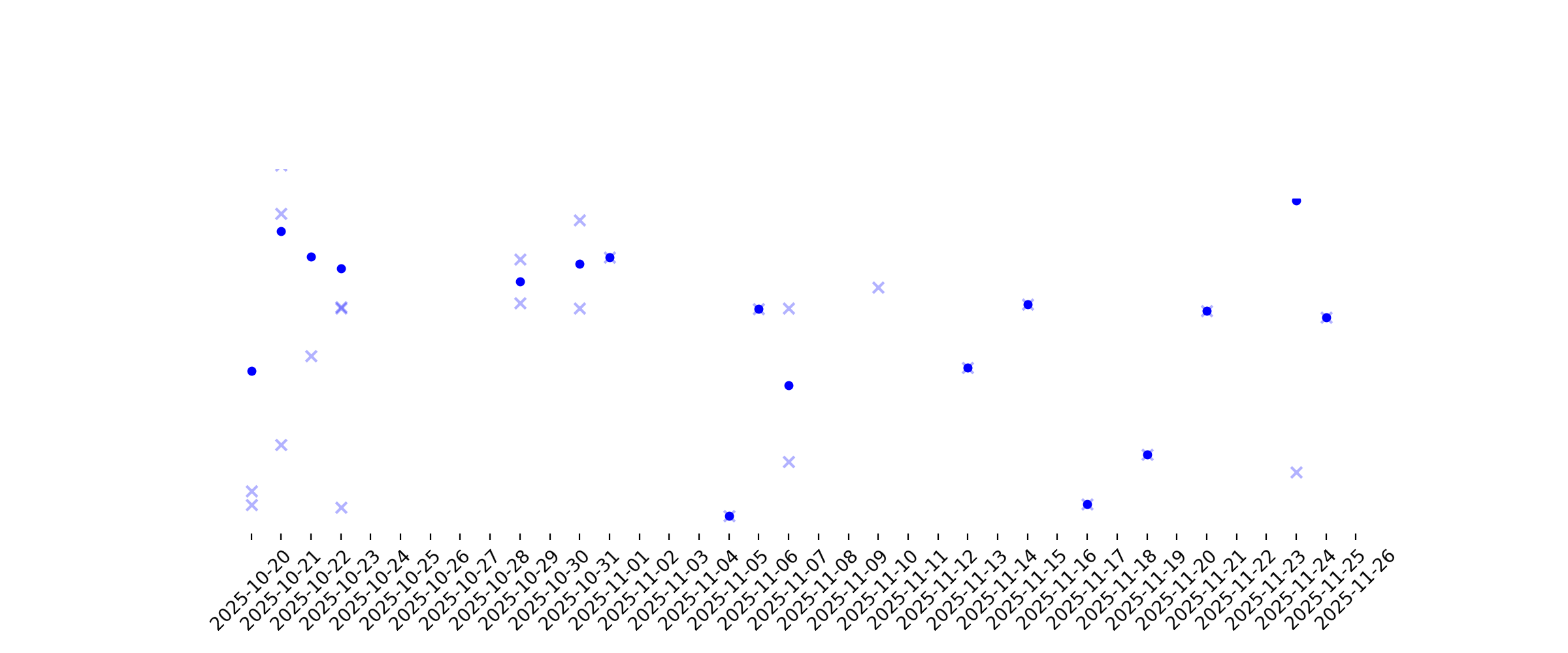

News sentiment analysis for GNRC

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Evaluating Generac Holdings (GNRC) Valuation After Recent Share Price Swings

Description: Generac Holdings (GNRC) is back in focus after recent share price swings, with the stock moving higher over the past week but showing weaker returns over the past month and past 3 months. See our latest analysis for Generac Holdings. Zooming out, Generac’s recent bounce comes after a 30 day share price return of 8.28% decline and a 90 day share price return of 10.17% decline, while the 1 year total shareholder return of 2.96% decline contrasts with a 3 year total shareholder return of 34.42%...

Why the Best Time to Own Generac Stock Is Now

Description: Generac stock has been frustrating and difficult for investors to time. For years, shares have been whipsawed by storms, data-center developments, and problems with its own inventory. The stock appears to be ready to buy, finally.

2026-01-08

Equities Mixed Intraday After Labor Market Data, Trump's Defense Budget Proposal

Description: US benchmark equity indexes were mixed intraday as investors assessed fresh labor market data and Pr

Premarket Movers: Palantir Still Running on Venezuela Operation

Description: Palantir (NASDAQ: PLTR), whose data analytics software is used by government defense and intelligence operations, is on the move again. For one, Truist upgraded PLTR to a buy rating. The firm noted that “GenAI adoption could ‘compress the market impact’ of the last four decades of enterprise technology into just the next five to ten years,” ... Premarket Movers: Palantir Still Running on Venezuela Operation

2026-01-07

2026-01-06

Generac Expands C&I Capacity With New Sussex Manufacturing Site

Description: GNRC buys a Sussex, WI plant to boost C&I capacity, tapping data center demand as large-megawatt orders and backlog surge with jobs planned by 2026.

2026-01-05

Generac Holdings Inc.'s (NYSE:GNRC) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

Description: With its stock down 15% over the past three months, it is easy to disregard Generac Holdings (NYSE:GNRC). But if you...

Generac Expands Its Commercial & Industrial Manufacturing Footprint with New Facility in Sussex, Wisconsin

Description: Generac Holdings Inc. (NYSE: GNRC), a leading global designer, manufacturer and provider of energy technology solutions and other power products, announced the acquisition of a new facility in Sussex, Wisconsin. This facility will enable the company to expand its manufacturing footprint for its Commercial & Industrial (C&I) products, which have delivered strong year-over-year growth in recent quarters. Combined with Generac's new state-of-the-art plant in Beaver Dam, WI and its expanded operatio

2026-01-04

2026-01-03

2026-01-02

Why Generac (GNRC) Stock Is Trading Up Today

Description: Shares of power generation products company Generac (NYSE:GNRC) jumped 3.1% in the afternoon session after it received positive sentiment from Wall Street analysts who held a consensus "Strong Buy" rating on the stock.

2026-01-01

2025-12-31

2025-12-30

AI Trade’s Next Leg Is All About Tech’s ‘Pick-and-Shovel’ Stocks

Description: Data storage companies dominated the S&P 500 Index in 2025, with Sandisk Corp. shares soaring almost 580% to make them the benchmark’s best performer, with Western Digital Corp. in second and Seagate Technology Holdings Plc in fourth. Meanwhile, AI-linked power providers and cable and fiber producers such as Amphenol Corp., Corning Inc., NRG Energy Inc. and GE Vernova Inc. were among the Top 25.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

Graham (GHM) Moves 7.3% Higher: Will This Strength Last?

Description: Graham (GHM) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Generac Holdings (GNRC) Is Down 13.6% After Cutting 2025 Outlook On Weak Outage-Driven Demand

Description: In late October 2025, Generac Holdings reported weaker-than-expected Q3 results, with a 5% year-over-year revenue decline and a 13% drop in residential product sales, blaming a significantly weaker power outage environment and cutting its full-year 2025 outlook to roughly flat net sales and an adjusted EBITDA margin of about 17%. This setback highlights how sensitive Generac’s core residential generator business remains to outage frequency, raising fresh questions about the company’s ability...

Generac (GNRC): Reassessing Valuation After Weaker Q3 2025 Earnings and Lowered Guidance

Description: Generac Holdings (GNRC) is back in the spotlight after its Q3 2025 report came in light, with softer power outages dragging down residential generator demand and forcing management to trim full year sales and margin guidance. See our latest analysis for Generac Holdings. The Q3 stumble adds to a tough stretch for Generac, with a 7 day share price return of negative 13.57 percent and a 90 day share price return of negative 23.78 percent signaling fading momentum, even though the 3 year total...

2025-12-19

Does Generac’s Recent Share Price Slide Create a Long Term Opportunity for Investors in 2025

Description: Wondering if Generac Holdings is a bargain or a value trap at around $138.94? You are not alone, and this article is going to unpack exactly what the market might be missing. The stock has slid recently, down 13.6% over the last week, 5.6% over the past month, and 11.5% year to date, even though it is still up 50.7% over three years. That volatility comes against a backdrop of ongoing interest in backup power and energy resilience, with Generac frequently cited in discussions about grid...

S&P 500 Stocks Upgraded: AI Data Center Power Plays And Truck Makers

Description: A pair of AI data center backup power plays and suppliers of heavy trucks and parts earned upgrades.

Circle Internet initiated, Lyft downgraded: Wall Street's top analyst calls

Description: Circle Internet initiated, Lyft downgraded: Wall Street's top analyst calls

Here Are Friday’s Top Wall Street Analyst Research Calls: Birkenstock, Coreweave, Lockheed Martin, Lyft, Paccar, Stryker, Synaptics, and More

Description: Pre-Market Stock Futures: Futures are trading higher on Friday as we prepare for the holiday-shortened week leading up to Christmas, following a solid risk-on Thursday. The Consumer Price Index print for November lit a fire under stocks as it came in much lower than expected at 2.7%. However, many on Wall Street were quick to ... Here Are Friday’s Top Wall Street Analyst Research Calls: Birkenstock, Coreweave, Lockheed Martin, Lyft, Paccar, Stryker, Synaptics, and More

2025-12-18

Generac Holdings Stock: Is GNRC Underperforming the Industrial Sector?

Description: Although Generac Holdings fell short of the industrial sector over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

2025-12-17

2025-12-16

The three-year decline in earnings might be taking its toll on Generac Holdings (NYSE:GNRC) shareholders as stock falls 3.4% over the past week

Description: While Generac Holdings Inc. ( NYSE:GNRC ) shareholders are probably generally happy, the stock hasn't had particularly...

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Jim Cramer Says Alaska Air is Good “But as a Trading Vehicle Only”

Description: Alaska Air Group, Inc. (NYSE:ALK) is one of the stocks Jim Cramer recently commented on. During the lightning round, a caller inquired about the stock, and here’s what Mad Money’s host had to say in response: “Yeah, I think Alaska’s good, I think, but as a trading vehicle only. You want to buy it… [as] […]

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

GNRC- Ignore Short-Term Weather Impact, Focus on Long-Term Opportunity

Description: Generac Holdings Inc. (GNRC) delivered a softer-than-expected third quarter, with revenue of $1.11 billion, down 5% year-over-year and missing estimates by about $79 million. On the surface the numbers look ugly, but the story is far less dramatic than the headlines suggest, writes Tom Hayes, editor of HedgeFundTips.

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Does Generac’s Recent Renewable Energy Push Signal an Opportunity for Investors in 2025?

Description: Ever wondered if Generac Holdings might actually be undervalued in today’s market, or if its recent moves are just noise? Here are the key figures driving investor interest. After rising 3.8% in the past week, Generac’s stock has still fallen around 16% this past month and is down nearly 19% over the last year. This mix hints at changing risk perceptions and shifting growth expectations. Recent headlines have centered on Generac’s strategic expansion into renewable energy services and...

2025-11-28

Generac Holdings (GNRC) Down 10.2% Since Last Earnings Report: Can It Rebound?

Description: Generac Holdings (GNRC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

2025-11-26

2025-11-25

Having Loser AI Stocks Like Ouster Inc. (OUST) In Your Portfolio is … Good?

Description: Summary: Can having losers in your AI portfolio be a good thing? Two of our 24/7 Wall St. Analysts believe it is. During a recent discussion on The AI Investor Podcast, Eric Bleeker and Austin Smith talked about several stocks that performed poorly after earnings, highlighting that not every position in a portfolio will be ... Having Loser AI Stocks Like Ouster Inc. (OUST) In Your Portfolio is … Good?

2025-11-24

2025-11-23

2025-11-22

2025-11-21

1 Cash-Producing Stock with Exciting Potential and 2 That Underwhelm

Description: A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

2025-11-20

ChargePoint, Generac, Lucid, Vishay Precision, and RXO Shares Are Falling, What You Need To Know

Description: A number of stocks fell in the afternoon session after markets faded the Nvidia rally in the morning session, as investors remained uncertain about future rate cuts.

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

A Fresh Look at Generac Holdings (GNRC) Valuation After Recent Share Price Decline

Description: Generac Holdings (GNRC) has seen its shares fall over the past month, dropping about 21% as investors weigh its growth potential against recent performance. The stock's current valuation might prompt some renewed attention from value-focused buyers. See our latest analysis for Generac Holdings. Generac’s momentum has clearly faded in recent months, with a sharp 1-month share price return of -20.62% capping off a year where long-term holders saw a total shareholder return of -16.84%. This...

2025-11-14

Generac putting 'best foot forward' on AI data centers: CEO

Description: AI data centers have been the talk of many earnings calls this quarter, as Big Tech commits billions into building out its artificial intelligence infrastructure. One player positioned to win big on these massive data center projects is Generac Holdings (GNRC), the manufacturer of backup generator systems. Generac Chairman, CEO, and President Aaron Jagdfeld sits down with Market Catalysts host Julie Hyman to speak about more about Generac's entry into the competitive AI data center landscape, while also commenting on rising electricity costs and the impact of tariffs. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Generac CEO on rising electricity costs amid data center projects

Description: With Generac Holdings (GNRC) positioned to win big in Silicon Valley's plans to build out AI data center infrastructure, Generac Chairman, CEO, and President Aaron Jagdfeld comes on Market Catalysts to speak more on the rise in electricity costs for American households and relating it back to how major energy companies can work to relieve strain on the US grid systems. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-11-13

2025-11-12

Generac, REV Group, Plug Power, Resideo, and Universal Logistics Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investors continued to pile into value-oriented names amid growing valuation concerns. This shift reflected growing caution over high valuations within the technology and artificial intelligence (AI) spheres. As market participants reassessed risk, they reallocated capital from growth-heavy indices, like the Nasdaq, to companies in areas like industrials and financials, perceived to be more reasonably priced. Contributing to the positive m

2025-11-11

As Cold Weather Looms, Generac Urges Homeowners to Prepare for Power Outages

Description: Generac Holdings Inc. (NYSE: GNRC), a leading global designer, manufacturer and provider of energy technology solutions and other power products, is encouraging homeowners across the country to build a cold weather preparedness and backup power plan to protect their homes and families during potential winter-weather induced power outages.

2025-11-10

2025-11-09

2025-11-08

Generac (GNRC) Is Down 7.6% After Cutting 2025 Sales Guidance Amid Competitive Pressure – What's Changed

Description: In the past week, Generac Holdings Inc. reported third quarter 2025 earnings with quarterly sales of US$1.11 billion and net income of US$66.16 million, both declining compared to the prior year, and also lowered its full-year 2025 net sales growth guidance to be flat versus the previous year, instead of the earlier projected 2% to 5% increase. This guidance cut highlights ongoing weakness in residential product demand and increased competition in the backup generator market, which have...

2025-11-07

2025-11-06

2025-11-05

AI’s Power Rush Lifts Smaller, Pricier Equipment Makers

Description: Tech companies working on artificial intelligence are in a rush to get electricity. Large natural-gas turbines are a natural fit for data centers with huge power needs, but these face yearslong wait lists and lengthy construction schedules. In a recent report, Morgan Stanley estimated that U.S. data centers face a shortfall of 45 gigawatts of power, roughly the generation capacity of Illinois, through 2028.

5 Insightful Analyst Questions From Generac’s Q3 Earnings Call

Description: Generac’s third-quarter performance fell short of Wall Street’s expectations, as both revenue and non-GAAP profit missed analyst estimates and the market responded with a significant share price decline. Management attributed the underperformance mainly to an unusually low number of power outages, which led to softer demand for home standby and portable generators. CEO Aaron Jagdfeld described the weather as “really nice everywhere,” leading to outage hours 75% to 80% below normal for the quarte

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Generac (GNRC) Stock Trades Up, Here Is Why

Description: Shares of power generation products company Generac (NYSE:GNRC) jumped 2.8% in the afternoon session after the stock appeared to rebound from a sharp decline in the previous session that was caused by disappointing third-quarter results and a reduced forecast.

Jim Cramer on Generac: “They Didn’t Bet Big Enough on the Data Center”

Description: Generac Holdings Inc. (NYSE:GNRC) is one of the stocks Jim Cramer recently discussed. Cramer noted that the company “got slammed” after reporting its quarter, as he stated: “But then you take a look at Generac. Well, what do they do? They’re the maker of backup generators with some data center exposure, even though it’s clearly […]

Generac (GNRC) “Wanted To Blame Storms,” Says Jim Cramer

Description: We recently published Jim Cramer Talked About These 14 Stocks & Discussed AI And Layoffs. Generac Holdings Inc. (NYSE:GNRC) is one of the stocks Jim Cramer recently discussed. Generac Holdings Inc. (NYSE:GNRC) is an industrial machinery manufacturer that makes and sells products such as generators, monitoring systems, and home energy management systems. The firm reported […]

How Recent Developments Are Shaping the Generac Holdings Investment Story

Description: Generac Holdings stock has recently seen a modest increase in its consensus analyst price target, moving from $203.88 to $209.59. This uptick comes amid a blend of optimism about long-term growth and caution regarding short-term uncertainties. Stay tuned to discover how you can keep updated as Wall Street’s expectations and the broader story around Generac Holdings continue to evolve. Stay updated as the Fair Value for Generac Holdings shifts by adding it to your watchlist or portfolio...

2025-10-30

Generac (GNRC) Margin Hold Reinforces Sector Profitability Concerns After Earnings Release

Description: Generac Holdings (GNRC) reported net profit margins of 7.1%, unchanged from the prior year, alongside earnings growth of 6.1%, which contrasts with its five-year average annual decline of 11.3%. Looking forward, company earnings are forecast to accelerate at 22% per year, comfortably outpacing the expected US market average of 15.7% per year. However, revenue growth forecasts of 8.8% per year lag the broader market’s 10.3% pace. Investors may find the current share price appealing, as it...

Generac Holdings Inc (GNRC) Q3 2025 Earnings Call Highlights: Navigating Challenges with ...

Description: Despite a decline in net sales, Generac Holdings Inc (GNRC) focuses on expanding its dealer network and capitalizing on opportunities in the data center market.

GNRC Q3 Deep Dive: Weak Outage Environment and Data Center Expansion Shape Results

Description: Power generation products company Generac (NYSE:GNRC) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 5% year on year to $1.11 billion. Its non-GAAP profit of $1.83 per share was 16.7% below analysts’ consensus estimates.

2025-10-29

Generac sales fall 5% due to 'crappy season' with few outages. Betting big on data centers

Description: “It was a crappy season, I mean, let’s be honest. The weather was really nice everywhere,” said Aaron Jagdfeld, president and CEO.

Generac Q3 Earnings & Revenues Miss Estimates, 2025 Outlook Revised

Description: GNRC's third-quarter earnings and sales fall short of estimates, with weaker generator demand prompting it to cut the 2025 revenue outlook.

Here's What Key Metrics Tell Us About Generac Holdings (GNRC) Q3 Earnings

Description: Although the revenue and EPS for Generac Holdings (GNRC) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Generac Holdings (GNRC) Q3 Earnings and Revenues Lag Estimates

Description: Generac Holdings (GNRC) delivered earnings and revenue surprises of -18.67% and -7.44%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Generac Holdings slashes net sales outlook amid weak seasonal generator demand

Description: Investing.com - Generac Holdings reported third-quarter profit and sales that fell short of Wall Street expectations and lowered its annual financial guidance, citing a "significantly weaker power outage environment" that has dented demand for its backup generators.

Generac (NYSE:GNRC) Misses Q3 Revenue Estimates, Stock Drops 15.3%

Description: Power generation products company Generac (NYSE:GNRC) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 5% year on year to $1.11 billion. Its non-GAAP profit of $1.83 per share was 16.7% below analysts’ consensus estimates.

Generac Holdings: Q3 Earnings Snapshot

Description: WAUKESHA, Wis. AP) — Generac Holdings Inc. GNRC) on Wednesday reported third-quarter earnings of $66.2 million.

Generac Reports Third Quarter 2025 Results

Description: Growing data center market opportunities provide counterweight to below average power outage environmentWAUKESHA, Wisc., Oct. 29, 2025 (GLOBE NEWSWIRE) -- Generac Holdings Inc. (NYSE: GNRC) (“Generac” or the “Company”), a leading global designer and manufacturer of energy technology solutions and other power products, today reported financial results for its third quarter ended September 30, 2025 and provided an update on its outlook for the full-year 2025. Third Quarter 2025 Highlights Net sale

2025-10-28

Is Generac Holdings (GNRC) The Best Small-Cap AI Data Center Stock to Buy Now?

Description: We recently published Top 10 Buzzing Stocks to Watch as Analysts Predict AI-Led Bull Market Will Continue. Generac Holdings Inc (NYSE:GNRC) is one of the top buzzing stocks to watch. Chris Retzler, Needham portfolio manager, said in a recent program on CNBC that small-cap stocks have strong growth potential amid the Fed’s rate cut cycle. […]

2025-10-27

What To Expect From Generac’s (GNRC) Q3 Earnings

Description: Power generation products company Generac (NYSE:GNRC) will be reporting results this Wednesday morning. Here’s what to look for.

Generac to Report Q3 Earnings: What Should Investors Expect?

Description: GNRC's third-quarter results may show modest sales gains, driven by strong energy tech demand but tempered by muted home generator sales.

2025-10-26

Generac Holdings (GNRC): Assessing Valuation as Analyst Focus Intensifies on AI and Data Center Growth Potential

Description: Generac Holdings (GNRC) has come into focus as analysts point to the company's stake in powering the latest wave of AI and data center growth. With tech giants pouring money into infrastructure, Generac’s position supporting dependable energy is receiving fresh attention from investors. See our latest analysis for Generac Holdings. Momentum has clearly been building for Generac Holdings, with a 1-month share price return of 14.07% and a strong 23.47% gain over the past three months. These...

2025-10-25

Needham Sees Opportunity in 2 Lesser-Known Energy Stocks Riding the Data-Center Boom

Description: One of the biggest stories in markets today is the boom in AI – and with it, the surge in data center development. This trend extends far beyond the digital realm; data centers are massive physical structures, and their expansion has impacts in numerous industries. At the heart of this construction wave are the world’s largest tech firms, whose AI ambitions are driving unprecedented levels of capital spending. Companies such as Microsoft, Amazon, Meta, and Alphabet are pouring record amounts int

2025-10-24

2025-10-23

2025-10-22

Generac Holdings (GNRC) Q3 Earnings Preview: What's in the Cards?

Description: Generac Holdings (GNRC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-21

2025-10-20

Industrials Post Positive Earnings. 3 Stocks Whose Charts Say ‘Buy.’

Description: An equipment manufacturer, an industrial machinery play, and a safety science company with constructive technical indicators.

Here’s Why Generac Holdings (GNRC) Surged in Q3

Description: Conestoga Capital Advisors, an asset management company, released its third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Equity markets continued their momentum that began in early April, reaching new all-time highs in the third quarter. Conestoga Smid Cap Composite underperformed the Russell 2500 Growth Index in the quarter and returned -1.1% […]

2025-10-19

2025-10-18

2025-10-17

Will Generac Holdings (GNRC) Bridge Margin Pressures With Upcoming Results?

Description: Generac Holdings announced it will release its third-quarter 2025 financial results on October 29 before the market opens, followed by a management conference call and webcast. Market attention centers on analyst expectations for incremental earnings growth and Generac’s ongoing efforts to address challenges in margins and operational performance despite industry headwinds. With investor focus set on possible earnings growth, we'll examine how anticipation for the upcoming quarterly results...