News sentiment analysis for HST

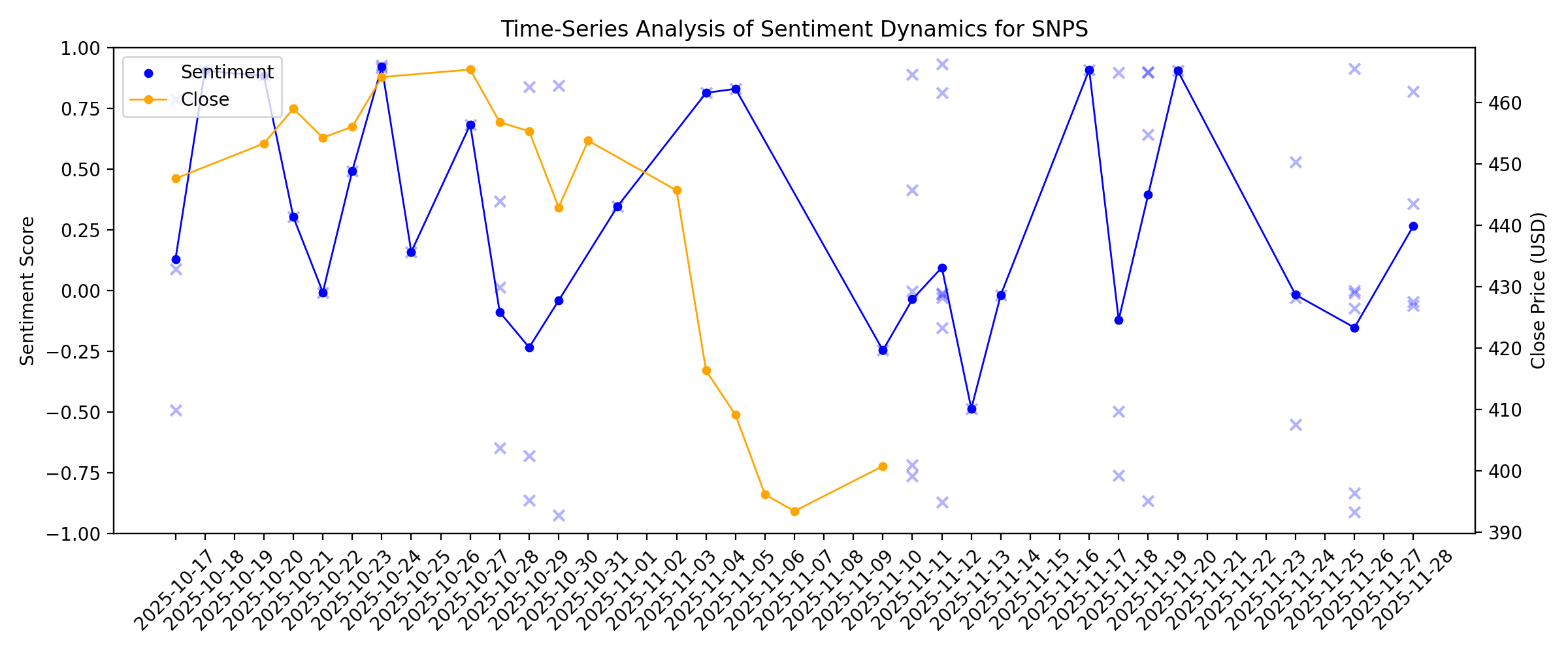

Sentiment chart

2026-01-14

2026-01-13

Zacks.com featured highlights include Arista Networks, Corning, Banco Bilbao Vizcaya Argentaria, Assurant and Host Hotels & Resorts

Description: Arista Networks leads a screen of high-ROE stocks as investors look for cash-efficient performers while the U.S. economy stays resilient.

2026-01-12

Are Investors Undervaluing Host Hotels & Resorts (HST) Right Now?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

3 Dividend Stocks Yielding Between 3% And 5.1% For Your Income Portfolio

Description: As the Dow and S&P 500 close at record highs, buoyed by a decline in unemployment rates, investors are increasingly looking to solidify their portfolios with reliable income sources. In this thriving market environment, dividend stocks yielding between 3% and 5.1% can offer a stable income stream while capitalizing on the current economic momentum.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

Are You a Momentum Investor? This 1 Stock Could Be the Perfect Pick

Description: Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

Dividend Stocks To Consider In December 2025

Description: As the U.S. stock market continues its upward trajectory, with the S&P 500 hitting new all-time highs and major indices advancing, investors are keenly observing opportunities for stable returns amidst this bullish environment. In such a climate, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive consideration for those looking to balance growth with income in their portfolios.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Three Prominent Dividend Stocks To Consider

Description: As the U.S. stock market experiences a resurgence, with major indexes like the Nasdaq and S&P 500 seeing notable gains driven by tech shares, investors are keenly observing opportunities across various sectors. In this dynamic environment, dividend stocks stand out as a compelling option for those seeking consistent income streams alongside potential capital appreciation.

Host Hotels Stock Rises 9.8% in a Month: Will the Trend Last?

Description: HST shares jump 9.8%, driven by RevPAR growth expectations, disciplined capital recycling and a strong balance sheet.

3 Dividend Stocks To Consider With Up To 3.5% Yield

Description: As major indexes in the United States, including the S&P 500 and Dow Jones Industrial Average, face consecutive declines amid tech stock retreats and AI bubble concerns, investors are increasingly looking toward stable income sources. In such a volatile market environment, dividend stocks with yields up to 3.5% can offer a reliable stream of income while potentially providing some buffer against market fluctuations.

2025-12-18

Top 3 Dividend Stocks To Consider For Your Portfolio

Description: In the wake of recent inflation data that came in cooler than expected, major U.S. stock indexes like the Dow Jones and S&P 500 have rebounded, snapping a four-session losing streak and reflecting renewed investor optimism. Amidst this backdrop of market recovery, dividend stocks continue to attract attention for their potential to provide steady income streams, making them an appealing consideration for investors looking to balance growth with stability in their portfolios.

3 Reliable Dividend Stocks Yielding Up To 9.3%

Description: As the U.S. stock market navigates a mixed landscape with rising unemployment and fluctuating indices, investors are increasingly seeking stability through dividend stocks. In such uncertain times, reliable dividend payers can offer consistent income streams, making them an attractive option for those looking to balance risk and reward in their portfolios.

The Zacks Analyst Blog Tapestry, Signet Jewelers and Host Hotels & Resorts

Description: Tapestry is benefiting from accelerating demand, Gen Z customer gains and global growth as pricing power and digital strength support momentum into 2026.

2025-12-17

Top Dividend Stocks To Consider In December 2025

Description: As the U.S. stock market navigates a challenging landscape with AI stocks under pressure and economic data closely watched, investors are increasingly seeking stability amid volatility. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance potential risks with steady returns.

2025-12-16

Should Value Investors Buy Host Hotels & Resorts (HST) Stock?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2025-12-15

Is Host Hotels & Resorts Stock Underperforming the Nasdaq?

Description: Although Host Hotels & Resorts has slightly underperformed the Nasdaq recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

Host Hotels Announces Special Dividend: Time to Buy the Stock?

Description: HST boosts investment appeal with a 15 cents per share special dividend atop its regular payout, lifting the total 2025 dividend annualized yield of 5.24%.

Dividend Stocks To Consider In December 2025

Description: As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, investors are eyeing opportunities in dividend stocks that can offer steady income amidst fluctuating market conditions. A good dividend stock typically combines strong fundamentals with a reliable payout history, making it an attractive option for those looking to balance growth potential with income stability in today's dynamic economic landscape.

2025-12-11

Host Hotels & Resorts Announces Fourth Quarter Dividend and Special Dividend on Common Stock

Description: BETHESDA, Md., Dec. 11, 2025 (GLOBE NEWSWIRE) -- Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the nation’s largest lodging real estate investment trust, today announced that its board of directors authorized a regular quarterly cash dividend of $0.20 per share. In addition, the Company announced a special dividend of $0.15 per share, bringing the total dividends declared for the year to $0.95 per share. The dividend is payable on January 15, 2026, to stockholders of record as of De

2025-12-10

Host Hotels & Resorts Announces Fourth Quarter 2025 Earnings Call to be Held on February 19, 2026

Description: BETHESDA, Md., Dec. 10, 2025 (GLOBE NEWSWIRE) -- Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the nation’s largest lodging real estate investment trust, will report fourth quarter 2025 financial results on Wednesday, February 18, 2026, after the market close. The Company will hold a conference call to discuss its fourth quarter 2025 results and business outlook on Thursday, February 19, 2026, at 10:00 a.m. ET. Conference call access information is as follows: Conference Call: USA/C

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Why Is Host Hotels (HST) Down 0.9% Since Last Earnings Report?

Description: Host Hotels (HST) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Host Hotels & Resorts: A Lodging Titan with Room to Grow

Description: Host Hotels & Resorts combines a top-tier hotel portfolio, solid balance sheet, and attractive valuation, offering long-term value despite cycles.

2025-12-04

2025-12-03

2025-12-02

2025-12-01

4 Reasons to Add Host Hotels Stock to Your Portfolio Now

Description: HST leverages advantageous locations, improved group and transient business demand, strategic capital recycling moves and solid dividend payouts.

2025-11-30

What Host Hotels & Resorts (HST)'s $400 Million Debt Offering and Insider Sale Mean for Shareholders

Description: Earlier in November 2025, Host Hotels & Resorts announced a US$400 million offering of 4.250% Senior Notes due in 2028, while Executive Vice President Michael E. Lentz sold approximately US$617,000 in shares. Shortly after raising its earnings guidance, Host Hotels was downgraded by Evercore ISI, illustrating how new debt issuances and analyst sentiment can rapidly affect investor perception. We’ll explore how the recent US$400 million debt offering may influence Host Hotels & Resorts’...

Assessing Host Hotels & Resorts Value After Share Price Rises 9.6% on Travel Demand News

Description: Ever wondered if Host Hotels & Resorts could be trading for less than it's truly worth? You're not alone, and today's market gives us plenty of reasons to dig into the numbers. After climbing 9.6% over the past month and returning 33.7% in five years, the stock has shown there is both growth potential and fresh investor interest bubbling beneath the surface. New developments in the hospitality sector, such as increased travel demand and strategic acquisitions by competitors, have added some...

2025-11-29

'We needed to go to work': Hilton CEO details how a winning offering evolved

Description: Hilton CEO Chris Nassetta shares about reaching customers at every price point after more than a decade at the helm

2025-11-28

2025-11-27

Are Investors Undervaluing Host Hotels & Resorts (HST) Right Now?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Host Hotels & Resorts, Inc. Announces Pricing Of $400 Million Of 4.250% Senior Notes Due 2028, By Host Hotels & Resorts, L.P.

Description: BETHESDA, Md., Nov. 12, 2025 (GLOBE NEWSWIRE) -- Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the nation’s largest lodging real estate investment trust, today announced that Host Hotels & Resorts, L.P. ("Host L.P."), for whom the Company acts as sole general partner, has priced its offering (the "Offering") of $400 million aggregate principal amount of 4.250% Senior Notes due 2028 (the "Notes"). The Notes are Host L.P.’s senior unsecured obligations. The Offering is expected to clo

2025-11-11

Here are Tuesday’s Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

Description: Pre-Market Stock Futures: The futures are trading mixed after a massive bounce-back rally on Monday across Wall Street, which saw all the major indices trade higher, with the NASDAQ closing up 2.27% at 23,554. In comparison, the S&P 500 saw a hefty 1.54% gain to close at 6,832, and the venerable Dow Jones Industrial Average ... Here are Tuesday’s Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

2025-11-10

2025-11-09

2025-11-08

2025-11-07

How Analyst Views Are Shifting the Narrative for Host Hotels and Its Future Prospects

Description: Host Hotels & Resorts has seen its fair value estimate nudged upward to $18.86, reflecting new performance metrics. The discount rate has notably dropped to 7.77 percent, signaling improved perceptions of the company's risk profile. This change arrives amid strong second-quarter results and an increase in the company's 2025 outlook, fueling both bullish enthusiasm and ongoing debate among analysts. Stay tuned to learn proactive ways to track these evolving perspectives in the months...

Why Host Hotels (HST) is a Top Momentum Stock for the Long-Term

Description: Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Host Hotels & Resorts (HST): Valuation Update Following Strong Q3 Beat and Upgraded Guidance

Description: Host Hotels & Resorts (HST) delivered third-quarter results that surprised to the upside, powered by steady demand in top leisure and city destinations. Higher room rates and surging net income stood out as key highlights. See our latest analysis for Host Hotels & Resorts. After the upbeat earnings report and guidance raise, Host Hotels & Resorts’ share price jumped 6.85% in a single day, defying a broader market dip and highlighting renewed investor confidence in the hospitality sector. This...

3 Top Dividend Stocks To Enhance Your Portfolio

Description: As concerns about AI valuations and economic uncertainties weigh on the U.S. stock market, investors are turning their focus to more stable options. In such a climate, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive choice for enhancing your portfolio.

Why Host Hotels & Resorts (HST) Is Up 8.1% After Doubling Net Income in Q3 2025

Description: Host Hotels & Resorts, Inc. recently reported its third-quarter 2025 earnings, posting US$1.33 billion in revenue and US$161 million in net income, both higher than the same quarter last year. An interesting highlight is that net income and earnings per share from continuing operations more than doubled year-over-year, signaling improved profitability despite analyst expectations of only marginal performance. We'll explore how this stronger-than-expected increase in net income is likely to...

2025-11-06

Host Hotels & Resorts Provides Updated Third Quarter 2025 Investor Presentation

Description: BETHESDA, Md., Nov. 06, 2025 (GLOBE NEWSWIRE) -- Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the nation’s largest lodging real estate investment trust, today provided an updated investor presentation for third quarter 2025 results. The investor presentation can be found on the Investor Relations section on the Company’s website at https://www.hosthotels.com/#key-investors-materials. ABOUT HOST HOTELS & RESORTS Host Hotels & Resorts, Inc. is an S&P 500 company and is the largest lo

Host Hotels' Q3 FFO Tops, Revenues Meet Estimates, Hotel RevPAR Rises

Description: HST delivers stronger-than-expected Q3 results, raises its 2025 AFFO outlook and gains a Moody's credit upgrade amid steady revenue growth.

2025-11-05

Host Hotels (HST) Reports Q3 Earnings: What Key Metrics Have to Say

Description: While the top- and bottom-line numbers for Host Hotels (HST) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Host Hotels: Q3 Earnings Snapshot

Description: The Bethesda, Maryland-based real estate investment trust said it had funds from operations of $240 million, or 35 cents per share, in the period. The average estimate of eight analysts surveyed by Zacks Investment Research was for funds from operations of 33 cents per share. Funds from operations is a closely watched measure in the REIT industry.

Host Hotels & Resorts, Inc. Reports Results for the Third Quarter 2025

Description: Quarterly Comparable Hotel Total RevPAR Growth of 0.8% and Comparable Hotel RevPAR Growth of 0.2%Raises Full Year Comparable Hotel RevPAR Growth Guidance to ~3.0% Over 2024Announces Second Marriott Transformational Capital ProgramCompleted Sale of Washington Marriott at Metro Center BETHESDA, Md., Nov. 05, 2025 (GLOBE NEWSWIRE) -- Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the nation’s largest lodging real estate investment trust (“REIT”), today announced results for the third qu

2025-11-04

2025-11-03

Are Wall Street Analysts Bullish on Host Hotels & Resorts Stock?

Description: Host Hotels & Resorts has trailed the broader market over the past year, and while analysts see potential ahead, their outlook remains measured given the company's slower growth backdrop.

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

Here's What to Expect From Host Hotels & Resorts' Next Earnings Report

Description: Host Hotels & Resorts will release its third-quarter earnings next month, and analysts anticipate a single-digit FFO dip.

2025-10-21

Should Value Investors Buy Host Hotels & Resorts (HST) Stock?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.