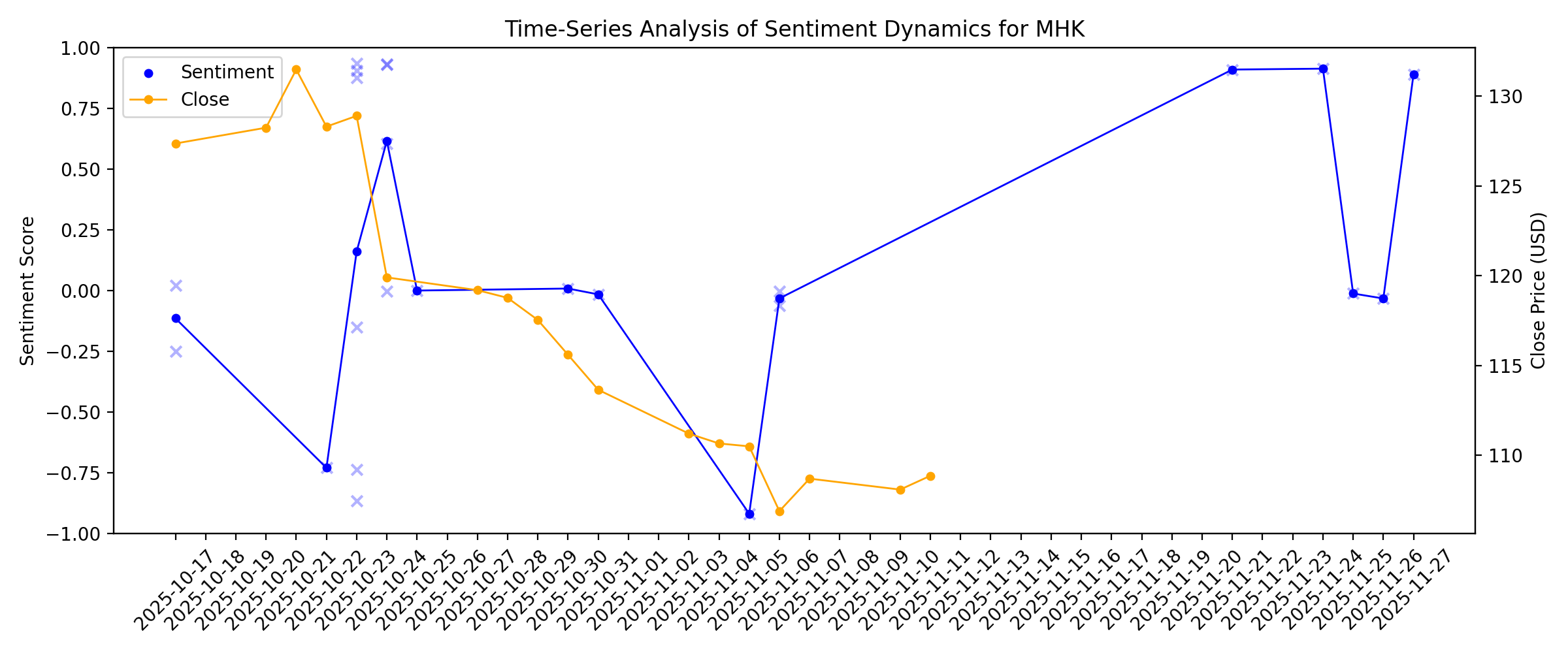

News sentiment analysis for MHK

Sentiment chart

2026-01-14

Returns On Capital At Mohawk Industries (NYSE:MHK) Have Stalled

Description: What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly...

2026-01-13

2026-01-12

Mohawk Industries Earnings Preview: What to Expect

Description: Mohawk Industries will release its fourth-quarter earnings soon, and analysts anticipate a low single-digit bottom-line growth.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Churchill Downs, Boyd Gaming, Mohawk Industries, Wyndham, and Marriott Vacations Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investors wagered geopolitical tension would be contained following the U.S. military's operation in Venezuela, with the Dow hitting a fresh record.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Soft Housing Clouds Mohawk Industries, Inc. (MHK)’s Upside

Description: Mohawk Industries, Inc. (NYSE:MHK) is among the ridiculously cheap stocks to buy now. As of December 26, Mohawk Industries, Inc. (NYSE:MHK) has drawn a mixed response from analysts, with 47% recommending buying the stock and the remaining 53% maintaining a neutral stance. With a median price target of $138.50, the stock exhibits an upside potential […]

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

Is Mohawk’s Index Shuffle Reshaping The Investment Case For Mohawk Industries (MHK)?

Description: In December 2025, Mohawk Industries, Inc. (NYSE:MHK) was removed from the S&P 500 Equal Weighted Index and subsequently added to both the S&P 1000 and the Russell Small Cap Comp Value Index, reshaping its position across major US equity benchmarks. These index shifts can alter how many institutional and passive funds hold Mohawk’s shares, potentially changing trading volumes, liquidity, and the stock’s investor base. We’ll now examine how Mohawk’s shift into the S&P 1000 and a Russell...

Mohawk Industries (MHK): Valuation Check After Rapid S&P and Russell Index Shuffles

Description: Mohawk Industries (MHK) has been on an index rollercoaster this month, getting dropped from the S&P 500 Equal Weighted index, then quickly added to both the S&P 1000 and Russell Small Cap Value Index. See our latest analysis for Mohawk Industries. Those rapid index shifts have put Mohawk back on traders’ radar, with index-linked buying helping to steady the share price around $110.03. This comes even as its 90-day share price return of minus 12.36 percent contrasts with a stronger three-year...

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Mohawk Industries Stock: Is MHK Underperforming the Consumer Discretionary Sector?

Description: Mohawk has underperformed the broader consumer discretionary sector over the past year. However, Wall Street analysts remain moderately optimistic about its prospects.

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

Mohawk Industries (MHK): Assessing Undervaluation After a Year of Weak Share Price Momentum

Description: Mohawk Industries (MHK) has been grinding through a tough stretch, with shares down about 19% over the past year, even as revenue and net income ticked higher, a setup value focused investors tend to notice. See our latest analysis for Mohawk Industries. Over the past year, Mohawk’s share price return of around negative 19% and a five year total shareholder return of roughly negative 20% suggest momentum has been fading, even as earnings stabilise and investors reassess cyclical risk. If...

Ares Replaces Pop-Tarts Purveyor Kellanova on S&P 500

Description: Ares is a major player in the private-credit market, which is facing both a surge in popularity and mounting concerns.

2025-12-09

2025-12-08

These 3 Stocks Are Set to Join the S&P 500 Soon and Rising

Description: Carvana, CRH, and Comfort Systems USA shares climbed Monday after S&P Dow Jones Indices said the stocks are set to join the S&P 500.

2025-12-07

Carvana, Comfort Systems, CRH To Join S&P 500 Index. The Stocks Are Jumping.

Description: Carvana, Comfort Systems and CRH jumped on news they'll join the S&P 500 index before the open on Dec. 22. Vertiv and SoFi are notable snubs.

2025-12-06

2025-12-05

Carvana, Comfort Systems, CRH To Join S&P 500 Index. The Stocks Are Jumping.

Description: Carvana, Comfort Systems and CRH jumped on news they'll join the S&P 500 index before the open on Dec. 22. Vertiv and SoFi are notable snubs.

Carvana, CRH, Comfort Systems to join S&P 500 in rebalancing

Description: The companies will join the benchmark in a quarterly rebalance at the end of December, S&P Dow Jones Indices said Friday.

Carvana, CRH, and Comfort Systems USA to Join S&P 500

Description: CRH Carvana and Comfort Systems USA will join the S&P 500 as part of the benchmark index’s quarterly rebalancing, said S&P Dow Jones Indices after Friday’s market close. LKQ Solstice Advanced Materials and Mohawk Industries —companies with some of the smallest market values in the S&P 500—will be removed from the large-cap S&P 500 and demoted to the S&P 600 small-cap benchmark. The S&P 500 index is rebalanced each quarter, with new companies added if they meet the criteria of S&P Dow Jones Indices, which oversees the index.

CRH, Carvana and Comfort Systems USA Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600

Description: S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 22, to coincide with the quarterly rebalance. The changes ensure that each index is more representative of its market capitalization range. The companies being removed from the S&P SmallCap 600 are no longer representative of the small-cap market space.

2025-12-04

2025-12-03

2025-12-02

2025-12-01

3 Small-Cap Stocks We Find Risky

Description: Many small-cap stocks have limited Wall Street coverage, giving savvy investors the chance to act before everyone else catches on. But the flip side is that these businesses have increased downside risk because they lack the scale and staying power of their larger competitors.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Is Mohawk Industries a Hidden Opportunity After 10% Rally and Industry Shifts?

Description: Curious if Mohawk Industries is a hidden gem or an overlooked risk? You are not alone; many investors are looking to see if the company’s current price signals an opportunity. The stock recently jumped 10.4% over the last week, bouncing back after a tougher stretch with a 1-year return of -17.0%. Recent headlines highlight ongoing shifts in the flooring industry and renewed attention around raw material costs, which seem to have fueled recent price moves. News of supply chain improvements...

2025-11-26

How Analyst Opinions Are Shaping the Evolving Story for Mohawk Industries

Description: Mohawk Industries stock has recently seen a slight adjustment in its consensus analyst price target, moving down from $138.50 to $138.13. This marginal decrease is driven by new research insights. The modest shift reflects a blend of optimism and caution among analysts, as diverging views on future performance shape expectations. Stay tuned to discover how you can stay informed on the changing narrative for Mohawk Industries moving forward. Stay updated as the Fair Value for Mohawk Industries...

2025-11-25

3 Low-Volatility Stocks We Approach with Caution

Description: Stability is great, but low-volatility stocks may struggle to deliver market-beating returns over time as they sometimes underperform during bull markets.

2025-11-24

Mohawk Industries Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Mohawk Industries has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-11-23

2025-11-22

2025-11-21

PlayStudios, Sonos, Travel + Leisure, Inspired, and Mohawk Industries Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Mohawk Industries' (NYSE:MHK) Soft Earnings Are Actually Better Than They Appear

Description: Investors were disappointed with the weak earnings posted by Mohawk Industries, Inc. ( NYSE:MHK ). While the headline...

3 Cash-Producing Stocks We Steer Clear Of

Description: Generating cash is essential for any business, but not all cash-rich companies are great investments. Some produce plenty of cash but fail to allocate it effectively, leading to missed opportunities.

2025-11-05

Mohawk Industries Announces Planned Leadership Transition

Description: Chief Financial Officer James F. Brunk to retire next yearNicholas P. Manthey to succeed Brunk as next CFO, effective April 1, 2026 CALHOUN, Ga., Nov. 05, 2025 (GLOBE NEWSWIRE) -- Mohawk Industries, Inc. (NYSE: MHK) today announced that James F. Brunk, the Company’s Chief Financial Officer, plans to retire, effective April 1, 2026, and Nicholas P. Manthey, Vice President of Corporate Finance and Investor Relations, will succeed Mr. Brunk as Mohawk’s next chief financial officer. “It has been a p

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

3 S&P 500 Stocks with Questionable Fundamentals

Description: While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner. Some companies are past their prime, weighed down by poor execution, weak financials, or structural headwinds.

2025-10-30

Mohawk Industries’s Q3 Earnings Call: Our Top 5 Analyst Questions

Description: Mohawk Industries’ third-quarter results were met with a negative market reaction, reflecting investor concerns over deteriorating margins and persistent demand softness. Management highlighted that while sales and product mix benefited from premium residential and commercial offerings, higher input costs and temporary plant shutdowns weighed on profitability. CEO Jeff Lorberbaum noted, “Our adjusted earnings per share of $2.67 reflected benefits from ongoing productivity and restructuring initi

2025-10-29

2025-10-28

2025-10-27

2025-10-26

2025-10-25

Mohawk Industries (MHK): Profit Margin Drop Challenges Quality Narrative Despite Bullish Earnings Forecast

Description: Mohawk Industries (MHK) saw its earnings forecast climb to an impressive 19.92% growth per year. However, revenue is only expected to rise by 2.5% annually, noticeably lagging behind the US market’s projected 10% annual revenue growth. Net profit margins landed at 3.9%, down from last year’s 5.1%, marking a dip in profitability. Over the last five years, earnings have declined 26.3% each year with negative growth in the most recent period. Despite these challenges, the shares are trading at...

2025-10-24

MHK Q3 Deep Dive: Tariff Pressures, Cost Controls, and Margin Headwinds Dominate Outlook

Description: Flooring manufacturer Mohawk Industries (NYSE:MHK) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 1.4% year on year to $2.76 billion. Its non-GAAP profit of $2.67 per share was 1.2% above analysts’ consensus estimates.

Mohawk Industries Inc (MHK) Q3 2025 Earnings Call Highlights: Navigating Economic Challenges ...

Description: Despite economic headwinds, Mohawk Industries Inc (MHK) reports steady sales and strategic restructuring for future growth.

Why Mohawk Industries (MHK) Shares Are Plunging Today

Description: Shares of flooring manufacturer Mohawk Industries (NYSE:MHK) fell 7.1% in the afternoon session after the company reported third-quarter results and issued a weak fourth-quarter profit forecast that fell short of expectations. While Mohawk's third-quarter revenue increased 1.4% year on year to $2.76 billion, beating analyst expectations, its adjusted earnings per share of $2.67 fell from $2.90 in the same period a year earlier. However, the primary driver for the stock's decline was its guidance

Mohawk Q3 Earnings Miss, Revenues Beat Estimates, Stock Down

Description: MHK's Q3 earnings narrowly miss estimates, while revenues top forecasts as cost cuts and new product launches help offset inflation and tariffs.

2025-10-23

How the Narrative for Mohawk Industries Is Shifting Amid Analyst Upgrades and Buybacks

Description: Mohawk Industries' stock price target has seen a slight upward revision, rising from $135.94 to $139.06 per share. This reflects evolving analyst sentiment. The change is supported by a mix of optimism surrounding enhanced earnings estimates and higher sector valuation, along with some caution regarding the sources of this improvement. Readers interested in understanding the shifting narrative around Mohawk Industries will want to follow future updates closely as new developments continue to...

Mohawk Industries (MHK) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: While the top- and bottom-line numbers for Mohawk Industries (MHK) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Mohawk Industries (MHK) Q3 Earnings Miss Estimates

Description: Mohawk Industries (MHK) delivered earnings and revenue surprises of -0.37% and +1.13%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Mohawk Industries (NYSE:MHK) Posts Better-Than-Expected Sales In Q3

Description: Flooring manufacturer Mohawk Industries (NYSE:MHK) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 1.4% year on year to $2.76 billion. Its non-GAAP profit of $2.67 per share was 1.2% above analysts’ consensus estimates.

Mohawk Industries: Q3 Earnings Snapshot

Description: MHK) on Thursday reported third-quarter profit of $108.8 million. On a per-share basis, the Calhoun, Georgia-based company said it had profit of $1.75. Earnings, adjusted for one-time gains and costs, came to $2.67 per share.

Mohawk Industries Reports Q3 2025 Results

Description: CALHOUN, Ga., Oct. 23, 2025 (GLOBE NEWSWIRE) -- Mohawk Industries, Inc. (NYSE: MHK) today announced third quarter 2025 net earnings of $109 million and earnings per share (“EPS”) of $1.75; adjusted net earnings were $167 million, and adjusted EPS was $2.67. Net sales for the third quarter of 2025 were $2.8 billion, up 1.4% as reported and essentially flat on an adjusted basis versus the prior year. During the third quarter of 2024, the Company reported net sales of $2.7 billion, net earnings of

2025-10-22

Unlocking Q3 Potential of Mohawk Industries (MHK): Exploring Wall Street Estimates for Key Metrics

Description: Evaluate the expected performance of Mohawk Industries (MHK) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

2025-10-21

2025-10-20

2025-10-19

2025-10-18

2025-10-17

A Fresh Look at Mohawk Industries (MHK): Is the Stock Undervalued After Its Recent Rebound?

Description: Mohawk Industries (MHK) shares have moved modestly in recent trading, giving investors a reason to review the home flooring company’s recent results and business fundamentals. Let’s break down how the stock is shaping up right now. See our latest analysis for Mohawk Industries. Mohawk Industries' stock has shown renewed momentum recently, with an 8% share price gain over the past week and a 15% rebound in the last three months. However, its one-year total shareholder return is still down...

3 Unpopular Stocks with Warning Signs

Description: When Wall Street turns bearish on a stock, it’s worth paying attention. These calls stand out because analysts rarely issue grim ratings on companies for fear their firms will lose out in other business lines such as M&A advisory.