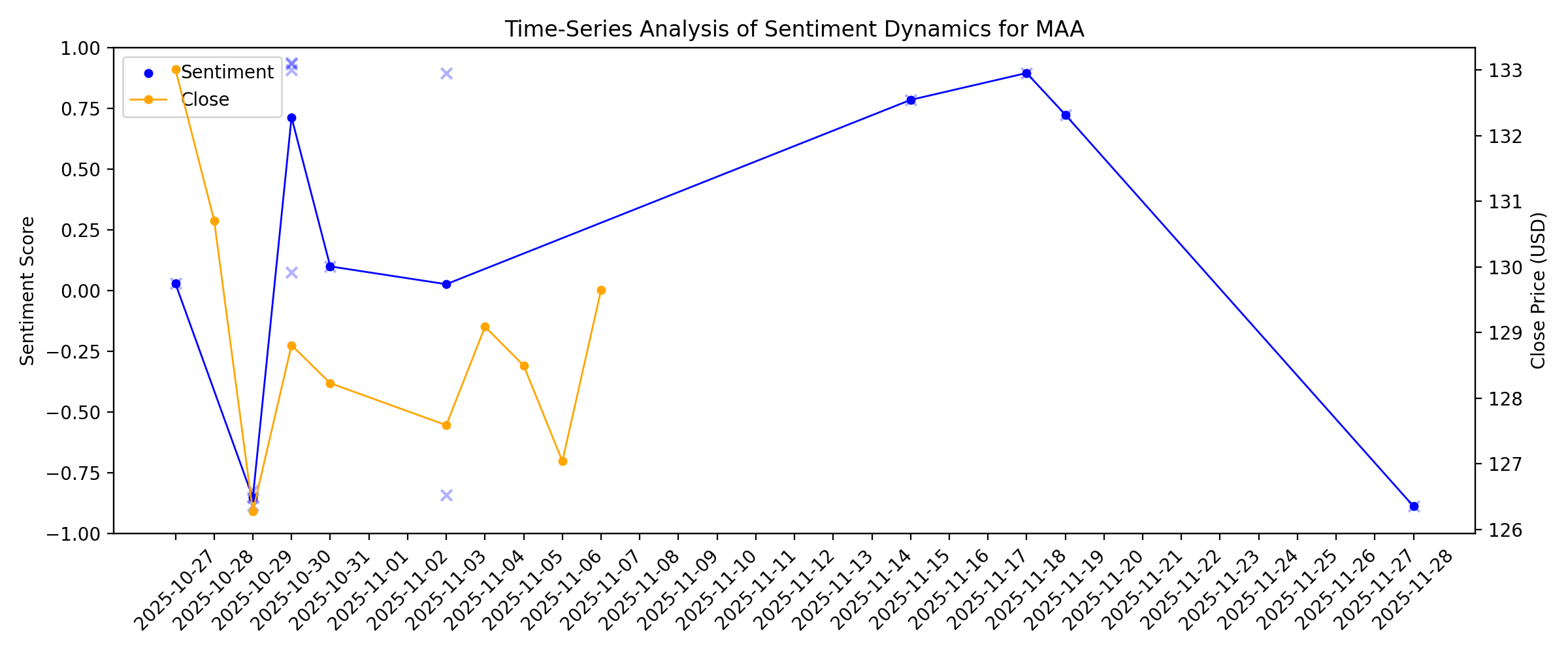

News sentiment analysis for MAA

Sentiment chart

2026-01-14

MAA Announces Date of Fourth Quarter and Full-Year 2025 Earnings Release, Conference Call

Description: MAA (NYSE: MAA) announced today that the Company expects to release its fourth quarter and full-year 2025 results on Wednesday, February 4, 2026, after market close and will hold a conference call on Thursday, February 5, 2026, at 9:00 a.m. Central Time. During the conference call, company officers will review fourth quarter and full-year performance and conduct a question-and-answer session.

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

Mid-America Apartment’s Q4 2025 Earnings: What to Expect

Description: Mid-America Apartment Communities is set to report its fiscal fourth-quarter results later this month, with Wall Street expecting funds from operations to be largely unchanged from the prior year.

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Evercore ISI Trims MAA Target as NAREIT Highlights Mixed REIT Signals

Description: Mid-America Apartment Communities, Inc. (NYSE:MAA) is included among the Best Stocks for a Dividend Achievers List. Top 100 Places Where the Rich People Own Real Estate On December 15, Evercore ISI trimmed its price target on Mid-America Apartment Communities, Inc. (NYSE:MAA) to $143 from $144 and kept an In Line rating on the stock. The […]

2025-12-22

What Mid-America Apartment Communities (MAA)'s 16th Straight Dividend Increase Means For Shareholders

Description: Earlier this month, Mid-America Apartment Communities, Inc. announced its 16th consecutive annual dividend increase, approving a quarterly payment of US$1.53 per share to be paid on January 30, 2026, raising the annualized dividend to US$6.12 and highlighting compounded dividend growth of 8.3% over five years. This long-running pattern of dividend growth, set against more cautious analyst views following weaker quarterly results, highlights a tension between income resilience and concerns...

Is Mid-America Apartment Communities a Hidden Opportunity After a Tough 12 Month Share Price Slide?

Description: If you are wondering whether Mid-America Apartment Communities is quietly turning into a value opportunity while the market looks the other way, this article will walk through what the numbers are really saying about the stock. The share price is sitting around $134.23 after a modest 1.2% gain over the last week and a 0.5% rise over the past month. However, this is still against a backdrop of a -12.0% year-to-date return and a -8.8% 1-year return, reminding investors that sentiment has been...

2025-12-21

A Look at Mid-America Apartment Communities (MAA) Valuation After Scotiabank Downgrade and Softer Quarterly Results

Description: Mid-America Apartment Communities (MAA) is back in the spotlight after Scotiabank downgraded the stock. This extends a cautious streak that began with downbeat October results, even as the REIT quietly approved another dividend increase. See our latest analysis for Mid-America Apartment Communities. At around $134.23, MAA’s recent share price decline over the last quarter and year to date suggests momentum is fading, even though its five year total shareholder return of 28.15% points to a...

3 Brilliant High-Yield Dividend Stocks to Buy Now and Hold for the Long Term

Description: These REITs have exceptional records of increasing their dividends.

2025-12-20

2025-12-19

2025-12-18

Is Mid-America Apartment's Latest Dividend Hike Sustainable?

Description: Mid-America Apartment Communities lifts its quarterly dividend 1%, extending a 16-year streak as strong cash flow and balance sheet support payouts.

2025-12-17

MAA Announces Increase to Quarterly Common Dividend

Description: Mid-America Apartment Communities, Inc., or MAA (NYSE: MAA), today announced that its board of directors approved a quarterly dividend payment of $1.53 per share of common stock to be paid on January 30, 2026, to shareholders of record on January 15, 2026.

Is Mid-America Apartment Communities Stock Underperforming the S&P 500?

Description: Mid-America Apartment Communities’ stock has underperformed the S&P 500 over the past year, but analysts are moderately bullish about its prospects.

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

Does Mid-America Apartment Communities Recent Share Price Slide Signal a Compelling 2025 Opportunity?

Description: If you are wondering whether Mid-America Apartment Communities is starting to look like good value again after a choppy run, you are not alone, as this stock has been back on the radar of many value and income investors. The share price has slipped 3.1% over the last week and is still down 13.6% year to date, but that comes after a 28.7% gain over five years that highlights the longer term compounding power of quality apartment REITs. Recent moves have been shaped by shifting expectations...

2025-12-06

Wells Fargo Sees Solid Outlook for MAA Despite Price Target Cut

Description: Mid-America Apartment Communities, Inc. (NYSE:MAA) is included among the 15 Blue Chip Dividend Stocks to Build a Passive Income Porfolio. Wells Fargo reduced its price target on Mid-America Apartment Communities, Inc. (NYSE:MAA) to $150 from $157 on November 26, but maintained an Overweight rating. The firm attributed this revision to the solid operating conditions highlighted […]

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

MAA Announces Regular Quarterly Preferred Dividend

Description: Mid-America Apartment Communities, Inc., or MAA (NYSE: MAA), today announced a full quarterly dividend of $1.0625 per outstanding share of its 8.50% Series I Cumulative Redeemable Preferred Stock. The dividend is payable on December 31, 2025, to shareholders of record on December 15, 2025.

3 High-Yield Dividend Stocks I'm Buying to Boost My Passive Income in December

Description: These REITs should enable me to produce more passive income in 2026.

2025-11-30

2025-11-29

2025-11-28

Mid-America Apartment Communities (MAA) Up 5.2% Since Last Earnings Report: Can It Continue?

Description: Mid-America Apartment Communities (MAA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

Is Mid-America Apartment Communities (MAA) Undervalued? A Fresh Look at Current Valuation Drivers

Description: Mid-America Apartment Communities (MAA) has caught investor attention after its recent performance trends in the multifamily real estate sector. The company’s stock price has moved quietly over the past week, and shares showed a slight uptick in the most recent session. See our latest analysis for Mid-America Apartment Communities. After a subdued stretch for Mid-America Apartment Communities, the latest minor share price gains offer a refreshing change of pace. Even with this uptick, the...

2025-11-18

Are Wall Street Analysts Predicting Mid-America Apartment Stock Will Climb or Sink?

Description: While Mid-America Apartment has considerably underperformed the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-17

2025-11-16

2025-11-15

Looking For Yields: MAA, PepsiCo, And Mondelez International Are Consistent Moneymakers

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Mid-America Apartment Communities, PepsiCo, and Mondelez International have rewarded shareholders for years and recently ...

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

MAA Announces Pricing of Senior Unsecured Notes Offering

Description: Mid-America Apartment Communities, Inc., ("MAA") (NYSE: MAA) today announced that its operating partnership, Mid-America Apartments, L.P. ("MAALP"), priced a $400,000,000 offering of MAALP's 4.650% senior unsecured notes due January 15, 2033 (the "Notes") under its existing shelf registration statement. The Notes were priced at 99.354% of the principal amount. The closing of the offering is expected to occur on November 10, 2025, subject to the satisfaction of customary closing conditions.

3 High-Yielding Dividend Stocks I Plan to Buy in November to Boost My Passive Income

Description: These REITs pay attractive dividends that should rise in the future.

2025-11-02

2025-11-01

2025-10-31

MAA Net Profit Margin Surpasses Expectations but One-Off Gain Challenges Earnings Quality Narrative

Description: Mid-America Apartment Communities (MAA) booked net profit margins of 25.1%, up from last year’s 23.7%. The company recorded a five-year average annual earnings growth of 8.6%, though growth slowed to 6.7% in the most recent year. Looking ahead, analysts expect earnings to shrink by 5% per year over the next three years. Revenue is forecast to grow at 4.7% annually, trailing the broader US market's 10.3% projected pace. These results reflect steady historical profitability but raise questions...

2025-10-30

Mid-America Apartment Communities Inc (MAA) Q3 2025 Earnings Call Highlights: Resilient ...

Description: Mid-America Apartment Communities Inc (MAA) reports steady occupancy and strategic growth plans despite economic headwinds and pricing pressures.

UDR's Q3 FFOA Beats Estimates, Revenues & Same-Store NOI Grow

Description: UDR posts higher Q3 FFOA and raises full-year guidance, fueled by rent growth and resilient same-store NOI performance.

Invitation Homes' Q3 FFO In Line, Revenues Beat, Rents Improve Y/Y

Description: Invitation Homes posts steady Q3 core FFO of 47 cents per share as higher rents offset lower occupancy, prompting a slight full-year outlook raise.

Mid-America Apartment's Q3 FFO & Revenues Lag Estimates, Rent Declines

Description: MAA's Q3 results highlight a slight FFO miss and softer same-store revenues, but low resident turnover and active development plans support stability.

2025-10-29

Mid-America Apartment Communities (MAA) Q3 FFO and Revenues Miss Estimates

Description: Mid-America Apartment Communities (MAA) delivered FFO and revenue surprises of -0.46% and -0.30%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Mid-America Apartment Communities: Q3 Earnings Snapshot

Description: The real estate investment trust, based in Germantown, Tennessee, said it had funds from operations of $217.3 million, or $2.16 per share, in the period. The average estimate of eight analysts surveyed by Zacks Investment Research was for funds from operations of $2.17 per share. Funds from operations is a closely watched measure in the REIT industry.

MAA REPORTS THIRD QUARTER 2025 RESULTS

Description: Mid-America Apartment Communities, Inc., or MAA (NYSE: MAA), today announced operating results for the three months ended September 30, 2025.

2025-10-28

2025-10-27

What's in Store for Mid-America Apartment Stock in Q3 Earnings?

Description: MAA's Q3 results are likely to reflect steady Sunbelt demand but face headwinds from rent cuts and higher borrowing costs.