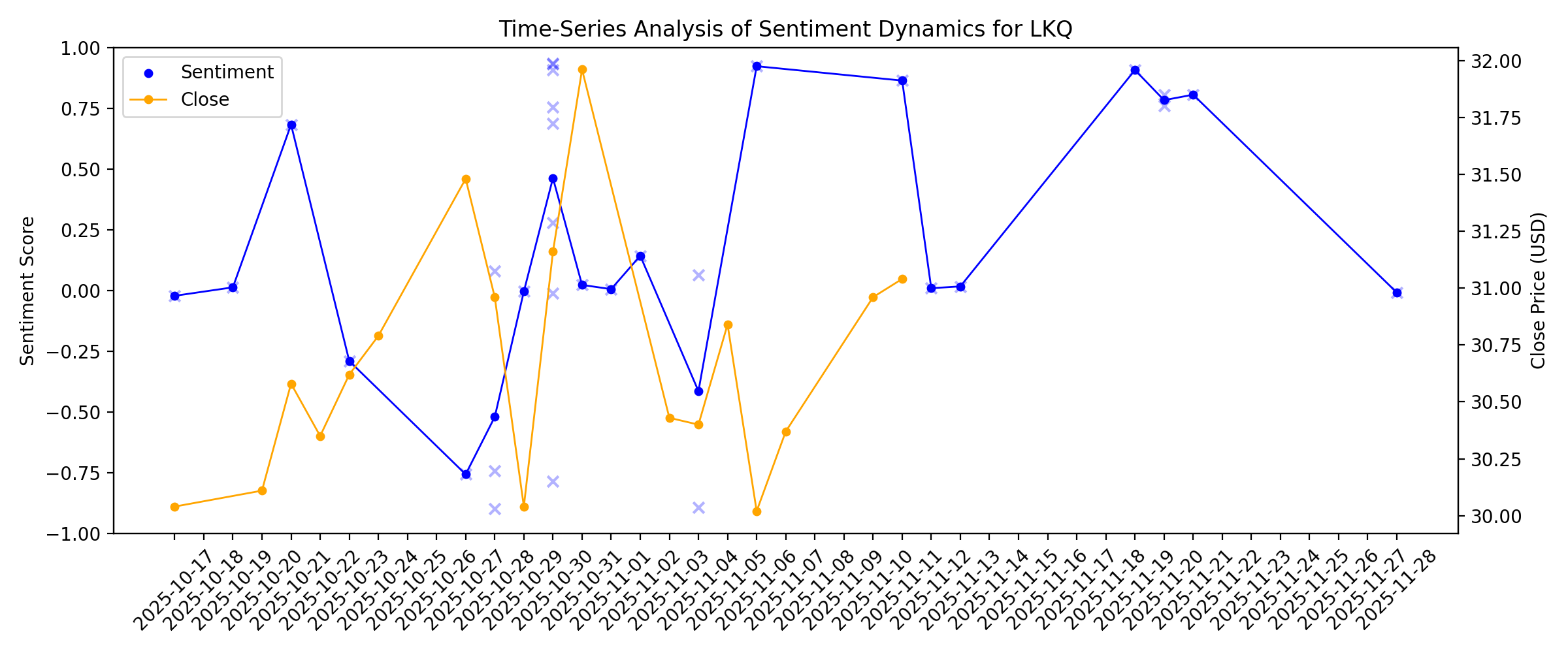

News sentiment analysis for LKQ

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

This Adviser Walked Away From an $11 Million Auto Parts Stock Down 8% This Past Year

Description: LKQ Corporation distributes new and recycled automotive parts across North America and Europe, serving repair shops and dealerships.

2026-01-08

2026-01-07

LKQ (NASDAQ:LKQ) investors are sitting on a loss of 39% if they invested three years ago

Description: As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain...

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

Wall Street Maintains a Positive Opinion on LKQ Corporation (LKQ), Here’s Why

Description: LKQ Corporation (NASDAQ:LKQ) is one of the Best Affordable Stocks to Buy According to Analysts. Wall Street maintains a positive opinion on LKQ Corporation (NASDAQ:LKQ) after the company announced the initiation of a potential sale process for its Specialty segment on December 4. After the release, on December 5, John Babcock from Barclays reiterated a […]

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

Is LKQ Stock a Hidden Bargain After Recent Acquisition Integration Efforts?

Description: If you are wondering whether LKQ is quietly turning into a value play while the market looks the other way, this article is for you. Despite a choppy ride, with the share price up 6.2% over the last week but down 17.4% year to date and 15.5% over the past year, LKQ is drawing fresh attention from value focused investors. Recent headlines have centered on LKQ's ongoing integration of past acquisitions and strategic moves to streamline its global parts distribution network. Investors are...

2025-12-16

Is LKQ Stock Underperforming the Dow?

Description: LKQ has significantly underperformed compared to the Dow over the past year, yet analysts remain optimistic about the stock’s prospects.

2025-12-15

2025-12-14

S&P Inclusion Adds to the Excitement Around Comfort Systems (FIX) stock

Description: Comfort Systems (NYSE:FIX) is one of the 10 Data Center Cooling Companies to Invest In . On December 5, Comfort Systems was selected to become a part of the S&P 500 index. The news came after the quarterly rebalancing of the index, meaning FIX will now be included in the S&P 500 index before the […]

2025-12-13

2025-12-12

Stephens & Co. Initiates Coverage of LKQ Corporation (NASDAQ:LKQ) with Overweight Rating

Description: LKQ Corporation (NASDAQ:LKQ) is among the 11 Most Oversold S&P 500 Stocks Heading into 2026. On December 10, Stephens & Co. analyst Jeff Lick initiated coverage of the stock with an Overweight rating and assigned a share price target of $39. In a research note to investors, the analyst characterized the auto parts provider as […]

2025-12-11

Is LKQ (LKQ) Using Asset Sales to Unlock a Leaner, Higher-Margin Core Business?

Description: Earlier this month, LKQ Corp announced it had formally begun a sale process for its Keystone Automotive specialty parts division, aiming to simplify its portfolio and focus on core North American operations, with reports suggesting a potential deal value of US$500 million to US$1.00 billion. This move follows pressure from investors, including Ananym Capital Management LP, and comes on the heels of LKQ’s August sale of its Pick Your Part business for US$410 million, underscoring a broader...

Kettle Hill Builds $35 Million Position in LKQ as Stock Slides 19%

Description: Kettle Hill Capital Management bought $35 million of LKQ stock during the third quarter.

Kettle Hill Drops Its Entire Stake in Abercrombie & Fitch Stock, According to Recent Filing

Description: Kettle Hill Capital Management sold $23 million worth of Abercrombie & Fitch stock during the third quarter.

Why LKQ (LKQ) Stock Is Trading Up Today

Description: Shares of automotive parts company LKQ (NASDAQ:LKQ) jumped 2.6% in the afternoon session after Stephens & Co. initiated coverage on the automotive parts company with an Overweight rating and a $39 price target. An "Overweight" rating generally meant the analyst believed the stock would perform better than the overall market. The positive outlook appeared to spark investor interest. This new rating came after the company's shares had faced pressure, hitting a 52-week low after its removal from th

How the Story Behind LKQ Is Evolving Amid Digital Growth Hopes and Execution Risks

Description: LKQ’s latest narrative update comes with a modestly lower fair value estimate, moving from about $42.92 to $41.19 per share as analysts recalibrate expectations around its long term outlook. A slightly higher discount rate and a notably softer revenue growth assumption reflect a more cautious stance on the auto retail backdrop, even as the company’s role in digital auctions and resilient parts distribution supports a still constructive view on its prospects. Stay tuned to see how you can...

2025-12-10

Guardian Wealth Doubles Down on LKQ Stock With $1.8 Million Purchase, According to Recent SEC Filing

Description: Guardian Wealth Management raised its stake in LKQ stock to nearly $4.9 Million during the third quarter of 2025.

LKQ (LKQ) Stock Trades Up, Here Is Why

Description: Shares of automotive parts company LKQ (NASDAQ:LKQ) jumped 4.8% in the afternoon session after Stephens & Co. initiated coverage on the stock with an Overweight rating and a price target of $39.00. This was the first time the investment firm covered LKQ. An "Overweight" rating generally means the analyst believes the stock will perform better than the overall market. The positive outlook appeared to spark investor interest. This was reflected in the options market, where traders acquired a signi

2025-12-09

Thompson, Siegel, & Walmsley Adds Another $31 Million to its 2nd-Largest Holding, LKQ

Description: Thompson, Siegel, & Walmsley (TSW) has held LKQ since 2018 and has continually added to its position over time.

2025-12-08

LKQ (LKQ) Valuation Check After This Year’s Share Price Slide

Description: LKQ (LKQ) has quietly fallen out of favor this year, with the stock down about 20% year to date and more than 10% over the past 3 months, despite modest revenue and earnings growth. See our latest analysis for LKQ. The slide in LKQ's share price to about $28.87, alongside a weak 1 year total shareholder return of roughly minus 23 percent and even deeper 3 year losses, suggests sentiment has cooled and investors are reassessing how much they will pay for its steady but unspectacular growth. If...

These 3 Stocks Are Set to Join the S&P 500 Soon and Rising

Description: Carvana, CRH, and Comfort Systems USA shares climbed Monday after S&P Dow Jones Indices said the stocks are set to join the S&P 500.

2025-12-07

2025-12-06

2025-12-05

Carvana, CRH, Comfort Systems to join S&P 500 in rebalancing

Description: The companies will join the benchmark in a quarterly rebalance at the end of December, S&P Dow Jones Indices said Friday.

CRH, Carvana and Comfort Systems USA Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600

Description: S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 22, to coincide with the quarterly rebalance. The changes ensure that each index is more representative of its market capitalization range. The companies being removed from the S&P SmallCap 600 are no longer representative of the small-cap market space.

2025-12-04

LKQ Corporation (LKQ): A Bull Case Theory

Description: We came across a bullish thesis on LKQ Corporation on Value & Error’s Substack. In this article, we will summarize the bulls’ thesis on LKQ. LKQ Corporation’s share was trading at $29.18 as of December 2nd. LKQ’s trailing and forward P/E were 10.92 and 8.84 respectively according to Yahoo Finance. LKQ Corporation (LKQ) is the leading distributor of […]

LKQ Corporation Initiates Sale Process for Specialty Segment

Description: Continues Multi-Year Portfolio Simplification StrategyANTIOCH, Tenn., Dec. 04, 2025 (GLOBE NEWSWIRE) -- LKQ Corporation (Nasdaq: LKQ) today announced that it has commenced a process to explore the potential sale of its Specialty segment. “Our Specialty segment is a leading distributor of automotive, RV and marine parts and accessories in North America. It is a strong business supported by an exceptional team. To unlock its full potential, we initiated a strategic review earlier this year to eval

2025-12-03

2025-12-02

2025-12-01

3 Value Stocks That Fall Short

Description: The low valuation multiples for value stocks provide a margin of safety that growth stocks rarely offer. However, the challenge lies in determining whether these cheap assets are genuinely undervalued or simply on sale due to their potentially deteriorating business models.

2025-11-30

2025-11-29

2025-11-28

Is LKQ a Bargain After an 18.4% Year-to-Date Stock Drop in 2025?

Description: Curious if LKQ might be offering serious long-term value right now? Let’s dig deeper than the headlines to see if this auto parts giant is truly bargain-priced or just treading water. Even after a modest 0.1% move last week, LKQ’s stock price is down 1.5% for the month and off 18.4% year-to-date, signaling the market is weighing shifts in growth or risk factors. Recent headlines have highlighted LKQ’s strategic international expansions alongside industry chatter about evolving supply chain...

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Kontoor Brands, Under Armour, and LKQ Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut.

2025-11-20

Here's Why You Should Retain LKQ Stock in Your Portfolio Now

Description: LKQ leans on acquisitions and major cost cuts for growth, even as repairable-claim softness and European weakness pressure its outlook.

Zacks Industry Outlook Highlights LKQ, Dorman Products and Standard Motor Products

Description: Aging vehicles and rising maintenance needs put LKQ, Dorman and Standard Motor Products in focus despite industry headwinds.

2025-11-19

3 Auto Replacement Parts Stocks to Benefit From Aging Fleet

Description: LKQ, DORM and SMP are set to benefit as rising vehicle age boosts demand despite tariff and complexity pressures.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Sector Update: Consumer Stocks Mixed in Late Afternoon Trading

Description: Consumer stocks were mixed late Thursday afternoon, with the Consumer Staples Select Sector SPDR Fun

2025-11-12

LKQ (LKQ): Assessing Valuation After Updated 2025 Guidance and Capital Return Initiatives

Description: LKQ (LKQ) just revised its full-year 2025 guidance, slightly narrowing the range for both organic revenue and earnings per share. The updated outlook arrived together with third-quarter results and ongoing shareholder initiatives. See our latest analysis for LKQ. Amid refreshed 2025 guidance, robust buyback activity, and a steady dividend, LKQ has seen its share price rebound 8% over the past month. However, it is still down 14% year-to-date. That mirrors a longer-term headwind, with a 1-year...

2025-11-11

Are Wall Street Analysts Bullish on LKQ Corporation Stock?

Description: LKQ Corporation has significantly underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

LKQ’s Q3 Earnings Call: Our Top 5 Analyst Questions

Description: LKQ’s third quarter results were met with a positive market response, as the company delivered non-GAAP earnings per share above Wall Street expectations despite slightly missing on revenue. Management attributed the quarter’s performance to ongoing cost reduction efforts, progress on portfolio simplification, and gains from operational discipline across its North American and European businesses. CEO Justin Jude acknowledged challenging macroeconomic conditions, particularly reduced consumer sp

2025-11-05

2025-11-04

LKQ Corp. price target lowered to $43 from $46 at Roth Capital

Description: Roth Capital lowered the firm’s price target on LKQ Corp. (LKQ) to $43 from $46 but keeps a Buy rating on the shares after its Q3 earnings beat. Following outsized Q3 performance aided by a one-time tax benefit and the modest increasing of FY25 guidance, the firm maintains its net constructive stance on shares, the analyst tells investors in a research note. North America collision market continues to face headwinds and Europe is exhibiting softness, but Roth still sees no change to the longer t

LKQ's (NASDAQ:LKQ) Dividend Will Be $0.30

Description: LKQ Corporation ( NASDAQ:LKQ ) has announced that it will pay a dividend of $0.30 per share on the 4th of December...

2025-11-03

2025-11-02

LKQ Corporation Just Beat EPS By 7.7%: Here's What Analysts Think Will Happen Next

Description: It's been a good week for LKQ Corporation ( NASDAQ:LKQ ) shareholders, because the company has just released its latest...

2025-11-01

LKQ (LKQ) Margin Decline Reinforces Bearish Narrative Despite Low Valuation

Description: LKQ (LKQ) reported forecasted annual earnings growth of 7.7% and revenue growth of 1.5%, both of which lag behind the broader US market. Net profit margin ticked down slightly to 4.9% from last year's 5%. Over the past five years, earnings have declined by 3.9% per year and recent results have been negative, making direct long-term comparisons tricky for investors. Despite these mixed trends, the company is considered to have high-quality past earnings and is regarded as a good value based on...

2025-10-31

LKQ Q3 Deep Dive: Portfolio Simplification and Cost Controls Stand Out Amidst Macroeconomic Headwinds

Description: Automotive parts company LKQ (NASDAQ:LKQ) missed Wall Street’s revenue expectations in Q3 CY2025 as sales only rose 1.3% year on year to $3.50 billion. Its non-GAAP profit of $0.84 per share was 11% above analysts’ consensus estimates.

2025-10-30

LKQ Corp (LKQ) Q3 2025 Earnings Call Highlights: Navigating Challenges with Strategic Growth

Description: Despite macroeconomic headwinds, LKQ Corp (LKQ) reports strong free cash flow and Specialty segment growth, while adjusting its full-year guidance.

LKQ (LKQ) Stock Trades Up, Here Is Why

Description: Shares of automotive parts company LKQ (NASDAQ:LKQ) jumped 6.2% in the morning session after it reported third-quarter profits that significantly beat Wall Street's expectations, overshadowing a slight revenue miss and a cut to its full-year guidance.

LKQ's Q3 Earnings Outpace Estimates, Revenues Fall Short

Description: LKQ's Q3 earnings beat estimates, with European and Specialty segments exceeding both sales and EBITDA estimates.

LKQ (LKQ) Reports Q3 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for LKQ (LKQ) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

The Bull Case For LKQ (LKQ) Could Change Following Activist Push to Divest European and Specialty Units

Description: On October 23, 2025, Ananym Capital Management LP urged LKQ Corporation to divest its European operations and auto specialties division, collaborating with investment banks to review portfolio strategy and explore actions aimed at enhancing shareholder value. This activist initiative comes as LKQ faces increasing investor scrutiny and industry headwinds, prompting discussions about business focus and operational efficiency amid changing market conditions. We'll examine how investor pressure...

LKQ (NASDAQ:LKQ) Misses Q3 Revenue Estimates

Description: Automotive parts company LKQ (NASDAQ:LKQ) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 2.4% year on year to $3.50 billion. Its non-GAAP profit of $0.84 per share was 11% above analysts’ consensus estimates.

LKQ: Q3 Earnings Snapshot

Description: LKQ) on Thursday reported third-quarter net income of $180 million. On a per-share basis, the Antioch, Tennessee-based company said it had net income of 70 cents. Earnings, adjusted for one-time gains and costs, came to 84 cents per share.

LKQ Corporation Announces Results for Third Quarter 2025

Description: Simplified Portfolio with Successful Closing on Sale of Self Service Segment Returned $118 Million of Capital to Shareholders; $40 Million of Share Repurchases and $78 Million in Cash Dividends Raised Midpoint and Narrowed Range for Full Year 2025 EPS Outlook Following Sale of Self Service ANTIOCH, Tenn., Oct. 30, 2025 (GLOBE NEWSWIRE) -- LKQ Corporation (Nasdaq: LKQ) today reported third quarter 2025 financial results and updates outlook for 2025 following the sale of the Company's Self Service

2025-10-29

Does the Recent LKQ Restructuring Signal Opportunity Amid a 14.6% Year-to-Date Drop?

Description: If you have been watching LKQ’s stock performance recently and wondering whether it’s the moment to buy, hold, or walk away, you are not alone. The stock closed at $30.96, and while the surface-level reactions might look mixed, there’s an interesting story behind the recent movements. Over the last week, LKQ is up 1.2%, and it has managed a modest 2.2% gain in the past 30 days. Step back, though, and the picture looks more challenging: the stock is down roughly 14.6% year-to-date, 14.5% over...

2025-10-28

LKQ (LKQ) Q3 Earnings Report Preview: What To Look For

Description: Automotive parts company LKQ (NASDAQ:LKQ) will be reporting results this Thursday before the bell. Here’s what to look for.

Here’s Why the RS Large Cap Value Strategy Decided to Exit Its Position in LKQ Corporation (LKQ)

Description: RS Investments, an investment management company, released its “RS Large Cap Value Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy underperformed the benchmark, Russell 1000 Value Index, in the quarter, returning 4.47% net vs 5.33% for the Index. Adverse stock selection in the Consumer Discretionary and Consumer […]

Gabelli Funds to Host 49th Annual Automotive Symposium at The Encore at Wynn, Las Vegas, Nevada

Description: GREENWICH, Conn., Oct. 28, 2025 (GLOBE NEWSWIRE) -- Gabelli Funds will host its 49th Annual Automotive Symposium on November 3rd and 4th, 2025 at the Encore at Wynn in Las Vegas, Nevada. This two-day symposium will feature presentations by senior management of leading automotive and trucking companies, with a lineup that allows investors to understand the ever-changing dynamics within the automotive industry. Discussions will cover a variety of topics, including the potential effect of tariffs,

2025-10-27

LKQ Corporation to Present at Upcoming Investor Conference

Description: ANTIOCH, Tenn., Oct. 27, 2025 (GLOBE NEWSWIRE) -- LKQ Corporation (Nasdaq: LKQ), today announced that members of its senior management will be presenting at the following investor conference: Gabelli Funds 49th Annual Automotive SymposiumNovember 4, 2025Las Vegas, Nevada Materials used during the presentation will be posted to the Company's website: www.lkqcorp.com on the day of the conference. About LKQ Corporation LKQ Corporation (www.lkqcorp.com) is a leading provider of alternative and speci

2025-10-26

2025-10-25

2025-10-24

2025-10-23

1 Small-Cap Stock to Own for Decades and 2 Facing Headwinds

Description: Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street. Many opportunities exist in this part of the market, but it is also a high-risk, high-reward environment due to the lack of reliable analyst price targets.

2025-10-22

2025-10-21

LKQ Corporation Advances Renewable Energy Strategy with Solar Project at German Logistics Hub

Description: ANTIOCH, Tenn., Oct. 21, 2025 (GLOBE NEWSWIRE) -- LKQ Corporation (Nasdaq: LKQ), today announced that it has partnered with Ecobility Services GmbH to implement a large-scale rooftop solar power system at its central logistics centers in Sulzbach-Rosenberg, Germany. The project will be delivered through a 20-year Power Purchase Agreement (PPA), representing a key step in LKQ’s broader sustainability and long-term greenhouse gas emissions reduction strategy. Covering more than 12,000 square metre

2025-10-20

2025-10-19

LKQ (LKQ) Valuation in Focus as Shares Trade Below Analyst Targets

Description: LKQ (LKQ) shares have been trading in a tight range recently, with the stock showing some short-term gains over the past week but remaining down for the month and past 3 months. Many investors are taking a closer look at the company’s fundamentals to assess what might come next. See our latest analysis for LKQ. LKQ’s share price has staged a slight rebound this week, but recent momentum is still dampened by a challenging year. While shares are up 4.7% over the past seven days, they remain...

2025-10-18

2025-10-17

3 Profitable Stocks We Steer Clear Of

Description: While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".