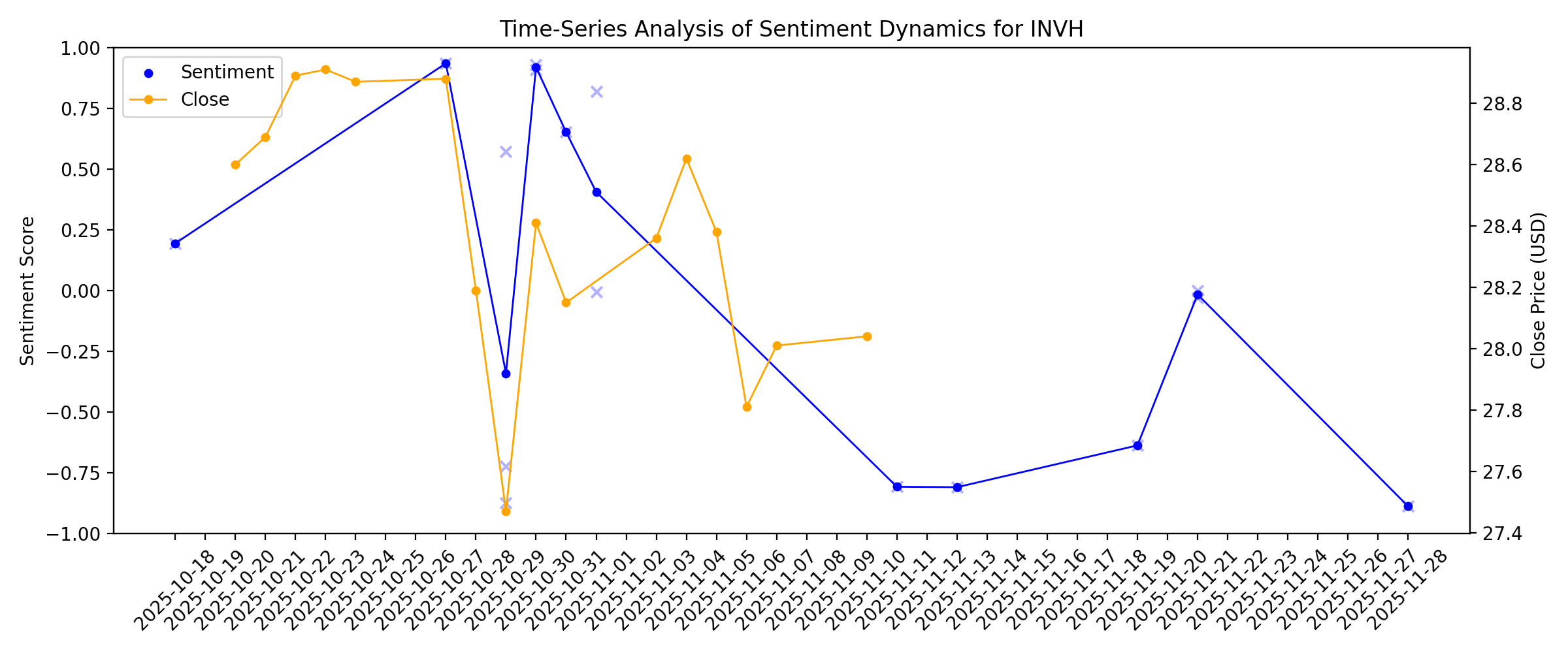

News sentiment analysis for INVH

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Wall Street Homebuyers Plan Counter-Offer After Trump Threat

Description: “If the administration were to sit down with a group of us we could put a we could put a proposal — we could put a project — together,” Pretium Co-President Stephen Scherr said in an interview Monday on Bloomberg Television. Later remarks by Treasury Secretary Scott Bessent suggested that the Trump administration would restrict future purchases without forcing companies like Invitation Homes Inc. or Blackstone Inc.’s Tricon Residential to divest their current holdings. Both banks and government-sponsored entities could play a role in such a scenario, Scherr said.

2026-01-11

2026-01-10

Invitation Homes (INVH) Valuation Check After Recent Share Price Weakness

Description: Invitation Homes (INVH) has drawn fresh attention after recent share performance left the stock with mixed returns over the past year, prompting investors to reassess how its current valuation lines up with fundamentals. See our latest analysis for Invitation Homes. At a share price of $26.50, Invitation Homes has seen pressure recently, with a 7 day share price return of a 4.40% decline and a 1 year total shareholder return of a 9.06% decline, suggesting momentum has been fading rather than...

2026-01-09

Trump Blindsides Wall Street Allies With Crackdown on Housing Investors

Description: Blackstone Chief Executive Officer Stephen Schwarzman helped launch Wall Street into the business of buying and renting out single-family homes in the aftermath of the 2008 housing crash. This past week, his firm and others across the industry were blindsided when President Trump —himself a property mogul whom many in the sector consider an ally—said he plans to boot investors from the market. “People are scared and don’t want to touch these residential stocks given the political narrative,” said John Pawlowski, managing director at the real-estate research firm Green Street.

Why Trump's big housing move could pose a 'threat' to these stocks

Description: In a post on Truth Social, President Trump said that he is "immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it." Mizuho Americas senior REIT and homebuilders analyst Haendel St. Juste downgraded American Homes 4 Rent (AMH) and Invitation Homes (INVH) on the news. Find out why in the video above. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2026-01-08

Blackstone Likely Faces 'Manageable' Risks From Potential Trump Ban on Institutional Home Buying, UBS Says

Description: Blackstone (BX) likely faces "manageable" risks from US President Donald Trump's proposed ban on ins

Mortgage rates tick up, Alphabet's market cap overtakes Apple

Description: Yahoo Finance's John Hyland tracks today's top moving stocks and biggest market stories in this Market Minute, including the 30-year fixed rate mortgages ticking up to 6.16%, homebuilder stocks receiving downgrades due to headwinds tied to President Trump's policy proposals, and Alphabet's (GOOG, GOOGL) market cap overtaking Apple (AAPL) to become the second most valuable company in the world. Stay up to date on the latest market action, minute-by-minute, with Yahoo Finance's Market Minute.

Trump wants to ban Wall Street investments in single-family homes. Experts aren’t sure it would help much.

Description: The idea of banning large investors from buying single-family homes has popular appeal, but might not make a major dent in the housing shortage.

Donald Trump Is Meddling in Markets. It’s a Dangerous Line to Cross.

Description: Trump threatened to penalize defense companies that pay dividends to shareholder or buy back stock, and he said he might ban institutional investor purchases of single-family homes.

Trump Seeks to Lock Corporate America Out of Local Housing Markets

Description: For prospective buyers, this could lead to not having to go up against, say, Blackstone, when you put in a bid for a home.

Heard on the Street Wednesday Recap: Trump’s Housing Salvo

Description: President Trump said he planned to ban large investors from buying single-family homes. Shares of Invitation Homes and Blackstone each fell 6%, while American Homes 4 Rent declined 4%. It is unclear whether Trump can institute a ban without congressional approval.

2026-01-07

Heard on the Street Recap: Trump’s Housing Salvo

Description: President Trump said he would take steps to ban large investors from buying single-family homes. Invitation Homes and Blackstone each fell 6%, while American Homes 4 Rent declined 4%. It isn’t clear if Trump can carry out the ban without congressional approval.

Dow, S&P 500 Fall From Records as Traders Assess Trump's Move to Ban Institutional Home Buying

Description: The Dow Jones Industrial Average and the S&P 500 fell from their record highs as traders assessed Pr

Sector Update: Financial Stocks Decline Late Afternoon

Description: Financial stocks were decreasing in late Wednesday trading, with the NYSE Financial Index down 1% an

Real Estate, Defense Stocks Fall as Trump Targets Institutional Home Buying, Defense Companies' Dividends

Description: Real estate and defense stocks fell after President Donald Trump said he would ban institutional inv

Trump proposes ban on institutional home buying, sending real estate stocks down

Description: Investing.com -- Shares of major institutional landlords and asset managers tumbled Wednesday after President Donald Trump announced plans to "immediately" ban large corporations from purchasing single-family homes. The move, aimed at restoring the "American Dream" of homeownership for individuals, sent shockwaves through a real estate sector that has become increasingly dominated by Wall Street capital. The President’s Truth Social post triggered an immediate sell-off across firms with heavy ex

Trump’s Pledge to Evict Big Investors from Housing Market Hits Rental Stocks

Description: Shares of rental home companies Invitation Homes and AMH are selling off after President Trump said that he wants to prohibit big investors from buying single-family homes. “I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it,” Trump wrote on his Truth Social platform Wednesday. When the flood of foreclosures subsided, they took to the open market, buying homes in many of the most desirable suburban neighborhoods.

2026-01-06

2026-01-05

2026-01-04

Thinking About Buying a Rental Property in 2026? Consider These Passive Income Investments Instead.

Description: REITs offer a lower cost and a more passive and predictable way to make income from real estate.

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

What Invitation Homes (INVH)'s Higher Dividend Says About Its Confidence in Rental Cash Flows

Description: Invitation Homes Inc. recently declared a quarterly cash dividend of US$0.30 per share, a 3.4% increase from its prior US$0.29 payout, payable on or before January 16, 2026, to shareholders of record as of December 23, 2025. This dividend increase, coming alongside management’s emphasis on resident satisfaction and operational efficiency, signals confidence in the company’s cash generation and single-family rental market positioning. Next, we’ll explore how this dividend increase shapes...

2025-12-13

2025-12-12

Invitation Homes Announces Cash Dividend

Description: DALLAS, December 12, 2025--Invitation Homes Inc. (NYSE: INVH) ("Invitation Homes," the "Company," or "our"), the nation’s premier single-family home leasing and management company, announced today that it has declared a quarterly cash dividend of $0.30 per share payable on shares of its common stock, representing a 3.4% increase over the prior quarterly dividend of $0.29 per share. The dividend will be paid on or before January 16, 2026, to stockholders of record of the Company’s common stock as

2025-12-11

Esusu Raises $50 Million Series C at $1.2 Billion Valuation to Transform Financial Health for Millions of Americans

Description: Esusu Evolves from Rent Reporting Pioneer to the Market Leader in Economic Mobility Solutions Unlock Credit and Economic Opportunity with Esusu NEW YORK, Dec. 11, 2025 (GLOBE NEWSWIRE) -- Esusu, the nation’s leading financial technology platform advancing credit building and economic mobility, announced it has raised $50 million in its Series C financing, bringing the company’s total capital raised to over $200 million. Esusu is available in over 5 million rental units, encompassing 12 million p

2025-12-10

Is Invitation Homes Stock Underperforming the Dow?

Description: Although Invitation Homes has lagged behind the Dow over the past year, analysts remain moderately optimistic about the stock’s prospects.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

Invitation Home (INVH) Down 1.7% Since Last Earnings Report: Can It Rebound?

Description: Invitation Home (INVH) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Invitation Homes (INVH): Examining Current Valuation as Shares Remain in a Tight Trading Range

Description: Invitation Homes (INVH) shares saw a slight move upward today. The stock continues to trade in a relatively narrow range over the past month. Investors are watching closely for signals about future rent trends and the company’s outlook in the single-family rental market. See our latest analysis for Invitation Homes. Invitation Homes' share price has drifted lower this year, reflecting a 10.3% year-to-date decline and a one-year total shareholder return of -13.7%. While the 1-day move was...

How the Story for Invitation Homes Is Evolving Following Recent Analyst Forecasts and Earnings

Description: The consensus analyst price target for Invitation Homes has seen a slight decrease, recently slipping from $35.57 to $34.84 per share. This adjustment comes as analysts recalibrate expectations in response to recent earnings and shifting market dynamics. The change highlights both optimism for long-term growth and caution over near-term challenges. Stay tuned to find out how you can keep up with the evolving narrative around Invitation Homes and its outlook. Stay updated as the Fair Value for...

2025-11-20

2025-11-19

Invitation Homes price target lowered to $37 from $38 at JPMorgan

Description: JPMorgan lowered the firm’s price target on Invitation Homes (INVH) to $37 from $38 and keeps an Overweight rating on the shares following the investor day. The company offered color on its ancillary earnings drivers, with less a focus on buybacks, the analyst tells investors in a research note. Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> See Insiders’ Hot Stocks on TipRanks >> Read More on INVH: Invitation Homes: Hold Rating Am

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Wall Street giants like Blackstone are betting big on the US rental housing market as demand skyrockets

Description: There are ways in to invest in real estate even if you are priced out of buying property right now.

2025-11-12

2025-11-11

Invitation Homes to Host Investor & Analyst Day

Description: DALLAS, November 11, 2025--Invitation Homes Inc. (NYSE: INVH) ("Invitation Homes," the "Company," or "our"), the nation’s premier single-family home leasing and management company, today announced additional details regarding its upcoming Investor & Analyst Day, which will be held on Monday, November 17, 2025. The event will feature presentations from senior leadership covering the Company’s operating environment, near- and long-term growth strategies, innovation and efficiency initiatives, and

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

Invitation Homes (INVH): Evaluating Valuation After Recent 7% Decline in Share Price

Description: Invitation Homes (INVH) shares have slipped recently, with the stock down roughly 7% over the past 3 months. Investors seem to be weighing the impact of sluggish net income growth along with modest revenue gains during this period. See our latest analysis for Invitation Homes. While Invitation Homes’ share price has lost momentum lately, with a 90-day decline of 7.2%, it is worth noting that the pace of selling has matched generally fading sentiment across the real estate sector this year...

4 Top Dividend Stocks Yielding More Than 4% to Buy Hand Over Fist This November

Description: These stocks offer attractive dividend yields in today's low-yield environment.

2025-10-31

Is Wall Street Bullish or Bearish on Invitation Homes Stock?

Description: Residential REIT Invitation Homes has notably underperformed the broader market over the past year, yet analysts remain cautiously optimistic about the stock’s prospects.

2025-10-30

Invitation Homes Inc (INVH) Q3 2025 Earnings Call Highlights: Strong Renewal Rates and ...

Description: Invitation Homes Inc (INVH) reports robust same-store renewal rate growth and increased full-year guidance, while navigating supply pressures in key markets.

Invitation Homes' Q3 FFO In Line, Revenues Beat, Rents Improve Y/Y

Description: Invitation Homes posts steady Q3 core FFO of 47 cents per share as higher rents offset lower occupancy, prompting a slight full-year outlook raise.

2025-10-29

Invitation Home (INVH) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for Invitation Home (INVH) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Invitation Home (INVH) Meets Q3 FFO Estimates

Description: Invitation Home (INVH) delivered FFO and revenue surprises of 0.00% and +1.31%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Invitation Homes Reports Third Quarter 2025 Results

Description: DALLAS, October 29, 2025--Invitation Homes Inc. (NYSE: INVH) ("Invitation Homes," "we," "our," and "us"), the nation’s premier single-family home leasing and management company, today announced our Third Quarter ("Q3") 2025 financial and operating results.

2025-10-28

2025-10-27

Invitation Homes to Report Q3 Earnings: What to Expect From the Stock?

Description: INVH's Q3 results are likely to reflect strong demand for single-family rentals and tech-driven margin gains amid supply pressures.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

2025-10-19

2025-10-18

Why I Recently Bought More Shares of This Beaten Down 4.1%-Yielding Dividend Stock

Description: Invitation Homes is a compelling investment opportunity these days.