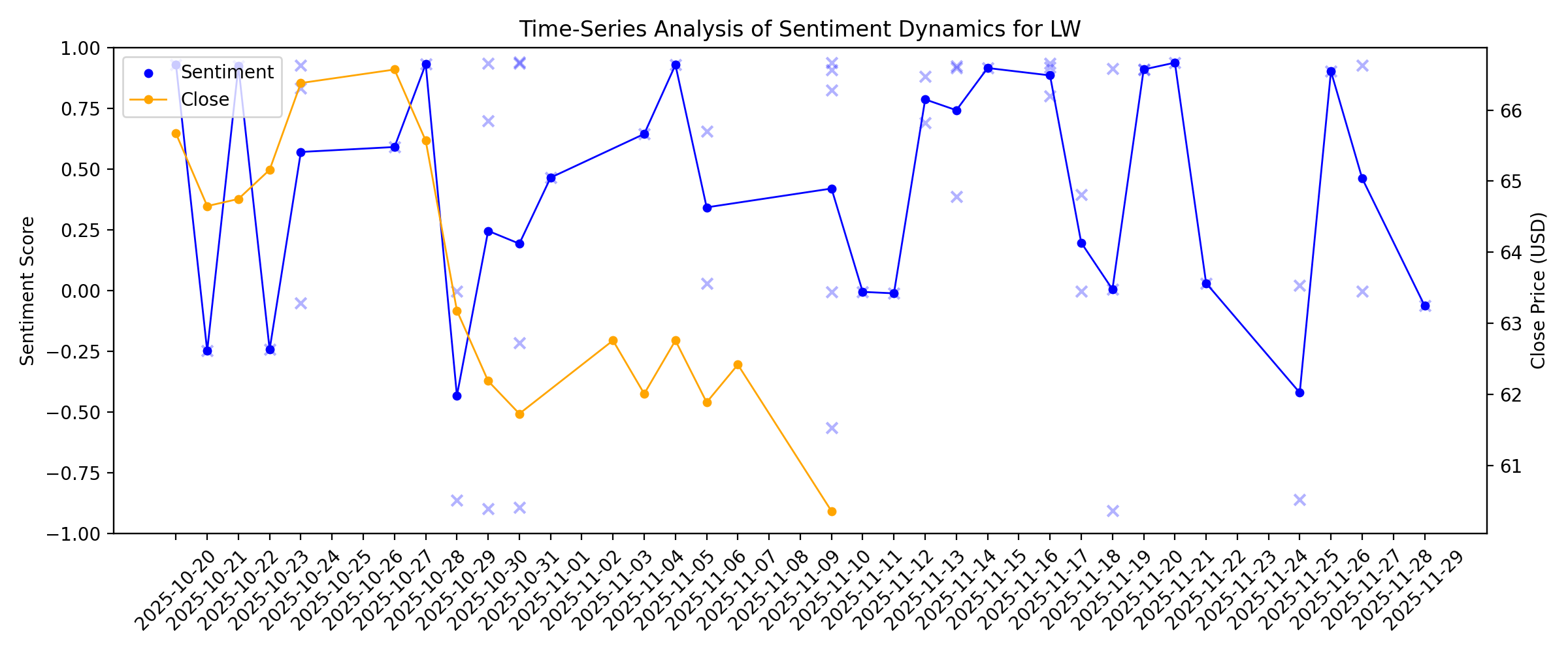

News sentiment analysis for LW

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Does Lamb Weston (LW) Production Consolidation Reveal a Deeper Shift in Its Global Efficiency Strategy?

Description: Lamb Weston Holdings has closed its Munro, Argentina plant and consolidated Latin American production at its newer Mar del Plata facility, while also temporarily curtailing a line in the Netherlands as part of its Focus to Win efficiency program, with affected Munro employees receiving severance in line with local regulations. This consolidation and production curtailment highlight how Lamb Weston is reshaping its manufacturing footprint to balance cost efficiency, regional capacity, and...

Has Lamb Weston (LW) Share Slump Opened A New Valuation Opportunity

Description: If you are wondering whether Lamb Weston Holdings is starting to look interesting at current levels, this article walks through what the recent share price means for value focused investors. The stock last closed at US$41.37, with returns of 0.2% over 7 days, a 30.7% decline over 30 days, a 2.2% decline year to date, and declines of 30.2%, 55.5%, and 42.8% over 1, 3, and 5 years respectively. These moves may change how you think about risk and potential upside. These moves sit against a...

2026-01-11

Barclays Sees Lamb Weston (LW) Selloff as Overdone, Cuts Price Target

Description: Lamb Weston Holdings, Inc. (NYSE:LW) is included among the 13 Best Consumer Staples Dividend Stocks to Invest in Now. On December 23, Barclays cut its price target on Lamb Weston Holdings, Inc. (NYSE:LW) to $55 from $68 and kept an Overweight rating on the shares. The firm acknowledged investor frustration after the company posted a […]

2026-01-10

2026-01-09

Lamb Weston Streamlines Global Footprint to Improve Efficiency

Description: LW plans to close its Munro plant in Argentina, shift Latin America output to Mar del Plata and curb a Netherlands line to cut costs and boost efficiency.

2026-01-08

Lamb Weston to Close Munro, Argentina Plant, Consolidating Latin America Production to State-of-the-Art Mar del Plata Facility

Description: EAGLE, Idaho, January 08, 2026--Lamb Weston Holdings, Inc. (NYSE: LW) announced today plans to close its Munro, Argentina plant and consolidate production for the Latin America region to its new, modern facility in Mar del Plata, Argentina.

A Look At Lamb Weston Holdings (LW) Valuation After The Recent Share Price Pullback

Description: Event context and recent share performance Lamb Weston Holdings (LW) has drawn investor attention after a sharp pullback, with the stock showing declines over the past week, month, past 3 months, and year. This has prompted closer scrutiny of its fundamentals. See our latest analysis for Lamb Weston Holdings. The recent slide in Lamb Weston Holdings’ share price, including a 32.3% 30 day share price return decline and a 32.1% 1 year total shareholder return decline, points to fading momentum...

2026-01-07

2026-01-06

Lamb Weston (LW) Q3 2025 Earnings Call Transcript

Description: Mike Smith: Thank you, Debbie, and congratulations on your new role. Throughout our history, Lamb Weston Holdings, Inc. has been a leader in innovation, product quality, customer relationships, and operations. To meet evolving industry dynamics, Lamb Weston Holdings, Inc. needs to change.

KRYAY vs. LW: Which Stock Is the Better Value Option?

Description: KRYAY vs. LW: Which Stock Is the Better Value Option?

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

Does Lamb Weston (LW) Prioritizing Buybacks and Dividends Reveal Its Evolving Margin Strategy?

Description: Lamb Weston Holdings recently reported fiscal second-quarter results showing modest sales growth to about US$1.62 billion and a return to net profitability, while reaffirming its fiscal 2026 net sales outlook of US$6.35 billion to US$6.55 billion. At the same time, the company increased its quarterly dividend to US$0.38 per share and completed a long-running US$817.3 million share repurchase program, even as management signaled margin pressure from competition and weaker pricing. We’ll now...

2025-12-24

Stocks making big moves yesterday: Lucid, Lamb Weston, Figs, Dillard's, and Asana

Description: Check out the companies making headlines yesterday:

2025-12-23

Sector Update: Consumer Stocks Softer Late Afternoon

Description: Consumer stocks were lower late Tuesday afternoon, with the State Street Consumer Staples Select Sec

Lamb Weston (LW) Stock Trades Down, Here Is Why

Description: Shares of potato products company Lamb Weston (NYSE:LW) fell 2.6% in the afternoon session after analysts continued to express concerns about the company's outlook, with several firms cutting their price targets.

2025-12-22

Why Lamb Weston (LW) Shares Are Sliding Today

Description: Shares of potato products company Lamb Weston (NYSE:LW) fell 2.1% in the afternoon session after BNP Paribas Exane downgraded the stock to 'Neutral' from 'Outperform', citing concerns over intensifying competition.

International Markets and Lamb Weston (LW): A Deep Dive for Investors

Description: Explore how Lamb Weston's (LW) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Here Are Monday’s Top Wall Street Analyst Research Calls: BlackSky Technology, Cummins, Lamb Watson, Ollie’s Bargain Outlet, Sealed Air, Volaris, and More

Description: Pre-Market Stock Futures: Futures are trading higher as we get ready to start a holiday-shortened trading week after an outstanding triple-witching Friday rally that may have kicked the “Santa Claus” rally into high gear. All of the major indices, including the Russell 2000, finished the day higher, and Oracle Corp. (NYSE: ORCL), which has been ... Here Are Monday’s Top Wall Street Analyst Research Calls: BlackSky Technology, Cummins, Lamb Watson, Ollie’s Bargain Outlet, Sealed Air, Volaris, and

2025-12-21

Lamb Weston (LW): Reassessing Valuation After Earnings Beat, Weak Guidance and Margin Pressures

Description: Lamb Weston Holdings (LW) just delivered an earnings beat with 8% volume growth, yet the stock sank after management reaffirmed flat sales guidance and flagged ongoing margin pressure from pricing and rising costs. See our latest analysis for Lamb Weston Holdings. The earnings beat and cost saving plan arrive after a tough stretch, with the share price down sharply in recent sessions and a one year total shareholder return of minus 27.4 percent. This underscores how sentiment has cooled...

2025-12-20

2025-12-19

Review & Preview: Here Comes Santa Claus

Description: Stocks continued to head higher despite a quiet day on Wall Street. Why the bull market could continue in 2026.

Stock Market Today, Dec. 19: AI Optimism and Inflation Data Buoys Stocks

Description: On Dec. 19, 2025, upbeat AI sentiment helped lift major U.S. indexes even as quad‑witching volatility kept trading choppy.

Stocks to Watch Friday Recap: Lamb Weston, Intuitive Machines, Nike, Oracle

Description: ↗️ Oracle (ORCL): TikTok parent Bytedance formally agreed to form a new U.S. joint venture that will be 50% held by an investor consortium that includes Oracle. Shares jumped 6.6%. ↗️ CoreWeave (CRWV): Shares in the data-center operator jumped, extending a rebound that follows punishing declines.

US Equity Markets Rise as Tech Sector Paces Rally

Description: US equity indexes closed higher Friday as tech stocks paced the rally. * US existing home sales e

Lamb Weston Holdings Inc (LW) Q2 2026 Earnings Call Highlights: Navigating Growth Amidst ...

Description: Lamb Weston Holdings Inc (LW) reports strong volume growth and cash flow, while facing international pricing challenges and cost pressures.

Sector Update: Consumer Stocks Decline Late Afternoon

Description: Consumer stocks were lower late Friday afternoon, with the State Street Consumer Staples Select Sect

Lamb Weston Stock Plunged as Price Discounts Pressured Profits

Description: Lamb Weston reported 44 cents in earnings per share, compared with the 25-cents loss a year earlier thanks to restructuring costs.

Why Lamb Weston (LW) Shares Are Sliding Today

Description: Shares of potato products company Lamb Weston (NYSE:LW) fell 24.1% in the afternoon session after its fourth-quarter (fiscal Q2) results beat expectations but its full-year outlook fell short of analyst forecasts, raising concerns about future profitability.

Top Midday Decliners

Description: Mangoceuticals (MGRX) reported Friday the closing of its registered direct offering and concurrent p

Lamb Weston Warns of Profit Pressure Ahead Due to Discounts, Rising Costs

Description: The french-fry maker reaffirmed its sales guidance for the year but warned that pricing dynamics, rising costs and underutilized production in Europe could put pressure on profits.

Carnival stock pops, Lamb Weston plunges, Conagra costs weigh

Description: Carnival (CCL), Lamb Weston (LW), and Conagra Brands (CAG) are some of the trending stocks that investors are watching on Yahoo Finance. Market Catalysts Host Julie Hyman outlines the stories that are driving interest in these names. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Why Lamb Weston Stock Is Plummeting Today

Description: Frozen potato behemoth Lamb Weston saw its stock sell-off again after offering underwhelming earnings.

Lamb Weston's Q2 Earnings Beat Estimates, Sales Rise Y/Y

Description: LW beats fiscal second-quarter earnings and sales estimates as volume gains offset pricing pressure, even as profit declines from last year.

Pre-Markets Mixed on Last Trading Day of the Week

Description: Pre-Markets Mixed on Last Trading Day of the Week

Are the Markets Setting Up for a Santa Claus Rally?

Description: With equilibrium still being sought in the indexes this morning, it appears we are currently in a sweet spot for a Santa Claus Rally to occur.

Lamb Weston (LW) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for Lamb Weston (LW) give a sense of how its business performed in the quarter ended November 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Lamb Weston (LW) Q2 Earnings and Revenues Top Estimates

Description: Lamb Weston (LW) delivered earnings and revenue surprises of +2.99% and +1.60%, respectively, for the quarter ended November 2025. Do the numbers hold clues to what lies ahead for the stock?

Lamb Weston (NYSE:LW) Beats Q4 CY2025 Sales Expectations But Stock Drops

Description: Potato products company Lamb Weston (NYSE:LW) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 1.1% year on year to $1.62 billion. On the other hand, the company’s full-year revenue guidance of $6.45 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $0.69 per share was 6.4% above analysts’ consensus estimates.

Lamb Weston: Fiscal Q2 Earnings Snapshot

Description: EAGLE, Idaho (AP) — Lamb Weston Holdings Inc. LW) on Friday reported fiscal second-quarter net income of $62.1 million. On a per-share basis, the Eagle, Idaho-based company said it had profit of 44 cents.

Lamb Weston Reports Second Quarter Fiscal 2026 Results; Reaffirms Fiscal Year 2026 Outlook

Description: EAGLE, Idaho, December 19, 2025--Lamb Weston Holdings, Inc. (NYSE: LW) announced today its results for the second quarter of fiscal 2026 and updated its full year financial targets for fiscal 2026.

2025-12-18

Carnival earnings, home sales, consumer sentiment: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come tomorrow, Friday, December 19, including earnings results from Conagra Brands (CAG) and cruise operator Carnival Corporation (CCL), existing home sales data, and the latest reading on consumer sentiment for the month of December. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

What to Expect From Lamb Weston's Next Quarterly Earnings Report

Description: Lamb Weston is expected to announce its fiscal second-quarter earnings tomorrow, and analysts project a single-digit profit rise.

2025-12-17

Lamb Weston Q2 Earnings on Deck: Key Factors You Should Understand

Description: LW's second-quarter results are likely to show softer revenues and pricing pressure, partly offset by steady volume growth and benefits from restructuring efforts.

2025-12-16

2025-12-15

Will Lamb Weston (LW) Beat Estimates Again in Its Next Earnings Report?

Description: Lamb Weston (LW) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Lamb Weston Stock: Is LW Underperforming the Consumer Defensive Sector?

Description: Though Lamb Weston has performed weaker than the consumer defensive sector over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

Clorox's Brand Investments Are Up: Will They Translate to Growth?

Description: CLX leans on heavier brand investment and new product launches to rebuild momentum as ERP-related disruptions weigh on near-term sales.

Can Molson Coors' Premium Bets Make Up for Sluggish Beer Demand?

Description: TAP leans on premium brands like Peroni to lift margins, but whether strong above-premium growth can offset broad beer softness remains uncertain.

2025-12-11

Is Monster Beverage's Pricing Strategy a Catalyst for Margin Growth?

Description: MNST's third-quarter 2025 pricing moves fuel sharp margin gains as strong demand and mix shifts lead to higher earnings growth rates compared to sales.

UNFI Sets New Long-Term Targets, Outlines Multi-Year Growth Plan

Description: United Natural Foods outlines a multi-year plan targeting steadier growth, stronger cash flow and major operational upgrades through fiscal 2028.

2025-12-10

What Lamb Weston Holdings (LW)'s Flat Sales Outlook and Margin Pressure Means For Shareholders

Description: In recent months, Lamb Weston Holdings, the frozen potato producer behind the Grown in Idaho brand, has faced projections for largely flat sales over the next year amid slowing demand. At the same time, intensifying competition and weaker gross and operating margins have raised fresh concerns about the company’s ability to sustain profitability in the face of these pressures. We’ll now explore how concerns about flat sales and margin pressure could influence Lamb Weston’s existing...

Is Lamb Weston Attractively Priced After a 20% Slide and Mixed Valuation Signals?

Description: If you have been wondering whether Lamb Weston Holdings is starting to look like a bargain or just a value trap, this breakdown will help you separate noise from real opportunity. The stock has slid to around $58.23, with returns of -3.7% over the last week, -3.5% over the last month, and -20.3% over the past year, shifting market sentiment and resetting expectations. Recently, investors have been reacting to management updates on cost pressures, capacity expansion plans, and shifting demand...

2025-12-09

Campbell's Q1 Earnings Beat Estimates, Net Sales Drop 3% Y/Y

Description: CPB beats EPS estimates even as sales and margins slip, with cost pressures and a planned La Regina stake shaping its 2026 outlook.

Mama's Creations Q3 Earnings Beat Estimates, Sales Rise 50% Y/Y

Description: MAMA posts strong third quarter with a 50% sales jump, margin gains and new retail placements driving momentum after integrating Crown 1.

2025-12-08

Mama's Creations, Inc. (MAMA) Tops Q3 Earnings and Revenue Estimates

Description: Mama's Creations, Inc. (MAMA) delivered earnings and revenue surprises of +400.00% and +8.66%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-12-07

Lamb Weston (LW): Has the 2024 Share Price Pullback Created a Valuation Opportunity?

Description: Lamb Weston Holdings (LW) has quietly slipped about 10% this year, even as annual revenue and net income are still growing. That disconnect is exactly what has value focused investors taking a closer look. See our latest analysis for Lamb Weston Holdings. Despite a modest 7 day share price return, Lamb Weston’s year to date share price decline and a one year total shareholder return of about negative 21 percent suggest momentum has cooled as investors reassess growth versus execution...

2025-12-06

2025-12-05

2025-12-04

Hormel Foods Q4 Earnings Beat Estimates, Sales Increase Y/Y

Description: HRL posts a fourth-quarter earnings beat and modest sales growth, as segment results reveal mixed trends across retail, foodservice and international.

2025-12-03

United Natural Q1 Earnings Beat Estimates, Sales Decline Y/Y

Description: UNFI tops first-quarter earnings estimates despite a sales dip, with natural-segment growth and cost cuts lifting margins and EBITDA.

2025-12-02

MKC's Q3 Shows Solid Consumer Momentum: Will the Strength Last in 2026?

Description: McCormick's consumer momentum strengthens as volume-led growth, broad share gains, and health-focused trends fuel demand across key categories.

2025-12-01

Is Monster Beverage's International Push the Next Big Driver of Sales?

Description: MNST's international momentum accelerates as Q3 overseas sales jump 23%, expanding margins and boosting global brand reach.

2025-11-30

2025-11-29

How Recent Developments Are Rewriting the Story for Lamb Weston

Description: Lamb Weston Holdings recently maintained its fair value at $66 per share, with analysts noting minimal changes in the company’s long-term outlook. The discount rate has edged down slightly to 6.96%, which suggests decreased perceived risk, while revenue growth projections remain steady. As industry sentiment shifts, investors will want to follow the evolving narrative closely to stay ahead of future updates and insights. Analyst Price Targets don't always capture the full story. Head over to...

2025-11-28

2025-11-27

Is POST's New $500 Million Buyback a Signal of Confidence for FY26?

Description: POST's new $500 million buyback, backed by strong fiscal 2025 cash flow, highlights its flexibility heading into fiscal 2026.

Mondelez Delivers a Solid Q3: Does the Guidance Cut Signal Trouble?

Description: MDLZ posts a strong Q3 but trims its outlook as retailer destocking, soft Europe demand and tariff uncertainty cloud near-term momentum.

2025-11-26

Flavor Solutions Lifts MKC's Q3 Results: Will the Growth Last?

Description: MKC's Flavor Solutions posts steady Q3 volume gains and rising health-focused demand, though tariffs and costs pressure near-term margins.

2025-11-25

SJM Q2 Earnings Miss Despite Higher Sales, FY26 Guidance Tightened

Description: SJM's Q2 shows rising sales but a steep earnings slump, prompting tightened FY26 guidance as pricing gains clash with softer volumes and higher costs.

Smucker (SJM) Q2 Earnings Lag Estimates

Description: Smucker (SJM) delivered earnings and revenue surprises of -0.94% and +0.34%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-11-24

2025-11-23

2025-11-22

Assessing Lamb Weston (LW) Valuation Following Recent Share Price Decline

Description: Lamb Weston Holdings (LW) shares have struggled recently, sitting at $57.68 after a month in which the stock slid around 11%. Investors may be reassessing the company’s fundamentals in light of these moves. See our latest analysis for Lamb Weston Holdings. Zooming out, Lamb Weston Holdings’ 1-year total shareholder return stands at -23%, reflecting a period of cooling momentum after a tough month for the share price. Despite some short-term volatility, the longer-term picture suggests...

2025-11-21

Post Holdings Q4 Earnings Beat Estimates, Sales Up 11.8% Y/Y

Description: POST's fiscal fourth-quarter results show year-over-year sales growth, as acquisitions boost revenues despite mixed segment performance.

2025-11-20

Is Colgate's Innovation Engine Enough to Revive Its Volumes?

Description: CL bets on faster, science-led innovation and a global Colgate Total relaunch to overcome soft volumes and regain momentum.

Hershey's LesserEvil Buyout to Strengthen Better-for-You Snacks

Description: HSY expands better-for-you lineup with the completed LesserEvil acquisition, boosting its reach in clean-label, fast-growing salty snacks.

2025-11-19

The J.M. Smucker Sets the Stage for Q2 Earnings: Things to Watch

Description: SJM heads into Q2 with strong coffee-driven sales momentum, but cost pressures, and weak snack and pet volumes threaten margins.

Lamb Weston to Announce Fiscal Year 2026 Second Quarter Financial Results on December 19, 2025

Description: EAGLE, Idaho, November 19, 2025--Lamb Weston Holdings, Inc. (NYSE: LW) announced today it will report fiscal 2026 second quarter financial results on December 19, 2025. The news release will be issued at approximately 8:30 a.m. ET, followed by a conference call at 10:00 a.m. ET.

McCormick Raises Quarterly Dividend: A Look at Its Growth Strategy

Description: MKC lifts its quarterly dividend to 48 cents, marking 102 years of payouts and 40 straight increases.

2025-11-18

Energizer Q4 Earnings Miss Estimates, Organic Sales Decline Y/Y

Description: ENR delivers higher fourth-quarter sales but weaker earnings as organic demand softens and rising tariff-related costs shape its early fiscal 2026 trajectory.

BJ's Wholesale Kicks Off Black Friday Deals to Power Holiday Spending

Description: BJ rolls out extended Black Friday deals from Nov. 17 to Dec. 1, offering major savings and flexible shopping options for holiday shoppers.

2025-11-17

Will Monster Beverage's Expansion Strategy & Energy Drinks Unit Aid?

Description: MNST rides global energy-drink momentum and innovation strength to fuel growth across key markets and its core portfolio.

Buy 5 Consumer Staples Stocks Despite the Sector's Weak Show in 2025

Description: Consumer staples lag in 2025, but PEP, MNST, LW, UNFI and OLLI are five stocks that show improving growth drivers for 2026.

Post Holdings to Report Q4 Earnings: What Should Investors Expect?

Description: POST eyes a stronger fourth-quarter fueled by 8th Avenue gains, seasonal cereal demand and solid momentum across cold-chain and foodservice units.

2025-11-16

2025-11-15

How the Narrative Around Lamb Weston Is Shifting Amid Recovery Signs and Ongoing Risks

Description: Lamb Weston Holdings stock is drawing increased attention as updated research keeps its fair value steady at $66.00 per share. Despite nuanced shifts in the broader investment narrative, the revenue growth estimate holds firm. However, the discount rate has edged up to 6.96 percent, reflecting a blend of optimism about volume gains and caution regarding sector challenges. Investors should stay tuned for insights on how to monitor this evolving narrative and stay informed about future...

2025-11-14

Zacks Industry Outlook Highlights J.M. Smucker, Lamb Weston and United Natural Foods

Description: Zacks highlights J.M. Smucker, Lamb Weston and United Natural Foods as brand strength, cost discipline and health-focused demand shape the food industry outlook.

Mondelez Battles Cocoa Inflation: Will Margin Pressure Ease in 2026?

Description: MDLZ faces record cocoa costs and rising elasticity as it works to rebuild margins through pricing resets and productivity gains.

Is Pilgrim's Pride's U.S. Fresh Segment Driving Margin Stability?

Description: PPC leans on its U.S. Fresh segment as Case Ready and Small Bird demand helps steady margins despite weak commodity chicken prices.

2025-11-13

Buy These 3 Miscellaneous Food Stocks to Ride Out Industry Challenges

Description: While the Zacks Food-Miscellaneous industry battles inflation and soft demand, SJM, LW and UNFI lean on strong brands and cost controls to drive growth.

Lamb Weston Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Despite Lamb Weston’s underperformance relative to the broader market over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-11-12

Beyond Meat Stock Falls 12% on Wider Q3 Loss & Weak Q4 Outlook

Description: BYND shares tumble after reporting a wider Q3 loss and providing a weak Q4 sales outlook, as soft demand and cost pressures weigh on the company.

2025-11-11

TreeHouse Foods Q3 Earnings Miss Estimates, Sales Rise Y/Y

Description: THS's third-quarter results have disappointed as earnings declined despite modest sales growth driven by pricing gains and acquisitions.

2025-11-10

Does the Share Price Drop Signal a Value Opportunity in Lamb Weston Holdings for 2025?

Description: Curious whether Lamb Weston Holdings is a hidden value play or just another stock on your watchlist? Let’s break down what the numbers and some real-world developments are telling us. The share price has been on a choppy ride, falling by 3.8% over the past week and 5.3% over the last month, bringing its year-to-date return to -8.6% and trailing a hefty -23.5% over the last year. Much of the recent movement comes as investors have reacted to shifts in the frozen foods market and headlines...

Tyson Foods' Q4 Earnings Top Estimates, Sales Grow on Pricing

Description: TSN posts a strong Q4 with higher earnings and sales driven by pricing gains, showcasing the strength of its diversified protein portfolio.

Can McCormick's CCI Savings Maintain EPS Momentum in 2025?

Description: MKC leans on its CCI program savings to offset cost pressures and drive steady EPS growth in fiscal 2025.

HAIN Stock Jumps 12% Despite Reporting Q1 Loss & Y/Y Sales Decline

Description: Hain Celestial shares jump 12% as investors cheer management's confident turnaround tone despite Q1 losses and weaker sales.

Want Better Returns? Don't Ignore These 2 Consumer Staples Stocks Set to Beat Earnings

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Coty's Q1 Earnings Miss Estimates, Revenues Decline 6% Y/Y

Description: COTY's fiscal first-quarter results fall short as sales drop 6% year over year, but Prestige momentum and major fragrance launches may lift FY26.

B&G Foods' Q3 Earnings Beat Estimates Despite Soft Sales

Description: BGS' earnings surpass the Zacks Consensus Estimate in Q3, with pricing gains and cost cuts offsetting volume and sales declines.

2025-11-05

McCormick's Gross Margin Under Pressure: Will Q4 Show Relief?

Description: MKC battles cost pressures and tariff impacts but eyes a modest Q4 margin lift as savings initiatives gain traction.

2025-11-04

Medifast's Q3 Loss Wider Than Expected, Sales Decline 36% Y/Y

Description: MED's third-quarter results reflect pressure from fewer active OPTAVIA Coaches, but it is steering toward metabolic health for growth.

2025-11-03

2025-11-02

2025-11-01

Looking at the Narrative for Lamb Weston After Mixed Analyst Views and Recovery Signals

Description: Lamb Weston Holdings’ stock has seen its fair value price target reaffirmed at $66 per share, with analysts holding steady in their outlook despite ongoing sector fluctuations. This consistency follows recent research highlighting both the company’s strong first quarter and continued market headwinds. As the landscape for Lamb Weston develops, stay tuned for ways to monitor important updates in the evolving story. Stay updated as the Fair Value for Lamb Weston Holdings shifts by adding it to...

2025-10-31

Why Is Conagra Brands (CAG) Down 9.2% Since Last Earnings Report?

Description: Conagra Brands (CAG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Kellanova's Q3 Earnings Top Estimates, Organic Sales Edge Lower

Description: K posts higher Q3 earnings and sales, fueled by emerging market gains and cost discipline ahead of its Mars acquisition.

Church & Dwight Q3 Earnings Beat Estimates, Sales Up 5% Y/Y

Description: CHD posts third-quarter EPS and sales beats, driven by volume gains, e-commerce growth and strength across key consumer brands.

1 Small-Cap Stock with Competitive Advantages and 2 We Question

Description: Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings. However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

2025-10-30

Lamb Weston (LW) Up 1.9% Since Last Earnings Report: Can It Continue?

Description: Lamb Weston (LW) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Altria's Q3 Earnings Beat Estimates, Revenues Decline Y/Y

Description: MO's third-quarter profit tops expectations on higher pricing and cost savings, even as cigarette and oral tobacco sales slip.

KMB Q3 Earnings Beat Estimates, Sales In Line With the Year-Ago Level

Description: KMB's Q3 results highlight steady sales, solid volume gains and cost discipline amid ongoing margin pressures.

2025-10-29

Kraft Heinz Q3 Earnings Beat, '25 View Narrowed on Soft Volumes

Description: KHC's Q3 earnings fall on weaker volumes and inflation, but efficiency gains and a 2026 split plan signal a reshaped future ahead.

Are Options Traders Betting on a Big Move in Lamb Weston Stock?

Description: Investors need to pay close attention to Lamb Weston stock based on the movements in the options market lately.

2025-10-28

Sysco Q1 Earnings Surpass Estimates, Sales Increase 3.2% Y/Y

Description: SYY starts fiscal 2026 strong as Q1 earnings beat estimates, sales rise 3.2% and gross margins expand despite higher costs.

2025-10-27

Zacks.com featured highlights include Lamb Weston, Universal Health, FirstEnergy, NetEase and JPMorgan Chase

Description: Lamb Weston, Universal Health, FirstEnergy, NetEase and JPMorgan shine as Zacks spotlights stocks with strong sales growth in a volatile market.

2025-10-26

2025-10-25

2025-10-24

Assessing Lamb Weston's (LW) Valuation After Its Recent Share Price Rebound

Description: Lamb Weston Holdings (LW) shares have moved just slightly in the past week, but the stock has gained 20% over the past month. This performance has drawn new attention from investors looking for signals on where things could head from here. See our latest analysis for Lamb Weston Holdings. After a bumpy start to the year, Lamb Weston Holdings is showing some renewed momentum, with a 1-month share price return of nearly 20%. However, zooming out, the 1-year total shareholder return sits in...

5 Stocks With Robust Sales Growth to Buy Amid a Challenging Backdrop

Description: Amid market volatility, strong sales growth makes stocks like Lamb Weston, UHS, FirstEnergy, NetEase and JPMorgan compelling buys.

1 Cash-Producing Stock Worth Your Attention and 2 Facing Challenges

Description: A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

2025-10-23

Best Income Stocks to Buy for Oct. 23

Description: GES, TRV and LW made it to the Zacks Rank #1 (Strong Buy) income stocks list on Oct. 23, 2025.

2025-10-22

Philip Morris Q3 Earnings Beat Estimates, Revenues Increase 9% Y/Y

Description: PM posts a third-quarter earnings and revenue beat as its smoke-free business drives record profits and double-digit growth.

2025-10-21

Best Income Stocks to Buy for Oct. 21

Description: NEM, LW and RY made it to the Zacks Rank #1 (Strong Buy) income stocks list on Oct. 21, 2025.

2025-10-20

Why Lamb Weston (LW) Might be Well Poised for a Surge

Description: Lamb Weston (LW) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.