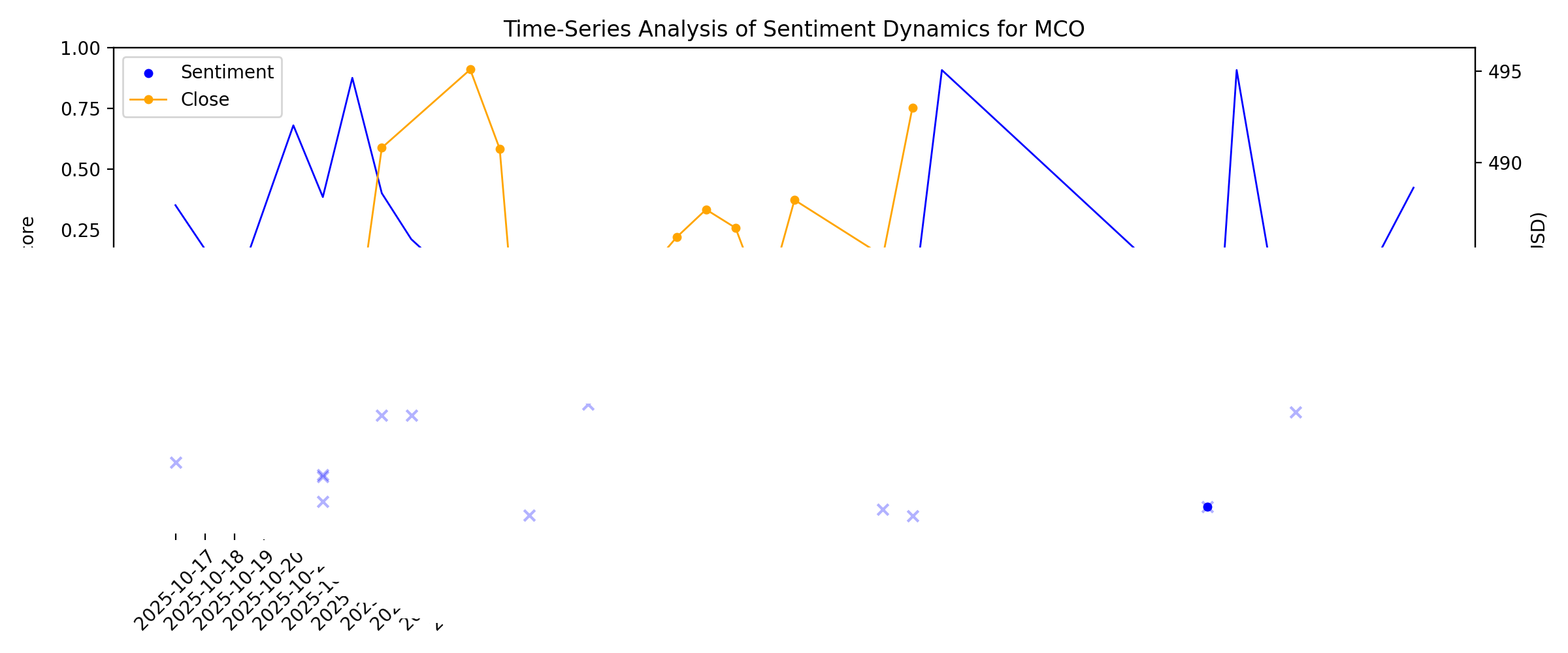

News sentiment analysis for MCO

Sentiment chart

2026-01-14

A $3 Trillion Reason to Buy Nvidia Stock in January 2026

Description: NVDA stock is back in focus as a projected $3 trillion wave of global data center investment reinforces long-term demand for AI infrastructure.

Assessing Moody's (MCO) Valuation After Lisa P. Sawicki Joins The Board

Description: Moody's (MCO) is back in focus after the company elected Lisa P. Sawicki to its Board of Directors, a governance shift that has investors reconsidering how board expertise might intersect with the stock’s current valuation. See our latest analysis for Moody's. At a share price of $534.9, Moody's has seen a 9.93% 1 month share price return and an 11.78% 3 month share price return, while its 5 year total shareholder return of 107.11% points to longer term momentum that frames the board refresh...

2026-01-13

Is It Too Late To Consider Moody's (MCO) After Strong Multi‑Year Share Price Gains

Description: If you are wondering whether Moody's current share price fairly reflects its long-term prospects or if the market is getting ahead of itself, this article walks through the numbers so you can judge the value for yourself. Moody's shares last closed at US$534.90, with returns of 0.4% over 7 days, 9.9% over 30 days, 7.2% year to date, 16.5% over 1 year, 74.9% over 3 years and 107.1% over 5 years. Recent attention on Moody's has been shaped by ongoing discussion around credit markets and demand...

2026-01-12

Moody’s Corporation Elects Lisa P. Sawicki to Board of Directors

Description: NEW YORK, January 12, 2026--Moody’s Corporation (NYSE:MCO) has elected Lisa P. Sawicki to the Company’s Board of Directors, effective March 16, 2026.

Data center investments to hit $3 trillion over next five years, says Moody’s

Description: Investing.com -- At least $3 trillion will flow into data-center-related investments over the next five years, according to a report released by Moody’s Ratings on Monday.

2026-01-11

2026-01-10

Here's Why Moody's (NYSE:MCO) Has Caught The Eye Of Investors

Description: The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even...

2026-01-09

2026-01-08

Digital Finance Will Evolve Into ‘Foundational Infrastructure Layer’ in 2026: Moody’s

Description: The ratings agency predicts that financial institutions and service firms will compete on the effectiveness of their infrastructure layers.

2026-01-07

BBSEY or MCO: Which Is the Better Value Stock Right Now?

Description: BBSEY vs. MCO: Which Stock Is the Better Value Option?

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

Insiders At Moody's Sold US$3.7m In Stock, Alluding To Potential Weakness

Description: The fact that multiple Moody's Corporation ( NYSE:MCO ) insiders offloaded a considerable amount of shares over the...

2025-12-31

2025-12-30

2025-12-29

2025-12-28

Moody's' (NYSE:MCO) three-year earnings growth trails the decent shareholder returns

Description: Thanks in no small measure to Vanguard founder Jack Bogle, it's easy buy a low cost index fund, which should provide...

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Qualivian Investment Partners’ Updates on Moody’s (MCO)

Description: Qualivian Investment Partners, an investment partnership focused on long-only public equities, released its Q3 2025 investor letter. A copy of the letter can be downloaded here. The fund outperformed the iShares MSCI USA Quality Factor ETF (QUAL) by 69.2% and 61.3% on a gross and net basis, since inception through September 30, 2025. It also exceeded […]

2025-12-22

VIRT vs. MCO: Which Stock Is the Better Value Option?

Description: VIRT vs. MCO: Which Stock Is the Better Value Option?

Moody’s to Move Global Headquarters to Brookfield Place, Enhancing Connections and Customer Experience

Description: NEW YORK, December 22, 2025--Moody’s Corporation (NYSE: MCO) today announced that it will relocate its global headquarters to 200 Liberty Street at Brookfield Place in Lower Manhattan, continuing the company’s 115+ year connection to New York City. The move, which is expected to be completed in 2027, represents a bold step in Moody’s ongoing evolution and commitment to creating world-class workspaces that enhance how teams collaborate and serve customers.

2025-12-21

2025-12-20

2025-12-19

Is It Too Late To Consider Moody's After Its Strong Multi Year Share Price Surge?

Description: If you are wondering whether Moody's is still worth considering after its big multi year run, or if all the upside has already been priced in, this breakdown is for you. The stock has climbed about 83.0% over 3 years and 86.1% over 5 years, with more modest gains of 2.3% over the last week and 5.3% over both the past month and year. This hints that momentum may be cooling as investors reassess the risk reward trade off. Recent coverage has focused on Moody's central role in global credit and...

EUROASIA INSURANCE Executes on Capital Strengthening Program, Reinforcing Commitments to International Partners

Description: With a clear path to a $43 million capital base, the Moody's B2-rated insurer is on track to meet commitments to its international rating agency and foreign creditorsTASHKENT, Uzbekistan, Dec. 19, 2025 (GLOBE NEWSWIRE) -- JSC "EUROASIA INSURANCE", a leading Uzbek insurer currently rated B2 by Moody's, today announced significant progress in its capital strengthening initiative. The company's Supervisory Board has approved a plan to increase charter capital to the equivalent of USD 43 million by

2025-12-18

Moody's (MCO) Valuation Check After Its Recent Share Price Climb

Description: Moody's (MCO) has quietly continued its climb, with shares up around 6% over the past month and roughly 9% over the past year, reflecting investors growing comfort with its earnings trajectory. See our latest analysis for Moody's. At around $497.73 per share, Moody's recent gains build on solid longer term momentum, with a 1 year total shareholder return comfortably positive and multi year total shareholder returns still signaling investors see durable growth rather than fading enthusiasm. If...

Regnology Signs an Agreement to Acquire Moody’s Regulatory Reporting & ALM Solutions

Description: FRANKFURT, Germany, December 18, 2025--Regnology to acquire Moody’s Regulatory Reporting & ALM Solutions, boosting global reach and innovation in financial compliance.

2025-12-17

SES Acknowledges Moody’s Rating Action and Reiterates Deleveraging Commitments

Description: LUXEMBOURG, December 17, 2025--SES S.A. ("SES" or the "Company"), a leading space solutions company, acknowledges the credit rating action announced by Moody’s Investor Service today, which follows the release of SES’ Q3 2025 results and Intelsat integration update.

Moody's Ratings Upgrades Diebold Nixdorf's Credit Rating to B1

Description: Diebold Nixdorf (NYSE: DBD), a world leader in transforming the way people bank and shop, today announced that Moody's Ratings (Moody's) upgraded the credit ratings of Diebold Nixdorf, Incorporated, to B1 from B2 with a stable outlook.

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

Moody's (NYSE:MCO) Ticks All The Boxes When It Comes To Earnings Growth

Description: For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to...

2025-12-08

Heavy debt load, flat container shipments lead Moody’s to cut TRAC rating

Description: Chassis provider TRAC has had its debt rating cut by Moody’s. The post Heavy debt load, flat container shipments lead Moody’s to cut TRAC rating appeared first on FreightWaves.

2025-12-07

2025-12-06

Why Consumers May Keep Spending Despite Affordability Angst

Description: While President Donald Trump this week called concern about the cost of living a “con job,” the strain American households are feeling is real.

2025-12-05

2025-12-04

Moody’s Corporation (MCO): A Bull Case Theory

Description: We came across a bullish thesis on Moody’s Corporation on Daniel’s Deep Dive’s Substack. In this article, we will summarize the bulls’ thesis on MCO. Moody’s Corporation’s share was trading at $487.24 as of December 1st. MCO’s trailing and forward P/E were 39.48 and 30.03, respectively according to Yahoo Finance. Moody’s Corporation remains one of the dominant players […]

A Look at Moody’s (MCO) Valuation After New Pegasystems Compliance Data Partnership

Description: Moody's (MCO) is back in focus after Pegasystems integrated its entity verification data into Pega’s AI driven client lifecycle and KYC platform, a move that could deepen Moody’s recurring compliance data revenues. See our latest analysis for Moody's. These kinds of data heavy partnerships have underpinned a steady narrative for Moody's, with the share price now at $489.48 and a modestly positive year to date share price return of 3.52 percent, while the three year total shareholder return of...

BBSEY vs. MCO: Which Stock Should Value Investors Buy Now?

Description: BBSEY vs. MCO: Which Stock Is the Better Value Option?

2025-12-03

2025-12-02

Pega and Moody’s Collaborate to Streamline Customer Lifecycle Management and KYC Processes for Financial Services

Description: WALTHAM, Mass., December 02, 2025--Pegasystems, Inc. (NASDAQ: PEGA), The Enterprise Transformation Company™, today announced a strategic collaboration with Moody’s Corporation (NYSE:MCO) to enhance customer lifecycle management (CLM) and Know Your Customer (KYC) processes for financial services organizations. Now Pega Client Lifecycle Management™ clients can access Moody’s industry-leading entity verification data directly in the solution for improved operational efficiency, accuracy, and compli

Evercore ISI Analyst has a Positive Outlook on Moody’s Corporation (MCO)

Description: Moody’s Corporation (NYSE:MCO) is one of the best dividend stocks in the financial sector. On November 5, analyst David Motemaden from Evercore ISI reiterated a Buy call on Moody’s while assigning a price target of $540. Separately, the company reported its Q3 financial results on October 22. Moody’s Corporation (NYSE:MCO)’s revenue for the third quarter […]

2025-12-01

Is Moody’s Corporation Stock Underperforming the Dow?

Description: Moody’s Corp has underperformed the Dow Jones index over the past year. However, Wall Street analysts remain moderately optimistic about its prospects.

2025-11-30

Possible Bearish Signals With Moody's Insiders Disposing Stock

Description: Many Moody's Corporation ( NYSE:MCO ) insiders ditched their stock over the past year, which may be of interest to the...

2025-11-29

2025-11-28

Buy 5 Financial Technology Ginats Amid Fed Rate Cut Hope in December

Description: Fed rate-cut hopes lift fintech outlook as HOOD, IBKR, FICO, SOFI and MCO gain momentum.

Odyssey Logistics hit with a 2nd Moody’s ratings downgrade since September

Description: For the second time in three months, Odyssey Logistics has seen Moody’s cut its debt rating. The post Odyssey Logistics hit with a 2nd Moody’s ratings downgrade since September appeared first on FreightWaves.

2025-11-27

2025-11-26

2025-11-25

2025-11-24

Entegra to Integrate Moody’s Data, Advancing Data-Driven Insight in Structured-Credit Markets

Description: NEW YORK, November 24, 2025--Entegra LLC, an innovator in Trading as a Service (TaaS), today announced that it will integrate Moody’s Corporation’s (NYSE: MCO) cash flow analytics into its TaaS platform.

2025-11-23

2025-11-22

Does Moody's Recent Fintech Partnerships Justify Its Share Price in 2025?

Description: Wondering if Moody's current share price reflects real value or just market hype? You're not alone, and we're about to break it down in plain terms. After mostly holding steady this year, Moody's stock has ticked up 1.4% year-to-date and gained over 80% in the last five years. This suggests long-term growth but also raises questions about future upside. Recent headlines have focused on Moody's expanding its risk assessment coverage and forming new partnerships in the financial technology...

2025-11-21

Why Is Moody's (MCO) Down 1% Since Last Earnings Report?

Description: Moody's (MCO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-20

2 Large-Cap Stocks to Own for Decades and 1 We Brush Off

Description: Large-cap stocks are known for their staying power and ability to weather market storms better than smaller competitors. However, their sheer size makes it more challenging to maintain high growth rates as they’ve already captured significant portions of their markets.

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Top Wide-Moat Stocks to Invest in for Long-Term Wealth and Stability

Description: LRCX, ASML, NVDA and MCO use strong moats to fend off rivals and deliver consistent returns amid market shifts.

2025-11-11

Moody's (MCO): Is the Current Valuation Justified After Subtle Share Price Gains?

Description: Moody's (MCO) stock edged higher recently, with shares showing a small uptick that caught investor attention. Its gains come even as the market digests mixed signals from the broader financial sector. See our latest analysis for Moody's. That subtle move higher in Moody’s share price adds to what has mostly been a steady year. The stock has posted a 4.26% year-to-date share price return and a 4.45% total return over the past twelve months. Momentum may be pausing after years of impressive...

Nexperia dispute a "warning shot for global supply chains," Moody’s says

Description: Investing.com - A dispute between the Netherlands and China over ownership and control of chipmaker Nexperia is not only about governance, it marks a "warning shot for global supply chains," according to Sapna Amlani, Supply Chain Director at financial services company Moody’s Corporation.

Moody’s Corporation to Present at the J.P. Morgan Ultimate Services Investor Conference on November 18, 2025

Description: NEW YORK, November 11, 2025--Moody’s Corporation (NYSE: MCO) announced today that Rob Fauber, President and Chief Executive Officer, will speak at the J.P. Morgan Ultimate Services Investor Conference on Tuesday, November 18, 2025. The presentation will begin at approximately 1:20 p.m. Eastern Time and will be webcast live. The webcast will be accessible at Moody’s Investor Relations website, ir.moodys.com.

2025-11-10

AI Is Upending Jobs. Corporate Tech and HR Are Teaming Up to Figure It Out.

Description: IT and HR departments are coming together to manage the workforce disruption wrought by AI—and quell employee fears around the technology.

Tryg Forsikring A/S mandates Restricted Tier 1 Capital Notes transaction

Description: NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION Tryg Forsikring A/S mandates Restricted Tier 1 Capital Notes transactionTryg Forsikring A/S (the Issuer), rated A1 (Positive) by Moody's, has mandated Danske Bank and Nordea as Joint Lead Managers to arrange a digital fixed income investor meeting on Monday 10 November 2025

2025-11-09

2025-11-08

2025-11-07

Moody's (NYSE:MCO) Ticks All The Boxes When It Comes To Earnings Growth

Description: The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even...

2025-11-06

Wabash, tied down in a weak trailer market, gets a debt downgrade

Description: For the second time this year, Moody’s Investors Service has downgraded the debt rating of trailer manufacturer Wabash National. The latest move takes the company’s corporate family rating (CFR) to B2 from B1. Other changes implemented by Moody’s Wednesday were to take Wabash’s probability of default rating to B2-PD from B1-PD, and to cut its […] The post Wabash, tied down in a weak trailer market, gets a debt downgrade appeared first on FreightWaves.

2025-11-05

America's $15 Billion-a-Week Shutdown Meltdown: The Economy Is Starting to Crack

Description: The longest government shutdown in U.S. history is turning from political standoff to full-blown economic risk.

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

How Bad Could the Private-Credit Crisis Get? Just Look at 1929.

Description: Moody’s warns of banks’ $300 billion exposure to private credit, noting rapid loan growth often precedes asset-quality deterioration.

Moody's (NYSE:MCO) shareholders have earned a 24% CAGR over the last three years

Description: Thanks in no small measure to Vanguard founder Jack Bogle, it's easy buy a low cost index fund, which should provide...

2025-10-30

How Bad Could the Private-Credit Crisis Get? Just Look at 1929.

Description: Moody’s warns of banks’ $300 billion exposure to private credit, noting rapid loan growth often precedes asset-quality deterioration.

2025-10-29

NYSE Content Advisory: Pre-Market Update + S&P 500 Hits 6,900 for First Time

Description: The New York Stock Exchange (NYSE) provides a daily pre-market update directly from the NYSE Trading Floor. Access today's NYSE Pre-market update for market insights before trading begins.

5 Must-Read Analyst Questions From Moody's’s Q3 Earnings Call

Description: Moody’s third quarter results topped analyst expectations, supported by robust revenue growth across both its credit ratings and analytics segments. Management pointed to a surge in debt issuance activity, particularly in leveraged finance and private credit, as a key driver. CEO Rob Fauber noted, “Markets closed with the busiest September on record, and Moody’s notched a new record of our own.” The company also benefited from tight credit spreads and heightened demand in specialty areas like da

2025-10-28

Insuring Against an Oracle Default Is Getting Costlier. Is It a Bad Omen for AI?

Description: As Oracle pours money into artificial intelligence, investors are finding it more and more expensive to insure against a potential AI meltdown. The price of Oracle’s five-year credit default swaps hit their highest point in more than two years earlier this month and now sit just below that peak. A credit default swap acts as insurance for corporate debt, with the buyer receiving a payout if the company can’t repay its bonds.

2025-10-27

2025-10-26

2025-10-25

Moody’s Puts France on Watch for a Credit Downgrade. Why It’s Become a ‘Hot Mess.’

Description: France has its issues, and credit-rating firm Moody’s is finally acknowledging them. Moody’s changed its outlook on French government bonds to Negative from Stable. The firm rates France’s bonds Aa3, the equivalent of AA-, and a downgrade would bring them to A1.

Is Moody's (MCO) Record Q3 Earnings and Upbeat Guidance Shaping Its Long-Term Growth Story?

Description: Moody's Corporation recently announced its third-quarter 2025 results, reporting record revenue of US$2.01 billion and adjusted earnings per share of US$3.92, both exceeding analyst expectations, alongside an upward revision to its full-year earnings guidance. The company attributed this performance to strong growth in both its Moody’s Analytics and Investors Service divisions, margin expansion, and continued investments in artificial intelligence and international expansion...

2025-10-24

Moody’s Puts France on Watch for a Credit Downgrade. Why It’s Become a ‘Hot Mess.’

Description: France has its issues, and credit-rating firm Moody’s is finally acknowledging them. Moody’s changed its outlook on French government bonds to Negative from Stable. The firm rates France’s bonds Aa3, the equivalent of AA-, and a downgrade would bring them to A1.

Moody’s Named #1 in Chartis RiskTech100® for the Fourth Year Running

Description: NEW YORK, October 24, 2025--Moody’s Corporation (NYSE: MCO) has been named the #1 company in the 2026 Chartis RiskTech100® report, marking the firm’s fourth straight year at the top of the ranking.

BFH Q3 Earnings & Revenues Beat Estimates, Credit Sales Rise Y/Y

Description: Bread Financial's third-quarter results reflect higher credit sales and reduced non-interest expenses, offset by lower average and end-of-period loans.

2025-10-23

Moody’s Named #1 in Chartis RiskTech100® for the Fourth Year Running

Description: NEW YORK, October 23, 2025--Moody’s Corporation (NYSE: MCO) has been named the #1 company in the 2026 Chartis RiskTech100® report, marking the firm’s fourth straight year at the top of the ranking.

MCO Q3 Deep Dive: Multi-Segment Growth Driven by Issuance, AI, and Margin Expansion

Description: Credit rating agency Moody's (NYSE:MCO) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10.7% year on year to $2.01 billion. Its non-GAAP profit of $3.92 per share was 6.4% above analysts’ consensus estimates.

2025-10-22

Moody's (MCO): Margin Improvement Reinforces Bullish Narratives Despite Valuation Premium

Description: Moody’s (MCO) reported strong earnings with net profit margins climbing to 29.2%, up from last year’s 28.3%. Earnings per share continued to impress, with recent growth of 14.7% over the past year. This outpaced the company’s 5-year annual average of -0.1%. The numbers show high-quality earnings and improved profitability. However, with revenue forecast to grow 6.9% per year and earnings set for 13.1% annual growth, both figures are expected to trail the broader US market. See our full...

Moodys Corp (MCO) Q3 2025 Earnings Call Highlights: Record Revenue and Strong Growth Amid Challenges

Description: Moodys Corp (MCO) reports over $2 billion in quarterly revenue with significant margin improvements, while navigating economic and geopolitical uncertainties.

Moody's Q3 Earnings Beat Estimates on Y/Y Revenue Growth

Description: MCO posts strong Q3 results as revenues climb 10.7% y/y and earnings top estimates, prompting a raised full-year outlook.

Here's What Key Metrics Tell Us About Moody's (MCO) Q3 Earnings

Description: While the top- and bottom-line numbers for Moody's (MCO) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

The Zacks Analyst Blog Highlights Moodys, Stryker and CBRE

Description: Zacks highlights three wide-moat leaders Moody's, Stryker, and CBRE poised to deliver durable returns through strong fundamentals, innovation, and strategic expansion.

Moody's (MCO) Q3 Earnings and Revenues Surpass Estimates

Description: Moody's (MCO) delivered earnings and revenue surprises of +5.95% and +2.15%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Moody’s Lifts Outlook as Profit, Revenue Rise

Description: The New York credit-ratings and research company raised its full-year outlook after logging higher profit and revenue in the third quarter.

Moody’s (NYSE:MCO) Q3 Sales Beat Estimates

Description: Credit rating agency Moody's (NYSE:MCO) announced better-than-expected revenue in Q3 CY2025, with sales up 10.7% year on year to $2.01 billion. Its non-GAAP profit of $3.92 per share was 6.4% above analysts’ consensus estimates.

Moody's: Q3 Earnings Snapshot

Description: On a per-share basis, the New York-based company said it had profit of $3.60. Earnings, adjusted for costs related to mergers and acquisitions and restructuring costs, were $3.92 per share. The results beat Wall Street expectations.

Moody's Corporation Reports Results for Third Quarter 2025

Description: NEW YORK, October 22, 2025--Moody's Corporation (NYSE: MCO) today announced results for the third quarter 2025 and updated select metrics within its outlook for full year 2025.

2025-10-21

Weatherford Announces Third Quarter 2025 Results

Description: Third quarter revenue of $1,232 million increased 2% sequentiallyThird quarter operating income of $178 million decreased 25% sequentiallyThird quarter net income of $81 million decreased 40% sequentially; net income margin of 6.6%Third quarter adjusted EBITDA* of $269 million increased 6% sequentially; adjusted EBITDA margin* of 21.8% increased 74 basis points sequentiallyThird quarter cash provided by operating activities of $138 million and adjusted free cash flow* of $99 millionExpanded the

Top Stock Reports for Apple, Meta Platforms & JPMorgan

Description: Apple's Services surge, Meta's AI push, and JPMorgan's strong capital markets results headline today's top stock research picks.

Blackstone Set to Report Q3 Earnings: What's in the Cards?

Description: BX's Q3 results are expected to reflect strong earnings and revenue gains, driven by growth in AUM and segment revenues.

Buy 3 Wide Moat Stocks to Enhance Your Portfolio Returns in Q4

Description: MCO, SYK and CBRE stand out as wide moat stocks with strong growth forecasts and strategic expansions to boost portfolio resilience.

2025-10-20

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

Moody’s (MCO) Valuation in Focus After Analyst Upgrade and Revenue Growth Signals

Description: Raymond James recently moved its outlook on Moody's (MCO) to Market Perform, highlighting the company’s improved issuance activity and reduced valuation risk. Tighter credit spreads have continued to drive revenue within Moody’s dominant ratings business. See our latest analysis for Moody's. This latest analyst upgrade comes as Moody's share price has traded lower recently, with a 1-month share price return of -7.96% and a year-to-date decline of 0.38%. Despite this short-term softness, the...

2025-10-18

2025-10-17

Will Moody's (MCO) Beat Estimates Again in Its Next Earnings Report?

Description: Moody's (MCO) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Moody’s upgraded ahead of Q3 on strong issuance boost

Description: Investing.com -- Raymond James upgraded Moody’s to Market Perform from Underperform ahead of the company’s third-quarter results on stronger issuance activity and reduced downside risk to its valuation multiple.

Insights Into Moody's (MCO) Q3: Wall Street Projections for Key Metrics

Description: Besides Wall Street's top-and-bottom-line estimates for Moody's (MCO), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.