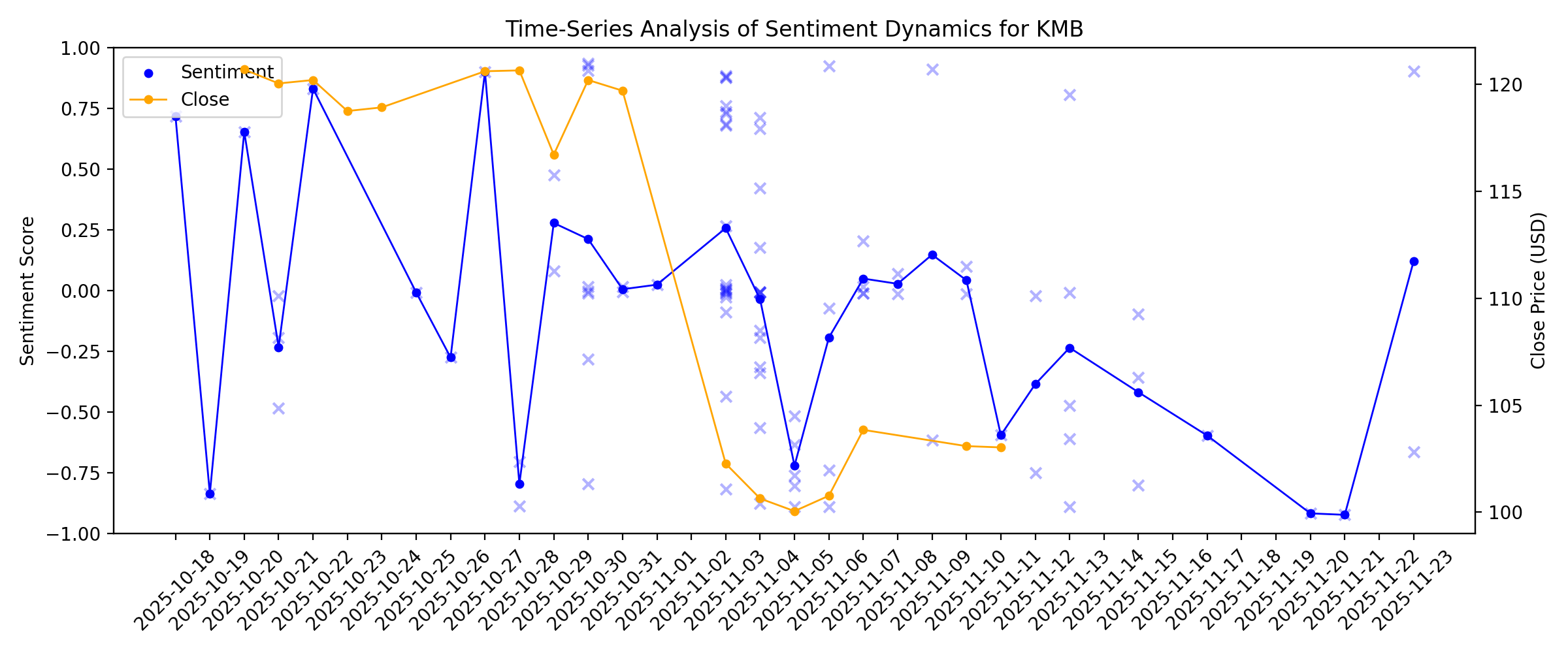

News sentiment analysis for KMB

Sentiment chart

2026-01-14

How Recent Developments Are Reframing The Kimberly-Clark (KMB) Investment Story

Description: What Changed in the Kimberly-Clark Story The recent trim in Kimberly-Clark’s fair value estimate from US$127.73 to US$126.60 reflects a small recalibration of the model rather than a major rethink of the story behind the stock. The analyst work behind this tweak pairs a higher revenue growth assumption of 15.64% versus 10.35% previously with an essentially unchanged discount rate of about 6.96%, balancing stronger top line expectations with ongoing caution around execution and category...

Jim Cramer on Kimberly-Clark: “I Think Michael Hsu Is Doing a Fantastic Job With What the Hand He’s Got”

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently looked at. During the episode, a caller asked if they should hold or sell it. In response, Cramer said: “Okay, so I think a lot of the weakness is more involved with Kenvue, but remember, Procter, which we own for the Charitable Trust, also […]

2026-01-13

Kimberly-Clark (KMB) Fell Following the Acquisition Announcement

Description: Heartland Advisors, an investment management company, released its “Heartland Mid Cap Value Fund” fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. As the overall stock market continues to widen, mid-caps are not experiencing the same. The high-quality value stocks continue to underperform, while speculative, low-quality, and momentum-driven sections of the […]

2026-01-12

2026-01-11

Wells Fargo Lowers Kimberly-Clark (KMB) Target to $105, Keeps Equal Weight

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is included among the 13 Best Consumer Staples Dividend Stocks to Invest in Now. On January 5, Wells Fargo cut its price target on Kimberly-Clark Corporation (NASDAQ:KMB) to $105 from $110 and kept an Equal Weight rating on the shares. The change reflects updates to Wells’ models across Beverage, Food, and Home […]

2026-01-10

2026-01-09

2026-01-08

2026-01-07

Could Buying Kimberly-Clark Stock Today Set You Up For Life?

Description: The maker of bathroom products is about to undergo a significant change in its business.

2026-01-06

Assessing Kimberly-Clark (KMB) Valuation After A 20% One Year Total Return Loss

Description: Kimberly-Clark (KMB) has been drawing attention after a weak share performance over the past year, with the stock down about 20% on a total return basis, despite reporting US$19.7b in revenue. See our latest analysis for Kimberly-Clark. The recent weakness in Kimberly-Clark's share price, including an 18.38% 90 day share price decline and a 20.16% total shareholder return loss over the past year, points to fading momentum despite its US$19.7b in sales. If this defensive household name has you...

Forget 2025: 3 High-Yield Dividend Stocks to Power Your Passive Income Stream in 2026

Description: With yields over 4%, these dividend stocks are great buys for income investors in the new year.

Is Kimberly-Clark (KMB) Now Attractive After A 20% Share Price Slide?

Description: If you are wondering whether Kimberly-Clark is starting to look like value at around US$98.07 per share, you are not alone. The stock is down 3.4% over the last week, 4.7% over the last month, and 19.8% over the past year, which has shifted how some investors think about both its return potential and its risk profile. Recent attention on consumer staples and household products companies has put Kimberly-Clark back on watchlists, as investors reassess how more defensive names fit into their...

2026-01-05

5 Best Passive Income Dividend Kings With Yields Up to 7% to Buy in 2026

Description: These five top Dividend Kings with yields up to 7% looked poised to deliver strong total return and passive income in 2026.

2026-01-04

2026-01-03

2026-01-02

Americans Are Looking to the Midwest to Find Affordability

Description: APPLETON, Wis.—Greg and Sara Cebulski enjoyed their years in Los Angeles, but when it came time to buy a bigger home for their family, they packed up and moved back to a place where they could actually afford one: the Midwest. The couple, who grew up outside this quaint town in Wisconsin’s Fox River Valley, just closed on a 2,400-square-foot split level for $360,000—almost twice the size of the starter home they sold in the San Fernando Valley for more than twice that price. Utilities, gasoline and dance and piano lessons for their two children are cheaper in Appleton, too.

2026-01-01

2025-12-31

2025-12-30

Kimberly-Clark (KMB) Target Lowered as Citi Rebalances Household Care View

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is included among the 14 Best Dividend Aristocrats to Invest in Heading into 2026. On December 17, Citi lowered its price target on Kimberly-Clark Corporation (NASDAQ:KMB) to $95 from $100 and kept a Sell rating on the stock. The change came as part of the firm’s 2026 outlook for the beverages, household, […]

2025-12-29

Activist Investor Toms Capital Is Buying Up Target Stock. Should You?

Description: Target faces heightened scrutiny as activist investor Toms Capital builds a stake. Does this mark a turning point, or justify continued caution?

2025-12-28

The Smartest Dividend Stocks to Buy With $1,000 Right Now

Description: These companies pay steadily rising dividends.

2025-12-27

2025-12-26

Pressure grows on Target as activist investor builds stake

Description: US retail chain Target is facing pressure from an activist investor after a sales slump that has wiped out nearly a third of its share value...

2025-12-25

2025-12-24

Here's What to Expect From Kimberly-Clark's Next Earnings Report

Description: Kimberly-Clark will release its fourth-quarter earnings next month, and analysts anticipate a single-digit profit dip.

2025-12-23

2025-12-22

2025-12-21

The Bull Case For Graphic Packaging (GPK) Could Change Following CEO Shake-Up And Activist Backlash – Learn Why

Description: Graphic Packaging Holding Company recently replaced long-standing CEO Michael P. Doss with incoming CEO Robbert E. Rietbroek, a consumer-products veteran with extensive global leadership experience across Primo Brands, PepsiCo, Kimberly-Clark, and Procter & Gamble. The abrupt transition has drawn sharp public criticism from major shareholder Eminence Capital, which is calling for Doss’s reinstatement and the resignation of board chair Philip Martens over governance concerns. We’ll now...

Makers of Everyday Essentials Once Offered Investors Safety. Do They Still?

Description: Packaged-food producers outperform during rotations to safety. But shifts in consumer habits mean investors need to be selective.

2025-12-20

2025-12-19

KMB vs. PG: Which Consumer Staples Stock Offers Better Upside Now?

Description: Procter & Gamble's scale and cash flow strength contrast with Kimberly-Clark's execution-heavy recovery, shaping the upside debate in staples.

2025-12-18

2025-12-17

Share Offerings Prompt Huge Insider Buying in These 3 Biotechs

Description: Secondary offerings from biotechs Immunovant, Kymera Therapeutics, and Wave Life Sciences prompted some huge insider buying recently.

2025-12-16

Can Premiumization Keep KMB Growing Ahead of Category Trends?

Description: Kimberly-Clark's Q3 2025 results show premiumization, driving a seventh straight quarter of volume-plus-mix growth despite pressured categories.

2025-12-15

How the Narrative Surrounding Kimberly-Clark Is Shifting After the Planned Kenvue Acquisition

Description: Kimberly-Clark's latest valuation update reflects only a slight trim to its fair value estimate, nudging it from about $128.87 to $127.73 per share, even as assumptions for long term revenue growth climb from roughly 7.0% to around 10.4%. With the discount rate effectively steady near 6.956%, the shift in price target appears driven more by caution over Kenvue related execution risk than by any loss of confidence in the company’s growth outlook. Read on to see how you can track these evolving...

Hain Celestial appoints Alison Lewis as president, CEO on permanent basis

Description: Lewis took on the roles in an interim capacity in May following the departure of Wendy Davidson.

2025-12-14

2025-12-13

2025-12-12

Kimberly-Clark to Announce Fourth Quarter and Full Year 2025 Results on January 27, 2026

Description: Kimberly-Clark (NASDAQ: KMB) will issue its fourth quarter and full year 2025 results on Tuesday, January 27, 2026. A press release and supplemental materials will be issued at approximately 6:30 a.m. EST.

2025-12-11

KMB Stock Tumbles 19% in 3 Months: Buy the Dip or Stay Cautious?

Description: Kimberly-Clark slides 19% in three months as soft demand, currency pressure and heavy promotions weigh on margins and sentiment.

Is the Options Market Predicting a Spike in Kimberly-Clark Stock?

Description: Investors need to pay close attention to KMB stock based on the movements in the options market lately.

2025-12-10

Is Kimberly-Clark Now a Value Opportunity After Its 21% Share Price Slide?

Description: Wondering if Kimberly-Clark at around $102.89 is a bargain hiding in plain sight, or a classic consumer staple that the market is finally re-pricing correctly, you are not alone. The stock has slipped recently, down 3.1% over the last week and 0.2% over the last month, and it is also firmly in negative territory year-to-date at -21.2% and -18.0% over the last year, raising questions about whether sentiment has overshot fundamentals. Investors have been digesting a mix of macro headlines,...

Kimberly-Clark (KMB): Assessing Valuation After a Three-Month Share Price Slide

Description: Kimberly-Clark (KMB) has quietly slipped over the past 3 months, even as its underlying business keeps growing revenue and earnings. That disconnect is what makes the stock interesting right now. See our latest analysis for Kimberly-Clark. Zooming out, the stock’s 90 day share price return of around negative 21 percent and 1 year total shareholder return of roughly negative 18 percent suggest momentum has clearly been fading as investors reassess near term risks despite improving...

2025-12-09

The 5 Best S&P 500 Dividend Aristocrat Stocks to Buy Before 2026

Description: Given the potential for a sizable sell-off, it makes sense for investors to move to S&P 500 Dividend Aristocrat stocks like these now.

2025-12-08

Kimberly-Clark Progresses Toward Its Gross Margin Goal of 40%

Description: KMB's Q3 progress boosts confidence that it can hit its 40% gross margin goal sooner as mix gains and cost cuts strengthen profitability.

2025-12-07

2025-12-06

BNP Paribas Exane Lowers Outlook on Kimberly-Clark (KMB) Ahead of 2026 Acquisition

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is included among the 15 Blue Chip Dividend Stocks to Build a Passive Income Porfolio. On December 1, Kimberly-Clark Corporation (NASDAQ:KMB)’s price target was reduced by BNP Paribas Exane to $110 from $127. The firm reaffirmed a Neutral rating on the stock. The adjustment followed the company’s planned acquisition of Kenvue, which […]

2025-12-05

2025-12-04

2025-12-03

KMB Accelerates Growth Through Digital & Club Channel Expansion

Description: Kimberly powers growth through surging digital sales and strong club channel gains as shoppers seek convenience and value.

Kimberly-Clark Corporation (NASDAQ:KMB) is favoured by institutional owners who hold 84% of the company

Description: Key Insights Given the large stake in the stock by institutions, Kimberly-Clark's stock price might be vulnerable to...

Is Kimberly-Clark Stock Underperforming the Nasdaq?

Description: While Kimberly-Clark has lagged behind the broader Nasdaq Composite over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-12-02

2025-12-01

2025-11-30

Analysts Note Stronger Outlook as Kimberly-Clark (KMB) Deepens Its Consumer Health Footprint

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is included among the 15 Best Boring Dividend Stocks to Buy. On November 13, Argus analyst John Staszak upgraded Kimberly-Clark Corporation (NASDAQ:KMB) to a Buy rating from Hold and set a $120 price target, according to a report by The Fly. He pointed out that the stock has been lagging lately, but […]

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

Jim Cramer Dissects Kimberly-Clark’s Acquisition of Kenvue

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently offered insights on. Cramer discussed the company’s planned acquisition of Kenvue during the episode. He said: “Alright, this is one we’ve talked about a bunch, Kimberly-Clark’s bold, nearly $49 billion bid to buy Kenvue, which is the J&J’s old over-the-counter business that makes Tylenol, […]

Kimberly-Clark (KMB): Exploring Valuation After Recent Share Price Decline

Description: Kimberly-Clark (KMB) shares edged up just over 1% over the past week, even as broader market sentiment remained mixed. Investors have seen returns pull back by nearly 12% over the past month, prompting some to revisit the company's valuation and outlook. See our latest analysis for Kimberly-Clark. Even with a brief uptick this week, Kimberly-Clark's recent slide stands out more. The stock's 30-day share price return of -11.6% and one-year total shareholder return of -21.2% show that momentum...

2025-11-22

2025-11-21

Kimberly-Clark To Webcast Its Presentation At Morgan Stanley's Global Consumer & Retail Conference

Description: Mike Hsu, Chairman and Chief Executive Officer of Kimberly-Clark Corporation (NASDAQ: KMB), and Nelson Urdaneta, Chief Financial Officer, will be featured speakers at the Morgan Stanley Global Consumer & Retail Conference on Wednesday, December 3, at 8:00 a.m. EST.

2025-11-20

Kimberly-Clark Declares Quarterly Dividend

Description: The board of directors of Kimberly-Clark Corporation (NASDAQ: KMB) has declared a regular quarterly dividend of $1.26 per share. The dividend is payable in cash on January 5, 2026, to stockholders of record at the close of business on December 5, 2025.

2025-11-19

2025-11-18

2025-11-17

Kimberly-Clark (KMB)’s Created the Perfect Scenarior, Says Jim Cramer

Description: We recently published 16 Latest Stocks on Jim Cramer’s Radar. Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks on Jim Cramer’s radar. After Kimberly-Clark Corporation (NASDAQ:KMB) announced its mega $48.7 billion acquisition of Kenvue, Jim Cramer hasn’t been able to help himself when discussing the firm. While the shares appeared to react negatively to the […]

2025-11-16

2025-11-15

What Catalysts Could Shift the Narrative for Kimberly-Clark Stock?

Description: Kimberly-Clark's stock narrative has shifted as analysts adjusted the Fair Value Estimate downward from $137.22 to $128.63 per share. This change reflects a cautious approach to the company's intrinsic value, guided by updated sentiment around its growth potential and ongoing risks. Stay tuned to discover the factors moving this estimate and how you can stay ahead of future changes in the story of Kimberly-Clark. Stay updated as the Fair Value for Kimberly-Clark shifts by adding it to your...

Kimberly-Clark’s (KMB) at a “Generational Low,” Says Jim Cramer

Description: We recently published 11 Stocks Jim Cramer Talked About. Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently discussed. After personal care products firm Kimberly-Clark Corporation (NASDAQ:KMB) announced its $48.7 billion acquisition of Kenvue last week, Cramer couldn’t stop praising the decision as he commented that the deal enabled the two firms to […]

Procter & Gamble’s (PG) at a “Real Low,” Says Jim Cramer

Description: We recently published 11 Stocks Jim Cramer Talked About. The Procter & Gamble Company (NYSE:PG) is one of the stocks Jim Cramer recently discussed. The Procter & Gamble Company (NYSE:PG) is one of the biggest consumer goods companies in the world. Cramer has praised the firm’s management in previous appearances. More recently, he discussed The […]

2025-11-14

2025-11-13

Why Kimberly-Clark, Fidelity National Financial, And WEC Energy Are Winners For Passive Income

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Kimberly-Clark, Fidelity National Financial, and WEC Energy have rewarded shareholders for years and recently announced ...

Activist investors make Wall Street 'efficient': Starboard CEO

Description: Starboard Value managing member, CEO, and chief investment officer Jeffrey Smith is among the most influential activist investors on Wall Street. Smith sits down with Yahoo Finance Executive Editor Brian Sozzi to discuss what drew him to activist investing, how he selects investment targets, the Kenvue (KVUE) and Kimberly-Clark (KMB) deal, and more. For full interviews, highlights, and key insights, check out more from Yahoo Finance Invest.

Jim Cramer Says Procter & Gamble “Has the Scale and the Science to Make Things Cheaper”

Description: The Procter & Gamble Company (NYSE:PG) is one of the stocks Jim Cramer recently put under a microscope. Cramer highlighted that he used the company as an example in his book. He said: “Sometimes when stocks are doing badly, I get worried, not because I want to get out, but because I wonder if I […]

Jim Cramer Says Kenvue’s Brands “Complement Kimberly-Clark Perfectly”

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently put under a microscope. Cramer discussed the company’s planned acquisition, as he commented: “Sometimes when stocks are doing badly, I get worried, not because I want to get out, but because I wonder if I might be missing a once-in-a-generational bottom. Those don’t come […]

Is Kimberly-Clark’s Recent 4.1% Rally a Sign of Hidden Value in 2025?

Description: Ever wondered if Kimberly-Clark is quietly trading at a bargain, or if its stock movements hint at something bigger under the surface? The share price has seen a recent bump of 4.1% in the last week, but it's still down over 20% year-to-date and has dropped more than 18% over the past year, signaling some big shifts in sentiment. Much of the recent volatility can be traced to headline news around inflationary pressures, supply chain improvements, and strategic moves in their personal care...

2025-11-12

4 Highest Yielding Dividend Stocks in the Nasdaq Composite

Description: Dividend stocks might not sound like an exciting investment in your portfolio, but if you can invest in the right ones, they can generate years of passive income. The Nasdaq Composite index includes the stocks listed on the Nasdaq stock exchange and has some of the biggest and the best U.S. companies. The government uncertainty ... 4 Highest Yielding Dividend Stocks in the Nasdaq Composite

Kimberly-Clark Stock: Is Wall Street Bullish or Bearish?

Description: As Kimberly-Clark has lagged behind the broader market over the past year, Wall Street analysts maintain a cautious outlook on the stock’s prospects.

2025-11-11

Mergers Are Back — But Wall Street’s Not Buying the Hype

Description: Many mergers claim to be “transformative,” but history shows that most destroy shareholder value — often benefiting executives and bankers more than investors.

2025-11-10

3 Beaten-Down Stocks That Haven't Been This Cheap in Over 5 Years

Description: These stocks are down between 20% and 57% this year.

Stock Market News for Nov 10, 2025

Description: Wall Street closed mixed on Friday, pulled up by consumer and energy stocks.

2025-11-09

Kenvue (KVUE) Jumps 17% on Strong Earnings, Kimberly-Clark $48.7-Billion Merger

Description: We recently published 10 Stocks Soaring Past Expectations. Kenvue Inc. (NYSE:KVUE) is one of the big names that led last week’s charge. Kenvue grew its share prices by 17.47 percent week-on-week, as investors loaded portfolios following twin news that it achieved a strong earnings performance in the past quarter of the year, alongside plans to […]

Jim Cramer Says Haleon’s “Stock’s Been Struggling”

Description: Haleon plc (NYSE:HLN) is one of the stocks Jim Cramer recently discussed. Cramer highlighted the stock’s struggles, as he commented: “With Kimberly-Clark shelling out nearly $49 billion to buy Kenvue, which was originally J&J’s over-the-counter medicine business, I think it’s time to check in with Haleon, the former consumer business of GlaxoSmithKline and Pfizer… Oh, […]

2025-11-08

Looking at the Narrative for Kenvue After Legal Risks and the Acquisition Deal

Description: Kenvue stock has recently experienced a shift in analyst sentiment, leading to a reduction in the consensus price target from $20.63 to $19.42 per share, a decrease of approximately 5.9%. This adjustment reflects both the evolving legal landscape and a mix of optimism and caution among market watchers regarding the company's future growth potential. Stay tuned to discover how you can remain informed as the narrative around Kenvue continues to evolve. Analyst Price Targets don't always capture...

Investing.com’s stocks of the week

Description: Investing.com – U.S. equities were extremely volatile this week, as investor concerns regarding valuations led to declines, especially among technology stocks. However, there were some names that managed to make solid gains.

2025-11-07

Nothing to Celebrate: The Median Age of First-Time Home Buyers Hits 40.

Description: Data from the National Association of Realtors reveal a struggling housing market. Sales are down, prices up, and down payments are rising. That means younger buyers have to wait.

The Score: GM, Tesla, Palantir, American Airlines and More Stocks That Defined the Week

Description: Trade-sensitive stocks rose Wednesday as the Supreme Court heard oral arguments on the case challenging the broad array of global tariffs President Trump has imposed. The levies appeared to be on shaky ground after the hearing, during which justices expressed skepticism about Trump’s authority to impose sweeping measures on countries around the world. The Trump administration’s top lawyer faced sharp questioning, including from some members of the court’s conservative wing.

“Kimberly-Clark (KMB) Is A Really Well Run Company,” Says Jim Cramer

Description: We recently published 10 Stocks Jim Cramer Discussed Including His Palantir Deep Dive. Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently discussed. Kimberly-Clark Corporation (NASDAQ:KMB)’s $48.7 billion Kenvue acquisition announcement was well-received by Jim Cramer despite the stock’s negative reaction. The CNBC TV host believes that the deal allows the firm to […]

Why Staples Aren’t Safe Anymore—and 11 Stocks That May Be Worth a Look

Description: For a sector known for safety, consumer staples have been living dangerously. It’s been a tough year for consumer staples. The exchange-traded fund is down 1.7% this year, while all other sectors were in the green as of Wednesday’s close.

2025-11-06

Jim Cramer on Kimberly-Clark: “They Have to Think Bigger”

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the latest stocks on Jim Cramer’s radar. Cramer discussed the company’s earnings, acquisition plans, and market reaction after both. He commented: “How about Kimberly-Clark? Sure, it got hit hard off the announcement of the Kenvue acquisition yesterday, but consider this. This, Kimberly just reported that it earned a $1.82 […]

There May Be Some Bright Spots In Kimberly-Clark's (NASDAQ:KMB) Earnings

Description: Kimberly-Clark Corporation's ( NASDAQ:KMB ) earnings announcement last week didn't impress shareholders. While the...

Want Safe Dividend Income in 2025 and Beyond? Invest in the Following 3 Ultra-High-Yield Stocks.

Description: Ultra-high yields don't have to translate to ultra-high risk.

5 Revealing Analyst Questions From Kimberly-Clark’s Q3 Earnings Call

Description: Kimberly-Clark’s third quarter saw a positive response from the market as management highlighted volume and mix-led growth despite a flat sales environment. The company leveraged new product introductions and a focus on innovation across its product tiers to maintain market share in a competitive landscape. CEO Michael Hsu explained that “our inflection to volume plus mix-led growth that began last year continued into the third quarter,” attributing performance to meeting customers’ needs throug

2025-11-05

Jim Cramer Notes Kimberly-Clark’s Stock Got “Clobbered” After Kenvue Acquisition Announcement

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently commented on. Cramer highlighted the company’s acquisition plans, as he commented: “Now, I want you to contrast that with Kimberly-Clark, a great company, saw its stock get clobbered today after the company announced it was buying Kenvue. That’s the maker of Tylenol, Band-Aids, Neutrogena, […]

No Tylenol-Kleenex Deal Might Be Best for Dividend Investors

Description: Both Kimberly Clark and Kenvue are Dividend Aristocrats. Dividends after a merger could well disappoint.

Kimberly-Clark (KVUE) Buying Kenvue Isn’t A Mistake, Asserts Jim Cramer

Description: We recently published 11 Latest Stocks Jim Cramer Talked About. Kenvue Inc. (NYSE:KVUE) is one of the stocks Jim Cramer recently discussed. Personal healthcare products provider Kenvue Inc. (NYSE:KVUE) has been in the news for one reason or another recently. The firm faced turmoil on the stock market in September after President Trump raised concerns […]

“Proctor (PG)’s A Juggernaut,” Says Jim Cramer

Description: We recently published 11 Latest Stocks Jim Cramer Talked About. The Procter & Gamble Company (NYSE:PG) is one of the stocks Jim Cramer recently discussed. The Procter & Gamble Company (NYSE:PG) is one of the largest consumer goods companies in the world. In his previous comments, Cramer has called the firm one of “the best” […]

Jim Cramer Just Couldn’t Help Himself When Talking About Kimberly-Clark (KMB)’s Kenvue Acquisition

Description: We recently published 11 Latest Stocks Jim Cramer Talked About. Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently discussed. Along with OpenAI’s Amazon deal, Kimberly-Clark Corporation (NASDAQ:KMB) also made headlines after it announced that it would acquire household and personal products company Kenvue for $48.7 billion. Cramer discussed Kimberly-Clark Corporation (NASDAQ:KMB)’s CEO […]

2025-11-04

What Could Stop Kimberly-Clark’s Deal for Kenvue

Description: Kimberly-Clark’s stock is down 1.7% to $100.55 after hitting a new 52-week low earlier in the session on Tuesday. Investors wondered why Kimberly-Clark was willing to buy a company with weakening sales and sizable potential legal liability related to Tylenol and talc. The deal requires shareholder approval from both Kimberly-Clark and Kenvue.

Kimberly-Clark buys troubled Tylenol-maker Kenvue for $48.7bn

Description: Kenvue is under the microscope from the Trump administration, though Kimberly-Clark sees a $32bn horizon.

A solid earnings season reveals tech strength and consumer weakness

Description: A price-sensitive, value-conscious consumer adds a degree of unevenness and uncertainty to a robust earnings season.

Kimberly-Clark, Kenvue’s $48.7B deal among recent multibillion-dollar M&A

Description: In other news, Apple suppliers Qorvo and Skyworks plan to combine and metal card maker Composecure offers a bid for Husky Technologies.

Markets Face a Big Risk From This AI Spending Spree. What to Watch.

Description: OpenAI strikes cloud computing deal with Amazon, Palantir CEO touts strong third-quarter results, Trump threatens to cut NYC funds, and more news to start your day.

Unease About Warren Buffett’s Retirement Overshadows Berkshire Earnings Beat

Description: For the 12th consecutive quarter, Berkshire Hathaway was a net seller of stocks, offloading $6 billion worth.

Kimberly-Clark Takeover Offers $48 Billion of Pain Relief to Tylenol-Maker Kenvue

Description: The deal, expected to close in the second half of 2026, comes as Kenvue's Tylenol political fight is heating up.

Kenvue (KVUE) Soars 12% on $48.7-Billion Kimberly-Clark Merger

Description: We recently published Wall Street Can’t Keep up With These 10 Crushing Stocks; 6 at Fresh Record Highs. Kenvue Inc. (NYSE:KVUE) is one of the best-performing on Monday. Kenvue saw its share prices jump by 12.32 percent on Monday to close at $16.14 apiece as investors loaded portfolios following news that it was set to […]

Kimberly-Clark To Acquire Kenvue In $48.7 Billion Mega Deal

Description: Combined company aims to become global health leader by 2026.

Kimberly-Clark (KMB): Assessing Value After Recent 17% Share Price Slide

Description: Kimberly-Clark (KMB) shares have edged lower in recent trading, catching investors’ attention as the company’s performance trends have lagged over the past month. The stock’s nearly 17% slide in that period prompts a closer look at what could be driving sentiment. See our latest analysis for Kimberly-Clark. Kimberly-Clark’s sharp 16.6% slide in the past month is the latest in a string of losses for the year, with its 1-year total shareholder return down 20.7%. This steady retreat suggests...

S&P 500 Futures Drop as Fed Caution Weighs

Description: The Morning Bull - US Market Morning Update Tuesday, Nov, 4 2025 US stock futures are sliding premarket as investors digest hawkish signals from the Federal Reserve and ongoing signs of strain in the manufacturing sector. With Fed officials making it clear that a December rate cut is not guaranteed, and manufacturing data painting a mixed, uncertain picture, market sentiment is becoming more cautious as investors weigh the impact of elevated yields and weaker production on broader economic...

Trending tickers: Palantir, Uber, Kimberly-Clark, AB Foods and Saudi Aramco

Description: The latest investor updates on stocks that are trending on Tuesday

Heard on the Street Monday Recap: Amazon Gets a Piece

Description: Amazon finally gets in on OpenAI action. Amazon's shares jumped 4% after the tech giant landed a $38 billion deal with OpenAI. Amazon's AWS cloud service will provide computing capacity to the ChatGPT parent for the next seven years.

These 2 Dividend Kings Are Combining in a $48.7 Billion Megadeal. Is It A Win-Win for Dividend Investors?

Description: Kimberly-Clark is creating a consumer health and wellness giant.

2025-11-03

Tylenol maker Kenvue secures deal from consumer goods giant

Description: Kimberly-Clark, manufacturer of consumer goods and personal care products, is best known for its paper-based products, including Scott, Cottonelle, Kleenex, Kotex, Huggies, and Pull-ups. The company is now expanding its portfolio with more everyday American products through a strategic ...

The CEO Behind Kimberly-Clark’s $40 Billion Gamble on Tylenol Maker

Description: Mike Hsu aims to stoke the consumer company’s growth by veering into Kenvue’s higher-margin but risky health products.

Tylenol’s parent company will combine with the maker of Huggies in a $48.7 billion mega-deal

Description: Huggies maker Kimberly-Clark announced Monday it will buy Tylenol’s parent company Kenvue in a nearly $50 billion deal, creating a massive consumer products conglomerate.

Kimberly-Clark Strikes $40 Billion Deal for Tylenol Maker Kenvue

Description: One of biggest takeovers so far this year will create a global company with annual revenues of roughly $32 billion.

Nasdaq, S&P 500 Rise in Mixed Session as Amazon Leads Tech Advance

Description: The Nasdaq Composite and the S&P 500 advanced in an overall mixed session on Monday, with Amazon.com

Kimberly-Clark Stock Takes Biggest One-Day Hit Since Black Monday

Description: Kimberly-Clark shares suffered their biggest one-day drop since the 1980s after the Huggies diapers maker agreed to buy Kenvue. Shares in the Tylenol maker leapt. At the close of trading: Kimberly-Clark's stock fell 15% to $102.

Stocks Close Higher on M&A and AI Optimism

Description: The S&P 500 Index ($SPX ) (SPY ) on Monday rose +0.10%, the Dow Jones Industrials Index ($DOWI ) (DIA ) fell -0.52%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) rose +0.37%. December E-mini S&P futures (ESZ25 ) rose +0.09%, and December E-mini Nasdaq futures (NQZ25 ) rose...

Stocks to Watch Monday Recap: Kenvue, IREN, Berkshire, Amazon

Description: ↗️ Kenvue (KVUE): Shares of the Tylenol maker jumped 12% on the news that Kimberly-Clark (KMB) would purchase the company. Shares in the Huggies maker skidded, falling nearly 15%. ↗️ Amazon.com (AMZN): OpenAI agreed to pay $38 billion for computing power in a multiyear deal that marks the first partnership between the startup and the cloud giant.

US Equity Indexes Mixed as Amazon's Gains Help S&P 500, Nasdaq Outperform Dow

Description: US equity indexes traded mixed at Monday's close as Amazon.com's (AMZN) $38 billion deal with the Mi

Stock Market Today: Indexes End Mixed, But Palantir Pops; This Tech Stock Drops Amid AMD Lawsuit (Live Coverage)

Description: The Dow Jones index fell but Amazon surged on deal with OpenAI. Kimberly-Clark plunged on the stock market today. Palantir popped.

Heard on the Street Recap: Amazon Gets a Piece

Description: Amazon finally gets in on OpenAI action. Amazon's shares jumped 4% after the tech giant landed a $38 billion deal with OpenAI. The deal calls for Amazon's AWS cloud service to provide computing capacity to the ChatGPT parent for the next seven years.

These Stocks Moved the Most Today: Kenvue, Kimberly-Clark, Amazon, uniQure, Palantir, Idexx, Cipher Mining, and More

Description: Kimberly-Clark agrees to buy Tylenol maker Kenvue in a cash-and-stock deal valued at about $48.7 billion, including debt.

S&P 500 Gains & Losses Today: Amazon Stock Jumps After OpenAI Deal; Kimberly-Clark Acquires Kenvue

Description: An AI collaboration boosted the company behind the largest U.S. cloud service on Monday, Nov. 3, 2025, while shares of the two companies involved in a consumer goods deal saw major moves.

How major US stock indexes fared Monday, 11/3/2025

Description: Nvidia and other AI superstar stocks propped up Wall Street. The S&P 500 rose 0.2% Monday, even though the majority of stocks within the index fell. The Dow Jones Industrial Average dropped 0.5%, and the Nasdaq composite rose 0.5%.

US Equity Markets Close Mixed as Amazon Rises on OpenAI Deal Amid Market Decline

Description: US equity indexes closed mixed on Monday, bolstered by a surge in Amazon.com's (AMZN) shares followi

Stock market today: Dow slips, Nasdaq pops as AI optimism sends Amazon, Nvidia higher

Description: US stocks made gains, with Wall Street looking to maintain upward momentum.

Sector Update: Consumer Stocks Mixed Late Afternoon

Description: Consumer stocks were mixed late Monday afternoon, with the Consumer Staples Select Sector SPDR Fund

Kimberly-Clark to Buy Tylenol Maker Kenvue. Why the Stock Market Hates the Deal.

Description: Kimberly-Clark is buying Tylenol maker Kenvue for nearly $50 billion. The cash-and-stock transaction, announced Monday, values Kenvue at an enterprise value of about $48.7 billion, including debt. Under the terms of the deal, Kenvue shareholders will receive $21.01 a share, based on Kenvue’s closing price of $14.37 on Friday.

Dear Kenvue Stock Fans, Mark Your Calendars for November 6 Upcoming earnings

Description: Kenvue stock has struggled this year, but an acquisition offer is giving investors hope leading up to this week's earnings report.

Is the End of the Line Near for Kenvue?

Description: The purchase of Kenvue by Kimberly-Clark announced Monday would mark the close of a short, rocky term of independence for the Tylenol maker, which was spun off from Johnson & Johnson in 2023. Kenvue shares have been under pressure since President Trump’s warning that acetaminophen—the active ingredient in Tylenol—is a potential cause of autism. Kenvue has called the claims baseless.

2025-11-02

2025-11-01

Kimberly-Clark (KMB): Net Margin Drops to 10%, Challenging Bullish Profitability Narratives

Description: Kimberly-Clark (KMB) reported an average annual earnings growth of 1.5% over the past five years, with the net profit margin sliding to 10% from 13.1% in the prior year. The company’s stock trades below its estimated fair value at $119.71 compared to $135.68. Its Price-To-Earnings ratio of 20.2x is below peer averages but above the broader industry. Looking ahead, analysts expect earnings to climb at a moderate 9.3% per year, even as revenue is projected to decline by 3.3% annually. This...

2025-10-31

KMB Q3 Deep Dive: Premiumization, Innovation, and Cost Management in Focus

Description: Household products company Kimberly-Clark (NYSE:KMB) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $4.15 billion. Its non-GAAP profit of $1.82 per share was 3.9% above analysts’ consensus estimates.

1 Consumer Stock to Keep an Eye On and 2 Facing Challenges

Description: Consumer staples are considered safe havens in turbulent markets due to their inelastic demand profiles. The flip side is that they frequently fall behind growth industries when times are good, and this perception became a reality over the past six months as the sector was down 7.2% while the S&P 500 was up 22.6%.

2025-10-30

Kimberly-Clark Corp (KMB) Q3 2025 Earnings Call Highlights: Strong Market Performance Amidst ...

Description: Kimberly-Clark Corp (KMB) reports robust growth driven by innovation, despite challenges in the US diaper market.

Roblox, Fox, Kimberly-Clark: Trending Tickers

Description: Market Domination host Josh Lipton tracks several of the day's top trending stock tickers, including Roblox's (RBLX) third quarter loss, FOX (FOX, FOXA) stock popping on its fiscal first quarter earnings beat, and Kimberly-Clark (KMB) topping its own earnings estimates. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

KMB Q3 Earnings Beat Estimates, Sales In Line With the Year-Ago Level

Description: KMB's Q3 results highlight steady sales, solid volume gains and cost discipline amid ongoing margin pressures.

Kimberly-Clark (KMB) Reports Q3 Earnings: What Key Metrics Have to Say

Description: The headline numbers for Kimberly-Clark (KMB) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Exchange-Traded Funds Down, Equity Futures Mixed Pre-Bell Thursday Amid December Rate Cut Doubts

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.03% and the actively t

Kimberly-Clark (NASDAQ:KMB) Reports Q3 In Line With Expectations

Description: Household products company Kimberly-Clark (NYSE:KMB) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $4.15 billion. Its non-GAAP profit of $1.82 per share was 3.9% above analysts’ consensus estimates.

Kimberly-Clark Profit Falls, Organic Sales Rise

Description: Kimberly-Clark’s third-quarter profit fell 51% as a result of divestitures, business exits and recent tariffs, although sales ticked up slightly.

Kimberly-Clark Announces Third Quarter 2025 Results, Updates 2025 Outlook

Description: Kimberly-Clark Corporation (Nasdaq: KMB) today reported third quarter 2025 results driven by resilient consumer demand for the company's brands, the introduction of pioneering innovative new products, and leveraging sustained, industry-leading productivity.

2025-10-29

10 Cheap Dividend Stocks With Fortress-Like Businesses

Description: Morningstar says to look for dividend-paying companies with strong track records and easy-to-defend business models.

Are Kimberly-Clark Shares Trading Below Their True Value After Investment in Sustainable Packaging?

Description: If you find yourself weighing whether to hold, buy, or simply keep an eye on Kimberly-Clark, you are not alone. Investors everywhere are looking closely at this global consumer products giant as its stock price navigates an interesting phase. At a recent close of $120.66, Kimberly-Clark has seen modest movement over the past week, up just 0.5%. However, looking further back, its year-to-date is still in the red, down 7.6%, and the 1-year return sits at -6.9%. Yet, step back even further and...

2025-10-28

Earnings To Watch: Kimberly-Clark (KMB) Reports Q3 Results Tomorrow

Description: Household products company Kimberly-Clark (NYSE:KMB) will be announcing earnings results this Thursday before the bell. Here’s what you need to know.

Analyst Says Kimberly-Clark (KMB) The Best Dividend Stock to ‘Hide Out’ in Q4

Description: We recently published Top 10 Trending Stocks and ETFs as Analyst Predicts $9 Trillion Productivity Gains Due to AI. Kimberly-Clark Corp (NASDAQ:KMB) is one of the top trending stocks. Jenny Harrington, CEO and Portfolio Manager at Gilman Hill Asset Management, said in a recent program on CNBC that KMB is currently one of her favorite stocks. […]

2025-10-27

KMB to Report Q3 Earnings: Should You Expect a Beat This Time?

Description: KMB faces currency and cost pressures ahead of Q3 results, but its Powering Care strategy may offer some relief.

2025-10-26

3 Dividend Stocks to Double Up on Right Now

Description: With interest rates headed lower, this is a great time to add some dividend payers to your portfolio.

2025-10-25

Is Kimberly-Clark's (KMB) Defensive Reputation Enough to Withstand Market Uncertainty?

Description: Kimberly-Clark's stock recently fell to its lowest point since February 2024, reflecting broader market volatility and concerns about the company's financial outlook. Despite this, some analysts and investors continue to view Kimberly-Clark as a potential defensive choice, citing its dividend yield and perceived stability during uncertain times. We'll examine how this renewed focus on the company's defensive reputation could influence Kimberly-Clark's investment narrative amid shifting...

2025-10-24

2025-10-23

2025-10-22

Why CareTrust REIT, Hess Midstream, And Kimberly-Clark Are Winners For Passive Income

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. CareTrust REIT, Hess Midstream, and Kimberly-Clark have rewarded shareholders for years and recently announced dividend ...

2025-10-21

Thinx Supports Teens by Giving Away Free Period Products to Girls' Teams

Description: Thinx, Inc., a leading reusable period underwear brand, is launching the "Thinx Leakproof MVP Giveaway" to help teens feel supported during extracurricular activities and reduce the fear of leaking.

Analyst Recommends This Top Dividend Stock to Avoid AI Market ‘Froth’

Description: We recently published 10 Trending Stocks This Week. Kimberly-Clark Corp (NASDAQ:KMB) is one of the trending stocks this week. Jenny Harrington, CEO at Gilman Hill Asset Management, said in a recent program on CNBC that she likes Kimberly-Clark amid the company’s dividend yield and strong business. She believes the stock could be a good buy […]

3 Profitable Stocks We Keep Off Our Radar

Description: While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

2025-10-20

3 High-Yield Dividend King Stocks Down Between 9% and 14% to Buy in October

Description: These ultra-reliable consumer staples stocks are a great way to boost your passive income.

2025-10-19

Jim Cramer Says “Kimberly-Clark Could Be Bottoming”

Description: Kimberly-Clark Corporation (NASDAQ:KMB) is one of the stocks Jim Cramer recently offered insights on. Cramer made a prediction about the company during the episode, as he said: “Here are some predictions: I think Kimberly-Clark could be bottoming. Procter & Gamble already started the process.” Kimberly-Clark Corporation (NASDAQ:KMB) manufactures and sells personal care and tissue products. […]

2025-10-18

Kimberly-Clark (KMB): Evaluating Valuation After New Global Social Impact Partnerships Announcement

Description: Kimberly-Clark (KMB) just unveiled an ambitious new chapter in its social impact strategy, announcing four enhanced partnerships to expand essential care for women and girls in several global regions. These long-term efforts highlight the company’s broader commitment to social responsibility. See our latest analysis for Kimberly-Clark. Kimberly-Clark’s latest partnerships build on a steady stream of activity, from new product showcases at industry summits to strategic discussions on the AI...