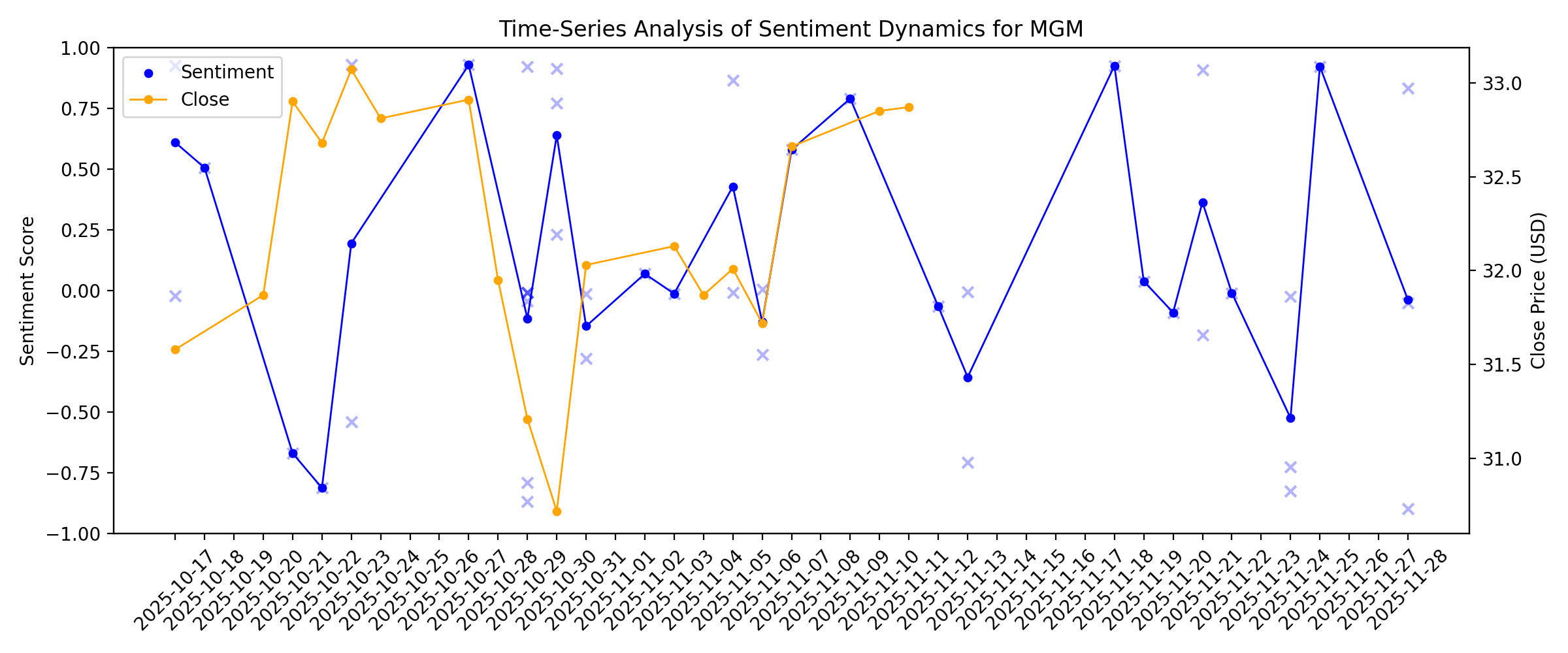

News sentiment analysis for MGM

Sentiment chart

2026-01-14

What to Expect From MGM Resorts' Q4 2025 Earnings Report

Description: MGM Resorts is all set to announce its fiscal fourth-quarter earnings next month, and analysts project a double-digit profit growth.

Roblox (RBLX) Surges 10.5%: Is This an Indication of Further Gains?

Description: Roblox (RBLX) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

2026-01-13

Three Stocks That May Be Undervalued In January 2026

Description: As the U.S. stock market navigates through a landscape of record highs and inflationary pressures, investors are keenly assessing the implications of recent consumer price index data and corporate earnings reports. In this environment, identifying undervalued stocks requires a careful analysis of fundamentals and market sentiment, offering potential opportunities for those looking to capitalize on discrepancies between current valuations and intrinsic worth.

Zip Launches Enterprise Transformation Office, Tapping Former Fortune 500 CPOs to Guide Procurement Leaders Through AI-Era Change

Description: SAN FRANCISCO, January 13, 2026--Zip Launches Enterprise Transformation Office, Tapping Former Fortune 500 CPOs to Guide Procurement Leaders Through AI-Era Change

3 Stocks Estimated To Be Trading At Discounts Of Up To 40.7%

Description: As the U.S. stock market reaches new highs, buoyed by investor confidence despite recent political developments, attention turns to identifying opportunities that may be undervalued amidst this bullish environment. In such a climate, discerning investors often seek stocks trading at significant discounts to their intrinsic value, offering potential for future appreciation while navigating the complexities of current economic conditions.

2026-01-12

3 Stocks Estimated To Be Trading At A Discount In January 2026

Description: As the U.S. stock market navigates a mixed landscape with major indices showing varied performances and precious metals reaching record highs, investors are closely watching economic indicators and political developments that could influence market dynamics. In this environment, identifying undervalued stocks can be particularly appealing, as these opportunities may offer potential value when broader market conditions create uncertainty.

3 Stocks Estimated To Be Undervalued By Up To 36.9%

Description: As the Dow and S&P 500 close at record highs, reflecting a strong start to 2026, investors are keenly observing the broader market dynamics shaped by recent economic indicators and policy developments. In this environment of heightened market performance, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities amidst these record-setting indices.

2026-01-11

2026-01-10

2026-01-09

January 2026's Trio of Stocks That May Be Trading Below Estimated Value

Description: As the U.S. stock market experiences a surge, with the S&P 500 reaching new all-time highs and major indexes poised for weekly gains, investors are keenly observing opportunities amidst mixed economic signals like a falling unemployment rate. In this environment of fluctuating indices and evolving economic policies, identifying stocks that may be trading below their estimated value could offer potential avenues for growth and diversification.

3 Stocks That May Be Trading Below Their Estimated Intrinsic Value

Description: As the U.S. stock market shows mixed signals with the Dow Jones Industrial Average advancing while the Nasdaq faces pressure from data-storage shares, investors are closely watching for opportunities in undervalued stocks. In such a fluctuating environment, identifying stocks that may be trading below their estimated intrinsic value can offer potential avenues for growth and stability amidst broader market uncertainties.

2026-01-08

3 Stocks That May Be Trading At An Estimated Discount Of Up To 21.8%

Description: As the U.S. stock market experiences mixed signals with major indices like the Dow Jones climbing while the Nasdaq faces pressure from data-storage shares, investors are keenly observing sectors and stocks that might offer value amidst this volatility. In such a climate, identifying undervalued stocks can be particularly appealing, as they present opportunities to capitalize on potential price corrections when broader economic conditions stabilize or improve.

Xanterra Travel Collection® and T-Mobile Arena Announce New Multi-Year Partnership Putting the Spotlight On The Oasis at Death Valley

Description: LAS VEGAS, January 08, 2026--Xanterra Travel Collection® and T-Mobile Arena Announce New Multi-Year Partnership Putting the Spotlight On The Oasis at Death Valley

3 Stocks That Might Be Priced Below Their True Value

Description: As the U.S. stock market navigates a period of volatility, marked by recent highs followed by declines in major indices like the S&P 500 and Dow Jones Industrial Average, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying stocks that might be priced below their true value can be crucial for investors seeking to capitalize on potential market inefficiencies.

2026-01-07

Assessing MGM Resorts (MGM) Valuation After Recent Share Price Weakness

Description: Why MGM Resorts International Has Come Onto Investors’ Radar MGM Resorts International (MGM) has drawn attention after a mixed run in its shares, with a recent 1 day return of about a 4.5% decline, but a roughly 5% gain over the past 3 months. See our latest analysis for MGM Resorts International. Despite the recent 1 day share price return of a 4.5% decline and a 7 day share price return of a 6.5% decline, MGM Resorts International’s 1 year total shareholder return of 4.4% and 5 year total...

2026-01-06

2026-01-05

2026-01-04

2026-01-03

MGM Resorts price target lowered to $45 from $47 at Truist

Description: Truist lowered the firm’s price target on MGM Resorts (MGM) to $45 from $47 and keeps a Buy rating on the shares. The firm cites “more conservatism” on the company’s Las Vegas Strip growth inflection for the target cut. November Strip gross gaming revenue dropped 1% year-over-year, primarily on lower table and baccarat win, the analyst tells investors in a research note. Truist reduced estimates for both MGM and Caesars (CZR) citing “soft” Strip RevPAR but views both stocks as “inexpensive” with

2026-01-02

Macau Gaming Revenue Falls Short; Las Vegas Sands, Wynn Resorts, MGM In Focus

Description: Macau gaming revenue rose 14.8% in December vs. a year earlier, less than expected. That could affect shares of Las Vegas Sands, Wynn Resorts and MGM.

2026-01-01

Macau Gaming Revenue Falls Short; Las Vegas Sands, Wynn Resorts, MGM In Focus

Description: Macau gaming revenue rose 14.8% in December vs. a year earlier, less than expected. That could affect shares of Las Vegas Sands, Wynn Resorts and MGM.

2025-12-31

2025-12-30

2025-12-29

Marriott hotel cracks down on perk many expect

Description: In 2025, multiple hotel brands have landed in hot water over something to do with the basic liquid that we all need for survival. At the end of October, MGM Resorts International President and CEO William Hornbuckle apologized for the sticker shock that many of the hotel giant's customers ...

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

What MGM’s Digital Expansion Means for Its Valuation After a 15% Share Price Jump

Description: If you are wondering whether MGM Resorts International is a quietly mispriced opportunity or fairly valued at current levels, you are not alone. That is exactly what we are going to unpack. After a 15.3% gain over the last 30 days but only 7.1% over the past year, the stock has been signaling shifting expectations around both its growth prospects and risk profile. Recent headlines have focused on MGM's ongoing digital expansion and strategic investments in its resort portfolio, which help...

Gap, Coinbase, Hyatt, MGM Resorts: Top Analyst Calls

Description: Yahoo Finance senior reporter Brooke DiPalma keeps track of several Wall Street analyst calls on top trending stocks, including calls around shares of Gap, Inc. (GAP), Coinbase Global (COIN), Hyatt Resorts (WYNN), and MGM Resorts International (MGM). To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Spotify initiated, Airbnb upgraded: Wall Street's top analyst calls

Description: Spotify initiated, Airbnb upgraded: Wall Street's top analyst calls

Here Are Wednesday’s Top Wall Street Analyst Research Calls: Ally Financial, CyberArk, Fortinet, Robinhood Markets, Salesforce, ServiceNow, Procter & Gamble, and More

Description: Pre-Market Stock Futures: Futures are trading higher on Wednesday as we reach the midpoint of the last full trading week of the year. Sellers once again took their toll on two of the major indices, while the Nasdaq squeaked out a minimal gain after being down around the noon hour. The most significant talking point ... Here Are Wednesday’s Top Wall Street Analyst Research Calls: Ally Financial, CyberArk, Fortinet, Robinhood Markets, Salesforce, ServiceNow, Procter & Gamble, and More

2025-12-16

MGM Resorts Stock: Is MGM Outperforming the Consumer Discretionary Sector?

Description: As MGM Resorts has outperformed its sector peers recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-15

Why IAC (IAC) Stock Is Trading Lower Today

Description: Shares of digital media conglomerate IAC (NASDAQGS:IAC) fell 3.1% in the afternoon session after Oppenheimer downgraded the company's stock to 'Perform' from 'Outperform,' citing concerns about its valuation.

2025-12-14

2025-12-13

What MGM Resorts International (MGM)'s Insider Buying and Zoox Partnership Means for Shareholders

Description: IAC Inc., a 10% shareholder of MGM Resorts International, recently disclosed buying about US$39.88 million of additional MGM stock, while T-Mobile Arena and autonomous ride-hailing firm Zoox agreed a multi-year venue partnership that will bring dedicated autonomous pickup and drop-off to the Las Vegas arena from early 2026. Together, increased insider ownership by IAC and MGM’s embrace of Zoox’s autonomous transport ecosystem highlight how influential stakeholders and new technology partners...

2025-12-12

3 Stocks Trading At Estimated Discounts Up To 49.3% Below Intrinsic Value

Description: In recent weeks, the U.S. stock market has experienced volatility, with technology stocks under pressure due to concerns about an AI bubble, even as the Dow Jones Industrial Average reached new highs before pulling back. Amidst these fluctuations, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value in a turbulent market environment. Understanding intrinsic value and recognizing discounts in stock prices can help investors make...

DraftKings' iGaming Up 25%: A Second Growth Engine Emerging?

Description: DKNG's 25% iGaming surge signals a steadier growth engine as upgrades and stronger customer metrics lift third-quarter momentum.

Huge Insider Buying in MGM and Salesforce

Description: As the year winds down, insiders make huge buys in MGM Resorts and Salesforce. However, those were not the only notable instances of insider buying seen recently.

2025-12-11

Zoox and T-Mobile Arena Join Forces for Futuristic Ride-Hailing

Description: LAS VEGAS, December 11, 2025--T-Mobile Arena and Zoox, the autonomous ride-hailing company, launched an agreement naming Zoox an Official Venue Partner of the Las Vegas arena

2025-12-10

2025-12-09

Tenant Concerns Lead Barclays to Lower VICI Target

Description: VICI Properties Inc. (NYSE:VICI) is included among the 15 Dividend Stocks Paying 4%+ Yield in 2025. On December 3, Barclays lowered its price target on VICI Properties Inc. (NYSE:VICI) to $33 from $37 and kept an Overweight rating on the shares. The firm adjusted its net lease estimates based on Q3 earnings and recent transactions. The […]

What to Watch With MGM Stock in 2026

Description: After outperforming its main competitor, next year could be a banner one for MGM Resorts International.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Netflix–Warner Bros. deal: 6 things to keep an eye on

Description: Netflix (NFLX) announced it has reached a deal to buy Warner Bros. (WBD). Yahoo Finance Executive Editor Brian Sozzi outlines six key aspects of the deal that he's paying particular attention to. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

2025-12-04

MGM Resorts (MGM): Reassessing Valuation After a Recent Share Price Rebound

Description: MGM Resorts International (MGM) has quietly put together a mixed performance, with shares up about 11% over the past month but still down roughly 5% over the past year. See our latest analysis for MGM Resorts International. That rebound reflects a shift in sentiment, with the 30 day share price return of 10.61% starting to counter a weak 1 year total shareholder return of about minus 5%. This hints that momentum is rebuilding from a low base. If MGM’s recent move has you rethinking the...

2025-12-03

Realty Income invests $800M in 2 Las Vegas resorts

Description: The perpetual preferred equity investment in Aria Resort & Casino and Vdara Hotel & Spa builds on the firm’s relationship with owner Blackstone Real Estate.

2025-12-02

Blackstone Sells the Yield, Keeps the Crown in Las Vegas

Description: Realty Income steps in with $800M for a preferred slice of CityCenter -- but Blackstone still runs the show.

MGM's BetMGM Expands Into Missouri With New Sportsbook & Mobile App

Description: MGM Resorts pushes deeper into Missouri as BetMGM launches mobile and in-person sports betting through its new partnership with Century Casinos.

Realty Income's $800M CityCenter Bet: Will Diversification Pay Off?

Description: O's $800M CityCenter move adds ARIA and Vdara exposure with a 7.4% return structure as the REIT pushes beyond its traditional footprint.

MGM rebrands NoMad Las Vegas as The Reserve at Park MGM

Description: The brand transition will take effect in mid-December, and the property is expected to join Marriott Bonvoy's Autograph Collection in early 2026.

2025-12-01

Realty Income Announces $800 Million Preferred Equity Investment in CityCenter Las Vegas Real Estate Assets

Description: Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company® and Blackstone Real Estate announced today a definitive agreement under which Realty Income will make an $800 million perpetual preferred equity investment in the real estate of CityCenter, comprised of the ARIA Resort & Casino and Vdara Hotel & Spa, which is owned by funds affiliated with Blackstone Real Estate. Blackstone Real Estate will retain 100% of the common equity ownership of the property, which will cont

Why These Casino Stocks May See a Bull Market, Even If the Rest of the Market Is Selling Off

Description: Whether you’re a gambling aficionado or not, most investors are well aware of how profitable casinos are. The house edge that they carry tends to produce very consistent profits over the long-term, given the law of large numbers. It’s hard to lose money running a gambling outfit, and that’s something that investors (and many municipal ... Why These Casino Stocks May See a Bull Market, Even If the Rest of the Market Is Selling Off

2025-11-30

2025-11-29

2025-11-28

How the Narrative Around MGM Resorts Is Shifting Amid Changing Analyst Expectations and Market Trends

Description: MGM Resorts International stock has recently seen its consensus analyst price target revised downward from $44.15 to $42.50. This move reflects updated expectations for the company’s near-term prospects. While the discount rate has remained steady, analysts are balancing optimism around international operations with concerns over domestic market softness. Stay tuned to learn how investors can keep pace with these shifting valuations and analyst outlooks for MGM stock. Analyst Price Targets...

Why Is MGM (MGM) Up 13.2% Since Last Earnings Report?

Description: MGM (MGM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

MGM Resorts (MGM) Jumps 6.9% After F1 Visitor Surge and BetMGM Record—Is Momentum Sustainable?

Description: MGM Resorts International recently benefited from the Las Vegas F1 weekend, attracting around 150,000 extra visitors, full hotel occupancy, and record-setting activity on its BetMGM platform. This surge in engagement coincided with the company announcing plans to hire 12,000 staff for its upcoming MGM Osaka project, reflecting ongoing growth ambitions. We'll examine how the record Las Vegas event attendance and BetMGM milestones might influence MGM's broader investment narrative and...

2025-11-27

2025-11-26

2025-11-25

Why Are MGM Resorts (MGM) Shares Soaring Today

Description: Shares of hospitality and casino entertainment company MGM Resorts (NYSE:MGM) jumped 6.1% in the afternoon session after the recent Las Vegas F1 weekend provided a significant boost to the company, attracting a large number of visitors and setting new betting records.

2025-11-24

1 Value Stock with Competitive Advantages and 2 We Avoid

Description: Value stocks typically trade at discounts to the broader market, offering patient investors the opportunity to buy businesses when they’re out of favor. The key risk, however, is that these stocks are usually cheap for a reason – five cents for a piece of fruit may seem like a great deal until you find out it’s rotten.

Are MGM Stock Investors Happy, Or Did They Miss Out?

Description: They say the house always wins, but investors in this top gaming stock likely don't feel that way.

Are CZR Stock Investors Happy, or Did They Miss Out?

Description: Five years after the merger that created "new Caesars," this casino stock has been a consistent source of frustration and value destruction.

2025-11-23

2025-11-22

Is MGM a Bargain After a 13.9% Share Price Drop and New Resort Expansion?

Description: Thinking about whether MGM Resorts International is a bargain or overpriced right now? You are not alone, as plenty of investors are looking for the smartest way to value the stock in today’s market. Over the last year, MGM’s share price has dropped by 13.9%, while this year it is down 3.3%. The past five years have actually seen a gain of 13.8%. Several headlines have caught investor attention, including the company’s expansion efforts and new resort developments, as well as industry-wide...

2025-11-21

Hyatt Hotels, MasterCraft, and MGM Resorts Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

Nvidia resumed, Palo Alto downgraded: Wall Street's top analyst calls

Description: Nvidia resumed, Palo Alto downgraded: Wall Street's top analyst calls

2025-11-20

MGM CEO just apologized to guests over high prices

Description: While the hotel industry sees growth amid strong travel numbers in many parts of the world, the high costs of operations, which to some extent gets passed on to visitors, is the primary roadblock for both small family-owned spots and global chains. At the end of October, hotel giant MGM Resorts ...

2025-11-19

MGM Resorts (MGM): Reassessing Valuation After Share Price Decline and Changing Market Sentiment

Description: MGM Resorts International (MGM) shares have seen moderate movement over the past week, giving investors reason to reexamine its valuation. The company's year-to-date performance highlights shifts in both consumer sentiment and sector dynamics. See our latest analysis for MGM Resorts International. MGM Resorts International's share price continues to reflect shifting market sentiment, with recent dips adding to a year-to-date decline of 6.7%. The one-year total shareholder return stands at...

2025-11-18

Is DraftKings Still on Track for Sustainable Profitability in 2026?

Description: DKNG signals its profit path stays intact as third-quarter volatility eases and product expansion, partnerships and handle growth bolster its 2026 outlook.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

DraftKings Stock Down 28% in Three Months: Buy the Dip or Stay Away?

Description: DKNG's 27.8% slide follows weak third-quarter results, softer 2025 guidance and rising spend on new products and media partnerships.

EVERBAY CAPITAL RELEASES FOLLOW-UP LETTER TO GOLDEN ENTERTAINMENT'S BOARD OF DIRECTORS, EXPRESSING SIGNIFICANT CONCERNS ABOUT THE ANNOUNCED TRANSACTIONS

Description: Today, Everbay Capital LP ("Everbay"), a New York-based alternative investment management firm, which manages funds which have been shareholders of Golden Entertainment Inc. (NASDAQ: GDEN), a Minnesota corporation (the "Company"), since 2021, released a new letter to the Company's Board of Directors, following up on the letter it sent last week. In the new letter, Everbay expresses significant concerns regarding the transactions announced last week, including the sale of the company's casino rea

2025-11-12

Clairvest Reports Fiscal 2026 Second Quarter Results

Description: TORONTO, Nov. 12, 2025 (GLOBE NEWSWIRE) -- Clairvest Group Inc. (TSX: CVG) today reported results for the fiscal 2026 second quarter and six months ended September 30, 2025. (All figures are in Canadian dollars unless otherwise stated) Highlights September 30, 2025 book value was $1,154 million or $83.92 per share compared with $1,260 million or $88.94 per share as at June 30, 2025.Net loss for the quarter ended September 30, 2025 was $76.8 million or $5.43 per share. The net loss for the quarte

2025-11-11

2025-11-10

2025-11-09

How MGM's Shift in Las Vegas Pricing and Q3 Losses (MGM) Has Changed Its Investment Story

Description: MGM Resorts International reported third quarter earnings showing revenue growth to US$4.25 billion but moving from net income to a net loss of US$285.26 million, with loss per share of US$1.05 compared to earnings per share of US$0.61 a year earlier. Management acknowledged recent pricing and occupancy challenges at Las Vegas properties, with the CEO taking steps to adjust pricing and improve value perceptions as bookings started to recover following a decline in visitation. We'll examine...

2025-11-08

2025-11-07

Bellagio and Major Food Group Unveil CARBONE RIVIERA, Ushering in a New Era of Fine Dining on the Las Vegas Strip

Description: Set against the unrivaled backdrop of the Fountains of Bellagio, CARBONE RIVIERA is now open, ushering in a new chapter of the CARBONE brand. Created by Major Food Group (MFG) co-founders Mario Carbone, Jeff Zalaznick and Rich Torrisi, in partnership with MGM Resorts International, the restaurant is poised to rank among the world's best fish restaurants located in one of the city's most storied dining rooms.

2025-11-06

Bear of the Day: MGM Resorts International (MGM)

Description: MGM Resorts fell short of our Q3 earnings estimate on October 29 and provided downbeat guidance, earning it a Zacks Rank #5 (Strong Sell).

nVent Electric and MGM Resorts International have been highlighted as Zacks Bull and Bear of the Day

Description: nVent Electric and MGM Resorts International have been highlighted as Zacks Bull and Bear of the Day

2025-11-05

Do Wall Street Analysts Like MGM Resorts Stock?

Description: MGM Resorts has considerably underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

5 Must-Read Analyst Questions From MGM Resorts’s Q3 Earnings Call

Description: MGM Resorts faced a challenging third quarter, with revenue growth meeting Wall Street expectations but profitability metrics missing analyst forecasts. Management attributed the margin pressure to several factors, including higher insurance expenses, renovation disruptions at MGM Grand, and softer occupancy and room rates, especially at mid-tier properties. CEO Bill Hornbuckle acknowledged, “We lost control of the narrative over the summer,” citing guest sensitivity to value in Las Vegas and th

2025-11-04

2025-11-03

Barry Diller’s IAC Inks AI Deal With Microsoft. That Isn’t Why the Stock Is Sliding.

Description: The publishing giant also has a partnership with ChatGPT owner OpenAI. Investors are worried about slumping revenue.

2025-11-02

How Recent Trends Are Rewriting the Story for MGM Resorts

Description: MGM Resorts International's consensus analyst price target has been trimmed from $46.68 to $44.21, reflecting shifting valuations as new data emerges. Contributors point to both strengthening trends in Macau and increased caution surrounding Las Vegas revenues as well as recent market softness. For those monitoring the evolving story, staying alert to updated analyst perspectives will be key to understanding what lies ahead for MGM Resorts' stock narrative. Stay updated as the Fair Value for...

2025-11-01

2025-10-31

Caesars Made a Bet on Las Vegas. Now It’s Paying For It.

Description: The casino operator saw its shares fall 15% after its quarterly earnings, mostly attributable to weak Las Vegas revenue. After the pandemic, and with the gambling industry changing, putting most of its chips on Vegas might not have been such a good idea.

Vanguard Bought $3.5 Billion of This Gaming Stock That’s Down 26%. Time to Buy, Too?

Description: Investors often turn to 13F filings from institutional giants to gain insights into smart money moves. These quarterly reports reveal what hedge funds, asset managers, and other big players are buying or selling, offering a window into their extensive research and analysis on companies. It’s not about blindly copying their trades — after all, these ... Vanguard Bought $3.5 Billion of This Gaming Stock That’s Down 26%. Time to Buy, Too?

2025-10-30

MGM Resorts Q3 Earnings Miss Estimates, Revenues Rise Y/Y, Stock Down

Description: MGM posts mixed Q3 results as earnings miss estimates but revenues edge higher, fueled by MGM China and digital growth.

MGM Resorts revenue dragged down by continuing losses in Las Vegas

Description: Growth in China and from its digital division helped stem Q3 losses as the company looks to fourth-quarter stabilization following the divestment of its Northfield Park operations.

MGM Q3 Deep Dive: Margin Pressure and Portfolio Moves Shape Outlook

Description: Hospitality and casino entertainment company MGM Resorts (NYSE:MGM) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.6% year on year to $4.25 billion. Its non-GAAP profit of $0.24 per share was 19.9% below analysts’ consensus estimates.

2025-10-29

Evaluating MGM Resorts (MGM) Stock Value After Recent 15% Decline in Share Price

Description: MGM Resorts International (MGM) stock has drifted over the past month, declining about 15%. Investors might be taking a closer look at recent trends, considering reasons behind the steady slide and possible directions from here. See our latest analysis for MGM Resorts International. The recent slide in MGM Resorts International’s share price has caught some attention, especially given that its 30-day share price return of -14.6% stands out, and the 1-year total shareholder return has fallen...

Here's What Key Metrics Tell Us About MGM (MGM) Q3 Earnings

Description: Although the revenue and EPS for MGM (MGM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

MGM Resorts’s (NYSE:MGM) Q3 Earnings Results: Revenue In Line With Expectations

Description: Hospitality and casino entertainment company MGM Resorts (NYSE:MGM) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.6% year on year to $4.25 billion. Its non-GAAP profit of $0.24 per share was 19.9% below analysts’ consensus estimates.

MGM Resorts (MGM) Q3 Earnings Miss Estimates

Description: MGM (MGM) delivered earnings and revenue surprises of -35.14% and +0.82%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

MGM Resorts Swings to Loss on Charges Tied to N.Y. Casino

Description: The Las Vegas-based hotel and casino operator bottom line was hit by a $256 million noncash goodwill impairment charge tied to withdrawing an application for a New York casino.

MGM: Q3 Earnings Snapshot

Description: LAS VEGAS (AP) — MGM Resorts International (MGM) on Wednesday reported a loss of $285.3 million in its third quarter. On a per-share basis, the Las Vegas-based company said it had a loss of $1.05. Earnings, adjusted for non-recurring costs, were 24 cents per share.

Trouble in Vegas? Caesars Entertainment Stock Tumbles on Earnings.

Description: Shares of Caesars Entertainment tumbled Wednesday after the casino operator reported disappointing quarterly earnings, driven in part by weak results in Las Vegas. Caesars is on pace for its fifth annual loss in six years. While revenue in regional casinos grew, Las Vegas revenue—it accounts for about one-third of Caesars’ business—dropped 9.8% from a year ago.

2025-10-28

2025-10-27

MGM Resorts Gears Up to Report Q3 Earnings: Here's What to Expect

Description: MGM's Q3 results are likely to reflect solid growth in MGM China and digital operations, partly offset by higher costs and renovation impacts.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Las Vegas Sands Stock Tops the S&P 500. The Gambling Industry Is Having a Wild Day.

Description: Las Vegas Sands was the top-performing stock in the Thursday after the casino operator reported quarterly earnings that exceeded Wall Street’s expectations. Las Vegas Sands stock climbed 12% Thursday to $56.69, putting it on pace for its largest single-day gain since Sept. 26, 2022, according to Dow Jones Market Data. The company had a particularly strong quarter at its Marina Bay Sands resort in Singapore, where revenue grew 56% from a year before.

Roblox (RBLX) Expected to Beat Earnings Estimates: What to Know Ahead of Q3 Release

Description: Roblox (RBLX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-22

Earnings Preview: MGM Resorts (MGM) Q3 Earnings Expected to Decline

Description: MGM (MGM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-21

MGM Resorts International (MGM) Sells MGM Northfield Park Operations to Private Equity Funds Managed by Clairvest Group

Description: Fisher Asset Management holds $4.10 million worth of MGM Resorts International (NYSE:MGM) shares, helping it secure a place on our list of billionaire Ken Fisher’s 10 consumer stock picks with the highest upside potential. On October 16, 2025, in a $546 million cash deal, MGM Resorts International (NYSE:MGM) announced the sale of the operations of […]

2025-10-20

2025-10-19

2025-10-18

MGM Is Out of New York Casino Competition. Here's Why it May Be Good for the Stock.

Description: MGM looked primed to land one of the three New York City-area casino licenses, but it surprisingly dropped out of the fray. That could be a long-term positive for investors.

2025-10-17

MGM Resorts to Sell MGM Northfield Park Operations for $546M

Description: MGM is divesting its MGM Northfield Park operations for $546 million, boosting liquidity and trimming annual rent costs by $54 million.

BetMGM’s Positive Cash Flow Could Be a Game Changer for MGM Resorts International (MGM)

Description: Earlier this week, BetMGM, a joint venture between MGM Resorts International and Entain, announced a strong third-quarter performance, with net revenue rising 23% year-over-year and full-year guidance increased, reflecting growth in iGaming and online sports betting. The announcement that BetMGM will distribute at least US$200 million to its parent companies signals a material shift, showing online gaming is now a consistent contributor to MGM Resorts International’s cash flow. We'll...

Looking at the Narrative for MGM as Analyst Views Shift After Recent Developments

Description: MGM Resorts International stock has seen its consensus analyst price target inch down from $47.92 to $46.68 per share, signaling a modest downward revision. This change reflects recent analyst commentary, which highlights factors such as performance trends in Las Vegas and Macau, evolving capital decisions, and broader industry dynamics that are shaping investor sentiment. Stay tuned to discover how investors can remain informed as these narratives continue to evolve. What Wall Street Has...