN vs. FFIV: Which Stock Is the Better Value Option?

2025-12-17

Is F5 Stock Underperforming the Nasdaq?

Description: F5 has substantially underperformed the Nasdaq Composite over the past year, and analysts remain cautious about the stock’s prospects.

2025-12-16

Is It Too Late To Consider F5 After Its Strong Three Year Share Price Rally?

Description: Wondering if F5 is still a smart buy at today’s price, or if most of the upside is already baked in? You are not alone. That is exactly what we are going to unpack here. After climbing to around $263 a share, F5 is up 1.9% over the last week, 12.4% over the past month, and 84.0% over three years, which hints that the market has been steadily re-rating the stock. Recently, investors have been focused on F5’s role in securing and managing modern application traffic, as demand for resilient,...

2025-12-15

Alger Russell Innovation Index Updates for Fourth Quarter 2025

Description: Fred Alger Management, LLC ("Alger"), a privately held growth equity investment manager, today announced the quarterly rebalancing of the Alger Russell Innovation Index ("Index"). Following the close of trading on Friday, December 19, 2025, the Index will be rebalanced, and the following changes will be effective.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

F5 Elevates Application Delivery and Security Platform with Comprehensive API Discovery and Application Delivery Enhancements

Description: SEATTLE, December 10, 2025--F5 (NASDAQ: FFIV) today unveiled significant enhancements to the F5 Application Delivery and Security Platform (ADSP). The latest updates focus on strengthening API discovery capabilities, improving threat detection, and optimizing network connectivity, underscoring F5’s commitment to delivering unified visibility, security, and operational efficiencies across hybrid and multicloud environments.

Stocks making big moves yesterday: Uber, Revolve, Advance Auto Parts, CarGurus, and F5

Description: Check out the companies making headlines yesterday:

2025-12-09

Why F5 (FFIV) Stock Is Up Today

Description: Shares of application security provider F5 (NASDAQ:FFIV) jumped 4.2% in the afternoon session after the company announced an expanded collaboration with NetApp to enhance AI application performance and prepare for the post-quantum cryptography era. The partnership combined F5's application delivery and security platform with NetApp's intelligent data infrastructure. This team-up aimed to support the high-performance demands of AI workloads while also strengthening defenses against emerging cyber

Sector Update: Tech Stocks Mixed Late Afternoon

Description: Tech stocks were mixed late Tuesday afternoon, with the State Street Technology Select Sector SPDR E

F5 Expands Strategic Collaboration With NetApp to Enhance AI Application Performance and Safeguard Data With Post-Quantum Cryptography

Description: SEATTLE, December 09, 2025--F5 (NASDAQ: FFIV) today announced an expanded collaboration with NetApp, the intelligent data infrastructure company, to drive high-performance AI data delivery and prepare enterprises for the post-quantum cryptography (PQC) era. This builds on a long-standing collaboration between F5 and NetApp, and aims to address the increasing demand for secure, resilient, and scalable solutions for AI workloads and S3 storage environments.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

F5 (FFIV): Assessing Valuation After a Recent Pullback Despite Ongoing Earnings and Cash Flow Growth

Description: F5 (FFIV) has quietly slipped around 21% over the past 3 months even as its underlying business reports steady revenue and earnings gains, putting the stock in an interesting spot for patient investors. See our latest analysis for F5. That slide sits against a more mixed backdrop, with a modest year to date share price decline and a slightly negative 1 year total shareholder return, but a strong 3 year total shareholder return suggesting the longer term momentum story is intact. If F5’s move...

How Investors Are Reacting To F5 (FFIV) Insider Selling Amid Ongoing Buybacks And Analyst Skepticism

Description: In the past quarter, F5 Inc completed another US$125.0 million share repurchase tranche and saw continued insider stock sales by senior executives, including Director Alan Higginson and EVP Thomas Fountain. This combination of persistent insider selling alongside a strong sell analyst ranking, despite recent earnings beats, highlights growing concern about the company’s outlook. Next, we’ll examine how this persistent insider selling trend could affect F5’s previously optimistic investment...

2025-12-04

F5 to Participate in Upcoming Financial Conference

Description: SEATTLE, December 04, 2025--F5, Inc. (NASDAQ: FFIV), the global leader in delivering and securing every app and API, today announced that it will participate in the Barclays 2025 Global Technology Conference. F5’s presentation will be webcast live on Wednesday, December 10, 2025, at 2:00 p.m. ET. Interested attendees can access the live webcast via the Events & Presentations tab within the Investor Relations section of f5.com or via this link. An archived version of the webcast will be available

2025-12-03

2025-12-02

Bear Of The Day: F5 (FFIV)

Description: Despite beating the number in each of the last four quarters, estimates have fallen based on low growth but the valuation is compelling.

2025-12-01

STNE or FFIV: Which Is the Better Value Stock Right Now?

Description: STNE vs. FFIV: Which Stock Is the Better Value Option?

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Why Is F5 (FFIV) Down 10.3% Since Last Earnings Report?

Description: F5 (FFIV) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-25

2025-11-24

2025-11-23

Is F5 Attractively Priced After Recent Cloud and Cybersecurity Innovations?

Description: Ever wondered whether F5 is a bargain or overpriced right now? You are not alone, as plenty of investors are keeping a close eye on where the company's value stands. The stock has seen some interesting swings lately, climbing 2.5% over the past week, yet still sitting 21.5% lower than a month ago and down 6.9% so far this year. Recent headlines highlight ongoing innovation and product launches within the cloud and cybersecurity space. This has helped put F5 at the forefront of digital...

2025-11-22

2025-11-21

F5, Flywire, PubMatic, Bentley Systems, and American Express Global Business Travel Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. The positive sentiment followed comments from New York Federal Reserve President John Williams, a voting member of the rate-setting Federal Open Market Committee (FOMC), who indicated he sees room for further policy easing. Following his remarks, the probability of a December rate cut surged from 39% to 71%, according to the CME FedWatch Tool, causing Tr

2025-11-20

Do Wall Street Analysts Like F5 Stock?

Description: F5 has underperformed the broader market over the past year, and analysts are cautious about the stock’s prospects.

2025-11-19

F5 Launches ADSP Partner Program With Leading Technology Companies to Revolutionize Application Delivery and Security

Description: SEATTLE, November 19, 2025--F5 (NASDAQ: FFIV) today announced the creation of its Application Delivery and Security Platform (ADSP) Partner Program, designed to cultivate a sophisticated ecosystem of technology partners that extend the capabilities of F5’s industry-leading platform. Focused on simplifying multicloud operations, enhancing security, and accelerating application delivery for enterprises, the program brings together validated solutions that can be integrated into the F5 ADSP and tai

2025-11-18

F5 Launches BIG-IP v21.0 to Power Application Delivery and Security in the AI Era

Description: SEATTLE, November 18, 2025--F5 (NASDAQ: FFIV) today introduced BIG-IP v21.0, giving customers a unified approach to app delivery, security, and scale in the AI era. This major release extends the F5 Application Delivery and Security Platform (ADSP) with a purpose-built delivery engine for application workloads—reducing operational friction, accelerating data movement, and improving performance and resiliency across hybrid and multicloud environments. Introducing the next generation of app servic

2025-11-17

2025-11-16

2025-11-15

F5 (FFIV): Evaluating Valuation After New CrowdStrike Alliance Accelerates Security Strategy

Description: F5 (FFIV) has just unveiled a new strategic alliance with CrowdStrike, bringing advanced workload security and AI-powered threat hunting to F5 BIG-IP customers. The partnership is already drawing attention for its immediate and practical benefits. See our latest analysis for F5. F5’s latest collaboration with CrowdStrike comes after a turbulent stretch for the stock, following last quarter’s cybersecurity breach and subsequent lowered growth forecast. While the recent strategic moves have...

2025-11-14

Salesforce Inc. Leads HOTCHKIS & WILEY's Strategic Portfolio Moves

Description: Exploring the Latest 13F Filing for Q3 2025

2025-11-13

2025-11-12

F5 to Participate in Upcoming Financial Conference

Description: SEATTLE, November 12, 2025--F5, Inc. (NASDAQ: FFIV), the global leader in delivering and securing every app and API, today announced that it will participate in the 2025 RBC Capital Markets Global Technology, Internet, Media and Telecommunications Conference. F5’s presentation will be webcast live on Wednesday, November 19, 2025, at 1:20 p.m. ET. Interested attendees can access the live webcast via the Events & Presentations tab within the Investor Relations section of f5.com or via this link. A

F5 and CrowdStrike Strengthen Web Traffic Security with Falcon for F5 BIG-IP

Description: SEATTLE & AUSTIN, Texas, November 12, 2025--F5 (NASDAQ: FFIV) and CrowdStrike (NASDAQ: CRWD) today announced a new strategic technology alliance and first-of-its-kind integration that brings advanced workload security to F5 BIG-IP. By enabling F5 customers to embed CrowdStrike’s Falcon Sensor directly into F5 BIG-IP and leverage CrowdStrike Falcon® Adversary OverWatch managed threat hunting service, the companies are advancing adaptive, AI-driven security to the network perimeter where enterpris

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Is There Opportunity in F5 After Recent 25% Price Drop?

Description: Wondering if F5 stock is a smart addition to your portfolio? Let’s dig into whether recent prices could mean opportunity or a warning sign for investors seeking value. F5’s stock price has seen notable swings, down 4.7% in the last week and falling 25.1% over the past month. Despite this, it has gained 2.7% in the past year and nearly 54.4% over five years. These recent moves follow sector-wide volatility and renewed focus on cybersecurity, driven by headlines around growing digital threats...

2025-11-05

GTM or FFIV: Which Is the Better Value Stock Right Now?

Description: GTM vs. FFIV: Which Stock Is the Better Value Option?

2025-11-04

2025-11-03

F5 Leverages NVIDIA RTX PRO Server to Deliver High-Performance Enterprise AI Infrastructure

Description: SEATTLE, November 03, 2025--F5 (NASDAQ: FFIV) today announced the integration and validation of F5 BIG-IP Next for Kubernetes, part of the F5 Application Delivery and Security Platform (ADSP), with NVIDIA RTX PRO 6000 Blackwell Server Edition, the leading universal data center platform for enterprise and industrial AI. This integration expands the collaboration between F5 and NVIDIA to enhance high-performance traffic management, intelligent security, and scalability for advanced AI applications

The 5 Most Interesting Analyst Questions From F5’s Q3 Earnings Call

Description: F5’s third quarter was marked by robust revenue growth supported by data center reinvestment and demand for hybrid cloud and AI infrastructure. However, the market reacted negatively following management’s disclosure of a recent security incident impacting its BIG-IP product line. CEO François Locoh-Donou acknowledged, “We are disappointed that this happened and very aware...of the burden that this has placed in our customers who have had to work long hours to upgrade.” While product refreshes a

2025-11-02

2025-11-01

2025-10-31

These Were the S&P 500’s Best and Worst Stocks in October

Description: The ChatGPT maker plans to deploy 6 gigawatts worth of AMD chips in exchange for up to 160 million shares of AMD stock. The deal propelled AMD shares to their best month since 2001, according to Dow Jones Market Data. Micron Technology continued its banner year in October, with shares rising 34% for the month.

2025-10-30

2025-10-29

F5 (FFIV) Margin Expansion Reinforces Bullish Narratives Despite Slower Forward Growth

Description: F5 (FFIV) reported earnings growth of 22.2% over the past year, outpacing its robust five-year average yearly increase of 19.2%. Net profit margins improved to 22.4% from 20.1% a year ago, while earnings are forecast to grow at 10.01% annually with revenue expected to rise at 3.9% per year. Both figures trail the broader US market’s outlook. Shares recently changed hands at $267.58, trading below an estimated fair value and reflecting a price-to-earnings ratio of 22.3x, noticeably lower than...

2025-10-28

F5 Unlocks Gigascale AI Infrastructure Using NVIDIA BlueField-4 DPUs

Description: SEATTLE, October 28, 2025--F5 (NASDAQ: FFIV) today announced expansion of its BIG-IP Next for Kubernetes network and security solution on the newly announced NVIDIA BlueField-4 data processing unit (DPU). This integration of F5 BIG-IP Next for Kubernetes with NVIDIA AI infrastructure is designed to support gigascale AI factories. The combination of these technologies delivers unparalleled AI computing power, intelligent control, advanced security features, and multi-tenant networking at speeds u

The Bull Case for F5 (FFIV) Could Change Following Security Breach and Revised Outlook – Learn Why

Description: F5, Inc. recently reported record quarterly and annual results, surpassing US$3 billion in revenue for the fiscal year ended September 2025 and issuing guidance for modest full-year 2026 growth amid anticipated demand impacts in the first half. However, the company disclosed a significant security incident involving unauthorized access and exfiltration of sensitive source code from its BIG-IP product environment, which triggered regulatory investigations and prompted a cautious outlook for...

Why F5 (FFIV) Stock Is Trading Lower Today

Description: Shares of application security provider F5 (NASDAQ:FFIV) fell 8.3% in the morning session after the company issued a disappointing financial outlook for its fourth quarter, overshadowing results for the third quarter that beat Wall Street's expectations.

Warner Bros. Discovery upgraded, F5 downgraded: Wall Street's top analyst calls

Description: Warner Bros. Discovery upgraded, F5 downgraded: Wall Street's top analyst calls

F5 Q4 Earnings and Revenues Beat Estimates, Stock Down on Dim Guidance

Description: FFIV's strong Q4 results beat expectations, but cautious first-quarter and fiscal 2026 guidance send shares lower despite solid growth metrics.

FFIV Q3 Deep Dive: Security Incident Overshadows Solid Revenue Momentum

Description: Application security provider F5 (NASDAQ:FFIV) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 8.5% year on year to $810.1 million. On the other hand, next quarter’s revenue guidance of $755 million was less impressive, coming in 4.7% below analysts’ estimates. Its non-GAAP profit of $4.39 per share was 10.6% above analysts’ consensus estimates.

2025-10-27

F5 Inc (FFIV) Q4 2025 Earnings Call Highlights: Record Revenue and Profit Amid Security Challenges

Description: F5 Inc (FFIV) surpasses $3 billion in annual revenue and $1 billion in operating profit, while addressing security incident impacts on future growth.

F5 (NASDAQ:FFIV) Posts Better-Than-Expected Sales In Q3

Description: Application security provider F5 (NASDAQ:FFIV) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 8.5% year on year to $810.1 million. On the other hand, next quarter’s revenue guidance of $755 million was less impressive, coming in 4.7% below analysts’ estimates. Its non-GAAP profit of $4.39 per share was 10.6% above analysts’ consensus estimates.

F5 shares tumble as security incident clouds outlook

Description: Investing.com -- F5 Networks Inc (NASDAQ:FFIV) reported better-than-expected fourth quarter results but saw its shares tumble 7.5% in after-hours trading Monday as the company warned of potential sales disruptions following a recent security incident.

F5: Fiscal Q4 Earnings Snapshot

Description: The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of $3.96 per share. The computer networking company posted revenue of $810.1 million in the period, also topping Street forecasts. Six analysts surveyed by Zacks expected $792.5 million.

F5 Reports Strong Fourth Quarter Results with 8% Revenue Growth; FY25 Revenue of $3.1 Billion Reflects 10% Annual Growth, Driven by Transformative Industry Trends

Description: SEATTLE, October 27, 2025--F5, Inc. (NASDAQ: FFIV), the global leader in delivering and securing every app and API, today announced financial results for its fourth quarter and fiscal year 2025 ended September 30, 2025.

2025-10-26

2025-10-25

Earnings To Watch: F5 (FFIV) Reports Q3 Results Tomorrow

Description: Application security provider F5 (NASDAQ:FFIV) will be reporting results this Monday after the bell. Here’s what to look for.

What Catalysts Are Reshaping the Narrative for F5 After Recent Security and Growth Developments

Description: F5’s consensus analyst price target has inched up from $330.82 to $333.00, hinting at slightly more optimistic expectations despite a shifting outlook. Recent analysis suggests that the modest increase reflects not only the company’s continued operational strength and growing demand for its systems, but also the caution introduced by new risks and uncertainties. Stay tuned to discover how you can track evolving analyst perspectives on F5 as the story unfolds. What Wall Street Has Been...

2025-10-24

Big Tech earnings, Fed meeting, Trump & Xi meet: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come next week, including earnings results from Magnificent Seven companies Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG, GOOGL), and Meta Platforms (META); Federal Reserve officials convening for their October FOMC meeting; and President Trump is meeting Chinese President Xi Jinping in South Korea as the government shutdown nears its fifth week. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

2025-10-23

F5 Appoints Michael Montoya as Chief Technology Operations Officer

Description: SEATTLE, October 23, 2025--F5 (NASDAQ: FFIV) today announced the appointment of Michael Montoya as Chief Technology Operations Officer. Montoya has transitioned from his position on the F5 Board of Directors, where he has served since 2021. In this new role, he will lead the enterprise-wide strategy and execution to further embed security into every aspect of how F5 operates.

2025-10-22

F5 Gears Up to Report Q4 Earnings: What's in the Offing?

Description: FFIV projects higher Q4 revenues on strong hybrid and subscription demand, though earnings may slip year over year.

Seeking Clues to F5 (FFIV) Q4 Earnings? A Peek Into Wall Street Projections for Key Metrics

Description: Evaluate the expected performance of F5 (FFIV) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.