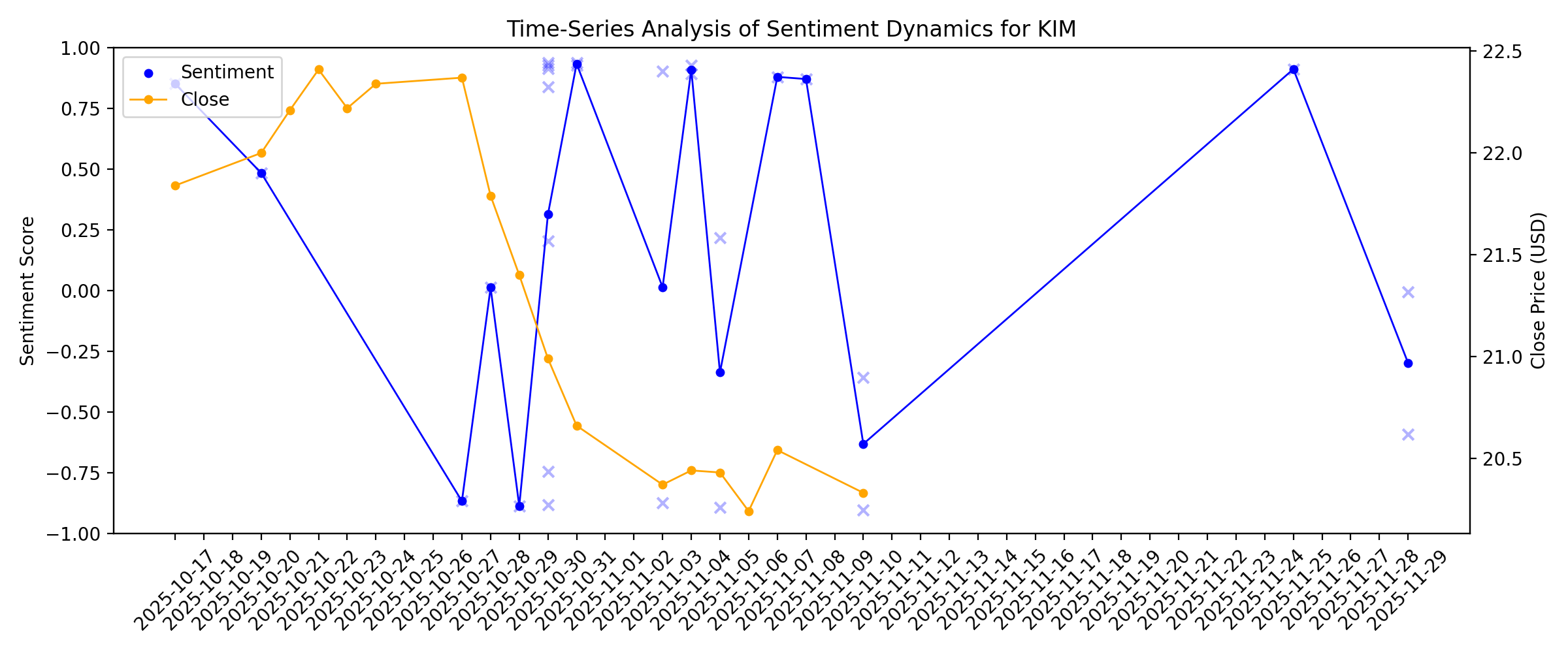

News sentiment analysis for KIM

Sentiment chart

2026-01-14

2026-01-13

Realty Income's Strategic Partnerships: Will it Boost Growth?

Description: O teams up with GIC in a $1.5B-plus JV targeting U.S. logistics build-to-suit projects and Mexico expansion to broaden funding and growth.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

A Look At Kimco Realty (KIM) Valuation After Recent Mixed Share Performance

Description: What Kimco Realty’s Recent Share Performance Might Be Telling You Kimco Realty (KIM) has seen mixed share performance recently, with a small 1 day decline, a modest gain over the past week, and a slightly positive month that contrasts with weaker past 3 months and 1 year returns. See our latest analysis for Kimco Realty. Zooming out, Kimco Realty’s recent 30 day share price return of 2.68% sits against a weaker 90 day share price return of 4.33% and a slightly negative 1 year total...

2026-01-06

Kimco Realty price target raised to $23.50 from $22 at Morgan Stanley

Description: Morgan Stanley raised the firm’s price target on Kimco Realty (KIM) to $23.50 from $22 and keeps an Equal Weight rating on the shares after the firm updated its FY25 FFO per share estimate.Claim 70% Off TipRanks PremiumUnlock hedge fund-level data and powerful investing tools for smarter, sharper decisions Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential Published first on TheFly – the ultimate source for real-time, market-moving breaking financi

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

TCW Concentrated Large Cap Growth Fund Added Kimco Realty Corporation (KIM) to Reduce Exposure to Discretionary Consumer Spend

Description: TCW funds, an investment management company, released its “TCW Global Real Estate Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The fund (I Share) returned +2.37% in the quarter compared to +4.50% for the S&P Global REIT Index. The overweight allocation in Diversified Real Estate Activities had a favorable […]

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

Kimco Realty® Invites You to Join Its Fourth Quarter Earnings Conference Call

Description: JERICHO, N.Y., Dec. 15, 2025 (GLOBE NEWSWIRE) -- Kimco Realty® (NYSE: KIM) will announce its fourth quarter 2025 earnings on February 12, 2026, before market open. You are invited to listen to our quarterly earnings conference call. The webcast information is as follows: When: 8:30 AM ET, February 12, 2026 Live Webcast: 4Q25 Kimco Realty Earnings Conference Call or on Kimco Realty’s website investors.kimcorealty.com Dial #: 1-833-470-1428 (International: 1-929-526-1599). Passcode: 056657 Audio f

How Is Kimco Realty's Stock Performance Compared to Other Real Estate Stocks?

Description: Kimco Realty has lagged behind its industry peers over the past year, yet Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

How the Narrative Surrounding Kimco Realty Is Evolving Amid Mixed Analyst Targets and New Guidance

Description: Kimco Realty's fair value estimate has nudged down slightly even as its revenue growth outlook edges higher, reflecting a market that is cautiously recalibrating expectations rather than abandoning the bullish long term story. A modestly lower discount rate highlights confidence in the durability of cash flows from grocery anchored and necessity based centers, even as investors debate how macro headwinds should influence valuations. As these incremental shifts in assumptions reshape the...

2025-12-05

2025-12-04

ICSC Announces John Peter (JP) Suarez as ICSC Chairman and Conor Flynn as ICSC Vice Chairman for 2026

Description: NEW YORK, December 04, 2025--ICSC announced today that the organization’s Board of Trustees elected John Peter (JP) Suarez, Former Walmart International Regional CEO, Executive Vice President and Chief Administration Officer, to serve as ICSC’s Chairman and Conor Flynn, Kimco Realty CEO, to serve as Vice Chairman for the 2026 term. JP succeeds Angele Robinson-Gaylord, SVP, Store Development Americas, Starbucks Coffee Company, as ICSC’s 65th Chairman.

Kimco Earns Credit Rating Upgrade, Boosts Shareholder Confidence

Description: KIM secures a rating upgrade to A3, enhancing its credit strength and easing future borrowing as it advances growth plans.

2025-12-03

Kimco Realty® Achieves ‘A3’ Credit Rating from Moody’s

Description: JERICHO, New York, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Kimco Realty® (NYSE: KIM), a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States, today announced the company achieved an ‘A3’ credit rating with a stable outlook from Moody’s Ratings (“Moody’s”), placing Kimco among a select group of REITs with A-level ratings from the three largest ratings agencies. Moody’s attributed the

2025-12-02

Realty Income's $800M CityCenter Bet: Will Diversification Pay Off?

Description: O's $800M CityCenter move adds ARIA and Vdara exposure with a 7.4% return structure as the REIT pushes beyond its traditional footprint.

2025-12-01

2025-11-30

2025-11-29

Kimco Realty (KIM): Assessing Valuation Following Strong Results and Cramer’s Spotlight on Dividend Quality

Description: Kimco Realty (KIM) is in the spotlight after Jim Cramer highlighted its dividend, shortly after the company reported a better than expected quarter and raised its forecast for full-year funds from operations. See our latest analysis for Kimco Realty. Even with upbeat financials and a spotlight on its attractive dividend, Kimco Realty’s share price has slipped about 10% year-to-date. Its 1-year total shareholder return shows a 15.5% decline. However, its three- and five-year total returns...

Jim Cramer on Kimco Realty: “I Still Like the Idea of Dividend Protection Here”

Description: Kimco Realty Corporation (NYSE:KIM) is one of the stocks that received Jim Cramer’s latest comments. Cramer highlighted the company’s dividend during the episode. He commented: “Last week, I spotlighted a trio of high-quality companies with dividend yields north of 5% because look, it’s a tricky environment. You can do a lot worse than owning stocks […]

2025-11-28

2025-11-27

2025-11-26

2025-11-25

Can Non-Discretionary Tenants Help Realty Income Withstand Any Cycle?

Description: O's focus on resilient, non-discretionary tenants underpins rising occupancy, solid leasing gains and stable cash flows.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

AvalonBay Communities, Inc. Announces Appointment of Conor C. Flynn to Board of Directors

Description: ARLINGTON, Va., November 10, 2025--AVALONBAY COMMUNITIES, INC. (NYSE: AVB) (the "Company" or "AvalonBay") announced today that Conor C. Flynn has been appointed to the Board of Directors. Mr. Flynn will serve as an independent director of the Company.

Digital Turbine and The Trade Dek have been highlighted as Zacks Bull and Bear of the Day

Description: Digital Turbine and The Trade Dek have been highlighted as Zacks Bull and Bear of the Day

2025-11-09

2025-11-08

Is Kimco Realty’s (KIM) New Equity Sale and Buyback Shifting the Capital Allocation Story?

Description: Kimco Realty Corporation recently announced a new equity sales agreement to issue and sell up to US$750 million in common stock, replacing its previous arrangement, along with Board approval of a new US$750 million share repurchase program. This dual authorization reflects purposeful capital management, positioning the company to fund acquisitions, reduce debt, and enhance flexibility amid changing market conditions. We’ll explore how the launch of a major equity sale alongside a new...

2025-11-07

Europe Leads Realty Income's Investment Surge: What Comes Next?

Description: O's growing European footprint, higher yields and strong deal pipeline power its 2025 investment outlook.

2025-11-06

2025-11-05

Macerich Q3 FFO & Revenues Miss Estimates, Occupancy Declines Y/Y

Description: MAC posts a slight FFO miss in Q3 as higher interest costs ail, but strong leasing and rent growth highlight portfolio resilience.

Here's How You Can Earn $100 In Passive Income By Investing In Kimco Realty Stock

Description: Kimco Realty Corp. (NYSE:KIM) is a real estate investment trust that owns and operates grocery-anchored shopping centers and mixed-use properties in the U.S. The 52-week range of Kimco Realty stock price was $17.93 to $25.83. Kimco Realty's dividend ...

2025-11-04

Realty Income's Q3 AFFO Beat Estimates, Revenues Rise Y/Y

Description: O's third-quarter 2025 results reflect a year-over-year rise in revenues. However, higher interest expenses remain a concern.

Simon Property Q3 FFO Beats Estimates on Higher Revenues & Occupancy

Description: SPG's Q3 FFO tops estimates as rising rents, occupancy gains and a key acquisition fuel stronger guidance.

2025-11-03

Kimco Realty® Announces $750 Million ATM Equity Offering Program and $750 Million Stock Repurchase Program

Description: JERICHO, N.Y., Nov. 03, 2025 (GLOBE NEWSWIRE) -- Kimco Realty Corp. (NYSE: KIM) (the “Company” or “Kimco”) today announced the establishment of an “at the market” continuous offering program, pursuant to which the Company may offer and sell shares of its common stock, par value $0.01 per share, with an aggregate gross sales price of up to $750,000,000 through BofA Securities, Inc., Barclays Capital Inc., BMO Capital Markets Corp., BNP Paribas Securities Corp., BNY Mellon Capital Markets, LLC, BT

Are Wall Street Analysts Predicting Kimco Realty Stock Will Climb or Sink?

Description: Kimco Realty has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-02

2025-11-01

2025-10-31

Kimco Realty (KIM) Profit Margins Jump, Challenging Persistent Bearish Narratives on Operational Strength

Description: Kimco Realty (KIM) delivered a net profit margin of 26.4% in its latest period, a meaningful jump from last year’s 18%. Earnings growth surged 58.5% year-over-year, a sharp reversal compared to its five-year track record of annual declines averaging 17.6%. These margin gains and accelerated profits point to a stronger operational performance, even as the long-term trend highlights recent recovery from previous challenges. See our full analysis for Kimco Realty. Up next, we will see how these...

Federal Realty Beats Q3 FFO & Revenue Estimates, Raises 2025 View

Description: FRT tops Q3 FFO and revenue estimates, driven by strong leasing gains and occupancy growth, and lifts its 2025 outlook.

2025-10-30

Kimco Realty Keeps Retail Centers Thriving, Boosts Profit Forecast

Description: Small-shop demand and rent gains continue to power growth

Kimco Realty Corp (KIM) Q3 2025 Earnings Call Highlights: Record Occupancy and Robust Leasing ...

Description: Kimco Realty Corp (KIM) reports strong Q3 performance with increased FFO, record small shop occupancy, and a promising redevelopment pipeline.

Kimco's Q3 FFO & Revenues Beat Estimates, Dividend Raised

Description: KIM posts solid Q3 results, with higher FFO per share and revenues, boosted by rising rents and occupancy and lifts its dividend and 2025 FFO per share outlook.

Kimco Realty (KIM) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for Kimco Realty (KIM) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Kimco Realty (KIM) Tops Q3 FFO and Revenue Estimates

Description: Kimco Realty (KIM) delivered FFO and revenue surprises of +2.33% and +2.21%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Kimco Realty: Q3 Earnings Snapshot

Description: JERICHO, N.Y. (AP) — Kimco Realty Corp. KIM on Thursday reported a key measure of profitability in its third quarter. The results beat Wall Street expectations.

Kimco Realty® Announces Third Quarter 2025 Results

Description: – Achieves Record Leased-to-Economic Occupancy Spread –– New High in Small Shop Occupancy –– 4% Increase to Cash Dividend on Common Shares –– Raises 2025 Outlook Range – JERICHO, N.Y., Oct. 30, 2025 (GLOBE NEWSWIRE) -- Kimco Realty® (NYSE: KIM), a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States, today reported results for the third quarter ended September 30, 2025. For th

2025-10-29

EPR Properties (EPR) Q3 FFO Beat Estimates

Description: EPR Properties (EPR) delivered FFO and revenue surprises of +5.30% and -1.53%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-28

What's in the Cards for Kimco Realty Stock in Q3 Earnings?

Description: While a healthy retail real estate market and focus on developing mixed-use assets are likely to aid KIM's Q3 earnings, high interest expenses may have hurt it.

2025-10-27

Brixmor Property (BRX) Matches Q3 FFO Estimates

Description: Brixmor (BRX) delivered FFO and revenue surprises of 0.00% and +0.59%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

How Do Kimco Realty’s 2025 Prospects Look After Latest Earnings Beat?

Description: If you’re wondering whether it’s the right moment to make a move on Kimco Realty stock, you’re not alone. Investors have had plenty to consider lately. After a bit of a dip earlier this year, shares have bounced up 3.8% in the past seven days, even as the year-to-date return is down around 4.9%. This mix of modest recent momentum and a longer-term pullback might have you thinking about whether the tides are about to turn for Kimco, or if caution is still present in the market. Interestingly,...

2025-10-19

2025-10-18

2025-10-17

Here's Why Realty Income's Focus on Essential Retail Keeps It Steady

Description: O's focus on non-discretionary tenants drives steady cash flow and keeps its portfolio nearly full even in uncertain markets.