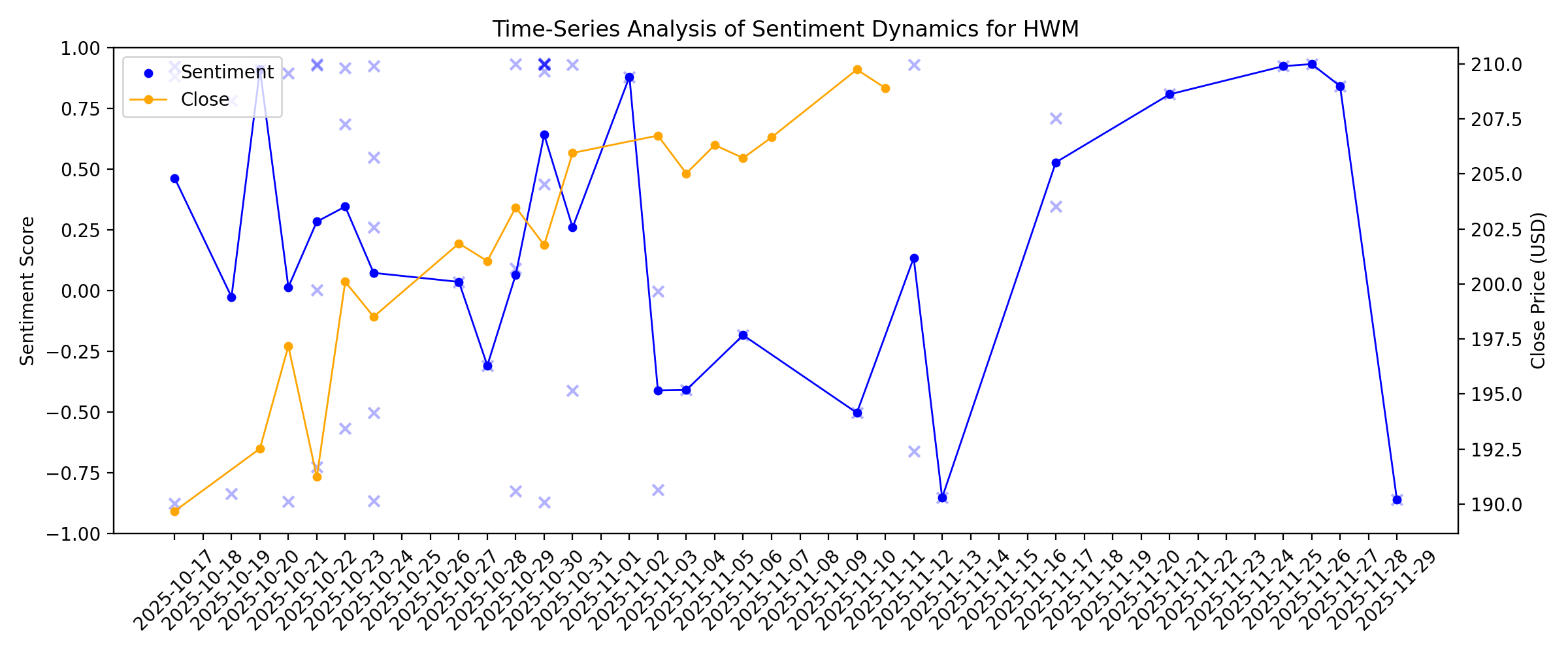

News sentiment analysis for HWM

Sentiment chart

2026-01-14

Is It Too Late To Consider Howmet Aerospace (HWM) After An 81% One Year Surge?

Description: If you are wondering whether Howmet Aerospace's current share price still makes sense after a strong run, this article will walk through what that price might be implying about the company. The stock last closed at US$220.25, with returns of 4.4% over 7 days, 11.7% over 30 days, 4.0% year to date and 81.2% over 1 year, along with a very large return over 3 and 5 years that is around 7x over 5 years. Recent coverage has focused on Howmet Aerospace as a long term structural supplier to...

Why This Star Mid-Cap Fund Likes Ralph Lauren and Planet Fitness

Description: Fed rate cuts could boost mid-cap companies—and the earnings outlook is strong. The T. Rowe Price Diversified Mid Cap Growth fund stands to gain.

2026-01-13

HII or HWM: Which Is the Better Value Stock Right Now?

Description: HII vs. HWM: Which Stock Is the Better Value Option?

HWM Faces Weakness in Commercial Transportation Market: What's Ahead?

Description: Howmet is seeing continued pressure in commercial transportation, with Q3 revenues down 3% year over year as truck builds slow and costs rise.

2026-01-12

This Internet Retailer And Three Other Stocks Outperforming The S&P 500

Description: Wayfair stock and three others were in or near buy zones in Monday trades. The internet retailer's relative strength line is at a new high.

Howmet Aerospace to buy hardware business for $1.8B, among other M&A to end 2025

Description: South Korea-based Samsung Biologics plans to acquire its first U.S. manufacturing site, and Deere is expanding its technology services with the purchase of equipment management provider Tenna.

2026-01-11

2026-01-10

A Look At Howmet Aerospace (HWM) Valuation After Analyst Upgrades And Raised Guidance

Description: Recent analyst upgrades have pushed Howmet Aerospace (HWM) into focus after the company raised its financial guidance, supported by revenue growth across commercial and defense aerospace, as well as higher dividends and share repurchases. See our latest analysis for Howmet Aerospace. Those upgrades and guidance changes come after a strong run in the shares, with the latest close at $218.27, a 30 day share price return of 13.45% and a 1 year total shareholder return of 94.29%. Together, these...

2026-01-09

Palantir, Two Other Defense Names Head Toward Wins After Volatile Industry Week

Description: Palantir stock undercut its 50-day moving average on Thursday. Aerospace and defense names Howmet and Rocket Lab also fell.

Why Howmet (HWM) Stock Is Up Today

Description: Shares of aerospace and defense company Howmet (NYSE:HWM) jumped 3.3% in the morning session after Baird raised its price target on the company to $310 from $225 while keeping an Outperform rating.

Aircraft Machining Industry Research Report 2025-2032, Profiles of GE, GKN, Howmet, Magellan, Mitsubishi, MTU Aero Engines, Precision Castparts, Premium AEROTEC, and Spirit AeroSystems

Description: The aircraft machining market is expanding due to increasing complexity in aerospace components, rising advanced machining technologies, and demand for MRO services. Key opportunities include precision machining for commercial and military aircraft, growing use of titanium and refined production methods in North America and Asia-Pacific.Dublin, Jan. 09, 2026 (GLOBE NEWSWIRE) -- The "Aircraft Machining Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2025-2032" r

2026-01-08

Why Howmet Stock Could Ride This Sector's Big Boost

Description: Howmet Aerospace is emerging as a key defense stock play from 2025 that could still have currency in 2026. In 2025, the aerospace-focused metals stock gained from several tailwinds, including news it would acquire Stanley Black & Decker's aerospace division for $1.8 billion late last year. Howmet stock surged more than 87% last year after spiking 102% in 2024.

2026-01-07

Howmet (HWM) Declines More Than Market: Some Information for Investors

Description: Howmet (HWM) concluded the recent trading session at $210.9, signifying a -1.77% move from its prior day's close.

Howmet Trades Near 52-Week High: Should You Buy the Stock or Wait?

Description: HWM is trading near a 52-week high as aerospace demand surges, but premium valuation and transport weakness raise caution.

2026-01-06

Honeywell Aerospace's Growth Picks Up: Can the Momentum Sustain?

Description: HON's aerospace business is accelerating as strong aftermarket demand, OEM recovery, and defense spending drive double-digit growth.

Looking At The Narrative For Howmet Aerospace After Q3 Beats And 2026 Growth Targets

Description: Howmet Aerospace’s updated valuation work has edged its fair value estimate slightly higher, from about US$232.15 to roughly US$233.70 per share, as analysts refresh their models after Q3. The small lift in the price target and the modestly lower discount rate and higher revenue growth assumptions are being tied to Q3 results described as beating across the board, stronger guidance, and management’s US$9b revenue discussion for 2026 supported by rising production rates, engine spares, and...

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Jefferies Backs Howmet (HWM) Acquisition, Sees EPS Lift into 2026

Description: Howmet Aerospace Inc. (NYSE:HWM) is included among the 20 Best Performing Dividend Stocks in 2025. On December 22, Jefferies analyst Sheila Kahyaoglu said Howmet Aerospace Inc. (NYSE:HWM) is acquiring Consolidated Aerospace Manufacturing from Stanley Black & Decker in an all-cash deal valued at $1.8 billion. Jefferies assumes the transaction closes around mid-Q2, with roughly half […]

Stanley Black & Decker (SWK) Target Lifted as Baird Revises Model Post-Divestiture

Description: Stanley Black & Decker, Inc. (NYSE:SWK) is included among the 12 Best Income Stocks to Buy Now. On December 23, Baird analyst Timothy Wojs raised the firm’s price target on Stanley Black & Decker, Inc. (NYSE:SWK) to $85 from $75 and kept a Neutral rating on the shares. The update followed the company’s announcement to […]

Solid Demand in Defense Aerospace Drives Howmet: Can the Momentum Last?

Description: HWM is riding strong defense aerospace demand, as rising engine spares orders and military funding fuel solid revenue momentum.

Boeing Wins $8B Israel F-15 Deal: Defense ETFs to Watch for Gains

Description: Boeing secures an $8.6B F-15IA deal for Israel, but its thin margins might keep investors' focus on defense ETFs like ITA.

Aviation Stocks End 2025 Strong; GE Aerospace Stock Trades Near Buy Point After 84% Annual Climb

Description: Highly rated GE Aerospace stock is this week's Big Cap 20 pick to watch, as it looks to retake a buy point. The Ohio-based company's shares rose nearly 84% in 2025.

2026-01-01

2025-12-31

2025-12-30

FTAI Unit To Pursue AI Data Center Power Market; Stock Breaks Out

Description: FTAI Aviation stock soared after the company announced plans for a new business unit dedicated to converting jet engines into power turbines that would supply energy to data centers.

2025-12-29

2025-12-28

Jim Cramer Says Stanley Black & Decker’s Deal With Howmet Is “Terrific” for SWK Shareholders

Description: Stanley Black & Decker, Inc. (NYSE:SWK) is one of the stocks Jim Cramer shared his take on. Cramer highlighted the company’s latest deal with Howmet, as he commented: “Finally, there’s the everybody wins kind of M&A. This morning, Stanley Black & Decker sold its aerospace manufacturing business, consolidated aerospace manufacturing to Howmet, a crackerjack aerospace […]

2025-12-27

2025-12-26

JPMorgan Chase Hits New Highs As Nasdaq Stock Trades With Others At Peaks In Buy Zones

Description: JPMorgan Chase and Deutsche Bank are also hitting all-time highs along with Howmet Aerospace on Friday.

Here's Why Howmet's CAM Acquisition is Strategically Important

Description: HWM is set to acquire CAM from Stanley Black for $1.8 billion, boosting its aerospace fastening solutions portfolio and market reach.

RBC Bearings' Aerospace & Defense Growth Picks Up: A Sign of More Upside?

Description: RBC is seeing accelerating aerospace and defense growth, fueled by strong OEM demand, a rising backlog and robust defense orders.

Is GE Aerospace (GE) Outperforming Other Aerospace Stocks This Year?

Description: Here is how GE Aerospace (GE) and Howmet (HWM) have performed compared to their sector so far this year.

2025-12-25

2025-12-24

Aerospace Leader Howmet Poised To Hit New Buy Point

Description: Howmet Stock: The aerospace leader is approaching a new buy point following strong gains in recent sessions.

The Zacks Analyst Blog Highlights Archer Aviation, GE Aerospace and Howmet Aerospace

Description: Archer Aviation is highlighted by Zacks as defense spending rises, positioning the eVTOL developer to benefit from military modernization in 2026.

2025-12-23

Rising Geopolitical Tensions - 3 Defense Stocks to Watch in 2026

Description: ACHR, GE and HWM are positioned to benefit as geopolitical tensions drive sustained defense spending and accelerated military modernization.

Can Howmet Sustain Growth as Commercial Aerospace Demand Surges?

Description: HWM is riding a surge in commercial aerospace demand, with rising air travel and strong aircraft programs driving steady revenue growth.

Howmet Aerospace (HWM): Examining Valuation After a Multi‑Year Share Price Surge

Description: Howmet Aerospace (HWM) has quietly turned into one of the market’s stronger aerospace performers, with the stock up roughly 88% over the past year and about 4 times over the past 3 years. See our latest analysis for Howmet Aerospace. That strength is still very much in play, with the share price now around $208 and supported by a 1 year total shareholder return close to 89 percent, while the 3 year total shareholder return above 430 percent underlines how durable the momentum has been. If...

2025-12-22

Is It Too Late To Consider Howmet Aerospace After Its 661% Five Year Surge?

Description: If you are wondering whether Howmet Aerospace is still worth buying after its huge run up, or if you are late to the party, you are in the right place. We are going to dig into what the market is really pricing in. The stock has surged, up about 5.5% over the last week and month, 87.9% year to date, 88.8% over the past year, and an eye catching 661.0% over five years, which naturally raises questions about how much upside is left. Those gains have come as investors have leaned into aerospace...

Two Hot Aerospace Stocks Near Buy Points Amid Merger, Target Hikes

Description: Aerospace parts suppliers Heico and Howmet are moving toward buy points, as Wall Street eyes a good year for the industry.

Why Stanley Black & Decker Stock Jumped Today

Description: The Dividend King's latest move should dispel fears of a potential dividend cut and could even be the stock's turning point.

Why Stanley Black & Decker Stock is Surging Monday

Description: Stanley Black & Decker said it was selling its Consolidated Aerospace Manufacturing business to rival Howmet Aerospace for $1.8 billion in cash.

Howmet to Buy Stanley Black & Decker's Aerospace Manufacturing Business for $1.8 Billion

Description: Howmet Aerospace (HWM) has agreed to acquire Stanley Black & Decker's (SWK) consolidated aerospace m

Stanley Black & Decker’s $1.8 bln aerospace unit sale will ease debt load

Description: Investing.com -- Stanley Black & Decker’s agreement to sell its aerospace business for about $1.8 billion on Monday improves the company’s balance sheet and sharpen its focus in core and stronger market areas. Stanley Black & Decker shares rose about 5% in early trading. The sale was not a surprise, as management had signaled plans to separate the aerospace fastening business for months. Airplane parts maker Howmet, which is seeing a surge in demand from its customers is acquiring the Consolidat

Stanley Black & Decker Further Shaves Portfolio with Aerospace Component Sale

Description: Stanley Black & Decker is further slimming its product lines with a $1.8 billion deal to sell its aerospace component business to Howmet Aerospace. The business makes latches, quick-release pins and tube assemblies for commercial jets and the defense industry, but it is secondary to Stanley’s bread-and-butter power tools and outdoor equipment businesses. CEO Chris Nelson said the deal will reduce Stanley’s debt and allow it to focus on its largest brands.

Howmet Aerospace to Acquire Consolidated Aerospace Manufacturing from Stanley Black & Decker for approximately $1.8 Billion

Description: Howmet Aerospace Inc. (NYSE: HWM) today announced it has entered into a definitive agreement to acquire Consolidated Aerospace Manufacturing, LLC (CAM), a leading global designer and manufacturer of precision fasteners, fluid fittings, and other complex, highly engineered products for demanding aerospace and defense applications, from Stanley Black & Decker, Inc. (NYSE: SWK) for an all-cash purchase price of approximately $1.8 billion. The transaction will receive favorable treatment for federal

Stanley Black & Decker Announces Agreement to Sell Consolidated Aerospace Manufacturing Business to Howmet Aerospace for $1.8 Billion

Description: Stanley Black & Decker(NYSE: SWK) today announced it has entered into a definitive agreement to sell its Consolidated Aerospace Manufacturing ("CAM") business to Howmet Aerospace for $1.8 billion in cash. CAM provides critical fasteners, fittings, and other engineered components for the aerospace and defense industries.

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

Jim Cramer Says “Hexcel’s a Very Good Company”

Description: Hexcel Corporation (NYSE:HXL) is one of the stocks Jim Cramer expressed thoughts on. During the lightning round, when a caller inquired about the stock, Cramer said: “Hexcel’s a very good company, sir. The only reason I said to buy Boeing is both Hexcel and Howmet had gone up too high. Boeing is still lagging.” Hexcel […]

2025-12-12

We Ran A Stock Scan For Earnings Growth And Howmet Aerospace (NYSE:HWM) Passed With Ease

Description: For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to...

2025-12-11

Wall Street Analysts Think Howmet (HWM) Is a Good Investment: Is It?

Description: According to the average brokerage recommendation (ABR), one should invest in Howmet (HWM). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

2025-12-10

The Aerospace Recovery Is at ‘End of the Beginning.’ 7 Stocks for 2026.

Description: Deutsche Bank analyst Scott Deuschle published an outlook report on the sector on Wednesday. He has some ideas for investors.

2025-12-09

Howmet (HWM) is an Incredible Growth Stock: 3 Reasons Why

Description: Howmet (HWM) is well positioned to outperform the market, as it exhibits above-average growth in financials.

Howmet (HWM) Upgraded to Buy: Here's Why

Description: Howmet (HWM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-12-08

We Think Howmet Aerospace (NYSE:HWM) Might Have The DNA Of A Multi-Bagger

Description: If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll...

2025-12-07

2025-12-06

2025-12-05

Is Howmet Aerospace Stock Outperforming the Dow?

Description: Jet Engine components manufacturer Howmet Aerospace has notably outperformed the Dow over the past year, and analysts remain strongly bullish on the stock’s prospects.

2025-12-04

Assessing Howmet Aerospace (HWM) Valuation After a Strong Multi‑Year Run and Recent Share Price Breather

Description: Howmet Aerospace (HWM) has been quietly rewarding patient investors, with shares up sharply this year despite some recent cooling. Let us unpack what is driving the move and whether the valuation still makes sense. See our latest analysis for Howmet Aerospace. At around $194.29 per share, the recent pullback in Howmet’s 1 week and 1 month share price returns looks more like a breather within a strong uptrend, supported by robust year to date gains and hefty multi year total shareholder...

Is Howmet (HWM) Turning Lower Interest Costs and Engine Strength Into a More Durable Margin Story?

Description: In recent months, Howmet Aerospace priced US$500,000,000 of 4.550% notes due 2032 to help redeem about US$625,000,000 of its 5.90% notes maturing in 2027, alongside reporting third-quarter revenue growth of 13.8% year on year that exceeded analysts’ expectations, particularly in its Engine products segment. This combination of interest-cost-reducing refinancing and stronger-than-expected operational results in a key product line has sharpened investor focus on Howmet’s longer-term earnings...

2025-12-03

2025-12-02

BNP Paribas Is Bullish on Howmet Aerospace (HWM)

Description: Howmet Aerospace Inc. (NYSE:HWM) is one of the best industrial stocks to buy. On November 18, BNP Paribas Exane started covering Howmet Aerospace stock, assigning it an Outperform rating and a $240 price target, according to a report by the Fly. In a separate update, dated November 3, Howmet Aerospace Inc. (NYSE:HWM) priced $500 million […]

2025-12-01

Stocks To Watch As Google Drives Rattled But Rebounding Market

Description: As the Nasdaq holds tough after a five-day win streak, Google stock, Robinhood and others land on list of stocks to watch.

Is the Options Market Predicting a Spike in Howmet Aerospace Stock?

Description: Investors need to pay close attention to HWM stock based on the movements in the options market lately.

Those who invested in Howmet Aerospace (NYSE:HWM) five years ago are up 711%

Description: For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock...

2025-11-30

2025-11-29

Jim Cramer Says “Hold on to Howmet”

Description: Howmet Aerospace Inc. (NYSE:HWM) is one of the stocks Jim Cramer recently answered questions about. During the lightning round, a caller mentioned that they bought the stock in 2014 and inquired if they should hold or sell it. In response, Cramer said: “Okay, I want you to hold Howmet. I think it’s probably the best […]

2025-11-28

2025-11-27

Is Howmet Aerospace’s Expansion Strategy Justifying Its 84.7% Surge in 2025?

Description: Ever wondered if Howmet Aerospace might be a hidden gem or already priced to perfection? You are not alone. The stock has caught the attention of investors hunting for true value. After soaring by an impressive 755.0% over the last five years, with a 75.8% gain in the past year and 84.7% year-to-date, the stock’s strong momentum is hard to ignore. Recent headlines have highlighted Howmet’s moves in expanding its aerospace components portfolio and new contract wins, painting a picture of an...

2025-11-26

Strength in Aerospace Segment Drives Honeywell: Can the Momentum Sustain?

Description: HON's aerospace strength accelerates with surging commercial aftermarket and steady defense demand, driving Q3 gains.

2025-11-25

Strength in Defense Aerospace Drives Howmet: Will the Momentum Last?

Description: HWM's defense sales surge on strong F-35 and legacy fighter demand, fueling growth as new military funding boosts momentum.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2 Mooning Stocks on Our Buy List and 1 That Underwhelm

Description: The stocks in this article are all trading near their 52-week highs. This strength often reflects positive developments such as new product launches, favorable industry trends, or improved financial performance.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

Defense Stocks To Watch: Embraer Breaks Out, Safeguards Buy Zone

Description: As fellow defense stocks GE and Howmet trade around their record highs, Embraer stock remains in buy range.

When Should You Buy Howmet Aerospace Inc. (NYSE:HWM)?

Description: Today we're going to take a look at the well-established Howmet Aerospace Inc. ( NYSE:HWM ). The company's stock saw a...

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Howmet Aerospace Insiders Sold US$134m Of Shares Suggesting Hesitancy

Description: In the last year, many Howmet Aerospace Inc. ( NYSE:HWM ) insiders sold a substantial stake in the company which may...

2025-11-12

What TransDigm Earnings Say About a Booming Aerospace Sector

Description: Wednesday, TransDigm reported fiscal fourth-quarter adjusted EPS of $10.82 from sales of $2.4 billion. Wall Street was looking for EPS of $10.08 and sales of $2.4 billion.

Howmet's Commercial Aerospace Market Gains Momentum: Can It Sustain?

Description: HWM continues to witness commercial aerospace strength as engine product sales surge, fueled by new aircraft and strong spare parts needs.

2025-11-11

2025-11-10

Here's How Much a $1000 Investment in Howmet Made 10 Years Ago Would Be Worth Today

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Investors Should Be Encouraged By Howmet Aerospace's (NYSE:HWM) Returns On Capital

Description: Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key...

2025-11-05

2025-11-04

12 Stocks Reliably Make Big Money For Investors Starting Now

Description: The last two months of the year are typically the best for the S&P 500. And a dozen stocks pull ahead of the rest.

2025-11-03

Howmet Aerospace Inc. Announces Pricing of Debt Offering

Description: Howmet Aerospace Inc. ("Howmet Aerospace" or the "Company") (NYSE: HWM) today announced that it has priced its underwritten public offering of $500 million aggregate principal amount of its 4.550% Notes due 2032 (the "New Notes"). The offering is expected to close on November 12, 2025, subject to customary closing conditions.

Howmet Aerospace Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Due to Howmet Aerospace’s significant outperformance realtive to the broader market over the past year, Wall Street analysts remain bullish about the stock’s prospects.

2025-11-02

Howmet Aerospace Inc. (NYSE:HWM) Just Reported Third-Quarter Earnings: Have Analysts Changed Their Mind On The Stock?

Description: Howmet Aerospace Inc. ( NYSE:HWM ) just released its quarterly report and things are looking bullish. Results were good...

2025-11-01

2025-10-31

Howmet (HWM) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: The headline numbers for Howmet (HWM) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Howmet Aerospace (HWM) Margin Expansion Outpaces Expectations, Reinforcing Bullish Profitability Narratives

Description: Howmet Aerospace (HWM) delivered a standout year, with net profit margins jumping to 18.1% from 13.1% and earnings expanding by 49.8% year over year, well above its 41.3% five-year average. The company’s earnings quality remains high and forward guidance calls for earnings growth of 15.02% per year, though that lags the wider US market rate. Investors see a mix of strong profitability and robust margin expansion set against a premium valuation and growth forecasts that could temper...

2025-10-30

Howmet Aerospace Inc (HWM) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and ...

Description: Howmet Aerospace Inc (HWM) reports robust financial performance with significant revenue and EBITDA growth, while navigating challenges in commercial transportation.

Howmet's Q3 Earnings & Revenues Top Estimates, Increase Y/Y

Description: HWM posts a 34% earnings surge and raises its 2025 revenue outlook on robust aerospace demand.

Howmet (HWM) Q3 2025 Earnings Call Transcript

Description: John Plant: Thank you, Paul, and welcome to the Howmet Aerospace Inc. Q3 call. Q3 was a very strong quarter for Howmet Aerospace Inc. Revenue growth continues to accelerate and was up 14% to 8% in the first half. Within this revenue growth, Commercial Aerospace increased 15% and within this number, commercial aero part sales increased by 38%, for a total spares increase of 31%.

Howmet (HWM) Q3 Earnings and Revenues Top Estimates

Description: Howmet (HWM) delivered earnings and revenue surprises of +4.40% and +2.14%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Howmet’s (NYSE:HWM) Q3 Sales Top Estimates

Description: Aerospace and defense company Howmet (NYSE:HWM) announced better-than-expected revenue in Q3 CY2025, with sales up 13.8% year on year to $2.09 billion. The company expects next quarter’s revenue to be around $2.1 billion, close to analysts’ estimates. Its non-GAAP profit of $0.95 per share was 4.5% above analysts’ consensus estimates.

Howmet Aerospace Q3 Adjusted Earnings, Revenue Rise; 2025 Outlook Raised

Description: Howmet Aerospace (HWM) reported Q3 adjusted earnings Thursday of $0.95 per diluted share, up from $0

Howmet: Q3 Earnings Snapshot

Description: The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 91 cents per share. The maker of engineered products for the aerospace and other industries posted revenue of $2.09 billion in the period, which also topped Street forecasts. Four analysts surveyed by Zacks expected $2.05 billion.

Howmet Aerospace Reports Third Quarter 2025 Results

Description: Howmet Aerospace (NYSE: HWM) today reported third quarter 2025 results. The Company reported record third quarter 2025 revenue of $2.09 billion, up 14% year over year, driven by growth in the commercial aerospace market of 15%, growth in the defense aerospace market of 24%, and growth in the industrial and other market of 18%, partially offset by declines in the commercial transportation market of 3%.

2025-10-29

5 Key Earnings Charts to Watch

Description: Look beyond big technology at stocks in other areas like big pharma, infrastructure, energy and aerospace.

247-Year-Old Boeing Supplier Eyes Wall Street Windfall in 2026 IPO Comeback

Description: Doncasters bets on America's defense boom and fading London IPO scene with bold New York listing plan

Howmet Aerospace Inc.'s (NYSE:HWM) Stock Been Rising: Are Strong Financials Guiding The Market?

Description: Howmet Aerospace's (NYSE:HWM) stock up by 4.6% over the past three months. Given that the market rewards strong...

2025-10-28

Countdown to Howmet (HWM) Q3 Earnings: A Look at Estimates Beyond Revenue and EPS

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Howmet (HWM), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

2025-10-27

How to Approach Howmet Stock Ahead of Its Q3 Earnings Release?

Description: HWM heads into Q3 earnings with solid aerospace momentum but faces valuation pressures and transport market softness.

2025-10-26

2025-10-25

2025-10-24

Two Data Center Plays Race To New Highs, Near Buy Points

Description: Four stocks hit new highs in Friday's stock market. Zscaler, Howmet Aerospace, Arlo Technologies, and Johnson Controls are near buy points.

Can Howmet Sustain Growth as Defense Aerospace Demand Surges?

Description: HWM's defense aerospace strength, fueled by F-35 engine parts demand and new contracts, is propelling robust revenue growth.

How Should You Position Boeing Stock Ahead of Q3 Earnings Release?

Description: BA's Q3 results may show higher revenues on stronger jet deliveries, but supply-chain issues and weak defense shipments could weigh on profits.

If You Invested $1000 in Howmet a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2 Large-Cap Stocks with Competitive Advantages and 1 We Brush Off

Description: Large-cap stocks have the power to shape entire industries thanks to their size and widespread influence. With such vast footprints, however, finding new areas for growth is much harder than for smaller, more agile players.

2025-10-23

How Recent Developments Are Rewriting the Story for Howmet Aerospace

Description: Howmet Aerospace stock has experienced a modest upward revision in its price target, with analysts increasing the fair value from $206.38 to $211.99. This change reflects greater confidence in the company’s strategies and a slight adjustment in risk outlook, as the discount rate moved from 7.74% to 7.76%. Stay tuned to discover how you can remain informed about future shifts in Howmet Aerospace’s investment narrative as the landscape evolves. What Wall Street Has Been Saying Analyst...

Howmet (HWM) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Howmet (HWM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

1 Industrials Stock Worth Your Attention and 2 We Brush Off

Description: Industrials businesses quietly power the physical things we depend on, from cars and homes to e-commerce infrastructure. They are also bound to benefit from a friendlier regulatory environment with the Trump administration, and this excitement has led to a six-month gain of 37.4% for the sector - higher than the S&P 500’s 24.7% return.

2025-10-22

Howmet Aerospace Announces Executive Leadership Changes

Description: After 21 years of service to Howmet Aerospace Inc. (NYSE:HWM) and in turning 60, Ken Giacobbe, Executive Vice President and Chief Financial Officer, has decided to retire on December 31, 2025. Mr. Giacobbe has been a valued contributor to Howmet's success. He has been a trusted partner to John Plant, Executive Chairman and Chief Executive Officer, and an invaluable resource to the Company's Board of Directors and the businesses within Howmet. From December 1 to December 31, 2025, Mr. Giacobbe wi

Stock Market News for Oct 22, 2025

Description: Wall Street closed mixed on Tuesday, driven by industrial and discretionary stocks.

General Dynamics to Post Q3 Earnings: Here's What You Need to Know

Description: GD is set to post strong Q3 earnings and revenues, fueled by Gulfstream deliveries and strong defense demand.

What to Expect From Howmet Aerospace’s Next Quarterly Earnings Report

Description: Howmet Aerospace is geared to release its third-quarter results later this month, and analysts forecast a double-digit rise in earnings.

2025-10-21

Howmet vs. General Dynamics: Which Aerospace & Defense Stock is a Smart Buy?

Description: GD's strong backlog, new aircraft launches and favorable valuation make it stand out over HWM in the aerospace and defense race.

GE Aerospace (GE) Tops Q3 Earnings and Revenue Estimates

Description: GE (GE) delivered earnings and revenue surprises of +13.70% and +9.36%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-20

Howmet Aerospace (HWM): Examining Valuation After Recent Share Price Gains and Long-Term Growth

Description: Howmet Aerospace (HWM) shares have seen some movement over the past month, rising about 3% as investors digest recent company performance and sector trends. Many are now watching how strong annual growth might shape future results. See our latest analysis for Howmet Aerospace. Zooming out, Howmet Aerospace’s stock has shown extraordinary long-term momentum, with a massive 78.9% total shareholder return over the past year and a staggering 951% total return over five years. This signals that...

2025-10-19

Should Investors Rethink Howmet Aerospace After Its 80% Surge and Rising Market Optimism in 2025?

Description: Thinking about what to do with Howmet Aerospace stock right now? If you’ve checked your portfolio lately, you might have noticed some remarkable numbers popping up. This isn’t just a story of a stock that’s having a good week; Howmet has delivered returns that are hard to ignore. Over the past seven days, the stock is up 3.0%, with the past month also showing a respectable 2.3% gain. But what really stands out is the bigger picture: year-to-date returns are at 71.2%, absolutely dwarfing...

Howmet Aerospace's (NYSE:HWM) five-year earnings growth trails the 59% YoY shareholder returns

Description: Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock...

2025-10-18

2025-10-17

Howmet (HWM) Stock Drops Despite Market Gains: Important Facts to Note

Description: In the latest trading session, Howmet (HWM) closed at $189.68, marking a -1.04% move from the previous day.

LHX or HWM: Which Is the Better Value Stock Right Now?

Description: LHX vs. HWM: Which Stock Is the Better Value Option?

3M Gears Up to Report Q3 Earnings: Is a Beat in the Offing?

Description: MMM readies its Q3 results with steady gains in key segments and a positive earnings signal hinting at another potential beat.

Teledyne Technologies to Report Q3 Earnings: Here's What to Expect

Description: TDY gears up for Q3 results with expected 7.8% EPS growth, fueled by acquisitions and strong defense demand.