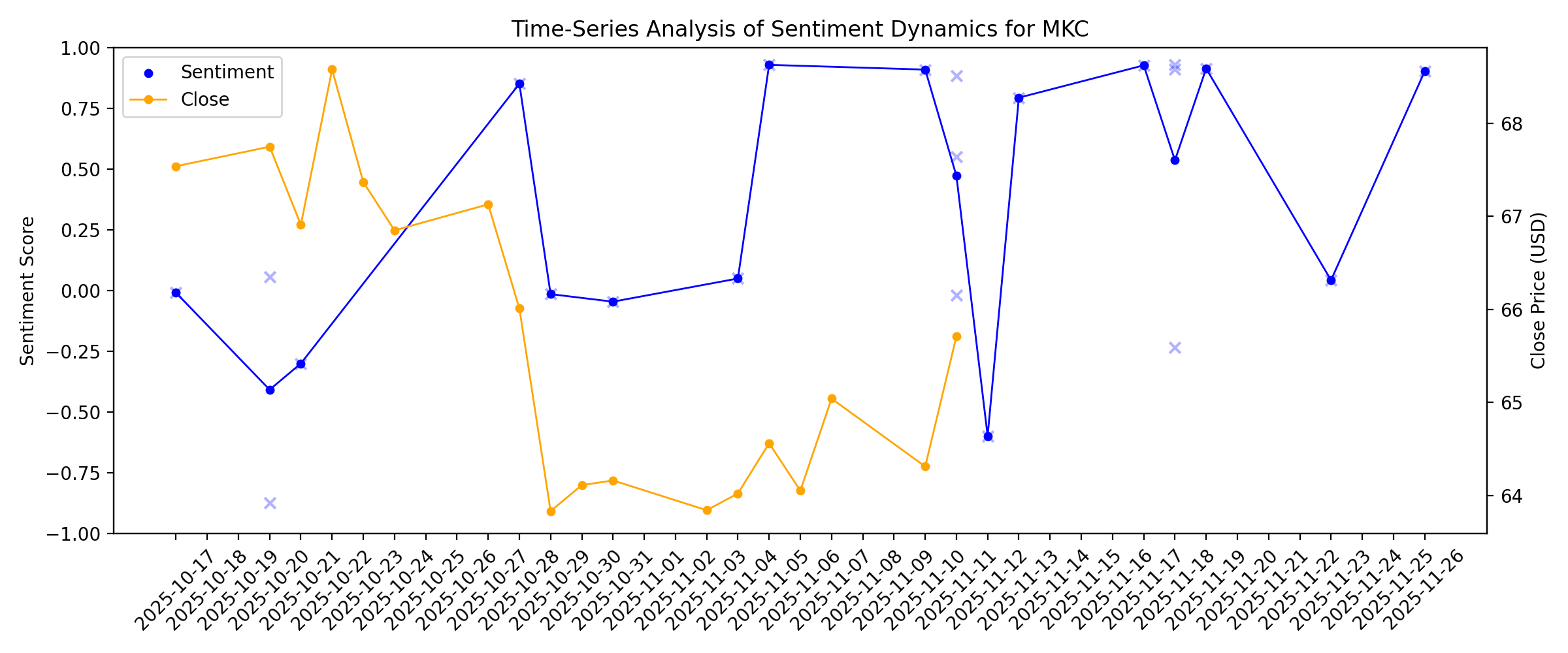

News sentiment analysis for MKC

Sentiment chart

2026-01-14

Can McCormick's Innovation & Distribution Wins Offset Cost Pressures?

Description: MKC delivers a fifth straight quarter of volume growth, using brand investment and innovation to offset cost pressures.

2026-01-13

Is Colgate's Cost Discipline Enough in a Softer Demand Cycle?

Description: CL is leaning on productivity, AI and cost discipline to offset input inflation and protect margins amid uneven demand.

Can Tyson Foods' Chicken Segment Drive Consistent Profit Growth?

Description: TSN's chicken unit has delivered strong margin gains and profit growth in fiscal 2025, but sustaining momentum hinges on execution and cost discipline.

Is McCormick’s (MKC) Paris Hilton Tie-Up a Glimpse Into Its Next Brand Chapter?

Description: In January 2026, McCormick & Company, Incorporated announced a two-year collaboration with Paris Hilton and her media company 11:11 Media, centered on a new ad campaign that links its spices, seasonings, and extracts to memorable film and TV moments. The partnership positions Hilton and 11:11 Media as multi-year partners to help McCormick engage a younger generation of consumers while balancing the brand’s heritage with what’s considered culturally “hot.” We’ll now look at how this Paris...

Are Sysco's U.S. Foodservice Operations Gaining Executional Traction?

Description: SYY's U.S. Foodservice highlights steady execution in Q1, with sales up 2.9% and local volumes stabilizing despite mixed demand.

2026-01-12

J.M. Smucker's Pet Food Sales Soft: Is Demand Normalizing Yet?

Description: SJM's Q2 pet food sales drop 7% as dog snacks lag, but pricing gains and margin expansion suggest demand is stabilizing.

2026-01-11

2026-01-10

2026-01-09

SMPL Stock Jumps 7% After Posting Earnings & Sales Beat in Q1

Description: Simply Good Foods jumps 7% after Q1 earnings and sales beat estimates, as Quest growth and margin recovery hopes offset year-over-year declines.

HELE Q3 Earnings Meet Estimates, Home & Outdoor Sales Decline Y/Y

Description: HELE's third-quarter earnings meet estimates as sales decline year over year, with Home & Outdoor weakness partly offset by Olive & June growth.

Service Corporation Revenue Mix: What's Powering the Top Line?

Description: SCI's Q3 revenue rose 4.4% as cemetery preneed gains outweighed mixed funeral trends, reshaping the company's top-line mix.

Lamb Weston Streamlines Global Footprint to Improve Efficiency

Description: LW plans to close its Munro plant in Argentina, shift Latin America output to Mar del Plata and curb a Netherlands line to cut costs and boost efficiency.

2026-01-08

Medifast Shifts to Metabolic Health: A Durable Growth Path?

Description: MED is pivoting to metabolic health, using clinical data and new products to address root causes beyond GLP-1 weight loss.

Constellation Brands Posts Q3 Earnings Beat, Soft Wine & Spirits Sales

Description: STZ beat Q3 estimates despite sales and earnings declines, as beer outperformed the industry and cash flow supported dividends and buybacks.

Church & Dwight Accelerates Innovation to Defend Market Share

Description: CHD is leaning on steady product innovation across power brands to defend market share and stay competitive in a promotion-heavy consumer market.

United Natural Foods' Natural vs. Conventional: Margin Divide Widens?

Description: UNFI's fiscal first quarter has shown a widening margin split as Natural sales jumped while Conventional volumes fell amid network optimization.

Flowers Foods Faces Margin Pressure: Can Profitability Recover?

Description: FLO posts 3% sales growth in Q3, but EBITDA, net income and margins slide as mix, volumes and Simple Mills costs weigh on profitability.

McCormick to Invest $750 Million for Majority Control of Mexican Joint Venture

Description: Company plans to raise its McCormick de Mexico stake to 75%, with accretion expected from 2026.

2026-01-07

2026-01-06

A Look At McCormick (MKC) Valuation After Recent Short-Term Share Price Gains

Description: What McCormick’s recent returns tell you McCormick (MKC) has drawn investor attention after a mixed stretch for the stock, with a 1 day return of 2.38%, a 7 day decline of 4.09%, and a month gain of 3.76%. Over longer periods, the stock shows pressure, with a past 3 months total return near flat, and negative total returns over the past year, 3 years, and 5 years. In that context, investors are looking at McCormick’s US$6.79b in revenue and US$778.0m in net income, along with its current...

McCormick Takes Majority Control in Mexico JV: Growth Lever in 2026?

Description: MKC boosts its Mexico presence by lifting its stake in McCormick de Mexico to 75%, gaining control and positioning the business for growth.

2026-01-05

Anne Bramman Elected to Morningstar’s Board of Directors

Description: CHICAGO, January 05, 2026--Morningstar, Inc. (Nasdaq: MORN), a leading provider of independent investment insights, today announced that Anne Bramman has been elected to Morningstar’s board of directors. Bramman currently serves as a board director and audit committee chair at McCormick & Company and as a senior advisor at Boston Consulting Group.

2026-01-04

2026-01-03

2026-01-02

McCormick Completes Acquisition of Controlling Interest in McCormick de Mexico

Description: McCormick & Company Inc. (NYSE: MKC) (the "Company"), a global leader in flavor, today announced that it has completed the acquisition of an additional 25% ownership interest in McCormick de Mexico from Grupo Herdez, increasing its ownership to 75%. The Company previously announced its agreement to expand ownership in McCormick de Mexico on August 21, 2025.

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

McCormick & Company's Quarterly Earnings Preview: What You Need to Know

Description: McCormick & Company is set to report its fourth-quarter results next month, and analysts expect a double-digit earnings growth.

2025-12-22

McCormick & Company to Report 2025 Fourth Quarter Financial Results on January 22, 2026

Description: McCormick & Company, Incorporated (NYSE: MKC), a global leader in flavor, is scheduled to conduct a conference call and webcast of its fourth quarter 2025 financial results on Thursday January 22, 2026, at 8:00 a.m. Eastern Time. Brendan Foley, Chairman, President & CEO; Marcos Gabriel, Executive Vice President & CFO; and Faten Freiha, Vice President of Investor Relations will be hosting the call. A live audio webcast of the call along with the accompanying presentation materials will be availab

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Is McCormick Now a Value Opportunity After Its Recent Share Price Rebound?

Description: Wondering if McCormick at around $68.65 is a flavorful bargain or still a bit too spicy for your portfolio? This breakdown is designed to help you decide with a clear, valuation-first lens. The stock has bounced recently, up about 6.7% over the last week and 6.3% over the past month, but it remains down roughly 9.5% year to date and 11.1% over the last year, which hints at a possible reset in expectations rather than a full recovery. Much of the recent share price action reflects shifting...

2025-12-17

Why McCormick (MKC) Is Up 6.7% After Volume-Led Beat Amid Rising Cost Pressures - And What's Next

Description: Earlier this week, McCormick reported quarterly revenues that exceeded analysts’ expectations, delivering its fifth consecutive period of volume-led growth despite ongoing cost pressures from the global trade environment. The update underscored how disciplined cost savings and agile operations are helping McCormick grow operating profit even as rising input costs weigh on gross margins. We’ll now explore how this stronger-than-expected, volume-led revenue performance could influence...

Why Analysts See McCormick’s Story Shifting Amid Margin Pressures and Reset Valuations

Description: McCormick's fair value estimate has edged down slightly from $76.92 to $76.17 per share, even as analysts mark up their expectations for revenue growth from 4.65% to 5.09%. This subtle recalibration reflects a stable 6.96% discount rate but a more cautious stance on how far the current narrative can stretch through 2026 amid mixed quarterly signals. Read on to see how you can track these evolving targets and stay ahead of the shifting story around McCormick's stock. Stay updated as the Fair...

2025-12-16

2025-12-15

McCormick's Q3 Volumes Gain Traction: What to Expect in 2026?

Description: MKC's volume-led momentum accelerates as consumer demand, share gains, and brand execution drive sustained growth into 2026.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

How Is McCormick’s Stock Performance Compared to Other Food & Beverage Stocks?

Description: McCormick & Company has notably underperformed compared to other food & beverage stocks, yet analysts remain moderately bullish on the stock’s prospects.

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

McCormick (MKC): Reassessing Valuation After a Year of Share Price Weakness and Earnings Growth

Description: McCormick (MKC) shares have been grinding lower this year, but the business itself is still quietly growing. Revenue and net income both increased in the latest annual period, even as the stock has lagged. See our latest analysis for McCormick. That said, the mood around the stock has cooled, with a double digit year to date share price return in negative territory and a similarly weak one year total shareholder return, suggesting investors are still cautious despite improving...

2025-12-03

OMP's AI-driven Unison Planning(TM) Platform Enhances Supply Chain Agility for McCormick & Co.

Description: ATLANTA, GEORGIA / ACCESS Newswire / December 3, 2025 /OMP is helping McCormick & Co., the global leader in flavor, with an AI-driven and autonomous operational planning initiative. This partnership enables McCormick to manage both assembly-to-order ...

2025-12-02

MKC's Q3 Shows Solid Consumer Momentum: Will the Strength Last in 2026?

Description: McCormick's consumer momentum strengthens as volume-led growth, broad share gains, and health-focused trends fuel demand across key categories.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Flavor Solutions Lifts MKC's Q3 Results: Will the Growth Last?

Description: MKC's Flavor Solutions posts steady Q3 volume gains and rising health-focused demand, though tariffs and costs pressure near-term margins.

2025-11-25

2025-11-24

2025-11-23

Does McCormick’s Rebound Signal a Fresh Opportunity After Analyst Upgrades in 2025?

Description: Wondering if McCormick is a smart buy now? You are not alone, as many investors are searching for signs that the spice giant is undervalued at today’s price. After a rocky start to the year, McCormick’s stock price has climbed 4.3% in the last week and 2.0% over the past month. However, it is still down by nearly 10% year-to-date. Recent analyst upgrades and growing speculation over food sector consolidation have fueled renewed interest in the stock. This renewed interest may highlight...

2025-11-22

2025-11-21

2025-11-20

2025-11-19

McCormick Raises Quarterly Dividend: A Look at Its Growth Strategy

Description: MKC lifts its quarterly dividend to 48 cents, marking 102 years of payouts and 40 straight increases.

2025-11-18

McCormick Announces Increase in Quarterly Dividend

Description: The Board of Directors of McCormick & Company, Incorporated (NYSE: MKC) today declared an increase in the quarterly dividend from $0.45 to $0.48 per share on its common stocks, payable January 12, 2026, to shareholders of record December 29, 2025. This marks the Company's 102nd year of continuous dividend payments and the 40th consecutive year it has increased its quarterly dividend.

Why Analysts See a Shifting Story for McCormick as Valuation and Growth Outlook Evolves

Description: McCormick’s consensus fair value estimate has decreased slightly and now sits at $76.92, following a previous target of $77.38. This adjustment comes as recent street research reflects both optimism and caution among analysts regarding the company’s valuation. Stay tuned to discover how investors and market watchers can keep pace with shifts in McCormick’s evolving stock narrative going forward. Stay updated as the Fair Value for McCormick shifts by adding it to your watchlist or portfolio...

Will McCormick Be Able to Sustain Its 2% Organic Growth in 2026?

Description: MKC posts its fifth straight quarter of volume-led growth as consumer demand and brand investment offset tariff and cost pressures.

2025-11-17

JPMorgan sees major EPS tailwinds for these food producers from new tariff relief

Description: Investing.com -- JPMorgan says newly announced tariff exemptions from the White House could deliver meaningful earnings upside for several major U.S. food producers, with Hershey, Smucker and McCormick positioned to benefit the most.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Are Wall Street Analysts Bullish on McCormick & Company Stock?

Description: While McCormick & Company has considerably lagged behind the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-12

BofA says AI excitement is eclipsing other investing opportunities

Description: Outside the AI trade, names that focus on premium offerings, tariff resilience, and consumer deals may offer hidden opportunities.

2025-11-11

BofA lists 16 stock opportunities away from AI

Description: Investing.com -- Bank of America analysts said investor enthusiasm around artificial intelligence has left a range of attractively valued companies overlooked, identifying 16 “non-AI” opportunities that combine solid earnings momentum with discounted valuations.

McCormick (MKC): Exploring the Valuation Case for This Spice Giant in 2024

Description: McCormick (MKC) stock is getting renewed attention from investors curious about its performance this year. With mixed returns over the past month and year, there are questions about where the company may be heading next. See our latest analysis for McCormick. McCormick’s recent price return of -15.25% year-to-date has weighed on sentiment, and its 1-year total shareholder return of -14.43% reflects a longer stretch of underperformance. While momentum has faded lately, investors are watching...

Is McCormick's (MKC) Gourmet Packaging Refresh a Strategic Play for Next-Gen Consumer Loyalty?

Description: Earlier this month, McCormick unveiled a major redesign of its Gourmet Collection packaging, featuring an updated look, gold screwcap lids, and transparent bottles for enhanced freshness and visibility, spanning 72 flavors with 54 organic varieties. This marks the first comprehensive update in over 30 years and is tailored to appeal to Millennial and Gen Z consumers who are driving demand for authenticity, responsible sourcing, and global flavor experiences in their cooking choices. We'll...

2025-11-10

Can McCormick's CCI Savings Maintain EPS Momentum in 2025?

Description: MKC leans on its CCI program savings to offset cost pressures and drive steady EPS growth in fiscal 2025.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

McCormick's Gross Margin Under Pressure: Will Q4 Show Relief?

Description: MKC battles cost pressures and tariff impacts but eyes a modest Q4 margin lift as savings initiatives gain traction.

2025-11-04

1 Consumer Stock with Competitive Advantages and 2 We Ignore

Description: Regarded as defensive investments, consumer staples stocks are generally safe bets in choppy markets. On the other hand, they usually underperform during bull runs, and this paradigm has rung true over the past six months as the sector’s -7.5% decline paled in comparison to the S&P 500’s 20% gain.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

1 Profitable Stock on Our Buy List and 2 We Question

Description: Even if a company is profitable, it doesn’t always mean it’s a great investment. Some struggle to maintain growth, face looming threats, or fail to reinvest wisely, limiting their future potential.

2025-10-30

2025-10-29

Is There Now an Opportunity in McCormick After a 12.7% Share Price Drop?

Description: If you are watching McCormick, you are definitely not alone. With all the talk lately about which food giants are still spicing up portfolios, it is natural to wonder: is MKC finally primed for a comeback, or are we looking at a company still searching for direction in a shifting market? Let us start with the obvious. The stock has not had the smoothest ride. In just the past year, McCormick’s share price has slipped by 12.7%, and over five years, it is down 22.3%. Even shorter-term figures...

2025-10-28

McCormick ups tariff impact to $140M despite mitigation efforts

Description: The spice giant is trying to offset tariff costs through productivity savings, alternative sourcing and higher prices.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

Prediction: These 3 High-Yield Dividend Stocks Will Raise Their Payouts to Record Highs in November

Description: One of them currently boasts a dividend yield approaching 5%.

2025-10-20

This has been the 'biggest surprise' for food companies

Description: TD Cowen managing director, Robert Moskow, joins Asking for a Trend host Josh Lipton to discuss the Big Food sector, why its era of pricing power is over, and which names investors should be watching. To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend.

Smucker vs. Trader Joe’s, Lululemon vs. Costco: Fight Over Brands Goes to Court

Description: Frozen PB&J products square off, the latest in a long-running battle between big-name brands and retailers’ private-label products.

2025-10-19

2025-10-18

2025-10-17

McCormick (MKC): Evaluating the Spice Maker’s Valuation After Q3 Beat and Lowered Earnings Guidance

Description: McCormick (NYSE:MKC) just posted third quarter results that beat expectations on both revenue and non-GAAP profit, driven by ongoing strength in its consumer segment as brand marketing and new products paid off. See our latest analysis for McCormick. Despite McCormick’s solid third quarter beat, the share price has drifted down roughly 12% year-to-date and total shareholder return sits at about -15% over the past 12 months. Recent investor caution seems tied to tightened full-year earnings...