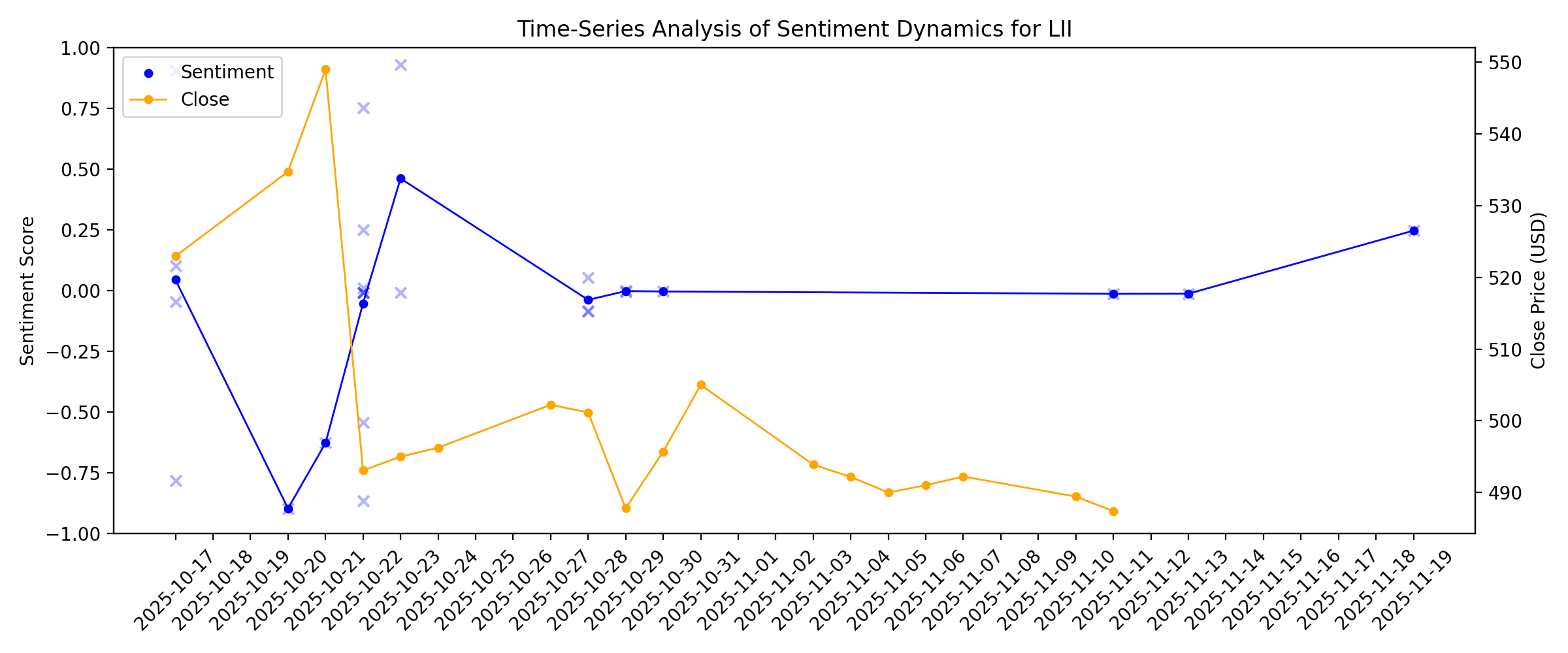

News sentiment analysis for LII

Sentiment chart

2026-01-14

Lennox Invests in Distribution and Digital Capabilities to Strengthen Commercial HVAC Business

Description: Lennox (NYSE: LII) is investing in its commercial HVAC business to enhance product availability, expand distribution capacity, and elevate the overall customer experience. These investments support Lennox's commitment to serve the growing needs of today's commercial contractors, engineers and building owners.

2026-01-13

2026-01-12

Lennox Schedules Fourth Quarter Results and 2026 Guidance Conference Call

Description: Lennox (NYSE: LII), a leader in energy-efficient climate control solutions, will report fourth quarter and full year 2025 financial results before the market opens on Wednesday, January 28, 2026. The company will also provide guidance for FY 2026. An earnings conference call and webcast are scheduled for the same day at 8:30 a.m. Central Time. CEO Alok Maskara and CFO Michael Quenzer will provide a summary of the company's financial results and outlook, followed by a question-and-answer session.

2026-01-11

2026-01-10

2026-01-09

Earnings Preview: What to Expect From Lennox International’s Report

Description: Lennox International is expected to report its fiscal fourth-quarter results shortly, with analysts projecting a low double-digit decline in earnings.

2026-01-08

Lennox International Inc. (NYSE:LII) Shares Could Be 25% Above Their Intrinsic Value Estimate

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, Lennox International fair value estimate is US$403 Current...

Lennox Launches Gas Furnace Featuring Integrated Refrigerant Detection System

Description: Lennox Residential HVAC, a leader in energy-efficient home comfort solutions, announced today the release of the Dave Lennox Signature® SLP99VK Gas Furnace, designed to deliver high-efficiency heating with built-in refrigerant detection capability.

2026-01-07

2026-01-06

Lennox resumed with a Neutral at UBS

Description: UBS analyst Amit Ahrotra resumed coverage of Lennox (LII) with a Neutral rating with a price target of $530, down from $560. Conversations with 20 Multi-Industry companies suggest Q4 reporting is unlikely to be a major catalyst, as full-year expectations are well calibrated and December commentary limits surprise potential, the analyst tells investors in a research note. Initial 2026 guidance may be conservative, with upside opportunities later, says UBS. Claim 70% Off TipRanks PremiumUnlock hed

2026-01-05

PayPal downgraded, Costco upgraded: Wall Street's top analyst calls

Description: PayPal downgraded, Costco upgraded: Wall Street's top analyst calls

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

Lennox International (LII): Assessing Valuation After a Recent Share Price Rebound

Description: Lennox International (LII) has quietly staged a solid rebound this month, with the stock climbing about 7% even as its year to date and past year returns remain firmly in the red. See our latest analysis for Lennox International. That recent 6.9 percent 1 month share price return to about 497 dollars comes after a weaker stretch, and while the 3 year total shareholder return of roughly 115 percent still looks impressive, near term momentum is only cautiously rebuilding. As you weigh Lennox...

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

HVAC Revenues Are Contracting. We Compared Three Manufacturers to Find the Winner.

Description: The HVAC industry is facing a painful reality check. After years of robust growth driven by pandemic-era construction booms and infrastructure spending, commercial heating and cooling manufacturers are watching revenues contract and margins compress. The question for investors: which companies are positioned to weather it and emerge stronger when demand returns. We compared three HVAC ... HVAC Revenues Are Contracting. We Compared Three Manufacturers to Find the Winner.

2025-12-18

2025-12-17

Lennox Named to the Drucker Institute's Management Top 250

Description: Lennox (NYSE: LII), a leading provider of innovative climate control solutions, has been named to the Drucker Institute Management Top 250 for the third consecutive year. The annual ranking, published in The Wall Street Journal, evaluates companies across customer satisfaction, employee engagement and development, innovation, social responsibility, and financial strength. Lennox placed among the top 50 for financial strength and the top 100 for customer satisfaction.

Is Lennox International Stock Underperforming the S&P 500?

Description: Lennox International has considerably underperformed the S&P 500 over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-12-16

2025-12-15

2025-12-14

Does Lennox (LII) Dividend Policy Mask Deeper Questions on 2026 Demand and ROIC?

Description: Lennox International recently approved a quarterly cash dividend of US$1.30 per share, payable on January 15, 2026, to shareholders of record as of December 31, 2025. At the same time, concerns raised about residential HVAC cyclicality and the impact of the NSI Industries acquisition have sharpened focus on Lennox’s capital allocation and returns profile. We’ll now explore how questions about 2026 demand and return on invested capital could reshape Lennox’s existing investment...

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Lennox Declares Quarterly Dividend and Announces Annual Meeting

Description: The Lennox board of directors (NYSE: LII) approved a quarterly cash dividend of $1.30 per share of common stock, payable January 15, 2026, to stockholders of record as of December 31, 2025.

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

Lennox Donates Over 400 Heating and Cooling Units to Homeowners and Nonprofits in Need Across North America

Description: Lennox Residential HVAC donated 402 heating and cooling (HVAC) units to homeowners and nonprofits in need through its Feel The Love program sponsored by the LII Lennox Foundation. During Installation Week, October 3–12, Lennox dealers across 46 U.S. states and several Canadian provinces volunteered their time and expertise to install HVAC units at no cost.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Lennox International Inc. (NYSE:LII) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Description: Lennox International (NYSE:LII) has had a rough three months with its share price down 20%. But if you pay close...

2025-11-12

2025-11-11

Do Wall Street Analysts Like Lennox International Stock?

Description: Lennox International has been trailing behind the broader market over the past year, and analysts are cautious about its prospects.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

A Look at Lennox International's Valuation After Lowered 2025 Outlook and Third-Quarter Revenue Decline

Description: Lennox International (NYSE:LII) is drawing investor attention after management reported third-quarter revenue fell year-over-year and revised its full-year 2025 outlook lower in response to continued weakness across key HVAC markets. See our latest analysis for Lennox International. Lennox International’s share price has seen a rough patch recently, down over 19% year-to-date and nearly 20% lower over the last three months. Markets have reacted quickly to softer revenues, downbeat 2025...

2025-10-29

Lennox International (LII) Lowers Guidance Amid Demand Shifts—What Does This Mean for Its Growth Strategy?

Description: Lennox International recently reported third quarter results showing a year-over-year decline in sales to US$1,426.8 million, while net income increased to US$245.8 million, and management lowered full-year 2025 revenue guidance by approximately 1% due to continued weakness in residential and commercial demand. An interesting insight is that persistent inventory destocking among distributors, as well as a greater focus on repairs over replacements, contributed to the revenue softness,...

5 Insightful Analyst Questions From Lennox’s Q3 Earnings Call

Description: Lennox’s third quarter results were met with a significant negative market reaction, as revenue declined more than expected due to persistent softness in both residential and commercial markets. Management attributed these challenges primarily to ongoing inventory destocking among distributors and dealers, compounded by subdued end-market demand and cautious contractor behavior following regulatory changes. CEO Alok Maskara acknowledged that the scale of channel inventory destocking was larger t

2025-10-28

Barclays Trims Target on Lennox, But Still Sees Structural Strength

Description: Lennox International Inc. (NYSE:LII) is one of the most profitable manufacturing stocks to buy now. On October 23, 2025, Barclays reiterated its “Overweight” rating on Lennox International but trimmed its 12‑month price target from $730 to $700, signaling a slight cooling in optimism. The note pointed out the company’s mixed Q3/2025 results: adjusted EPS came in at […]

Lennox price target lowered to $560 from $610 at UBS

Description: UBS analyst Damian Karas lowered the firm’s price target on Lennox (LII) to $560 from $610 and keeps a Neutral rating on the shares. The firm is lowering its estimates by 2%-3% as residential industry headwinds persist, the analyst tells investors in a research note. Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> See Insiders’ Hot Stocks on TipRanks >> Read More on LII: Lennox files automatic mixed securities shelf Lennox price tar

1 Mid-Cap Stock with Competitive Advantages and 2 We Question

Description: Mid-cap stocks often strike the right balance between having proven business models and market opportunities that can support $100 billion corporations. However, they face intense competition from scaled industry giants and can be disrupted by new innovative players vying for a slice of the pie.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

LII Q3 Deep Dive: Inventory Destocking and Weak Residential Demand Pressure Results

Description: Climate control solutions innovator Lennox International (NYSE:LII) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 4.8% year on year to $1.43 billion. Its non-GAAP profit of $6.98 per share was 2% above analysts’ consensus estimates.

Lennox International (LII) Margin Expansion Reinforces Bullish Narratives Despite Slower Growth Forecasts

Description: Lennox International (LII) delivered a notable earnings performance, with current net profit margins reaching 15.4%, up from 12.9% last year. Over the past year, EPS rose by 29.4%, topping its own five-year average earnings growth rate of 16.2% per year. Forward-looking guidance points to 8.15% annual earnings growth on a 6.7% revenue growth outlook. Against this track record, investors are seeing a company with steadily expanding profitability, even as projected growth rates are expected to...

2025-10-22

Lennox International Inc (LII) Q3 2025 Earnings Call Highlights: Record Segment Margins Amid ...

Description: Despite a 5% revenue drop, Lennox International Inc (LII) achieved record segment margins and a 4% increase in adjusted EPS, signaling resilience in challenging markets.

Lennox (LII) Q3 2025 Earnings Call Transcript

Description: Alok Maskara: Thank you, Chelsey. Revenue this quarter declined 5% as growth initiatives and share gains were unable to fully offset the impact of soft residential and commercial end markets. HCA's revenues declined 12% as the residential industry faced a weak summer selling season and as both contractors and distributors rebalance inventory post-regulatory transition.

Lennox (LII) Stock Trades Down, Here Is Why

Description: Shares of climate control solutions innovator Lennox International (NYSE:LII) fell 4.1% in the morning session after it reported weak third-quarter results and lowered its full-year financial forecast, sending its shares lower.

Here's What Key Metrics Tell Us About Lennox (LII) Q3 Earnings

Description: The headline numbers for Lennox (LII) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Lennox International (LII) Beats Q3 Earnings Estimates

Description: Lennox (LII) delivered earnings and revenue surprises of +4.33% and -2.66%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Lennox (NYSE:LII) Misses Q3 Sales Expectations

Description: Climate control solutions innovator Lennox International (NYSE:LII) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 4.8% year on year to $1.43 billion. Its non-GAAP profit of $6.98 per share was 2% above analysts’ consensus estimates.

Lennox: Q3 Earnings Snapshot

Description: The results surpassed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $6.69 per share. The manufacturer of furnaces, air conditioners and other products posted revenue of $1.43 billion in the period, falling short of Street forecasts.

Lennox Reports Third Quarter Results

Description: Lennox (NYSE: LII), a leader in energy-efficient climate-control solutions, today reported third quarter financial results with $1.4 billion of revenue, $310 million of operating income, and $6.98 GAAP diluted earnings per share.

2025-10-21

Mission Critical Group Appoints Julie Peffer as Chief Financial Officer

Description: Seasoned finance executive brings deep experience across technology, manufacturing, and defense sectors to support MCG’s next phase of growthMCKINNEY, Texas, Oct. 21, 2025 (GLOBE NEWSWIRE) -- Mission Critical Group (“MCG”), a critical power infrastructure company specializing in the design, manufacturing, delivery, and service of advanced electrical systems, today announces the appointment of Julie Peffer as Chief Financial Officer. Peffer brings more than three decades of experience leading fin

2025-10-20

Lennox (LII) Q3 Earnings: What To Expect

Description: Climate control solutions innovator Lennox International (NYSE:LII) will be announcing earnings results this Wednesday before market hours. Here’s what investors should know.

2025-10-19

2025-10-18

2025-10-17

Curious about Lennox (LII) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Description: Get a deeper insight into the potential performance of Lennox (LII) for the quarter ended September 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Lennox price target lowered to $598 from $705 at RBC Capital

Description: RBC Capital lowered the firm’s price target on Lennox (LII) to $598 from $705 and keeps a Sector Perform rating on the shares as part of a broader research note previewing Q3 earnings in Industrials space. Multiple multi-year sector drivers – like electrification, reshoring, and datacenter/AI – and a Fed ease cycle should fuel continued mid-cycle growth and strong earnings visibility, while tariffs remain a fluid but manageable headwind for now, the analyst tells investors in a research note. Da

With acquisition, Lennox becomes big seller of HVAC parts

Description: The industry giant is expanding its component sales at a time when manufacturers are passing along price increases of close to 10% in large part because of tariffs.

1 Profitable Stock to Research Further and 2 We Find Risky

Description: Even if a company is profitable, it doesn’t always mean it’s a great investment. Some struggle to maintain growth, face looming threats, or fail to reinvest wisely, limiting their future potential.