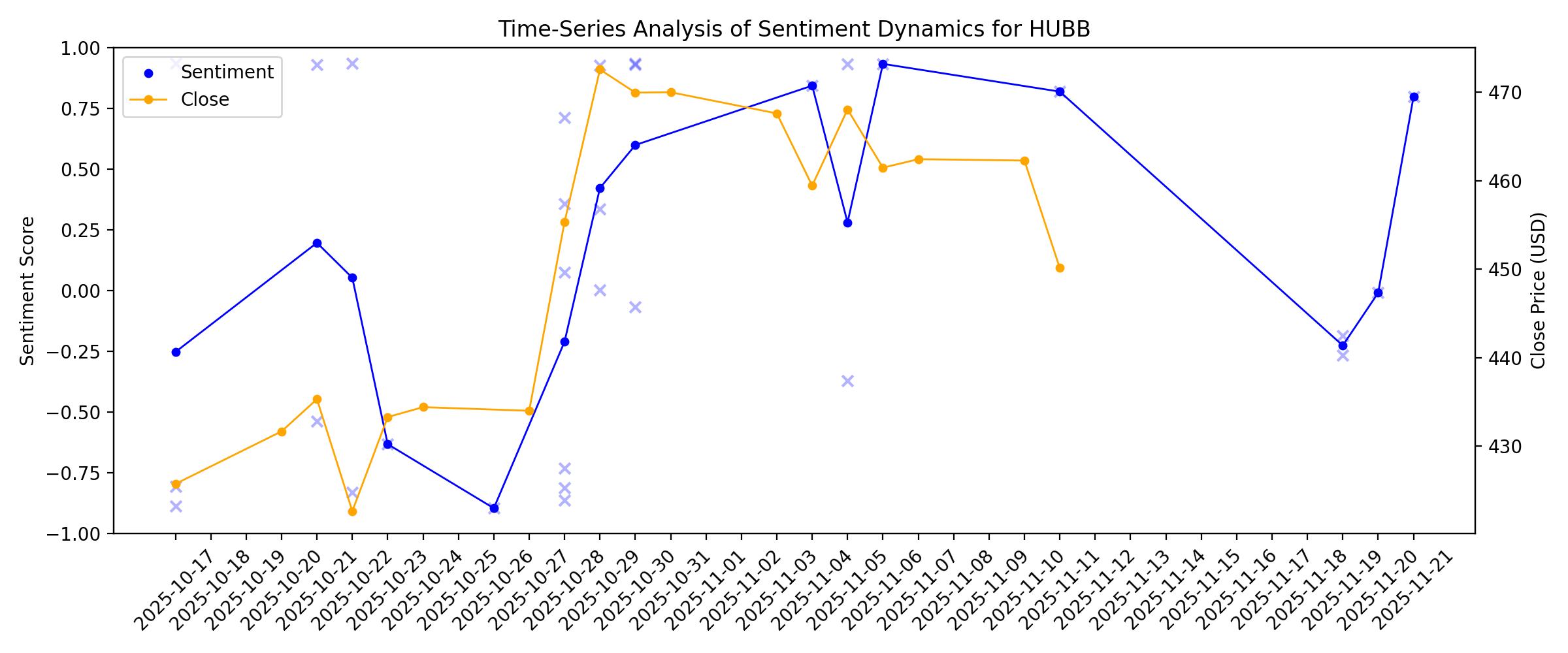

News sentiment analysis for HUBB

Sentiment chart

2026-01-14

Hubbell to Announce Fourth Quarter and Full Year 2025 Results on February 3, 2026

Description: Shelton, CT, Jan. 14, 2026 (GLOBE NEWSWIRE) -- Hubbell Incorporated (NYSE: HUBB) today announced it will release its fourth quarter and full year 2025 financial results prior to the opening of the market on February 3, 2026. The Company will then webcast its Analysts' Conference Call to discuss the results at 10:00 AM ET. The full text of the press release announcing the results will be posted on Hubbell's corporate website under the Press Release section. You can also access this information by

2026-01-13

2026-01-12

What to Expect From Hubbell’s Next Quarterly Earnings Report

Description: Hubbell shows steady earnings growth expectations and broadly positive analyst sentiment, despite mixed share performance.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

Why Hubbell (HUBB) is Poised to Beat Earnings Estimates Again

Description: Hubbell (HUBB) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

These 2 Industrial Products Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

2026-01-07

Assessing Hubbell (HUBB) Valuation After Recent Share Price Momentum And Mixed Fair Value Signals

Description: Hubbell (HUBB) has recently drawn investor attention after its latest trading session, with the share price closing at $468.20 as returns over the past month and past 3 months stayed in positive territory. See our latest analysis for Hubbell. While the 1 day share price return showed a 1.94% decline, the 7 day and 90 day share price returns of 5.42% and 11.77% respectively point to building momentum, supported by a 1 year total shareholder return of 9.12% and a very large 5 year total...

2026-01-06

Hubbell (HUBB) Upgraded to Buy: Here's What You Should Know

Description: Hubbell (HUBB) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

Here's Why We Think Hubbell (NYSE:HUBB) Is Well Worth Watching

Description: It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story...

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

Does Stronger Margins Amid Soft Sales Change The Bull Case For Hubbell’s Grid Story (HUBB)?

Description: In late October, Hubbell reported mixed third-quarter results, with net sales rising but missing estimates, while adjusted EPS grew more than 10% and surpassed analyst expectations, prompting an upward revision to its fiscal 2025 adjusted EPS guidance. This combination of stronger-than-expected profitability and higher earnings guidance, despite softer sales, highlights the company’s improving efficiency and cost control. Next, we’ll examine how Hubbell’s upgraded earnings guidance reshapes...

2025-12-12

2025-12-11

2025-12-10

Hubbell Stock: Is HUBB Underperforming the Industrial Sector?

Description: Hubbell has underperformed its sector peers recently, yet analysts remain moderately optimistic about the stock’s prospects

2025-12-09

Can AI Data Center Demand Keep Driving nVent Electric's Growth?

Description: NVT rides surging AI data center demand as liquid cooling orders, backlog strength and new capacity fuel multi-year growth.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Hubbell Incorporated (HUBB): A Bull Case Theory

Description: We came across a bullish thesis on Hubbell Incorporated on Quality Value Investing’s Substack by David J. Waldron. In this article, we will summarize the bulls’ thesis on HUBB. Hubbell Incorporated’s share was trading at $427.85 as of December 1st. HUBB’s trailing and forward P/E were 26.76 and 21.93 respectively according to Yahoo Finance. Hubbell Incorporated (HUBB) is […]

2025-12-03

2025-12-02

Has Hubbell’s Multi Year Surge Left Limited Upside Amid Grid Modernization Optimism?

Description: If you are wondering whether Hubbell is still worth buying after its big multi year run, this is a good moment to step back and ask what you are really paying for. The stock has cooled off recently, slipping about 0.5% over the last week, 9.0% over the past month, and is only up 1.8% year to date after an 81.6% gain over 3 years and 188.4% over 5 years. Investors have been digesting a mix of macro headlines around infrastructure spending, grid modernization, and industrial capital...

All You Need to Know About Hubbell (HUBB) Rating Upgrade to Buy

Description: Hubbell (HUBB) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Are Wall Street Analysts Predicting Hubbell Stock Will Climb or Sink?

Description: Although Hubbell has lagged behind the broader market over the past 52 weeks, Wall Street analysts remain moderately optimistic about the stock's prospects.

2025-11-20

AAON, FTAI Aviation, Hubbell, MYR Group, and Allient Shares Plummet, What You Need To Know

Description: A number of stocks fell in the afternoon session after markets faded the Nvidia rally in the morning session, as investors remained uncertain about future rate cuts.

2025-11-19

How Analyst Optimism and Growth Forecasts Are Shaping the Evolving Hubbell Investment Story

Description: Hubbell’s stock has experienced a significant shift in price target following a fresh round of research, reflecting increased optimism for the company’s prospects. The fair value estimate remains steady at $481.27 per share, while the discount rate has seen a minor uptick. Stay tuned to discover how you can track these evolving perspectives and remain informed about updates to Hubbell’s investment narrative. Analyst Price Targets don't always capture the full story. Head over to our Company...

At US$417, Is Hubbell Incorporated (NYSE:HUBB) Worth Looking At Closely?

Description: Let's talk about the popular Hubbell Incorporated ( NYSE:HUBB ). The company's shares received a lot of attention from...

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

Seaport Research Raises Price Target on Hubbell (HUBB) to $515, Maintains Buy Rating

Description: Hubbell Incorporated (NYSE:HUBB) is included among the 15 Overlooked Dividend Stocks to Buy Right Now. On October 29, Seaport Research raised its price target on Hubbell Incorporated (NYSE:HUBB) from $500 to $515 and maintained a Buy rating, as reported by The Fly. The analyst noted that the company is “uniquely positioned” to benefit from investments […]

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Trimble Q3 Earnings Beat Estimates, Revenues Increase Y/Y

Description: TRMB's Q3 results outpace estimates with solid AECO and Field Systems growth, driving strong margins and upbeat guidance for 2025.

2025-11-05

A Closer Look at Hubbell (HUBB) Valuation Following Recent Share Price Strength

Description: Hubbell (HUBB) shares have shown steady gains over the past month, rising 11%, with yearly returns also trending higher. Investors interested in the capital goods sector may find recent performance data worth a closer look. See our latest analysis for Hubbell. Momentum is certainly picking up for Hubbell, with an 11.2% share price return over the past month following a series of steady advances throughout the year. While the short-term move stands out, long-term investors have also benefited...

1 S&P 500 Stock with Exciting Potential and 2 Facing Headwinds

Description: The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning. Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

2025-11-04

5 Revealing Analyst Questions From Hubbell’s Q3 Earnings Call

Description: Hubbell’s third quarter was met with a positive market reaction, driven by improved profitability and strong performance in key business segments, despite falling short of Wall Street’s revenue expectations. Management attributed the quarter’s results to robust organic growth in Electrical Solutions and Grid Infrastructure, while noting that Grid Automation sales faced a significant decline due to project roll-offs. CEO Gerben Bakker emphasized continued strength in utility transmission and dist

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

Hubbell Incorporated Prices Offering of Senior Notes Due 2035

Description: Shelton, CT, Oct. 30, 2025 (GLOBE NEWSWIRE) -- Hubbell Incorporated (NYSE: HUBB) (“Hubbell” or the “Company”) today announced that it has successfully priced an offering of $400 million aggregate principal amount of 4.80% senior notes maturing in 2035. The offering is expected to close on November 14, 2025, subject to customary closing conditions. Net proceeds from the offering, together with cash on hand, are expected to be used to redeem in full all of the Company’s outstanding 3.350% Senior N

Hubbell Inc (HUBB) Q3 2025 Earnings Call Highlights: Strong Earnings Growth and Raised ...

Description: Hubbell Inc (HUBB) reports robust Q3 performance with double-digit earnings growth, increased cash flow, and an optimistic outlook for 2026.

Hubbell (HUBB) Net Margins Rise, Reinforcing Bullish Narrative Despite Slower Earnings Growth

Description: Hubbell (HUBB) posted earnings growth of 15.5% year-over-year, a solid result although slower than its five-year average of 21.3% per year. Net profit margins rose to 15.1%, up from last year’s 13.2%, highlighting an improving margin profile. With revenue and earnings forecasts set to trail the broader US market, investors are considering whether the continued profit gains and attractive valuation multiples justify the current price premium. See our full analysis for Hubbell. The next section...

2025-10-29

Why Hubbell (HUBB) Stock Is Up Today

Description: Shares of electrical and electronic products company Hubbell (NYSE:HUBB) jumped 4.6% in the afternoon session after the stock's positive momentum continued as the company reported strong third-quarter results that beat profit expectations and raised its full-year earnings guidance.

HUBB Q3 Deep Dive: Data Center and Grid Markets Offset Utility Segment Volatility

Description: Electrical and electronic products company Hubbell (NYSE:HUBB) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 4.1% year on year to $1.50 billion. Its non-GAAP profit of $5.17 per share was 3.9% above analysts’ consensus estimates.

Is Atlas Copco (ATLKY) Stock Outpacing Its Industrial Products Peers This Year?

Description: Here is how Atlas Copco AB (ATLKY) and Hubbell (HUBB) have performed compared to their sector so far this year.

2025-10-28

Why Hubbell (HUBB) Stock Is Up Today

Description: Shares of electrical and electronic products company Hubbell (NYSE:HUBB) jumped 3.9% in the afternoon session after the company reported third-quarter results that beat profit expectations and raised its full-year forecast, helping investors look past a slight miss on revenue. Hubbell's adjusted earnings per share came in at $5.17, which was higher than analysts had expected. However, its total revenue of $1.5 billion for the quarter was slightly below consensus estimates. Initially, the stock t

Hubbell (HUBB) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: While the top- and bottom-line numbers for Hubbell (HUBB) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Hubbell (HUBB) Tops Q3 Earnings Estimates

Description: Hubbell (HUBB) delivered earnings and revenue surprises of +3.61% and -1.82%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Hubbell (NYSE:HUBB) Reports Sales Below Analyst Estimates In Q3 Earnings

Description: Electrical and electronic products company Hubbell (NYSE:HUBB) missed Wall Street’s revenue expectations in Q3 CY2025 as sales rose 4.1% year on year to $1.50 billion. Its non-GAAP profit of $5.17 per share was 3.9% above analysts’ consensus estimates.

Hubbell: Q3 Earnings Snapshot

Description: HUBB) on Tuesday reported third-quarter profit of $255.5 million. The Shelton, Connecticut-based company said it had profit of $4.77 per share. Earnings, adjusted for one-time gains and costs, were $5.17 per share.

Hubbell Reports Third Quarter 2025 Results

Description: Shelton, CT, Oct. 28, 2025 (GLOBE NEWSWIRE) -- HUBBELL REPORTS THIRD QUARTER 2025 RESULTS 3Q diluted EPS of $4.77; adjusted diluted EPS of $5.173Q net sales +4% (organic +3%)3Q operating margin 22.0%; adjusted operating margin 23.9%Raising 2025 diluted EPS outlook to $16.55-$16.75; adj. diluted EPS of $18.10-$18.30 Hubbell Incorporated (NYSE: HUBB) today reported operating results for the third quarter ended September 30, 2025. “Hubbell delivered double digit adjusted earnings per diluted share

2025-10-27

2025-10-26

Hubbell (HUBB) Q3 Earnings: What To Expect

Description: Electrical and electronic products company Hubbell (NYSE:HUBB) will be announcing earnings results this Tuesday before market open. Here’s what to look for.

2025-10-25

2025-10-24

2025-10-23

Why Investors Need to Take Advantage of These 2 Industrial Products Stocks Now

Description: Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

2025-10-22

Looking at the Narrative for Hubbell as Analyst Views Shift with New Developments

Description: Hubbell's fair value per share has inched upward from $456.73 to $461.36, reflecting newly optimistic analyst perspectives. This adjustment comes as recent updates suggest improving company fundamentals, even amid ongoing industry uncertainties. Read on to discover how market watchers can keep pace with the evolving outlook for Hubbell in a shifting landscape. What Wall Street Has Been Saying 🐂 Bullish Takeaways Wells Fargo analyst Joseph O'Dea upgraded Hubbell to Overweight from Equal...

[Latest] Global Motor Starters Market Size/Share Worth USD 12.8 Billion by 2034 at a 5.8% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth Rate, Value, SWOT Analysis)

Description: [220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of Global Motor Starters Market size & share revenue was valued at approximately USD 7.4 Billion in 2024 and is expected to reach USD 7.8 Billion in 2025 and is expected to reach around USD 12.8 Billion by 2034, at a CAGR of 5.8% between 2025 and 2034. The key market players listed in the report with their sales, revenues and strategies are ABB Ltd., Siemens AG, Schneider Elec

2025-10-21

Dover Set to Report Q3 Earnings: What's in Store for the Stock?

Description: DOV is about to post Q3 results, with earnings projected to climb 10% y/y as strong demand and acquisitions offset divestitures.

Hubbell (HUBB) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Hubbell (HUBB) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-20

2025-10-19

2025-10-18

2025-10-17

Stocks making big moves this week: Cars.com, IonQ, Hubbell, Expedia, and Western Alliance Bancorporation

Description: Check out the companies making headlines this week:

Why Investors Need to Take Advantage of These 2 Industrial Products Stocks Now

Description: The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

Hubbell (HUBB) Valuation: Analyst Confidence Rises on Grid Upgrade Opportunity and Tariff Price Power

Description: Shares of Hubbell (HUBB) saw a lift after multiple analysts, including Bernstein SocGen Group, reiterated positive ratings. Their outlook was driven by the company’s role in supplying key products for national electrical grid upgrades and forthcoming tariff-related price hikes. See our latest analysis for Hubbell. This shift in sentiment comes after a strong year for Hubbell, where momentum around grid modernization and rising infrastructure investment has drawn more investor attention...