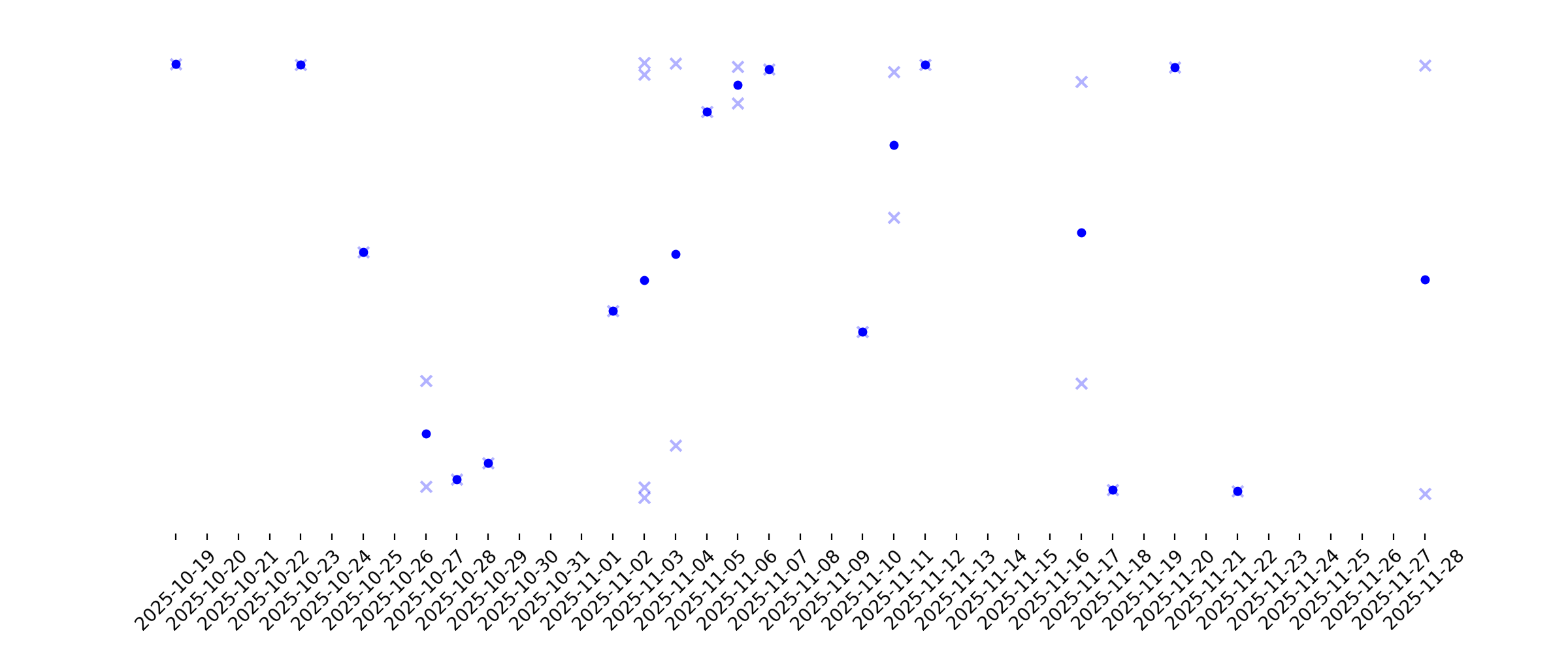

News sentiment analysis for FITB

Sentiment chart

2026-01-14

3 Stocks Estimated To Be Trading At A Discount Of Up To 28.6%

Description: As the U.S. stock market grapples with fluctuating bank earnings and inflation data, major indices like the Dow Jones, S&P 500, and Nasdaq have experienced recent declines. Amidst this volatility, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market inefficiencies and secure assets at a discount.

Gear Up for Fifth Third Bancorp (FITB) Q4 Earnings: Wall Street Estimates for Key Metrics

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Fifth Third Bancorp (FITB), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended December 2025.

Uncovering Advanced Micro Devices And Two Other Stocks Estimated To Be Trading Below Fair Value

Description: As the U.S. stock market reaches new highs, buoyed by investor confidence despite ongoing concerns such as the DOJ probe into Fed Chair Powell, identifying stocks that are trading below their fair value can be particularly appealing. In this environment of record-breaking indices and evolving economic conditions, finding undervalued stocks like Advanced Micro Devices and others could offer potential opportunities for investors looking to capitalize on market inefficiencies.

2026-01-13

Federal Reserve OK's Fifth Third-Comerica deal, set to happen Feb. 1

Description: The two banks announced the approval the night of Jan. 13. Comerica plans to fully rebrand as Fifth Third Bank later this year.

Fifth Third and Comerica Announce Receipt of All Material Approvals to Combine

Description: CINCINNATI & DALLAS, January 13, 2026--Fifth Third Bancorp (Nasdaq: FITB) and Comerica Incorporated (NYSE: CMA) today announced that the Board of Governors of the Federal Reserve System approved the combination of the two companies. As a result, all material regulatory and shareholder approvals to merge have been received. The transaction is expected to close on February 1, 2026, subject to the satisfaction or waiver of the remaining customary closing conditions, and will form the ninth largest

Three Stocks That May Be Undervalued In January 2026

Description: As the U.S. stock market navigates through a landscape of record highs and inflationary pressures, investors are keenly assessing the implications of recent consumer price index data and corporate earnings reports. In this environment, identifying undervalued stocks requires a careful analysis of fundamentals and market sentiment, offering potential opportunities for those looking to capitalize on discrepancies between current valuations and intrinsic worth.

Fifth Third Bancorp (FITB) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Fifth Third Bancorp (FITB) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Fifth Third Bank Announces Redemption of Subordinated Bank Notes due March 15, 2026

Description: CINCINNATI, January 13, 2026--Fifth Third Bancorp (Nasdaq: FITB) today announced that its subsidiary, Fifth Third Bank, National Association (the "Bank"), has submitted a redemption notice to the issuing and paying agent for redemption of all of the Bank’s outstanding 3.850% Subordinated Notes due March 15, 2026 (CUSIP 31677AAB0) issued in the principal amount of $750 million. The Bank notes will be redeemed on or after the February 13, 2026 redemption date pursuant to their terms and conditions

3 Stocks Estimated To Be Trading At Discounts Of Up To 40.7%

Description: As the U.S. stock market reaches new highs, buoyed by investor confidence despite recent political developments, attention turns to identifying opportunities that may be undervalued amidst this bullish environment. In such a climate, discerning investors often seek stocks trading at significant discounts to their intrinsic value, offering potential for future appreciation while navigating the complexities of current economic conditions.

Bank sector is hitting this 'trifecta,' set to outperform S&P 500

Description: Earnings season starts for major banks JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Morgan Stanley (MS), Wells Fargo (WFC), and Goldman Sachs (GS) this week, all of these major financial stocks set to report fourth quarter earnings results throughout the week. RBC Capital Markets analyst Gerard Cassidy shares his perspective on the KBW Bank ETF (KBWB) outperforming the S&P 500 (^GSPC), while also discussing his outlook for regional bank stocks Fifth Third Bancorp (FITB) and M&T Bank (MTB). Also hear Gerard Cassidy explain why President Trump's suggested 10% cap on credit card rates would have "real negative repercussions" for borrowers. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2026-01-12

3 Stocks Estimated To Be Trading At A Discount In January 2026

Description: As the U.S. stock market navigates a mixed landscape with major indices showing varied performances and precious metals reaching record highs, investors are closely watching economic indicators and political developments that could influence market dynamics. In this environment, identifying undervalued stocks can be particularly appealing, as these opportunities may offer potential value when broader market conditions create uncertainty.

Banks Enter Earnings Season on Firmer Footing, Though Risks Linger

Description: U.S. banks are entering the new year on solid footing after a strong 2025, and analysts say that momentum should continue, barring any unforeseen shocks.

3 Stocks Estimated To Be Undervalued By Up To 36.9%

Description: As the Dow and S&P 500 close at record highs, reflecting a strong start to 2026, investors are keenly observing the broader market dynamics shaped by recent economic indicators and policy developments. In this environment of heightened market performance, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities amidst these record-setting indices.

2026-01-11

2026-01-10

2026-01-09

Will Fifth Third Bancorp (FITB) Beat Estimates Again in Its Next Earnings Report?

Description: Fifth Third Bancorp (FITB) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Jim Cramer on Fifth Third Bancorp: “I Think It’s a Buy”

Description: Fifth Third Bancorp (NASDAQ:FITB) is one of the stocks Jim Cramer shared his takes on. Answering a caller’s query about the stock, Cramer remarked: “Yeah, FITB, this is a good combination. I’ve wanted it. They are going to bring some, they will bring some discipline to Comerica. I think it’s a buy.” Fifth Third Bancorp […]

2026-01-08

3 Stocks That May Be Trading At An Estimated Discount Of Up To 21.8%

Description: As the U.S. stock market experiences mixed signals with major indices like the Dow Jones climbing while the Nasdaq faces pressure from data-storage shares, investors are keenly observing sectors and stocks that might offer value amidst this volatility. In such a climate, identifying undervalued stocks can be particularly appealing, as they present opportunities to capitalize on potential price corrections when broader economic conditions stabilize or improve.

3 Stocks That Might Be Priced Below Their True Value

Description: As the U.S. stock market navigates a period of volatility, marked by recent highs followed by declines in major indices like the S&P 500 and Dow Jones Industrial Average, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying stocks that might be priced below their true value can be crucial for investors seeking to capitalize on potential market inefficiencies.

2026-01-07

Fifth Third Bancorp's (NASDAQ:FITB) 13% CAGR outpaced the company's earnings growth over the same five-year period

Description: If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share...

2026-01-06

Sector Update: Financial Stocks Advance Late Afternoon

Description: Financial stocks rose in late Tuesday afternoon trading with the NYSE Financial Index up 0.4% and th

Shareholders overwhelmingly approve Fifth Third/Comerica Bank deal

Description: The deal, while still subject to approval by the Federal Reserve Board, is expected to close before the end of the first quarter.

Fifth Third-Comerica deal easily wins shareholder approval

Description: The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

Fifth Third Shareholders and Comerica Stockholders Vote to Approve Combination

Description: CINCINNATI & DALLAS, January 06, 2026--Today, shareholders of Fifth Third Bancorp (Nasdaq: FITB) and stockholders of Comerica Incorporated (NYSE: CMA) voted separately to approve the proposed merger of the two companies. The transaction is expected to close in the first quarter of 2026, subject to satisfaction of the remaining customary closing conditions.

3 Stocks That May Be Trading Below Their Estimated Value

Description: As the U.S. stock market continues to reach new heights, with the Dow Jones Industrial Average hitting an all-time high for the second consecutive day, investors are keenly observing opportunities that may be overlooked amidst this bullish momentum. In such a thriving environment, identifying stocks that might be trading below their estimated value can offer potential avenues for growth and diversification within a well-rounded investment strategy.

Fifth Third Private Bank Named Best Private Bank for Seventh Year by Global Finance

Description: CINCINNATI, January 06, 2026--Fifth Third Private Bank, a division of Fifth Third Bank (NASDAQ: FITB), was recognized as a Best Private Bank (US, Regional) for the seventh consecutive year. In addition, the Private Bank was named Best Private Bank or Wealth Manager for Net Worth up to $5 Million (Globally). Global Finance announced the honors for its 2026 World’s Best Private Bank Awards.

3 Companies Estimated To Be Priced Below Their True Value In January 2026

Description: As the U.S. stock market kicks off 2026 with major indexes reaching new heights, buoyed by significant geopolitical events and a surge in oil stocks, investors are keenly observing opportunities that may be priced below their intrinsic value. In this environment of heightened activity and record-setting performances, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

2026-01-05

3 Stocks Estimated To Be Up To 48.4% Below Intrinsic Value

Description: As the U.S. stock market reaches new heights, driven by geopolitical events and a surge in energy shares, investors are increasingly looking for opportunities in undervalued stocks that may offer significant potential. In this environment, identifying stocks trading below their intrinsic value can be a strategic move for those seeking to capitalize on market inefficiencies and future growth prospects.

AeroVironment And 2 Other Stocks That May Be Priced Below Estimated Value

Description: As the new year begins, major stock indexes in the United States have mostly risen, with the Dow Jones Industrial Average and S&P 500 snapping recent losing streaks, while the Nasdaq continues to face pressure. In this fluctuating market environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking value amid broader economic shifts.

2026-01-04

2026-01-03

Klaviyo, Wingstop among Stephens Best Ideas for 2026

Description: Stephens analysts named their 2026 Best Ideas, with each of the firm’s 23 industry teams identifying one stock they expect to outpace the performance of their industry, the Russell 2000 and the markets in general. The list includes NBT Bancorp (NBTB), Glaukos (GKOS), Bio-Techne (TECH), Phreesia (PHR), QXO (QXO), First Bancorp (FBNC), Klaviyo (KVYO), Upbound Group (UPBD), BrightSpring Health (BTSG), Signet Jewelers (SIG), Exelixis (EXEL), Fifth Third (FITB), Digi International (DGII), FIS (FIS),

2026-01-02

Keefe Bruyette Refreshes Fifth Third (FITB) Outlook Following Recent Meetings

Description: Fifth Third Bancorp (NASDAQ:FITB) is included among the 12 Best Income Stocks to Buy Now. On December 17, Keefe Bruyette raised its price target on Fifth Third Bancorp (NASDAQ:FITB) to $53 from $50 and kept a Market Perform rating on the shares. The firm refreshed its estimates after recent conference updates and meetings with management. […]

2026-01-01

2025-12-31

3 Stocks That May Be Trading Below Their Estimated Value

Description: As 2025 draws to a close, major U.S. stock indexes have experienced a mixed performance, with recent declines following strong annual gains driven by technology stocks. In this fluctuating market environment, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on potential market inefficiencies and long-term growth prospects.

3 Stocks Possibly Trading At Discounts Ranging From 10.4% To 20.2%

Description: As the United States stock market experiences a slight downturn with major indexes closing lower for the third consecutive session, investors are keenly observing opportunities amidst fluctuating conditions. In such an environment, identifying stocks that may be undervalued can present potential advantages, especially when these stocks are trading at discounts ranging from 10.4% to 20.2%.

2025-12-30

Spotlight On Dividend Stocks For December 2025

Description: As the U.S. stock market navigates mixed performances with major indices experiencing fluctuations, investors are closely monitoring the rebound in precious metals and shifts in technology stocks. Amid these dynamic conditions, dividend stocks continue to attract attention for their potential to provide steady income streams and resilience during periods of market volatility.

Emboldened Activist Investors Are Circling U.S. Banks

Description: The Trump administration’s deregulation push could give activists more room to target banks, where big campaigns are rare.

2025-12-29

U.S. Bancorp Up Nearly 22% in 6 Months: Buy, Hold, or Sell the Stock?

Description: USB is up nearly 22% in six months, do strong revenue growth, liquidity, and digital investments make it a buy, hold, or sell now? Let us discuss.

2025-12-28

Dallas Is Booming—Except for Its Downtown

Description: Texas city’s central business district faces a crisis as companies look for snazzy suburban alternatives to aging office towers.

2025-12-27

2025-12-26

2025-12-25

Truist Raises Fifth Third Bancorp (FITB) Target to $55, Maintains Buy Rating

Description: We recently compiled a list of the 10 Cheap Stocks With Strong Buy Ratings on Wall Street. Fifth Third Bancorp is one of the cheap stocks to buy on our list. TheFly reported on December 22 that Truist Securities analyst Brian Foran maintained a Buy rating on FITB and raised the price target to $55 […]

2025-12-24

Discover 3 Stocks Including Atour Lifestyle Holdings That May Be Trading Below Estimated Value

Description: As the U.S. stock market continues to reach new heights with the S&P 500 hitting an all-time high, investors are keenly observing opportunities that might be trading below their estimated value. In such a vibrant market environment, identifying undervalued stocks requires careful analysis of fundamentals and market positioning, making it essential to consider companies like Atour Lifestyle Holdings that may offer potential value at current prices.

2025-12-23

2025-12-22

Fifth Third Bancorp's Quarterly Earnings Preview: What You Need to Know

Description: Fifth Third Bancorp is poised to announce its fourth-quarter results soon, and analysts predict a double-digit growth in the company’s bottom-line figure.

2025-12-21

2025-12-20

2025-12-19

Fifth Third (FITB): Assessing Valuation After a Strong Share Price Run and Long-Term Total Return

Description: Fifth Third Bancorp (FITB) has quietly delivered a strong run this month, and investors are starting to ask whether the recent momentum still leaves room for value or if expectations are getting ahead of fundamentals. See our latest analysis for Fifth Third Bancorp. That push higher has come on the back of solid recent results and improving sentiment toward regional banks, with Fifth Third’s 30 day share price return of 14.9 percent feeding into a healthy 1 year total shareholder return of...

2025-12-18

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Dec. 18, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.07075 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable January 9, 2026 to shareholders on record as at December 31, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigroup

2025-12-17

Fifth Third Awards Nearly $145,000 in Grants and Tips in Annual 'Swap, Snap, Share' Small Business Appreciation Campaign

Description: CINCINNATI, December 17, 2025--Fifth Third's third annual Swap, Snap, Share campaign has awarded nearly $145,000 in grants and tips to small businesses across the U.S.

Fifth Third-Comerica deal gets green light from OCC

Description: The regulator signed off on the transaction just two months after the banks applied to merge.

These 76 bank branches could close with Fifth Third, Comerica deal

Description: The acquisition is still subject to approval by the Fed and bank shareholders and the branch closures wouldn't happen until the second half of 2026.

America's biggest banks are ending 2025 on top with big growth goals and markets 'wide open'

Description: America's biggest banks are looking to accelerate growth in the year ahead as stocks reach record highs and looser rules push the industry into a new chapter.

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

Fifth Third Announces Changes to its Board of Directors

Description: CINCINNATI, December 12, 2025--Fifth Third (Nasdaq: FITB) today announced that Thomas H. (Hal) Harvey will retire from its Board of Directors, and Priscilla Almodovar will join the Board, effective January 7, 2026.

2025-12-11

Fifth Third (FITB) Gets Target Lift in Piper Sandler’s Review Ahead of Upcoming Conference

Description: Fifth Third Bancorp (NASDAQ:FITB) is included among the 11 Best Low Priced Dividend Stocks to Buy According to Analysts. On December 10, Piper Sandler lifted its price target on Fifth Third Bancorp (NASDAQ:FITB) to $50 from $48 and reiterated an Overweight rating on the shares after the bank filed the presentation it plans to share […]

Does Fifth Third Still Offer Value After Its Strong Multi Year Share Price Rally?

Description: If you have been wondering whether Fifth Third Bancorp is still good value after its run in bank stocks, you are not alone. This article is here to break that down in plain English. The stock has climbed 5.8% over the last week and 10.2% over the past month, adding to a longer track record of gains with a 66.6% return over 3 years and 110.4% over 5 years. Recent headlines have focused on regional banks regaining investor confidence as credit quality holds up better than feared and deposit...

2025-12-10

Fifth Third Bank to Decrease Prime Lending Rate to 6.75%

Description: CINCINNATI, December 10, 2025--Fifth Third Bank, National Association (Nasdaq: FITB) today announced it will decrease its prime lending rate to 6.75%, effective immediately.

Fifth Third Set to Expand Multifamily Lending With Fannie Mae DUS Deal

Description: FITB agrees to acquire Mechanics Bank's DUS business, gaining a $1.8B servicing portfolio as it broadens its multifamily lending reach.

Fifth Third Partners With Brex, Unlocks $5.6B Commercial Card Volume

Description: FITB teams up with Brex to roll out an AI-driven commercial card projected to unlock $5.6B in annual payment volume.

2025-12-09

Fifth Third to Acquire Fannie Mae DUS Business Line; Expanding Multifamily Financing Capabilities

Description: CINCINNATI, December 09, 2025--Fifth Third Bancorp (NASDAQ: FITB) today announced a strategic acquisition that will enhance its ability to finance multifamily housing across the United States. The Bank has entered into a definitive agreement to acquire Mechanics Bank’s Delegated Underwriting and Servicing (DUS) business line, which includes its experienced team and a $1.8 billion unpaid principal balance servicing portfolio.

Mechanics Bank Agrees to Sell Fannie Mae Delegated Underwriting and Servicing Business Line to Fifth Third

Description: WALNUT CREEK, Calif., December 09, 2025--Mechanics Bancorp ("Mechanics") (NASDAQ: MCHB) announced today that its subsidiary Mechanics Bank has entered into a definitive agreement to sell its Fannie Mae Delegated Underwriting and Servicing ("DUS") business line ("DUS Business") to Fifth Third Bancorp ("Fifth Third") (NASDAQ: FITB) in an all-cash transaction. Completion of the transaction is subject to Fannie Mae’s approval of Fifth Third as an authorized DUS lender.

Fifth Third Betting Big on Branch Expansion: A Smart Growth Move?

Description: Can FITB's $1.9B branch buildout and push into Texas redefine its growth across fast-growing markets? Let us discuss.

Fifth Third Bancorp (FITB) Announces New Financial Centers in the Southeast

Description: Fifth Third Bancorp (NASDAQ:FITB) is one of the Cheap NASDAQ Stocks to Buy Now. On December 3, Fifth Third Bancorp (NASDAQ:FITB) reached a major milestone in the Southeast expansion strategy by announcing the opening of its 200th financial center in Florida and 100th center in the Carolinas. The new openings reflect the bank’s execution of […]

Fifth Third Bancorp Stock: Is FITB Underperforming the Financial Sector?

Description: Fifth Third Bancorp has underperformed the Financial sector over the past year, but analysts are cautiously optimistic about the stock’s prospects.

Fifth Third and Brex Partner to Bring AI-Powered Finance to Businesses, Unlocking $5.6B in Commercial Card Volume

Description: CINCINNATI & SAN FRANCISCO, December 09, 2025--Fifth Third Bank (NASDAQ: FITB), a pioneer in financial innovation known for improving the lives of its customers, and Brex, the intelligent finance platform, today announced a multi-year partnership that unlocks $5.6 billion in annual commercial card payment volume. Built on Brex Embedded, Brex’s proprietary API-driven payments infrastructure, the Fifth Third Commercial Card powered by Brex will become the default commercial card solution for Fifth

2025-12-08

Fifth Third Bancorp Announces Cash Dividends

Description: CINCINNATI, December 08, 2025--Today, Fifth Third Bancorp announced the declaration of cash dividends on its common shares, Series H preferred shares, Series I preferred shares, Series J preferred shares, Series K preferred shares, and Class B Series A preferred shares.

2025-12-07

2025-12-06

2025-12-05

What The Comerica Merger Now Means For Fifth Third Bancorp’s Evolving Story And Valuation

Description: Fifth Third Bancorp's narrative has shifted incrementally but meaningfully, as a slightly higher fair value target of $50.50 per share reflects growing confidence in the financial upside of its planned Comerica acquisition and the expanded footprint into faster growing markets. With the discount rate nudged lower and revenue growth expectations essentially steady, the recalibrated target suggests that analysts now see a somewhat more favorable risk reward balance, supported by accretive EPS...

Bank Stocks Are Near Record Highs. What They Need to Break Them.

Description: FEATURE Bank stocks are coming close to breaking out to record highs, but they need one of a couple factors to turn their way. Banks have had a middling year. The is up 10% this year, underperforming the 17% gain.

Assessing Fifth Third (FITB) Valuation After Recent Share Price Strength

Description: Recent Performance and Investor Context Fifth Third Bancorp (FITB) has quietly outperformed in the past month, with shares up about 8% and modestly higher over the past week, even as the stock remains roughly flat over the past year. See our latest analysis for Fifth Third Bancorp. With the share price now around $45.46, that recent 1 month share price return of nearly 8% sits against a slightly negative 1 year total shareholder return. At the same time, a near doubling of total shareholder...

2025-12-04

Fifth Third Accelerates Southeast Expansion, Reaches Milestones

Description: FITB reaches Southeast milestones with its 200th Florida and 100th Carolinas centers, underscoring rapid regional expansion momentum.

2025-12-03

FITB vs. MTB: Which Regional Bank Stock Looks More Attractive Now?

Description: Do Fifth Third's expansion push, rising NII outlook set up a compelling contrast with M&T Bank's steady growth profile? Let us find out.

BankUnited Hits 52-Week High: How Should You Play the Stock Now?

Description: BKU hits a 52-week high as loan growth, rising deposits and improving margins fuel momentum despite cost and asset quality pressures.

Fifth Third’s Southeast Expansion Reaches Major Milestones in Florida and the Carolinas

Description: CINCINNATI, December 03, 2025--Fifth Third (Nasdaq: FITB) today announced the opening of its 200th financial center in Florida and its 100th in the Carolinas—two major milestones in the Bank’s Southeast expansion. The new locations, Champions Crossing in Davenport, Florida, and Weaverville near Asheville, North Carolina, reflect Fifth Third’s commitment to delivering exceptional banking experiences and strengthening its presence in high-growth markets.

2025-12-02

2025-12-01

3 Reliable Dividend Stocks Yielding Up To 3.8%

Description: As the U.S. stock market enters December, major indices like the Dow Jones, Nasdaq, and S&P 500 have experienced slight declines amid a risk-off sentiment impacting big tech and cryptocurrency-tied shares. In such uncertain times, dividend stocks can offer a measure of stability by providing regular income streams to investors.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

3 Stocks That Might Be Trading Below Their Estimated Value By Up To 44.6%

Description: As the U.S. stock market experiences a notable upswing, with major indexes on track for their best week since June, investors are keenly observing opportunities that may be flying under the radar. In this environment of rising indices and renewed optimism, identifying stocks that might be trading below their estimated value becomes crucial for those looking to capitalize on potential market inefficiencies.

3 Stocks That Could Be Trading At A Discount

Description: As U.S. markets enjoy a robust rally ahead of the Thanksgiving break, with major indexes on track for their best week since June, investors are keenly eyeing opportunities that might be trading at a discount. In such an environment, identifying undervalued stocks becomes crucial as they have the potential to offer significant value when market conditions stabilize or improve.

2025-11-26

3 Stocks That May Be Trading Below Their Estimated Value

Description: As the U.S. stock market experiences a notable upswing with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average showing significant gains entering the Thanksgiving holiday, investors are increasingly attentive to opportunities that may be trading below their estimated value. In such a buoyant environment, identifying stocks that are potentially undervalued can provide investors with strategic entry points to capitalize on broader market optimism while maintaining a focus...

3 Stocks Estimated To Be Undervalued By As Much As 32%

Description: In recent days, the U.S. stock market has experienced a notable upswing, with major indices like the Dow Jones Industrial Average and S&P 500 posting significant gains despite some sector-specific challenges. Amidst this environment of rising optimism and potential interest rate cuts, investors are on the lookout for stocks that may be undervalued by as much as 32%, presenting opportunities for those who prioritize strong fundamentals and long-term growth potential.

2025-11-25

3 Companies Including TransMedics Group That May Be Trading Below Estimated Value

Description: As the U.S. stock market experiences a mixed performance, with major indices like the Dow Jones and S&P 500 mostly rising while technology shares face pressure, investors are keenly observing opportunities amidst fluctuating economic indicators such as retail sales and consumer confidence. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential market inefficiencies, with companies like TransMedics Group offering intriguing possibilities...

Citizens Financial Group And 2 Other Stocks That May Be Priced Below Their Estimated Worth

Description: As the U.S. stock market kicks off a holiday-shortened trading week with significant gains, investors are buoyed by optimism around a potential Federal Reserve interest rate cut in December. In this environment of heightened confidence, identifying stocks that may be undervalued compared to their estimated worth can be particularly appealing, as they offer opportunities for growth amidst broader market enthusiasm.

2025-11-24

Discovering Pinnacle Financial Partners And Two Stocks Possibly Priced Below Estimated Value

Description: As the U.S. stock markets begin a holiday-shortened week with significant gains, buoyed by investor optimism over potential Federal Reserve interest rate cuts, there is increased attention on identifying stocks that may be undervalued amidst this positive momentum. In such an environment, discerning investors often look for opportunities where market prices do not fully reflect a company's intrinsic value, making it essential to explore stocks like Pinnacle Financial Partners and others that...

3 Stocks With Estimated Discounts Of Up To 44.2% Below Intrinsic Value

Description: As the U.S. stock market navigates a volatile landscape marked by fluctuating interest rate expectations and concerns over tech valuations, investors are keenly observing opportunities that may arise from these shifts. In such an environment, identifying undervalued stocks can be particularly appealing, as they offer potential for growth when trading at a significant discount to their intrinsic value.

2025-11-23

2025-11-22

2025-11-21

Trustmark, Fifth Third Bancorp, Frost Bank, Comerica, and Banner Bank Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to ma

2 S&P 500 Stocks to Research Further and 1 We Ignore

Description: The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning. Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

2025-11-20

How the Narrative Around Fifth Third Is Evolving After the Comerica Acquisition and Analyst Shifts

Description: Fifth Third Bancorp’s stock forecast has seen notable updates following its recent performance and acquisition activities. The fair value estimate remains steady at $50.25 per share, and revenue growth projections are unchanged. However, analysts have raised the discount rate in light of emerging risks and uncertainties. Stay tuned to discover how investors can stay ahead of ongoing changes in the company’s evolving narrative. Stay updated as the Fair Value for Fifth Third Bancorp shifts by...

Fifth Third Celebrates 20 Years of Exclusive Partnership with the Ohio 529 CollegeAdvantage Plan

Description: CINCINNATI, November 20, 2025--Fifth Third Bank (NASDAQ: FITB) is proud to celebrate 20 years of exclusive partnership with the Ohio Tuition Trust Authority’s Ohio 529 CollegeAdvantage plan, a collaboration that has empowered more than 74,000 families across the country save $2.5 billion for college since 2005 through dedicated savings accounts and certificates of deposit (CDs). Available across the country, the plan is the only one in the nation to offer multiple Fifth Third CD rate options—pro

2025-11-19

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Nov. 19, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.06983 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable December 10, 2025 to shareholders on record as at November 28, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigro

2025-11-18

Fifth Third Bancorp to Participate in the Goldman Sachs U.S. Financial Services Conference

Description: CINCINNATI, November 18, 2025--Fifth Third Bancorp (Nasdaq: FITB) will participate in the 2025 Goldman Sachs U.S. Financial Services Conference on December 10, 2025 at approximately 8:00 AM ET. Tim Spence, chairman, chief executive officer and president, and Bryan Preston, executive vice president and chief financial officer, will represent the Company.

Columbia Banking Rewards Shareholders With a 2.8% Dividend Hike

Description: COLB lifts its quarterly dividend by 2.8% as decent liquidity supports ongoing shareholder rewards.

2025-11-17

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In November 2025

Description: In the current climate of mixed market performance, with the Dow Jones Industrial Average experiencing fluctuations and tech stocks facing valuation concerns, investors are keenly observing opportunities for potential undervalued assets. As we explore three stocks estimated to be trading below their intrinsic value in November 2025, understanding what constitutes a good investment becomes crucial—particularly in identifying companies that may offer strong fundamentals and growth potential...

2025-11-16

2025-11-15

2025-11-14

2025-11-13

3 Stocks That May Be Priced Below Their Estimated Worth In November 2025

Description: As the U.S. stock market navigates the aftermath of a historic government shutdown, with major indices experiencing fluctuations and tech shares leading declines, investors are keenly observing opportunities that may arise in this volatile environment. In such times, identifying stocks that are potentially undervalued can offer strategic entry points for those looking to capitalize on discrepancies between current prices and intrinsic value.

Stocks That May Be Priced Below Intrinsic Value In November 2025

Description: As the U.S. market experiences mixed outcomes with the Dow Jones Industrial Average reaching unprecedented heights and the Nasdaq showing signs of volatility, investors are keenly observing how these fluctuations might impact stock valuations. In such an environment, identifying stocks that may be priced below their intrinsic value becomes crucial, as these opportunities could potentially offer resilience amid broader market uncertainties.

2025-11-12

Three Companies Estimated To Be Priced Below Their Intrinsic Value In November 2025

Description: As the Dow Jones Industrial Average reaches new heights amid optimism surrounding a potential end to the U.S. government shutdown, investors are closely watching market fluctuations with mixed performances across major indices. In this environment, identifying stocks that may be undervalued becomes crucial, as these investments could offer opportunities for growth when priced below their intrinsic value.

State Street Hits 52-Week High: Should You Buy the Stock Now?

Description: STT's 52-week high reflects strong fee income, acquisitions and rising AUM. Yet elevated costs are concerning for investors.

3 Prominent Stocks Estimated To Be Trading At Discounts Up To 33.7%

Description: As the U.S. stock market rebounds amid optimism for a resolution to the prolonged government shutdown, investors are eyeing opportunities within this volatile landscape. In such times, identifying undervalued stocks can be crucial for those looking to capitalize on potential discounts, as these stocks may offer significant value relative to their current trading prices.

2025-11-11

November 2025's Select Stocks That May Be Priced Below Estimated Value

Description: As the U.S. stock market navigates a period of mixed performance, with major indices like the S&P 500 and Nasdaq showing slight declines following an early-week rally, investors are closely monitoring developments such as the potential end to the government shutdown. In this environment, identifying stocks that may be undervalued becomes crucial for investors seeking opportunities amid fluctuating tech stock performances and broader market shifts.

3 Value Stock Picks Including Laureate Education For Estimated Undervaluation

Description: As the United States stock market experiences a surge in optimism due to potential resolutions to the government shutdown, major indices like the Nasdaq, S&P 500, and Dow Jones have posted significant gains. In this environment of renewed investor confidence, identifying undervalued stocks can be particularly advantageous as they may offer opportunities for growth amidst market fluctuations.

2025-11-10

Old National Bancorp And 2 Other Stocks Estimated To Be Priced Below Intrinsic Value

Description: As the major U.S. stock indexes bounce back from a challenging week, buoyed by optimism over a potential resolution to the prolonged government shutdown, investors are keenly eyeing opportunities that may be priced below their intrinsic value. In such market conditions, identifying stocks that are undervalued can offer significant potential for growth, making it crucial to focus on companies with strong fundamentals and resilience amidst economic uncertainties.

Three Companies That May Be Priced Below Their Estimated Value

Description: In the midst of a challenging period for U.S. markets, with the Nasdaq experiencing its worst week since 'Liberation Day' and ongoing concerns about tech stock valuations, investors are keenly observing opportunities that may arise from these fluctuations. Identifying undervalued stocks can be crucial in such volatile times, as they may offer potential value when broader market sentiment is cautious or uncertain.

Evaluating Fifth Third Bancorp (FITB): Is the Current Share Price a Bargain for Long-Term Investors?

Description: Fifth Third Bancorp (FITB) shares edged higher today, gaining almost 1% in the latest session. The stock has shown moderate strength over the month, which has sparked some discussion among investors about its broader performance and valuation. See our latest analysis for Fifth Third Bancorp. After weathering a challenging year, Fifth Third Bancorp’s recent gains add a bit of positive momentum to what has largely been a flat ride for shareholders. While the latest 1-day and monthly share price...

2025-11-09

How Investors May Respond To Fifth Third Bancorp (FITB) Earnings Strength and Comerica Merger Talks

Description: Fifth Third Bancorp recently reported strong net income growth and a robust liquidity position, with more than US$100 billion in readily available liquidity, while also pursuing a merger with Comerica Incorporated to enhance its market presence and product offerings. Although the company faces ongoing legal and regulatory challenges, its operational improvements and expense management were the primary drivers of positive sentiment following the latest results. Let's explore how Fifth Third...

2025-11-08

2025-11-07

How Virtus Investment, Fifth Third Bancorp, And VICI Properties Can Put Cash In Your Pocket

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Virtus Investment, Fifth Third Bancorp, and VICI Properties have rewarded shareholders for years and recently announced ...

Fifth Third Private Bank Named Best for Customer Service in North America for Second Year

Description: CINCINNATI, November 07, 2025--Fifth Third Private Bank, a division of Fifth Third Bank (Nasdaq: FITB), is pleased to announce its second consecutive recognition as the Best Private Bank in North America for Customer Service. The honor is part of the 2025 Global Private Banking Awards presented by Financial Times' group publications The Banker and Professional Wealth Management.

2025-11-06

Fifth Third's $11 Billion Comerica Grab: What It Means for Investors

Description: Last month, Fifth Third announced it would acquire Comerica in a large regional bank deal.

2025-11-05

Are Wall Street Analysts Bullish on Fifth Third Bancorp Stock?

Description: Fifth Third Bancorp has notably underperformed the broader market over the past year. But analysts remain optimistic about the stock’s prospects, with price targets suggesting notable double-digit upside potential.

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

Jamie Dimon warned of 'cockroaches' in the financial system. Fed Chair Powell doesn't see a 'broader' problem.

Description: Concerns in credit markets have percolated in recent weeks. Fed Chair Jay Powell isn't concerned that they may be indicative of broader problems.

2025-10-29

Fifth Third Bank to Decrease Prime Lending Rate to 7.00%

Description: CINCINNATI, October 29, 2025--Fifth Third Bank, National Association (Nasdaq: FITB) today announced it will decrease its prime lending rate to 7.00%, effective immediately.

ImmunityBio And 2 Other Stocks That May Be Priced Below Their Estimated Worth

Description: As major U.S. stock indexes continue to set new records, driven by significant developments in tech and anticipation of Federal Reserve decisions, investors are keenly observing the market for potential opportunities. In such an environment, identifying stocks that may be priced below their estimated worth can offer intriguing prospects for those looking to capitalize on market dynamics.

Three Dividend Stocks To Enhance Your Portfolio

Description: As major U.S. stock indexes reach new heights, bolstered by significant events such as Nvidia's unprecedented $5 trillion market cap and anticipation surrounding the Federal Reserve's interest rate decisions, investors are keenly evaluating their portfolios amidst these dynamic market conditions. In this environment, dividend stocks can offer a strategic advantage by providing consistent income streams and potential stability against market volatility.

Discover October 2025 Stocks That May Be Trading Below Estimated Value

Description: As of late October 2025, major U.S. stock indexes have been reaching new record highs, buoyed by strong corporate earnings and optimism surrounding potential trade agreements between the U.S. and China. Amid this robust market environment, identifying stocks that may be trading below their estimated value can offer intriguing opportunities for investors looking to capitalize on potential mispricings in a thriving economy.

2025-10-28

3 Stocks Estimated To Be Up To 34.7% Below Their Intrinsic Value

Description: As major stock indexes in the United States continue to set fresh records, buoyed by optimism surrounding U.S.-China trade talks and anticipated Federal Reserve rate cuts, investors are keenly watching for opportunities that may still offer substantial value. In this environment of soaring indices, identifying stocks that are potentially undervalued can be crucial for those looking to maximize their investment potential.

3 Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 46.9%

Description: As major U.S. stock indexes reach record highs fueled by optimism over U.S.-China trade discussions and expectations of a Federal Reserve rate cut, investors are increasingly on the lookout for opportunities to capitalize on undervalued stocks. In this buoyant market environment, identifying stocks trading below their intrinsic value can offer potential for growth, making them an attractive consideration for those seeking to enhance their investment portfolios.

Amazon Is Cutting Jobs. Why That’s a Strong Sign for the AI Boom.

Description: Qualcomm enters AI computing race, Texas emerges as banking M&A epicenter, suspension of food assistance during shutdown to hit economy, and more news to start your day.

Texas Emerges as a Hotbed in Bank M&A Boom

Description: Texas has emerged as a center of dealmaking between banks this year, drawing CEOs who are competing for access to the state’s deposit base and broader growth relative to other markets, even as some indicators tracked by the government reflect pressure on the economy there. The state is home to the largest share of banks targeted by other U.S. banks for acquisitions in 2025, according to an analysis by S&P Global Market Intelligence. A multibillion-dollar deal announced Monday became the latest in a series of Texas tie-ups that fit into a broader wave of bank mergers the Trump administration has helped to usher in.

2025-10-27

3 Stocks Estimated To Be Undervalued By Up To 48.5%

Description: As U.S. stock indices reach new heights, driven by optimism surrounding U.S.-China trade talks and strong corporate earnings, investors are keenly observing the potential impacts of these developments on market valuations. In this environment of record-setting highs, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer attractive entry points relative to their intrinsic value.

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 35.5%

Description: As the United States stock market reaches record highs, buoyed by a tame inflation report and expectations of an interest rate cut, investors are keenly eyeing opportunities to capitalize on this favorable environment. In such a climate, identifying stocks that may be trading below their intrinsic value can offer potential long-term benefits, as these undervalued assets might provide room for growth when the broader market conditions align positively.

3 Stocks Estimated To Be 24.1% To 35.5% Below Intrinsic Value

Description: As the United States stock market hits record highs, driven by a tame inflation reading and expectations of a Federal Reserve rate cut, investors are keenly eyeing opportunities for value amidst the bullish sentiment. In such an environment, identifying stocks that are estimated to be significantly below their intrinsic value can offer potential for long-term growth and portfolio diversification.

2025-10-26

2025-10-25

2025-10-24

5 Revealing Analyst Questions From Fifth Third Bancorp’s Q3 Earnings Call

Description: Fifth Third Bancorp’s third quarter was marked by positive market reception, as the company delivered results above Wall Street’s revenue and adjusted earnings expectations. Management attributed the performance to robust loan growth, disciplined cost management, and strong deposit inflows, particularly in the Southeast. CEO Timothy Spence noted that “average loans increased 6% year over year,” while average demand deposits and consumer accounts also saw meaningful gains. Continued investments i

2025-10-23

How Analyst Views on Fifth Third Are Shifting Amid Merger Moves and Profit Outlook Changes

Description: Fifth Third Bancorp has seen its consensus analyst price target edge up from $49.85 to $50.45, reflecting a modest uptick in the stock’s expected value. This update comes amid a mix of optimistic and cautious analyst views, influenced by the bank's ongoing mergers and recent performance trends. Stay tuned to discover how you can track these evolving analyst perspectives and stay informed about the changing narrative around Fifth Third Bancorp. What Wall Street Has Been Saying 🐂 Bullish...

Fifth Third Named a 2025 Leading Disability Employer by the National Organization on Disability

Description: CINCINNATI, October 23, 2025--In honor of National Disability Employment Awareness Month, Fifth Third’s inclusive employment practices have again been recognized by the National Organization on Disability.

UBS Remains Bullish on Capital One Financial Corporation (COF) Amid Substantial Sector Gains in Q2

Description: With significant hedge fund interest, Capital One Financial Corporation (NYSE:COF) secures a spot on our list of the 13 best Fortune 500 stocks to invest in now. On October 7, 2025, UBS modestly reduced its price target on Capital One Financial Corporation (NYSE:COF) from $270 to $266, maintaining a “Buy” rating. The investment firm’s bullish […]

2025-10-22

Fifth Third Bancorp to Participate in the BancAnalysts Association of Boston Conference

Description: CINCINNATI, October 22, 2025--Fifth Third Bancorp (Nasdaq: FITB) will participate in the 2025 BancAnalysts Association of Boston Conference on November 7, 2025, at approximately 9:00 AM ET. Jamie Leonard, executive vice president and chief operating officer, and Bryan Preston, executive vice president and chief financial officer, will represent the Company.

Stablecoins must become simple: panel

Description: To become widely used, the cryptocurrency needs to work as easily as other currencies, a panel of stablecoin experts said.

2025-10-21

2025-10-20

FITB Q3 Deep Dive: Southeast Expansion and Comerica Merger Define Strategic Direction

Description: Regional banking company Fifth Third Bancorp (NASDAQ:FITB) announced better-than-expected revenue in Q3 CY2025, with sales up 5.8% year on year to $2.30 billion. Its non-GAAP profit of $0.93 per share was 7.3% above analysts’ consensus estimates.

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Oct. 20, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.07083 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable November 10, 2025 to shareholders on record as at October 31, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigrou

2025-10-19

2025-10-18

Strong Q3 Results and Acquisition Progress Could Be a Game Changer for Fifth Third Bancorp (FITB)

Description: Fifth Third Bancorp recently reported third-quarter results, announcing net interest income of US$1.52 billion and net income of US$649 million, both higher than the previous year. The bank also completed a US$300 million share repurchase program and moved forward with its Comerica acquisition, expanding its geographic reach and service capabilities. An interesting insight is that these strong earnings and strategic actions arrived amid renewed concerns over regional bank credit quality,...

2025-10-17

Equities Rise as Trade, Banking Concerns Subside; Wall Street Posts Weekly Gains

Description: US stocks rose Friday, capping off a winning week as trade tensions with China appeared to ease whil

US Equity Indexes Rise as Regional Bank Earnings Alleviate Credit Risk Worries, Trump Eases China Trade Tensions

Description: US equity indexes rose at the close on Friday as regional banks' quarterly results helped dissipate

US Equity Indexes Rise This Week as Regional Banks Rebound Amid Easing China Trade Tensions

Description: US equity indexes rose this week as credit-stress concerns surrounding regional banks dissipated, th

Bank stocks stabilize as new earnings ease Wall Street credit fears

Description: Investor fears about worsening credit conditions eased Friday as a new round of regional bank earnings provided some relief following a Thursday rout that spooked Wall Street.

Stocks to Watch Recap: American Express, Zions, Novo Nordisk

Description: ↗️ American Express (AXP): The credit-card company reported a jump in profit and revenue, as cardholders spent more and card fees grew. Shares advanced 7.3%. ↗️ Zions Bancorp (ZION), Western Alliance Bancorp (WAL): Shares in the two lenders rose 5.

Stocks Settle Higher as Bank Worries and Trade Tensions Recede

Description: The S&P 500 Index ($SPX ) (SPY ) on Friday closed up +0.53%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed up +0.52%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed up +0.65%. December E-mini S&P futures (ESZ25 ) rose +0.55%, and December E-mini Nasdaq futures...

How regional bank earnings helped put bank stocks back on track

Description: Big Banks kicked off the third quarter earnings cycle earlier this week, followed by other banking names like Bank of New York Mellon (BK), Charles Schwab (SCHW), and US Bancorp (USB). Meanwhile, Friday's batch of bank earnings from regional names like Truist (TFC), Fifth Third (FITB), Huntington (HBAN), Ally Financial (ALLY), and more helped ease Wall Street's credit fears that had sparked on Thursday. Yahoo Finance Senior Reporter David Hollerith joins Market Domination Overtime host Josh Lipton to outline the details. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Bank Stocks Recoup Some Losses as Earnings Ease Credit Fears

Description: The S&P Regional Banks Select Industry Index jumped 1.7% Friday, with Zions Bancorp NA and Truist Financial Corp among the top performers. The modest rebound follows a 6.3% plunge on Thursday, led by Zions and Western Alliance Bancorp after they said they were victims of fraud on loans to funds that invest in distressed commercial mortgages. The latest crop of earnings helped abate concerns of credit stress spreading across the group following the high-profile bankruptcies of auto lender Tricolor Holdings and car-parts supplier First Brands Group.

Sector Update: Financial Stocks Rise Late Afternoon

Description: Financial stocks were advancing in late Friday afternoon trading, with the NYSE Financial Index up 0

US Equity Indexes Rise as Regional Banks Shake Off Credit Risk Concerns, China Trade Tensions Subside

Description: US equity indexes rose ahead of the close on Friday as regional banks' quarterly results helped tamp

Fifth Third Bancorp (FITB) Q3 2025 Earnings Call Highlights: Strong Growth Amidst Fraud Challenges

Description: Despite a $200 million fraud impact, Fifth Third Bancorp (FITB) reports robust loan growth and strategic merger progress.

Equities Rise Intraday as Markets Weigh Trump's Remarks on China

Description: US benchmark equity indexes were higher intraday as President Donald Trump said steep tariffs on Chi

Stock market today: Dow, S&P 500, Nasdaq notch weekly wins after volatile week as Trump signals China talks back on track

Description: Investor fears over regional banks' exposure to bad loans and credit quality eased while talks between the US and China appeared to be back on track.

Sector Update: Financial Stocks Rise Friday Afternoon

Description: Financial stocks were advancing in Friday afternoon trading, with the NYSE Financial Index up 0.5% a

US Equity Indexes Mixed as Credit Stress Concerns Surrounding Regional Banks Dissipate

Description: US equity indexes were mixed in midday trading on Friday as concerns that credit stress could be lur

Fifth Third Q3 Earnings Top Estimates on Higher NII, Stock Gains

Description: FITB's Q3 earnings beat estimates on stronger NII and fee income, while rising expenses and weaker credit quality weigh on the results.

US Equity Indexes Rise Midday as Regional Banks Dispel Credit Stress Concerns

Description: US equity indexes rose in midday trading on Friday as concern that credit stress could be lurking in

Fifth Third, Huntington, Regions Financial Sound Upbeat on Credit Quality

Description: Fifth Third Bancorp (FITB), Huntington Bancshares (HBAN), and Regions Financial (RF) on Friday provi

Regional banks post strong earnings, Zions stock gets upgrade

Description: Yahoo Finance senior reporter Allie Canal tracks today's top moving stocks and biggest market stories in this Market Minute, including the latest earnings results from regional banks Truist Financial (TFC), Fifth Third Bancorp (FITB), and Ally Financial (ALLY), and Zions Bancorporation (ZION) receives an upgrade. Stay up to date on the latest market action, minute-by-minute, with Yahoo Finance's Market Minute.

Stocks Mixed as Chipmakers Slip and Bank Stocks Stabilize

Description: The S&P 500 Index ($SPX ) (SPY ) today is down -0.07%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is up +0.04%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is down -0.20%. December E-mini S&P futures (ESZ25 ) are down -0.03%, and December E-mini Nasdaq futures...